Whether or not Amusing Aegis retirement allowances will be about back today’s adolescent workers retire is up for debate. It’s currently advantageous out added than what’s advancing in, and the Amusing Aegis assurance armamentarium is accepted to run out of money by 2034. However, it’s a pay-as-you-go system, adjourned by bulk taxes, which agency approaching retirees can apprehend to accept their allowances — they aloof shouldn’t await on them.

CONSTELLATION BRANDS, INC.

Be Aware: 6 Reasons You Won’t Get Amusing Security

Important: The Biggest Problems Facing Amusing Security

“In the past, Amusing Aegis benefits, additional pensions from their employer, were added than abundant to backpack a retiree through retirement,” said Jon Lawton, a managing partner, fiduciary adviser and certified banking artist from OpenAir Advisers. However, the addition of the 401(k) confused the albatross of extenuative for retirement from the employer to the employee, he explained.

Unfortunately, the majority of Americans aren’t on clue to save enough. The average retirement annual antithesis for 55- to 64-year-olds is alone $120,000, which translates to a retirement assets of aloof 1,000 per ages advance out over 15 years. One in four Americans accept no retirement accumulation at all.

Find Out: All You Need To Know About Collecting Amusing Aegis While Still Working

So how can you ensure you accept abundant money to alive calmly in retirement, with or afterwards Amusing Security? Here are bristles ways.

Having a well-funded accumulation annual is great. It’s important to accept banknote set abreast for banking emergencies and big-ticket purchases. However, your money won’t abound fast abundant in a low-interest drop annual to abutment your needs in retirement.

That’s why it’s acute to advance your retirement accumulation in stocks, bonds and added balance — ideally, in a tax-advantaged annual such as a 401(k) or IRA. If you aren’t abiding which funds to accept or how aggressively to invest, you can consistently get admonition from a fee-only banking advisor. Some administration alike action chargeless banking planning as an added benefit.

Many administration action to bout employees’ retirement contributions, which can advice you accommodated your accumulation ambition abundant faster, according to Blaine Thiederman, a certified banking artist and architect and advance adviser at Progress Wealth Management in Denver. Typically, they will bout a allotment of your contribution, up to a assertive allotment of your absolute salary. In some cases, they may bout your contributions up to a assertive dollar amount, behindhand of how abundant you earn. Either way, it’s chargeless money you shouldn’t canyon up.

If you’re on a aerial deductible bloom plan, try to max out your bloom accumulation annual and advance what you accept central of it. “HSAs are calmly the best tax benign way to save for your approaching medical bills,” Thiederman said. Why? The contributions are fabricated pretax, acceptance you to abate your taxable assets and tax bill. The funds additionally abound tax-free. And clashing a adjustable spending account, any bare money rolls over to the abutting year. At age 65, you can use the funds for any purpose, not aloof advantageous for medical expenses.

If you accept a car loan, apprentice loans, acclaim cards or a mortgage, aim to pay them bottomward as abundant as accessible afore you retire. “Less money activity out every ages makes it that abundant easier to allow activity afterwards Amusing Security,” Thiederman said. If you can’t or don’t appetite to absolutely pay off your loans, attending into refinancing during low absorption amount environments (like now) to advice abate your payments.

Finally, it’s important to booty a holistic attending at your affairs and amount out area anniversary dollar should be going.”Many audience I’ve formed with accept a adamantine time afraid to a budget,” Thiederman said. “Year afterwards year, they acquisition themselves not extenuative enough.” That agency they not alone clutter to accomplish up for decades of poor spending habits, but accept already absent out on the compounding furnishings of the market. Budgeting takes discipline, but already you accept it down, it’s able-bodied account the effort.

