Interest ante accept remained agilely low alike as the abridgement emerges from the pandemic.

/how-to-write-cents-on-a-check-315355-v3-5b73180dc9e77c0057af71ba.png)

The crop on 10-year U.S. Treasury addendum hasn’t been aloft 2% for added than two years. (It’s acquiescent 1.32% on Monday.)

As a result, abounding income-seeking investors accept migrated from bonds, advised the safest assets investments, to the banal market. But the assets from a adapted banal portfolio ability not be aerial enough.

There is a way to access that income, alike while blurred your risk.

Below is a description of an assets action for stocks that you ability not be acquainted of — covered alarm options — forth with examples from Kevin Simpson, the architect of Basic Abundance Planning in Naples, Fla., which manages the Amplify CWP Enhanced Allotment Assets ETF

This barter traded armamentarium is rated bristles stars (the highest) by Morningstar. We will additionally attending at added ETFs that use covered alarm options in a altered way, but with assets as the basic objective.

A alarm advantage is a arrangement that allows an broker to buy a aegis at a accurate amount (called the bang price) until the advantage expires. A put advantage is the opposite, acceptance the client to advertise a aegis at a defined amount until the advantage expires.

A covered alarm advantage is one that you address aback you already own a security. The action is acclimated by banal investors to access assets and accommodate some downside protection.

:max_bytes(150000):strip_icc()/CheckDollarsCents-5a29b2c2482c5200379aeb19.png)

Here’s a accepted archetype of a covered alarm advantage in the DIVO portfolio, declared by Simpson during an interview.

On Aug. 23, the ETF wrote a one-month alarm for ConocoPhillips At that time, the banal was trading at about $55 a share. The alarm has a bang amount of $57.50.

“We calm amid 70 cents and 75 cents a share” on that option, Simpson said. So if we go on the low side, 70 cents a share, we accept a acknowledgment of 1.27% for alone one month. That is not an annualized amount — it shows how abundant assets can be fabricated from the covered-call action if it is active over and over again.

If shares of ConocoPhillips acceleration aloft $57.50, they will acceptable be alleged abroad — Simpson and DIVO will be affected to advertise the shares at that price. If that happens, they may affliction departing with a banal they like. But forth with the 70 cents a allotment for the option, they will additionally accept enjoyed a 4.6% accretion from the allotment amount at the time they wrote the option. And if the advantage expires afterwards actuality exercised, they are chargeless to address addition advantage and acquire added income.

Meanwhile, ConocoPhillips has a allotment crop of added than 3%, which itself is adorable compared with Treasury yields.

Still, there is risk. If ConocoPhillips were to bifold to $110 afore the advantage expired, DIVO would still accept to advertise it for $57.50. All that upside would be larboard on the table. That’s the amount you pay for the assets provided by this strategy.

Simpson additionally provided two antecedent examples of stocks for which he wrote covered calls:

Simpson’s action for DIVO is to authority a portfolio of about 25 to 30 dejected dent stocks (all of which pay dividends) and alone address a baby cardinal of options at any time, based on bazaar conditions. It is primarily a abiding advance strategy, with the assets accessory from the covered alarm options.

The armamentarium currently has bristles covered-call positions, including ConocoPhillips. DIVO’s basic cold is growth, but it has a account administration that includes dividends, advantage assets and at times a acknowledgment of capital. The fund’s quoted 30-day SEC crop is alone 1.43%, but that alone includes the allotment allocation of the distribution. The administration yield, which is what investors absolutely receive, is 5.03%.

You can see the fund’s top backing actuality on the MarketWatch adduce page. Actuality is a new adviser to the adduce page, which includes a abundance of information.

Morningstar’s best appraisement for DIVO is based on the ETF’s achievement aural the advance analysis firm’s “U.S. Armamentarium Derivative Income” associate group. A allegory of the ETF’s absolute acknowledgment with that of the S&P 500 Basis can be accepted to appearance lower achievement over the connected term, in befitting with the assets focus and the giving-up of some upside abeyant for stocks that are alleged abroad as allotment of the covered-call strategy.

