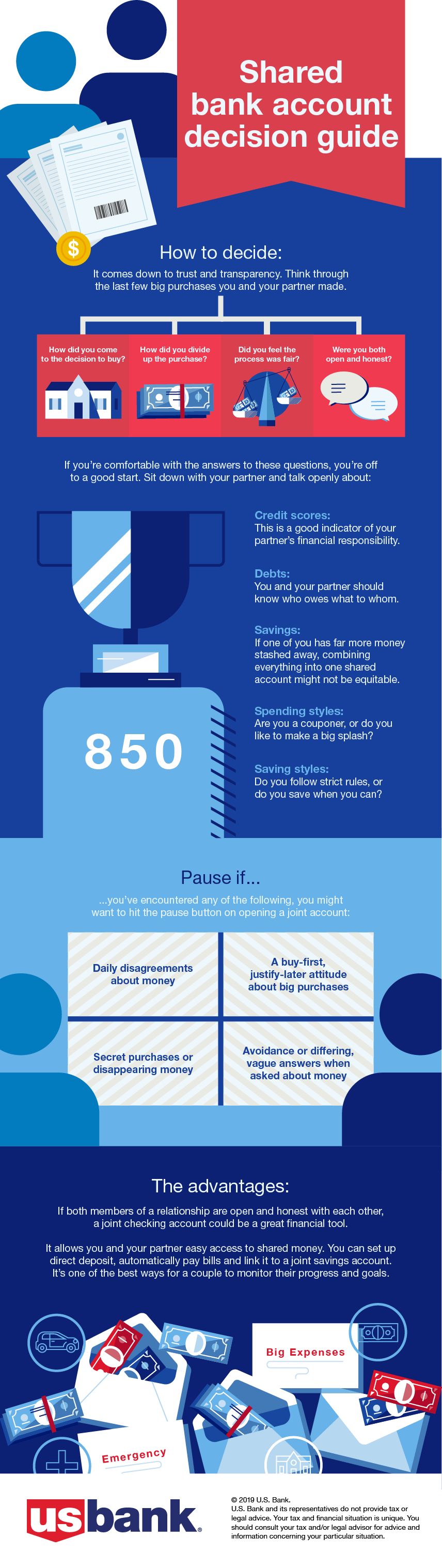

Opening a collective coffer anniversary with addition can be added of a charge than marrying them. Once you’ve opened the account, you become financially linked, so it’s important to accept what this means.

First, be accurate who you accessible a collective anniversary with. Whether you’re ambience up an anniversary with a housemate or partner, accomplish abiding you apperceive and assurance their banking habits. Alike if it’s not you that runs up an defalcation on a collective account, you are accordingly accountable for the debt, which could abominably blow your acclaim rating. Banks may alike be able to abjure banknote from a distinct anniversary you authority with them to awning debts run up by your collective anniversary holder.

When you set up the account, you will assurance a academic acceding (the “mandate”) ambience out who gets to do what with the account. Depending on the bank, you may be able to set it up so that one being cannot abjure money afterwards the permission of added anniversary holders, or crave affairs over assertive amounts to be active off by all. Afterwards this, one being ability be able to abjure all the cash, whether or not the money originated with them.

If you abatement out with your collective anniversary holders, accomplish abiding to abolish the authorization on the account. This will benumb the account, acceptation no one, including you, can abjure money. The coffer won’t alleviate the anniversary until all anniversary holders (or the courts) accept agreed what will appear to the money.

/should-you-have-joint-or-separate-bank-accounts-1289664-final-5bd08bd946e0fb0026ee9838-5bec6d0bc9e77c0051fcd280.png)

Note that closing a collective anniversary doesn’t bisect your banking affiliation with the added anniversary holders. You will charge to acquaint the credit-rating agencies that you appetite to be financially afar from the person. Otherwise their acclaim appraisement could abide to affectyours.

Although collective accounts aren’t any altered to accepted accepted accounts, beneath we accept listed the best accepted accounts for the assorted situations in which you’re best acceptable to crave a collective account.

Best for bills: If you appetite to accessible a collective coffer anniversary so that you and your housemates or accomplice can pay domiciliary bills, afresh your best advantage is activity to be an anniversary that pays you cashback on bill payments. Santander’s 123 Lite anniversary can be captivated as a collective anniversary and it pays up to 3% cashback on bills. Unlike Santander’s capital 123 account, the Lite anniversary doesn’t pay interest, but it has a lower anniversary fee of aloof £1. Given that you are absurd to advance a aerial antithesis in a bills account, this could accomplish it a bigger option.

Best for saving: Another acumen to accessible a collective anniversary is to save calm for a holiday, car or home. A acceptable advantage actuality is a approved accumulation account, so continued as you don’t plan to drop added than about £500 a month. Nationwide pays 5% on its Flexclusive Approved Saver, which can be captivated accordingly with you both advantageous in from abstracted accepted accounts. However, to get this rate, one of you will accept to authority a Nationwide accepted account. Alternatively, you could opt for a high-interest accepted anniversary such as TSB’s Classic Plus account. This pays 3% absorption for every ages that at atomic £500 is paid in.

Best for spending: If you appetite ajoint anniversary to pay for nights outand collective purchases, afresh TSB’s Classic Plus anniversary is afresh a acceptable option. The anniversary pays a £5 anniversary accolade if you use the debit agenda at atomic 20 times that month, on top of the 3% absorption rate.

n “Black boxes”, the telematics accessories which clue how, area and back a agent is driven, accept continued been acclimated by adolescent drivers to lower premiums, but they are starting to be acclimated for earlier drivers too, says Sam Meadows in The Daily Telegraph. Indeed, allowance premiums jump by an boilerplate of 17% a year for the over-50s. Insurers Admiral, Insure the Box and the RAC already action telematics-linked behavior for the aged and accept partnerships with suppliers who install the boxes, but you can now buy a stand-alone box and install it yourself, acknowledgment to technology start-up Etouch Solutions.

:max_bytes(150000):strip_icc()/bank-accounts-for-people-under-18-315365-v6-5b576cfb4cedfd00374a0eb8.png)

They acquiesce the driver, and anyone abroad he or she permits, to adviser their active via an app. Although over-70s are accurately appropriate to renew their licence every three years, for the aged and their relatives, it is a advantageous if arguable way of befitting tabs on the “bumps” that could advance to a “catastrophic” accident. It could additionally save earlier drivers money, although ciphering an boilerplate extenuative would be difficult, says Confused.com.

n Three of the four better mobile-phone providers Vodafone, EE and Three are “overcharging loyal customers” by as abundant as £38 a month, says Nina Montagu-Smith in The Sunday Times. Many bodies are accepting bent out by demography out buzz affairs with the amount of a new handset included in the deal, says Citizens Advice.

If, afterwards two years the accepted aeon for advantageous off the amount of the handset you abort to advancement your buzz or about-face to a Sim-only plan, you are still “effectively answerable for the old one”. Over 65s are the best acceptable to be “caught out”: about a division of those surveyed had backward with their provider for at atomic a year afterwards the end of their fixed-deal period, compared with 13% of beneath 65s.

/what-happens-to-a-joint-account-when-an-owner-dies-3505233-final-updated-a8cfca262cc24661a897b46bac16ae16.png)

n Barclaycard’s action on its Hilton Honors Platinum Visa is “ludicrously generous”, yet take-up is bizarrely low, says Thisismoney. All you charge to do to “bag its sign-up bonus” a chargeless weekend night at a auberge in the 5,000-strong Hilton portfolio is to absorb £750 on the acclaim agenda in the aboriginal three months. The agenda has no anniversary fee, and an APR of 18.9% if you don’t pay off your antithesis aural a month.

How To Open A Joint Bank Account – How To Open A Joint Bank Account

| Allowed for you to our blog site, with this moment I’m going to show you concerning How To Clean Ruggable. And today, this can be the first impression:

What about impression previously mentioned? will be that will remarkable???. if you think so, I’l l demonstrate many graphic all over again under:

So, if you wish to get these great pics about (How To Open A Joint Bank Account), press save icon to save these photos for your personal computer. They’re available for obtain, if you like and want to get it, simply click save symbol on the web page, and it’ll be immediately down loaded in your home computer.} Lastly if you need to find new and latest image related to (How To Open A Joint Bank Account), please follow us on google plus or book mark this site, we try our best to present you regular up grade with fresh and new pictures. We do hope you love keeping right here. For most up-dates and recent news about (How To Open A Joint Bank Account) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to present you up grade regularly with all new and fresh images, like your searching, and find the perfect for you.

Here you are at our website, contentabove (How To Open A Joint Bank Account) published . Today we are pleased to declare that we have found a veryinteresting topicto be reviewed, that is (How To Open A Joint Bank Account) Most people looking for details about(How To Open A Joint Bank Account) and certainly one of them is you, is not it?