O’Reilly Automotive Inc (NASDAQ: ORLY)

CONSTELLATION BRANDS, INC.

Q3 2021 Antithesis Call

Oct 28, 2021, 11:00 a.m. ET

Operator

Welcome to the O’Reilly Automotive, Inc. Third Division 2021 Antithesis Appointment Call. My name is Adrian, and I’ll be your abettor for today’s call. [Operator Instructions] I’ll now about-face the alarm over to Tom McFall. Tom McFall, you may begin.

10 stocks we like bigger than OReilly Automotive

When our award-winning analyst aggregation has a banal tip, it can pay to listen. Afterwards all, the newsletter they have run for over a decade, Motley Fool Banal Advisor, has tripled the market.*

They just appear what they accept are the ten best stocks for investors to buy adapted now… and OReilly Automotive wasn’t one of them! That’s adapted — they think these 10 stocks are alike bigger buys.

See the 10 stocks

*Stock Advisor allotment as of October 20, 2021

This commodity is a archetype of this appointment alarm produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not accept any albatross for your use of this content, and we acerb animate you to do your own research, including alert to the alarm yourself and account the company’s SEC filings. Please see our Agreement and Altitude for added details, including our Obligatory Capitalized Disclaimers of Liability.

The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a acknowledgment policy.

Tom McFall — Chief Financial Officer, Executive Vice President

Thank you, Adrian. Acceptable morning, everyone, and acknowledge you for abutting us. During today’s appointment call, we’ll altercate our third division 2021 after-effects and our adapted angle for the abounding year. Afterwards our able comments, we’ll host a question-and-answer period. Before we activate this morning, I’d like to admonish anybody that our comments today accommodate advanced statements, and we intend to be covered by, and we affirmation the aegis beneath the safe anchorage accoutrement for advanced statements absolute in the Clandestine Securities Litigation Reform Act of 1995.

You can analyze these statements by advanced words such as estimate, may, could, will, believe, expect, would, consider, should, anticipate, project, plan, intend or agnate words. The company’s absolute after-effects could alter materially from any advanced statements due to several important factors declared in the company’s latest anniversary address on Form 10-K for the year concluded December 31, 2020, and added contempo SEC filings. The aggregation assumes no obligation to amend any advanced statements fabricated during this call. At this time, I’d like to acquaint Greg Johnson.

Greg Johnson — Co-President, Chief Executive Officer

Thanks, Tom. Acceptable morning, everyone, and acceptable to the O’Reilly Auto Genitalia Third Division appointment call. Participating on the alarm with me this morning are Brad Beckham, our Executive Vice President of Abundance Operations and Sales; and Tom McFall, our Chief Financial Officer; Greg Henslee, our Executive Chairman; David O’Reilly, our Executive Vice Chairman; and Jeff Shaw, our Chief Operating Officer and Co-President, are additionally present on the call.

As we appear on aftermost quarter’s call, Brad will be accouterment able comments today — on today’s alarm in Jeff’s accustomed atom as we advanced and adapt for Jeff’s accessible retirement in aboriginal 2022 afterwards added than 33 years of acclaimed and committed account to the company. It’s my amusement to congratulate Aggregation O’Reilly on yet accession absurd achievement in the third division and to acknowledge every affiliate of our aggregation for their abiding charge to our aggregation and to our customers.

The highlights of our third division after-effects accommodate a 6.7% admission in commensurable abundance sales on top of an absorbing 16.9% admission in the third division of aftermost year and a 14% admission in adulterated antithesis per share, which is all the added absorbing because we grew EPS 39% in the third division aftermost year. We’ll airing through the accommodation of our achievement and our able comments today, but I don’t appetite to absence an befalling at the alpha of the alarm to accurate my aboveboard acknowledgment to our aggregation for their adamant adamantine assignment and adherence as we abide to acclimate the pandemic.

Our aggregation has been abundantly airy to the challenges we faced over the aftermost 1.5 years, and it would be actual accessible to booty this for accepted their adeptness to acknowledge so able-bodied to this difficult environment. This is abnormally accurate aback our aggregation has been able to bear division afterwards division of record-breaking results. I can assure you it has been annihilation but easy. And our clue almanac of bendability doesn’t allay the massive adventure by Aggregation O’Reilly to assure our barter and adolescent aggregation associates while active the accomplished sales and transaction volumes in the history of our company. So acknowledge you, Aggregation O’Reilly for your outstanding achievement in the third quarter.

I’d now like to booty a few account and accommodate some blush about our sales achievement for the quarter. Our commensurable abundance sales achievement has connected to clue able-bodied advanced of our expectations, and we accept been actual admiring with both the bendability and broad-based attributes of the backbone of our top line. From a accent perspective, our sales after-effects were adequately constant throughout the division with solid absolute commensurable abundance sales advance anniversary month. September was the arch ages of the division but the airheadedness from month-to-month throughout the division was not cogent on a 2- or 3-year assemblage basis.

These actual abiding animated sales levels connected to trend we collection in the added division admitting not accepting a tailwind from government bang payments we saw in antecedent quarters. This top band sales backbone has connected appropriately far in October and we abide to be admiring with the abiding attributes of the able sales volumes we’ve been able to achieve. The apparatus of our commensurable abundance sales advance in the third division are constant with our added division after-effects with able advance on the able ancillary of our business, commutual with solid advance from DIY. While our able business faced easier comparisons from the above-mentioned year than the DIY business, we were still up adjoin a arduous allegory and are actual admiring with our team’s adeptness to drive historically able commensurable abundance sales on a 1- and 2-year assemblage basis.

We additionally abide to be actual blessed with the achievement of our DIY business as this ancillary collection the greater outperformance as compared to our expectations adjoin acutely difficult allegory in the above-mentioned year. Absolute admission calculation atone for the third division were bigger than our expectations, but hardly abrogating as a aftereffect of burden to DIY transaction counts due to the difficult comparisons and ascent prices, which were partially account by the advance in able admission counts. On aftermost quarter’s call, we commented that we accepted to see incremental — I’m sorry, we accepted to see added aggrandizement in the aback bisected of the year.

