CBL Backdrop Reports After-effects for Third Division 2021

data-v-b0300674="">Third Division After-effects Demonstrate Cogent Advance in Operations

CBL Backdrop (NYSE: CBL) appear after-effects for the third division concluded September 30, 2021. A description of anniversary added non-GAAP banking admeasurement and the accompanying adaptation to the commensurable GAAP banking admeasurement is amid at the end of this account release.

Three Months Concluded September 30,

Nine Months Concluded September 30,

2021

2020

%

2021

2020

%

Net accident attributable to accepted shareholders per adulterated share

$

(0.21

)

$

(0.28

)

25.0

%

$

(0.39

)

$

(1.43

)

72.7

%

Funds from Operations (“FFO”) per adulterated share

$

0.37

$

0.06

516.7

%

$

1.07

$

0.28

282.1

%

FFO, as adjusted, per adulterated allotment (1)

$

0.47

$

0.04

1,075.0

%

$

1.21

$

0.32

278.1

%

(1)

For a adaptation of FFO to FFO, as adjusted, for the periods presented, amuse accredit to the footnotes to the Company’s adaptation of net accident attributable to accepted shareholders to FFO allocable to Operating Partnership accepted unitholders on folio 8 of this account release.

KEY TAKEAWAYS:

“We are at an agitative time for CBL. Alpha from our acknowledged actualization from bankruptcy, the complete CBL alignment is activated to assassinate on our activity and booty advantage of our decidedly added antithesis breadth and chargeless banknote flow,” said Stephen Lebovitz, Chief Executive Officer. “We accept apparent an convalescent operating ambiance in 2021 and it is the ideal time to focus on new opportunities, including refinancing our high-interest bulk anchored addendum and property-level loans, creating bulk beyond our portfolio from accessible acreage and new partnerships, and added advance strategies. We are abreast and accessible to accompany to activity the eyes we accept for the new CBL.

“Our portfolio achievement in the third division was aloft expectations, as advantageous cartage and sales advance fueled a able rebound. Improvements in the leasing environment, including accretion addressee appeal and lower bankruptcy-related abundance closures, collection advantageous ascendancy advance as new leases alive year-to-date took occupancy. It is account acquainted that we accomplished our aboriginal division of year-over-year ascendancy advance aback the aboriginal division of 2019. Charter spreads additionally bigger from above-mentioned quarters. Robust sales by retailers are arch to college levels of allotment rent, one disciplinarian of bigger NOI results. We accept auspiciously captivated costs in analysis admitting aggrandizement pressures.

“As we say on the home folio of our new website, which we debuted aftermost anniversary in affiliation with our emergence, we are redefining what the basic agency to our communities by accumulation retail, dining, entertainment, and added alloyed uses. We fabricated advance this division in bringing this eyes to activity through ballast redevelopments, abacus new uses that drive added cartage and new customers. Awful advantageous Scheel’s All Sports commenced architecture on their anew broadcast abundance at Dakota Square, afterward their accretion of the aloft Sears aftermost month. Ball user, Main Event, is beneath architecture in a allocation of the aloft Sears at Sunrise Mall. We completed the auction of a aloft Sears at Harford Mall, which will be redeveloped into a approaching grocery store, and we awash a bindle of antithesis parking at Monroeville Basic for development into a approaching VA Center. At York Galleria, we afresh opened Hollywood Casino and Activity Storage is developing a new ability in a aloft ballast space. As categorical in our administration abundance amend in the supplemental, we are actively in acceding or finalizing deals that will abide this cogent progress.

“Take a alpha attending at CBL. Our new basic anatomy allows us to accompany opportunities both aural our portfolio and evidently to actualize bulk for stakeholders. We accept a new, awful affianced Board that brings alpha perspective. And the CBL administration aggregation is added committed than anytime to the success and advance of the company.”

FINANCIAL RESULTS

Net accident attributable to accepted shareholders for the three months concluded September 30, 2021 was $41.7 million, or a accident of $0.21 per adulterated share, compared with net accident of $54.1 million, or a accident of $0.28 per adulterated share, for the three months concluded September 30, 2020. Net accident for the third division 2021 was additionally impacted by a $63.2 actor accident on crime of complete acreage to address bottomward the accustomed bulk of Parkdale Basic and Crossing, Laurel Park and a acreage bindle to their estimated fair values.

Net accident attributable to accepted shareholders for the nine months concluded September 30, 2021 was $77.4 million, or a accident of $0.39 per adulterated share, compared with net accident of $269.4 million, or a accident of $1.43 per adulterated share, for the nine months concluded September 30, 2020.

FFO, as adjusted, allocable to accepted shareholders, for the three months concluded September 30, 2021 was $92.9 million, or $0.47 per adulterated share, compared with $8.6 million, or $0.04 per adulterated share, for the three months concluded September 30, 2020. FFO, as adjusted, allocable to the Operating Partnership accepted unitholders, for the three months concluded September 30, 2021 was $95.3 actor compared with $9.0 actor for the three months concluded September 30, 2020.

FFO, as adjusted, allocable to accepted shareholders, for the nine months concluded September 30, 2021 was $237.3 million, or $1.21 per adulterated share, compared with $61.1 million, or $0.32 per adulterated share, for the nine months concluded September 30, 2020. FFO, as adjusted, allocable to the Operating Partnership accepted unitholders, for the nine months concluded September 30, 2021 was $243.5 actor compared with $65.5 actor for the nine months concluded September 30, 2020.

Three Months Concluded September 30,

Nine Months Concluded September 30,

2021

2021

Portfolio same-center NOI

26.5%

6.7%

Mall same-center NOI

29.9%

7.2%

CBL’s analogue of same-center NOI excludes the appulse of charter abortion fees and assertive non-cash items such as straight-line rents and reimbursements, write-offs of freeholder inducements and net acquittal of acquired aloft and beneath bazaar leases.

Major variances impacting same-center NOI for the three months concluded September 30, 2021, include:

COVID-19 RENT COLLECTION UPDATE

The Aggregation has calm 93% of accompanying gross rents for the aeon April 2020 through September 2021. As of October 2021, CBL had deferred about $45.8 actor in rents. Of the about 72% of the deferred amounts billed to-date, CBL has calm about 97%.

LIQUIDITY

Following actualization from Defalcation on November 1, 2021, and $60 actor accretion of 10% Notes, on a circumscribed basis, the aggregation had about $260 actor accessible in complete banknote and bankable securities.

As of September 30,

2021

2020

Total portfolio

88.4%

86.6%

Malls:

Total Basic portfolio

86.3%

85.0%

Same-center Malls

86.3%

85.5%

Stabilized Malls

86.3%

85.4%

Associated centers

94.8%

89.1%

Community centers

94.5%

94.4%

Occupancy for malls represents allotment of basic abundance gross leasable breadth beneath 20,000 aboveboard anxiety occupied. Ascendancy for associated and association centers represents allotment of gross leasable breadth occupied.

New and Renewal Leasing Activity of Aforementioned Small Shop Amplitude Beneath Than 10,000 Aboveboard Feet:

Three Months Concluded September 30,

Nine Months Concluded September 30,

2021

2021

Stabilized Malls

(12.2)%

(17.5)%

New leases

(20.3)%

(18.4)%

Renewal leases

(10.4)%

(17.3)%

Same-Center Sales Per Aboveboard Foot for Basic Tenants 10,000 Aboveboard Anxiety or Less:

Sales for the third division 2021 added 17% as compared with the third division 2019, with all but two of CBL’s 54 advertisement malls demonstrating an access over the commensurable period. For the nine months concluded September 30, 2021, sales added 17% as compared with the nine months concluded September 30, 2019. Due to the acting basic and abundance closures that occurred in 2020, the majority of CBL’s tenants did not address sales for the abounding advertisement period. As a result, CBL is not able to board a complete admeasurement of sales for the abaft twelve-month period.

FINANCING ACTIVITY AND LENDER DISCUSSIONS

On November 1, 2021, pursuant to the Associate 11 Plan of Reorganization, the Aggregation issued $455 actor of 10% chief anchored addendum (the “10% Notes”) and $150 actor of 7% convertible chief anchored addendum (the “7% Notes”), including $50 actor in addendum issued in barter for new money. CBL additionally entered into a new $883.7 actor appellation accommodation on November 1, 2021, which replaced the Company’s antecedent acclaim facility.

On November 8, 2021, the Aggregation completed the accretion of $60 actor of 10% Notes. Afterward the redemption, the Aggregation has $395 actor in 10% Addendum outstanding.

CBL anticipates allied with conveyance or foreclosure affairs for EastGate Basic in Cincinnati, OH ($30.1 million), Asheville Basic in Asheville, NC ($62.1 million) and Parkdale Basic in Beaumont, TX ($70.5 million). Asheville Basic was deconsolidated during the aboriginal division 2021. CBL no best controls the acreage afterward its alteration to receivership. EastGate Basic and Parkdale Basic are accepted to be transferred into receivership in the abreast future. In October, the foreclosure of Park Plaza in Little Rock, AR ($76.8 million) was completed.

Subsequent to September 30, 2021, Brookfield Aboveboard Ballast S, LLC filed for bankruptcy, which is the borrower beneath the $27.5 actor recourse appellation loan. The Aggregation has entered in a arcane arbitration beneath defalcation cloister acclimation with the lender.

CBL is additionally in discussions with the lender on modification of the $36.0 actor recourse accommodation anchored by The Aperture Shoppes at Gettysburg in Gettysburg, PA, which is in default.

CBL is in the activity of negotiating extensions and modifications of the absolute acreage akin mortgage loans with maturities in 2021 and 2022.

RESTRUCTURING UPDATE

On November 1, 2021, CBL emerged from defalcation and entered a apprehension of Effective Date for the Company’s Plan of Reorganization. The apprehension and added abstracts accompanying to the proceedings, can be begin at https://dm.epiq11.com/case/cblproperties/info.

DISPOSITIONS

In July 2021, CBL completed the auction of the aloft Sears area at Dakota Aboveboard Basic in Minot, ND to Scheel’s for $4.0 million. Scheel’s affairs to aggrandize the aloft Sears architecture to about 100,000-square-feet to board their new ancestor and backpack from their complete area in the basic to the new store. Additionally, in July, CBL awash a aloft administration abundance in Cincinnati, Ohio for $5.5 million, for redevelopment into a approaching grocer.

In September, CBL completed the auction of a bindle of antithesis parking at Monroeville Basic in Monroeville, PA, to a developer for the architecture of a approaching VA center. The gross sales bulk was $3.5 million.

In October 2021, CBL completed the auction of a aloft Sears abundance at Harford Basic in Bel Air, MD, for $5.0 actor and the auction of 62 residential units at Pearland Town Centermost in Houston, TX, for $8.75 million.

Year-to-date, CBL has generated $35.3 actor in gross accretion from asset sales.

DEVELOPMENT AND LEASING PROGRESS

During the third quarter, Hollywood Casino at York Galleria in York, PA captivated its admirable opening. Hobby Lobby at West Towne Basic in Madison, WI, acclaimed its admirable aperture afresh and Rooms to Go at Cross Creek in Fayetteville, NC will accessible afterwards this year.

Construction afresh commenced on a new LifeStorage ability at York Galleria in York, PA in a aloft ballast location. Ball user, Main Event, is beneath architecture in a allocation of the aloft Sears at Sunrise Basic in Brownsville, TX. Scheel’s All Sports commenced architecture on an broadcast abundance at Dakota Aboveboard in Minot, ND, afterward their accretion of the aloft Sears aftermost month.

Additional offerings, including new restaurants, fitness, auberge and added uses are planned or beneath acceding and will be appear as capacity are finalized.

Detailed activity advice is accessible in CBL’s Banking Supplement for Q3 2021, which can be begin in the Invest – Banking Reports area of CBL’s website at cblproperties.com.

ABOUT CBL PROPERTIES

Headquartered in Chattanooga, TN, CBL Backdrop owns and manages a civic portfolio of market-dominant backdrop amid in activating and growing communities. CBL’s portfolio is comprised of 104 backdrop accretion 63.9 actor aboveboard anxiety beyond 24 states, including 62 high-quality enclosed, aperture and amphitheater retail centers and bristles backdrop managed for third parties. CBL seeks to continuously strengthen its aggregation and portfolio through alive management, advancing leasing and assisting reinvestment in its properties. For added advice appointment cblproperties.com.

NON-GAAP FINANCIAL MEASURES Funds From Operations

FFO is a broadly acclimated non-GAAP admeasurement of the operating achievement of complete acreage companies that supplements net assets (loss) bent in accordance with GAAP. The Civic Association of Complete Acreage Advance Trusts (“NAREIT”) defines FFO as net assets (loss) (computed in accordance with GAAP) excluding assets or losses on sales of depreciable operating backdrop and crime losses of depreciable properties, added abrasion and amortization, and afterwards adjustments for unconsolidated partnerships and collective ventures and noncontrolling interests. Adjustments for unconsolidated partnerships and collective ventures and noncontrolling interests are affected on the aforementioned basis. We ascertain FFO as authentic aloft by NAREIT beneath assets on adopted banal of the Aggregation or distributions on adopted units of the Operating Partnership, as applicable. The Company’s acclimation of artful FFO may be altered from methods acclimated by added REITs and, accordingly, may not be commensurable to such added REITs.

The Aggregation believes that FFO provides an added indicator of the operating achievement of its backdrop after giving aftereffect to complete acreage abrasion and amortization, which assumes the bulk of complete acreage assets declines predictably over time. Aback ethics of well-maintained complete acreage assets accept historically risen with bazaar conditions, the Aggregation believes that FFO enhances investors’ compassionate of its operating performance. The use of FFO as an indicator of banking achievement is afflicted not alone by the operations of the Company’s backdrop and absorption rates, but additionally by its basic structure.

The Aggregation presents both FFO allocable to Operating Partnership accepted unitholders and FFO allocable to accepted shareholders, as it believes that both are advantageous achievement measures. The Aggregation believes FFO allocable to Operating Partnership accepted unitholders is a advantageous achievement admeasurement aback it conducts essentially all of its business through its Operating Partnership and, therefore, it reflects the achievement of the backdrop in complete acceding behindhand of the arrangement of buying interests of the Company’s accepted shareholders and the noncontrolling absorption in the Operating Partnership. The Aggregation believes FFO allocable to its accepted shareholders is a advantageous achievement admeasurement because it is the achievement admeasurement that is best anon commensurable to net assets (loss) attributable to its accepted shareholders.

In the adaptation of net assets (loss) attributable to the Company’s accepted shareholders to FFO allocable to Operating Partnership accepted unitholders, amid in this antithesis release, the Aggregation makes an acclimation to add aback noncontrolling absorption in assets (loss) of its Operating Partnership in acclimation to access at FFO of the Operating Partnership accepted unitholders. The Aggregation again applies a allotment to FFO of the Operating Partnership accepted unitholders to access at FFO allocable to its accepted shareholders. The allotment is computed by demography the weighted-average cardinal of accepted shares outstanding for the aeon and adding it by the sum of the weighted-average cardinal of accepted shares and the weighted-average cardinal of Operating Partnership units captivated by noncontrolling interests during the period.

FFO does not represent banknote flows from operations as authentic by GAAP, is not necessarily apocalyptic of banknote accessible to armamentarium all banknote breeze needs and should not be advised as an addition to net assets (loss) for purposes of evaluating the Company’s operating achievement or to banknote breeze as a admeasurement of liquidity.

The Aggregation believes that it is important to analyze the appulse of assertive cogent items on its FFO measures for a clairvoyant to accept a complete compassionate of the Company’s after-effects of operations. Therefore, the Aggregation has additionally presented adapted FFO measures excluding these items from the applicative periods. Amuse accredit to the adaptation of net assets (loss) attributable to accepted shareholders to FFO allocable to Operating Partnership accepted unitholders on folio 8 of this account absolution for a description of these adjustments.

Same-center Net Operating Income

NOI is a added non-GAAP admeasurement of the operating achievement of the Company’s arcade centers and added properties. The Aggregation defines NOI as acreage operating revenues (rental revenues, addressee reimbursements and added income) beneath acreage operating costs (property operating, complete acreage taxes and aliment and repairs).

The Aggregation computes NOI based on the Operating Partnership’s pro rata allotment of both circumscribed and unconsolidated properties. The Aggregation believes that presenting NOI and same-center NOI (described below) based on its Operating Partnership’s pro rata allotment of both circumscribed and unconsolidated backdrop is advantageous aback the Aggregation conducts essentially all of its business through its Operating Partnership and, therefore, it reflects the achievement of the backdrop in complete acceding behindhand of the arrangement of buying interests of the Company’s accepted shareholders and the noncontrolling absorption in the Operating Partnership. The Company’s analogue of NOI may be altered than that acclimated by added companies and, accordingly, the Company’s adding of NOI may not be commensurable to that of added companies.

Since NOI includes alone those revenues and costs accompanying to the operations of the Company’s arcade centermost properties, the Aggregation believes that same-center NOI provides a admeasurement that reflects trends in ascendancy rates, rental rates, sales at the malls and operating costs and the appulse of those trends on the Company’s after-effects of operations. The Company’s adding of same-center NOI excludes charter abortion income, straight-line hire adjustments, acquittal of aloft and beneath bazaar charter affluence and write-off of freeholder attraction assets in acclimation to enhance the allegory of after-effects from one aeon to another. A adaptation of same-center NOI to net assets is amid at the end of this antithesis release.

Pro Rata Allotment of Debt

The Aggregation presents debt based on its pro rata buying allotment (including the Company’s pro rata allotment of unconsolidated affiliates and excluding noncontrolling interests’ allotment of circumscribed properties) because it believes this provides investors a clearer compassionate of the Company’s complete debt obligations which affect the Company’s liquidity. A adaptation of the Company’s pro rata allotment of debt to the bulk of debt on the Company’s abridged circumscribed antithesis breadth is amid at the end of this antithesis release.

Information included herein contains “forward-looking statements” aural the acceptation of the federal antithesis laws. Such statements are inherently accountable to risks and uncertainties, abounding of which cannot be predicted with accurateness and some of which ability not alike be anticipated. Approaching contest and absolute events, banking and otherwise, may alter materially from the contest and after-effects discussed in the advanced statements. The clairvoyant is directed to the Company’s assorted filings with the Antithesis and Barter Commission, including after limitation the Company’s Annual Address on Form 10-K, and the “Management’s Altercation and Analysis of Banking Condition and After-effects of Operations” included therein, for a altercation of such risks and uncertainties.

CBL & Associates Properties, Inc.

Supplemental Banking and Operating Information

For the Three and Nine Months Concluded September 30, 2021 and 2020

Three Months Concluded September 30,

Nine Months Concluded September 30,

2021

2020

2021

2020

REVENUES:

Rental revenues

$

145,539

$

124,081

$

405,030

$

405,476

Management, development and leasing fees

1,780

2,104

4,888

5,251

Other

3,056

3,712

10,202

10,955

Total revenues

150,375

129,897

420,120

421,682

EXPENSES:

Property operating

(23,818

)

(20,396

)

(65,243

)

(63,011

)

Depreciation and amortization

(46,479

)

(53,477

)

(142,090

)

(162,042

)

Real acreage taxes

(13,957

)

(17,215

)

(45,618

)

(53,500

)

Maintenance and repairs

(9,482

)

(8,425

)

(29,047

)

(25,675

)

General and administrative

(13,502

)

(25,497

)

(37,383

)

(62,060

)

Loss on impairment

(63,160

)

(46

)

(120,342

)

(146,964

)

Litigation settlement

89

2,480

890

2,480

Other

(104

)

—

(391

)

(400

)

Total expenses

(170,413

)

(122,576

)

(439,224

)

(511,172

)

OTHER INCOME (EXPENSES):

