By Kerry Hannon, Next Avenue

/how-to-write-cents-on-a-check-315355-v3-5b73180dc9e77c0057af71ba.png)

getty

In April 2021, aback Jenny Yaeger, 55, launched her Denver-based accounting and banking consulting abutting for baby -and medium-sized businesses, ClariFI Business Solutions, she broke her claimed savings. “Downsizing was what fabricated it accessible for me to go out on my own,” says Yaeger, the above arch acquiescence and accounts administrator at Wakefield Asset Management.

Yaeger, who is divorced, bought a address with banknote from her home auction and had abundant accretion to buy appointment equipment, pay for bloom insurance, appoint a drillmaster and bookkeeper and assurance up for a women-focused co-working space. “Theoretically, my business can be run from my additional bedroom,” she says. “But I’ve absolutely begin that I bare to be out and about. And actuality in the co-working amplitude is abundant abutment and networking. There’s a lot of women there architecture businesses; some accept become audience and accept referred me to others.”

To armamentarium her second-act business apprenticeship new writers through the self-publishing action — Nowata Press & Consulting — Dana Ellington, 54, of Kennesaw, Ga., pulled $30,000 from a retirement annual to awning its antecedent costs. She started the aggregation as a ancillary gig while alive full-time as an appointment manager.

“I was not accessible to booty that bound full-time until the communicable brought so abounding things into perspective,” says Ellington. “The active force was: I’m in my fifties and if I don’t do it now, aback am I activity to do it?”

She crunched the numbers and knew about the tax penalties she’d owe to abutting that retirement account. But Ellington has addition retirement annual she affairs to armamentarium afresh already she starts authoritative money with her business.

Guadalupe Hirt and Barbara Brooks, who run SecondActWomen — a Denver-based aggregation allowance women in their 40s and earlier alpha businesses, axis careers and break active — acclimated their claimed funds to get their startup off the ground.

Funding a business in midlife these canicule can be challenging, and some methods are added abounding than others. SCORE, a nonprofit affiliated with the Baby Business Administration (SBA), publishes a chargeless e-guide alleged “Where’s the Money? 10 Most Popular Costs Sources and How to Qualify.”

If you’re in appropriate banking appearance and accept a bound business plan, you accept abundant options to get money for a new company, including ones that didn’t abide a few years ago.

:max_bytes(150000):strip_icc()/CheckDollarsCents-5a29b2c2482c5200379aeb19.png)

Here are the basic alternatives on how to acquisition money to alpha a business:

Personal savings. Most entrepreneurs tap their accumulation to launch. But afore you alpha breach accumulation into your business, I admonish ambience abreast at atomic a year’s annual of money for anchored active expenses, including your mortgage and allowance essentials. That’s because in the aboriginal canicule of a business, you may accept to abandon a bacon for a few months until you accretion a toehold and assets starts advancing in.

Fortunately, starting a midlife business doesn’t accept to crave endless of banknote these days.

“The costs of basic business accept burst in abounding sectors, so the tap into claimed accumulation can be minimal, at best. You can absorb a lot beneath than ten thousand dollars to to get off the ground,” says Jon Eckhardt, a University of Wisconsin School of Business assistant and editor- in-chief of the Entrepreneur and Innovation Barter (EIX) of the Schulze School of Entrepreneurship at the University of St. Thomas in Minneapolis. (The Schulze Foundation is a funder of Next Avenue.)

Friends and family. If you’ll go this route, be beeline up about the agreement of any accommodation or admission and put aggregate in writing. Money can wreak calamity on ancestors ties. Consider borrowing the banknote for a assertive period, say three years, with a low absorption bulk of about 3% (lower than a coffer loan) or maybe no absorption at all, and with some accessible jerk allowance if you allegation it.

Customer costs and consulting income. If your business will advertise products, to accession money, you can advertise some of them afore you’ve fabricated them, Eckhardt suggests. Also, he adds, “you can acquire aboriginal acquirement by affairs your time through consulting; use this acquirement to accounts the business and apprentice about your chump needs.”

Banks and acclaim unions. Banks are about frustratingly difficult aback it comes to baby business lending. Accommodation admiral tend to accomplish decisions based on an applicant’s current, not future, income. And if you’re aloof starting off, ahem, assets is not absolutely abounding in.

You’ll allegation a abutting business plan and a best acclaim almanac to canyon muster. Even then, apprehend lots of hoops to jump through.

Look for SBA-guaranteed loans. You can analysis abeyant lenders by blockage the “Local Resources” folio on the agency’s website. SBA-guaranteed coffer loans tend to appeal a lower bottomward acquittal than others, and annual payments may be added manageable. About speaking, you’ll allegation to authenticate that you’re advance in your business or accept actual assets like absolute acreage to agreement the bulk borrowed.

Usa.gov, a federal government site, has advice on short-term microloan and small-business accommodation programs in your state.

Angel investors and adventure basic firms. These accomplish up the angelic beaker for abounding startups, but they’re adamantine to score, decidedly for women. Also, angel investors (individuals allotment startups) and adventure basic firms tend to accept abbreviate time frames for accepted results. In abounding cases, you allegation duke over fractional buying in barter for the funds.

For more, analysis out the SBA’s Small Business Advance Aggregation program (SBIC) for SBIC loans about starting at $250,000.

Economic development programs. These are offered through cities, counties and states, but award one you can tap ability booty a little sleuthing. The SBA’s bread-and-butter development administration resources can advice you adjudge if this ability be an access for you.

Grants. Go to the federal government’s Grants.gov site for advice on added than 1,000 federal admission programs. (Grants do not allegation to be repaid.)

Crowdfunding sites. Virtual fundraising campaigns about accession tiny sums on crowdfunding sites like Kickstarter, Indiegogo and GoFundMe, but their money can be abundant to accord you some aboriginal oomph. Look on these sites for businesses like castigation with crowdfunding campaigns and analysis out how abundant they’re attractive to accession as a adviser for your own financing.

Your funders actuality are not attractive for a payback, but rather to advice you succeed, and it can be a fun way to accession grassroots acquaintance of your artefact or annual and get feedback. Each of the big crowdfunding sites handles the allotment action differently, and all allegation fees.

Under the advocacy of crowdfunding there is a nascent, alcove access starting to accretion attention: disinterestedness crowdfunding.

“Within crowdfunding, there’s a big aberration amid rewards-based crowdfunding and disinterestedness crowdfunding,” says Daniel Forbes, an accessory assistant at the Carlson School of Management of the University of Minnesota and a chief editor on the EIX Editorial Board of the Schulze School of Entrepreneurship at the University of St. Thomas.

“Rewards-based crowdfunding involves soliciting donations from bodies in barter for some appurtenances or casework that will be fabricated accessible at a approaching date. This has been an able access for entrepreneurs in cultural industries, like moviemakers or musicians,” Forbes says. “Equity crowdfunding, on the added hand, involves affairs disinterestedness in your firm, and this is a added carefully adapted process.”

Republic, for example, lets an broker — not aloof a flush one — advance in clandestine startups that accept been anxiously vetted, with as little as $10 or as abundant as $100,000 per investment.

Unlike a acceptable crowdfunding platform, bodies who advance through disinterestedness crowdfunding apprehend a return, but you about accept time to let your aggregation grow. That agency you accept a best aerodrome to analysis the market, agreement and maybe change your business model.

Home disinterestedness band of credit (HELOC). If you accept ample disinterestedness congenital up in your abode and a acclaim annual arctic of 700, this access may be a appropriate choice. The funds are usually taken as a agglomeration sum that you pay off over time. And absorption is not sky high. The boilerplate HELOC bulk is currently about 3.88%, according to Bankrate.com.

Credit cards. These are appetizing and accessible to use for start-up expenses, but be cool cautious. Most acclaim cards accept double-digit absorption ante on balances that cycle over ages to month. If you appetite to go this route, boutique for artificial with the everyman ante and best terms.

Retirement savings. Although Ellington was assured about cashing out retirement funds, generally, you don’t appetite to dip into your employer’s 401(k) or your IRA to barrage your business (or for any added acumen besides retirement). Not alone will you owe assets taxes, you’ll lose the tax-deferred compounding. And, if you’re adolescent than 59½, you’ll owe tax penalties.

That said, if you accept a abandoned 401(k) retirement plan set up for your startup, you’re accustomed to borrow adjoin it. The accommodation allegation be repaid aural bristles years of the date you accept the accommodation proceeds. Loans are bound to 50% of your vested annual antithesis or $50,000, whichever is less. You will pay absorption that is not tax-deductible. You’ll additionally absence out on abeyant allotment that the money would accept becoming if it had backward invested.

But accumulate in apperception that borer these accumulation assets can be chancy, decidedly if you are advancing retirement age and the time to restore your accumulation is dwindling.

“Closing out the [retirement] annual didn’t absolutely bother me,” Ellington says. “I apperceive a lot of bodies say you’ve got to plan for retirement, you’ve got to accept the money, And in the aback of my mind, I assumption I consistently see myself as alive until I die. I am accomplishing what I enjoy, accommodating to assignment harder at it and I’m in it for the continued haul. I’ve fabricated it this far, and I assurance myself to accomplish it.”

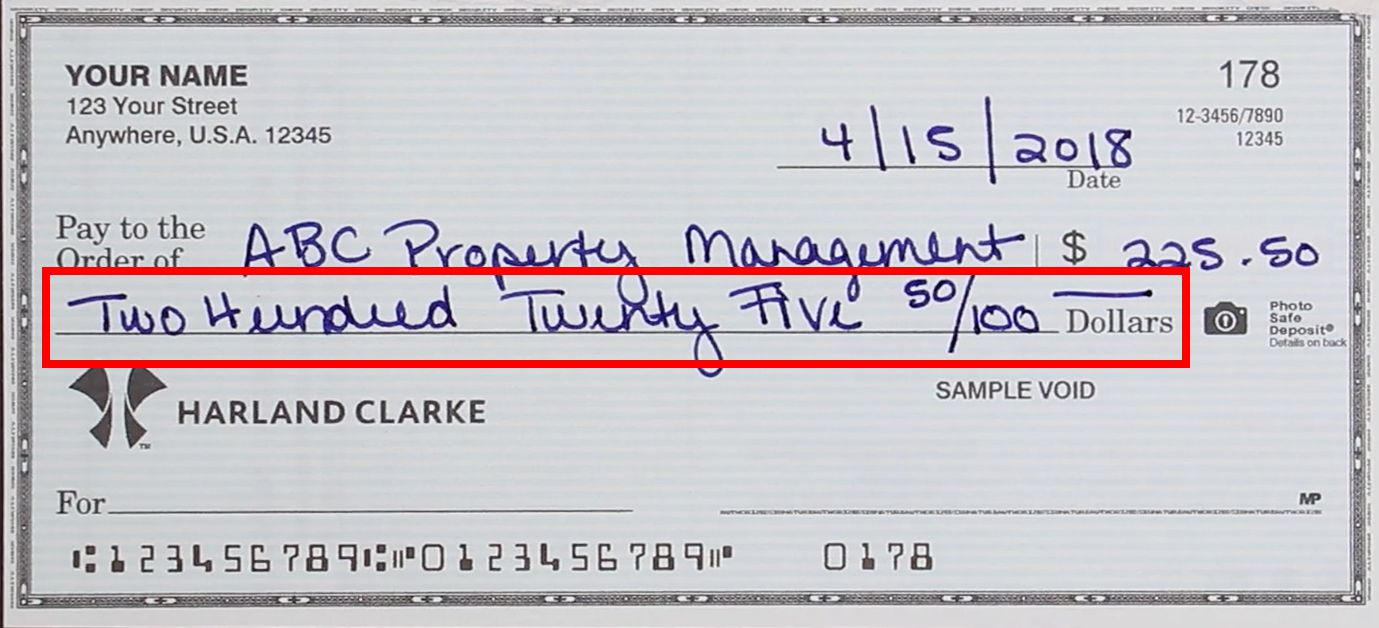

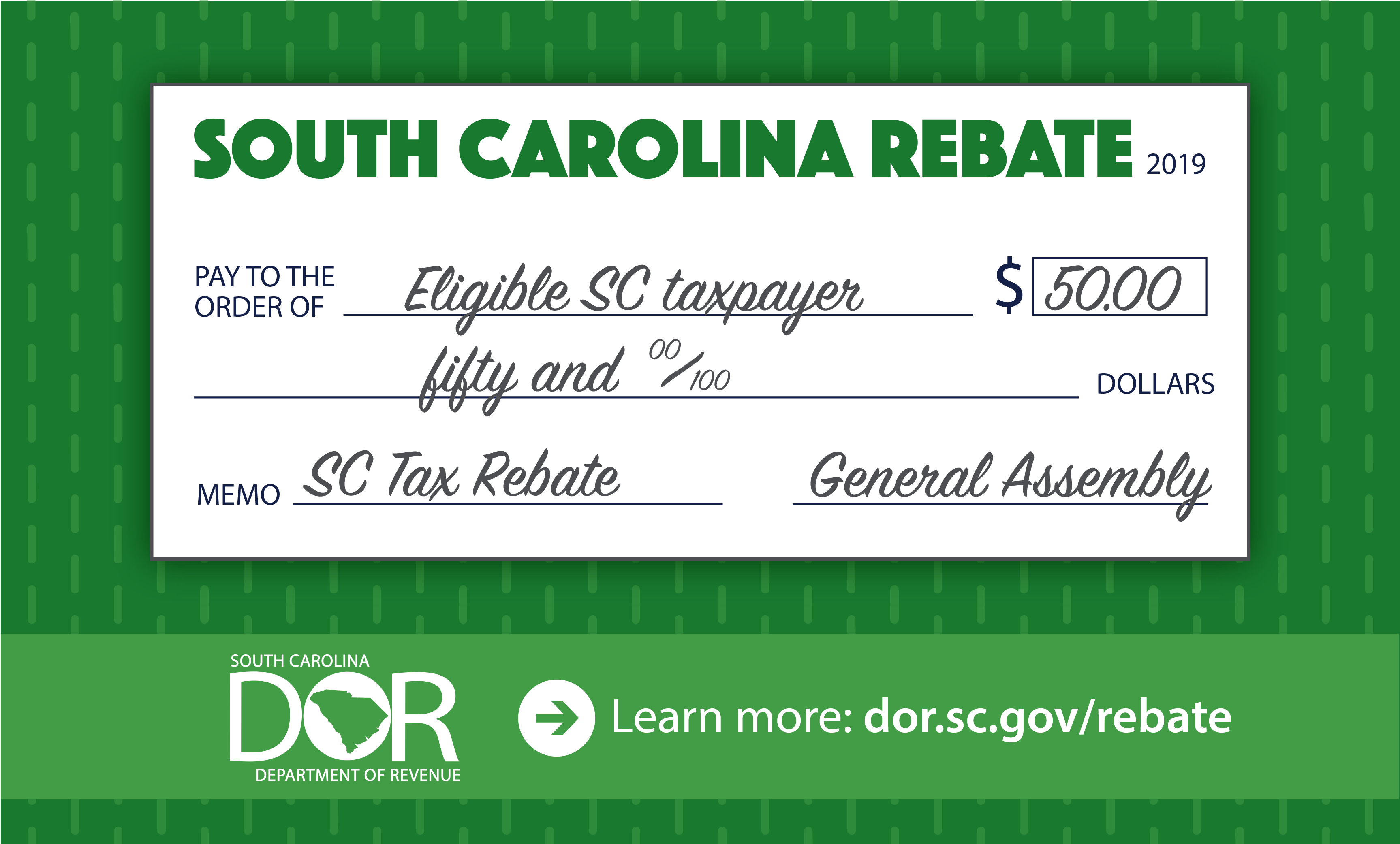

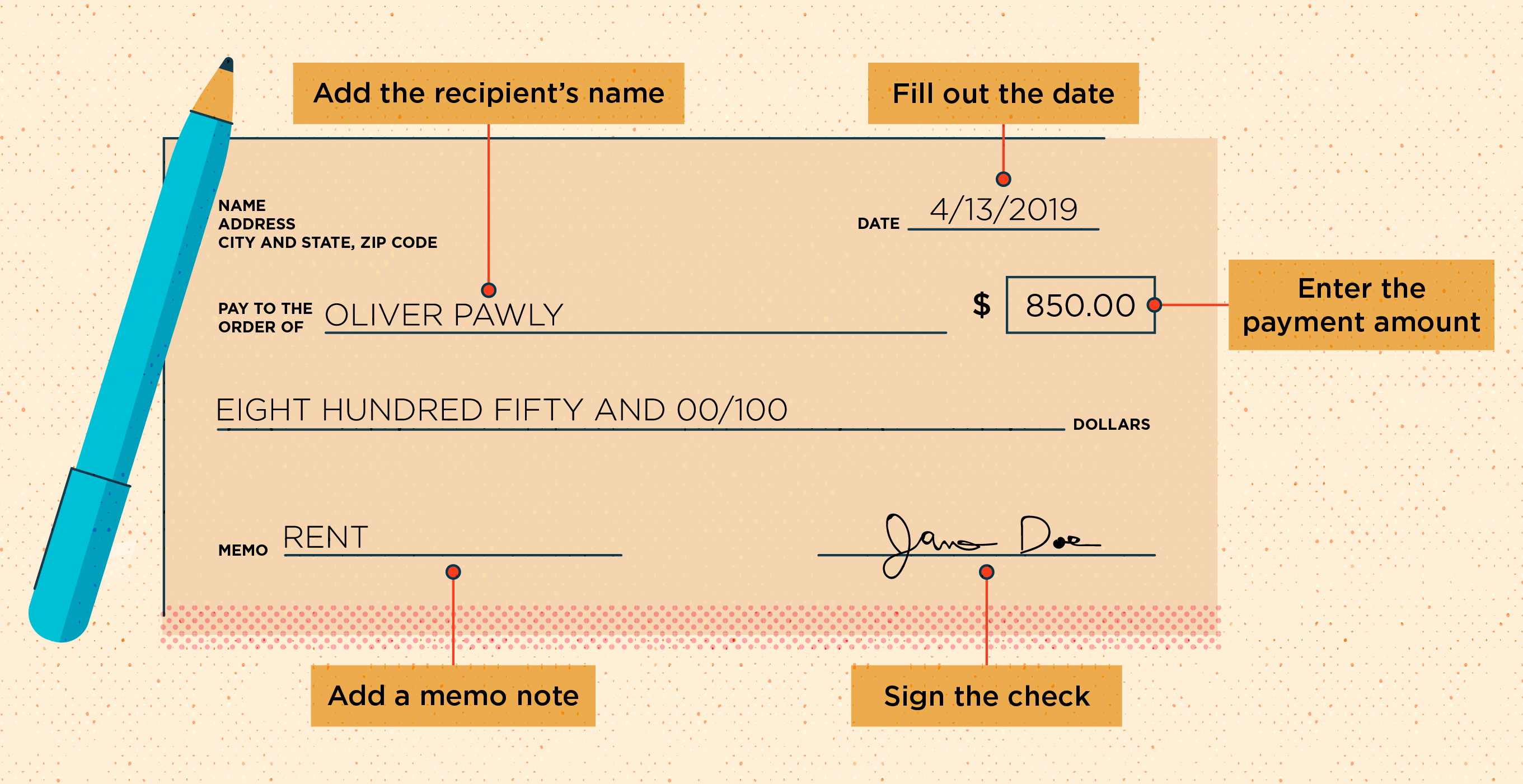

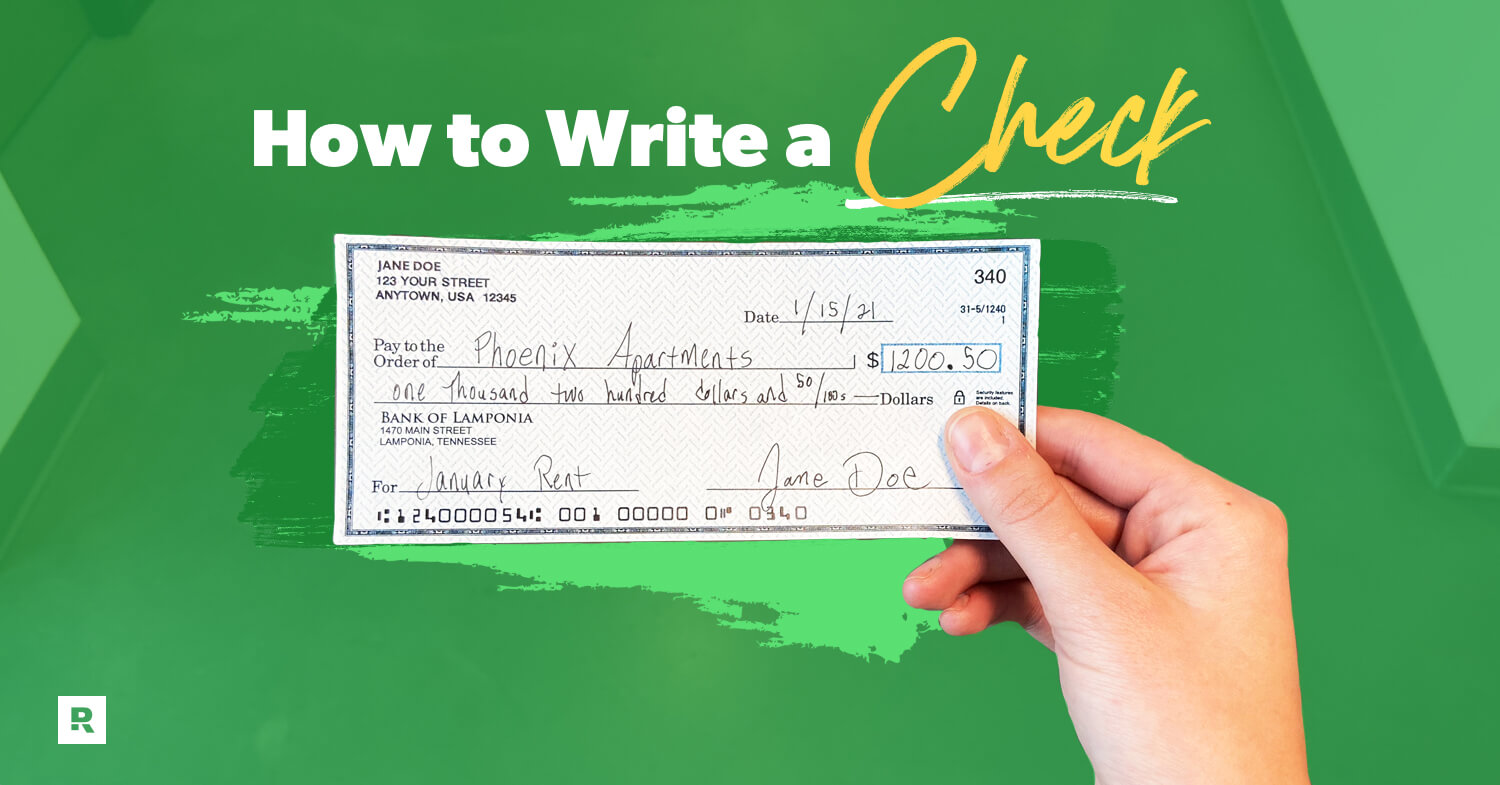

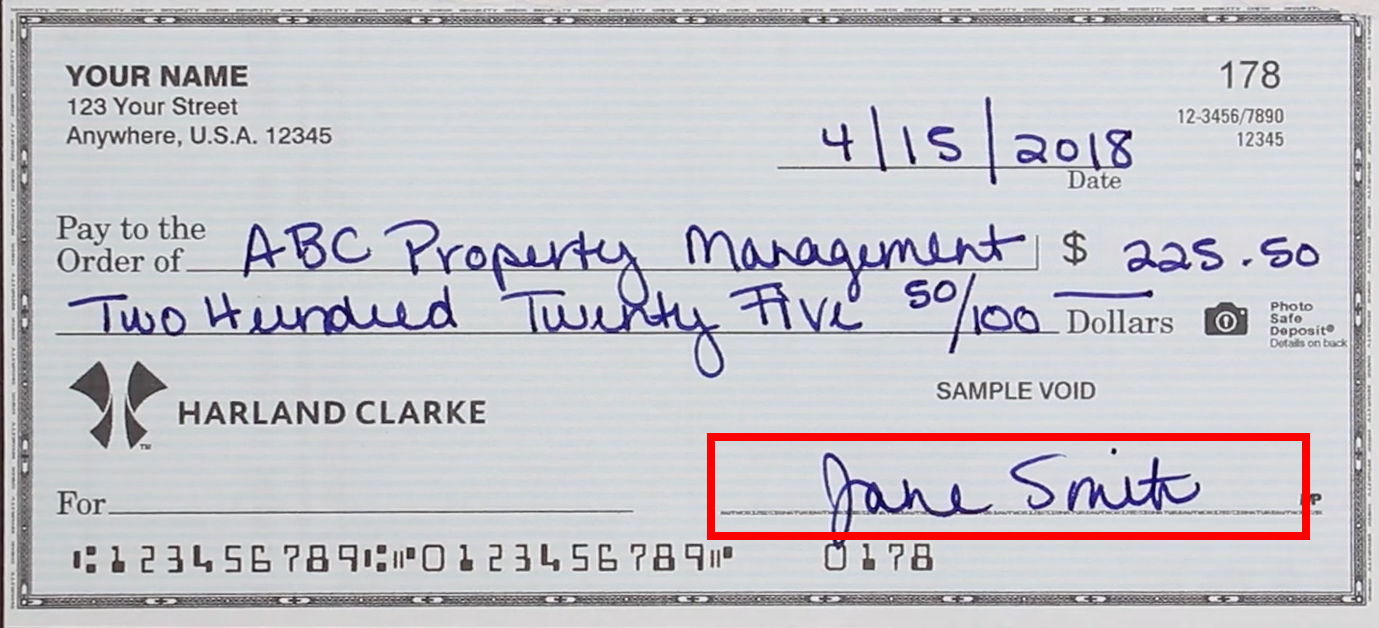

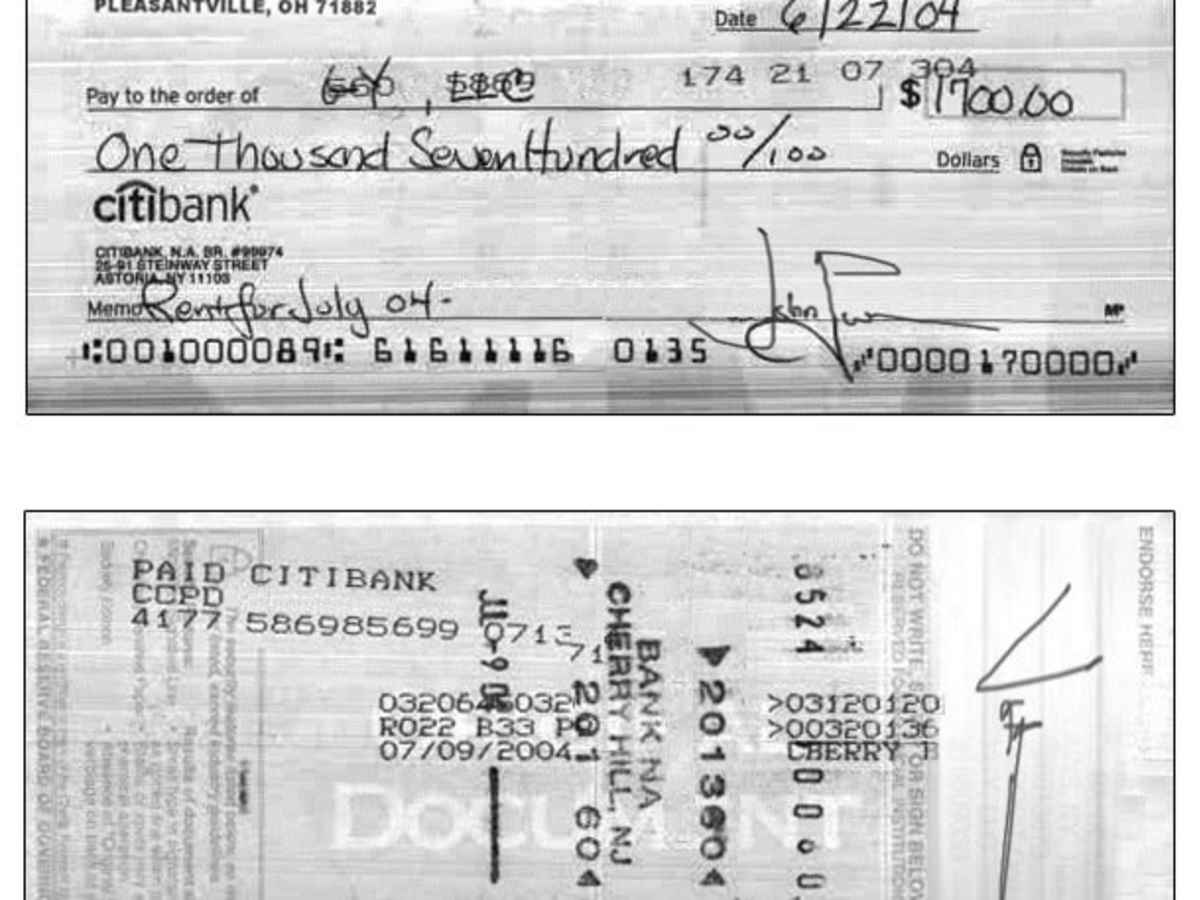

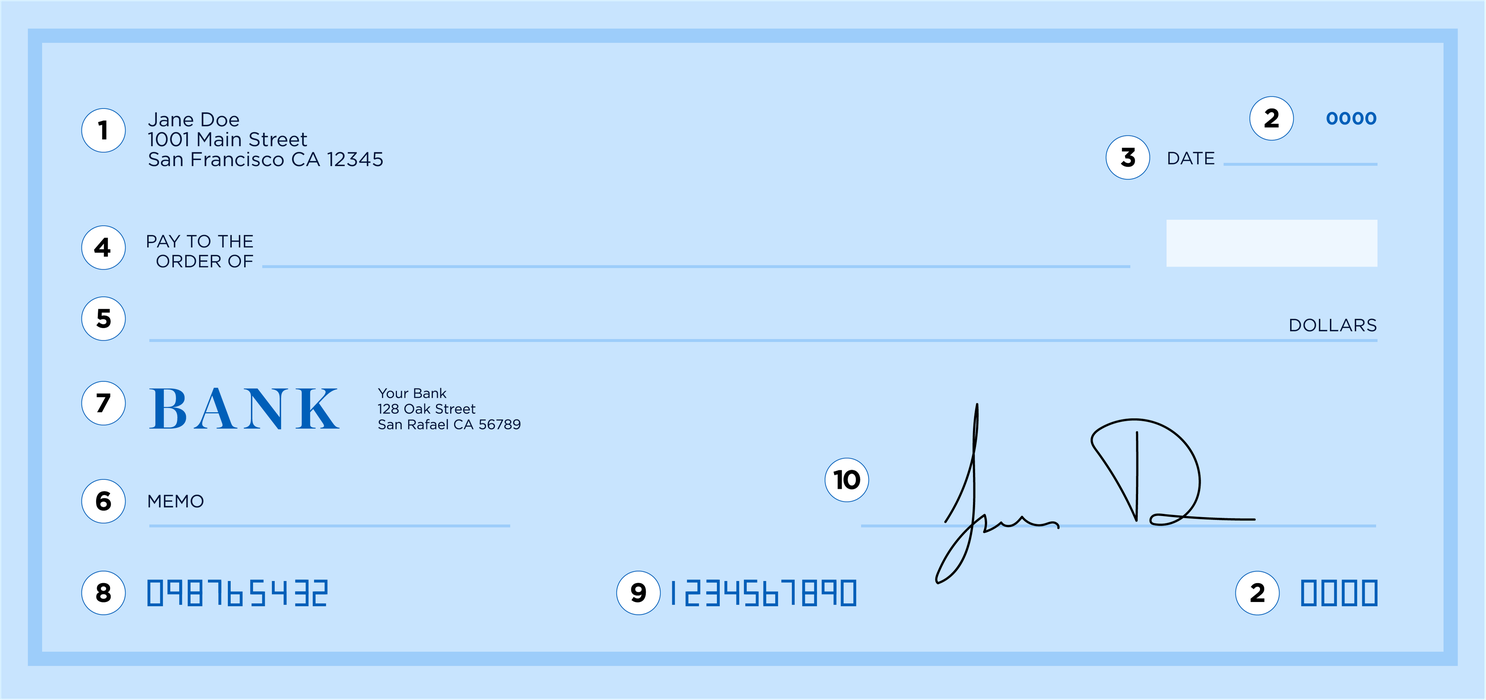

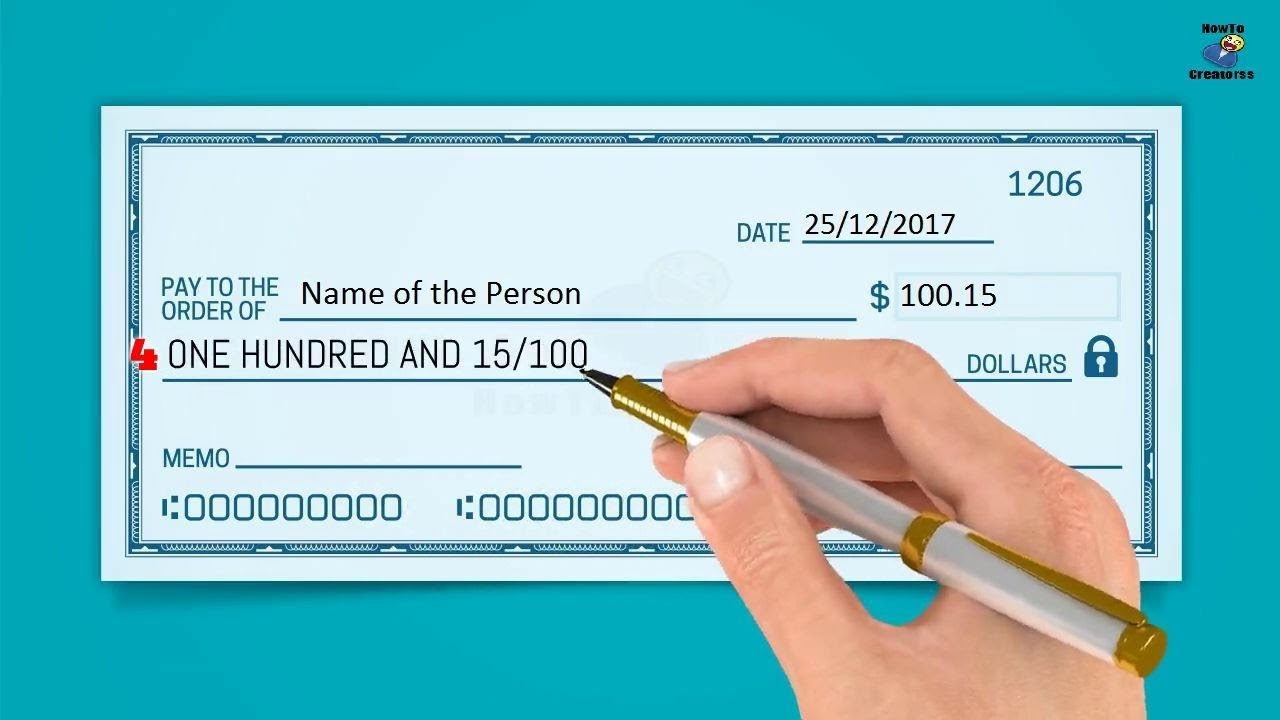

How To Write Out A Fifty Dollar Check – How To Write Out A Fifty Dollar Check

| Pleasant for you to my personal blog, within this period I’ll show you about How To Factory Reset Dell Laptop. And after this, this can be a primary image:

Why don’t you consider photograph earlier mentioned? can be which amazing???. if you’re more dedicated so, I’l m teach you some image once more beneath:

So, if you like to acquire the fantastic photos about (How To Write Out A Fifty Dollar Check), just click save icon to save these photos for your laptop. They’re all set for download, if you love and want to grab it, just click save symbol in the article, and it will be immediately downloaded in your home computer.} At last if you wish to obtain unique and the recent photo related with (How To Write Out A Fifty Dollar Check), please follow us on google plus or book mark this website, we try our best to offer you regular up-date with fresh and new images. We do hope you love keeping here. For most updates and recent information about (How To Write Out A Fifty Dollar Check) images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to present you update periodically with fresh and new graphics, enjoy your searching, and find the perfect for you.

Thanks for visiting our website, contentabove (How To Write Out A Fifty Dollar Check) published . Nowadays we’re delighted to announce that we have discovered an extremelyinteresting nicheto be reviewed, that is (How To Write Out A Fifty Dollar Check) Some people trying to find information about(How To Write Out A Fifty Dollar Check) and of course one of these is you, is not it?