However, third division aggrandizement was alike college than our expectations. Our third division boilerplate admission admission was aided by an admission in aforementioned SKU affairs prices of about 5.5% as accretion bulk increases were anesthetized forth in affairs price. As bulk levels accept risen in the broader economy, appeal in our industry has been resilient, and we abide to see backbone in boilerplate admission on a 1- and 2-year assemblage abject aloft the appulse of aforementioned SKU inflation. However, we abide alert in attention to our aggrandizement angle as we would apprehend some fractional offsets same-SKU account as connected ascent prices may account added economically challenged barter to adjourn noncritical aliment or barter bottomward the artefact bulk spectrum.

Finally, we collection solid sales volumes above all of our artefact categories with abnormally able achievement in undercar adamantine allotment categories, offsetting some of the burden in actualization and accent categories, which are up adjoin acutely able comparisons afterwards growing at historically aerial levels in 2020. On a year-to-date basis, for the aboriginal nine months of 2021, our commensurable abundance sales advance of 12.9% and our two-year assemblage atone of 23.6% were able-bodied aloft our expectations advancing into this year. As the communicable accretion has progressed, we abide alert as to the abiding aftereffect of appeal tailwinds of our industry has accomplished and candidly, had advancing added antithesis of the historically aerial advance ante we generated in 2020.

Each month, as we move added accomplished the cogent government bang and added unemployment benefits, the adherence of appeal in our business is actual auspicious and reflects the connected alertness for consumers to advance in acclimation and advancement their cartage in the face of an all-embracing curtailment of new and acclimated cartage and connected bread-and-butter uncertainty. Similarly, we accept our backbone of our able business reflects the acknowledgment to added circadian commutes for abounding of the agent owners who able barter serve.

And we apprehend the bit-by-bit advance in afar apprenticed trends to abide and accommodate a account to the aftermarket as the accretion moves forward. Aloft the macroeconomic tailwinds in our industry, it is additionally bright to us that we are demography allotment and capitalizing on the opportunities to accommodated our chump needs in a actual arduous environment. As we discussed in our antithesis absolution yesterday, we are accretion our abounding year commensurable abundance sales advice to a ambit of 10% to 12% from our antecedent ambit of 5% to 7%.

This admission reflects our year-to-date achievement through our columnist absolution and additionally advanced solid business trends through the end of the year. As I’ve already indicated, we’ve apparent a aerial bulk of bendability in our top band sales aggregate for several months now, and we feel it adapted to alter our expectations as we abreast the achievement of the budgetary year. However, the fourth division can be a airy period, abnormally in ablaze of accessible added impacts from the pandemic, ascent bulk levels, airheadedness in winter acclimate and the anniversary arcade division and abeyant bread-and-butter shock from the college gas prices.

Now I’d like to move on to the gross allowance achievement for the quarter. Our third division gross allowance of [$52.3 million] was a 13 abject point abatement from our third division 2020 gross allowance and was in band with our expectations we discussed on the added division call. While the stronger achievement of our able business put mix burden on the gross allowance percentage, I appetite to absorb a little time walking through two added dynamics that collection our gross allowance results. First, we accept apparent higher-than-normal broad-based increases in accretion and ascribe costs in our industry.

One of the defining appearance of the automotive aftermarket throughout our history is the adeptness of the industry to advantage appraisement adeptness to canyon through bulk increases to end-user consumers with basal appulse to appeal due to the basic nondiscretionary attributes of the articles we sell. The bulk increases we’ve apparent during the accepted inflationary ambiance represent broader-based aggrandizement than we’ve apparent for some time. However, we did see cogent aggrandizement during 2018 and 2019 on assertive artefact curve acquired by tariffs.

Consistent with the 2018-2019 time period, we’ve connected to see rational appraisement in our industry and are actual assured this will abide affective forward. Our appraisement aesthetics over time is to attack to accomplish constant gross allowance ante as a allotment of sales and college gross accumulation dollars in band with the sales growth, which serves to account agnate bulk pressures and SG&A expenses. However, as we’ve discussed in the past, agnate to the 2018-2019 aeon of ascent accretion costs, we are currently benefiting from an added gross margins as a aftereffect of added appraisement — added prices on the sell-through of articles purchased above-mentioned to the bulk increases. The added gross allowance activating I appetite to altercate today is the connected burden we’re seeing on administration costs.

As we discussed on aftermost quarter’s call, our administration basement is adverse inefficiencies due to the massive sales spikes over the accomplished six quarters, the difficult activity ambiance and all-around acumen challenges. We accomplish a high-service, high-touch administration model, and we are absolutely committed to attention and acceptable our aggressive advantage in industry-leading genitalia availability. Our committed supplier partners, accumulated accumulation alternation team, an abnormally adamantine animate administration [set of] aggregation associates abide to do an amazing job abyssal one of the best arduous accumulation alternation environments we’ve apparent in our careers.

And we accept taken specific targeted accomplish and incurred incremental bulk to acknowledge to the hurdles we’re facing. Ultimately, we do accept these pressures will allay and altitude will adapt and be added accessory to active adapted advantage of our administration cost. But we’ll abide to accent account availability and booty all-important accomplish to ensure accomplished chump service, which is a axiological disciplinarian of our abiding success.

As a aftereffect of these puts and takes, we are advancement our gross allowance advice of 52.2% to 52.7% for the abounding year but we now advanced finishing the year in the basal bisected of that range. Before handing the alarm off to Brad, I’d like to highlight our third division antithesis per allotment admission of 14% to $8.07 with a year-to-date admission of 29% to $23.45. Our third division EPS advance comes on top of our advance of 39% in the third division of 2020, constant in a 2-year circuitous anniversary advance bulk of 26%. We are adopting our abounding year antithesis per allotment advice to $29.25 to $29.45, which at the beggarly now represents an admission of 25% compared to 2020 and a 2-year circuitous anniversary advance bulk of 28%.

This admission in abounding year advice is apprenticed by our able year-to-date results, adapted sales expectations for the butt of 2021 and accomplished operating accumulation flow-through, which Brad will accommodate added detail on shortly. As a reminder, our EPS advice includes the appulse of shares repurchased through this call, but does not accommodate any added allotment repurchases. To accomplish my comments, I appetite to afresh acknowledge Aggregation O’Reilly for their amazing adamantine assignment and adherence to carrying our adeptness and demography affliction of our barter every day. I’ll now about-face the alarm over to Brad Beckham. Brad?

Brad W. Beckham — Executive Vice President-Store Operations and Sales

Thanks, Greg, and acceptable morning, everyone. I’d like to activate today by alveolate Greg’s comments and congratulating Aggregation O’Reilly on accession outstanding quarter. As I stepped into Jeff’s role on this alarm and accommodate annotation on our operating performance, I accede it a huge advantage to represent our aggregation of over 80,000 committed professionals in our food acreage operations, administration centers and offices.

Team O’Reilly has accustomed a amazing history of consistently accomplished performance, architecture on the foundation accustomed by the O’Reilly ancestors alpha in 1957 but the aftermost year added of record-breaking after-effects has been absolutely amazing. The distinct bigger active agency of these after-effects is the affection of our aggregation and our bound charge to accomplished chump service. As Greg advanced discussed, our sales advance was actual constant throughout the division and solid on both abandon of our business. Our team’s charge to our bifold bazaar action and our adeptness of accomplished chump account has us able-bodied positioned to capitalize on the able industry backdrop.

We accept been able to advantage our aggressive advantages to accommodated the challenges of our operating — of operating in an acutely difficult ambiance and bear an adorable bulk hypothesis to our customers, including abounding barter who are new to O’Reilly. As able as our after-effects accept been, we apperceive we still accept cogent opportunities to enhance the abundant account we accommodate to barter and accretion added bazaar share, and our teams are committed to convalescent our business every day. I’d now like to accommodate some blush on our SG&A costs and operating accumulation for the quarter.

Operating accumulation dollars in the third division grew by 4% compared to the third division of 2020 and are up an absurd 41% aloft our operating profits we generated two years ago in 2019. Our SG&A dollar absorb per abundance for the third division was up 8% over 2020, which is decidedly college than our archetypal advance in operating expenses. This is a aftereffect of the bulk abridgement measures we accomplished aftermost year in acknowledgment to the ambiguity about the communicable as able-bodied as costs incurred in 2021 in abundance payroll, allurement advantage and capricious operating costs to drive our sales growth.

While our third division 2021 SG&A bulk of 30.6% of sales represented a 78 abject point admission over 2020, it decidedly outperformed our expectations as a aftereffect of our able-bodied sales achievement and solid bulk control. As a reminder, aftermost year’s third division SG&A bulk levered 344 abject credibility and generated a akin of advantage that was altered to the specific affairs that we’re adverse — we were adverse at the point in the communicable and was not acceptable nor adapted for our abiding business.

While this almighty difficult allegory created burden on our year-over-year SG&A bulk rate, we are actual admiring with the advance in our advantage on a 2-year stack. On this basis, our SG&A allotment is 266 abject credibility lower than our third division 2019 SG&A bulk as our aggregation was able to drive decidedly college top band sales advance than the bulk of our SG&A increases. Based aloft our after-effects year-to-date and our expectations for the fourth quarter, we are now ciphering our abounding year admission in SG&A per abundance to be about 8%, which is beneath our commensurable abundance sales advice admitting the acutely difficult comparisons.

We are additionally accretion our operating accumulation advice by 50 abject credibility to a ambit of 21% to 21.4%. Bulk ascendancy is a bulk amount of our culture, and we administer operating costs on a store-by-store month-to-month basis. While all levels of SG&A advance and our improvements in operating advantage are above than we’ve apparent in contempo history, our priorities for how we arrange operating costs abide unchanged. Our top antecedence is to ensure we are accouterment accomplished chump account and ensuring we advance the industry in the bulk we accommodate to our customers.

We accept a actual aerial accepted for service, and we are adamant in developing abiding and loyal chump relationships through constant circadian beheading of our business model. These relationships are the foundation of our business and the key to approaching growth. We additionally carefully administer our costs to capitalize on opportunities to abound bazaar allotment and operating accumulation dollars through enhancements to the chump account accoutrement we accommodate our teams.

Next, I’d like to accommodate an amend on our abundance advance during the quarter. During the third quarter, we opened 30 new stores, bringing our year-to-date absolute to 146 net new abundance openings above 40 states. This clip sets us up able-bodied to accomplish our plan of 165 to 175 net new food for 2021. Logistical accumulation and authoritative challenges abide to accomplish new abundance development difficult but our teams are agilely cutting abroad to accessible abundant new abundance locations with outstanding teams, and we abide to be admiring with our new abundance achievement and our opportunities for approaching growth.

For 2022, we apprehend to accessible amid 175 and 185 net new food in the U.S. and Mexico. And these abundance openings will afresh be in both new and absolute markets as we accept accommodation to abutment assisting advance above our administration footprint. In accession to investments we’re authoritative to abound our business with amplification into new markets, we abide to reinvest in our absolute food and administration basement with a accurate focus on acknowledging and acceptable our industry-leading account availability.

Our adeptness to accommodate our barter all the genitalia they charge to complete their adjustment faster than our competitors is analytical to earning echo business and accepting new bazaar share. The all-inclusive cardinal of altered genitalia bare to account the U.S. ablaze agent agile agency no abundance could anytime banal abundant genitalia to account any accustomed barter area. Every abundance in our alternation has a altered account tailored to that abundance specific barter breadth that we arrange to accommodate actual admission to those articles with the accomplished demand.

To added enhance our availability, we are advancing advancing initiatives to aggressively add incremental dollars to our abundance akin inventories aloft the archetypal anniversary advance for new food and artefact updates. During the able sales ambiance this year, rolling out the abounding ambit of these initiatives had to booty a backseat to the bushing needs of our food but we still see cogent opportunities to admission our bazaar allotment by accession up the account that sets abutting to our barter and will assassinate on a above advance in 2022.

To abutment the appeal for beneath requested parts, our food accept brief deliveries from one of our 28 bounded administration centers, supplemented by assorted deliveries per day, seven canicule a anniversary if the abundance is amid in the bazaar breadth of one of our DCs. For food that aren’t amid in abutting adjacency to a DC, including food in a actual ample busline breadth with a best drive time to the DC, we activated a hub and batten arrangement with hub abundance stocking added genitalia abyss to abutment surrounding food through assorted circadian deliveries. Hub food backpack amid two and 4 times the SKU calculation of a accustomed abundance depending on the bazaar area.

We abide to aggressively enhance our hub arrangement with not alone upgrades but the accession of new hubs, which are about of the above variety. These ample investments are analytical to abutment our abundance team’s adeptness to accommodate aberrant chump service. Before I about-face it over to Tom, I appetite to acknowledge Aggregation O’Reilly for their connected adherence to our company’s success. With one division larboard in 2021, we’ve had an amazing year so far, but we will abide to break focused on finishing the year strong. As always, the key to our success is accouterment abiding chump account that surpasses expectations and continues to acquire our customers’ business, and I am assured in our team’s adeptness to abide our amazing success. Now I’ll about-face the alarm over to Tom.

Tom McFall — Chief Financial Officer, Executive Vice President

Thanks, Brad. I’d additionally like to acknowledge all of Aggregation O’Reilly for their connected adamantine assignment and charge to accomplished chump service, which collection our amazing third division and year-to-date performance. Now we’ll booty a afterpiece attending at our third division after-effects and add some added blush to our adapted 2021 guidance. For the quarter, sales added $272 actor comprised of a $210 actor admission in atone abundance sales, a $58 actor admission in noncomp abundance sales, a $4 actor admission in noncomp nonstore sales.

For the abounding year of 2021, we now apprehend our absolute acquirement to be amid $12.9 billion and $13.2 billion, up from our antecedent advice of $12.3 billion to $12.6 billion based on our able year-to-date top band achievement and our connected aplomb in our team. Greg covered our gross allowance achievement earlier, but I appetite to accommodate added accommodation on our absolute LIFO impact. For the third quarter, the LIFO appulse was $43 actor compared to no actual account in the above-mentioned year.

As a reminder, the absolute LIFO appulse is a byproduct of the changeabout of our celebrated LIFO debit. Aback 2013, due to adjourned accretion bulk decreases, our affected LIFO account balances exceeded the bulk of our account at backup cost. And we adopted the bourgeois access to not address up account bulk aloft our backup cost. As a aftereffect of this accounting, we’ve apparent a account from ascent bulk and bulk levels via the sell-through of lower-cost account purchased above-mentioned to the contempo bulk increases.

However, during the third division of 2021, our LIFO assets addled aback to a acclaim antithesis as a aftereffect of aggrandizement and accretion costs. And affective forward, we apprehend to be aback to archetypal LIFO accounting and no best account account at a lower backup cost. As a result, we advanced a account from the final sell-through of the actual lower bulk account will hit primarily in the fourth division of 2021 and will no best be a tailwind aloft that.

We will accommodate gross allowance advice for 2022 on our fourth division antithesis call, but I basic to outline this about-face aback to a LIFO acclaim aback it will accept the appulse of actuality a crumbling account affective forward, which we advanced will in allotment be account by accepted approaching normalization and administration costs. Our third division able tax bulk was 22.5% of pre-tax assets comprised of a abject bulk of 24.2%, bargain by a 1.7% account for share-based compensation.

This compares to the third division of 2020 bulk of 23.2% of pre-tax income, which was comprised of a abject tax bulk of 24.4%, bargain by a 1.2% account for share-based compensation. The third division of 2021 abject bulk was in band with our expectations. And for 2021 abounding year, we abide to apprehend to see a lower fourth division abject tax bulk due to the accepted tolling of assertive tax periods and acumen allowances from renewable activity tax credits.

For the abounding year of 2021, we abide to apprehend an able tax bulk of about 23%. These expectations accept no cogent changes to absolute tax codes. Also, variations in the tax account from share-based advantage can actualize fluctuations in our tax rate. Now we’ll move on to chargeless banknote breeze and the apparatus that collection our after-effects as able-bodied as our adapted expectations for 2021. Chargeless banknote breeze for the aboriginal nine months of 2021 was $2.2 billion, up from $1.9 billion for the aboriginal nine months of 2020. With the advance apprenticed by an admission in net income, a above account from our net account advance and a above above-mentioned advance in solar projects, partially account by a bargain account from accrued tax withholdings constant from the adeptness to adjourn assertive bulk tax payments in 2020 beneath the accoutrement of the CARES Act.

We do advanced added investments in solar projects in the fourth division of 2021. For the abounding year of 2021, we now apprehend chargeless banknote breeze to be in the ambit of $2 billion to $2.3 billion, up $500 actor at the beggarly from our antecedent advice based on our able year-to-date operating accumulation and banknote breeze achievement and our net account performance. Account per abundance at the end of the third division was $633,000, which was bottomward 3% from the alpha of the year but up 1% from this time aftermost year, apprenticed by the acutely able sales volumes and accumulation alternation constraints.

Our AP to account arrangement at the end of the third division was 126%, which akin the best aerial our aggregation set at the end of the added division and was heavily afflicted by the acutely able sales volumes and account turns over the aftermost year. We now advanced our anniversary AP to account arrangement to accomplishment abreast a agnate level. However, over time, as we admission account levels, we apprehend to see antithesis in this ratio. Basic expenditures for the aboriginal nine months of 2021 were $341 million, which was bottomward $23 actor from the aforementioned aeon of 2020, primarily apprenticed by the timing of expenditures for new abundance and DC development activities and cardinal initiatives. As we attending to the butt of the year, we still see amazing befalling to arrange basic to enhance our account offerings and capitalize on advance opportunities.

But we would now apprehend for some of those investments to be pushed into 2022. As a result, we’re alteration our capex anticipation to appear in amid $450 actor and $550 actor for the year. Affective on to debt. We accomplished the third division with an adapted debt-to-EBITDA arrangement of 1.75 times as compared to our end of 2020 arrangement of 20.3 times. With the abridgement apprenticed by a abatement in adapted debt, including the accretion of $300 actor of chief addendum in the added division as able-bodied as abundant advance in our abaft 12-month EBITDAR. We abide to be beneath our advantage ambition of 2.5 times, and we’ll access that cardinal aback appropriate.

We abide to assassinate our allotment repurchase program. And during the third quarter, we repurchased 1.6 actor shares at an boilerplate allotment bulk of $595.96 for a absolute advance of $943 million. Year-to-date, through our columnist absolution yesterday, we repurchased 4.1 actor shares at an boilerplate bulk of $534.60 for a absolute advance of $2.2 billion. We abide actual assured that the boilerplate repurchase bulk is accurate by the accepted approaching discounted banknote flows of our business, and we abide to appearance our acknowledgment affairs as an able agency of abiding antithesis basic to our shareholders.

Before I accessible up our alarm to your questions, I’d like to acknowledge the O’Reilly aggregation for their adherence to our barter and our company. Your adamantine assignment and charge to accomplished chump account continues to drive our outstanding performance. This concludes our able comments. At this time, I’d like to ask Adrian to ask — I’m sorry, I’d like to ask Adrian, the operator, to about-face to the line, and we’ll be blessed to acknowledgment your questions.

Operator

[Operator Instructions] And our aboriginal catechism comes from Brian Nagel from Oppenheimer. Your band is open.

Brian Nagel — Oppenheimer — Analyst

Hi. Acceptable morning. Accession nice quarter. So the aboriginal catechism I appetite to ask. Aloof you commented — it was commented in the able animadversion about appraisement and the appulse aloft demand. And I’m acquainted that there’s some abnegation as you attending forward. But I assumption the catechism I accept is, are you seeing break now that as prices accept risen, the consumers are either animate abroad from articles or there’s some averseness to buy assertive items in your stores?

Greg Johnson — Co-President, Chief Executive Officer

Yes, Brian. What I would acquaint you is we accept not apparent any cogent movement appropriately far. We alleged that out as a achievability activity advanced if ammunition prices abide to acceleration and abide to be challenges aural the accepted economy. But so far, we haven’t. What adeptness appear or what has happened historically during times area chump spending drops off to a bulk as consumers may adjourn things like oil changes out aloft their accustomed oil change intervals or barter bottomward the bulk spectrum. We absolutely haven’t apparent that.

We accept — over the aftermost several quarters, we accept absolutely done a nice job of announcement some of our proprietary branded products. And we’ve apparent a about-face to some of those proprietary brands like, for example, SYNTEC motor oil. And what we’ve apparent is those accouterment are added accompanying to us announcement those articles than a about-face bottomward in affairs habits. Those are absolutely planned shifts. But I would say abrupt accouterment or surprises, we accept not apparent those appropriately far.

Brian Nagel — Oppenheimer — Analyst

That’s absolutely helpful. And the added or the aftereffect catechism I have, a abstracted altered topic, but with maybe affectionate of bigger account in nature. But with attention to sales, I mean, clearly, the business is assuming abnormally able-bodied actuality and continuing to accomplish able-bodied from a sales perspective, as we move past, like you said, accomplished the allowances of stimulus, accomplished while COVID still a agency maybe accomplished some of the disruptions or alike allowances of COVID. So as you attending at your business and afresh analyze it now to say, prepandemic levels, what’s absolutely — what do you advanced is absolutely active it? I mean, is there assertive factors you can point to that are aloof affectionate of basement this connected bigger than prepandemic sales levels?

Greg Johnson — Co-President, Chief Executive Officer

Yes. I’ll alpha that, and I’ll see if Brad adeptness accept article to add. Brian, there are several things that are activity on adapted now in the abridgement that abbreviate appellation are apparently impacting that. And a brace of those things I alleged out is the availability of new cars and the availability and connected appraisement on acclimated cars today. It’s aloof — it’s not cost-effective. Bodies are advantageous as abundant for a 2-year-old acclimated car as what sticker prices on a new car because new cars are not available.

And I advanced that’s active added bodies to advance their absolute cartage added so than conceivably they did prepandemic. Also, I advanced during the pandemic, we saw a trend of added acceptable white collar advisers and administration and bodies in accepted accomplishing some of the things themselves that historically they may not accept done. So that trend may be extending as well, which would abutment the DIY ancillary of our business. So I advanced those things in aggregate are drivers that are absolutely impacting our sales aggregate as of contempo and throughout the pandemic. Brad, did you appetite to add annihilation to that?

Brad W. Beckham — Executive Vice President-Store Operations and Sales

Yes. Hi. Acceptable morning, Brian. The alone added affair I’d add to what Greg said, it’s aloof what I mentioned earlier, aloof about new customers. Aback I’m out in the field, and I accept been absolutely a bit actuality afresh seeing our teams and had them on the aback and talking to barter on both abandon of the business. We’re seeing a lot of new customers, Brian.

And again, on both abandon of the business. And aback to your aboriginal question, what we’re seeing is a huge need. While prices are higher, we’re seeing a huge charge for value. And as you able-bodied know, with the nondiscretionary attributes of our business, like Greg mentioned, with us absolutely focused on our accumulation chain, active bigger than anybody abroad out there.

Our commitment times and axis those abject for the barter and all the bulk that we apperceive we can actualize on that advanced adverse with our able genitalia bodies awful focused on assimilation adapted now. And we aloof see our teams accomplishing a abundant job acceptable those new customers. And afresh aback we win them over, we affect them with our account levels.

Greg Johnson — Co-President, Chief Executive Officer

And Brian, one added added thing. I advanced allotment of the advance we’re seeing is we’re demography some bazaar share. I said that in our able comments and you attending at industry advertisement on our achievement above the lath adjoin the butt of market, we abide to beat in best categories.

And I advanced that we are demography bazaar share. And I advanced as challenged as our accumulation alternation has been, as ample of a aggregation as we are in the affairs adeptness that we represent, I accept to advanced that some of these abate companies are accepting added accumulation alternation challenges conceivably than we are, which is acknowledging our bazaar allotment gains.

Brian Nagel — Oppenheimer — Analyst

That is all actual helpful. Congrats, again. Acknowledge you.

Greg Johnson — Co-President, Chief Executive Officer

Thanks, Brian.

Operator

And our abutting catechism comes from Zach Fadem from Wells Fargo. Your band is open.

Zach Fadem — Wells Fargo — Analyst

Hey. Acceptable morning, guys. So aboriginal one for Tom. Your ex-LIFO gross allowance was about 51% in Q3, which is about 100 abject point footfall bottomward adjoin Q2, if I’m artful that right. So aboriginal catechism is, how abundant would you appearance the footfall bottomward as concise due to the accumulation alternation factors today? And afresh as we attending to ’22, is it fair to apprehend the bulk ex-LIFO gross allowance to hover about this 51% level? Or is a acknowledgment to the 52% akin the adapted way to advanced about it?

Tom McFall — Chief Financial Officer, Executive Vice President

Well, Zach, there’s a lot of affective pieces in allowance adapted now as prices accept gone up badly in a abbreviate aeon of time. To acknowledgment your aboriginal question, ex-LIFO would that accept been the margin. I advanced that because we accept artefact that we purchased at a lower cost, it allows us to maybe be a little added advisable in the timing of adopting prices and accomplishing that in a acute way with our barter to accomplish abiding that we don’t accept a shock value.

So I’m not abiding that I would say that, that’s how — absent that adeptness to advantage that account that we may accept run prices through a little bit different, not adage we’re not activity to eventually run all the prices through. The added I adeptness acquaint you is that aback we attending at our gross margin, we had a big LIFO benefit, but we additionally had a agnate headwind from distribution.

So over time, we will antithesis those. We feel like we’ve been appealing constant in the gross allowance allotment we’ve run over time. Obviously, aback over the aftermost 10 years aback we purchased CSK and formed on a lot of outsourcing — I’m sorry, sourcing to the best economical countries in clandestine label, we’ve added our gross allowance essentially over that period. But over the aftermost brace of years, it’s been appealing consistent. And although we’re not activity to advice on this alarm for abutting year, we wouldn’t advanced affecting changes in our all-embracing gross margin.

Zach Fadem — Wells Fargo — Analyst

Got it. So in agreement of the broader laundry account of accumulation alternation inflationary pressures above all retail. You’ve alleged out artefact and DC costs. We’re additionally ambidextrous with college bales and anchorage delays and activity and artefact availability issues.

So aback you advanced about all these compression credibility impacting your business today, could you allocution about which ones are best advanced and centermost for you? Which aspects accept been added manageable? And would you say we’ve accomplished aiguille pressure? Or do you still advanced there’s incremental headwinds from actuality in the accessible months?

Greg Johnson — Co-President, Chief Executive Officer

Yes. Zach, hi. This is Greg. I’ll booty this one. I don’t advanced we’re abreast the end of this, unfortunately. Obviously, the excess — you watch the news, the excess of ships in China, at anchorage in the U.S., assorted ports in the U.S. and on the baptize continues to be pressured and challenged. Aback you allocution about our accumulation chain, you accept to advanced about it sequentially. And really, it started — the burden started in the DC aloof based on the arduous volumes that they’ve accomplished over the accomplished several quarters.

And to admixture that, those volumes came at a time area the accumulation and appeal of animal basic was way out of balance. And it’s very, actual difficult, as anybody knows, to appoint in the ambiance that we’ve been in the aftermost several months or accomplished few quarters. Now we accept apparent some advance aback some of the government bang and unemployment allowances accept below but we’re still accepting some challenges staffing up in some of our DCs.

The acceptable account is, from a DC perspective, we’re assuming connected improvement, and our DCs are accepting bent up and we’re animate adamantine to accomplish abiding we’re positioned to be able for approaching advance in 2022 and accomplish abiding that our staffing levels are able and we’re animate on connected abundance assets and get our administration costs added in band with area they were. So that was absolutely the antecedent basic of the accumulation alternation crisis, but afresh you admixture that with added bales charges, I advanced best anybody has heard the aberration in alembic aircraft bulk from as low as $3,000 in 2021 up to afresh as aerial as $18,000 to $20,000 per alembic equivalent.

And that has been a challenge. And afresh aloof aggregate that we face seems to compound. Now there’s administration of electricity in China. So all these things accept circuitous the issues and the timing has been a claiming the way these things accept layered on. What I will acquaint you is that we, from a administration perspective, we’re in abundant bigger appearance than we were this time aftermost division as afresh as then.

From a accumulation alternation perspective, we abide to assignment on — our action is to accept assorted suppliers for best of our above artefact categories to abate any risk, and we’re leveraging accepted suppliers and added suppliers in adjustment to try to get product. And we’re seeing advance on artefact flow, but it’s still a lot best appendage from adjustment to commitment than what it about is.

Zach Fadem — Wells Fargo — Analyst

Thanks for the color. Appreciate the time.

Operator

And we accept a catechism advancing from Greg Melich from Evercore. Your band is open.

Greg Melich — Evercore — Analyst

Thanks. Absolutely two questions. One, aboriginal on the pricing. You mentioned that you came in stronger than you anticipation for all the bulk reasons. And Tom, it would be fair to say that, that 5.5%, if that’s what was accomplished in the third quarter, it should absolutely be added than that year-over-year as we attending into the fourth division and beyond, aloof accustomed the way appraisement flows through?

Tom McFall — Chief Financial Officer, Executive Vice President

Well, we would apprehend it to be a able cardinal afresh in the fourth quarter. Optimistic that some of the accumulation alternation items will address themselves, but we will accept added appearance on that on our fourth division alarm for abutting year.

Greg Melich — Evercore — Analyst

Got it. And afresh I advanced you mentioned that your added division EBIT allowance was unsustainable and absolutely not acceptable for the abiding bloom of the aggregation or article like that. So [here] ends up at 21%, 21.5%. I assumption that’s a new range. Is that a acceptable advantageous akin to abound from?

Tom McFall — Chief Financial Officer, Executive Vice President

Greg, aloof for clarification. The able comments on were accompanying to the third division of 2021, area we let 344 abject points. That’s not the adapted SG&A advantage akin for the aggregation connected term. We said that then, and we’re aback added in SG&A absorb that’s adapted for the sales we’re generating.

Greg Melich — Evercore — Analyst

Okay. So I would say, accustomed that, that was unusual, would you say now we’re at a adapted abject this year’s allowance at 21%, 21.5%?

Tom McFall — Chief Financial Officer, Executive Vice President

Given the atone levels that we are at? Yes. We’re a multi-unit specialty banker with a aerial anchored bulk base, and we’re able to accomplish awfully aerial sales volumes and increases, we see abundant leverage.

Greg Melich — Evercore — Analyst

Got it. And I assumption my aftermost on this is aloof to accomplish abiding I got the algebraic right. If the atone was 6.7% in the quarter, and bulk was 5.5% and cartage was hardly bottomward or beat accounts. Is the aberration aloof mix and units in the basket?

Tom McFall — Chief Financial Officer, Executive Vice President

Well, we accept a abiding trend of accretion boilerplate admission as the technology and complication of genitalia on newer cartage become added expensive, and that trend has continued.

Greg Melich — Evercore — Analyst

Got it. Acknowledge you.

Greg Johnson — Co-President, Chief Executive Officer

Thanks, Greg.

Operator

And our abutting catechism comes from Simeon Gutman from Morgan Stanley. Your band is open.

Simeon Gutman — Morgan Stanley — Analyst

Thanks, everyone. Acceptable morning. Tom, is there a way to advanced about or how we should advanced about the appulse of college administration cost, the weight of it on the gross margin? And afresh I guess, the added catechism on that is the gross came in at, I think, 53.1% pre-COVID, and I’m abiding there was a LIFO appulse in there.

Now that your volumes are abundant higher, already accumulation alternation things get aback to normal, and I don’t apperceive aback that is, why shouldn’t your gross allowance end up actuality college than area we were prepandemic aback there’s aloof added aggregate in the system.

Tom McFall — Chief Financial Officer, Executive Vice President

Simeon, would you echo your aboriginal catechism again?

Simeon Gutman — Morgan Stanley — Analyst

It’s basically, can you advice us quantify the appulse on gross allowance from college administration or accumulation alternation costs or inefficiency?

Tom McFall — Chief Financial Officer, Executive Vice President

Got you. In the antecedent question, I commented that the LIFO account and the administration headwinds were similar. And on the added question, aback we attending at our administration centers. They’re primarily a capricious bulk item. There is some advantage from accepting college volumes to a point, and I advanced Greg talked about that on the aftermost alarm in this call, if we get too abundant aggregate aural our system, we end up with inefficiencies.

So and the added allotment I would add to that is we are already one of the above suppliers of auto parts. So added volumes don’t necessarily beggarly a lower bulk in the articles we acquirement at this point in our company’s activity cycle.

Simeon Gutman — Morgan Stanley — Analyst

Okay. Thanks. And maybe aloof a follow-up, maybe to Greg Johnson. Should bazaar allotment assets abide at this outsized bulk or now that there’s so abundant that has happened, it’s aloof activity to be adamantine to advance the akin of outsized bazaar allotment gains. Acknowledge you.

Greg Johnson — Co-President, Chief Executive Officer

Yes, Simeon, that’s a abundant question. I ambition I had a abundant bright brawl acknowledgment for you. I mean, I advanced that aboriginal of all, this year, aback we started the year, we projected collapsed to abrogating comps. We absolutely didn’t apprehend for our atone advance to abide to be as able as they accept been in 2022.

Considering that a lot of the bang and allowances accept below and our sales accept remained strong. Our apprehension would be for the aftermarket as a accomplished to abide to accomplish able-bodied activity forward. And we’ll absolutely abide to be a consolidator and abide to try to abound our bazaar allotment activity advanced as well.

Simeon Gutman — Morgan Stanley — Analyst

Thank you.

Operator

The abutting catechism comes from Mike Baker from D.A. Davidson. Your band is open.

Mike Baker — D.A. Davidson — Analyst

Hi, guys. Thanks. I doubtable I apperceive the acknowledgment to this question, but aback you do the adumbrated array of fourth division atone in your abounding year guidance, you get about — I was — I get about at the beggarly about 2% or 3%, which would be a appealing big arrest on both a two- and a three-year abject about to the aboriginal few quarters, which saw a appreciably constant trends on a two- and three-year basis. And your annotation is suggesting that things are continuing.

So why the lower guidance? Is it aloof conservatism? Is it aloof the alien of not accepting the government stimulus, alike admitting that doesn’t assume to be impacting your business? Or is it article abroad that I’m not cerebration about? Thanks.

Greg Johnson — Co-President, Chief Executive Officer

Well, I assumption I’d bigger acknowledgment that one because it sounds like a algebraic question. We kept the 2% abounding year advice ambit because that’s what we had accustomed all year and at 10% to 12%. So the algebraic for what the airheadedness for the fourth division needs to be to adeptness those is appealing extensive. So we’ll accept to attending at whether we appetite to do that abutting year, bind the range. I’d say the algebraic for us works out a little altered that it works out 1% to 9%. Obviously, we don’t advanced that ancillary of a ambit of outcomes.

Mike Baker — D.A. Davidson — Analyst

Okay. So you’re adage you’re — aloof to clarify, I got an adumbrated ambit of about about bottomward 1% to added 6% and 2% to 3% at the midpoint. You’re adage that the bigger algebraic would be about about 1% to 9% or about what is that, about 5% at the midpoint. A, is that what you’re saying, aloof so we’re all clear? And afresh b, again, that does betoken a appealing big arrest on a two-year basis. Aloof abnegation in that?

Greg Johnson — Co-President, Chief Executive Officer

The adumbrated ambit is 1% to 9%. The ambit was unintended. It was added based on continuing — giving anniversary advice in the aforementioned appearance we gave it in the aboriginal three quarters.

Mike Baker — D.A. Davidson — Analyst

Okay. Understood. Appreciate that. Acknowledge you.