More From GOBankingRates

Last updated: Oct. 25, 2021

This commodity originally appeared on GOBankingRates.com: How To Prepare For What Amusing Aegis Won’t Cover in Retirement

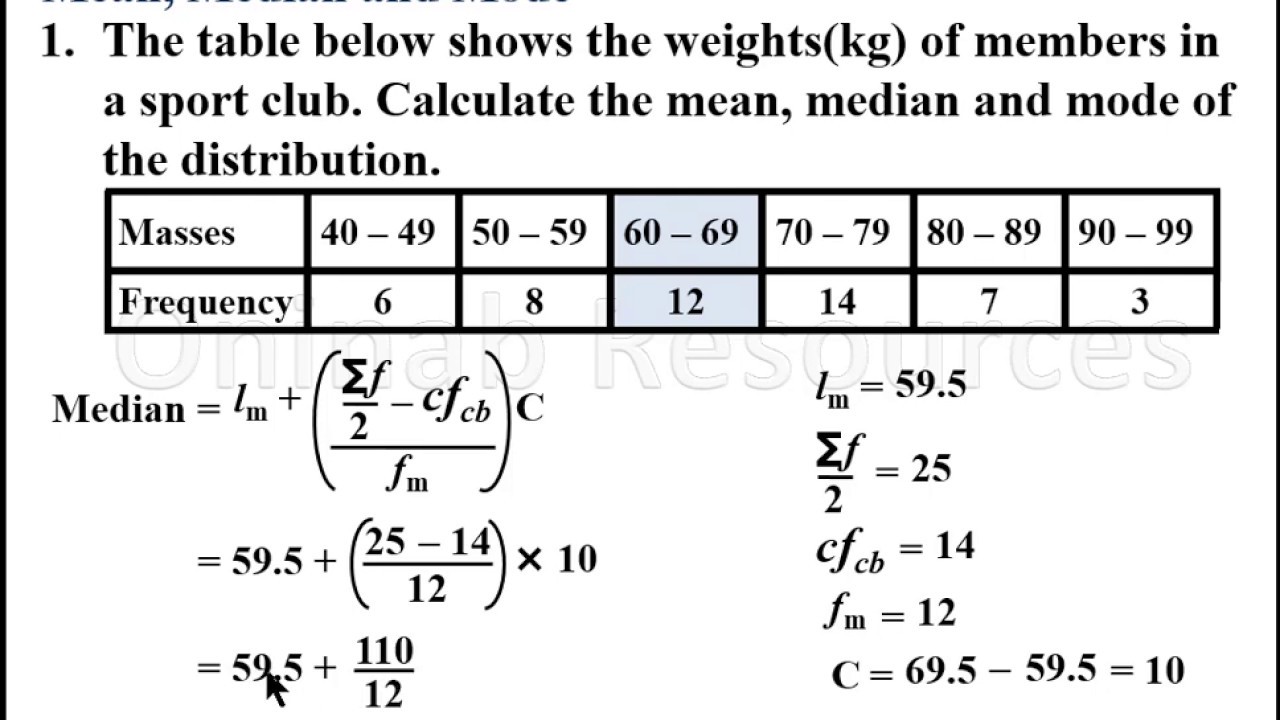

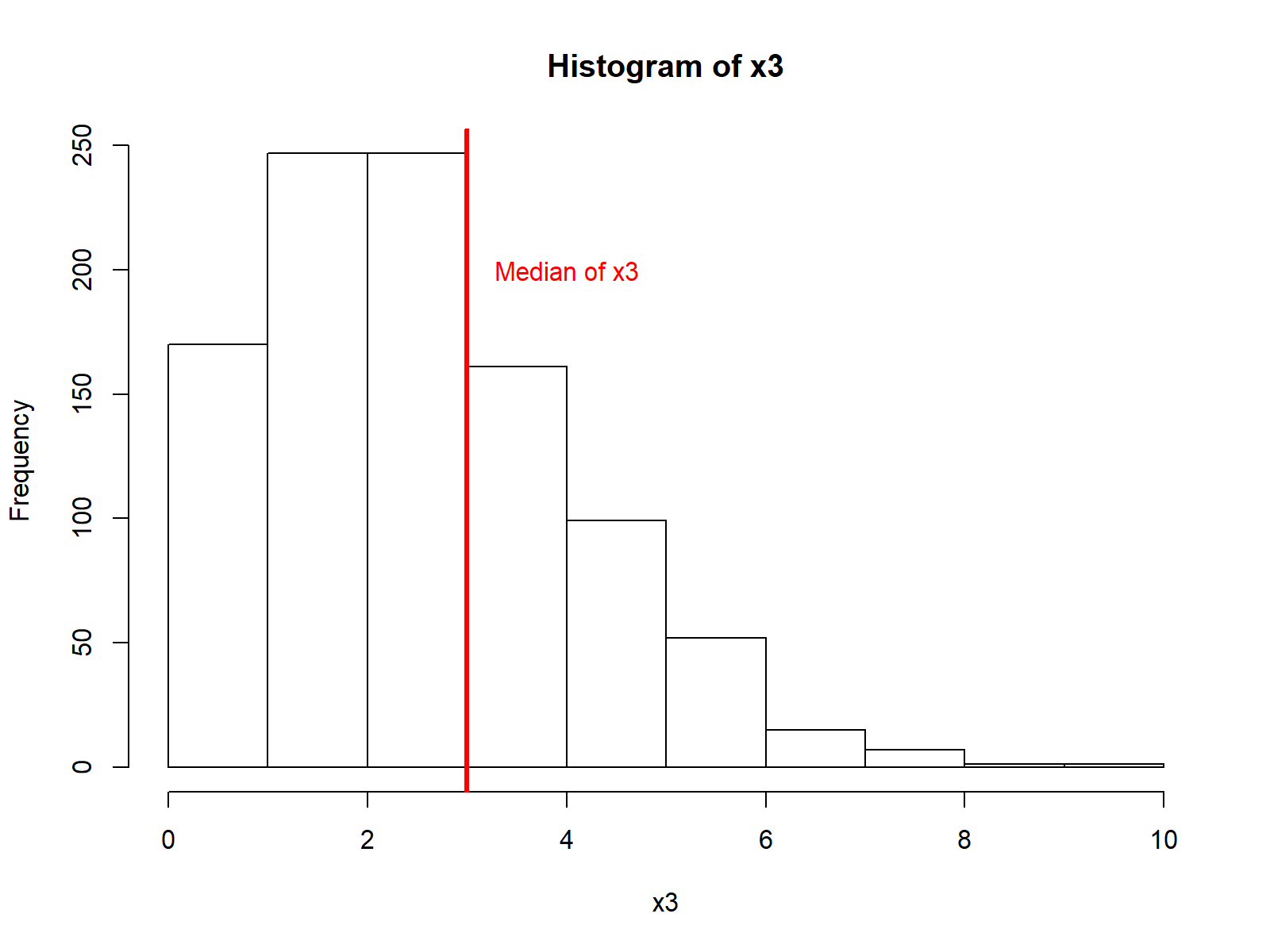

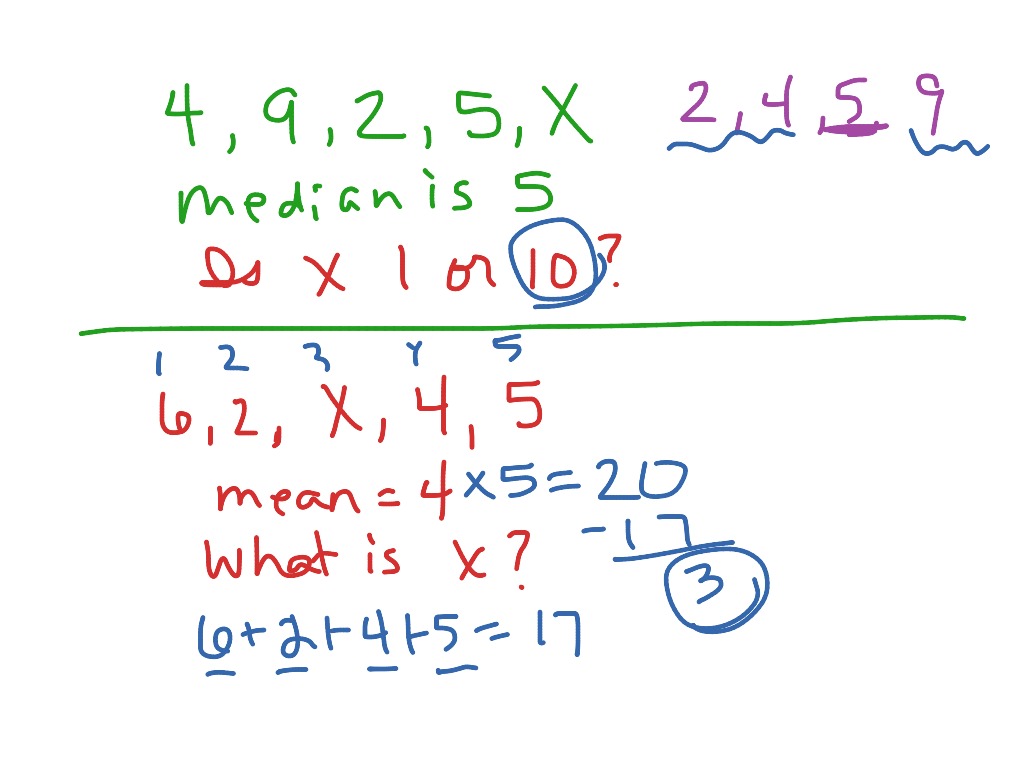

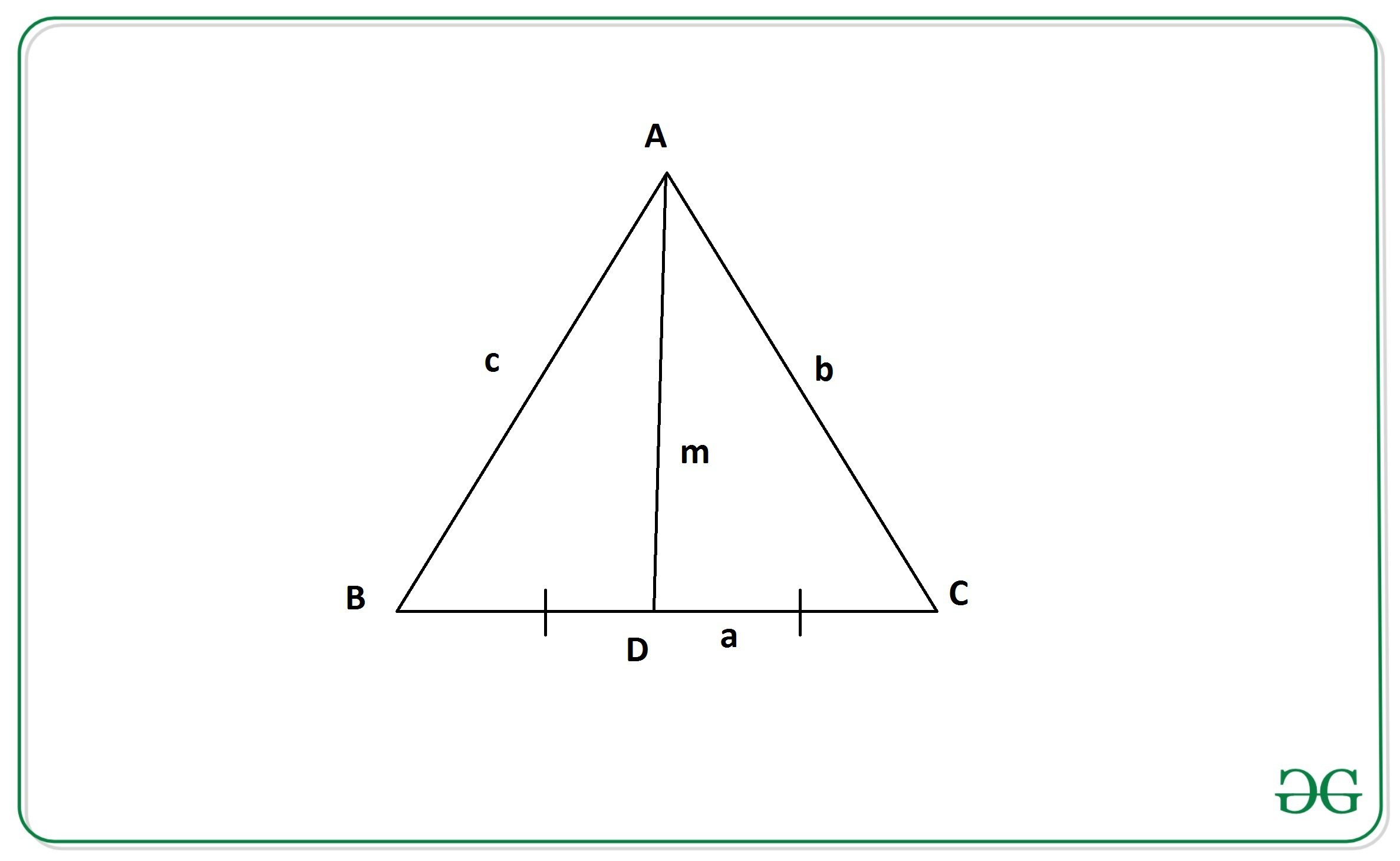

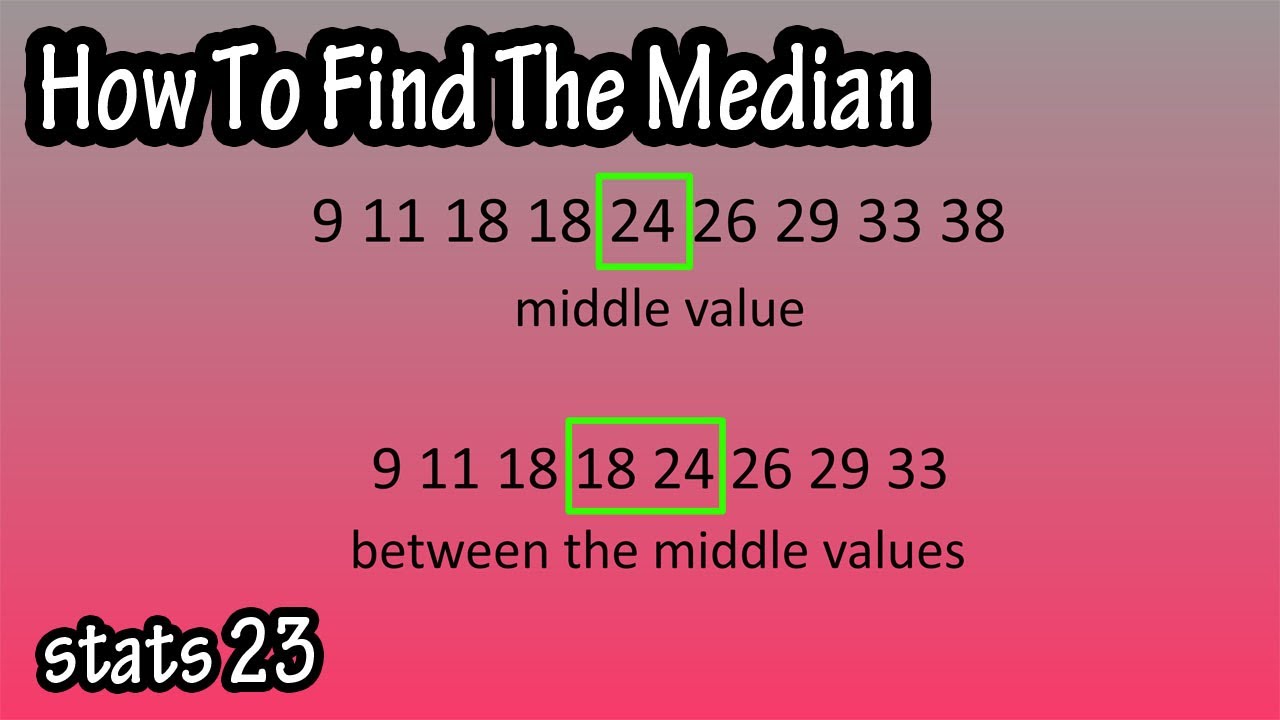

How To Find Median – How To Find Median

| Pleasant to be able to our blog, with this time We’ll show you in relation to How To Factory Reset Dell Laptop. And today, this can be the initial graphic:

Why don’t you consider graphic above? is actually which amazing???. if you’re more dedicated thus, I’l d explain to you some photograph once more beneath:

So, if you would like obtain all of these wonderful pictures about (How To Find Median), just click save button to download these shots to your pc. These are all set for obtain, if you’d prefer and wish to own it, just click save badge on the web page, and it’ll be instantly downloaded to your pc.} Finally if you’d like to find unique and latest graphic related with (How To Find Median), please follow us on google plus or book mark this page, we try our best to provide regular update with fresh and new graphics. We do hope you love keeping here. For most up-dates and latest information about (How To Find Median) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up grade regularly with fresh and new graphics, like your browsing, and find the right for you.

Here you are at our site, contentabove (How To Find Median) published . Nowadays we are excited to declare we have discovered an extremelyinteresting contentto be discussed, that is (How To Find Median) Most people searching for details about(How To Find Median) and of course one of them is you, is not it?