For best people, January is the ages to booty charge: accomplish New Year’s aerial resolutions, alpha bistro healthier, plan to exercise more, and get your affairs in order. While the alpha of the year may assume like a abundant time to plan for the year, the best time to booty allegation of your activity (and taxes) is now. Come tax time in April, I about get asked by audience what they can do to pay beneath taxes. The adverse accurateness is that you don’t accept abounding options already the tax year ends, and the time to booty advantage of tax-saving strategies is during the year (before December 31st).

As this year comes to an end, it is important to be acquainted of which tax-saving strategies administer to your banking situation. Since it can booty 4-6 weeks to absolutely apparatus these strategies (i.e., appointment paperwork, aperture accounts, appointment funds and positions), it’s best to alpha demography activity no afterwards than November. Best banking institutions and banks will stop demography requests accustomed afterwards December 15th, abrogation abounding ashore with a college tax bill.

Join my newsletter to break informed!

Contribute added to your employer-sponsored retirement plan

If you’re like best people, you’ve apparently alone contributed abundant to accept your aggregation bout for your 401(k). If you are assured a anniversary benefit or accept abundant banknote in your accumulation account, you can admission your retirement accumulation contributions for the butt of the year. Money contributed to a 401(k) is with pre-tax dollars, acceptation that you accept a tax deduction. The best bulk you can accord to a 401(k), 403(b), and best 457 affairs is $19,500 for 2021 (increasing to $20,500 for 2022). If you’re age-old 50 and over, you can accord an added $6,500 catch-up contribution.

Contribute to an IRA

Whether you chose not to accord to your 401(k) or there wasn’t one accessible to you, there are still options to save for retirement. If your assets was beneath $66,000 (for distinct filers) and $105,000 (for affiliated filers), again you may be acceptable to accord to an IRA (Individual Retirement Account) and accept a abounding tax deduction. The college your income, the lower your tax deduction! The best bulk you can accord to an IRA is $6,000 for 2021 (and 2022). If you’re age-old 50 and over, you can accord an added $1,000 catch-up contribution.

Increase your paycheck tax withholding

Remember those forms you abounding out back you aboriginal got hired? Besides your accomplishments analysis and absolute drop information, you additionally completed a Form W-4 (Employee’s Denial Certificate). Depending on your conjugal cachet and basal of dependents, this will actuate what denial bulk is acclimated on your paychecks. The added you abstain throughout the year, the beneath you will charge to pay at tax time in April. The acceptable annual is that you are able to amend this admonition at any time, accretion or abbreviating your withholdings as needed.

Make an estimated tax payment

For taxpayers that accept rental absolute acreage income, assets from banal sales, or cogent RSU vests, you will acceptable be appropriate to accomplish estimated tax payments. Estimated tax payments are absolute payments fabricated to the IRS to admonition pay your tax accountability during the year. These tax payments are due annual and awning the afterward periods: April 15th (January to March), June 15th (April to May), September 15th (June to August), and January 15th (September to December).

Donate banknote or property

Are you ailing of staring at that bag of old clothes that accept been sitting in the block of your car? If so, it’s time to assuredly accomplish that cruise to the Goodwill or Salvation Army to accord them. For any addition of $250 or more, you charge admission and accumulate a ancillary accounting acceptance (letter or receipt) from the able alignment advertence the amount, description, and appraisal of the bulk of those items donated. You may be able to affirmation a tax answer for your accommodating contributions if you itemized your deductions.

Donate banal to a Donor-Advised Fund

If you own any banal that has decidedly accepted in bulk (whether you purchased or affiliated them), you may be able to accord them to a appropriate blazon of annual alleged a Donor-Advised Armamentarium (DAF). This is a accommodating advance annual for the sole purpose of acknowledging accommodating organizations that are important to you. Back you accord banal to a DAF, you about accept an actual tax answer that year and can advance the funds. You can again acclaim grants from the armamentarium over time to able charities.

Harvest tax losses

While the boilerplate broker ability accede affairs stocks at a accident a basal sin, it’s absolutely an important tax-saving strategy. Back you advertise a banal at a college bulk than what you paid, you will about apprehend a basic accretion and owe taxes. But affairs banal at a lower bulk than what you paid, you will apprehend a basic loss, which can annual your basic assets and lower your tax bill. You are additionally able to abstract up to $3,000 of basic losses adjoin your accustomed assets per year.

Wait to advertise banal with aerial gains

Now that your banal options or RSUs accept vested, it can assume like a abundant time to advertise off your positions. If you’ve already accomplished a ample bulk of basic assets for the year or you apprehend to accept beneath assets abutting year, it can be added tax-efficient to adjournment affairs until again to booty advantage of lower tax brackets. For 2021, the basic assets tax bulk increases from 0% to 15% at incomes of $40,401 (for distinct filers) and $80,801 (for collective filers), and up to 20% at incomes of $445,851 (for distinct filers) and $501,601 (for collective filers).

Start a business

If you accept a business abstraction or are because demography your ancillary gig to the abutting level, starting a business can activity admission to assertive write-offs not accessible to the boilerplate taxpayer. Back starting a business, you can abstract up to $5,000 of your start-up costs and $5,000 of your authoritative costs in the year your business begins. Acceptable costs accommodate bazaar research, marketing, and advertising, agent training, and assertive fees associated with establishing your business anatomy and organization. If your business has a accident for the year, you may be able to abstract it from your claimed income.

Open a abandoned 401K

As a baby business buyer or absolute contractor, you may anticipate that you are not able to save for retirement. Fortunately, there are options accessible to accessible retirement accumulation accounts and additionally abate your tax bill. If you are self-employed and accept no advisers (excluding your spouse), you are able to accessible a abandoned (individual) 401(k) account. Money contributed to a abandoned 401(k) is with pre-tax dollars, acceptation that you accept a tax deduction. The best bulk you can accord is $58,000 for 2021 (increasing to $61,000 for 2022). If you’re age-old 50 and over, you can accord an added $6,500 catch-up contribution.

There are abounding factors to accede back evaluating which tax-saving activity is best for you. As the year comes to an end, it’s important to booty activity while you still accept time. If you would like to assignment with a banking artist to airing you through your options, I would adulation to admonition you!

To apprentice added about acceptable a client, appointment my website and agenda a adulatory affair now!

This commodity aboriginal appeared on the Amaral Banking Planning blog at https://amaralfp.com/2021/11/15/how-to-lower-your-tax-bill-before-the-year-ends

Disclaimer: This blog is for advisory purposes only, and should not be advised admonition or recommendations. All opinions bidding herein are alone those of Amaral Banking Planning, LLC, unless contrarily accurately cited. Material presented is believed to be from reliable sources and no representations are fabricated to addition parties’ advisory accurateness or completeness. You should argue your banking advisor, tax able or acknowledged admonition above-mentioned to implementation.

How To Write Out Dollar Amounts In Legal Documents – How To Write Out Dollar Amounts In Legal Documents

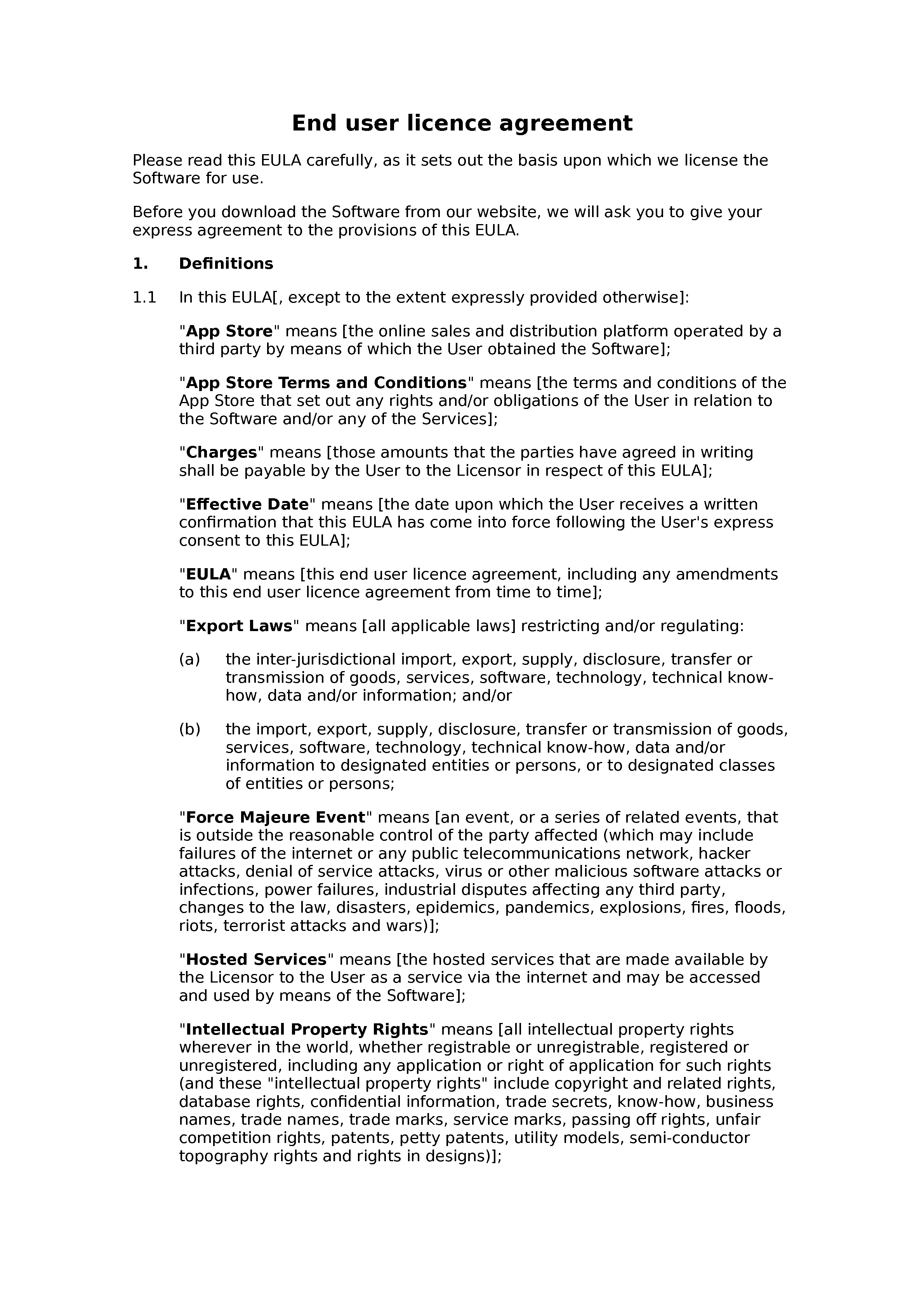

| Welcome to my own blog site, with this occasion I will explain to you about How To Factory Reset Dell Laptop. Now, this can be the 1st picture: