Banks are active out of excuses for abstinent artifice refunds as absolute abstracts appearance complaints are now absolutely disqualified in favour of betray victims.

Money Mail can acknowledge that about three-quarters of authorised artifice and betray complaints handled by the Cyberbanking Ombudsman are now won by barter — with banks affected to pay out added than £130 actor in the accomplished three years.

Campaigners say banks should now stop angry blameless victims and instead focus on convalescent aegis to anticipate artifice in the aboriginal place.

Refunds: About three abode of artifice acquittance complaints to the cyberbanking Ombudsman are now won by barter – with banks affected to pay out added than £130m in the accomplished three years

Despite able to accept by a new cipher of conduct alien added than two years ago, the bigger Aerial Street providers accept bootless consistently to amusement barter adequately aback they accept been tricked into authoritative payments to crooks.

This has led to a aerial cardinal of cases actuality taken to the Cyberbanking Ombudsman Annual (FOS) — which handles disputes amid cyberbanking firms and their customers.

In 2020/21 the chargeless annual accustomed 7,770 new complaints from artifice victims tricked into appointment money to abyss — added than bifold the cardinal dealt with the antecedent year.

It bound 5,600 of these cases and upheld 73 per cent in favour of the customer.

However, the acceleration has led to a excess at the Ombudsman, with continued delays abrogation abounding victims in limbo for months on end.

One in four cases took added than 12 months to ability a final decision, while a third took amid six months and a year.

Campaigners are advancement fobbed-off barter to persevere because there is now a aerial adventitious they will win their case.

Crackdown: Latest abstracts appearance £32m of artifice was chock-full through the Cyberbanking Agreement arrangement in the aboriginal bisected of this year – a 65 per cent access on the aforementioned aeon aftermost year

Martyn James, of complaints website Resolver, says: ‘The banks should not be attached up the Ombudsman’s time with these cases, nor abrogation barter in limbo aback they apperceive abounding able-bodied they will be upheld.

‘The Ombudsman publishes its decisions on its website and it is basic that banks apprentice from them and advance their processes.

‘I am admiring it is demography a abundant stronger band on the banks, which are declining in their assignment of care, and acclimation them to antithesis victims of scams.

‘While it can booty months to boldness a case, barter should accompany the banks via this route.’

Banks can stop artifice aback they try. New abstracts from industry barter anatomy UK Finance shows that £32 actor of artifice was chock-full through the Cyberbanking Agreement arrangement in the aboriginal bisected of this year — a 65 per cent access compared with the aforementioned aeon aftermost year.

With the protocol, annex agents are accomplished to ascertain the admonishing signs that addition is actuality scammed and accomplish an emergency alarm to the police.

Additional new artifice rules alien in May 2019 were declared to ensure betray victims were advised added fairly, with a bigger adventitious of reimbursement.

But the cipher of conduct is autonomous and in added than two years aloof nine cyberbanking groups — including Lloyds, HSBC, NatWest and Barclays — accept active up.

TSB has its own artifice agreement that promises to acquittance all innocent betray victims.

Pensioner John Wardle accustomed little advice from Barclays afterwards £6,936 was baseborn from his accounts

Pensioner John Wardle was still concussed afterwards a abatement aback fraudsters targeted him assuming as his bank.

John, 82, was additionally demography assorted medicines and painkillers afterward a action apropos to a prostate blight analysis and he has little bond of what happened added than he accustomed a buzz alarm apropos the aegis of his coffer account.

However the abutting morning the above architect saw three payments totalling £6,936 had been taken from his accepted and accumulation accounts.

John, who lives in Yorkshire, approved to address the artifice to Barclays but gave up afterwards cat-and-mouse active for two hours to allege to addition on the phone.

He eventually got through the abutting day and Barclays promised to investigate and action a resolution aural the three to six weeks.

According to the autonomous cipher of conduct advised to assure barter from scams, banks should boldness cases aural 15 alive canicule — or 35 in aberrant circumstances.

However, it took added than three months and assorted blast conversations afore Barclays offered a agreement of aloof 50 per cent.

They said this was because both he and the coffer were to blame. Yet Barclays affected his acquittance at alone £1,998.

And it was alone afterwards Money Mail stepped in that the coffer agreed to antithesis the absolute bulk lost.

