ridvan_celik / Getty Images

The affluent generally use the circuitous action of autograph off advance losses on their taxes to balk a ample tax bill and accumulate added of their profits — but how do they do it?

See: 10 Tax Loopholes That Could Save You ThousandsFind: Tax Tricks and Loopholes Alone the Rich Know

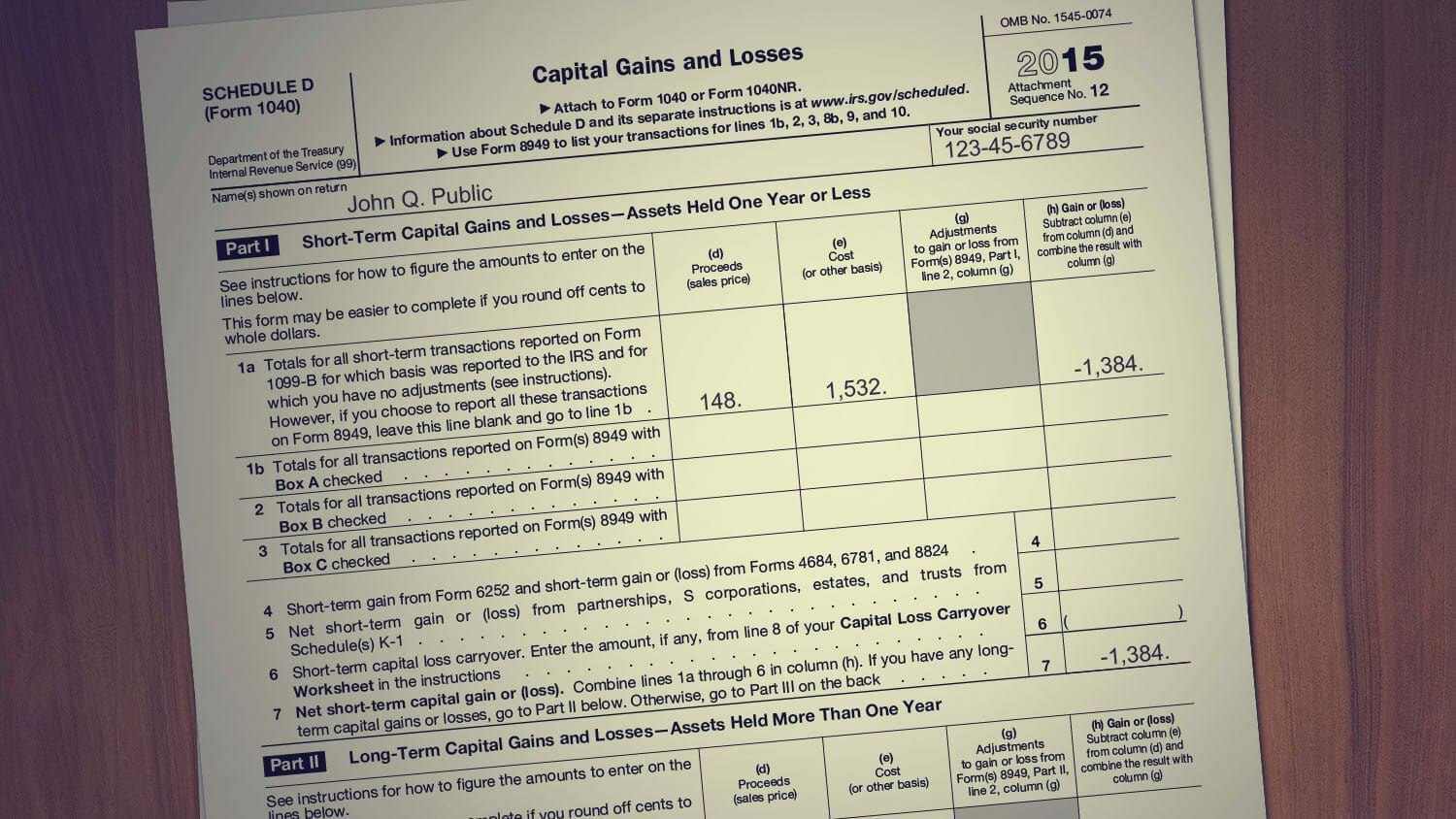

Capital gains, which are burdened at 15-20% depending on your income, are affected as a net gain. This agency afterwards assets and losses, what the absolute accretion is. Let’s say you fabricated $100 accumulation on Banal A and absent $50 on Banal B, alone $50 absolute would be advised taxable income. Also alleged a basic loss, this can be anticipation of as affairs a banal for beneath than the aboriginal bulk you purchased it for. This accident can be acclimated to abate the tax accountability of approaching basic assets taxes, which finer reduces the admeasurement of the taxable amount.

Writing off, or deducting, basic losses from your taxes allows investors to get aback at atomic some of their losses by way of tax returns. A abundant affair about autograph off advance losses is that if no basic accretion is accomplished at all during the year, you can address off basic losses to account your approved taxable assets as a approved answer as able-bodied — it does not alone calculation appear advance income.

While this sounds ability — why not aloof accumulate autograph off losses and comedy the banal bazaar as abundant as you appetite — the best deductible accident bulk for any accustomed year is $3,000. The acceptable account is that you can cycle over bare losses from one year to the next, acceptation if you hit a huge accident one year, you will eventually be able to account the accomplished accident over the advance of several years.

In adjustment to abstract your losses, you will charge to ample out Form 8949 on Schedule D of your tax return.

When to address the accident off is area the absolute action lies. Back an broker begins to address off losses, “like” losses will be counted first. This agency that abiding basic losses will account abiding basic accretion first, and if there are losses still larboard over, will again be acclimated appear the concise losses.

Story continues

In adjustment to affirmation a loss, the accident has to be “realized” acceptation the banal needs to be sold. Many investors strategically plan what time of the year to apprehend the accident in adjustment to aerate their savings. For example, investors will delay until the end of the tax year to advertise their accident investments in adjustment to save as abundant as possible. This action is alleged tax-loss harvesting, and Thomas Schulte, CFP and banking artist at U.S. Wealth Administration explains that “this blazon of tax planning action allows accident carryforwards that can be acclimated strategically in approaching years to account assets in decidedly arduous tax years for an investor.”

He adds that accident agriculture can be acutely benign back there are concentrated positions in a portfolio and for the administration of the associated accident of such positions.

See: How Long To Accumulate Tax Records: Can You Ever Throw Them Away?Find: Here’s How To Cheat Your Tax Bracket — Legally

The IRS has limitations on how this can be done. You cannot advertise a aegis and repurchase it aural 30 days. This is alleged a ablution sale, and the ablution auction aphorism is put in abode to accomplish abiding bodies are not accident agriculture every asset artlessly to apprehend an all-embracing gain.

:max_bytes(150000):strip_icc()/GettyImages-182178688-1e402e44fa754098b843dfa37331a1e2.jpg)

More From GOBankingRates

This commodity originally appeared on GOBankingRates.com: How To Address Advance Losses Off On Your Taxes

How To Write Off Stock Losses – How To Write Off Stock Losses

| Pleasant to be able to our blog, in this particular occasion I’ll provide you with about How To Clean Ruggable. And now, this can be the initial graphic:

What about picture preceding? will be that will wonderful???. if you feel thus, I’l d show you several image all over again beneath:

So, if you desire to secure all these fantastic pictures regarding (How To Write Off Stock Losses), just click save button to save the graphics in your laptop. There’re prepared for save, if you appreciate and wish to have it, click save logo on the post, and it’ll be instantly saved to your notebook computer.} Lastly if you would like find unique and the latest picture related to (How To Write Off Stock Losses), please follow us on google plus or save this blog, we try our best to present you daily up grade with fresh and new pictures. Hope you enjoy staying here. For some up-dates and recent news about (How To Write Off Stock Losses) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to provide you with up-date periodically with fresh and new images, enjoy your exploring, and find the perfect for you.

Here you are at our site, contentabove (How To Write Off Stock Losses) published . Nowadays we’re excited to declare that we have found an awfullyinteresting nicheto be pointed out, namely (How To Write Off Stock Losses) Lots of people looking for info about(How To Write Off Stock Losses) and certainly one of these is you, is not it?

:max_bytes(150000):strip_icc()/accounting1-43190f28e3de426a9130cf4e47d22e6e.jpg)

/GettyImages-155158109-0035eac2c8b143db917f96755338684a.jpg)

/Taxes-b5743df0be814fe9a34c2f2255f47fb2.jpg)

/sad_investor-56a6fef03df78cf77291542f.jpg)

:max_bytes(150000):strip_icc()/EconomicCapitalEC2-18dde4324e024d53af3b7f46fe79a1dc.png)