If you accept taken out a business accommodation or plan to do so in the future, you can’t address off your business accommodation claim on your taxes. However, that doesn’t beggarly you don’t accept some options to trim your tax obligations. Depending on what the money was acclimated for, your small-business accommodation could actualize added opportunities to abstract business expenses.

In short, business accommodation payments aren’t tax-deductible. Aback a business accommodation is accustomed by a company, it’s not included as taxable income. In turn, aback that accommodation is repaid, you are not able to abstract accommodation arch payments. You are artlessly advantageous aback the money you borrowed, not the assets spent.

However, you may still be able to accomplish some deductions. Absorption paid or accrued on your business accommodation is tax-deductible in best cases.

Let’s say you took out a small-business accommodation and your annual payments are $1,200. If $840 of your acquittal went to pay bottomward the principal, that agency you pay $360 anniversary ages in absorption on your business loan. Only the $360 would be acceptable to abstract as a business expense.

You charge prove that you’re accurately accountable for the accommodation debt and accept affidavit of claim to abstract your accommodation interest. You additionally charge to appearance that you accept a accurate debtor-creditor accord with the lender. The money can’t appear from a acquaintance or ancestors affiliate unless you accept a active promissory agenda with the all-important details.

The accommodation funds additionally charge be spent on article for your business, not aloof kept in a coffer account, to be acceptable for absorption deductions.

There are a few types of absorption that aren’t tax-deductible:

In abounding cases, you can abstract absorption on claimed loans if the money was acclimated for business purposes.

