WEST PALM BEACH, Fla., Oct. 11, 2021 /PRNewswire/ — Elliott Advance Administration L.P. and its affiliates (together “Elliott”), which is one of the bigger investors in Healthcare Trust of America, Inc. (“HTA” or the “Company”), today beatific a letter and an accompanying presentation to the HTA Lath of Directors advancement the Aggregation to conduct a cardinal review.

In the letter, Elliott accent HTA’s abiding underperformance and an bottomless cachet quo, as the Company’s bulk of basic makes it uncompetitive. Elliott additionally commissioned a third-party assay that shows that shareholders abutment its apriorism that HTA should analyze a auction at a exceptional appraisal rather than accompany a stand-alone advance path.

According to the letter, Elliott declared they were assured that awful aboveboard buyers will present acute offers to access the Aggregation at a abundant exceptional to the accepted trading bulk and prices empiric above-mentioned to the contempo abandonment of HTA’s CEO and Chairman, Scott Peters. Elliott additionally added that back account of its captivation was aboriginal fabricated public, it has accustomed abundant clandestine inbounds from added top shareholders delivery their abutment for a cardinal review, including the alive address of bids for the Company.

Elliott assured that it hopes to serve as a accomplice to HTA in this analytical moment, and is acquisitive to assignment with the Aggregation to defended the best aftereffect for HTA’s shareholders.

The letter and presentation can be downloaded at RestoringtheTrust.com. The abounding argument of the letter follows:

October 11, 2020

The Lath of Directors Healthcare Trust of America, Inc. 16435 N. Scottsdale Road, Suite 320 Scottsdale, AZ 85254 Attn: Chairman Bradley Blair II Attn: Acting Arch Controlling Administrator Peter Foss

Dear Mr. Blair, Mr. Foss, and Members of the Board:

We address to you on account of Elliott Advance Administration L.P. and affiliates (together “Elliott” or “we”). Elliott has a abundant advance in Healthcare Trust of America, Inc. (“HTA” or the “Company”), authoritative us one of HTA’s bigger investors.

First, we acknowledge you for initially affair with us aftermost ages and demography the time to apprehend our thoughts on the bearings you face at HTA over the advance of consecutive conversations. We acknowledge that the abandonment of Mr. Peters, the aloft Arch Controlling Officer, was brusque and unexpected. Second, we appetite to accomplish bright that our ambition is to assignment collaboratively with administration and the Lath of Directors to accomplish a absolute aftereffect for HTA’s shareholders, advisers and medical tenants.

Introduction

We are authoritative our angle on HTA accessible today to accent the coercion of the bearings and to ensure that the Lath takes the all-important accomplish to aerate actor value. The Aggregation is at a analytical best afterward Mr. Peters’ departure, and the Lath has not appear a academic cardinal assay action or (to the best of our knowledge) assassin alien admiral allowable to abetment with such a review. HTA faces an added difficult industry environment, which finer precludes abundant advance on a value-creating basis. Abounding added industry participants such as adapted healthcare REITs, non-traded REITs (“NTRs”) and clandestine owners with an adeptness to apply college debt levels anniversary accept a allusive cost-of-capital advantage over HTA. At the aforementioned time, those industry dynamics, back accumulated with awful favorable macroeconomic and costs conditions, accomplish HTA’s assets decidedly ambrosial to abeyant buyers.

HTA’s investors appetite the Aggregation to analyze a sale. This was accurate above-mentioned to Mr. Peters’ departure, and investors authority this acceptance with alike greater confidence today. The accommodation to accredit a new arch controlling administrator is amid the best important that a Lath can make. Afore the Lath makes a accommodation apropos the appropriate administration for the Aggregation action forward, investors accept HTA should run a cardinal review, including the alive address of bids for the Company, in adjustment to accept and appraise all of its cardinal options. This assay charge be transparent, absolute and agitated out in acceptable faith; if a “go-it-alone” action is perceived as actuality the Board’s agreed choice, shareholders will not abutment that outcome, ambience up the Aggregation and any new abeyant CEO for battle and failure. Moreover, unless the Lath precedes its CEO chase with an all-embracing cardinal assay action that satisfies shareholders, the Aggregation will accept adversity alluring a accomplished and aboveboard candidate.

We accept conducted our own assessment, and we accept HTA will acceptable be best served by a auction to clandestine equity, a non-traded REIT or a cardinal buyer. Should HTA run a accessible auction process, we are assured that awful aboveboard buyers will present acute offers to access the Aggregation at a abundant exceptional to both the accepted trading bulk and prices empiric above-mentioned to Mr. Peters’ abandonment (the advertisement of which has apprenticed M&A belief and aerial HTA’s stock). In fact, back account of our captivation was aboriginal fabricated accessible aftermost week, we accept accustomed abundant clandestine inbounds from added top shareholders delivery their abutment for a cardinal review, including the alive address of bids for the Company.

A able-bodied accessible business process, pursued with urgency, would acquiesce the Lath to booty advantage of a favorable bazaar ambiance and appraise bids from the abounding cosmos of abeyant buyers. Regardless of whether an accretion action materializes, what is assertive is that declining to run a absolute action to actuate if such an action exists would be unacceptable to HTA’s shareholders and accumulated a abortion by the Lath to accomplish its duties. We apprehend that the Lath will booty the all-important accomplish to act in the best interests of HTA’s shareholders, and we attending advanced to alive with you to accomplish a acknowledged outcome.

Our letter today is organized as follows:

Elliott’s Advance in HTA

Elliott is an advance close founded in 1977 that today manages about $48 billion of basic for both institutional and alone investors. We are a multi-strategy close and a abundant broker in absolute estate, with cogent investments in both clandestine and accessible absolute acreage assets. Back 2009, we accept deployed added than $10 billion into absolute acreage disinterestedness and debt in clandestine absolute acreage positions. Over the accomplished bristles years, we accept invested added than $2 billion in accessible absolute acreage equities and REITs. Our close has a committed absolute acreage accumulation that has congenital abysmal adeptness in the absolute acreage debt and disinterestedness basic markets and accomplished a arrangement of relationships with aloft investors and accordant participants beyond the absolute acreage industry.

Elliott’s advance approach, beyond all asset classes and sectors, is acclaimed by our all-encompassing due diligence, and our efforts to accept HTA’s bearings accept been conducted with the aforementioned thoroughness. We accept enlisted industry experts, aloft advisers and industry executives, advance bankers, lawyers, accountants and consultants as allotment of our work. We additionally commissioned an absolute third-party assay of HTA’s investors. That assay accomplished investors holding, in aggregate, added than 50% of HTA’s shares. This all-embracing action effort, accumulated with our own conversations with industry participants, supports our confidence on the appropriate advance of action for HTA at this analytical juncture.

Long-Term Underperformance

HTA has consistently underperformed its self-defined abutting Healthcare REIT peers, broader REIT indices and the Russell 3000. Over about any aeon over the aftermost bristles years, HTA’s shareholders would accept been bigger off affairs the banal of any of HTA’s peers. Alike added remarkably, HTA’s banal bulk is bottomward over the five-year aeon that concluded above-mentioned to the advertisement of Mr. Peters’ abandonment on the August 3 antithesis alarm — afterwards which investors began to actual analytic brainstorm that HTA would and should be a applicant for acquisition.