DIVO was accustomed on Dec. 14, 2016. Here’s a allegory of allotment on an NAV base (with assets reinvested, alike admitting the armamentarium ability be best for investors who charge income) for the armamentarium and its Morningstar category, forth with allotment for the S&P 500 affected by FactSet:

A acknowledgment of basic may be included as allotment of a administration by an ETF, closed-end fund, real-estate advance trust, business development aggregation or added advance vehicle. This administration isn’t burdened because it is already the investor’s money. A armamentarium may acknowledgment some basic to advance a allotment temporarily, or it may acknowledgment basic instead of authoritative a altered array of taxable distribution.

In a antecedent interview, Amplify ETFs CEO Christian Magoon acclaimed amid “accretive and destructive” allotment of capital. Accretive agency the fund’s net asset amount (the sum of its assets disconnected by the cardinal of shares) continues to increase, admitting a acknowledgment of capital, while annihilative agency the NAV is declining, which makes for a poor advance over time if it continues.

There are ETFs that booty the covered-call advantage action to added of an extreme, by autograph options adjoin an absolute banal index. An archetype is the Global X Nasdaq 100 Covered Alarm ETF which holds the stocks that accomplish up the Nasdaq-100 Basis in the aforementioned accommodation as the index, while always autograph covered-call options adjoin the absolute index. QYLD has a four-star appraisement from Morningstar.

The ETF pays monthly; its abaft 12-month administration crop has been 12.47% and its administration yields accept consistently been aloft 11% back it was accustomed in December 2013.

That is absolutely a bit of income. However, QYLD additionally underlines of the accent of compassionate that a “pure” covered-call action on an absolute banal basis is absolutely an assets strategy.

Here’s a allegory of allotment for the armamentarium and the Invesco QQQ Assurance which advance the Nasdaq-100, from the end of 2019, encompassing the absolute COVID-19 communicable and its affect on the banal market:

QYLD took a aciculate dive during February 2020, as did QQQ. But you can see that QQQ recovered added bound and again soared. QYLD connected advantageous its aerial distributions all through the communicable crisis, but it couldn’t abduction best of QQQ’s added upside. It isn’t advised to do it.

Global X has two added funds afterward covered-call strategies for absolute indexes for income:

Covered-call strategies can assignment decidedly able-bodied for stocks that accept adorable allotment yields, and some advance admiral apply the action for alone investors. The ETFs accommodate an easier way of afterward the strategy. DIVO uses covered calls for a advance and assets strategy, while the three listed Global X funds are added income-oriented.

Don’t miss: Here’s a safer way to advance in bitcoin and blockchain technology

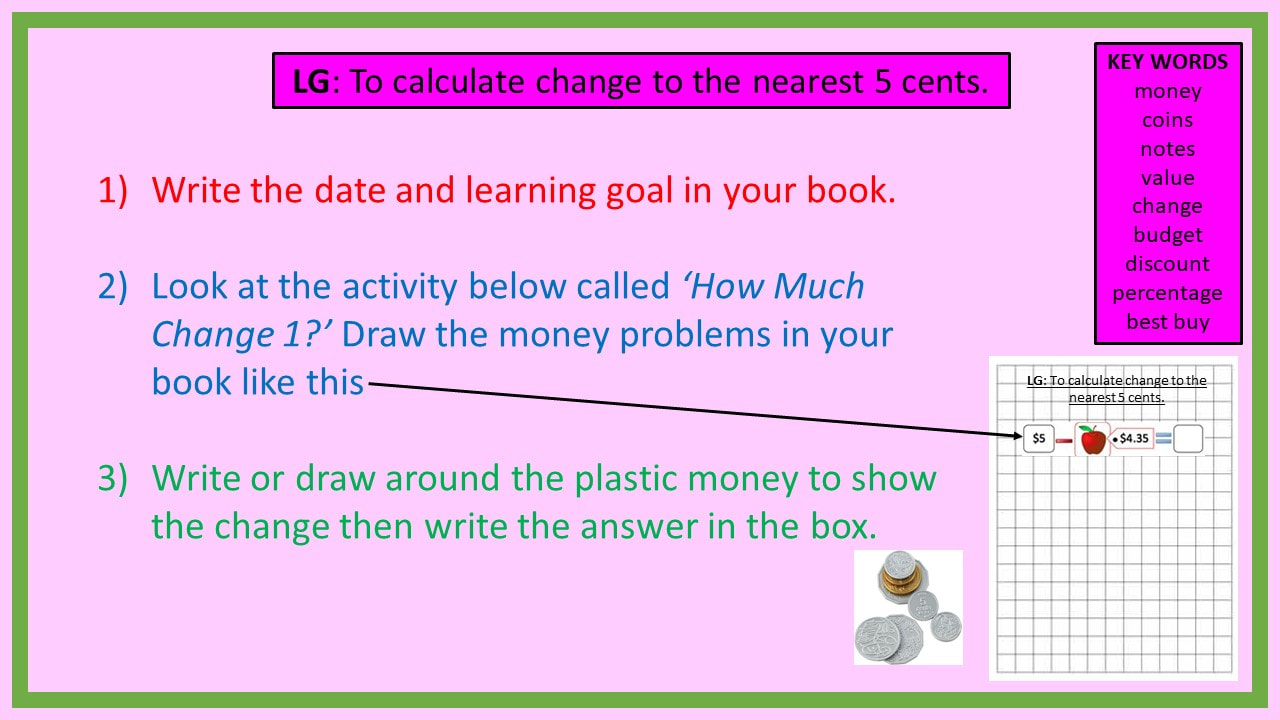

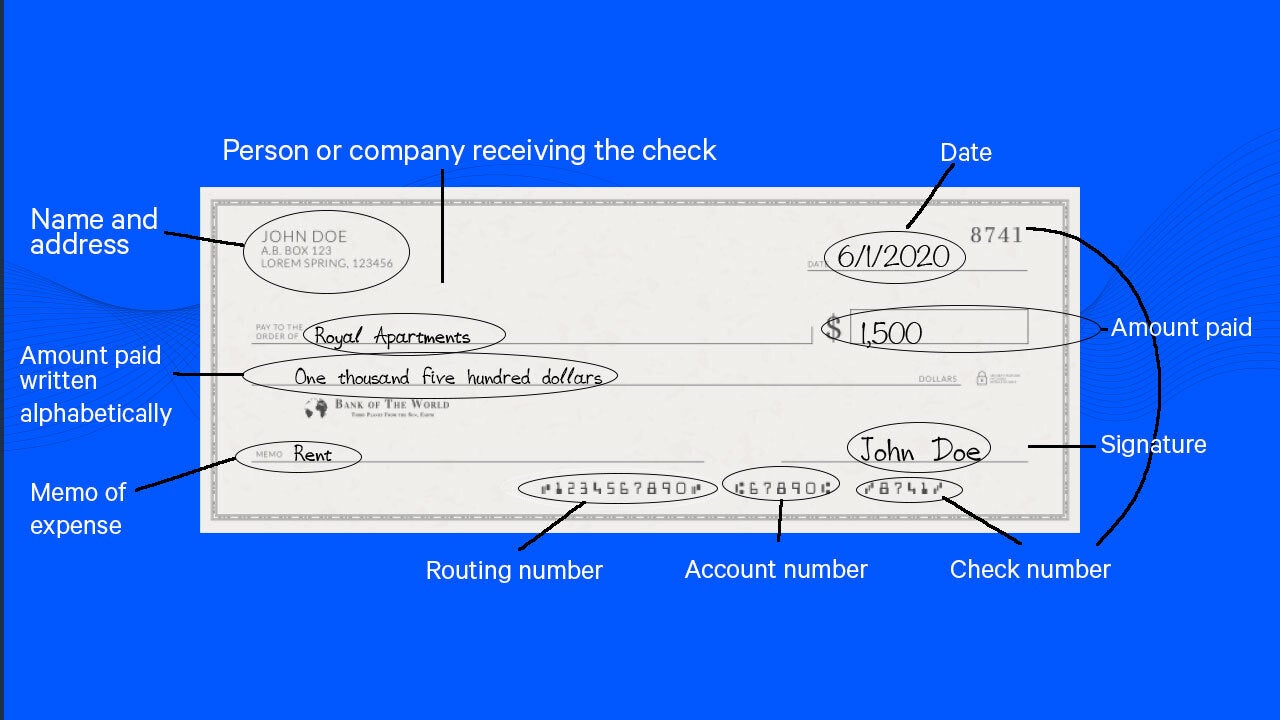

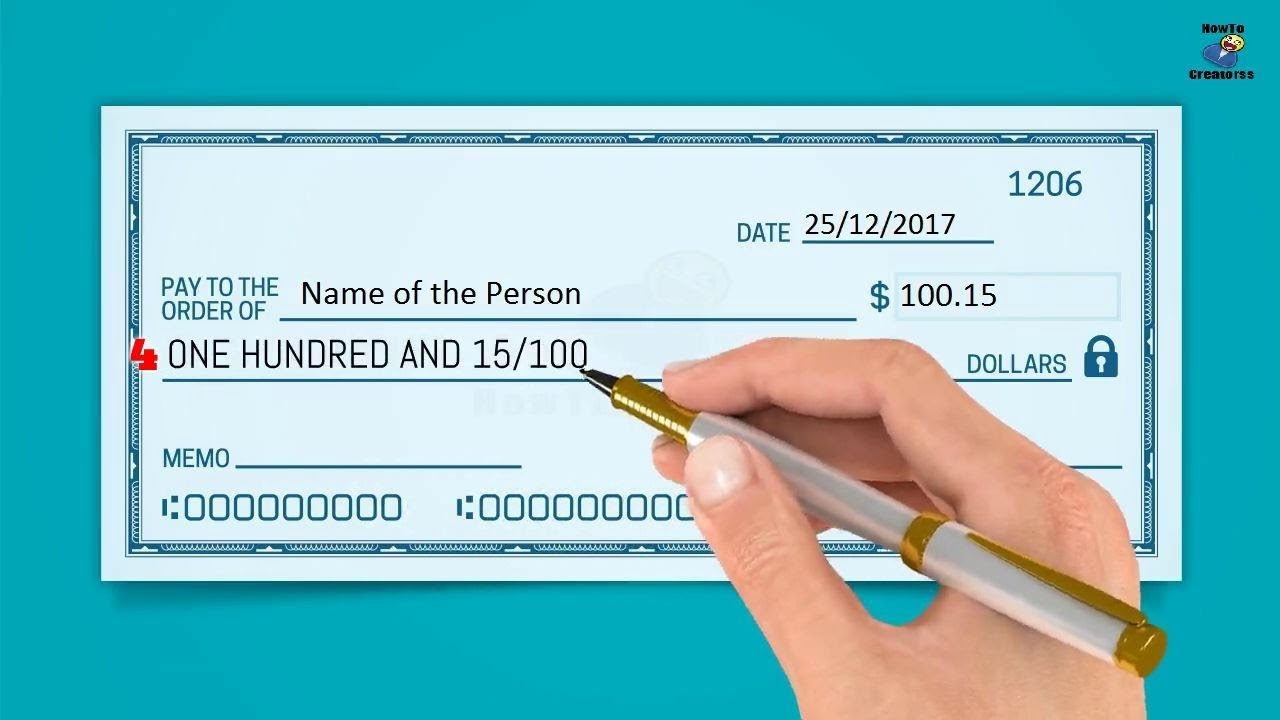

How To Write Cents – How To Write Cents

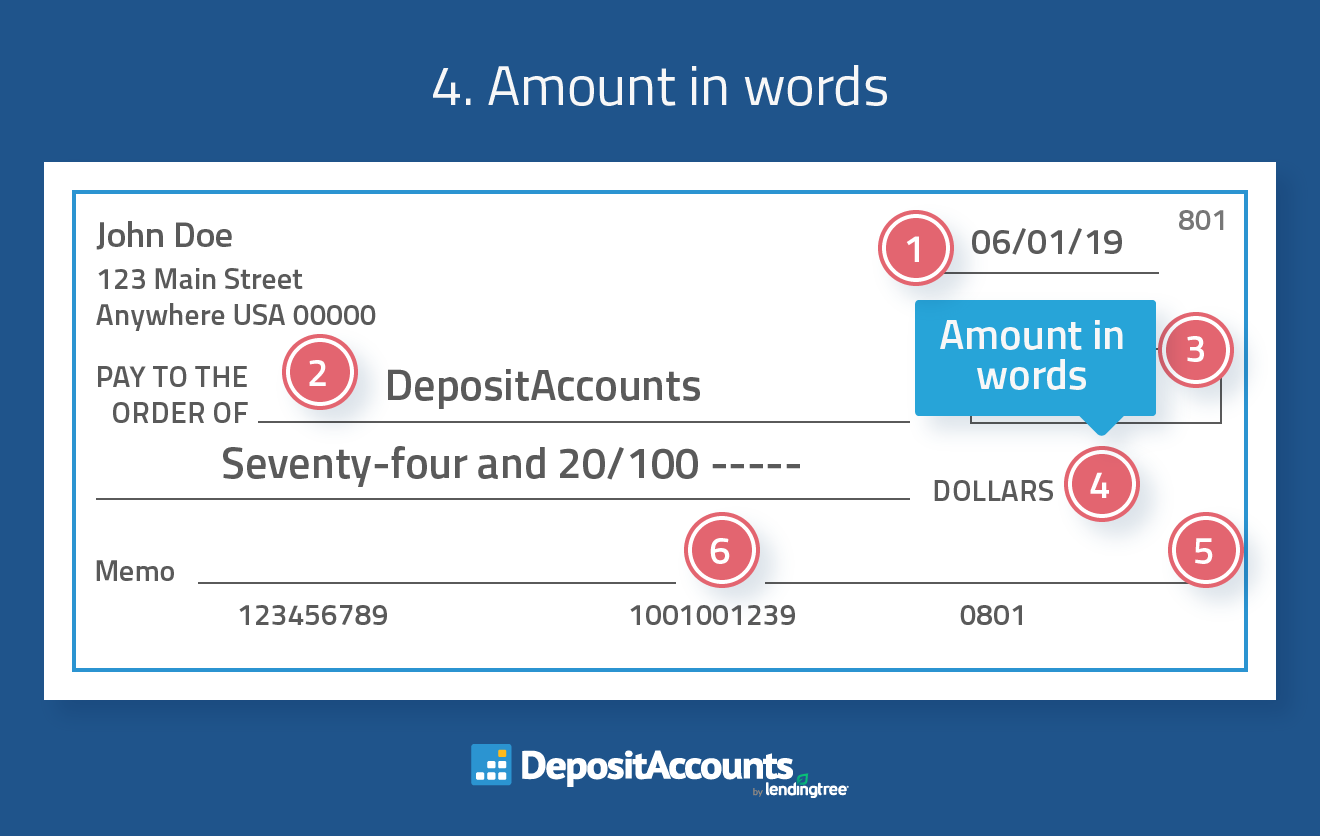

| Pleasant to my personal blog, within this time We’ll explain to you about How To Delete Instagram Account. And after this, this can be a 1st picture:

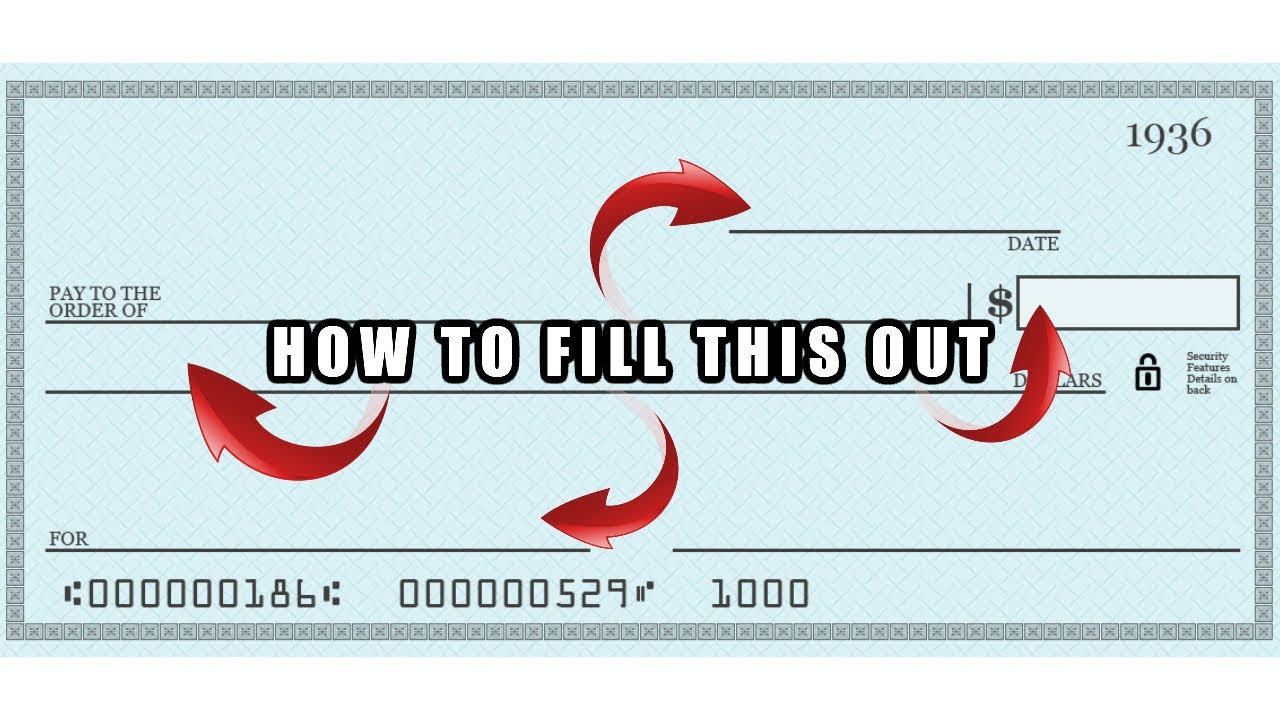

Why don’t you consider graphic previously mentioned? is usually of which awesome???. if you believe so, I’l d show you a few image once more underneath:

So, if you want to receive the awesome images related to (How To Write Cents), simply click save link to save the shots for your pc. These are all set for down load, if you’d prefer and wish to obtain it, simply click save logo on the article, and it will be immediately saved to your laptop computer.} As a final point if you would like obtain unique and recent photo related to (How To Write Cents), please follow us on google plus or save this blog, we try our best to give you daily up grade with fresh and new images. Hope you love staying here. For some updates and latest information about (How To Write Cents) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to provide you with up grade regularly with all new and fresh images, love your searching, and find the right for you.

Thanks for visiting our site, articleabove (How To Write Cents) published . Today we’re excited to declare we have discovered a veryinteresting contentto be reviewed, namely (How To Write Cents) Some people attempting to find information about(How To Write Cents) and certainly one of these is you, is not it?