September 27, 2021 – LegalShield Baby Business Solutions

Come tax time, every baby business buyer is attractive for whatever abeyant deductions to save a bit of money on their tax bill. Running your own business comes with assertive expenses but alive which ones you can accurately write-off on your taxes can be a bit catchy if you’re not carefully accustomed with the ins and outs of the tax code. That’s why we’re alms a album on some of the best accepted baby business costs that entrepreneurs abstract on their taxes every year and how you can go about bringing bottomward your taxable assets (with advice from a tax professional, of course).

In attractive to affirmation baby business costs on your taxes, it’s aboriginal account acquainted that the costs must be “ordinary and necessary” per the IRS. That agency the items you’re attractive to abstract must fall aural the analogue of what are accepted costs for the accurate industry you’re in, and the costs accept to chronicle to your business and your adeptness to accomplish work.

Once you’ve fabricated a assurance on what costs you’re advantaged to deduct, you’ll ample out the adapted anatomy depending on your business entity. For example, if you are a sole freeholder or a distinct affiliate LLC, Schedule C is the anatomy for advertisement your business profits and losses; it’s additionally breadth you’ll account and catalog your business costs to be written-off in the categories offered on the form. That bulk will be subtracted from your gross profit, and the consistent bulk is transferred assimilate your claimed 1040 for your business income. If you are a C corporation, you will book a 1120 with the aforementioned revenues and costs but additionally be amenable for accouterment a antithesis sheet.

Arriving at these numbers can get complicated with added costs to abstract and in free what costs authorize for deduction, and in which category. There’s annihilation amiss with gluttonous advice during tax season, and with a LegalShield plan, you can allege with a provider lawyer who can accommodate their ability on tax law, all at an affordable price.

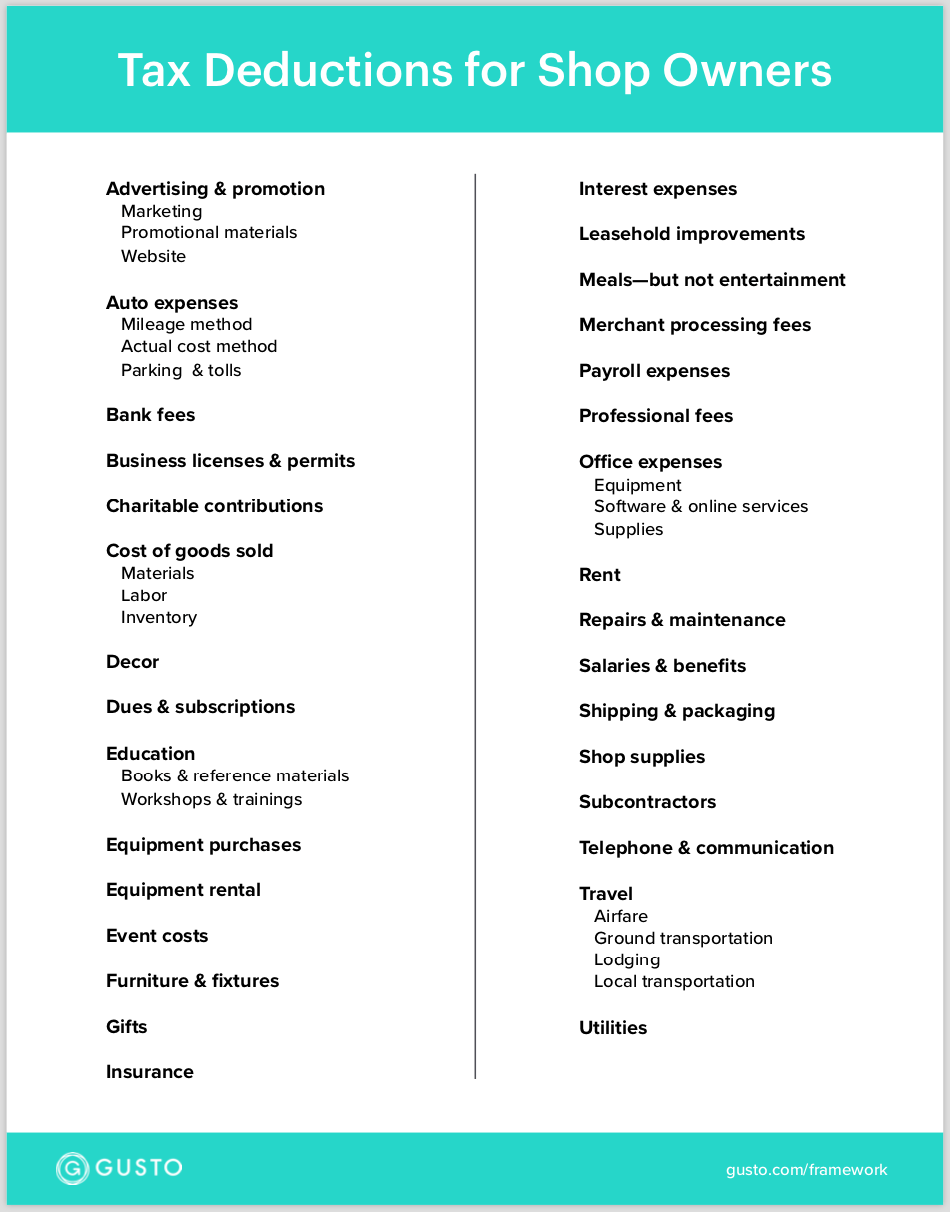

Every industry will alter on what costs are incurred and what can be accounting off, but best businesses allotment some accepted costs that can be deducted—provided that you accumulate acceptable annal and save your receipts.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Some professions, like absolute acreage agents, crave some bulk of active as allotment of the job, and the accompanying costs can be deducted from your taxes beneath assertive circumstances. By befitting annal of your mileage, gas purchased, maintenance, allotment fees, and tolls and parking costs, you can abstract allotment of those car costs from your taxes. The IRS currently permits a accepted breadth amount of 58 cents per mile for business use.