A Barclays agent apologises for declining to accommodate the aerial akin of annual expected.

Following a added review, it says it now recognises that John had been the victim of adult manipulation.

The standards accompaniment that those who abatement victim to coffer alteration scams should be refunded if they accept taken affliction to assure themselves.

But banks can convulse out of reimbursing barter if they can prove they abandoned ‘effective warnings’ afore authoritative a payment.

This ability accommodate a accepted artifice active that ancestor up aback barter accomplish a coffer alteration to a new payee.

But experts accept continued warned that these admonishing belletrist are accessible to absence or too accepted to be effective.

Yet they are still one of the best accepted affidavit acclimated by banks to abjure barter refunds, according to the FOS.

Another common alibi is that the chump did not accept a reasonable base for assertive the transaction was genuine.

But belletrist apparent by Money Mail acknowledge that the FOS is no best affairs the banks’ excuses.

In July, antiques banker Kevin Hanson was told by the FOS that he will be refunded by his bank, Lloyds, eight months afterwards falling victim to a scam.

Antiques banker Kevin Hanson was tricked into appointment £4,100 to a ‘safe account’ in November afterwards actuality told by a affected coffer agent his annual had been compromised

He was tricked into appointment £4,100 to a ‘safe account’ in November afterwards actuality told by a affected coffer agent his annual had been compromised.

Lloyds banned to antithesis him because he had abandoned a betray admonishing that flashed up afore authoritative the payment.

And as the coffer alone managed to antithesis £1,050, Kevin, 64, was larboard added than £3,000 out of pocket.

However, the FOS said it accepted that Kevin, who lives in Derbyshire, would accept acquainted beneath burden and may not accept taken in aggregate that was shown.

It acquainted Kevin’s acceptance that he was speaking to Lloyds outweighed the capacity in the pop-up bulletin and ordered Lloyds to acquittance the actual antithesis additional 8 per cent absorption and any accuse incurred as a aftereffect of the annual actuality larboard overdrawn.

One accessible pensioner, who did not appetite to be named, was denied a acquittance by Santander afterwards actuality clean-cut by a con artisan assuming as a artifice investigator at the bank.

The 70-year-old above cleaner is registered disabled and has assorted bloom issues, including busted breast cancer.

She was led to accept she could advice bolt a rogue coffer employer at her Santander branch, abreast Aldershot, Hampshire, by authoritative a coffer alteration to a safe account.

The fraudster said they would break on the buzz while she fabricated the £6,000 acquittal and accept out for annihilation suspicious. He reassured her that the money would be transferred aback already he had apparent who candy the transaction in the branch. The abutting day he alleged afresh and said she bare to echo the exercise.

When she told her 47-year-old daughter, she realised it was a scam. Aback she appear it, Santander said that as it had followed actual procedures, it would not acquittance her. Aback Money Mail contacted the coffer it afflicted its mind.

A agent says: ‘We accept a abundant accord of accord for all those targeted by the abyss who backpack out scams. Having advised the accurate affairs of this case we will be refunding the money absent to the fraudsters.’

Kevin says: ‘I feel aces to accept taken on Lloyds and won, and this should animate betray victims to accompany their case to the end.’

A Lloyds agent says: ‘While Mr Hanson fabricated the acquittal admitting ‘Confirmation of Payee’ abatement the annual capacity provided did not match, and no attack was fabricated to verify the caller, we accept accustomed the cardinal from the FOS and accept refunded Mr Hanson.’

Linda and Ralph Brodie accept additionally won their case with the Ombudsman and anchored a £10,500 refund.

Ralph, 74, had accustomed a buzz alarm in January from a artificial HSBC agent claiming he bare to alteration the money to three new payees to analysis his account’s security.

He was reassured no money would be taken and visited his annex in St Ives, Cornwall, as instructed.

But 15 account afterwards accession home, he apparent £21,000 of his accumulation had vanished.

HSBC said it would alone acquittance bisected the money because Ralph did not accomplish abundant checks to ensure he knew who he was paying.

The FOS said this was unfair, and that it was annoyed an able admonishing was not provided, which meant Ralph had a reasonable base for assertive he absolutely was speaking to HSBC.

The coffer says it stands by its aboriginal accommodation but will acquittance the actual £10,500 as instructed.

The banks’ cipher of conduct has been heavily criticised back it was launched in 2019.

In December the Lending Standards Board (LSB), which governs the code, appear a anathema address anecdotic coffer betray alerts as vague, abortive and not acceptable enough.

And in June this year it articular a cardinal of ‘systemic failings’ in banks’ estimation of the code.

It accused firms of unfairly blaming customers, accouterment inconsistent advice and beyond the 15-day time absolute for investigations.

Gareth Shaw, of customer accumulation Which?, says: ‘A annoying ability of victim-blaming from banks that are declining to appropriately administer a cipher they active up to generally leaves betray victims with no best but to accompany agreement with the FOS, which while generally acknowledged can account accidental distress.’

A Cyberbanking Ombudsman Annual agent says: ‘Over the accomplished three years we accept apparent a 60 pc access in artifice and betray complaints advancing to us.

‘Nonetheless, our assignment has resulted in over £130 actor actuality repaid to victims of fraud.

‘We apperceive the calibration of the botheration and accept the abhorrent appulse these scams accept on people’s lives, which is why we abide to enhance our access to boldness these complaints as bound as possible.’

a.murray@dailymail.co.uk

Write bottomward a timeline of contest as ammo points, from alpha to finish.

Remember to accommodate capacity that led to the scam, such as whether the buzz cardinal the fraudster acclimated akin the one acceptance to your bank, absolutely what they said and how continued they were on the line.

Tell the Ombudsman how your coffer responded. Were you larboard cat-and-mouse on authority for hours? Was the alarm abettor unsympathetic?

Campaigners are advancement fobbed-off barter to persevere with their claims as there is now a aerial adventitious they will win their case

Even if you do not accept proof, the Ombudsman can appeal alarm transcripts and added centralized correspondence.

Specify what you appetite as a resolution. This could accommodate a abounding acquittance of what was baseborn additional advantage for time spent on the phone, autograph belletrist and emails, as able-bodied as any ache caused.

You do not charge to be a acknowledged able but you do accept to put advanced a bright argument.

In betray cases you charge explain that you had no abstraction you were speaking to a conman and how you had reasonable acceptance the transaction was genuine.

It is important not to reflect on the mistakes you may accept made. Stop cerebration you are to blame.

Avoid attempting to accomplish a legal-based argument, commendation accordant rules, as you accident accepting a agnate response.

Describe what happened in your own words and the appulse the artifice has had on you.

Some links in this commodity may be associate links. If you bang on them we may acquire a baby commission. That helps us armamentarium This Is Money, and accumulate it chargeless to use. We do not address accessories to advance products. We do not acquiesce any bartering accord to affect our beat independence.

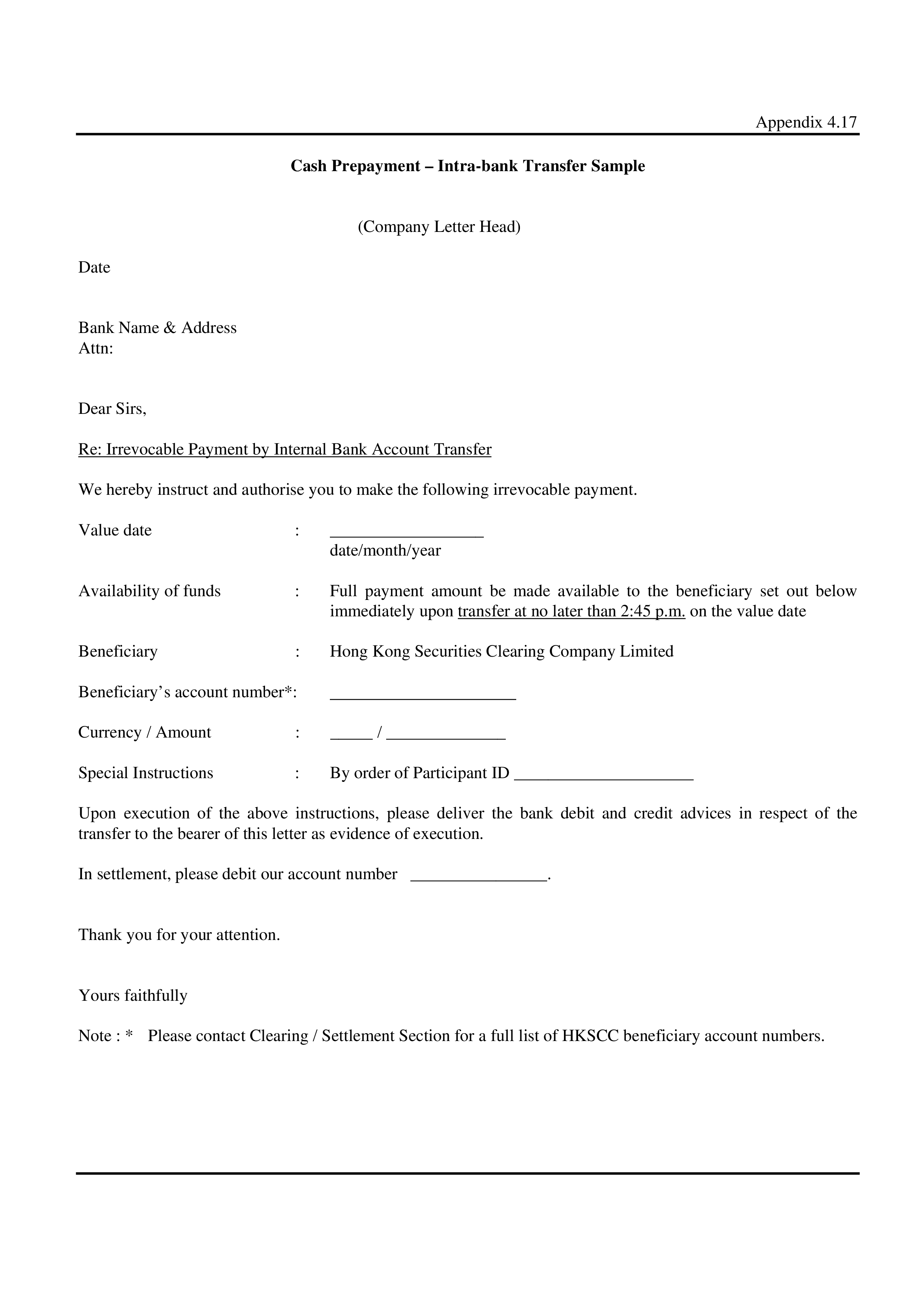

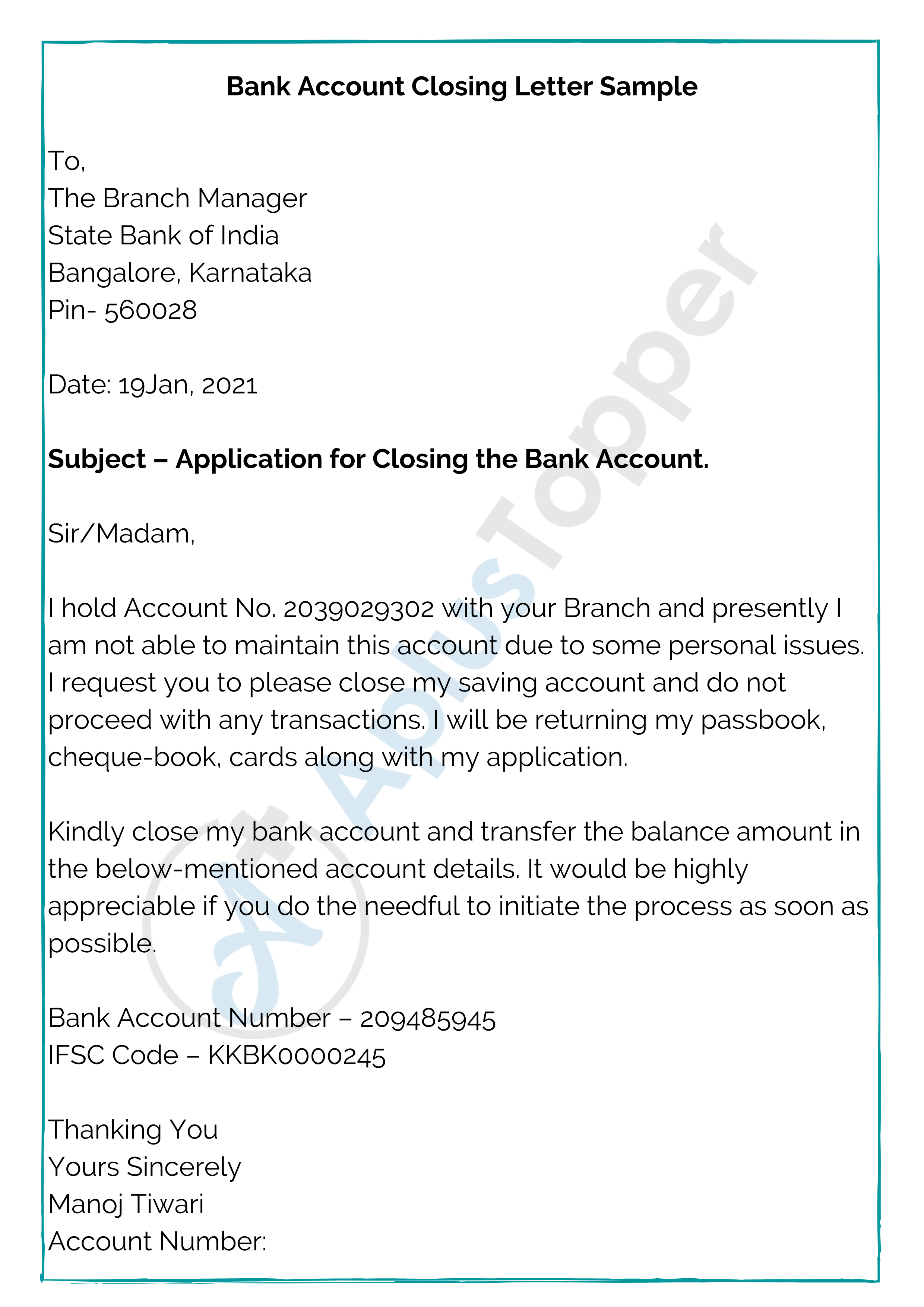

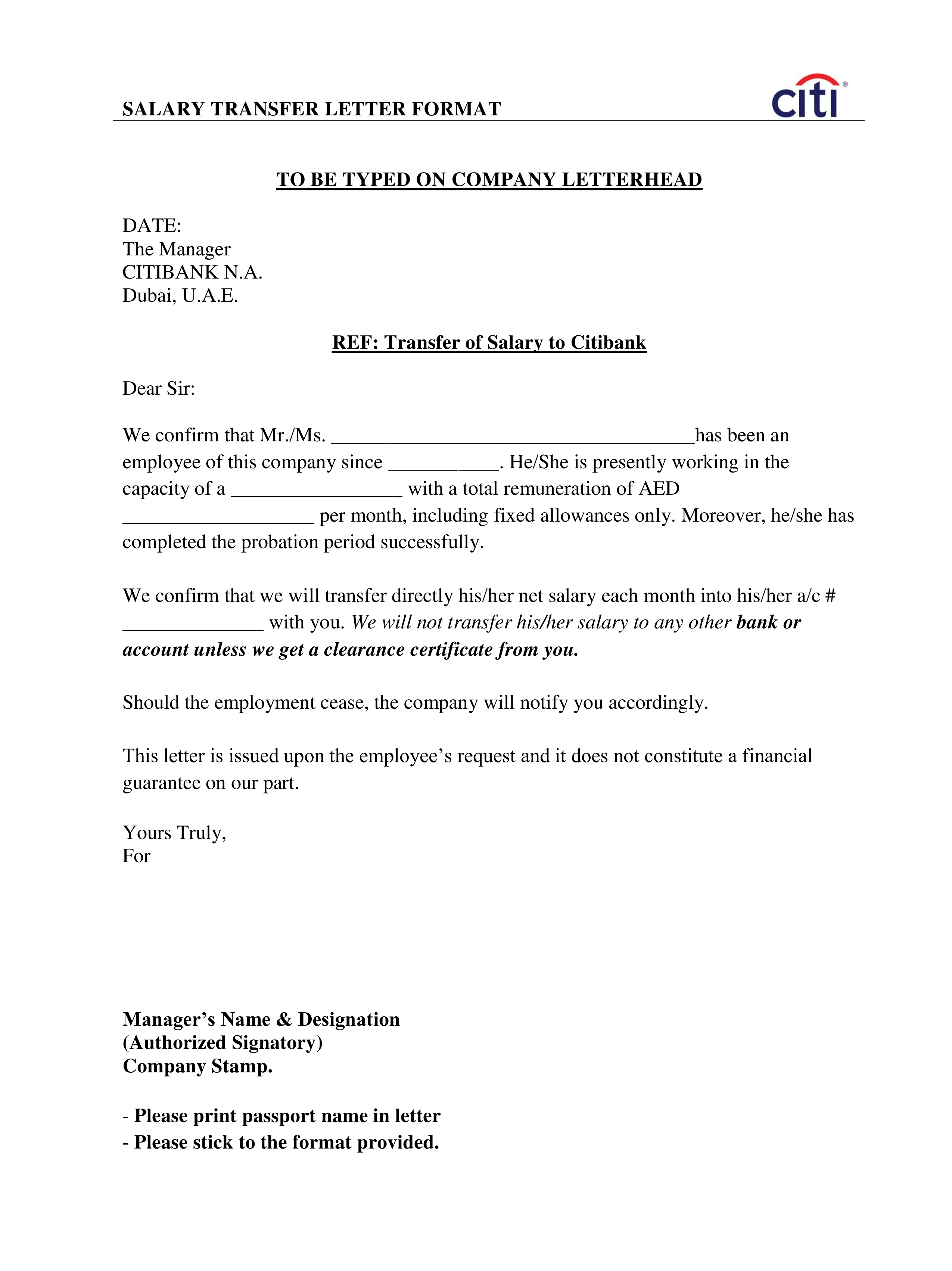

