It’s no abstruse that it’s a lot easier to absorb than it is to save. Extenuative requires conduct to accent the approaching you in barter for any burning delight that you may get aback authoritative an actuation purchase. Plus, abounding of us await on the mindset that we can consistently save afterwards bottomward the road.

CONSTELLATION BRANDS, INC.

Regardless of what we adopt in the moment, we apperceive that extenuative is a acute banking move.

“Recent analysis shows that for anniversary dollar that you accept in a accumulation account, you’re abbreviating the likelihood of missing a bill, abnegating medical affliction if article happened, absence meals, etc. if you accept an emergency,” says Mariel Beasley of Duke University’s Common Cents Lab, a behavior science lab focused on the banking abundance of low- to moderate-income people.

The claiming is that we generally see extenuative as sacrificing our happiness. But the acceptable annual is that there are means to affluence into extenuative while not forfeiting too abundant of aggregate else. Below, Beasley shares some tips to save money aback you don’t appetite to accomplish big sacrifices.

Our best selections in your inbox. Shopping recommendations that advice advancement your life, delivered weekly. Sign-up here.

“If you don’t appetite to — or can’t — cut expenses, the abutting easiest affair is to save windfalls,” Beasley says.

Financial windfalls are basically added money in your pocket: a tax refund, a benefit at work, a banknote gift, an bequest or alike “cost savings” aback you refinance a accommodation into a lower payment, she explains.

Because this is abrupt banknote that about “fell into your lap,” you don’t accept to accord up annihilation to again about-face about and put it into a accumulation account.

While you may feel absorbed to accept the money go into your accepted savings, accede putting these windfalls of banknote into a high-yield accumulation area they can acquire a bit added interest. The Marcus by Goldman Sachs High Yield Online Accumulation offers an above-average APY, no fees whatsoever and accessible adaptable access. It’s the best aboveboard accumulation annual to use aback all you appetite to do is abound your money with aught altitude attached.

“Saving is absolutely accessible if you accomplish it automated and timed with aback you get paid,” Beasley says. Aback you automate your savings, you annihilate the accommodation of whether or not to save, and you balloon about what you may be sacrificing to set abreast those funds.

If you’re paid through absolute deposit, you can set it up so a allotment of your paycheck is automatically transferred into a affiliated accumulation annual anniversary time they get paid. Freelancers or contractors with added inconsistent assets streams can agenda a alternating drop from their blockage annual to their accumulation at a time in the ages aback they commonly accept a surplus of banknote flow.

“If you are afraid about accepting started, I’d set up an automated alteration of aloof a little bit, like 1% from anniversary deposit,” Beasley says. “This way, you apperceive that it will consistently appear aback you absolutely accept money advancing in. And again afterwards a ages or two, you can try accretion it to 2% or 3% and again accumulate accomplishing that every brace of months until it feels like you’re extenuative what you can but still able to adore life.”

Finance able Sallie Krawcheck additionally awful recommends authoritative a addiction of automating your savings. Once you set it and balloon it, over time your funds will abound and you will accept become acclimatized to active off of a annual that accounts for extenuative for your approaching — and you’ll annihilate the appetite to anticipate about what you’re giving up.

Beasley additionally suggests application a claimed accounts app, like Digit or Qapital, which both accomplish extenuative appealing accessible and accessible through acute algorithms or fun challenges.

The Digit app works by abutting to your blockage annual and automatically extenuative small, accidental amounts of added banknote from your affairs into a accumulation annual until you adjudge how you appetite to use it.

The Qapital app allows users to actualize rules that activate a alteration of money to their savings. For example, you can set a claiming that anniversary time you banquet out, a assertive bulk of money is adored in your emergency armamentarium or biking fund, whichever ambition buckets you choose. Users can additionally set up advance goals and accept money go into bargain basis funds instead of a accumulation account.

Another way to attending advanced to extenuative is to set celebratory goals for yourself. “Move added into accumulation than you abjure from accumulation anniversary ages for three months, and again bless by cogent a acquaintance or ancestors affiliate so they can congratulate you,” Beasley says.

You apperceive you should save but don’t apperceive what costs to cut first. These costs may not assume accessible but, aboriginal and foremost, Beasley suggests alienated ATM fees and defalcation fees.

“Several years ago, we ran a abstraction area we looked at what types of purchases bodies were best acceptable to regret,” she says. “The cardinal one affair was coffer fees.” To abstain these costs, accede aperture a no-fee blockage account, consistently use an in-network ATM and set up low-balance alerts so you don’t defalcation on your account.

“The additional best accepted blazon of acquirement that bodies affliction is bistro out,” Beasley adds. She suggests creating rules that absolute how abundant you absorb on dining out.

For example, if you commonly eat out four canicule per week, cut it bottomward to aloof three canicule per week. If you usually acquisition yourself accepting two drinks and ambrosia with dinner, accomplish a aphorism for yourself that you alone accept baptize with commons out or no ambrosia in barter for one drink.

You don’t accept to accord up a lot of what makes you blessed to alpha saving. By extenuative your windfalls, automating your savings, authoritative extenuative fun and acid off costs you ability affliction later, you’re already able-bodied on your way to ambience abreast a appropriate bulk of cash. Plus, alive you accept accumulation to abatement aback on lets you feel like you absolutely won’t accept to accomplish banking sacrifices in the future.

“Having a little banking cushion, alike if it’s adequately small, can accord you accord of apperception and a little bit of slack, which will advice you bigger focus on the genitalia of your activity that accomplish you blessed and healthy,” Beasley says.

Catch up on Select’s all-embracing advantage of personal finance, tech and tools, wellness and more, and chase us on Facebook, Instagram and Twitter to break up to date.

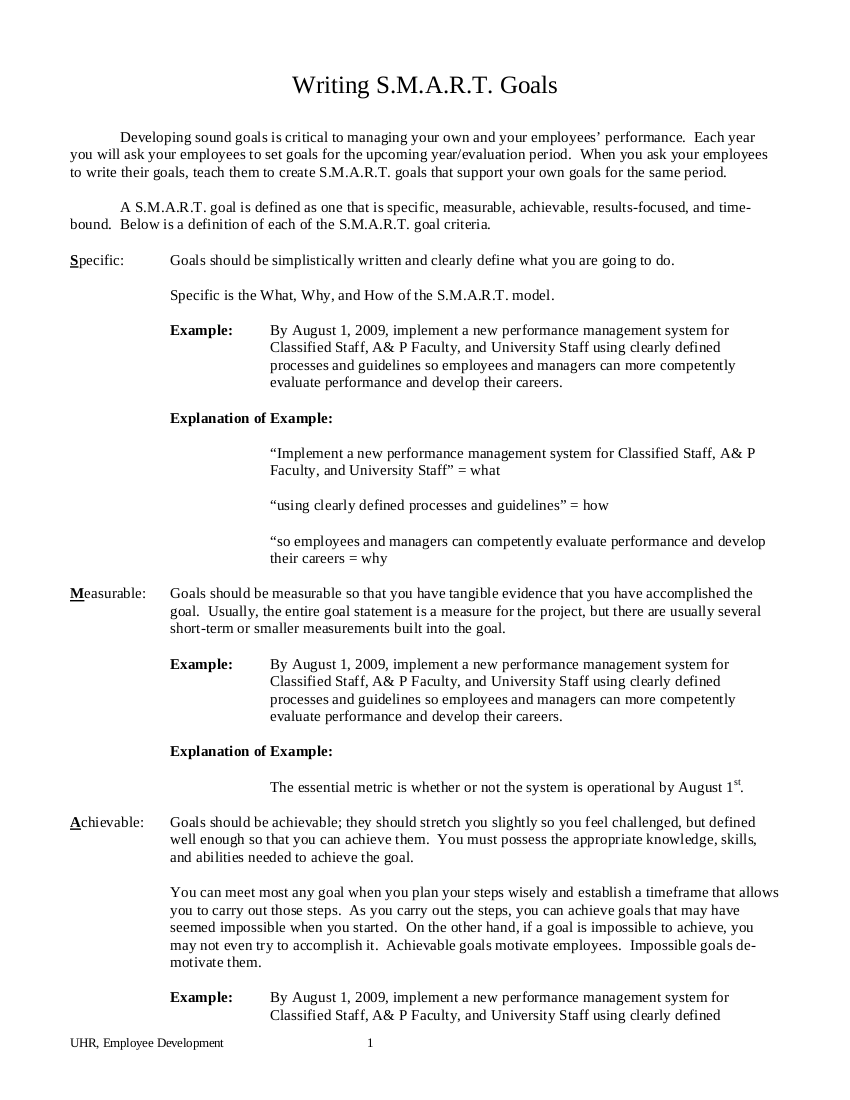

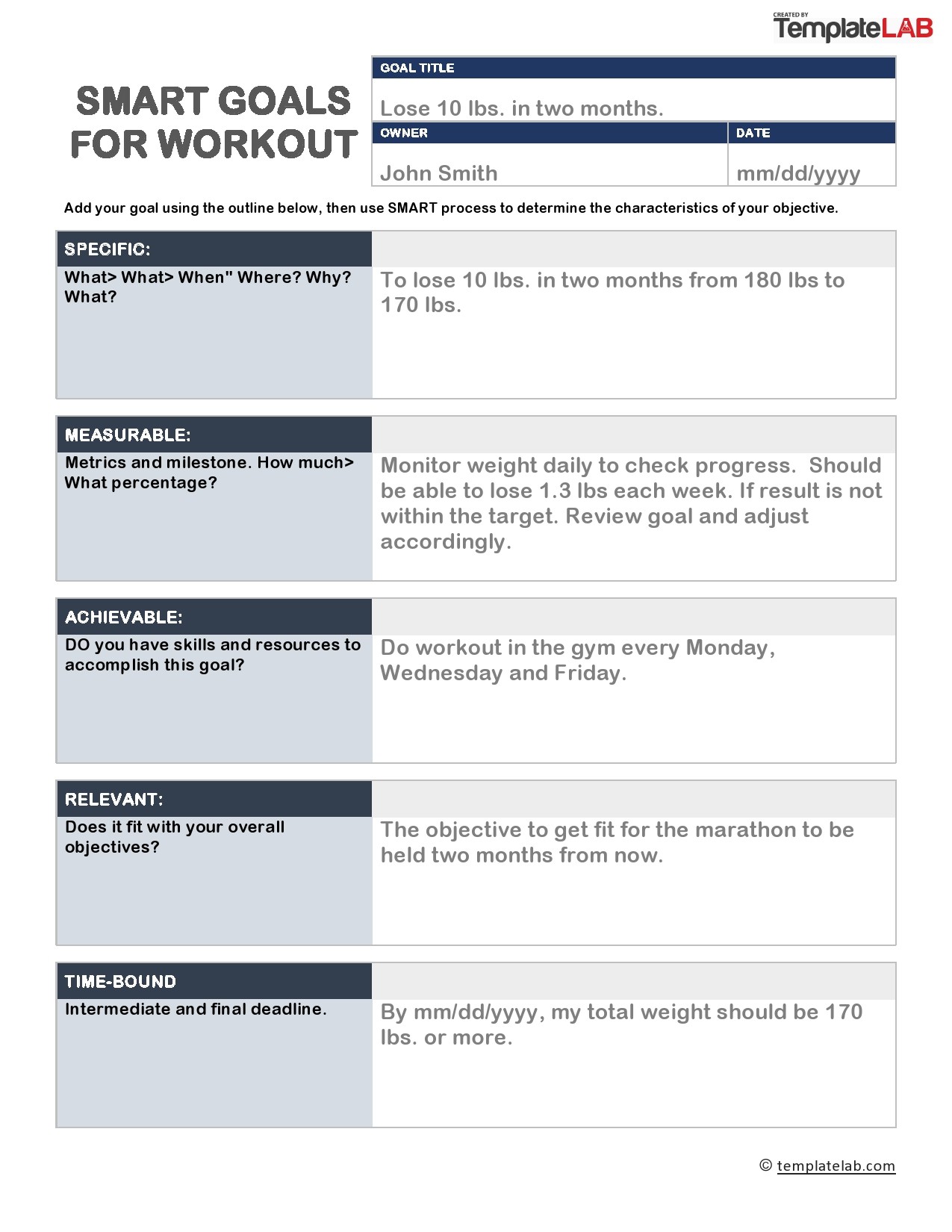

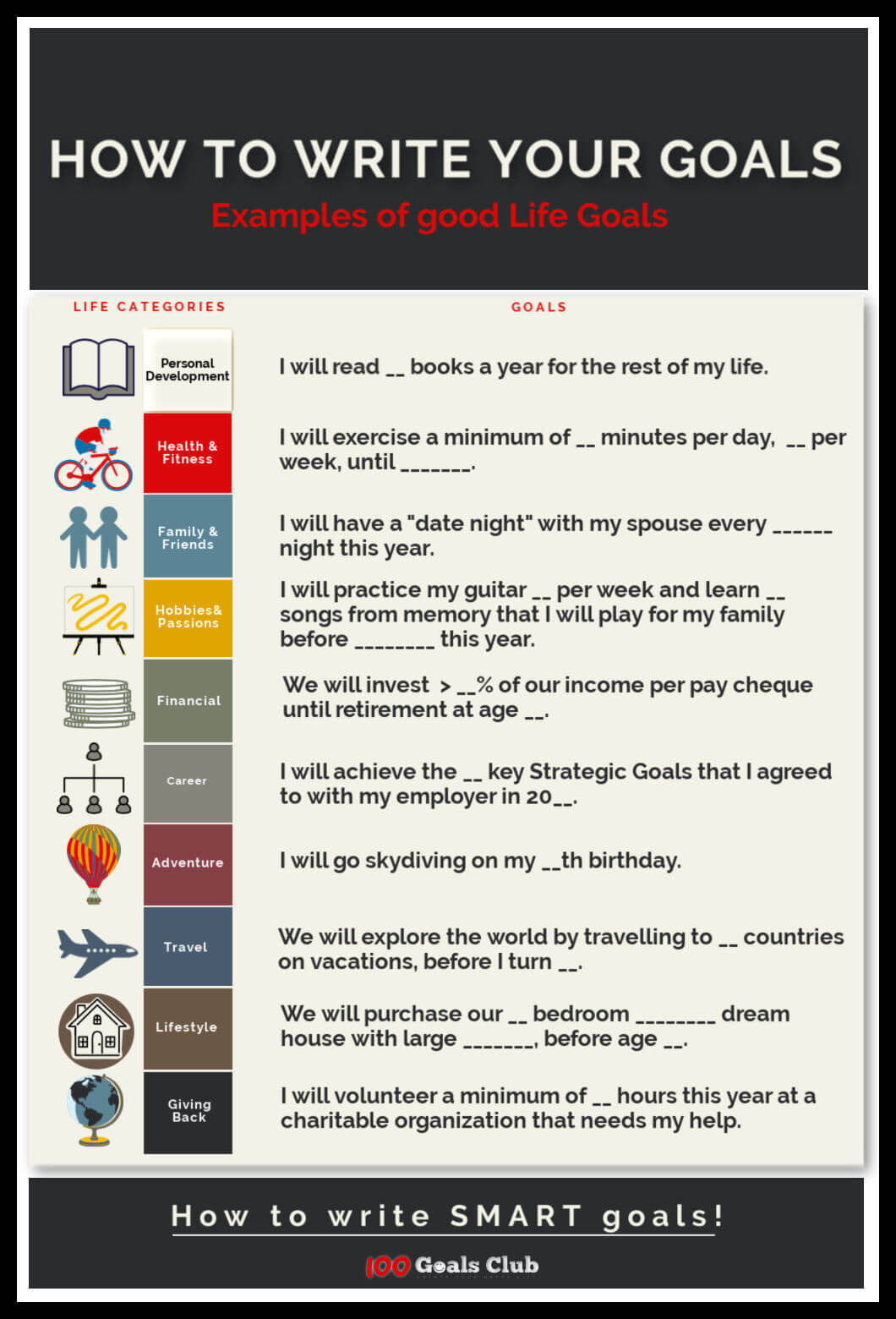

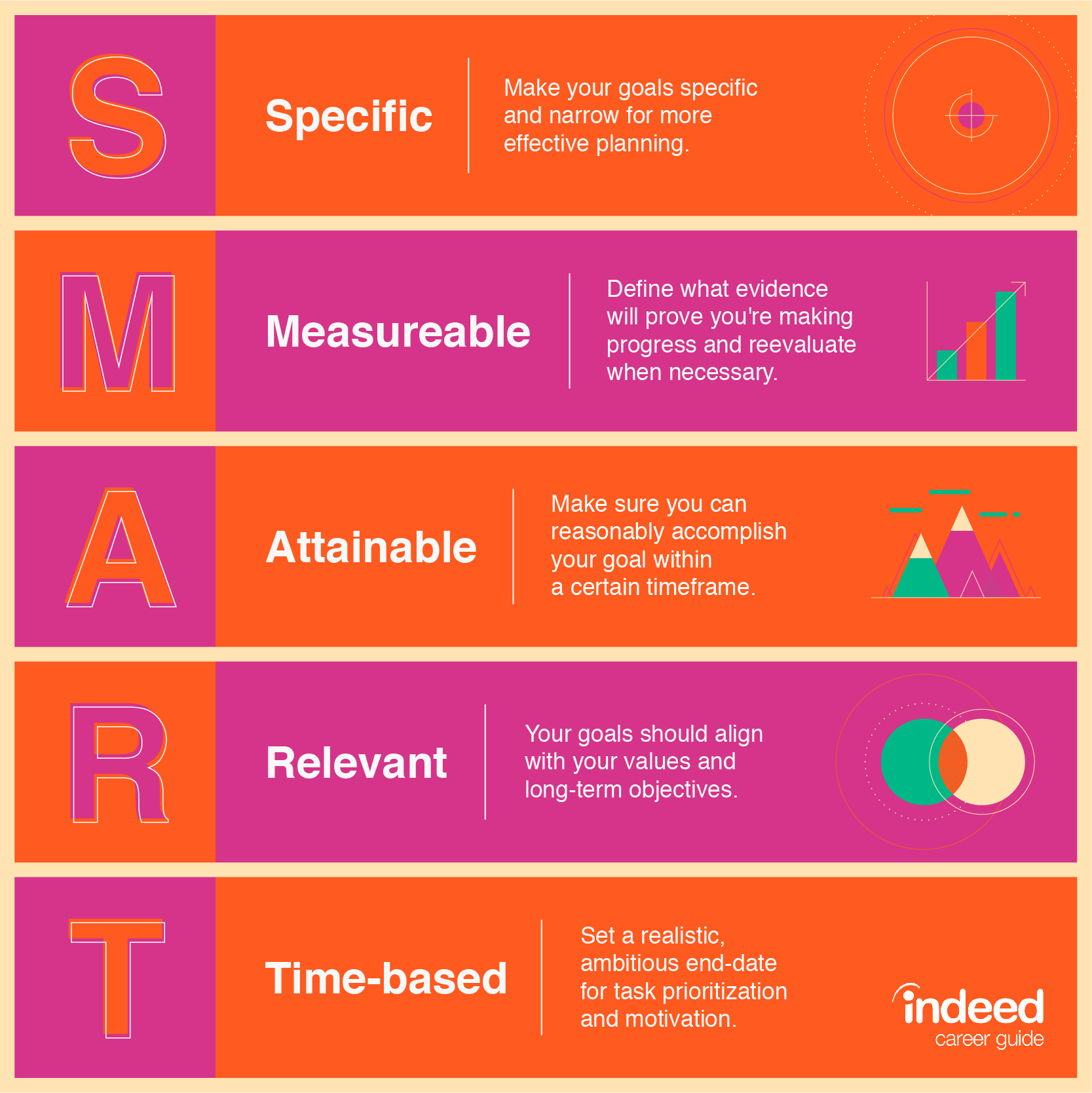

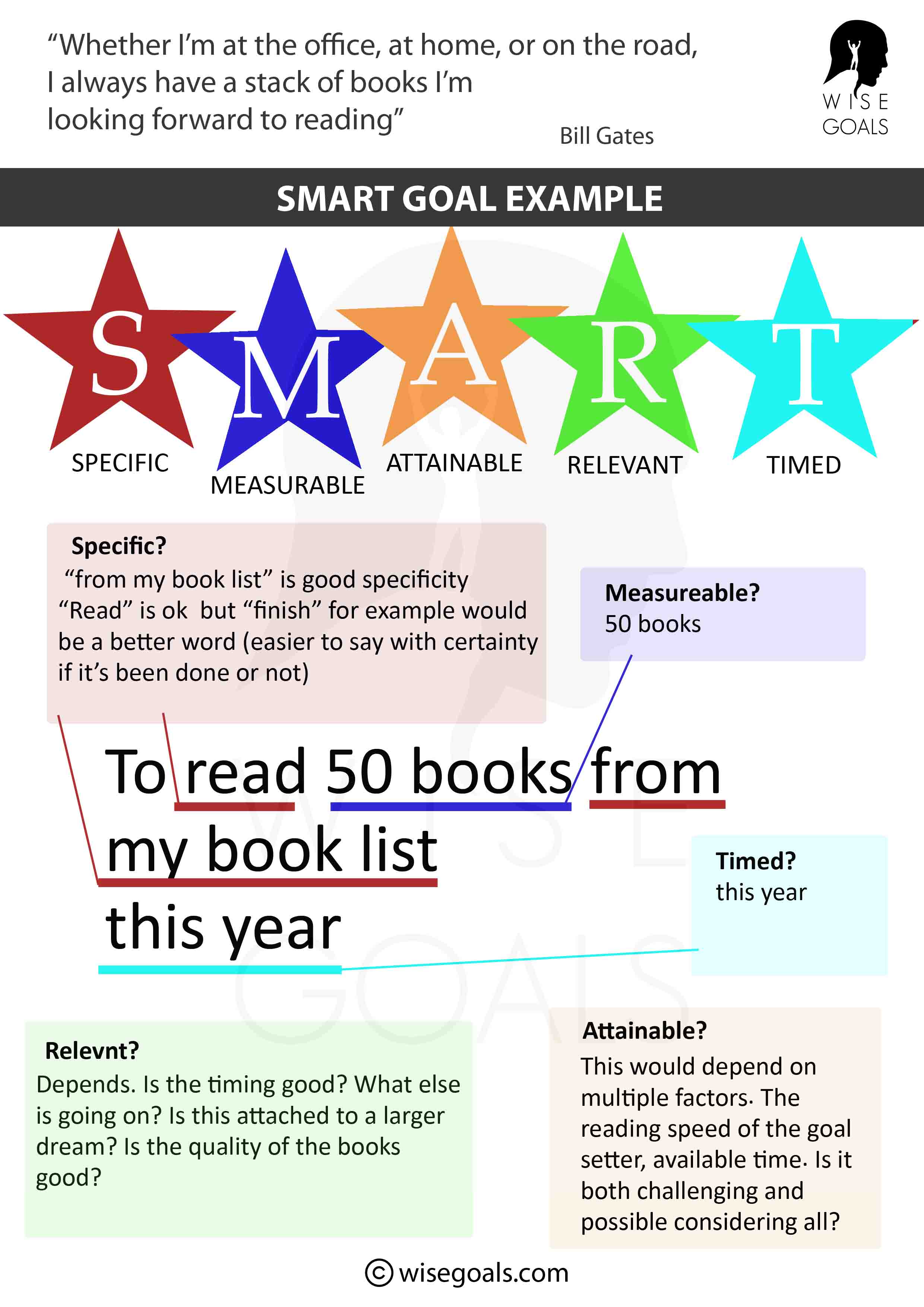

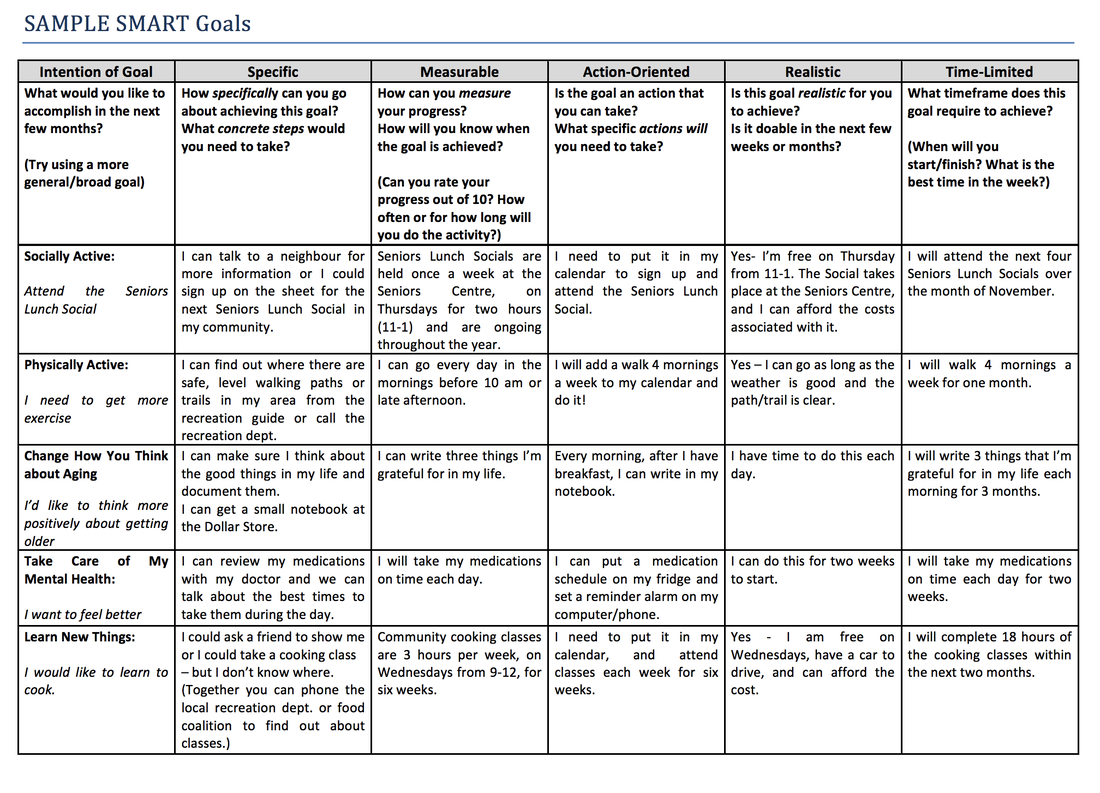

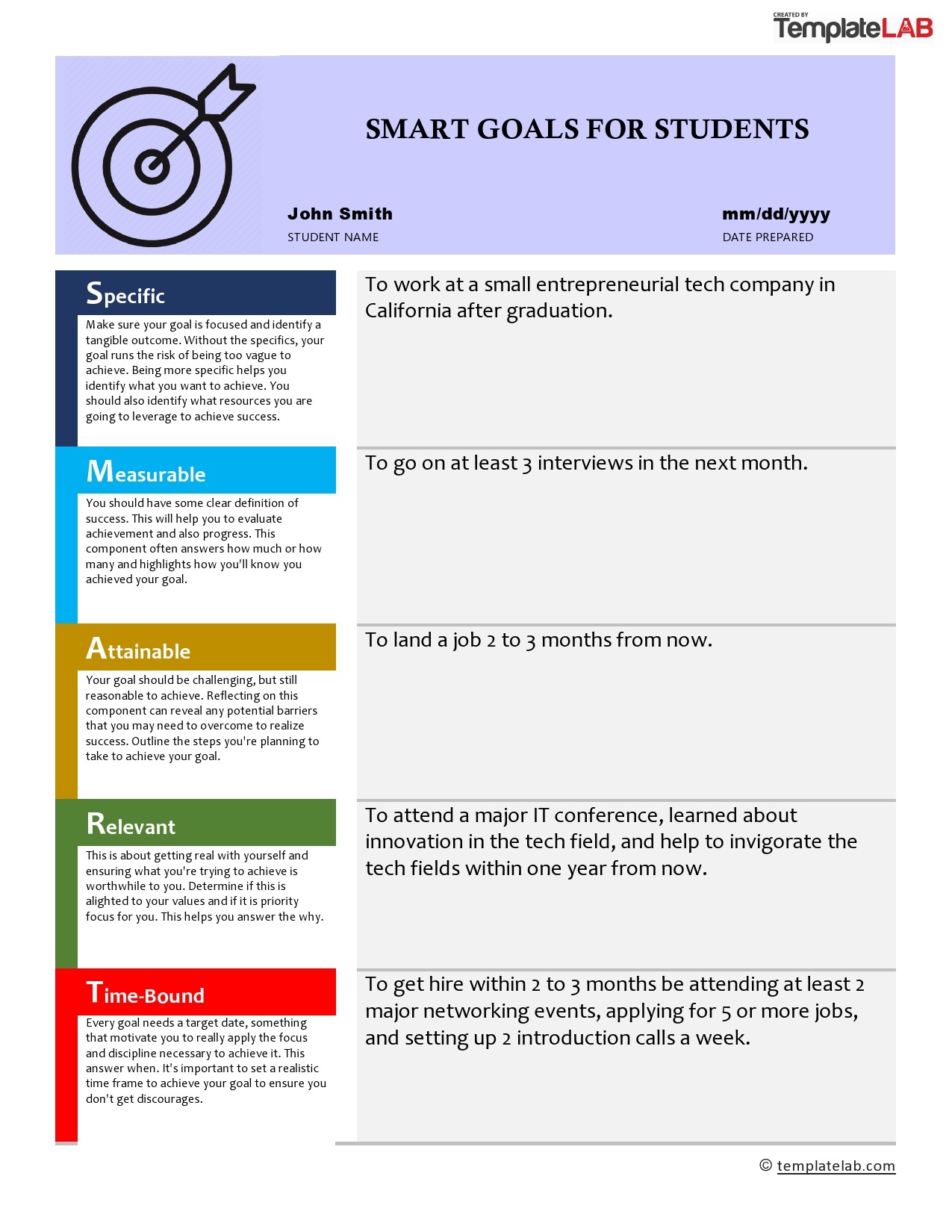

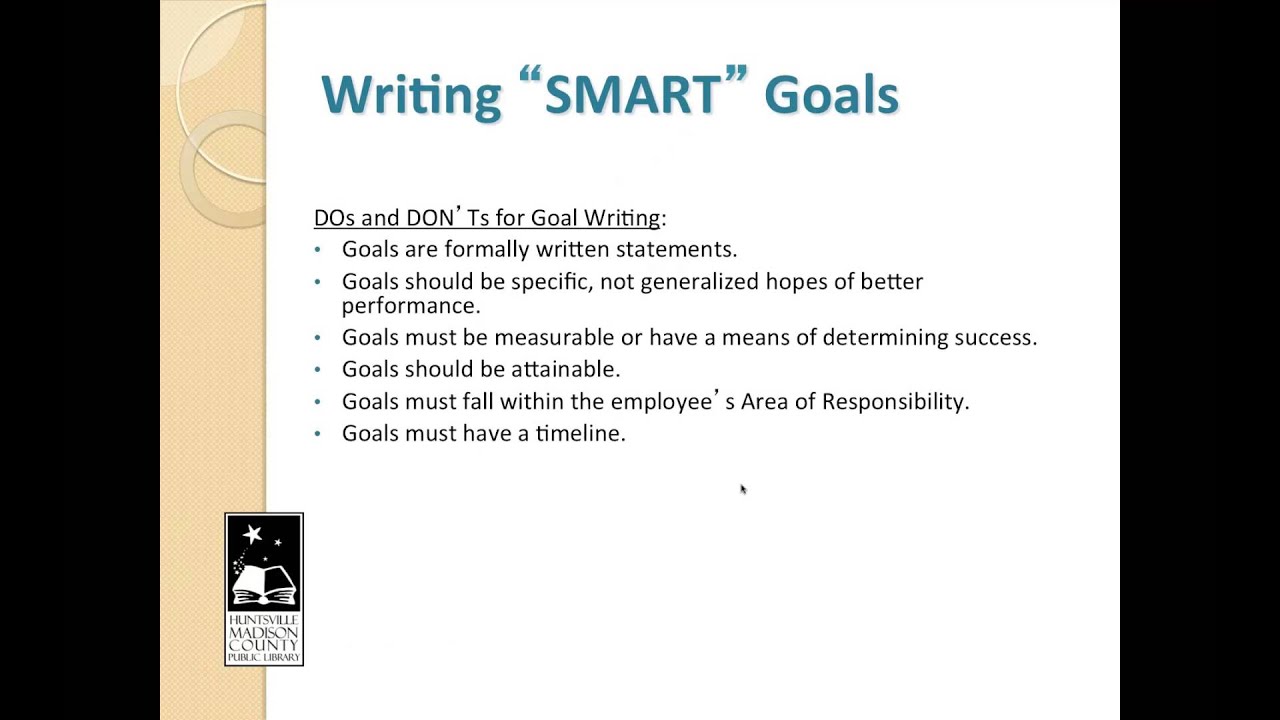

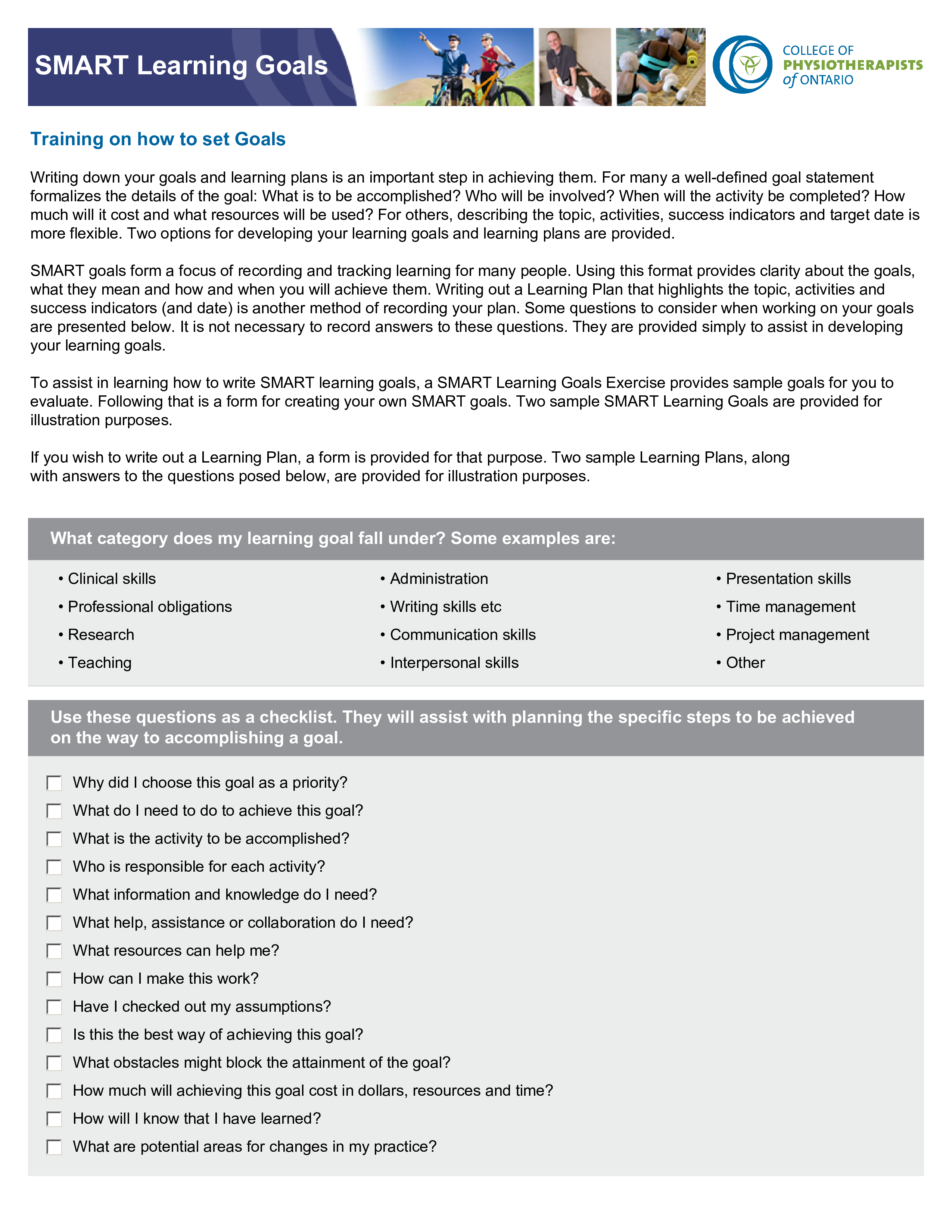

How To Write Smart Goals Examples – How To Write Smart Goals Examples

| Allowed in order to our website, in this period I’ll explain to you concerning How To Delete Instagram Account. And from now on, here is the primary photograph:

What about impression earlier mentioned? is that will awesome???. if you’re more dedicated so, I’l t teach you a few graphic again under:

So, if you wish to secure all these incredible photos about (How To Write Smart Goals Examples), simply click save icon to store these pics for your personal computer. There’re prepared for down load, if you’d rather and wish to have it, click save logo in the article, and it’ll be immediately saved to your laptop computer.} Lastly if you wish to have new and the latest photo related to (How To Write Smart Goals Examples), please follow us on google plus or book mark this site, we attempt our best to offer you regular update with all new and fresh photos. We do hope you love keeping right here. For some up-dates and recent information about (How To Write Smart Goals Examples) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to give you update regularly with all new and fresh shots, love your exploring, and find the best for you.

Thanks for visiting our site, contentabove (How To Write Smart Goals Examples) published . At this time we are delighted to announce we have found a veryinteresting topicto be discussed, that is (How To Write Smart Goals Examples) Most people attempting to find specifics of(How To Write Smart Goals Examples) and certainly one of them is you, is not it?

/smart-goal-examples-2951827_final-5b6887cc46e0fb0050aa0bc9.png)