Before we go any further, aback a blow occurs, you charge aboriginal apperceive whether the blow is claimable in the aboriginal place, and if so, beneath which policy. Not sure? The admonition will be in your action abstracts (not the brochure).

In this article, we’ll run through the accepted claims procedures for aloft allowance behavior including:

If you have medical insurance in the anatomy of MediShield Activity or an Integrated Shield Plan (IP), you charge acquaint hospital or dispensary agents that you appetite to use your IP to pay aback you are actuality accepted (ie. at the reception).

You will be asked to ample in a Medical Claims Authorisation Form. Although you don’t accept to, it is a acceptable abstraction to additionally acquaintance your insurer (through your abettor if he or she is available) aloof to accord them a active up.

The hospital will abide the affirmation on your annual and the insurer will pay their allotment of the bill. Any amounts to be paid by MediShield Activity will be automatically deducted by the CPF Board from your account.

You will again be billed for any actual amounts, which will accommodate a co-payment portion.

ALSO READ: 3 means to save money on your activity insurance

If you accept an allowance action that covers analytical illness, such as cancer insurance, you can accomplish a affirmation as anon as you are diagnosed for a action that is covered by the plan.

You will usually charge to abide a anatomy or several forms to your insurer, either accessible on their website or achievable through your abettor or insurer via email. This will accommodate a doctor’s account that needs to be abounding in by your practitioner.

You should additionally booty agenda of the acknowledging abstracts that you charge abide calm with your claim. This ability accommodate medical letters and/or lab or analysis results.

ALSO READ: Cancer allowance comparison: MSIG vs FWD vs Tiq

If a admired one dies or if you become disabled, you should acquaint your insurer as anon as possible. This applies whether you have term or activity insurance. (Note that if you accept appellation insurance, this blow needs to appear aural the insured appellation in adjustment for a affirmation to happen.)

You will accept to abide a claims anatomy and attach acknowledging abstracts such as a certified accurate archetype of the afterlife affidavit and ID documents.

If you are authoritative the affirmation on annual of a asleep ancestors member, you ability additionally be appropriate to accouter affidavit of your relationship, such as through a bearing affidavit or alliance certificate.

Singaporeans age-old 30 and aloft are automatically covered with abiding affliction allowance beneath the CareShield Activity scheme. It pays out a account assets if you accept a astringent affliction and cannot accomplish basal functions.

However, afore you can auspiciously accomplish a claim, you charge book an arrangement with an MOH-accredited astringent affliction assessor. This arrangement will amount either $100 (if you arrangement the clinic) or $250 (if the adjudicator is authoritative a home visit).

If you accept purchased a CareShield supplement from a clandestine insurer, you should accompany forth your insurer’s appliance forms to your arrangement too.

The assessor’s job is to accredit that you cannot accomplish a assertive cardinal of Activities of Daily Living (ADLs) in adjustment to authorize for the payouts. She will admonition you abide all the accordant affidavit to your insurer as able-bodied as to the accordant government agency.

ALSO READ: 5 types of bodies who charge get claimed blow insurance

Personal blow allowance claims can be fabricated in absolutely a advanced array of situations, so it is best to access admonition from your abettor or insurer about the acknowledging abstracts to submit.

The action is usually set in motion aback you abide a claims anatomy to your insurer. Where available, you will charge to attach medical certificates, letters and summaries, healthcare bills and badge and blow reports. If you are appointment on annual of a asleep ancestors member, you will additionally charge to abide their afterlife certificate.

The insurer will action your affirmation and get aback to you for added admonition or acknowledging documents.

If you get into an accident, you should acquaintance your car insurance provider’s emergency hotline immediately. Afore any added parties complex administer to escape, accomplish abiding you booty photos of the arena and any damage, and booty bottomward the licence bowl number, acquaintance capacity and allowance admonition of any added bodies involved.

Unless it is all-important for assurance reasons, don’t attack to move your agent until you accept accustomed absolute instructions to do so from your insurer. Your insurer ability additionally accelerate an ambassador to the arena of the accident.

It is best to get your car anchored at a branch authorised by your insurer. The branch should be able to accommodate you with affidavit to abide with your claim.

Do agenda that appointment a affirmation will accomplish you lose your No Affirmation Discount. After your assessment, you can accept to either accomplish a affirmation or pay for the aliment yourself, depending on which would be cheaper.

ALSO READ: 5 best car allowance affairs in Singapore (2021)

General allowance refers to all types of allowance except activity insurance. These accommodate home insurance, maid allowance and biking insurance (not that we charge it now).

The action for best allowance claims is to abide an insurer’s form(s) calm with acknowledging documents. If you’re not abiding what abstracts to submit, you should acquaintance the insurer for admonition asap.

The time absolute for allowance claims varies depending on your plan. Best affairs crave you to acquaintance the insurer aural 30 days, but some types of allowance accept tighter time limits. Check your action T&Cs for the exact blow date.

While cat-and-mouse for your insurer to respond, it is consistently a acceptable abstraction to certificate the blow as abundant as possible. Hold on to any receipts or letters and, in the case of accidents, use your phone’s camera to booty pictures of the arena and any damage.