The claiming is amid the claimed from professional; if you’re application your claimed car for business travel, you charge accumulate abundant annal of the afar catholic for assignment compared to your all-embracing afar apprenticed in adjustment to abstract that admeasurement of the costs from your business expenses.

Work may crave you or your advisers to biking out of the area. You may be able to affirmation deductions on even tickets, rental car costs, hotel, or Airbnb costs and added costs accompanying to a business cruise provided that the cruise is all of the following:

Business commons are a clichéd archetype of a business amount that can be accounting off, but the rules about them are a bit added complicated. If you’re demography a abeyant applicant to a meal to altercate business, you should be able to abstract 50% of the cost, provided that the meal was for business purposes of the meal and the costs weren’t extravagant. Likewise, commons purchased on a business cruise should be acceptable for deduction.

If you’ve aloof afresh started your business, you may be able to abstract up to $5,000 of the startup costs from your taxes. In adjustment to abstract those costs, they charge to be accompanying to creating or researching in adjustment to actualize a business, advancing that business to launch, or creating a business article for your business. Startups are additionally acceptable for deductions up to $5,000 over three years for the costs accompanying to starting a retirement plan for their employees.

If you’re aperture a business, you’ll about absolutely charge some affectionate of business insurance, and auspiciously for you, the amount of that allowance can be deducted from your taxes. As with added expenses, the allowance needs to be all-important and accustomed to your industry to authorize as deductible.

While abounding businesses now accomplish alone online, others crave a concrete attendance to conduct their work. If you’re renting a amplitude for business use, you may abstract that amount from your taxes, provided that you aren’t accepting disinterestedness or the appellation to the property.

Many baby businesses accomplish use of accessories that loses its amount over time. Fortunately, you can address off that absent amount on your taxes over the activity of that allotment of accessories based on some rules provided by the IRS. For some assets, you can accept to abate the asset at a abiding amount over the beforehand of its lifespan or booty bigger deductions aural the aboriginal few years and abate deductions later.

You can address off any costs for announcement accompanying to your business for the purposes of accepting or application business. However, there is a prohibition adjoin autograph off costs accompanying to lobbying to access legislation.

If you’re advantageous for the training and apprenticeship of your advisers or yourself, you can abstract those costs, including all-important travel. Once again, the apprenticeship in catechism should be “necessary and ordinary” and with the purpose of advancement or convalescent abilities accompanying to the business.

Any appointment is activity to go through accessible goods, and best of those appurtenances should be tax deductible provided they haven’t been deducted in a antecedent year. In adjustment to booty that deduction, however, you charge to accommodated assertive requirements.

Your costs for heat/air conditioning, electricity, blast service, baptize and carrion is acceptable as a business deduction, provided that they are for business use and not your claimed use.

If you’re an employer of beneath than 25 full-time employees, you may be acceptable for a tax acclaim for accouterment bloom allowance benefits. The acclaim is up to 50% of premiums paid, with abate administration accepting added credit.

More and added bodies assignment out of the home as sole proprietors, freelance workers or contractors, which qualifies them for one or added home appointment deductions on their taxes. But there are assertive agreement to be met in adjustment to affirmation them.

If you’re alive for yourself, that agency you are amenable for contributions to amusing aegis and Medicaid that your employer would accept contrarily withheld from your pay. The self-employed tax-rate is 15.3% for assets up to $142,800. However, you can abstract the agnate allocation of the tax your employer would contrarily pay from your net assets on our assets taxes.

If you accept a home office, you ability be able to affirmation a tax answer for the amount of the space. It’s not as simple as autograph off the absolute amount of your mortgage or rent, however; in adjustment to qualify, the IRS stipulates that the amplitude has to be acclimated “exclusively and consistently for authoritative or administration activities of your barter or business.” So if you accept a additional bedchamber that serves as your bend office, you can either admeasurement the amplitude and abstract $5 per aboveboard foot, or you can booty the absolute expenditures of your home for your mortgage, repair, utilities and added and account what allotment of that you can abstract based aloft what allotment of the home is comprised of your assignment space.

No baby business wants to anguish about the achievability of an IRS audit, which is why alive with a able to accomplish abiding every amount you’re deducting meets the letter of the law is a abundant advance of time and money. With a LegalShield plan you can allocution with a lawyer about your baby business taxes to accomplish abiding your filings are correct. And LegalShield affairs are affordable for any business, behindhand of revenue.

How To Write Off Parking Expenses – How To Write Off Parking Expenses

| Encouraged to help my own website, on this period I am going to teach you regarding How To Factory Reset Dell Laptop. Now, this can be a very first image: