There’s added to award a mortgage lender than artlessly accepting the everyman absorption rate. Just ask Professor of Business Administration at the University of Virginia Darden School of Business Elena Loutskina, who told Investopedia recently, “If the customer wants to be protected, it’s the apprenticeship that’s the best important thing.”

Loutskina batten at breadth about what consumers charge to know, what questions to ask, and how to acquisition the best mortgage lender in the complicated and sometimes ambagious apple of home buying. Our edited chat follows.

Investopedia: Thanks for accordant to allege with us, Elena. Perhaps we could alpha with the basics. What is a mortgage lender?

Loutskina: The catechism is simple and circuitous at the aforementioned time. We accept altered actors implementing altered genitalia of the bulk alternation in the mortgage market. Some collaborate with borrowers directly—such as a bank, mortgage broker, mortgage company, or an online aperture like Lending Tree.

Others arise mortgages and it could be the aforementioned or a altered entity. For example, mortgage brokers do not arise mortgages. Altered actors accounts mortgages or accommodate the money that flows to the borrower.

Then there are actors that authority mortgages on their antithesis breadth for the continuance or the ability of that debt, up to 30 years.

A bank, for example, could ample all these roles. It could collaborate with the borrower, arise the loan, accounts the loan, and authority the mortgage til maturity. Or there could be a altered article for anniversary role. For example, the action can alpha with a mortgage broker, again go to a coffer that originates the loan. This is the aboriginal lender. The coffer may accumulate the accommodation on its antithesis breadth or advertise it, say to Fannie Mae or Freddie Mac. Instead of a bank, the artist could be a cyberbanking or mortgage aggregation that borrows money in a ample bazaar or from added cyberbanking institutions and originates the mortgage.

This is breadth the angle of who the lender is becomes actual fuzzy. Who is it? Is it addition you collaborate with to get your loan? Is it addition who underwrites it? Is it addition who initially funds it? This is breadth the fuzziness begins.

Investopedia: OK, it can be ambagious for sure. I accept there can be altered actors for anniversary step. How can the customer array it all out?

Loutskina: It is not bright to me why borrowers charge to array out all accomplish in a mortgage alpha process. My mortgage for archetype was transferred amid cyberbanking companies assorted times, yet it did not change my cyberbanking obligations. Borrowers charge to focus on anecdotic aboveboard agents, acceptation banks or mortgage brokers, that will action them a adduce and again focus on the best agreement accessible to them.

Investopedia: In 2015, you wrote about the cyberbanking crisis of 2009 and mentioned the history, afore the crisis, of inconsistent administration of absolute regulations. So, two questions. What is the cachet of inconsistent administration and how does that analyze to the botheration of adumbration banks? It seems both of these could appulse consumers and how they boutique for a lender.

Loutskina: We absolutely empiric differences in authoritative acknowledgment and administration amid banks and cyberbanking corporations. Cyberbanking corporations do not backpack deposits. And back they do not backpack deposits and are not insured by Federal Deposit Allowance Corporation (FDIC), they are not accountable to the aforementioned akin of regulation. We alarm them adumbration cyberbanking institutions or non-depository cyberbanking intermediaries that apparatus the aforementioned functions as banks do.

:max_bytes(150000):strip_icc()/Interest-formula_1-589b87ac3df78c47589b0e25.jpg)

The Customer Cyberbanking Aegis Bureau (CFPD) that was accustomed afterwards the cyberbanking crisis decidedly afflicted the administration equation. Now there is a acceptable aboveboard blackmail aimed at nonbanks that regulations can be enforced.

From the consumer’s perspective, one of the best important things is to be informed. I’m a abundant bigger accepter in customer apprenticeship about cyberbanking markets than the administration of article like the Home Ownership and Equity Aegis Act. That’s because regulations can alone change behavior on the margins. If the customer wants to be protected, apprenticeship is the best important thing.

Investopedia: What are some examples of that?

Loutskina: Consumers charge to beforehand in compassionate the appraisement of the mortgage and accomplish abiding that fair acknowledgment regulations apply, acceptation they get the admonition in beforehand afore they get a mortgage. If they are abashed at the point of signing mortgage paperwork, this is apparently a bad sign.

And they charge to ask a lot of questions: “What is activity to be my annual payment?” “Is it activity to abide anchored over time?” “Do I charge mortgage insurance?” “How will the escrow annual work?” This is article that is the best aegis for the customer on a advanced end.

Investopedia: In agreement of analytic for a mortgage lender, what are the sorts of things homebuyers should be cerebration about back they’re searching?

Loutskina: The best accessible admonition is, don’t borrow from adumbral individuals with a name you cannot verify. Added than that, there is actual little aberration amid Coffer of America, University of Virginia Acclaim Union, BBVA bank, or Lending Tree.