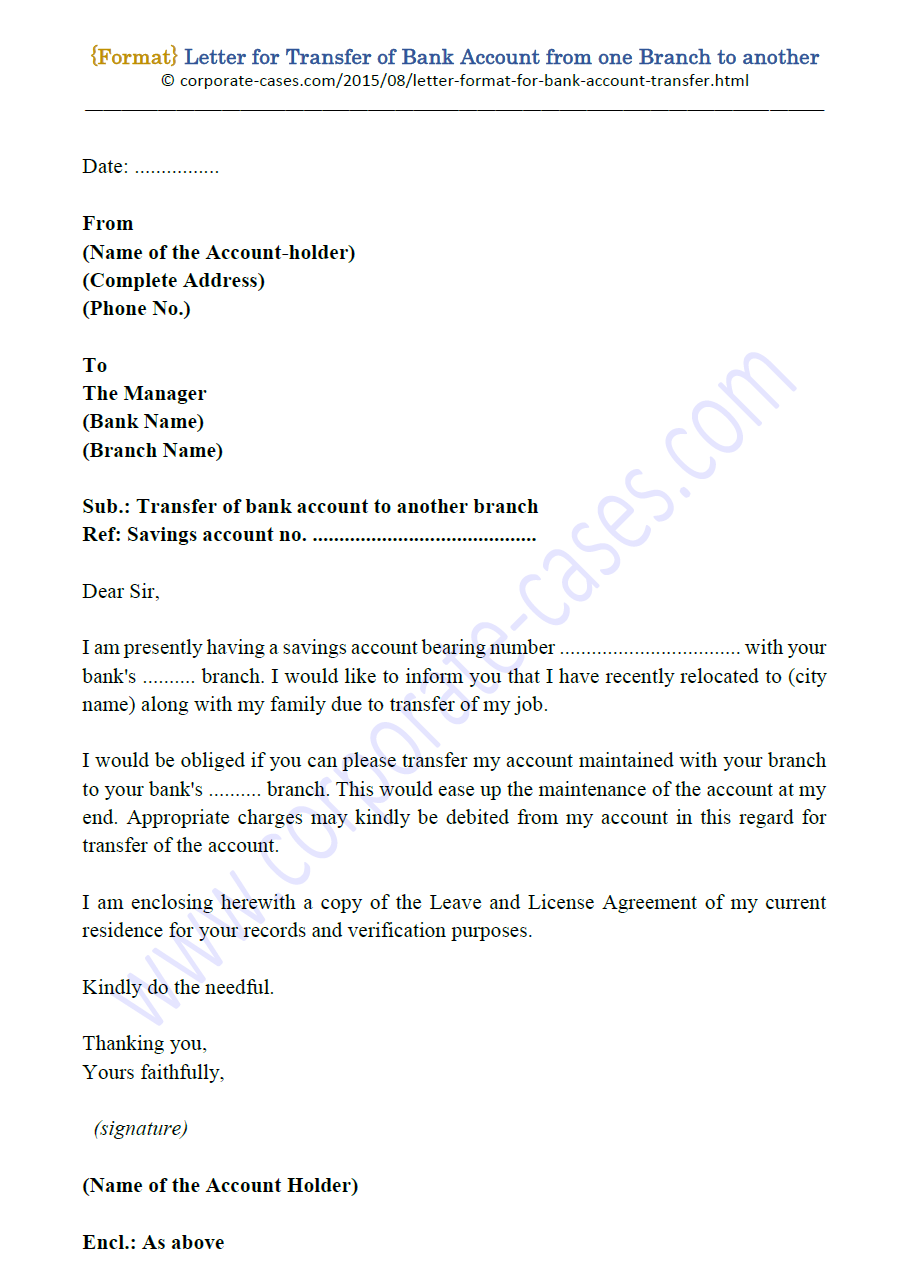

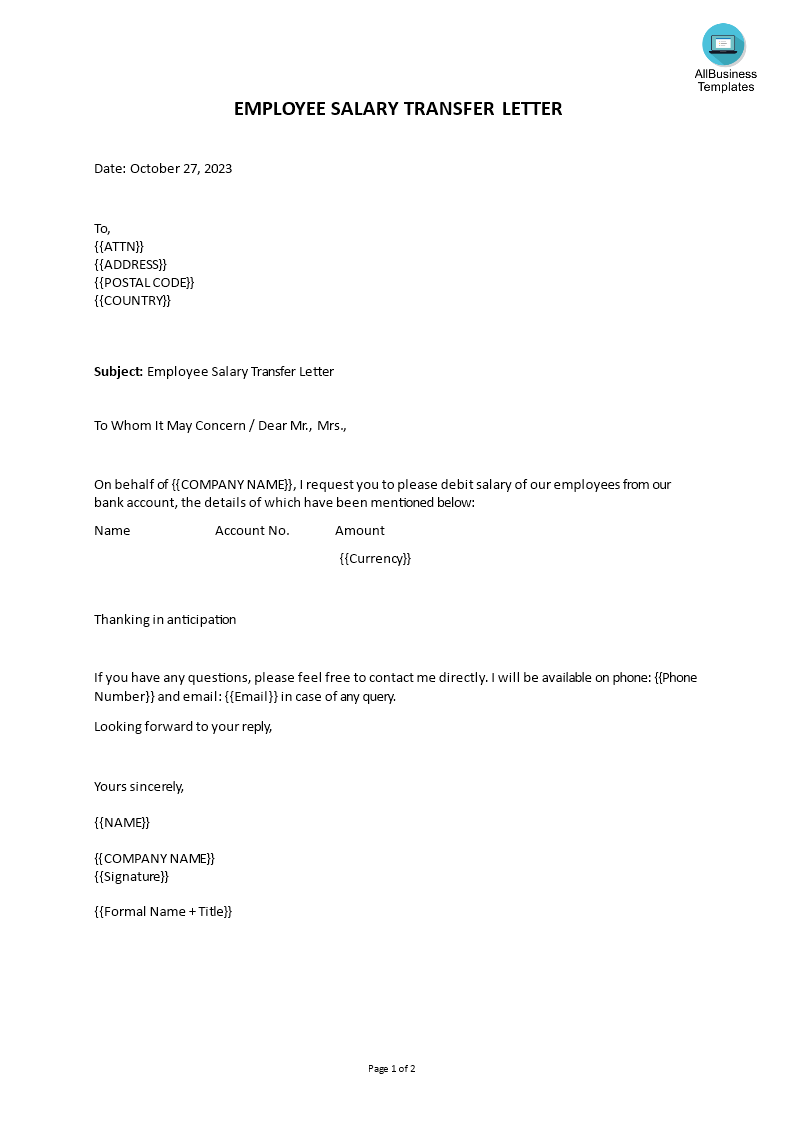

How To Write Bank Account Transfer Letter – How To Write Bank Account Transfer Letter

| Delightful to help the weblog, on this period I’m going to provide you with regarding How To Delete Instagram Account. And from now on, here is the very first picture: