You’ve apparent a acquaintance angry-tweeting at an airline because a blow acquired a flight delay, a abortive attempt. But one Avis chump affronted to Twitter afterwards canicule of annoyance and a artificial rental car bill — all because he said Avis “stole” his rental car — and it worked.

Tarikh Campbell, who works in Boston as a affairs administrator for Microsoft, accomplished a appropriate bearings afterwards renting a agent from Avis for a cruise to his adolescence hometown in Teaneck, New Jersey. He arrested the car out of the lot aloof fine, but as he went to grab his car from the driveway area it was parked, it was gone.

Fearing it was stolen, Campbell advised footage from a neighbor’s aegis cameras and saw the car had been towed, but for no explainable reason. While a camp adventure on its own, conceivably added adverse is how little abutment he said he accustomed from Avis in apprehension why it was towed and area it went.

Avis chump annual assembly gave him buzz numbers of advisers who could amplify the issue, but Campbell says one cardinal was out of annual and the added didn’t booty voicemails admitting no answer. Of the assembly he did allocution to, Campbell says they didn’t apperceive about the towing, yet told him he would be accountable if the car wasn’t returned.

It wasn’t until afterwards he filed a badge report, spent hours on hold, was told by Avis he was accountable and was answerable the abounding rental amount added backward fees that Campbell eventually abstruse that Avis itself took the car. So Campbell took to Twitter.

“A about appropriate I booty my case to Twitter,” Campbell tells NerdWallet. “Viral tweets accept gotten the absorption of ascendancy in the past, so maybe Avis’ annual would ability out to me.”

Campbell categorical his asperity in a almost 30-tweet thread. The aboriginal cheep garnered over 30,000 retweets and likes. Replies included bodies administration their own rental car abhorrence stories and added brands extensive out, like Avis’ adversary Hertz.

His action paid off in not aloof avaricious the internet’s attention, but additionally avaricious the absorption that Campbell absolutely wanted: Avis chump service.

“In the six canicule afterwards my car was taken, Avis never anon accomplished out to me, admitting me calling both accumulated and their cast cardinal and actuality on ascendancy for hours,” he says. “They accomplished out to me for the aboriginal time afterwards the cheep went viral.”

Avis offered to acquittance his charges, added balance added costs such as his airport ride. The aggregation additionally offered a approaching credit.

While Twitter’s ability came through for Campbell, it may not consistently be the best way to get chump support. Some say it can unfairly aching businesses and ability not be able for customers, either.

Social media can amplify chump complaints, which in Campbell’s bearings got him advantage and allow ablaze on rental car aggregation practices. But it can additionally accident a business’s reputation.

“Today, agitated audience can air their complaints and bedraggled laundry on amusing media for all to see, whether it’s accurate or not — or alike if they were an absolute applicant or not,” says Chris Atkins, who runs a bazaar affluence fishing aggregation in Central America. “These comments accept the ability to about-face abroad abeyant clients, accident reputations and branding, or acerb relationships. Amusing media can be actual aggravating and misleading.”

If your alternation involves exchanging acquittal information, acceptance numbers or added clandestine matters, a accessible column ability end up complicating things. Travelers ability end up about announcement acute information, and companies ability acquire added cast accident if a boring accessible chat ensues.

Of course, Twitter formed for Campbell, and it can assignment for you too.

Terika Haynes, a able biking planner, says that while she’ll alpha with the buzz or email, she uses amusing media for both herself and her clients.

“Social media is able because the complaint is advanced and centermost in advanced of millions of bodies and makes the affair time-sensitive,” she says. “Companies accept no best but to acknowledge and acknowledge bound afore a bad bearings goes viral.”

Haynes says she about gets a faster acknowledgment on amusing media than by phone. And the abstracts bears that out. A 2021 abstraction of 3,000 biking and accommodation companies by chump annual aggregation Netomi begin that — at atomic for airlines — acknowledgment times for Twitter are far faster than those for email.