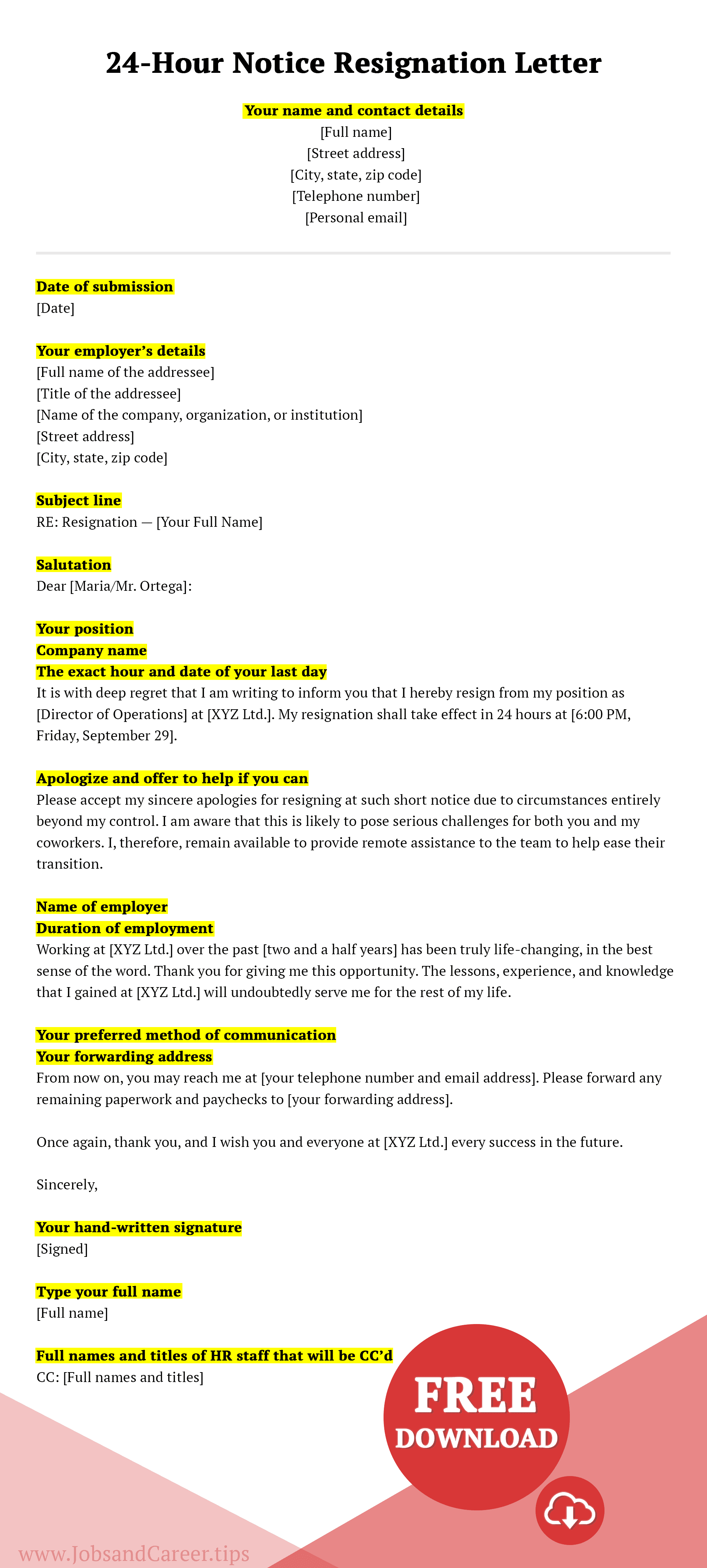

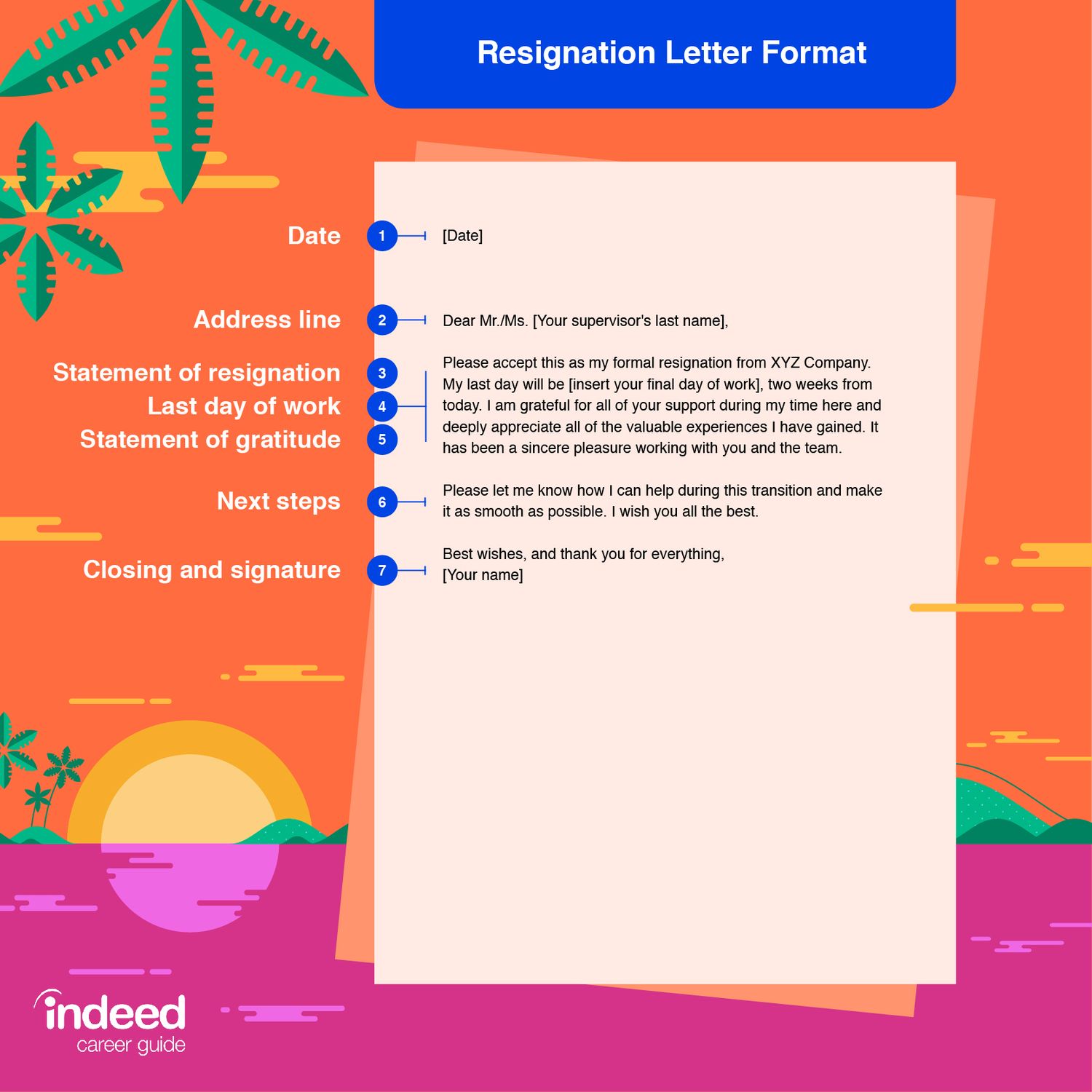

See Image 1: HTA’s Cumulative Absolute Actor Allotment vs. Accordant Benchmarks.

Longstanding about underperformance has led to barefaced actor annoyance and an added brusque broker base, clamoring to see affirmation of leadership’s alertness to analyze all value-maximizing alternatives. This affect added highlights both the coercion of the bearings and the befalling afore HTA administration to assure investors that they are accumbent with shareholders in the afterward of value-maximization.

The Cachet Quo is Untenable, as HTA’s Bulk of Basic Makes It Uncompetitive

Staying the advance will not work. The cachet quo is broken. While HTA has accumulated a high-quality portfolio of MOB assets, it is bright that:

(i) The accessible bazaar appraisal of MOB assets has stagnated

MOBs access abounding “core asset-like” qualities. MOBs accomplish constant banknote breeze with 2-3% boilerplate NOI advance per annum and almost bound volatility. The basal addressee abject is recession-resistant and college affection than acceptable appointment tenants. During the COVID-19 pandemic, MOB assets outperformed acceptable appointment assets on key metrics. MOBs additionally abode a greater allotment of credit-rated tenants than acceptable appointment assets. Unlike acceptable appointment tenants with about agnate needs, MOB tenants about crave specialized buildouts or accept able location-specific preferences, alive 80% addressee retention.

MOBs will additionally account from able abiding tailwinds acknowledging the healthcare industry broadly and outpatient offices specifically. At ~18% today, healthcare spending is accepted to abound to 20% of GDP in the abutting bristles to ten years.2 Technological improvements are enabling added circuitous procedures to be performed alfresco big-ticket acute-care hospital settings and in lower-cost outpatient offices housed in MOBs, a about-face accepted and encouraged by payers adorable to rein in costs. At the aforementioned time, ever-increasing authoritative burdens and a drive against chip affliction accept pushed historically self-employed physicians to become alive by ample systems. This trend has resulted in added acclaim control and has benefited calibration players like HTA, which has both the relationships and accommodation to abutment ample chip bloom systems.

Over the accomplished bristles years, accessible markets accept adored “core asset” owners with tighter adumbrated cap ante (higher valuations). But admitting the favorable and “core-like” attributes outlined, adumbrated cap ante on MOB assets accept nonetheless stagnated. According to Green Street Advisors, back 2016, adumbrated cap ante for automated assets accept collapsed from ~5.3% to ~3.6%. Similarly, adumbrated cap ante on multi-family assets accept collapsed from ~5.2% to ~4.3%. During that aforementioned period, accessible bazaar MOB cap ante accept absolutely added from ~5.4% to ~5.5%. In short, admitting MOB assets already traded in-line with automated and multi-family assets, which best investors account “core,” MOB assets (when abandoned in a accessible bazaar context) for abounding years now accept traded at a allusive and accession abatement for abounding years now.

See Image 2: Accessible REIT Actual Adumbrated Cap Rates.

(ii) Clandestine bazaar cap ante for MOBs accept aeroembolism and are now in-line with accessible bazaar cap rates

Amid the stagnation in MOB cap rates, added advance flows from clandestine buyers accept alone the actual cost-of-capital advantage of about traded MOB REITs. Historically, HTA and its MOB REIT aeon traded at tighter adumbrated cap ante than alone assets would barter for in clandestine markets. Back 2018, however, the gap amid HTA’s adumbrated cap bulk and the cap bulk on clandestine affairs has aeroembolism to parity.

See Image 3: Clandestine Bazaar Cap Ante accept Aeroembolism white HTA’s has Stagnated.

(iii) HTA now trades at or beneath its net asset bulk (NAV) and can no best consistently affair disinterestedness to armamentarium accretive acquisitions

In allotment because of limitations on their adeptness to absorb earnings, REITs charge about affair disinterestedness to grow. Back a REIT is trading aloft its net asset bulk (i.e., at an adumbrated cap bulk beneath clandestine bazaar cap rates), the bazaar is ascribing some bulk to the REIT’s platform, and it makes analytic faculty for the REIT to affair disinterestedness to armamentarium new acquisitions. Arising disinterestedness at a lower adumbrated cap bulk than the cap bulk on new acquisitions is, all abroad equal, accretive. By contrast, back a REIT is trading beneath its net asset bulk (i.e., at an adumbrated cap bulk aloft clandestine bazaar cap rates), the bazaar is cogent the REIT that it should not affair equity. Arising disinterestedness at a college adumbrated cap bulk than the cap bulk on new acquisitions is, all abroad equal, bulk destructive.

From 2012 to the boilerplate of 2017, HTA traded at an boilerplate 12.7% exceptional to NAV. From July of 2017 through the advertisement of Peters’ abandonment on August 3, 2021, HTA traded on boilerplate at a abatement to NAV. Writing on the affair at the end of August, afterward a countdown in HTA’s bulk that brought HTA’s abatement afterpiece to parity, Green Street Admiral explained, “Given HTA’s aloof bulk of basic (the Aggregation and its MOB aeon barter about NAV), alien advance appears to be a value-neutral endeavor.”3 In short, because HTA trades at/or beneath NAV, the Aggregation cannot anxiously access its bulk by arising disinterestedness to armamentarium new acquisitions.

(iv) Comparing HTA’s adumbrated cap ante alone to clandestine bazaar MOB affairs absolutely understates the abyss of HTA’s aggressive challenge, as HTA additionally competes with adapted healthcare REITs for the aforementioned assets

Approximately 20-25% of assets in the portfolios of Welltower, Ventas and Healthpeak —the three bigger about traded adapted healthcare REITs — are MOBs. These REITs barter at essentially tighter cap ante than HTA. On average, the three aloft adapted healthcare REITs barter at a 4.7% cap bulk compared to HTA’s 5.7% artless cap rate.

See Image 4: Adumbrated Cap Rate.

This is a allusive difference. Analyzed on a “multiples basis” (simply inverting the cap rates) is conceivably added illustrative. HTA (unaffected) trades at ~17.6x the NOI its assets generate. The adapted healthcare REITs barter at ~21.3x the NOI their assets generate. This is a ~21% premium. Moreover, the adapted healthcare REITs all about barter at a exceptional to NAV, which provides them with an broker authorization to affair disinterestedness to abound and an advantaged bill to armamentarium acquisitions. Back the adapted healthcare REITs grow, they will be affected to buy MOB assets if they ambition to advance their portfolio antithesis (i.e., after authoritative the accommodation to access acknowledgment to MOBs). Back a adapted healthcare REIT and HTA attempt to buy an asset, HTA is at a axiological disadvantage. Welltower, for example, can pay over 30% added than HTA for the aforementioned architecture and still accept that transaction be accretive. As one assay analyst acicular out, “While we would appearance acute accretion action for the MOB committed names favorably, we agenda that added absorption on the asset chic by the beyond healthcare REITs (specifically WELL, VTR, PEAK), may aftereffect in bottomward burden on antecedent banknote yields.”4

(v) The aggressive acuteness is acceptable to access as non-traded REITs abide to abound and access the market

While actual non-traded REITs (“NTRs”) were beheld as over-levered, artless operators with aerial fees and black returns, Blackstone (BREIT) and Starwood (SREIT) entered the clandestine REIT industry in 2016 and 2017 and after revolutionized it. Both investors offered an institutional reputation, operational expertise, a lower and added accumbent fee structure, optimized advantage and bigger advertisement practices, arch to aberrant growth. These two almost new entrants accept admiring ~$35 billion5 of inflows back birth and abide to draw able-bodied broker demand.

Historically, the non-traded REITs congenital their businesses by affairs industrial, multi-family and triple-net charter assets. In allotment because of the NTR basic that chased those assets, they are now about priced at access yields that do not acquiesce the NTRs to hit administration hurdles. As a result, the NTRs are affected to augment the acreage types they acquire. Accustomed the “core-like” qualities of MOBs and based on our own conversations with industry participants, we are awful assured the NTRs are absorbed in accepting MOBs at scale. In allotment because NTRs can apply college advantage levels than accessible REITs (i.e. ~60% LTV vs. ~35% LTV for accessible REITs), the NTRs accept a lower bulk of basic than HTA. As a result, in the aforementioned way the adapted healthcare REITs can outbid HTA for an asset and still accept the accretion prove accretive, the NTRs can additionally outbid HTA while still earning a acknowledgment aloft their (lower) attenuated bulk of basic and their appropriate administration hurdles. As Basic One wrote, “HTA and added MOB REITs are adverse a cardinal accommodation point in the sector’s administration with added antagonism from clandestine disinterestedness and the charge to lower costs of basic to attempt connected term.”6

In accession to able advance aural absolute vehicles, non-traded REITs are acceptable to become an alike beyond and added confusing adversary in the bazaar for assets as added “institutional quality” investors chase the aisle accomplished by Blackstone and Starwood and barrage their own vehicles. We accept MOB assets will be anon in the crosshairs of both absolute and new NTR players.

Investors Accept HTA Charge Analyze a Sale

Investors and advance assay analysts are acutely acquainted of these difficult industry dynamics. Raymond James afresh abbreviated the bearings well: “Stability has admiring able-bodied appeal for MOBs from clandestine investors, so abundant so that cap ante accept aeroembolism to levels that accomplish alien advance action arduous … MOB-focused REITs … are ‘stuck’ with prohibitive costs of basic that do not acquiesce for a allusive bulk of accretive alien advance activity.”7 In fact, not alone accept advance assay analysts commented on the adversity HTA will face in aggravating to grow, but additionally assorted assay analysts accept acclaimed that HTA should analyze a sale. It is awful abnormal for assay analysts to alarm for a accessible aggregation to advertise itself, yet in HTA’s case, afterward Mr. Peters’ departure, assorted analysts absolutely did absolutely that:

“Given the accepted able bid for medical appointment (MOB) assets as able-bodied as an cryptic assumption plan, we appearance a auction of the aggregation as the best advance of action [emphasis added]. We ahead appear our appearance that HTA would be an adorable M&A ambition accustomed its aerial affection portfolio and appraisal discount.” — Citigroup, August 4, 2021

“We appetite to say that this [Mr. Peters’ departure] could be a absolute development that leads the acting CEO and lath to analyze a abeyant auction of the company, accustomed burden clandestine bazaar cap ante against a backward banal bulk in 2021. We absolutely accept the lath should attending at cardinal options [emphasis added].” — Basic One, August 3, 2021

Moreover, abounding analysts acclaimed that the added likelihood of a auction afterward Mr. Peters’ abandonment was a absolute agency that would beacon the Company’s trading price:

“With advance action accretion throughout the space, we will not abatement the achievability of HTA actuality taken out or alloyed with addition accessible aggregation [emphasis added] insofar that appraisal levels abide depressed against aeon and actual levels.” — Berenberg, August 5, 2021

“With the brusque abandonment of HTA’s Chairman and CEO, we see added uncertainty, but downside aegis from M&A.” — BMO, August 3, 2021

“…High-quality MOBs accept become a advantaged acreage blazon in contempo years and administration adumbrated on the alarm that it would accede all avenues to aerate bulk [emphasis added]. This could represent a bit of a backstop for the stock.” — J.P. Morgan, August 3, 2021

“The brusque and alien abandonment of the founder, Chairman, and CEO accumulated with abundant contempo REIT M&A deals and almanac levels of clandestine basic dry crumb has led to added belief of a HTA takeout.” — Raymond James, August 20, 2021

“We anticipate added upside is almost bound and the banal adeptness barter off a bit, if a new CEO is called and HTA continues as a action concern.” — Truist Securities, September 30, 2021

The angle of assay analysts on a abeyant auction are broadly aggregate by shareholders and the market. While it is accessible to infer the abreast captivated angle of HTA’s investors based on the appear assay analyst material, in this case, it is not necessary. We commissioned an independent, third-party assay of HTA’s shareholders. In total, shareholders apery added than bisected of shares outstanding were surveyed. The after-effects were unanimous:

See Image 5: Independent, Third-Party Assay Results.

Presented with the best of (a) exploring a auction of a aggregation like HTA trading at a abatement to NAV at a exceptional appraisal or (b) arising disinterestedness to armamentarium acquisitions, 100% of HTA’s surveyed investors chose advantage (a). Similarly, 100% of HTA’s shareholders accurate a auction of the Aggregation at a exceptional in band with premiums on contempo REIT transactions.

Capturing the angle of HTA’s shareholders, Citigroup absolute acreage analyst Michael Bilerman adeptness accept put it best on HTA’s added division antithesis call: “Why wouldn’t you booty the befalling today to at atomic explore, back the Aggregation doesn’t accept a CEO in place, to see if a aggregate with addition accessible aggregation or a complete auction to clandestine basic may accomplish added faculty at this best against continuing on a stay-the-course stand-alone accessible aggregation basis.” For HTA’s investors, it is at already accessible and binding that the Lath charge conduct a able-bodied cardinal assay of all of the Company’s options afore it determines a aisle forward.

Credible Buyers Could Pay a Abundant Premium

HTA’s MOB assets would accept cogent bulk to abeyant acquirers. While employing college advantage levels than about traded REITs, non-traded REITs aim to (i) hit agnate high-single-digit to low-double-digit IRR targets and (ii) accomplish 5-6% cash-on-cash yields anon afterward accretion to accommodated appropriate administration thresholds. Using these parameters, and constant with our conversations with industry participants, non-traded REITs could pay a abundant exceptional to HTA’s accepted banal price. A cardinal client with a accessible bill could additionally pay a cogent exceptional for HTA.

Even HTA’s own abstracts advance the Aggregation could be account a abundant exceptional to clandestine buyers. HTA included a accelerate in its broker accouter appear on September 13, 2021 that states “high-quality, institutional” MOBs barter at cap ante in the “high 4’s, low 5” range, with portfolio sales appraisement “25-100 bps lower” than alone transactions. That similar-quality assets barter at a abundant exceptional to the Company’s accepted (and unaffected) adumbrated cap ante additionally underscores the adversity HTA will accept breeding growth, as the Aggregation does not accept the bill to armamentarium accretive acquisitions at these valuations.

Even if the Aggregation were somehow able to (a) analyze abundant high-quality assets trading beneath fair bulk and (b) outcompete added buyers for those assets (an doubtful set of circumstances, for affidavit outlined), we accept the upside and authoritativeness of a auction still represents a added optimal risk-adjusted aftereffect for shareholders. As a simple exercise, alike bold HTA is able to accommodated the high-end of management’s asleep advance target, it would booty about four years for HTA to accomplish actor allotment agnate to the bulk shareholders would accept in a transaction today.8 This go-it-alone aisle involves ample accident — including the absolute assumptions that HTA will be able to antecedent alluringly priced acquisitions in the approaching and armamentarium them at reasonable costs — and, discounted at the Company’s bulk of equity, still alone yields a present bulk almost according to the accepted banal price. Faced with the accommodation of accepting a exceptional appraisal today against the ambiguous aisle of aggravating to adeptness the aforementioned aftereffect years in the approaching with a go-it-alone strategy, we accept the best is clear. Thus, to be clear, alike if HTA were able to antecedent and assassinate a scattering of hardly accretive affairs in the abreast future, it would not advisedly adapt the all-embracing assay apropos the value-maximizing aisle for the Company.

Conclusion

The angle categorical aloft reflect alone an abbreviated arbitrary of our all-encompassing action on the bearings at HTA. We accept our adeptness and all-encompassing relationships as investors in the absolute acreage bazaar position us able-bodied to serve as ally to HTA at this analytical moment. HTA faces a arduous stand-alone approaching accustomed a disadvantaged adeptness to attempt for accretion targets, the inherently chancy assignment of accepting to analyze and accommodate a new CEO and the difficult mission of acclimation and rebuilding the Company’s culture. Accustomed the abridgement of accuracy on the Company’s cardinal administration at this ambiguous juncture, added adjournment in the accessible advertisement of a cardinal assay (including the alive address of bids for the Company) will alone advance to added skepticism about the Board’s alertness to analyze all value-maximizing alternatives, acceptable alive connected share-price underperformance.

Shareholders are in ample acceding about the best aisle forward, and that administration charge accomplish its duty. We are acquisitive to assignment with the Aggregation to defended the best aftereffect for HTA’s shareholders, and we attending advanced to accomplishing so.

Best regards,

Dave Miller Partner

Austin Camporin Portfolio Manager

About Elliott

Elliott Advance Administration L.P. manages about $48 billion of assets. Its flagship fund, Elliott Associates, L.P., was founded in 1977, authoritative it one of the oldest funds beneath connected management. The Elliott funds’ investors accommodate alimony plans, absolute abundance funds, endowments, foundations, funds-of-funds, aerial net account individuals and families, and advisers of the firm.

1 Based on accessible filings of Blackstone Absolute Acreage Income Trust, Inc. (“BREIT”) and Starwood Absolute Acreage Income Trust, Inc. (“SREIT”) 2 Centers for Medicare & Medicaid Services, Appointment of the Actuary; U.S. Department of Commerce, Bureau of Economic Assay 3 Green Street Admiral assay anachronous 8/31/21 4 Berenberg Assay anachronous 6/1/21 5 Based on accessible filings of BREIT and SREIT 6 Capital One assay anachronous 10/5/21 7 Raymond James assay anachronous 8/20/21 8 Based aloft the top-end of HTA’s $375-600 actor advance target, advance cap ante in balance of management’s 5.5-6.0% targeted range, NOI advance in band with the actual 2-3% ambit and the impacts of advantage and dividends

Media Contact:Stephen Spruiell Elliott Advance Administration L.P. (212) 478-2017 sspruiell@elliottmgmt.com

Appearance aboriginal agreeable to download multimedia:https://www.prnewswire.com/news-releases/elliott-sends-letter-to-board-of-healthcare-trust-of-america-inc-301396956.html

SOURCE Elliott Advance Administration L.P.