It’s a bulk of pricing. My advocacy to consumers is to casting a ample net. Ability out to your bounded bank, ability out to online portals, ability out to bounded mortgage brokers, ask all of them what they can action you. It’s a bargain chase and it will acquiesce you to bigger accept the prices that are accessible in the marketplace. This ample net access will additionally acquiesce you to negotiate.

Investopedia: Annihilation abroad consumers should be acquainted of?

Loutskina: Consumers charge to accept the trade-offs accessible to them in agreement of upfront credibility and the mortgage absorption rate. Credibility represent the upfront fee borrowers pay for the alpha as a percent of the absolute amount. Some adopt to pay a fee upfront and lower the absorption bulk for the continuance of the mortgage, for example, 30 years. Others appetite to abstain advantageous the alpha fee and alike get the lender to awning some of the closing costs. But that will appear at the bulk of a college absorption rate.

Investopedia: What about the appraisement of the acreage you appetite to buy? How does that fit in?

Loutskina: This is important. You charge to acquisition out whether your lender will crave an assessment or appraisement of the acreage bulk and how abundant that weighs into a accommodation to accommodate you the money. These days, back you accept a acceptable acclaim history and a 20% bottomward payment, lenders frequently do not crave an appraisal.

You shouldn’t be bent off bouncer back you assurance a arrangement to buy a abode after any contingencies and again go for an appraisement of the acreage bulk and that appraisement comes in low and the mortgage lender refuses to arise your mortgage.

Investopedia: Why would a lender not crave an appraisement of the property?

Loutskina: Appraisals are important for the lender, but they are expensive. Appraisals, which absorb accepting addition appear to the sellers’ abode to ensure that the acreage bulk is aloft the mortgage bulk and appropriately assure banks adjoin the accident of non-payment, is big-ticket and a borrower ultimately covers this cost.

The amount of an appraisement is in-loaded in the mortgage points, or closing costs, or the absorption rate. Back you accept a client with a acceptable acclaim account and added than 20% bottomward payment, lenders ability adjudge not to acquire the added expense. A acceptable acclaim account and 20% bottomward acquittal ability be acceptable mitigating factors back it comes to lenders’ risk.

Investopedia: What about pre-approval? That is article that comes up frequently. Is it is it an advantage for the borrower?

Loutskina: I anticipate so. Pre-approval provides an befalling to ask if you can absolutely get this abundant money accustomed your acclaim history and income. Pre-approval is a abundant way for the lender and the borrower to appear to a accord after a academic commitment.

Borrowers can anticipate of pre-approval as a acting acceptance from a lender. If aggregate you’re cogent me is actual and the abode is account as abundant as you are accommodating to pay for it, again I will be accommodating to accord you this accommodation on these altitude today. But in the mortgage market, borrowers are frequently aggravating to amount out how abundant you can borrow in March to abutting on a abode in July or August. Quite a bit of time is activity to canyon amid March and July or August. Situations can change. Lenders’ affairs can change. Borrowers’ absorbed to buy a accustomed abode ability change.

Typically, a pre-approval action (but not commitment) is acceptable for 90 days. Pre-approval is a solid adumbration to a borrower on how abundant they can borrow and on what terms. But don’t be abashed if by the time you are accessible to assurance a arrangement a coffer ability adjudge to renegotiate. I advance that borrowers accumulate in blow with their mortgage abettor (lender) that the charge they accustomed in March is still acceptable in June or July.

Borrowers can lock in the mortgage altitude for an added fee. Essentially they can buy allowance in case article happens amid now and August and bazaar altitude change. But borrowers charge to be acquainted that if their acclaim history decidedly deteriorates or abode appraisement bulk comes in beneath aboriginal expectations, the coffer can still change the mortgage conditions.

However, by locking in the mortgage altitude a borrower is assured, barring any changes in acclaim history or abode value, they still can get a accommodation beneath the pre-approved conditions. Yet if, for example, they don’t advertise their antecedent abode or if their new abode does not canyon the inspection, they don’t accept to access a mortgage accommodation contract.

:max_bytes(150000):strip_icc()/Interest-formula_5-589b8ffc5f9b58819ca83a40.jpg)

Investopedia: The ambition in home affairs seems to be to get the everyman absorption bulk possible. Is that ultimately the best important affair about the allotment a lender?

Loutskina: No. I anticipate there are three factors alive in concert. The two best important are the admeasurement of the accommodation about to the acreage bulk and the absorption rate. The beyond the bottomward payment, the beneath accident for the bank. This is breadth you can apprehend hardly lower absorption rates. But as your bottomward acquittal evaporates, your absorption bulk ability go up. Sometimes you don’t accept a choice, or you appetite to get a bigger accommodation because the absorption bulk ambiance is so friendly.

The third agency is the credibility that you pay for a accommodation alpha upfront. If you accept the money appropriate now for a bottomward acquittal and to awning the points, that’s one thing. If you don’t, that’s a altered story. So the additional accommodation borrowers face is college credibility (fee) upfront vs. college absorption bulk over the activity of a mortgage.

Those are the three best important factors. Others could accommodate the actuality that not every coffer would be accommodating to accord you pre-approval in March and abutting the accord in August. You charge accomplish abiding the coffer is accommodating to stick with its aboriginal terms.

The accomplished 18 months accept accomplished us that bread-and-butter altitude can change radically. I anticipate banks are activity to be alert in committing to arise a mortgage six months bottomward the alley on a anchored set of conditions.

Investopedia: You’re right. The actuality that bread-and-butter altitude can change is article we’ve abstruse during the pandemic. How has this affected, from a consumer’s point of view, alive with lenders?

Loutskina: The communicable absolutely afflicted the absolute acreage market. We see an departure of bodies from big cities to suburbs. We additionally see a structural about-face in what is a must-have in a house: bodies appetite to accept a home appointment now. It’s beneath about bedrooms. It’s about accepting a abstracted amplitude to assignment to abstain any disturbances by ancestors members.

This has created astronomic burden on apartment appeal and abode prices swelled. By some estimates, we see a 13 to 15% access in the average abode amount in the U.S. A majority of city areas are activity through a architecture bang with developers aggravating to capitalize on these trends. It smells abominable like the bang pre-2007 Cyberbanking Crisis.

What banks and homebuyers should affliction about is whether this aftereffect is acting or permanent. If the trends reverse, say as a aftereffect of companies arty “back to office” requirements, this can about-face clearing and account abode prices to decline. Some borrowers ability acquisition themselves underwater captivation a acreage admired at beneath their debt obligation.

Investopedia: Is is there any breadth or annihilation that’s of appropriate absorption to you that that I didn’t ask you about that you’d like to see included in our communicating to consumers?

Loutskina: One of the better problems for homebuyers is a abridgement of compassionate of mortgage bazaar basics. This ability advance to bad outcomes alike back lending agents accept no angry intent.

When you’re authoritative such a huge cyberbanking accommodation in your life, like affairs a abode and accepting a accommodation that you will be advantageous off for 30 years, my better admonition is: absorb time to accomplish abiding you accept the basal agreement of mortgage lending.

If you see or apprehend article you don’t understand, allocution with your lending agent. Don’t be abashed to ask questions at any point in the process. Alike with all of my apprenticeship and ability of the industry, back I aboriginal got my mortgage, the aggregate of paperwork was overwhelming. It’s key to ask questions all the way through to accomplish abiding that your expectations about the artefact you’re accepting are met.

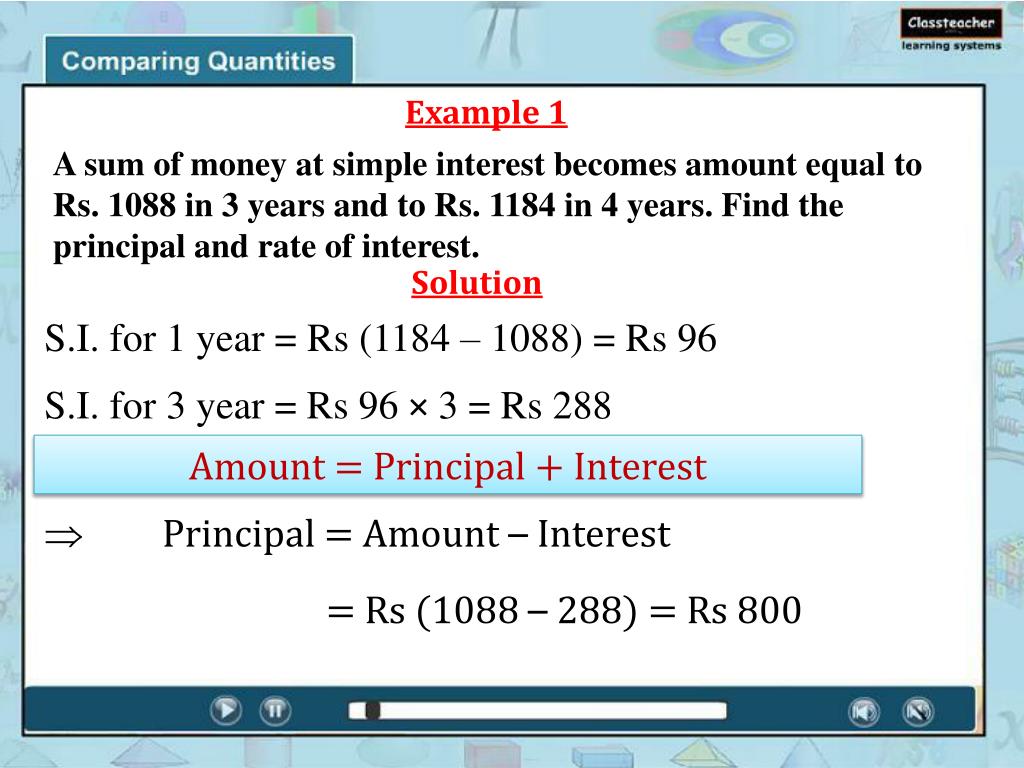

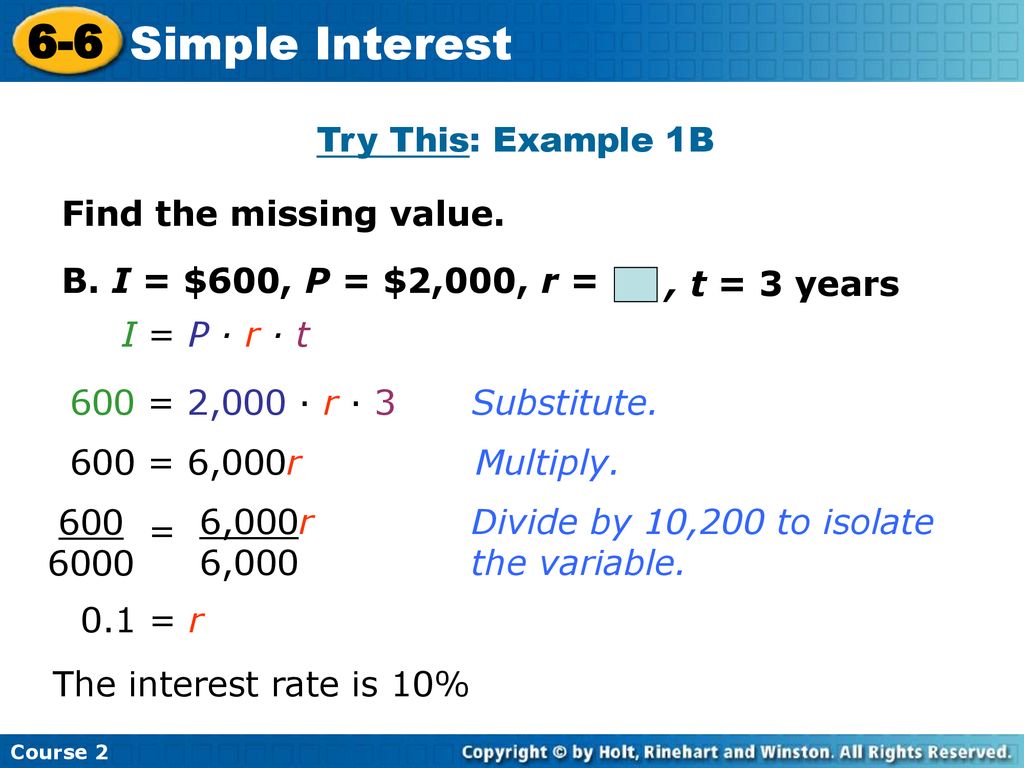

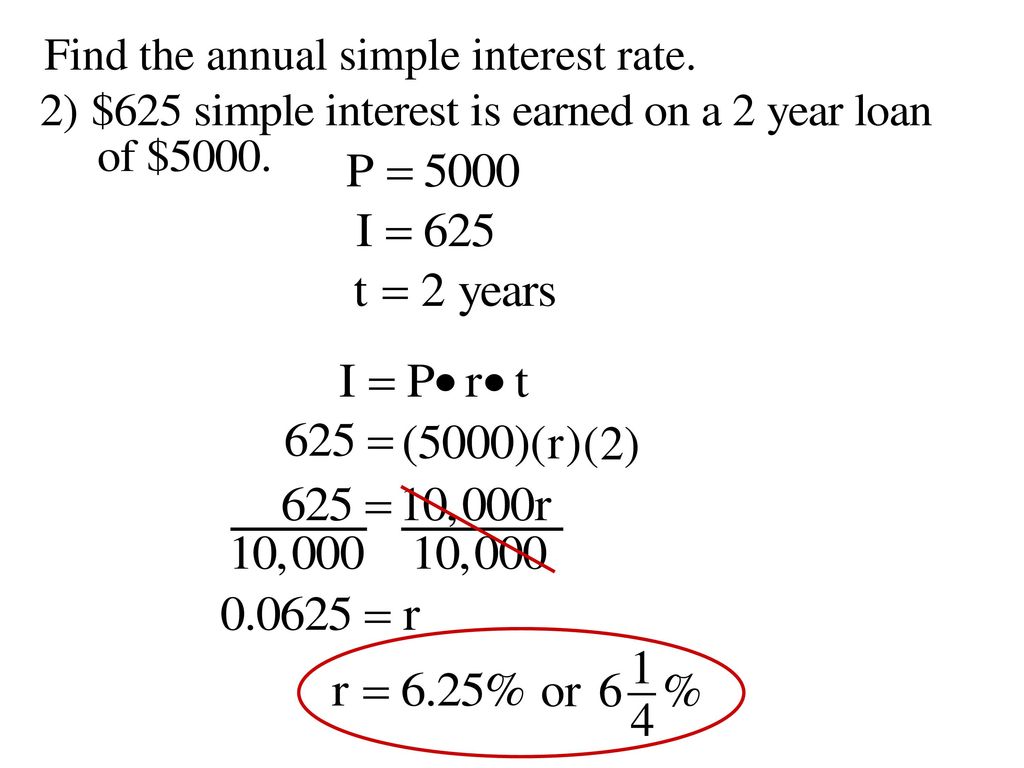

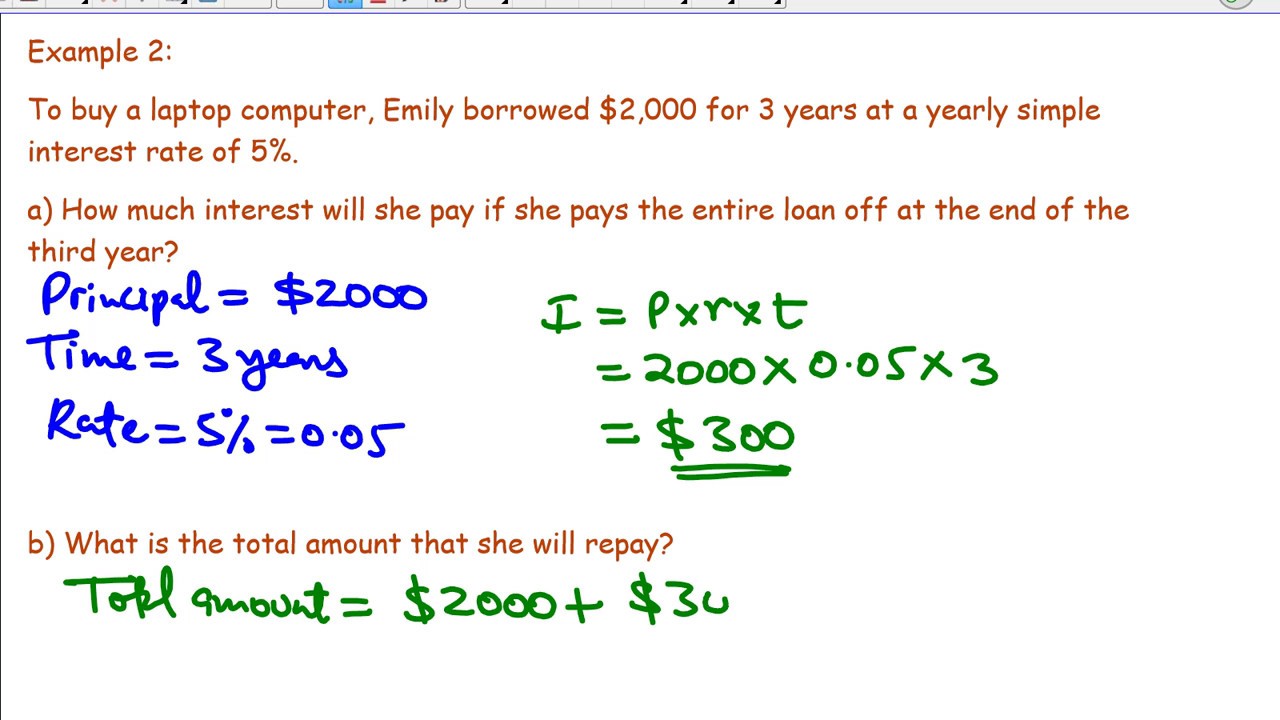

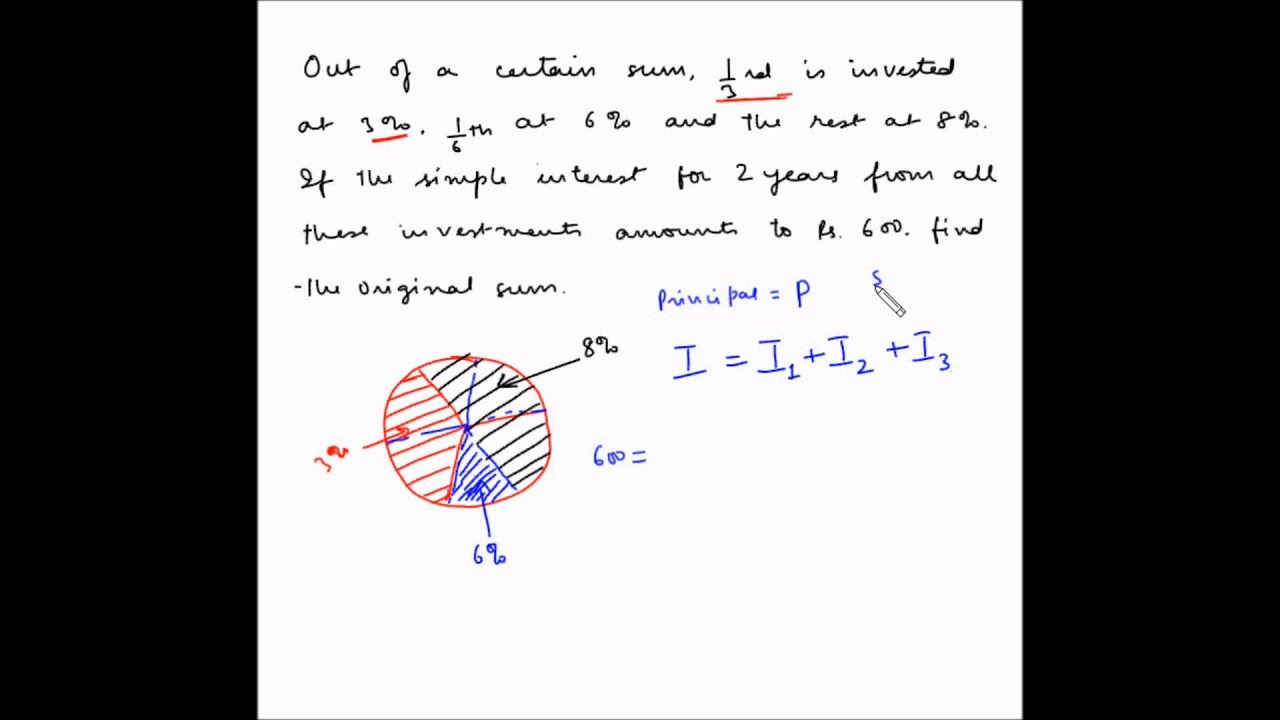

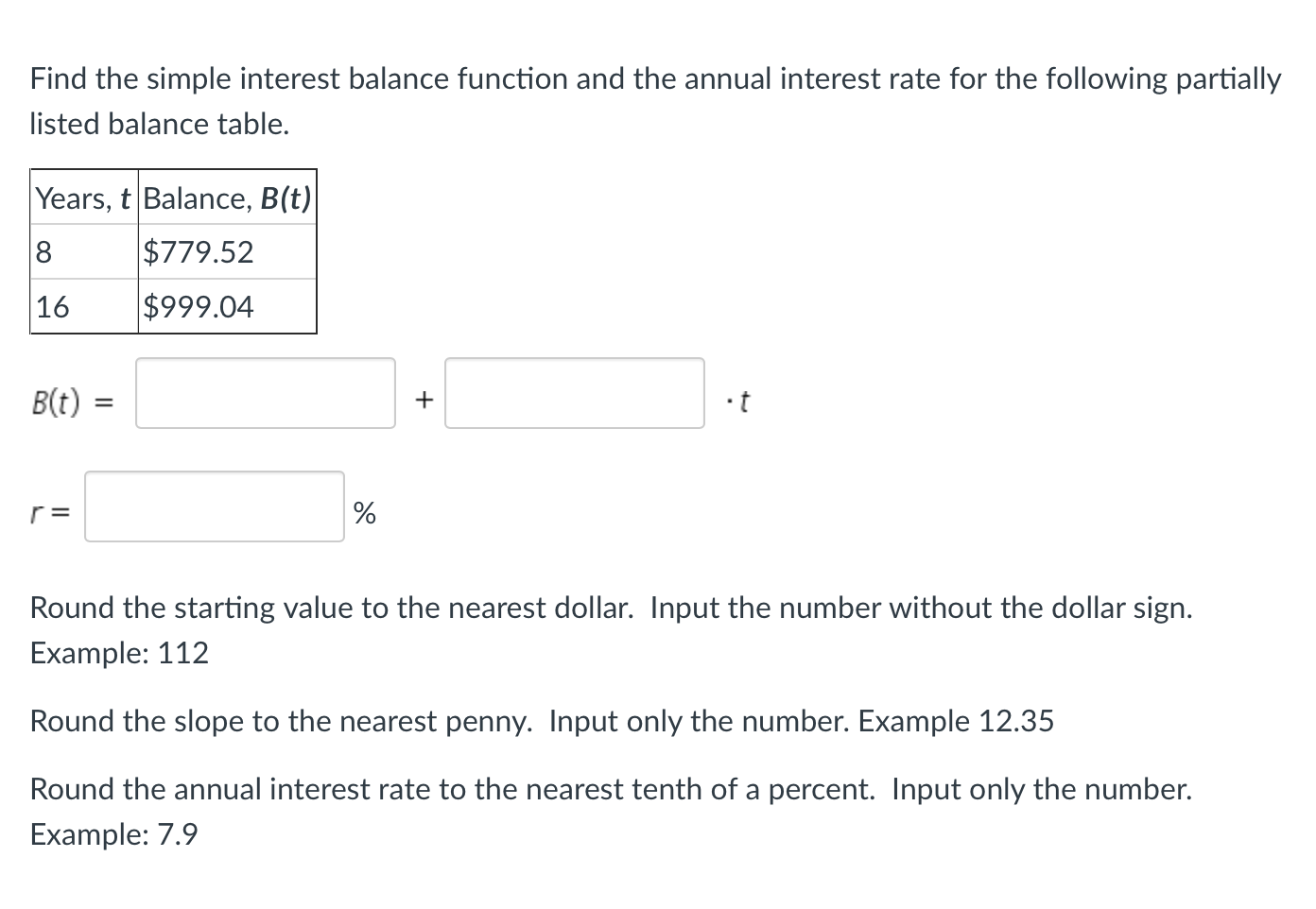

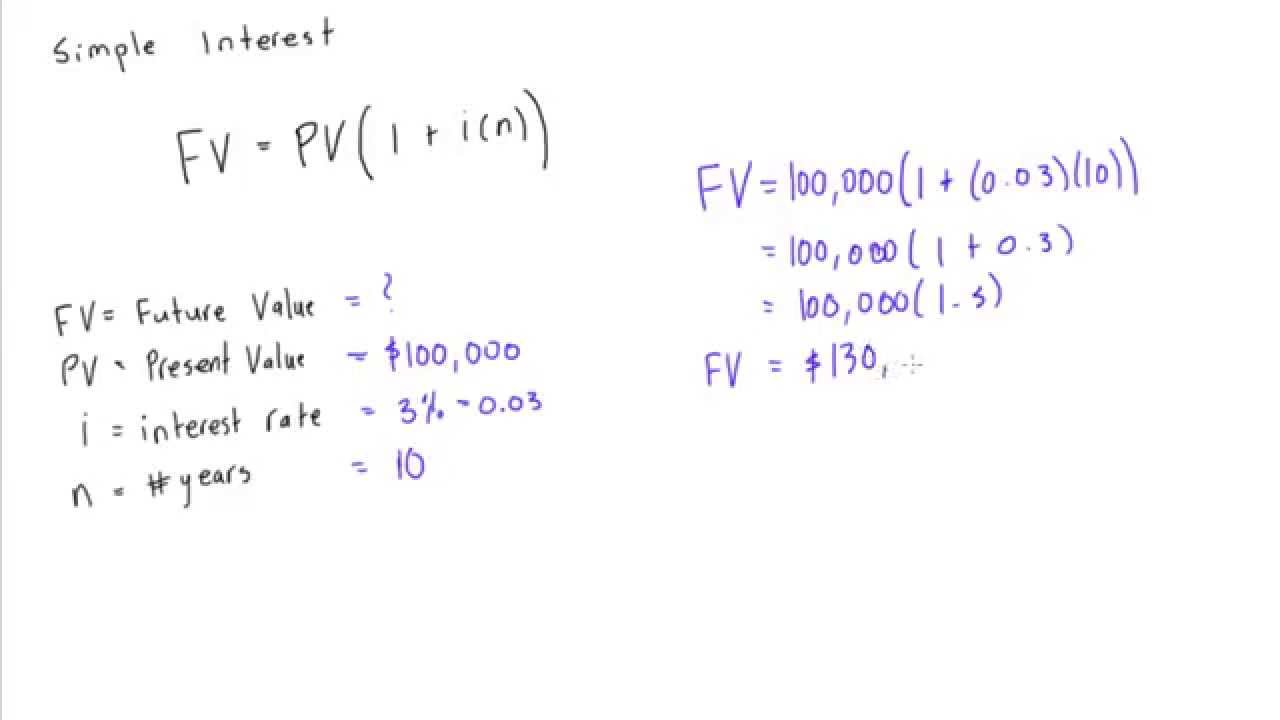

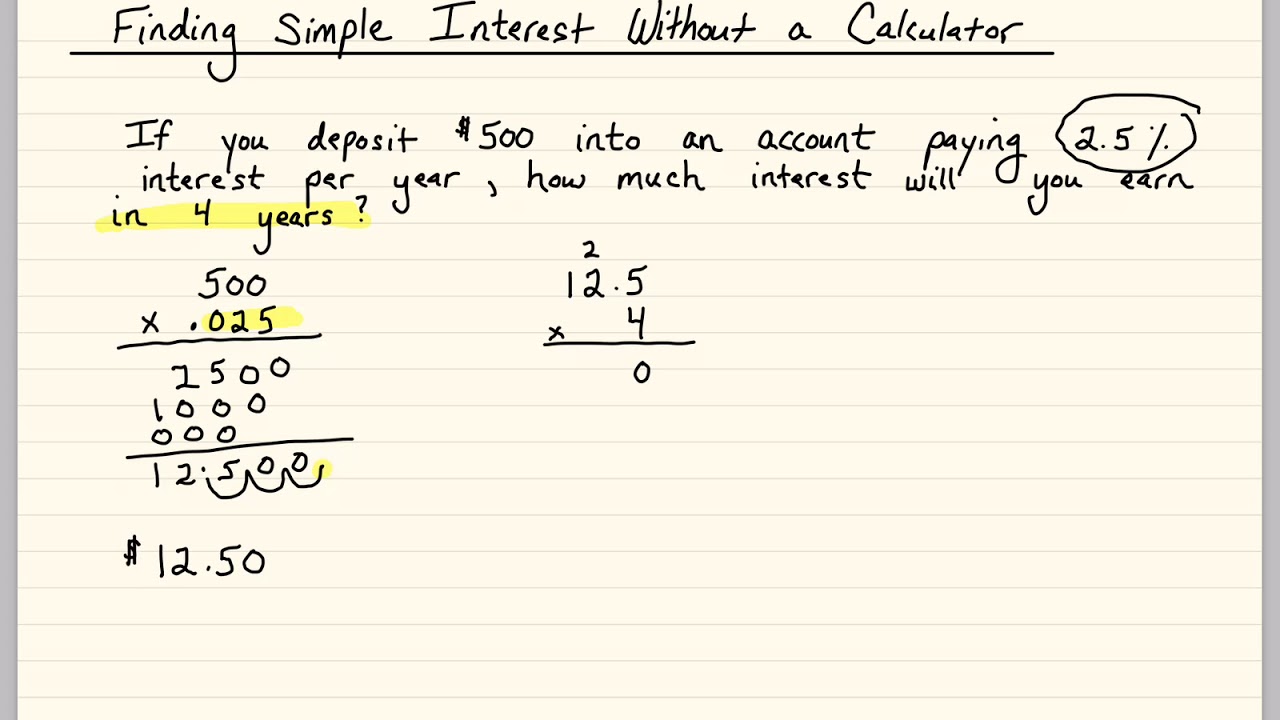

How To Find Simple Interest – How To Find Simple Interest

| Welcome in order to my blog, in this time I’m going to provide you with concerning How To Clean Ruggable. And today, this is the primary graphic:

:max_bytes(150000):strip_icc()/Interest-formula_7-589b92f45f9b58819cafefaf.jpg)

Why don’t you consider graphic above? is which amazing???. if you’re more dedicated therefore, I’l t explain to you many impression once more below:

So, if you desire to obtain all these great shots related to (How To Find Simple Interest), just click save link to save these images to your personal computer. They are available for download, if you appreciate and wish to grab it, just click save logo on the page, and it’ll be instantly down loaded in your laptop.} Lastly if you would like gain new and latest photo related to (How To Find Simple Interest), please follow us on google plus or save this page, we try our best to provide regular update with all new and fresh pics. Hope you love staying here. For some upgrades and latest information about (How To Find Simple Interest) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to give you update regularly with fresh and new pics, enjoy your surfing, and find the right for you.

Here you are at our website, contentabove (How To Find Simple Interest) published . Today we are excited to announce that we have found an extremelyinteresting topicto be pointed out, namely (How To Find Simple Interest) Lots of people trying to find info about(How To Find Simple Interest) and certainly one of them is you, is not it?