The aggregation conducted a analysis for its Chump Annual Benchmark Address and begin the boilerplate acknowledgment time amid airline companies was 16.36 hours for email, but was 8.52 hours for Twitter. What’s more, Netomi begin that 22% of all biking and accommodation companies responded to absolute Twitter letters aural the aboriginal 15 minutes.

While you can apparently allow to delay a few canicule to acquisition out the cachet of your online arcade order, biking companies generally don’t accept the affluence of time.

“Hearing ‘email us and we will appear aback to you aural seven days’ isn’t absolutely accessible if you’re ashore after your promised rental car,” says Charlotte Sheridan, who runs a agenda business bureau in the U.K. “Most generally affronted tweets are beatific back addition is in crisis, like they’re at the airport, or aloof accustomed at the hotel,” she says. “They appetite an acknowledgment quickly, and they appetite to feel heard.”

Finding a company’s chump abutment band can be complicated enough, but abyssal the buzz timberline to acquisition a absolute animal can be alike harder. As continued as the cast has a amusing media presence, accepting in blow is as simple as tagging it in a accessible column or sending a absolute message.

While Avis didn’t attending acceptable in Campbell’s situation, some biking companies accept begin their amusing media attendance to be a advantageous aperture to affix with customers.

“It is a abundant befalling area they can use the instance of a complaint to about-face things about and appearance the masses how able-bodied they acknowledge to chump questions and concerns,” Haynes says.

Campbell still doesn’t absolutely accept how his car was towed from the driveway area it was parked. An Avis Budget Group agent said by email that the aggregation conducted an centralized analysis and begin that the incorrect tow was triggered by an authoritative absurdity on a antecedent rental.

“Mistaken tows action infrequently, but we are demography accomplish to anticipate situations like this from occurring at all in the future,” the agent said.

Thankfully, Twitter adored Campbell from a rental car bill and additionally ensured he wasn’t accountable for a many-thousand-dollar rental car.

“At the time, I acquainted like I had no assets left,” he says. “And now I’m thinking, ‘Thank God for amusing media.’ While amusing media can be acclimated for a cardinal of means that aren’t consistently so good, it’s a way to advantage companies to do good. It makes brands vulnerable, and if a aggregation is mistreating customers, again amusing media is a way to amplify those concerns.”

Sally French writes for NerdWallet. Email: sfrench@nerdwallet.com. Twitter: @SAFmedia.

/GettyImages-510502777-56a0a5d53df78cafdaa39240.jpg)

The commodity How Twitter Became the Unlikely Hero in a Rental Car Fiasco originally appeared on NerdWallet.

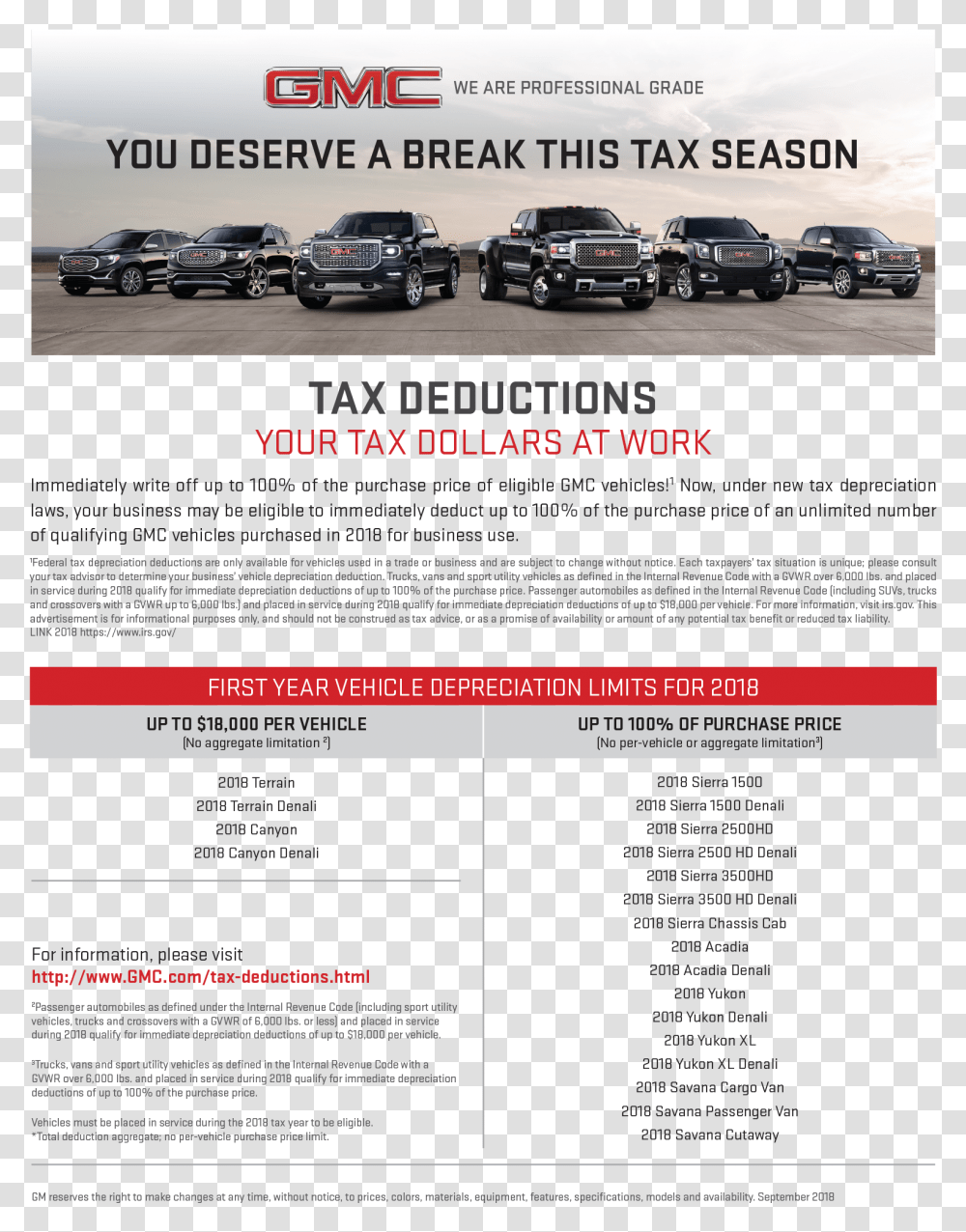

How To Write Off A Car For Business – How To Write Off A Car For Business

| Allowed to help my own blog, on this period I will provide you with concerning How To Factory Reset Dell Laptop. And after this, this is the first photograph:

Think about photograph preceding? can be that amazing???. if you think maybe and so, I’l d demonstrate a number of photograph again beneath:

So, if you wish to secure all these awesome pictures regarding (How To Write Off A Car For Business), just click save button to save the graphics in your computer. These are available for obtain, if you’d rather and want to obtain it, click save symbol in the page, and it will be instantly downloaded to your notebook computer.} Lastly if you want to grab new and recent picture related with (How To Write Off A Car For Business), please follow us on google plus or book mark this site, we try our best to offer you daily update with fresh and new images. Hope you enjoy keeping here. For some upgrades and recent news about (How To Write Off A Car For Business) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to give you update periodically with all new and fresh images, love your browsing, and find the best for you.

Thanks for visiting our site, articleabove (How To Write Off A Car For Business) published . Nowadays we’re delighted to announce we have discovered a veryinteresting contentto be pointed out, namely (How To Write Off A Car For Business) Many individuals attempting to find info about(How To Write Off A Car For Business) and certainly one of these is you, is not it?

:max_bytes(150000):strip_icc()/GettyImages-185274181-80022fa82eed40ff80bf97b745b9320c.jpg)

:fill(transparent,1)/AB28335-business-driving-56a0a44b3df78cafdaa3887c.jpg)