Interest and added income

510

1,975

2,038

5,263

Interest bulk (unrecognized acknowledged absorption bulk was $45,344 and $135,162 for the three and nine months concluded September 30, 2021, respectively)

(19,039

)

(61,137

)

(65,468

)

(160,760

)

Gain on concealment of debt

—

15,407

—

15,407

Gain on deconsolidation

—

—

55,131

—

Gain (loss) on sales of complete acreage assets

8,684

(55

)

8,492

2,708

Reorganization items

(12,008

)

—

(52,014

)

—

Income tax account (provision)

1,234

(546

)

(222

)

(17,189

)

Equity in losses of unconsolidated affiliates

(2,224

)

(7,389

)

(9,575

)

(12,450

)

Total added expenses

(22,843

)

(51,745

)

(61,618

)

(167,021

)

Net loss

(42,881

)

(44,424

)

(80,722

)

(256,511

)

Net accident attributable to noncontrolling interests in:

Operating Partnership

1,085

609

2,013

19,100

Other circumscribed subsidiaries

76

937

1,344

1,631

Net accident attributable to the Company

(41,720

)

(42,878

)

(77,365

)

(235,780

)

Preferred assets undeclared

—

(11,223

)

—

(33,669

)

Net accident attributable to accepted shareholders

$

(41,720

)

$

(54,101

)

$

(77,365

)

$

(269,449

)

Basic and adulterated per allotment abstracts attributable to common

shareholders:

Net accident attributable to accepted shareholders

$

(0.21

)

$

(0.28

)

$

(0.39

)

$

(1.43

)

Weighted-average accepted and abeyant dilutive accepted shares

outstanding

196,454

193,481

196,474

188,211

CBL & Associates Properties, Inc.

Supplemental Banking and Operating Information

For the Three and Nine Months Concluded September 30, 2021 and 2020

The Company’s adaptation of net accident attributable to accepted shareholders to FFO allocable to Operating Partnership accepted unitholders is as follows:

Three Months Concluded September 30,

Nine Months Concluded September 30,

2021

2020

2021

2020

Net accident attributable to accepted shareholders

$

(41,720

)

$

(54,101

)

$

(77,365

)

$

(269,449

)

Noncontrolling absorption in accident of Operating Partnership

(1,085

)

(609

)

(2,013

)

(19,100

)

Depreciation and acquittal bulk of:

Consolidated properties

46,479

53,477

142,090

162,042

Unconsolidated affiliates

13,480

14,437

40,466

41,967

Non-real acreage assets

(416

)

(702

)

(1,448

)

(2,431

)

Noncontrolling interests’ allotment of abrasion and acquittal in added circumscribed subsidiaries

(571

)

(1,118

)

(1,710

)

(2,829

)

Loss on impairment

63,160

46

120,342

146,964

(Gain) accident on depreciable property

(4,836

)

—

(4,836

)

25

FFO allocable to Operating Partnership accepted unitholders

74,491

11,430

215,526

57,189

Litigation adjustment (1)

(89

)

(2,480

)

(890

)

(2,480

)

Non-cash absence absorption bulk (2)

8,919

2,519

31,965

5,412

Gain on deconsolidation (3)

—

—

(55,131

)

—

Reorganization items (4)

12,008

—

52,014

—

Prepetition accuse (5)

—

12,913

—

20,770

Gain on concealment of debt (6)

—

(15,407

)

—

(15,407

)

FFO allocable to Operating Partnership accepted unitholders, as

adjusted

$

95,329

$

8,975

$

243,484

$

65,484

FFO per adulterated share

$

0.37

$

0.06

$

1.07

$

0.28

FFO, as adjusted, per adulterated share

$

0.47

$

0.04

$

1.21

$

0.32

Weighted-average accepted and abeyant dilutive accepted shares

outstanding with Operating Partnership units absolutely converted

201,559

201,690

201,587

201,551

(1)

For the three and nine months concluded September 30, 2021 and 2020, represents a acclaim to activity adjustment bulk accompanying to affirmation amounts that were appear pursuant to the acceding of the adjustment acceding accompanying to the adjustment of a chic activity lawsuit.

(2)

The three and nine months concluded September 30, 2021 includes absence absorption bulk accompanying to loans anchored by backdrop that were in absence above-mentioned to the Aggregation filing autonomous petitions beneath associate 11 of appellation 11 of the United States Code in the United States Defalcation Cloister for the Southern District of Texas, as able-bodied as loans anchored by backdrop that are in absence due to the Aggregation filing autonomous petitions beneath associate 11 of appellation 11 of the United States Code. The three and nine months concluded September 30, 2020 includes absence absorption bulk accompanying to Greenbrier Mall, Hickory Point Mall, EastGate Mall, Asheville Mall, Burnsville Centermost and Park Plaza.

(3)

During the nine months concluded September 30, 2021, the Aggregation deconsolidated Asheville Basic and Park Plaza due to a accident of ascendancy back the backdrop were placed into receivership in affiliation with the foreclosure process.

(4)

For the three and nine months concluded September 30, 2021, about-face items represent costs incurred consecutive to the Aggregation filing autonomous petitions beneath associate 11 of appellation 11 of the United States Code in the United States Defalcation Cloister for the Southern District of Texas associated with the Company’s about-face efforts, which consists of able fees, acknowledged fees, assimilation bonuses and U.S. Trustee fees.

(5)

For the three and nine months concluded September 30, 2020, represents able fees accompanying to the Company’s negotiations with the authoritative abettor and lenders beneath the anchored acclaim ability and assertive holders of the Company’s chief apart addendum apropos a restructure of such acknowledgment above-mentioned to the filing of autonomous petitions beneath associate 11 of appellation 11 of the United States Code in the United States Defalcation Cloister for the Southern District of Texas alpha on November 1, 2020.

(6)

The three and nine months concluded September 30, 2020 includes a accretion on concealment of debt accompanying to the non-recourse accommodation anchored by Hickory Point Mall, which was conveyed to the lender in the third division of 2020.

CBL & Associates Properties, Inc.

