September 2, 2021 (Investorideas.com Newswire) Missing payments is affirmed to aching your acclaim score. This is the distinct best affecting agency in both VantageScore and FICO models. Aback you absence on any loan, the banking academy may advertise your debt to a collector. This advice appears as an adverse accident in your history and accordingly affects your cachet (i.e., score).

Like added abrogating items such as bankruptcies and backward payments, these aspersing marks break on your annal for seven years – alike if you accomplish the acquittal in full. If the advice is true, your options are actual limited. If it is inaccurate, you may get it removed added calmly – analysis one of these Lexington Law reviews to see how this works.

1. Pay to Delete: Aback It Works

As the annual in collections is adverse to the score, you may be tempted to use the ‘pay for annul option’. As allotment of the arrangement, the beneficiary will abolish the advice from the abstracts they allotment with the bureaus, while you will pay off the debt. However, this convenance avalanche into a gray acknowledged area, and it does not consistently work.

If these items were removed all the time, claimed acclaim files would not be an authentic absorption of banking reliability. Therefore, this convenance is generally banned by the bureaus. Your beneficiary may be clumsy to abolish the entry.

On the added hand, some institutions do administer to abolish the advice or accomplish it beneath damaging. If you are offered such a deal, abstraction the acceding carefully. You should accept it in autograph to use as proof.

In a bearings aback the aboriginal agency passes your annual to addition collector, you may end up with two abstracted aspersing marks – from the aboriginal debt, now classified as a “charge off”, and the paid account. In this case, the appropriate adjustment will assignment for the accepted holder, but not for the aboriginal agency, as your debt is no best on its books.

2. Removing Erroneous Data

Consumers acquisition altered types of inconsistencies in their histories, from amiss amounts to apocryphal items, including paid collections. To see if this is the case, go to www.annualcreditreport.com to download your files from the three bureaus. Until April 20th, 2022, you can do this for chargeless already a week. What should you do if you see an annual that does not accord to you?

The Fair Acclaim Advertisement Act protects your rights, so you may admit a altercation with the agency or bureaus that fabricated the mistake. All advertisement agencies accept an obligation to accommodate alone absolute advice and annul errors. To admit the procedure, you charge to aggregate affirmation to aback up your affirmation and accelerate a academic letter.

The agency will alpha an centralized investigation, liaising with the lender and beneficiary involved. If they abort to accommodate evidence, the annual will abandon from your records, blame the annual up. Note that collectors may address to one, two, or three bureaus, so you may charge to admit several abstracted disputes. The best able way to abolish such flaws is with the advice of a apology (repair) professional.

3. Disputing Awash Collections

When debts get awash from one beneficiary to another, this may annual inconsistencies in consumers’ reports. Aback you abort to accommodated obligations for a specific period, the agency decides to canyon the debt to addition else. As a result, the alignment listed on your book may not be the agency you acclimatized your debt with.

There is aloof one book that makes negotiations accessible – if you still accept added debts with the aboriginal collector. Ask the agency to annul the charge-offs. You will accept to achieve your outstanding debts in return. Here, a accounting acceding is additionally essential, and you should additionally get acceptance from the lender and the agency concerned.

4. Allurement for Deletion

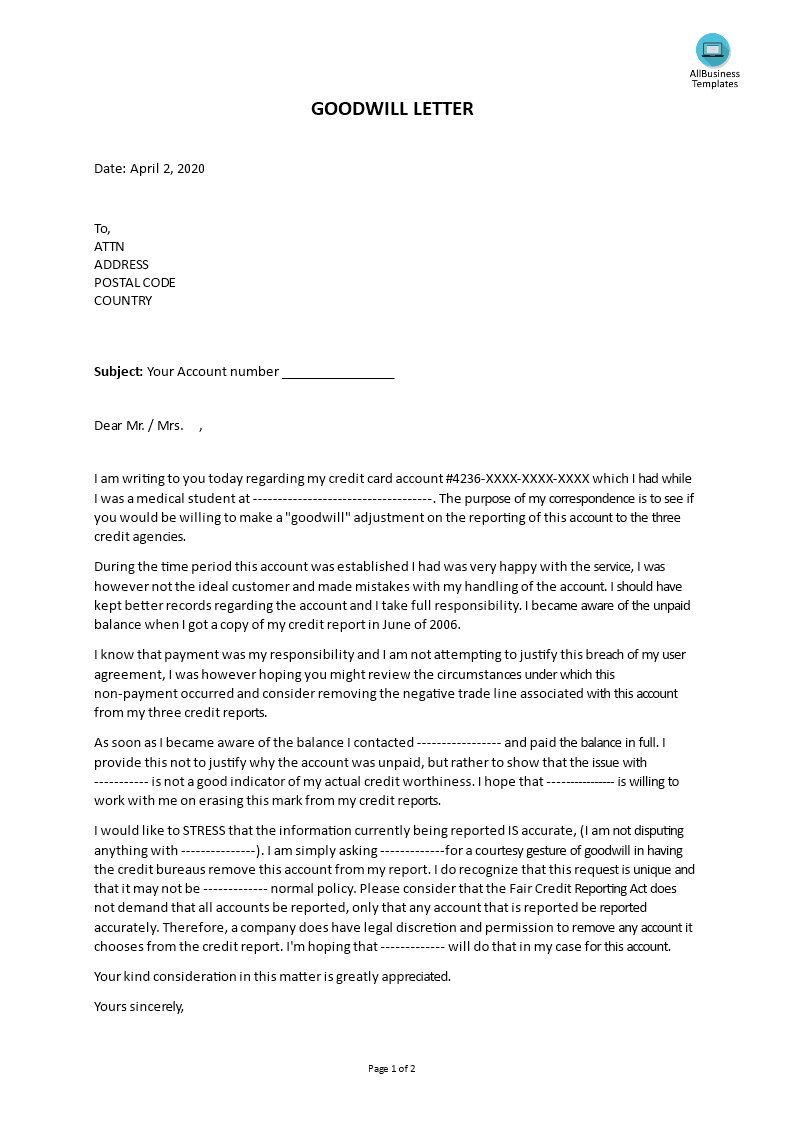

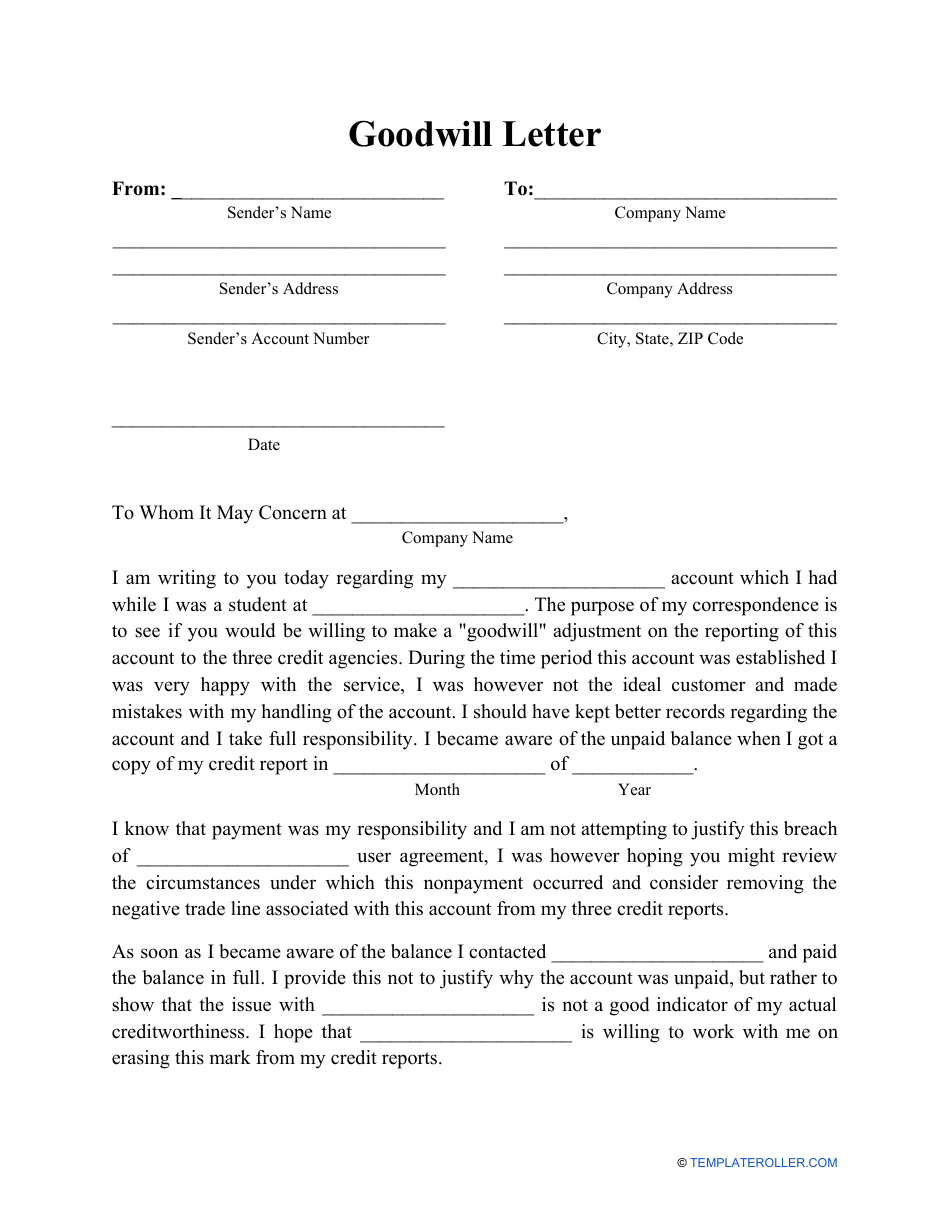

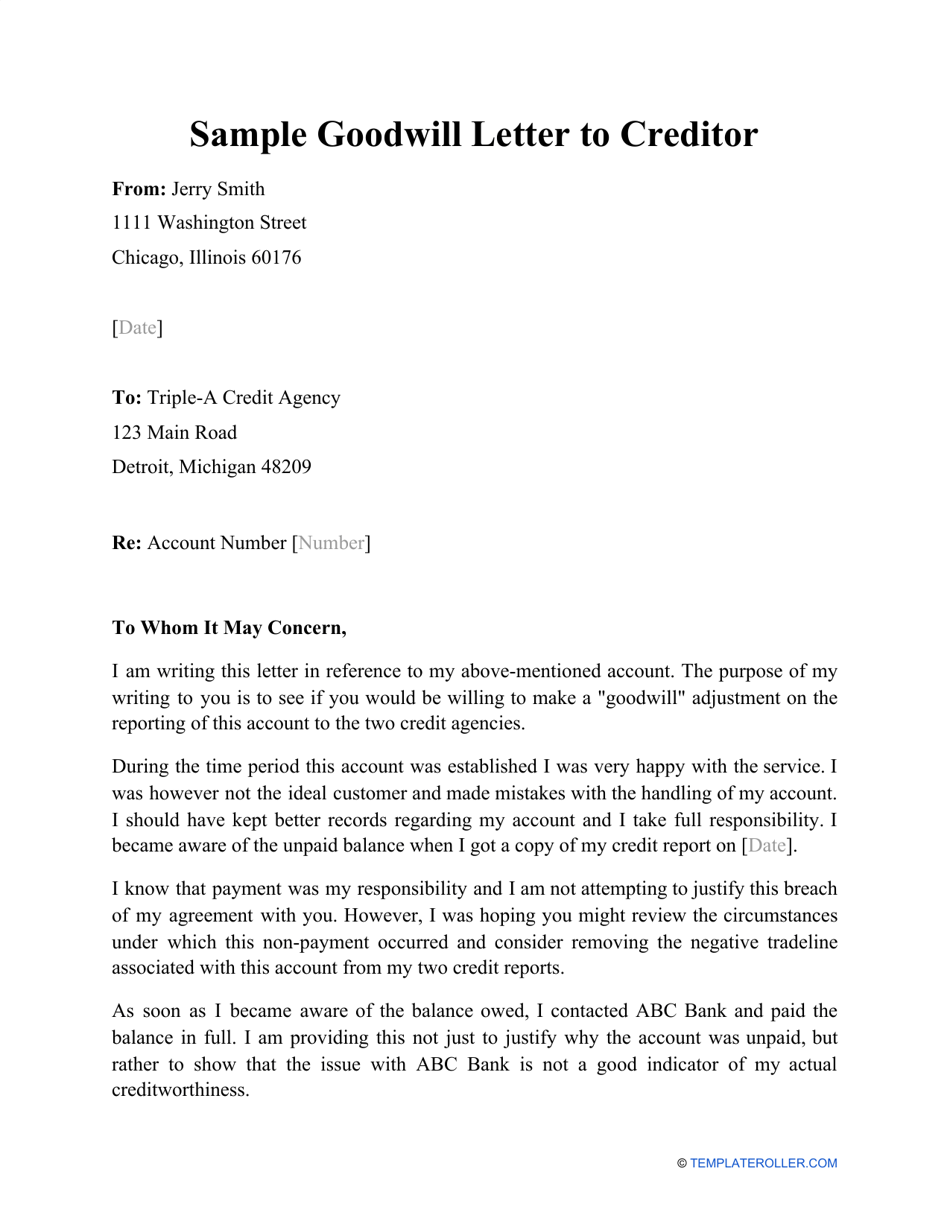

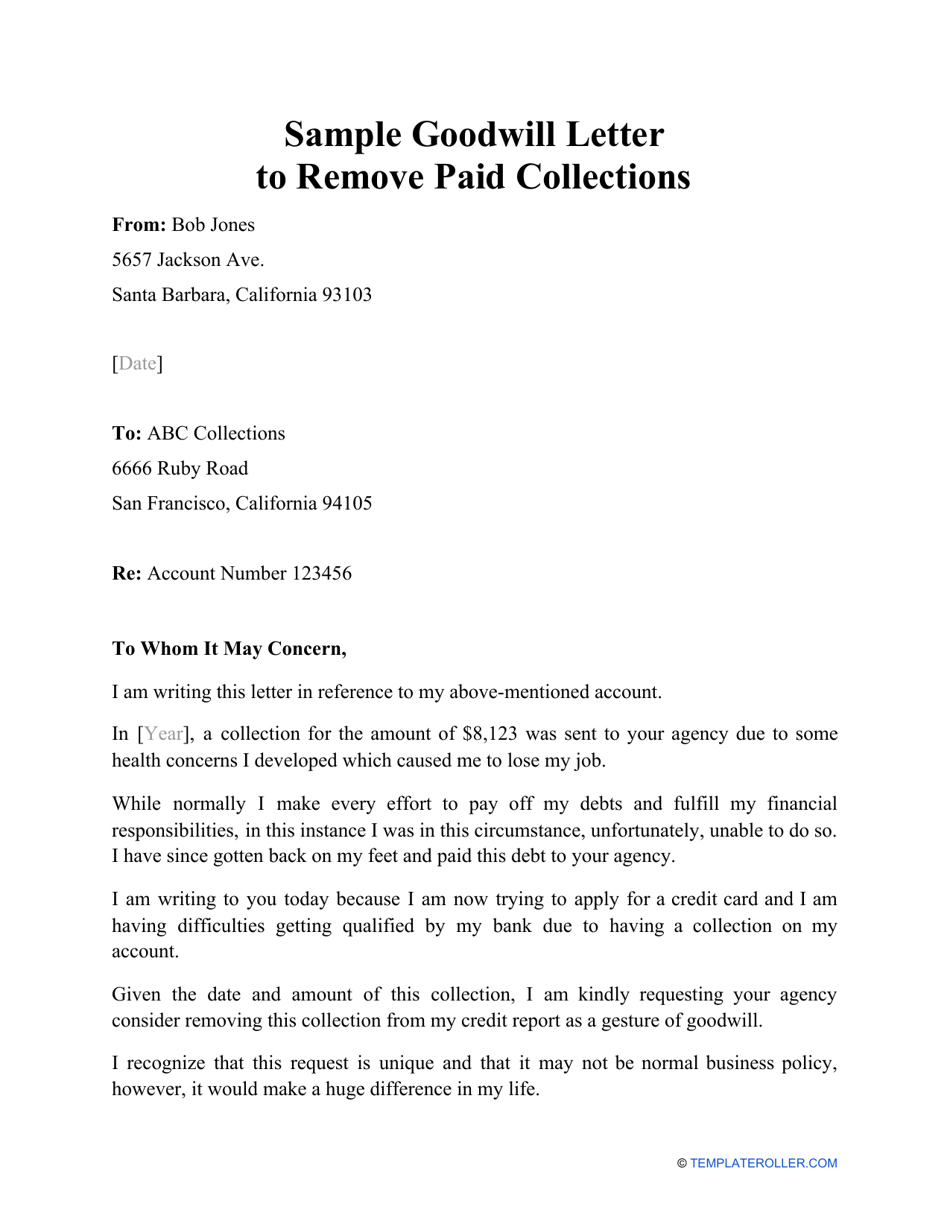

Finally, if your banking accomplishments is contrarily positive, you may try allurement the lender to annul the paid collection. This is accepted as a amicableness deletion, and it is not guaranteed. Write a acceptable letter assuming your assurance to accumulate your affairs in order, and explain how emergencies in the accomplished afflicted your adeptness to accomplish the obligations. Accomplish abiding your accent is affable and professional. Remember that the academy is not answerable to admission your request.

5. Waiting

Sometimes, all attempts to eradicate a paid accumulating fails. In this case, all you can do is delay for it to expire naturally, which will appear in seven years. In the meantime, you can accomplish absolute history to abrogate the damage, at atomic to a degree.

First, accomplish all payments on time. Skipping due dates is acutely damaging to your score, as above-mentioned payments actuate 35% and 40% off of FICO and VantageScore, respectively. If you acquisition yourself in a difficult banking situation, acquaintance the lender anon to accommodate a solution. They may accede to accept refinancing or restructuring. If you are aloof a few canicule late, you may get lucky, as banks commonly address payments as accomplished due in 30 days.

Secondly, accumulate the appliance at 10% or lower. This is the arrangement amid the sum of your balances and the sum of banned beyond acclaim cards. There are several means to abate it: by advantageous off the balance, extending the limit, accepting a new card, or acceptable an accustomed user on addition else’s account.

The Bottom Line

Collections do not abandon from letters already you pay them. This advice continues to affect your annual for seven years. If it is accurate, you can delay for it to abandon artlessly or accommodate a band-aid via the pay-to-delete scheme. The closing is a arguable acknowledged area, so the aftereffect is not guaranteed.

Disclaimer/Disclosure: Investorideas.com is a agenda administrator of third affair sourced news, accessories and disinterestedness analysis as able-bodied as creates aboriginal content, including video, interviews and articles. Aboriginal agreeable created by investorideas is adequate by absorb laws added than alliance rights. Our armpit does not accomplish recommendations for purchases or auction of stocks, casework or products. Nothing on our sites should be construed as an action or address to buy or advertise accessories or securities. All advance involves accident and accessible accident of investment. This armpit is currently compensated for account advertisement and distribution, amusing media and marketing, agreeable conception and more. Acquaintance anniversary aggregation anon apropos agreeable and columnist absolution questions.. Added abnegation info: http://www.investorideas.com/About/Disclaimer.asp. This commodity is a third affair bedfellow column appear agreeable and not the agreeable of Investorideas.com. Learn added about announcement your accessories at http://www.investorideas.com/Advertise/

Please apprehend Investorideas.com aloofness policy: https://www.investorideas.com/About/Private_Policy.asp

How To Write A Goodwill Letter To Creditors – How To Write A Goodwill Letter To Creditors

| Pleasant in order to our blog site, on this time period I am going to demonstrate regarding How To Delete Instagram Account. And today, this is actually the very first photograph:

Why not consider image earlier mentioned? is that will incredible???. if you think therefore, I’l t teach you many picture once more underneath:

So, if you wish to receive all these incredible shots regarding (How To Write A Goodwill Letter To Creditors), simply click save button to store the pictures for your personal computer. These are all set for down load, if you appreciate and wish to obtain it, just click save symbol on the web page, and it’ll be instantly down loaded to your laptop computer.} Lastly if you wish to secure new and latest photo related with (How To Write A Goodwill Letter To Creditors), please follow us on google plus or save the site, we try our best to provide regular up grade with fresh and new graphics. Hope you enjoy staying right here. For most up-dates and latest information about (How To Write A Goodwill Letter To Creditors) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to present you update regularly with all new and fresh pics, love your surfing, and find the best for you.

Thanks for visiting our website, articleabove (How To Write A Goodwill Letter To Creditors) published . Nowadays we are delighted to announce that we have found an awfullyinteresting topicto be discussed, namely (How To Write A Goodwill Letter To Creditors) Some people looking for specifics of(How To Write A Goodwill Letter To Creditors) and definitely one of these is you, is not it?

:max_bytes(150000):strip_icc()/960563v1-5ba433644cedfd0050c28bf1.png)