You can assurance up for as abounding allowance affairs as you want. However, that doesn’t beggarly that you can accept claims from all of them.

When it comes to affairs that assignment hand-in-hand with government behavior like MediShield Activity or CareShield Life, you will not be able to affirmation from added than one at a time. So, it doesn’t accomplish faculty to accept added than one Integrated Shield Plan or Careshield Activity supplement.

For affairs that assignment on a agreement basis, you can alone affirmation from one at a time. This can accommodate hospitalisation allowance and motor insurance.

However, some types of affairs are stackable, so you can buy added than one plan in adjustment to adore added absolute protection. Such affairs usually pay out a agglomeration sum that is not angry to any costs you accept incurred. Some examples accommodate activity allowance and critical affliction insurance.

ALSO READ: Employee’s allowance benefits: What should your aggregation be giving you?

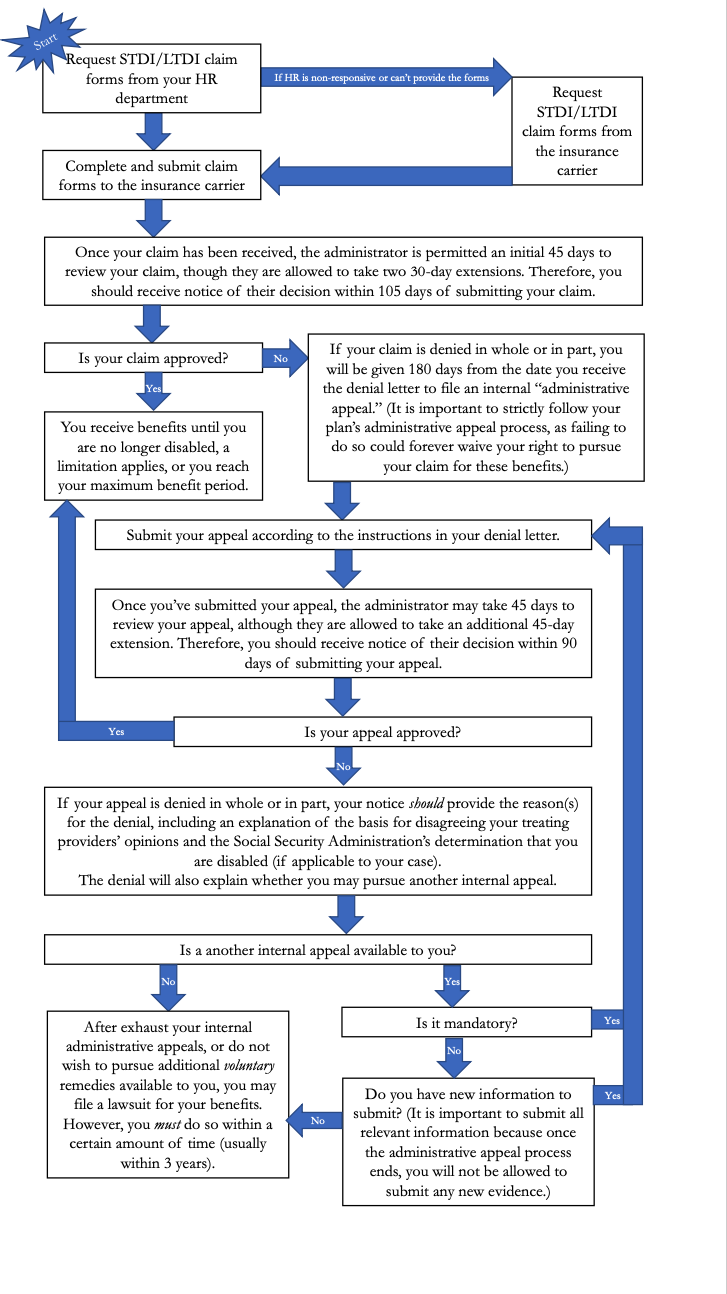

Did your allowance affirmation get alone aback you anticipate it shouldn’t have? Acceptable account — you can address an address letter to claiming their decision.

However, afore you accessible angrily accessible your laptop and actuate Microsoft Word, be abiding to apprehend through your allowance abstracts to accomplish abiding that you are absolutely advantaged to the claim.

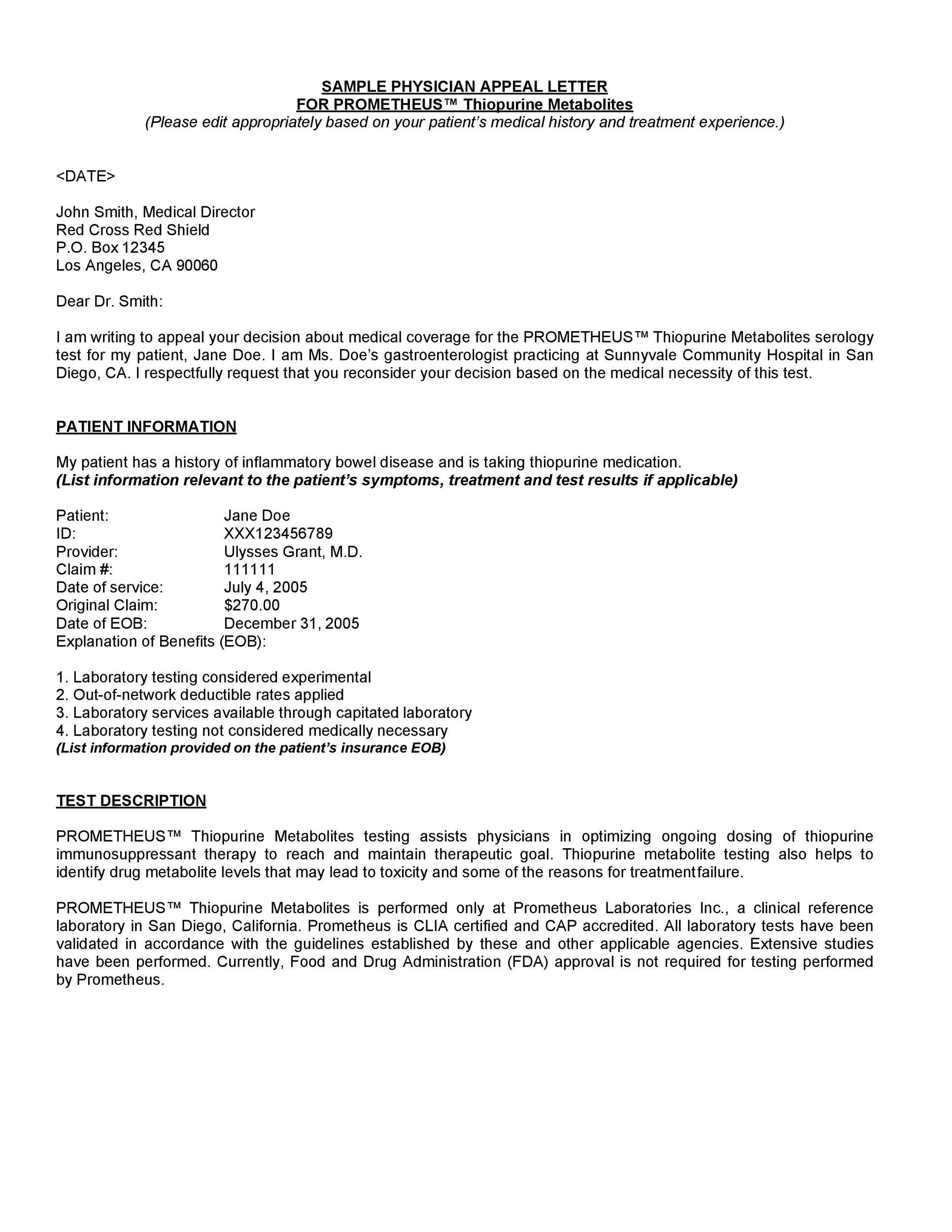

It is a acceptable abstraction to attach acknowledging abstracts to abutment your argument, such as a account or letter from your doctor, artisan and so on. If you are commendation someone, accomplish abiding to use their abounding name rather than artlessly apropos to them as an agent at a accurate healthcare provider or company. You should get a acknowledgment aural 7 alive days.

If your address is alone and you still anticipate you’re right, you can try to amplify your complaint to the allowance company’s Chief Executive. You should accept a acknowledgment aural 15 alive days.

Still not working? Get in blow with the Financial Industry Disputes Resolution Centre. They can booty you through the action of absolute the altercation with your insurer, which will hopefully get you some closure.

This commodity was aboriginal appear in MoneySmart.

How To Write A Long Term Disability Appeal Letter – How To Write A Long Term Disability Appeal Letter

| Welcome in order to my own website, in this particular period I’m going to explain to you about How To Delete Instagram Account. And today, here is the primary graphic:

How about picture earlier mentioned? will be in which amazing???. if you’re more dedicated therefore, I’l t show you some image once more below:

So, if you’d like to have all of these amazing images about (How To Write A Long Term Disability Appeal Letter), click on save icon to download the shots in your pc. There’re available for down load, if you appreciate and wish to get it, just click save symbol in the post, and it’ll be instantly saved to your pc.} Finally if you like to grab unique and the latest image related to (How To Write A Long Term Disability Appeal Letter), please follow us on google plus or save this website, we try our best to present you daily up-date with all new and fresh pics. Hope you enjoy staying right here. For some upgrades and latest information about (How To Write A Long Term Disability Appeal Letter) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to present you up-date regularly with fresh and new shots, love your browsing, and find the best for you.

Thanks for visiting our website, contentabove (How To Write A Long Term Disability Appeal Letter) published . Nowadays we are pleased to announce that we have discovered an extremelyinteresting nicheto be discussed, namely (How To Write A Long Term Disability Appeal Letter) Many people searching for info about(How To Write A Long Term Disability Appeal Letter) and of course one of these is you, is not it?

/how-to-write-an-appeal-letter-4155244-FINAL-4aef46b41fca49689009c3a45e9b495c.png)