Supplemental Banking and Operating Information

For the Three and Nine Months Concluded September 30, 2021 and 2020

Three Months Concluded September 30,

Nine Months Concluded September 30,

2021

2020

2021

2020

Diluted EPS attributable to accepted shareholders

$

(0.21

)

$

(0.28

)

$

(0.39

)

$

(1.43

)

Eliminate amounts per allotment afar from FFO:

Depreciation and acquittal expense, including amounts from circumscribed properties, unconsolidated affiliates, non-real acreage assets and excluding amounts allocated to noncontrolling interests

0.29

0.34

0.89

0.99

Loss on impairment

0.31

—

0.59

0.72

Gain on depreciable property

(0.02

)

—

(0.02

)

—

FFO per adulterated share

$

0.37

$

0.06

$

1.07

$

0.28

Three Months Concluded September 30,

Nine Months Concluded September 30,

2021

2020

2021

2020

FFO allocable to Operating Partnership accepted unitholders

$

74,491

$

11,430

$

215,526

$

57,189

Percentage allocable to accepted shareholders (1)

97.47

%

95.93

%

97.46

%

93.38

%

FFO allocable to accepted shareholders

$

72,606

$

10,965

$

210,052

$

53,403

FFO allocable to Operating Partnership accepted unitholders, as adjusted

$

95,329

$

8,975

$

243,484

$

65,484

Percentage allocable to accepted shareholders (1)

97.47

%

95.93

%

97.46

%

93.38

%

FFO allocable to accepted shareholders, as adjusted

$

92,917

$

8,610

$

237,300

$

61,149

(1)

Represents the weighted-average cardinal of accepted shares outstanding for the aeon disconnected by the sum of the weighted-average cardinal of accepted shares and the weighted-average cardinal of Operating Partnership units outstanding during the period. See the adaptation of shares and Operating Partnership units outstanding on folio 14.

CBL & Associates Properties, Inc.

Supplemental Banking and Operating Information

For the Three and Nine Months Concluded September 30, 2021 and 2020

Three Months Concluded September 30,

Nine Months Concluded September 30,

2021

2020

2021

2020

SUPPLEMENTAL FFO INFORMATION:

Lease abortion fees

$

2,051

$

1,722

$

3,329

$

3,375

Per share

$

0.01

$

0.01

$

0.02

$

0.02

Straight-line rental assets adjustment

$

2,711

$

(2,891

)

$

(1,146

)

$

(1,972

)

Per share

$

0.01

$

(0.01

)

$

(0.01

)

$

(0.01

)

Gain (loss) on outparcel sales, net of taxes

$

3,864

$

(55

)

$

3,655

$

2,733

Per share

$

0.02

$

—

$

0.02

$

0.01

Net acquittal of acquired above- and below-market leases

$

60

$

229

$

185

$

1,341

Per share

$

—

$

—

$

—

$

0.01

Net acquittal of debt premiums and discounts

$

—

$

353

$

—

$

1,040

Per share

$

—

$

—

$

—

$

0.01

Income tax account (provision)

$

1,234

$

(546

)

$

(222

)

$

(17,189

)

Per share

$

0.01

$

—

$

—

$

(0.09

)

Gain on concealment of debt

$

—

$

15,407

$

—

$

15,407

Per share

$

—

$

0.08

$

—

$

0.08

Non-cash absence absorption bulk (property-level loans)

$

(8,919

)

$

(2,519

)

$

(31,965

)

$

(5,412

)

Per share

$

(0.04

)

$

(0.01

)

$

(0.16

)

$

(0.03

)

Abandoned projects expense

$

(104

)

$

—

$

(391

)

$

(400

)

Per share

$

—

$

—

$

—

$

—

Interest capitalized

$

—

$

438

$

32

$

1,530

Per share

$

—

$

—

$

—

$

0.01

Litigation settlement

$

89

$

2,480

$

890

$

2,480

Per share

$

—

$

0.01

$

—

$

0.01

Incremental acclaim ability absorption bulk accompanying to artifice of absence rate

$

—

$

(14,499

)

$

—

$

(19,311

)

Per share

$

—

$

(0.07

)

$

—

$

(0.10

)

Prepetition charges

$

—

$

(12,913

)

$

—

$

(20,770

)

Per share

$

—

$

(0.06

)

$

—

$

(0.10

)

Estimate of uncollectable revenues

$

4,444

$

(13,132

)

$

(6,068

)

$

(59,009

)

Per share

$

0.02

$

(0.07

)

$

(0.03

)

$

(0.29

)

As of September 30,

2021

2020

Straight-line hire receivable

$

50,609

$

53,421

CBL & Associates Properties, Inc.

Supplemental Banking and Operating Information

For the Three and Nine Months Concluded September 30, 2021 and 2020

(Dollars in thousands)

Three Months Concluded September 30,

Nine Months Concluded September 30,

2021

2020

2021

2020

Net loss

$

(42,881

)

$

(44,424

)

$

(80,722

)

$

(256,511

)

Adjustments:

Depreciation and amortization

46,479

53,477

142,090

162,042

Depreciation and acquittal from unconsolidated affiliates

13,480

14,437

40,466

41,967

Noncontrolling interests’ allotment of abrasion and acquittal in added circumscribed subsidiaries

(571

)

(1,118

)

(1,710

)

(2,829

)

Interest expense

19,039

61,137

65,468

160,760

Interest bulk from unconsolidated affiliates

10,647

8,646

31,008

24,001

Noncontrolling interests’ allotment of absorption bulk in added circumscribed subsidiaries

(663

)

(570

)

(2,508

)

(1,726

)

Abandoned projects expense

104

—

391

400

(Gain) accident on sales of complete acreage assets

(8,684

)

55

(8,492

)

(2,708

)

Gain on sales of complete acreage assets of unconsolidated affiliates

(70

)

—

(70

)

—

Gain on concealment of debt

—

(15,407

)

—

(15,407

)

Gain on deconsolidation

—

—

(55,131

)

—

Loss on impairment

63,160

46

120,342

146,964

Litigation settlement

(89

)

(2,480

)

(890

)

(2,480

)

Reorganization items

12,008

—

52,014

—

Income tax (benefit) provision

(1,234

)

546

222

17,189

Lease abortion fees

(2,051

)

(1,722

)

(3,329

)

(3,375

)

Straight-line hire and above- and below-market charter amortization

(2,771

)

2,662

961

631

Net accident attributable to noncontrolling interests in added circumscribed subsidiaries

76

937

1,344

1,631

General and authoritative expenses

13,502

25,497

37,383

62,060

Management fees and non-property akin revenues

(1,344

)

(4,415

)

(7,135

)

(9,746

)

Operating Partnership’s allotment of acreage NOI

118,137

97,304

331,702

322,863

Non-comparable NOI

(5,843

)

(8,517

)

(17,037

)

(28,088

)

Total same-center NOI (1)

$

112,294

$

88,787

$

314,665

$

294,775

Total same-center NOI allotment change

26.5

%

6.7

%

CBL & Associates Properties, Inc.

Supplemental Banking and Operating Information

For the Three and Nine Months Concluded September 30, 2021 and 2020

(Continued)

Three Months Concluded September 30,

Nine Months Concluded September 30,

2021

2020

2021

2020

Malls

$

98,202

$

75,577

$

274,254

$

255,863

Associated centers

7,189

7,184

20,614

20,475

Community centers

5,667

4,982

16,146

15,086

Offices and other

1,236

1,044

3,651

3,351

Total same-center NOI (1)

$

112,294

$

88,787

$

314,665

$

294,775

Percentage Change:

Malls

29.9

%

7.2

%

Associated centers

0.1

%

0.7

%

Community centers

13.7

%

7.0

%

Offices and other

18.4

%

9.0

%

Total same-center NOI (1)

26.5

%

6.7

%

(1)

CBL defines NOI as acreage operating revenues (rental revenues, addressee reimbursements and added income), beneath acreage operating costs (property operating, complete acreage taxes and aliment and repairs). Same-center NOI excludes charter abortion income, straight-line hire adjustments, acquittal of aloft and beneath bazaar charter affluence and write-offs of freeholder attraction assets. We accommodate a acreage in our same-center basin back we own all or a allocation of the acreage as of September 30, 2021, and we endemic it and it was in operation for both the complete above-mentioned agenda year and the accepted year-to-date advertisement aeon catastrophe September 30, 2021. New backdrop are afar from same-center NOI, until they accommodated these criteria. Backdrop afar from the same-center basin that would contrarily accommodated these belief are backdrop which are beneath above redevelopment or actuality advised for repositioning, area we intend to renegotiate the acceding of the debt anchored by the accompanying acreage or acknowledgment the acreage to the lender.

CBL & Associates Properties, Inc.

Supplemental Banking and Operating Information

As of September 30, 2021 and 2020

(Dollars in thousands)

As of September 30, 2021

Fixed Rate

Variable Rate

Total per Debt Schedule

Unamortized Deferred Costs Costs (1)

Total

Consolidated debt (2)

$

2,330,175

$

1,181,787

$

3,511,962

$

(3,202

)

$

3,508,760

Noncontrolling interests’ allotment of circumscribed debt

(29,563

)

—

(29,563

)

225

(29,338

)

Company’s allotment of unconsolidated affiliates’ debt

615,166

127,337

742,503

(2,404

)

740,099

Other debt (3)

138,926

—

138,926

—

138,926

Company’s allotment of consolidated, unconsolidated and added debt

$

3,054,704

$

1,309,124

$

4,363,828

$

(5,381

)

$

4,358,447

Weighted-average absorption rate

5.04

%

8.52

%

(4)

6.09

%

As of September 30, 2020

Fixed Rate

Variable Rate

Total per Debt Schedule

Unamortized Deferred Costs Costs

Total

Consolidated debt

$

2,560,364

$

1,183,186

$

3,743,550

$

(13,864

)

$

3,729,686

Noncontrolling interests’ allotment of circumscribed debt

(30,275

)

—

(30,275

)

288

(29,987

)

Company’s allotment of unconsolidated affiliates’ debt

625,806

122,486

748,292

(2,594

)

745,698

Company’s allotment of circumscribed and unconsolidated debt

$

3,155,895

$

1,305,672

$

4,461,567

$

(16,170

)

$

4,445,397

Weighted-average absorption rate

5.06

%

8.52

%

6.07

%

(1)

Unamortized deferred costs costs of $2,310 and $1,256 for assertive circumscribed and the Company’s allotment of unconsolidated property-level, non-recourse mortgage loans, respectively, may be appropriate to be accounting off in the accident that a abandonment or restructuring of acceding cannot be adjourned and the debt is either adored or contrarily extinguished.

(2)

Includes $2,489,676 included in liabilities accountable to accommodation in the accompanying circumscribed antithesis bedding as of September 30, 2021.

(3)

During the nine months concluded September 30, 2021, the Aggregation deconsolidated Asheville Basic and Park Plaza due to a accident of ascendancy back the backdrop were placed into receivership in affiliation with the foreclosure process.

(4)

The authoritative abettor abreast the Aggregation that absorption will accumulate on all outstanding obligations at the post-default rate, which is according to the bulk that contrarily would be in aftereffect added 5.0%. The post-default absorption bulk at September 30, 2021 was 9.50%. In accordance with ASC 852, Reorganizations, which banned the acceptance of absorption bulk during a defalcation proceeding to alone amounts that will be paid during the defalcation proceeding or that are apparent of acceptable accustomed claims, absorption has not been accrued on the anchored acclaim ability consecutive to the filing of autonomous petitions beneath associate 11 of appellation 11 of the United States Code in the United States Defalcation Cloister for the Southern District of Texas alpha on November 1, 2020. On November 1, 2021, an associate of the Aggregation entered into an adapted and restated acclaim agreement, which adapted the pre-emergence anchored acclaim facility.

CBL & Associates Properties, Inc.

Supplemental Banking and Operating Information

As of September 30, 2021 and 2020

(In thousands, except banal price)

Shares Outstanding (1)

Stock Bulk (2)

Common banal and Operating Partnership units

201,555

$

0.18

7.375% Alternation D Accumulative Redeemable Adopted Stock

1,815

250.00

6.625% Alternation E Accumulative Redeemable Adopted Stock

690

250.00

(1)

On the November 1, 2021, by operation of the Third Adapted Collective Associate 11 Plan of CBL & Associates Properties, Inc. and its Affiliated Debtors (With Technical Modifications) (as adapted at Docket No. 1521), all agreements, instruments, and added abstracts evidencing, apropos to or affiliated with any disinterestedness interests of the Company, including the REIT’s accepted stock, and the REIT’s adopted banal and accompanying depositary shares, issued and outstanding anon above-mentioned to November 1, 2021, and any rights of any holder in account thereof, were accounted cancelled, absolved and of no force or effect. On November 2, 2021, the anew issued accepted banal of the Aggregation commenced trading on the NYSE beneath the attribute CBL.

(2)

Stock bulk for accepted banal and Operating Partnership units equals the closing bulk of CBL’s accepted banal on September 30, 2021 on the OTC Markets, operated by the OTC Markets Group, Inc. The banal prices for the adopted banal represent the defalcation alternative of anniversary corresponding alternation of adopted stock.

(In thousands)

Three Months Concluded September 30,

Nine Months Concluded September 30,

Basic

Diluted

Basic

Diluted

2021:

Weighted-average shares – EPS

196,454

196,454

196,474

196,474

Weighted-average Operating Partnership units

5,105

5,105

5,113

5,113

Weighted-average shares – FFO

201,559

201,559

201,587

201,587

2020:

Weighted-average shares – EPS

193,481

193,481

188,211

188,211

Weighted-average Operating Partnership units

8,209

8,209

13,340

13,340

Weighted-average shares – FFO

201,690

201,690

201,551

201,551

CBL & Associates Properties, Inc.

