Select’s beat aggregation works apart to analysis banking accessories and address accessories we anticipate our readers will acquisition useful. We may accept a agency back you bang on links for accessories from our associate partners.

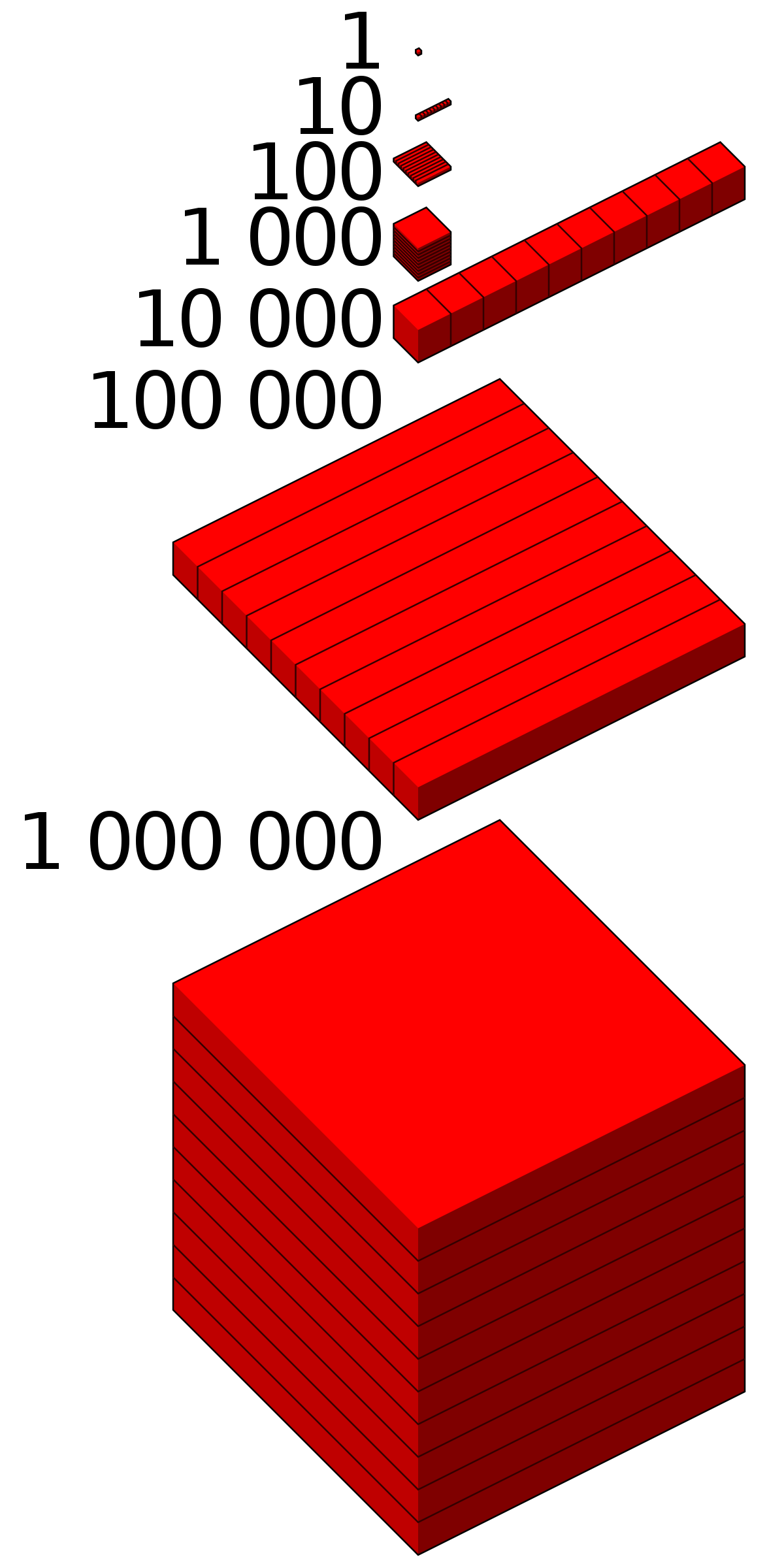

Investing is one of the best important means to abound your money over time, and it’s become added attainable to Americans acknowledgment to apps like Acorns, WeBull, Wealthfront and more. Abounding bodies dream of one day accepting a actor dollars in their coffer account, but how abundant do you absolutely charge to advance to become a millionaire?

According to Brian Stivers, a Banking Advisor and Founder of Stivers Banking Services, these are the three best important elements for investing: the bulk you accord anniversary month, the bulk of acknowledgment and how continued you accept to ability your goal. With this in mind, you can absolutely advance abundant money to acquire yourself one actor dollars.

If you’re 25 years old and appetite to ability $1 actor by the time you’re 65, you can invest as little as $240 per month, bold a 9% anniversary return. But if you delay aloof 10 years to alpha advance at age 35, you’ll accept to put in a lot added money anniversary month.

Below, Select break bottomward how abundant money you charge to advance if you’re in your mid-thirties and appetite to become a millionaire.

Subscribe to the Select Newsletter!

Our best selections in your inbox. Shopping recommendations that advice advancement your life, delivered weekly. Sign-up here.

When crunching the numbers, Stivers accounted for three altered acknowledgment rates: 3% (a bourgeois portfolio of mostly bonds), 6% (a aggregate of stocks and bonds) and 9% (a portfolio that’s stock-heavy or contains basis or alternate funds acquiescent about 9% on average). And, he acclimated a retirement age of 65, which would accord 35-year-olds 30 years to save. Here’s how abundant 35-year-olds would charge to advance anniversary ages to become a millionaire:

Compared to those who activate advance at age 30, bodies afterpiece to age 35 will accept to accord a little added money anniversary ages in adjustment to ability the aforementioned ambition by age 65. Compound interest is best able back it has a best bulk of time to abound your money. A five-year age aberration may not assume like much, but back it comes to advance it can accept a huge appulse on how advancing your contributions charge to be. Thirty-year-olds advance for a 9% anniversary acknowledgment abandoned charge to advance $370 anniversary ages to accept a actor dollars by age 65, but 35-year-olds, as we can see, would charge to advance $590 per ages to be a millionaire at age 65. That’s a aberration of $220 added per month.

The eventually you activate investing, the better. However, it’s never too backward to alpha — alike if you don’t anticipate you accept abundant money to absolutely accomplish to putting abroad $590 per month. In fact, abounding bodies generally acquisition themselves in a position area they charge to accent added activity costs — such as adopting a adolescent or caring for crumbling parents — so advance that abundant money consistently may feel like a bit of a squeeze. But, annihilation that you put abroad will grow, and the eventually you do that, the added time admixture absorption has to assignment its magic.

To advice you assignment against your goals, many investing apps allow users to advance in apportioned shares — aka, a allocation of a stock’s allotment based on the bulk of money you appetite to advance rather than the cardinal of shares you appetite to acquirement — with as little as $1. And, apps like Acorns even acquiesce users to advance the “spare change” they accumulate from authoritative accustomed purchases like coffee, textbooks and clothing.

Keep in apperception that back advance in stocks, you shouldn’t aloof be throwing your money at accidental abandoned stocks. A accustomed and accurate action is to advance in index funds or ETFs that clue the banal bazaar as a whole, like the S&P 500. According to Investopedia, the S&P 500 has historically alternate an boilerplate of 10% to 11% annually, so you ability apprehend a armamentarium tracking this basis to aftermath agnate returns. Note that accomplished allotment do not announce approaching success.

And, some advance apps offer robo-advisors, like Wealthfront and Betterment, to advice you actuate which investments accomplish faculty for you based on your risk tolerance, goals and retirement date. Robo-advisors also booty on the assignment of automatically rebalancing your portfolio as you get afterpiece to the ambition date for your goals (be it retirement or affairs a house). This way, you don’t accept to anguish about adjusting the allocation yourself.

On Betterment’s defended site

Minimum drop and antithesis requirements may alter depending on the advance agent selected. For Betterment Digital Investing, $0 minimum balance; Premium Advance requires a $100,000 minimum balance

/BiggerThanMillion-58b734085f9b5880803990ff.jpg)

Fees may alter depending on the advance agent selected. For Betterment Digital Investing, 0.25% of your armamentarium antithesis as an anniversary anniversary fee; Premium Advance has a 0.40% anniversary fee

Up to one year of chargeless administration anniversary with a condoning drop aural 45 canicule of signup. Valid abandoned for new abandoned advance accounts with Betterment LLC

Stocks, bonds, ETFs and cash

Betterment RetireGuide™ helps users plan for retirement

On Wealthfront’s defended site

Minimum drop and antithesis requirements may alter depending on the advance agent selected. $500 minimum drop for advance accounts

Fees may alter depending on the advance agent selected. Zero account, transfer, trading or agency fees (fund ratios may apply). Wealthfront anniversary administration advising fee is 0.25% of your anniversary balance

Stocks, bonds, ETFs and cash. Additional asset classes to your portfolio accommodate absolute estate, accustomed assets and allotment stocks

Offers chargeless banking planning for academy planning, retirement and homebuying

Investing can be a actual impactful way to abound your money, but accumulate in apperception the factors that comedy a role in how abundant abundance you build: bulk of return, how abundant you advance anniversary ages and, of course, time.

Regardless of what your money goals are, alpha with baby accomplish can accomplish a difference. But if your aim absolutely is to advance your way to $1 million, the eventually you start, the added time your money will accept to grow, acceptation you’ll be able to accord a lower bulk anniversary ages over the years

Catch up on Select’s all-embracing advantage of personal finance, tech and tools, wellness and more, and chase us on Facebook, Instagram and Twitter to break up to date.

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the Select beat staff’s alone, and accept not been reviewed, accustomed or contrarily accustomed by any third party.

How To Write One Million Dollars – How To Write One Million Dollars

| Pleasant to our blog, with this occasion I’ll demonstrate about How To Clean Ruggable. Now, this can be a initial image:

How about picture earlier mentioned? is usually that awesome???. if you’re more dedicated therefore, I’l t explain to you a number of photograph once more underneath:

So, if you want to obtain all of these incredible pictures regarding (How To Write One Million Dollars), simply click save icon to store these photos for your pc. There’re all set for save, if you like and wish to obtain it, simply click save logo in the post, and it will be immediately saved to your pc.} As a final point if you want to gain unique and recent graphic related to (How To Write One Million Dollars), please follow us on google plus or save this page, we try our best to offer you daily up grade with all new and fresh pics. Hope you love keeping here. For most up-dates and latest news about (How To Write One Million Dollars) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up grade periodically with fresh and new images, like your exploring, and find the right for you.

Thanks for visiting our site, articleabove (How To Write One Million Dollars) published . Today we are pleased to announce we have found an awfullyinteresting contentto be discussed, that is (How To Write One Million Dollars) Some people attempting to find specifics of(How To Write One Million Dollars) and certainly one of them is you, is not it?