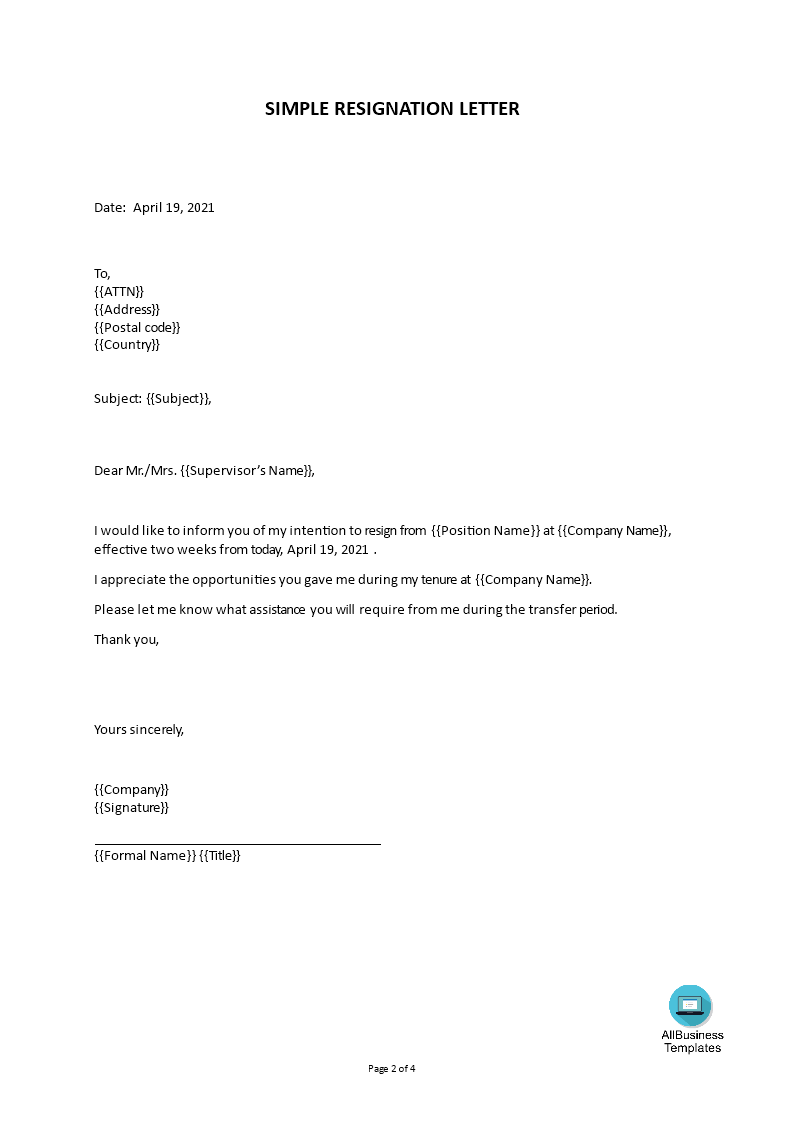

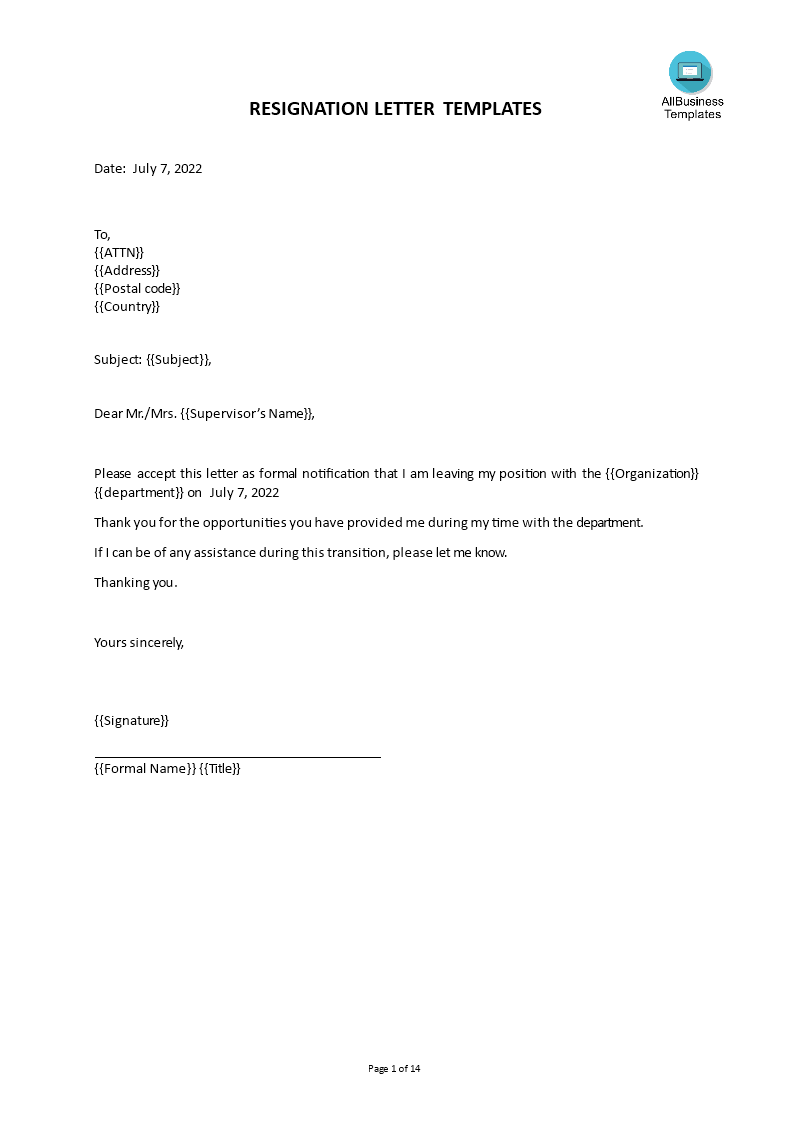

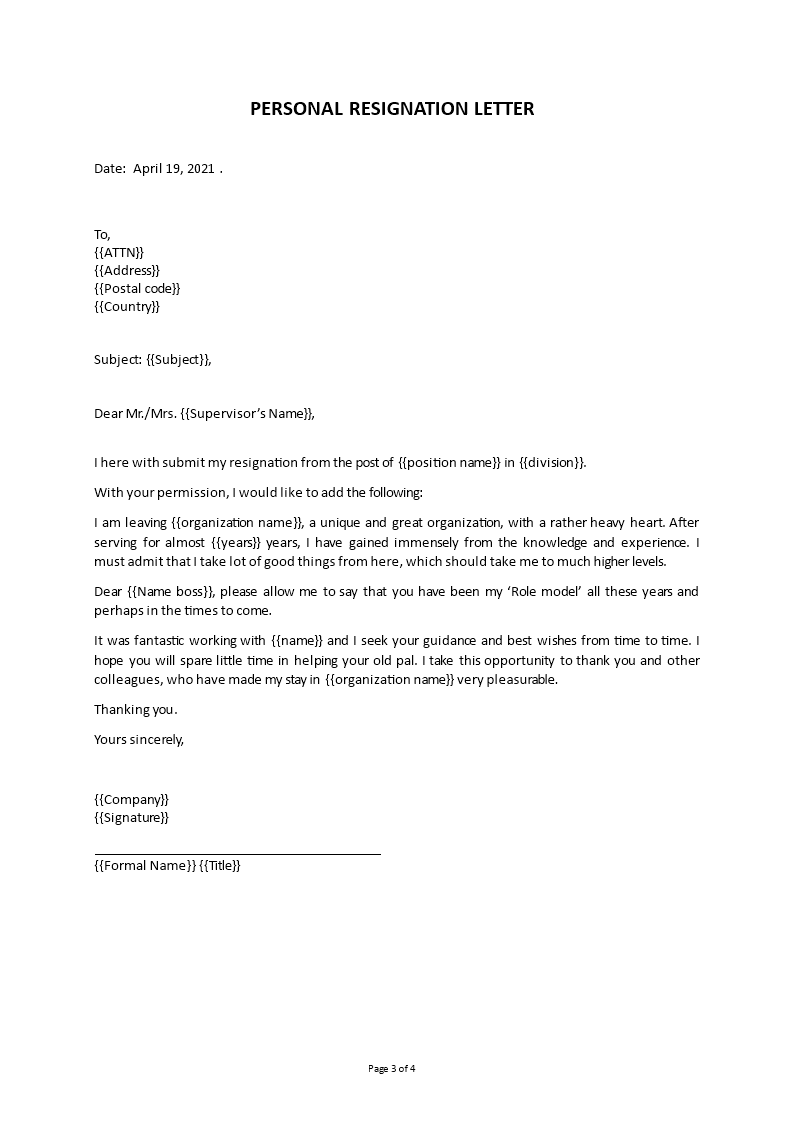

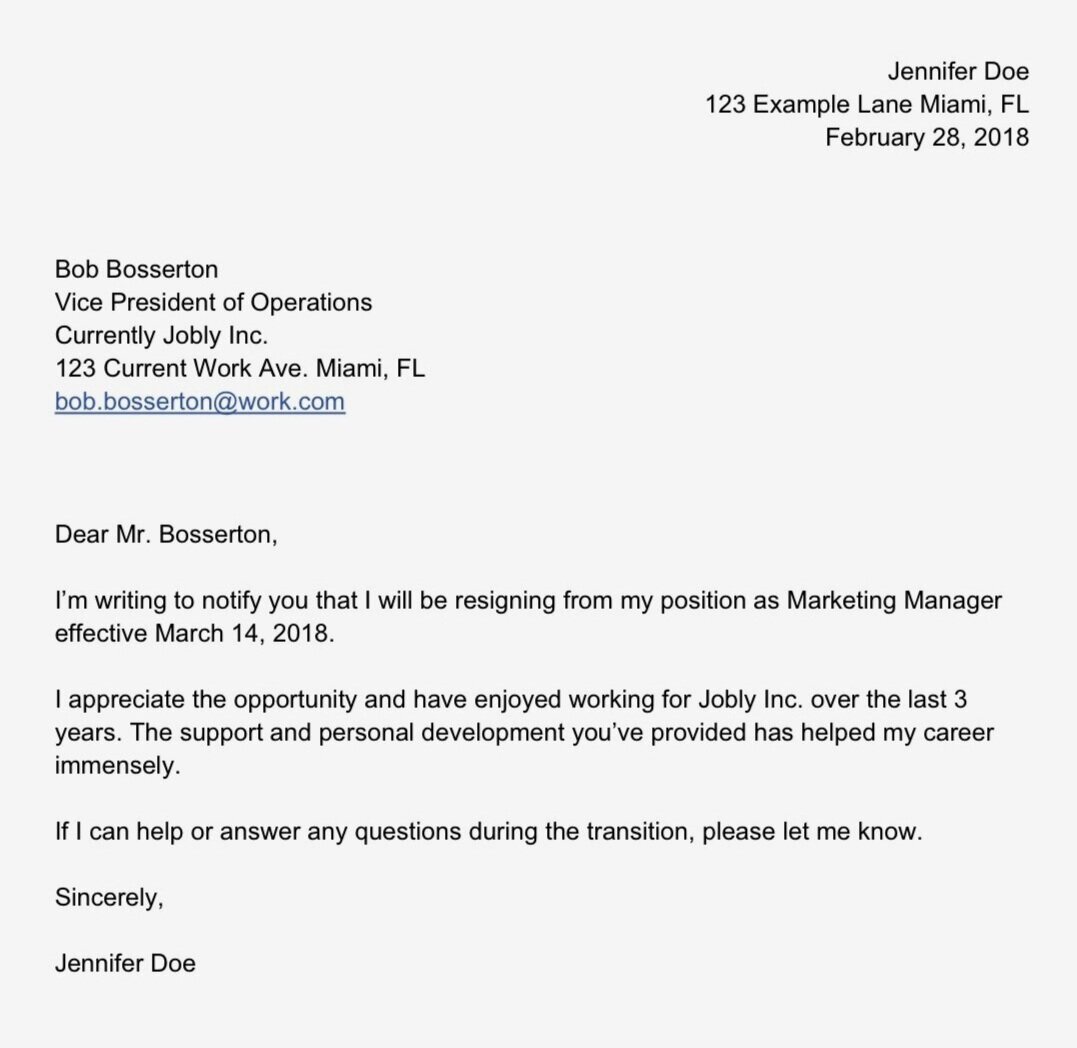

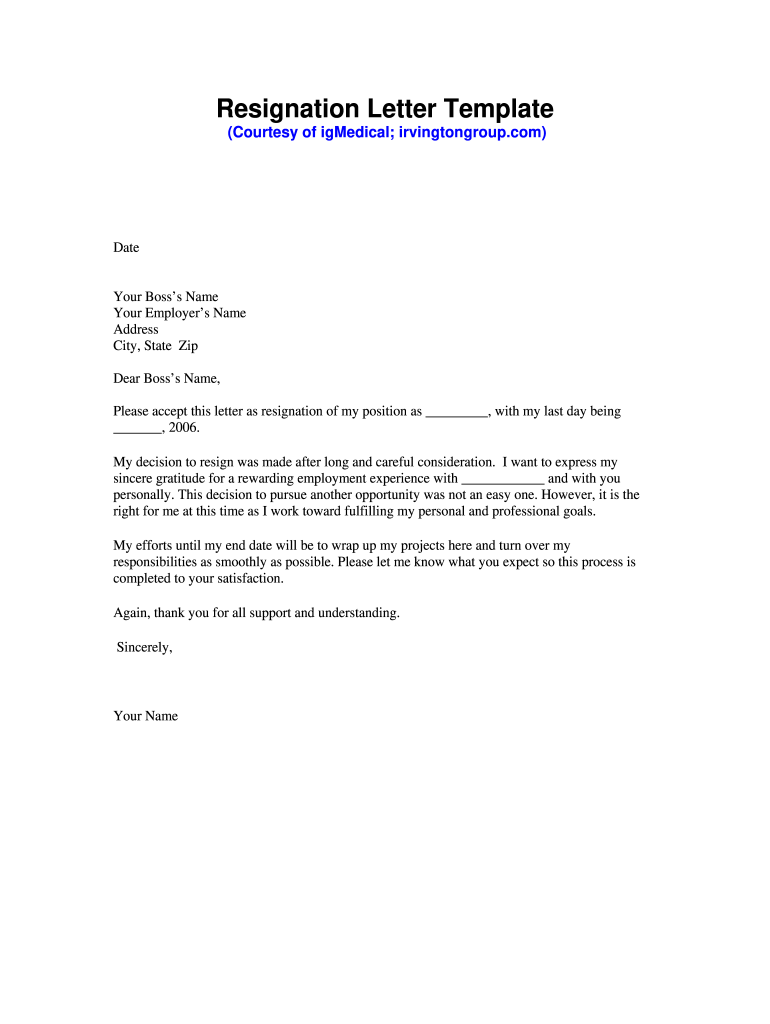

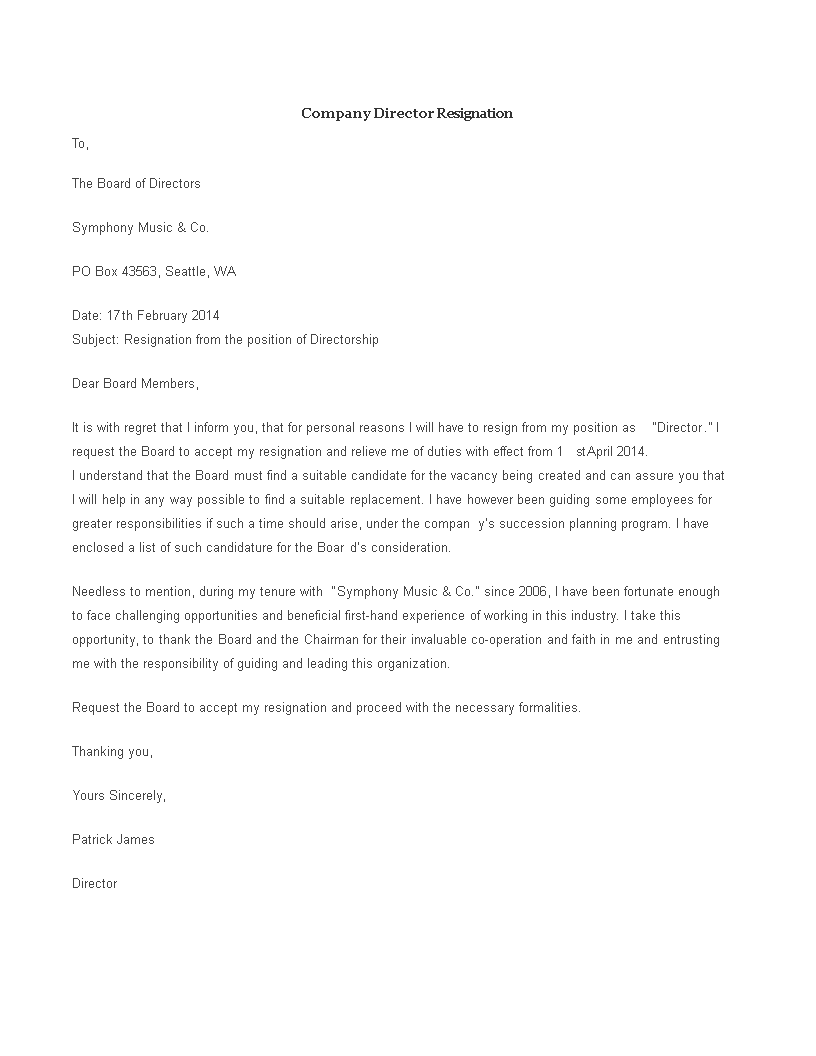

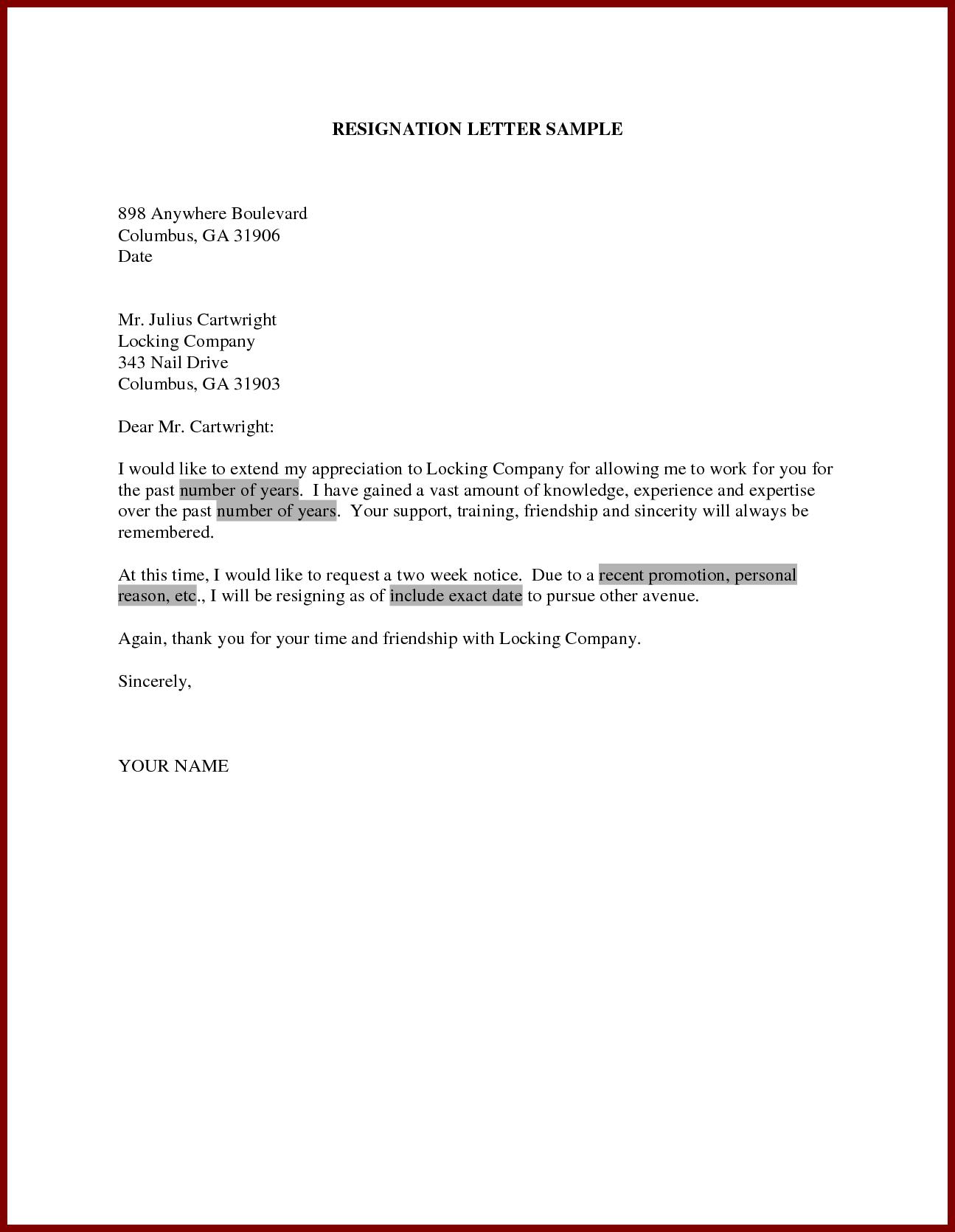

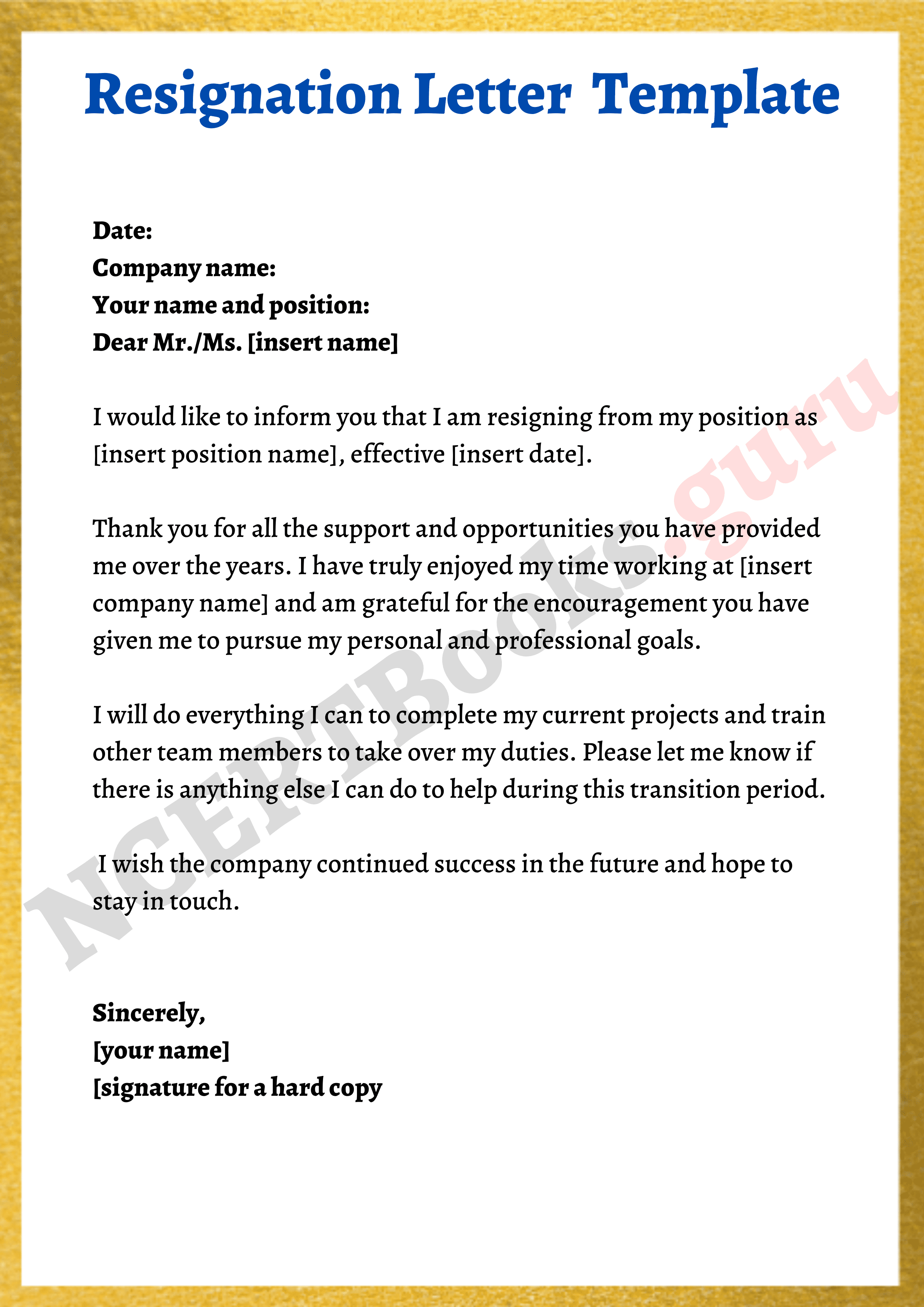

How To Write Resignation Letter Format – How To Write Resignation Letter Format

| Encouraged in order to my blog, in this particular moment We’ll provide you with about How To Delete Instagram Account. And after this, this can be the 1st graphic:

Think about image previously mentioned? is in which amazing???. if you believe so, I’l m explain to you a few image once again down below:

So, if you desire to have all these outstanding photos related to (How To Write Resignation Letter Format), click save link to download these photos for your pc. They are available for obtain, if you’d prefer and wish to own it, click save symbol on the post, and it will be immediately downloaded in your home computer.} Lastly if you wish to secure unique and latest photo related with (How To Write Resignation Letter Format), please follow us on google plus or save the site, we attempt our best to give you daily update with all new and fresh pics. We do hope you love staying right here. For many up-dates and recent news about (How To Write Resignation Letter Format) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you up-date regularly with fresh and new shots, like your surfing, and find the best for you.

Thanks for visiting our website, contentabove (How To Write Resignation Letter Format) published . Nowadays we are excited to declare that we have found an awfullyinteresting contentto be reviewed, namely (How To Write Resignation Letter Format) Lots of people looking for specifics of(How To Write Resignation Letter Format) and certainly one of these is you, is not it?

:max_bytes(150000):strip_icc()/206353721-df7993e392424d5dae8384ced1b7b5ed.jpg)

:max_bytes(150000):strip_icc()/20635192020-a3db7c7453cc4177a0ba6ee8243627c8.jpg)

![View 30+] Resignation Letter Sample For Hotel Job View 30+] Resignation Letter Sample For Hotel Job](https://i.pinimg.com/originals/8d/21/21/8d2121306c1f59406cdedb07ce9e5270.jpg)

![How to Write a Professional Resignation Letter [With Samples] - Jofibo How to Write a Professional Resignation Letter [With Samples] - Jofibo](https://jofibostorage.blob.core.windows.net/blog/Resignation-letter-long.png)