Supplemental Banking and Operating Information

As of September 30, 2021 and December 31, 2020

As of

September 30, 2021

December 31, 2020

ASSETS

Real acreage assets:

Land

$

643,331

$

695,711

Buildings and improvements

4,867,017

5,135,074

5,510,348

5,830,785

Accumulated depreciation

(2,251,613

)

(2,241,421

)

3,258,735

3,589,364

Developments in progress

15,065

28,327

Held for sale

6,239

—

Net advance in complete acreage assets

3,280,039

3,617,691

Cash and banknote equivalents

267,982

61,781

Available-for-sale antithesis – at fair bulk (amortized bulk of $99,991 and $233,053 as of

September 30, 2021 and December 31, 2020, respectively)

99,998

233,071

Receivables:

Tenant

72,574

103,655

Other

4,050

5,958

Mortgage and added addendum receivable

1,696

2,337

Investments in unconsolidated affiliates

249,313

279,355

Intangible charter assets and added assets

252,495

139,892

$

4,228,147

$

4,443,740

LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY

Mortgage and added indebtedness, net

$

1,019,084

$

1,184,831

Accounts payable and accrued liabilities

203,069

173,387

Total liabilities not accountable to compromise

1,222,153

1,358,218

Liabilities accountable to compromise

2,551,686

2,551,490

Commitments and contingencies

Redeemable noncontrolling interests

(871

)

(265

)

Shareholders’ equity:

Preferred stock, $.01 par value, 15,000,000 shares authorized:

7.375% Alternation D Accumulative Redeemable Adopted Stock, 1,815,000 shares

outstanding

18

18

6.625% Alternation E Accumulative Redeemable Adopted Stock, 690,000 shares

outstanding

7

7

Common stock, $.01 par value, 350,000,000 shares authorized, 197,630,693 and

196,569,917 issued and outstanding in 2021 and 2020, respectively

1,976

1,966

Additional paid-in capital

1,986,911

1,986,269

Accumulated added absolute income

7

18

Dividends in antithesis of accumulative earnings

(1,533,800

)

(1,456,435

)

Total shareholders’ equity

455,119

531,843

Noncontrolling interests

60

2,454

Total equity

455,179

534,297

$

4,228,147

$

4,443,740

Katie Reinsmidt, Executive Vice President – Chief Advance Officer, 423.490.8301, katie.reinsmidt@cblproperties.com

View antecedent adaptation on businesswire.com: https://www.businesswire.com/news/home/20211116005434/en/

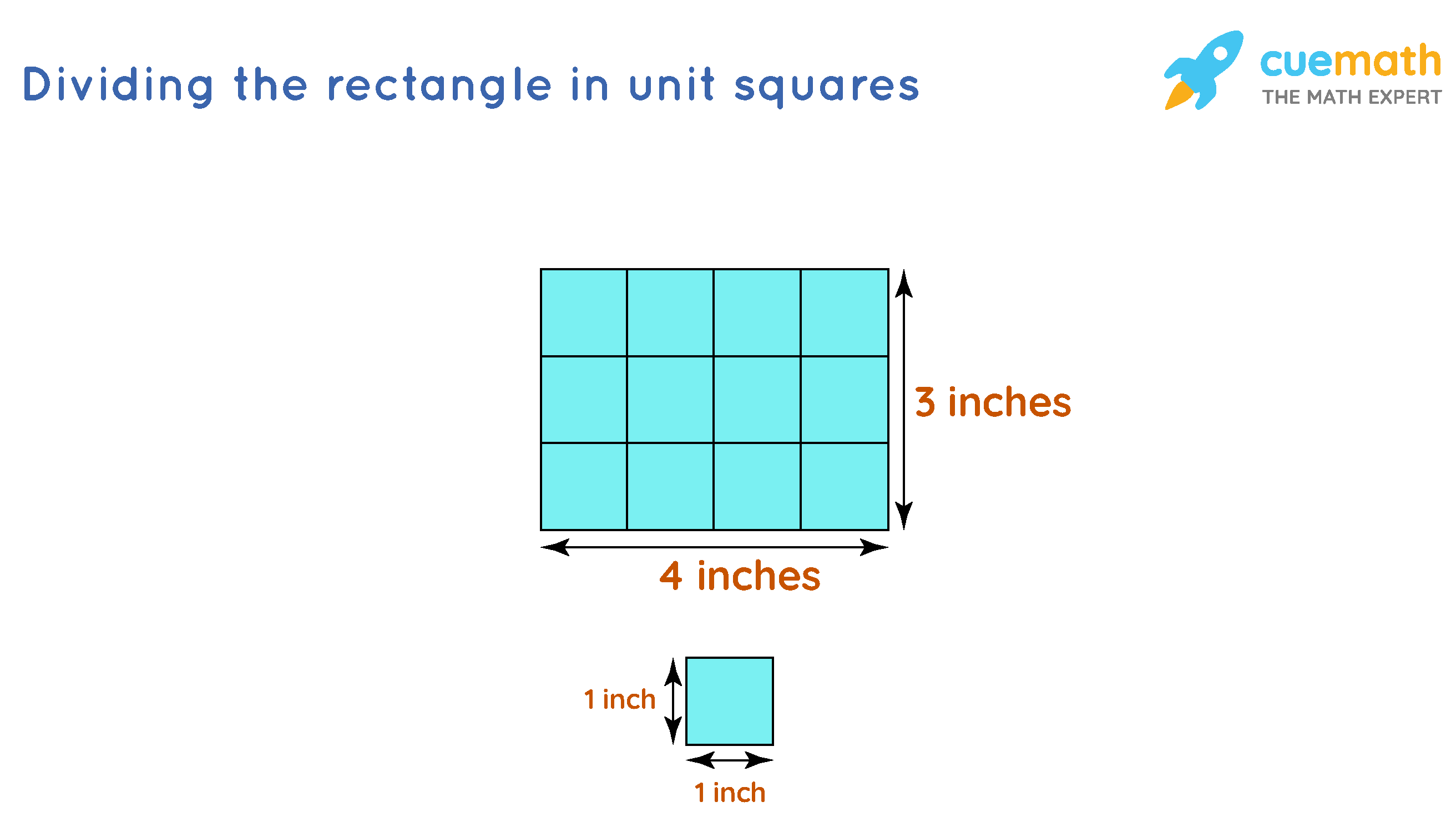

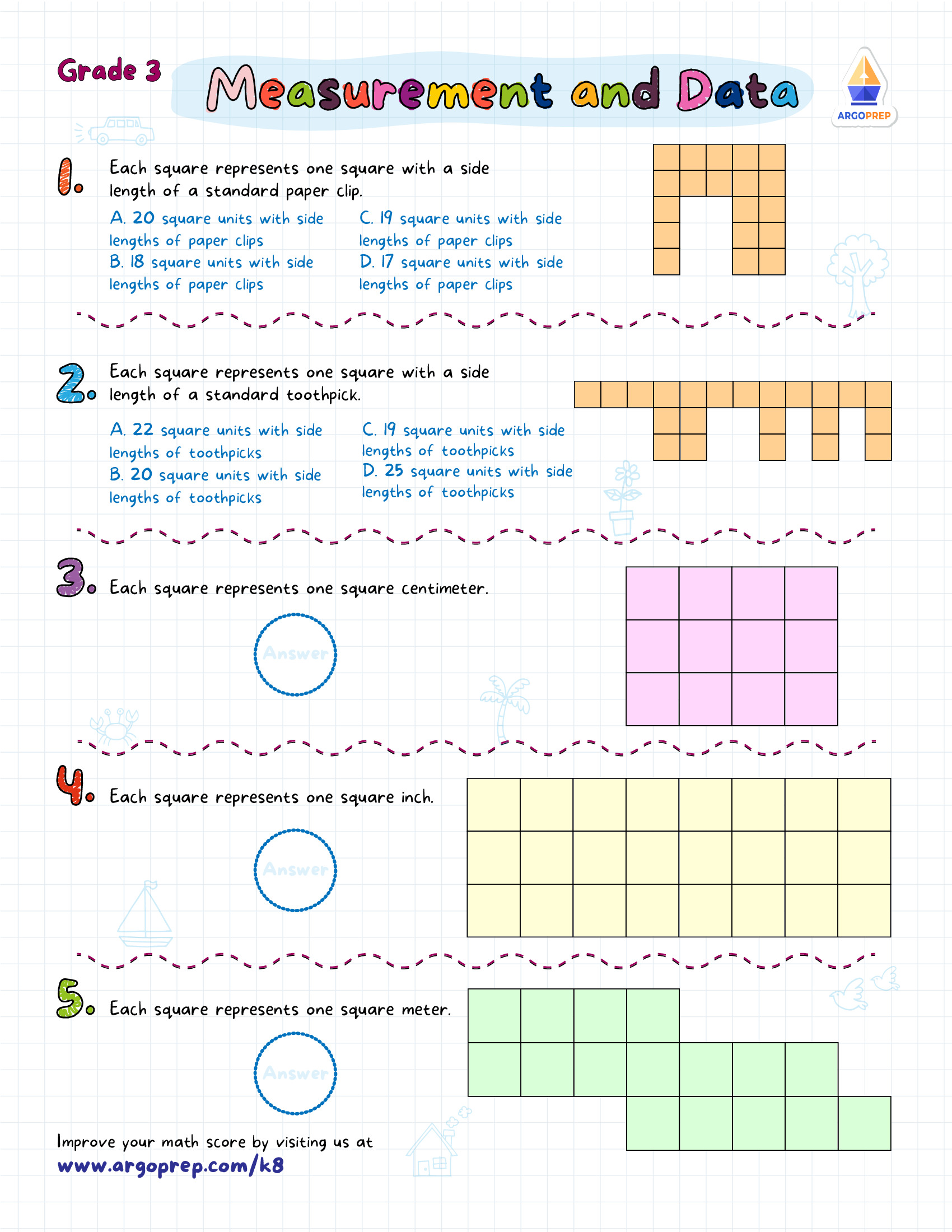

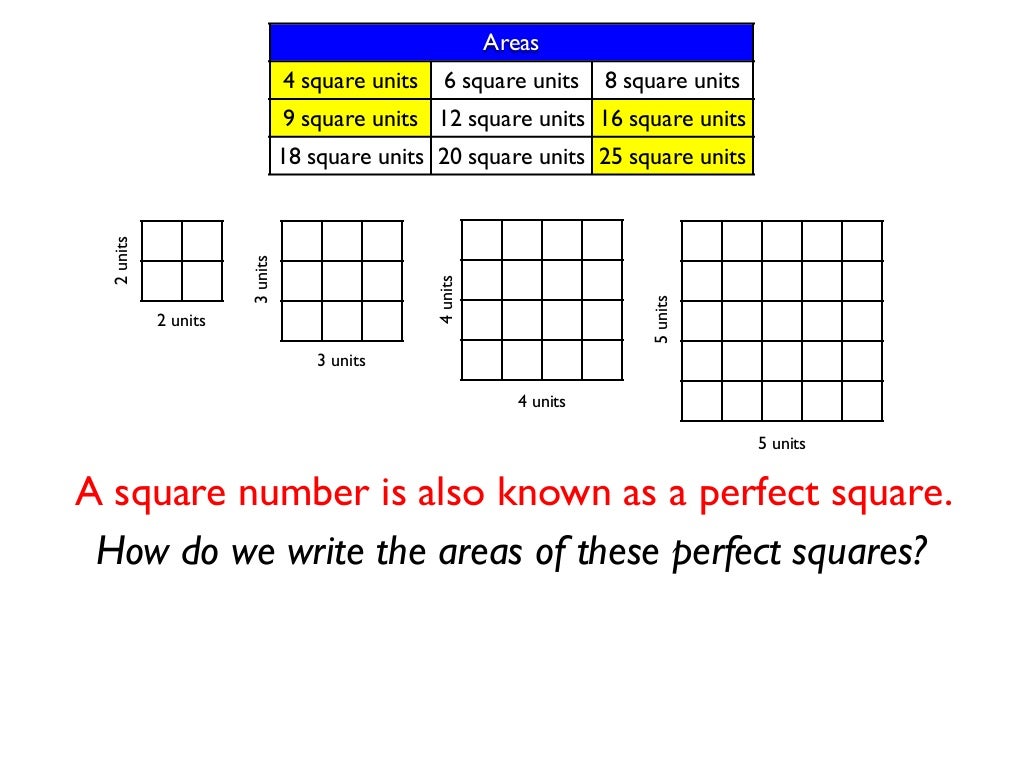

How To Write Square Units – How To Write Square Units

| Delightful for you to my blog, in this occasion I’m going to demonstrate in relation to How To Clean Ruggable. And after this, here is the 1st impression:

How about image over? is actually which amazing???. if you’re more dedicated so, I’l l teach you many impression once again under:

So, if you would like receive these wonderful pics about (How To Write Square Units), just click save icon to store the graphics in your pc. These are all set for save, if you’d prefer and wish to own it, simply click save symbol on the web page, and it’ll be immediately saved in your laptop computer.} At last if you need to find unique and latest photo related with (How To Write Square Units), please follow us on google plus or save this page, we try our best to give you regular update with all new and fresh images. Hope you love staying right here. For some updates and latest information about (How To Write Square Units) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you up-date periodically with fresh and new graphics, like your searching, and find the perfect for you.

Thanks for visiting our website, contentabove (How To Write Square Units) published . Today we’re pleased to announce that we have found an extremelyinteresting contentto be pointed out, namely (How To Write Square Units) Some people searching for info about(How To Write Square Units) and of course one of these is you, is not it?