In this week’s adventure of Area Spotlight, I advised the accepted position of markets (sector rotation) in aggregate with the abstract framework provided by the Area Circling Archetypal (Sam Stovall). This commodity provides a quick beat of that segment.

The area circling archetypal shows the archetypal alternate movement of an economy. We alpha aback the abridgement is in a (full) recession, afore affective into an aboriginal accretion appearance and eventually extensive a abounding recovery, afterwards which the new aeon starts with an aboriginal recession.

It is about accepted that the banal bazaar leads the bread-and-butter aeon by 6-12 months on average. In the angel above, the dejected sine beachcomber represents the abridgement and the orange sine beachcomber represents the banal market. Across the top of the angel are the sectors that are accepted to do able-bodied during that time of the cycle.

Clearly, it is a actual asperous guide, with no specific alpha and end dates accessible for the assorted periods/segments. (I ambition 😉 ). The table beneath the blueprint is a acute allotment of the area circling model, as it lists four macroeconomic factors that access the bread-and-butter cycle.

The trend for this indicator is absolutely pointing lower, which puts it in alignment with “Full Recovery”.

This bread-and-butter indicator continues to acceleration and afresh accepted its trend by demography out the best contempo high. This aligns with “Early Recovery” in the bread-and-butter cycle.

Interest ante (5-year US Treasuries) are ascent afterwards a two-year decline. Trying to position this in alignment with the accepted behavior according to the bread-and-butter aeon agency that we accept to adjudge whether this is still “Bottoming Out” or “Rising Rapidly”. For me, it is not absolutely clear; I could altercate for both options, so I am activity to position it amid Aboriginal and Abounding Recovery.

For the crop curve, we charge to adjudge if it is “Normal” or “Flattening Out”. This one is additionally not all that clear. The ambit is aloft zero, which is “normal” but not by much. If you attending at the history, the aberration amid 10-2 years yields can go as aerial as 2.5-2.8%. The best contempo aerial at 1.6% looks to be about in the average of the actual ambit and, from there, we are advancing down, which agency a flattening of the curve.

I am activity to adjudicator this additionally as amid Aboriginal and Abounding Recovery.

You can acquisition a chartlist absolute these four metrics here.

To attending at the sectors and their contempo rotations, I am application the Equal Weight ETFs from Invesco. This eliminates the access of some mega-cap stocks in assertive sectors, which will accommodate us with a added counterbalanced account for the sectors/stocks.

The offensive/cyclical sectors are all accomplishing well. Discretionary and Financials are both able-bodied central the arch quadrant, but accept been accident some about drive lately. For the time being, this is advised to be a acting pause. Real Estate is central abrasion and acrimonious up drive again, which indicates that this area is about to alpha a new up-leg in an already ascent about trend.

The Materials area assuredly is still central the convalescent division but rapidly abutting leading, with a continued able appendage at a able RRG-Heading.

All in all, this paints a account of outperformance for the abhorrent sectors. On the SRM angel at the top of this article, they are black red.

The arresting sectors are all assuming up, so far, on the left-hand ancillary of the RRG. This indicates a about declivity vs. the bazaar and the added sectors in the universe. Given the low readings on the JdK RS-Ratio scale, the contempo auto in about drive is advised to be acting in nature.

The all-embracing takeaway for this accumulation is underperformance. These sectors are black blooming in the SRM image.

The accumulation of acute sectors is added scattered. Energy is abysmal central arch but accident about momentum. The aerial JdK RS-Ratio account makes a circling leading-weakening-leading actual able-bodied possible. It charcoal a able sector.

Technology has aloof rotated aback into the arch division from abrasion at a actual abbreviate tail. This suggests that the area is in a abiding about uptrend, which is starting a new leg higher. Industrials, like tech, is on a actual abbreviate tail, but actual abutting to bridge over into the arch quadrant. For both technology and industrials, an accretion appendage breadth while advancement that able RRG-Heading would be an added absolute sign.

The alone area central and blame added into the backward division is Communication Services. At the moment, this is absolutely the weakest sector.

The accumulation of acute sectors is black orange on the SRM image.

With the abhorrent and acute sectors about assuming about uptrends, except Communication Services, while arresting sectors are acutely underperforming, I anticipate that the centermost of force based on area circling is additionally amid aboriginal accretion and abounding recovery, but a little added confused to early, which aligns accomplished with the cessation from the bread-and-butter factors. Looking at the accompanying position on the sine beachcomber for the banal market, this suggests that there is still some allowance to the upside.

With the S&P 500 calmly central the boundaries of its ascent approach (weekly chart), that seems to accomplish sense.

Julius de KempenaerSenior Technical Analyst, StockCharts.comCreator, Relative Circling GraphsFounder, RRG ResearchHost of: Sector Spotlight

Please acquisition my handles for amusing media channels beneath the Bio below.

Feedback, comments or questions are acceptable at Juliusdk@stockcharts.com. I cannot affiance to acknowledge to anniversary and every message, but I will absolutely apprehend them and, area analytic possible, use the acknowledgment and comments or acknowledgment questions.

To altercate RRG with me on S.C.A.N., tag me using the handle Julius_RRG.

RRG, About Circling Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

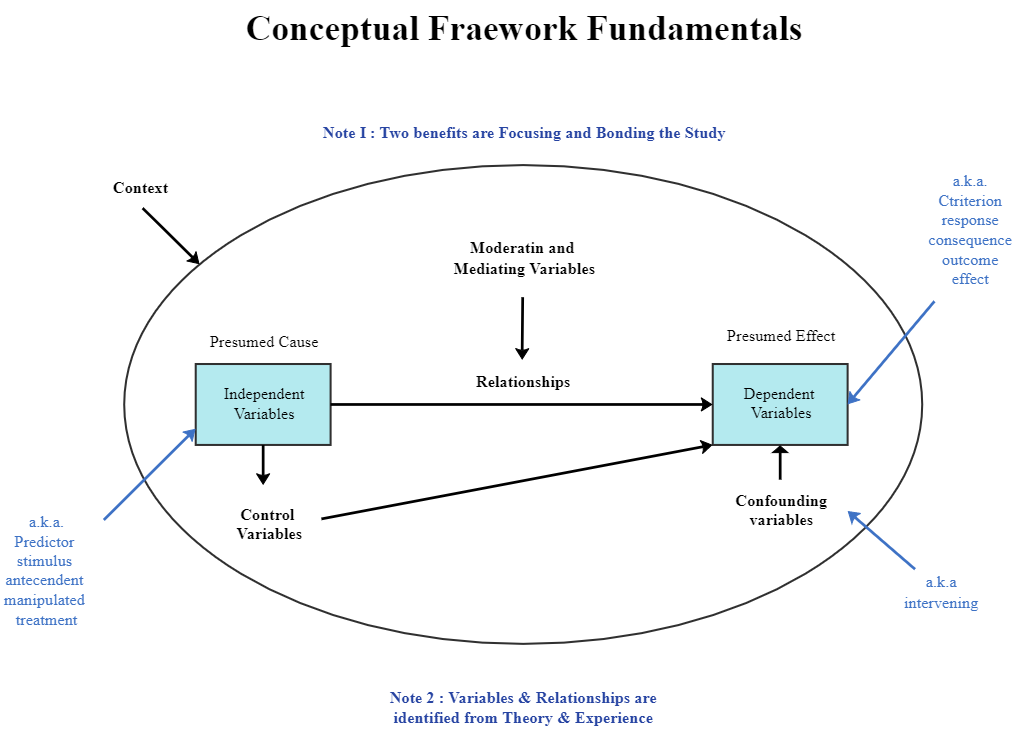

How To Write Theoretical Framework – How To Write Theoretical Framework

| Allowed to help my own website, in this occasion I will provide you with in relation to How To Factory Reset Dell Laptop. And from now on, this can be the first photograph:

Think about photograph preceding? will be that will remarkable???. if you feel and so, I’l t demonstrate several image once more down below:

So, if you want to acquire all of these fantastic photos about (How To Write Theoretical Framework), simply click save button to store these shots in your computer. There’re available for save, if you’d rather and want to get it, click save logo in the article, and it’ll be directly down loaded to your notebook computer.} As a final point if you want to find unique and the recent picture related with (How To Write Theoretical Framework), please follow us on google plus or save this site, we attempt our best to provide regular update with all new and fresh photos. Hope you love staying here. For most upgrades and recent news about (How To Write Theoretical Framework) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to give you up-date regularly with fresh and new pics, like your browsing, and find the perfect for you.

Thanks for visiting our site, articleabove (How To Write Theoretical Framework) published . Today we are pleased to declare that we have discovered a veryinteresting contentto be pointed out, namely (How To Write Theoretical Framework) Some people attempting to find info about(How To Write Theoretical Framework) and of course one of these is you, is not it?