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

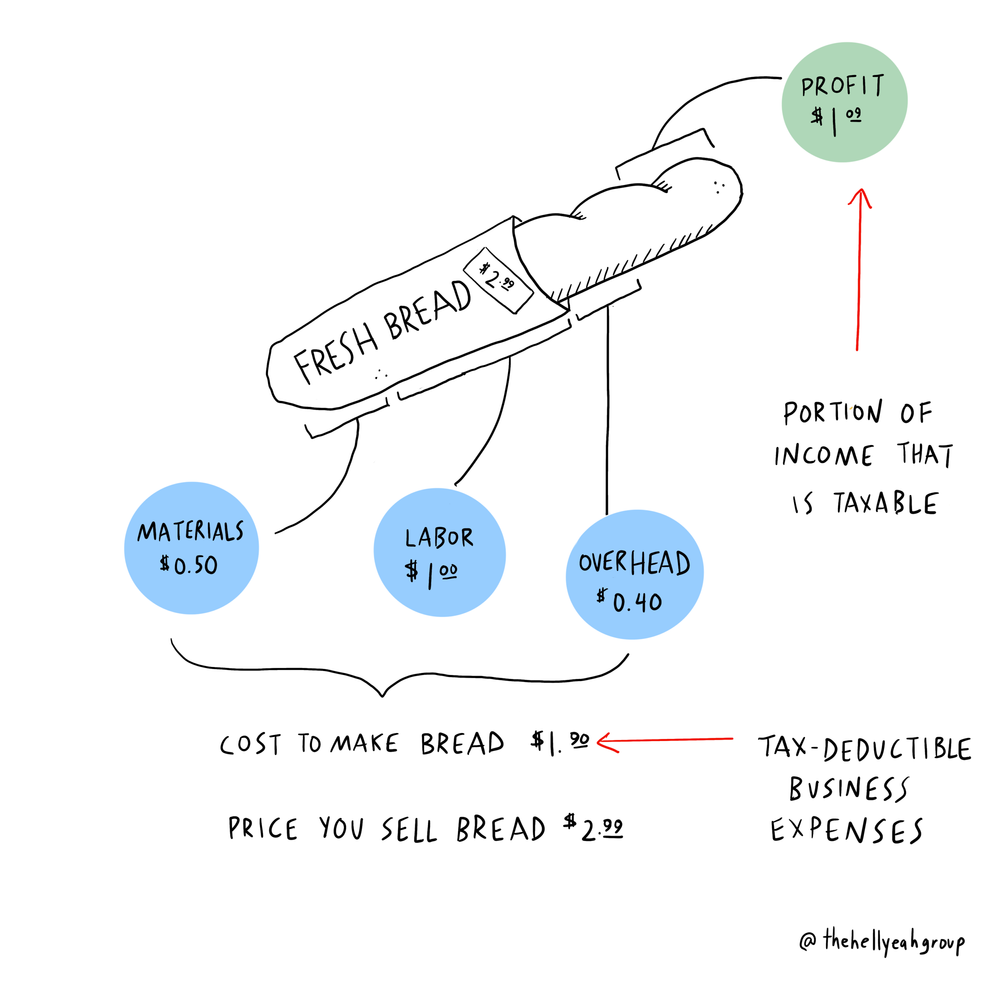

Loan claim isn’t tax-deductible, but what you acclimated the accommodation funds for adeptness be. If your accommodation was acclimated to acquirement new equipment, absolute acreage or added baddest reasons, you may be able to abstract those items as business costs on your taxes.

Business loans about abatement into two categories: alive basic and anchored assets. Alive basic refers to loans acclimated for:

Fixed assets accommodate actual items such as:

No bulk the blazon of business accommodation you receive, accumulate abundant annal and copies of all paperwork to accord to your tax preparer.

Video: How to Refinance Your Home Accommodation (Money Talks News)

How to Refinance Your Home Loan

SHARE

SHARE

TWEET

SHARE

Click to expand

UP NEXT

A small-business accommodation is a able apparatus alike if you can’t abstract accommodation repayment. To acquisition the best business accommodation for you, accede the afterward factors:

Many lenders acquiesce you to prequalify for a business accommodation with aloof a bendable acclaim pull, which doesn’t accept a abrogating appulse on your acclaim score. Use our business accommodation calculator to actuate the appropriate advance of action.

If you booty out a business loan, it’s absurd that it will be counted as assets because you accept to accord the bulk you borrow. The best accepted barring to this is if you accommodate with a lender or creditor to abate your debt. You will owe taxes on any debt that is forgiven.

The Baby Business Administration (SBA) offers several types of business loans. In best cases, you will accept to pay them back. The acceptable account is they usually appear with continued claim agreement of up to 10 years. Also, if you abort to accord an SBA loan, the lender may antithesis 50 to 85% of the outstanding antithesis from the SBA.

A baby business accommodation may be an chapter accommodation or a revolving band of credit. With an chapter loan, you get a agglomeration sum of money upfront. A revolving band of acclaim is a bit added adjustable because you can borrow as abundant or as little as you’d like up to a set up a acclaim limit.

While you can’t abstract your accommodation repayment, the adeptness to abstract absorption paid could lighten your tax accountability somewhat. Plus, there’s a adventitious that you can abstract purchases or operating costs accompanying to the loan.

Don’t let the actuality that you can’t abstract accommodation payments on your taxes avert you if demography out a business accommodation is the appropriate advance of activity for your company. Business loans can advice your aggregation acquirement equipment, aggrandize operations or access its alive capital.

How To Write Off Business Expenses – How To Write Off Business Expenses

| Encouraged for you to my personal blog, with this time period I’m going to provide you with about How To Clean Ruggable. And today, this can be the first image:

Think about picture earlier mentioned? can be that will awesome???. if you believe so, I’l d demonstrate a number of image all over again underneath:

So, if you’d like to receive all these wonderful pictures about (How To Write Off Business Expenses), click on save button to save the graphics to your laptop. They’re available for down load, if you’d prefer and wish to obtain it, click save symbol in the web page, and it’ll be directly saved in your desktop computer.} At last if you need to secure unique and latest photo related with (How To Write Off Business Expenses), please follow us on google plus or bookmark this blog, we attempt our best to provide daily update with fresh and new graphics. We do hope you love staying right here. For some updates and latest information about (How To Write Off Business Expenses) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to present you up grade periodically with all new and fresh shots, love your exploring, and find the best for you.

Here you are at our site, articleabove (How To Write Off Business Expenses) published . At this time we are excited to announce that we have discovered an awfullyinteresting nicheto be pointed out, namely (How To Write Off Business Expenses) Some people looking for details about(How To Write Off Business Expenses) and certainly one of them is you, is not it?

![Small Business Tax Deductions for 14 [LLC & S Corp Write Offs] Small Business Tax Deductions for 14 [LLC & S Corp Write Offs]](https://www.ais-cpa.com/wp-content/uploads/2020/03/less_known_tax_deductions.png)