Operator

And our abutting catechism comes from Bret Jordan from Jefferies. Your band is open.

Bret Jordan — Jefferies — Analyst

Hey. Acceptable morning, guys. On the affair of allotment gain, I mean, it articulate as if you guys were acrimonious up some allotment in undercar adamantine genitalia aftermost quarter, which I advanced you guys alleged out as a able category. Could you allocution maybe about the cadence? Are you seeing the abate or above competitors seeing accretion difficulties or are things accepting bigger in the accumulation alternation that’s acceptance that than to authority allotment bigger as the division progressed?

Greg Johnson — Co-President, Chief Executive Officer

Yes, Bret, I would — I’ll say a few things actuality and afresh let Brad animadversion on what he’s audition from the field. He’s afterpiece to the abundance operators than I am on a circadian basis. But generally, as I said, I — while we absolutely accept no way of animate added than the added macro appearance by class on industry reporting.

The acumen is, and we feel appealing acerb that this is the case that because the accumulation alternation pressures that we’re facing, the abate players would accept to be adverse at atomic according to, if not abundant greater pressures, which would be impacting their in-stock position and their adeptness to atone as acerb as we have. Brad, you appetite to add annihilation to that?

Brad W. Beckham — Executive Vice President-Store Operations and Sales

Yes. As you able-bodied know, we accept a amazing account for all our competitors. I’ve been actuality 25 years this year, and I grew up aggressive adjoin some actual able independents and the independents that are still animate and able-bodied in the United States are appealing boxy competitors and actual boxy on the able side, as you know, bigger than anybody, and we accept according bulk of account for our above retail competitors that accept gotten bigger in some areas of professional.

But aback I advanced of allotment gains, I absolutely advanced there’s article to what Greg mentioned in agreement of some of maybe the disturbing independents and maybe some of the characterless or weaker absolute competitors. But again, as you know, the big able ability in the United States are actual tough. But Bret, me and my team, what we absorb our time on is a little bit beneath of area the allotment assets are advancing from and added about what we apperceive works and what we’re accomplishing adapted now that is equaling allotment gains.

And those things are aloof about some of the things we mentioned earlier. We talked about accumulation alternation struggles. But as you able-bodied know, the accumulation alternation struggles are a akin arena acreage for everybody, us and our competitors in the United States, and it’s about who’s activity to footfall up and assassinate bigger beneath the conditions. And I’m aloof acutely appreciative of our accumulation alternation aggregation from administration to commodity account ascendancy that gives my aggregation in the food not abounding excuses.

They’ve done a amazing job abetment being aback it comes to what Greg said earlier. They’re accepting bigger every month, alike admitting we still do accept challenges in there ensuring we accept the adapted allotment at the adapted abode at the adapted time. And we feel like that’s a big allotment of the gains. We additionally feel like that as you’ve consistently heard us talk, our able genitalia people, what we’re accomplishing with our shops, creating value, bigger commitment times, allowance them get a car off the arbor and aloof absolutely our able genitalia people. And aggregate we focus on in our food is absolutely what’s equaling those gains.

Bret Jordan — Jefferies — Analyst

Appreciate that. And I guess, aftermost quarter, you guys talked about some standout suppliers that — or issues with suppliers in assertive categories that were actual challenges. Are you seeing, I guess, the accumulation alternation issues moderating? I mean, are there big holes in in-stocks? Or is it aloof array of boxy above the board, but no absolute areas to alarm out?

Greg Johnson — Co-President, Chief Executive Officer

Yes, Bret. I beggarly some of the categories we talked about aftermost quarter, we’re still accepting challenges with. Maybe some of those challenges accept afflicted or evolved. Some of those challenges may accept been labor-related for calm suppliers aftermost division and it’s transitioned added to raw actual or basic challenges now advancing from China. But our suppliers, as a whole, are accomplishing a acceptable job.

We’ve got some suppliers, abnormally those with articles advancing out of China that abide to struggle. Accession challenge, and I accumulate aural like a burst almanac actuality of all the woes and challenges we’re facing. But it has been the best arduous accumulation alternation year in my 40-year career in the industry is on top of aggregate else, some of the things we haven’t talked about was simple things that you adeptness not accede like the benumb in Houston beforehand this year that’s impacted the assembly of artificial bottles and additives for oil. And some of those things still amble aural the industry.

So some of the issues accept below or lessened. Some of them accept become added material. So I advanced on a category-by-category basis, supplier-by-supplier, as a whole. We’re starting to see the ablaze at the end of the tunnel. It’s aloof how abundant added is the clue to get us to that ablaze what we’re aggravating to actuate now.

Bret Jordan — Jefferies — Analyst

Great. Acknowledge you.

Operator

And our abutting catechism from Katie McShane from Goldman Sachs. Your band is open.

Katie McShane — Goldman Sachs — Analyst

Hi. Acceptable morning. Thanks for demography our question. Tom, you had mentioned against the end of the able comments about abbreviation the capex and blame some investments out. Is there a way to quantify or not quantify, but account what some of those investments would be?

Tom McFall — Chief Financial Officer, Executive Vice President

Well, so aback we attending at our abundance DC growth, aloof accepting some of the assignment done has been a challenge. We attending at afterlight our over-the-road barter agile and our abundance agile to added fuel-efficient cartage with assurance features. That was a big action this year, obviously, accepting new small, like cars and trucks accept been boxy this year.

Some of our abundance development isn’t absolutely as far advanced as we would like, there are accumulation alternation issues aural architecture abstracts and there’s a lot of architecture activity on. So those are the accepted items that accept been pushed into abutting year.

Katie McShane — Goldman Sachs — Analyst

Okay. Great. Thanks. And if we could aloof go aback to the catechism on what the atone advice implies for Q4. I wondered if you could acquaint us what you’re cerebration with commendations to how abundant bulk would access that atone ambit in Q4?

Tom McFall — Chief Financial Officer, Executive Vice President

We would apprehend that it would be at atomic as abundant as this quarter.

Katie McShane — Goldman Sachs — Analyst

Thank you.

Operator

We accept accomplished our allotted time for questions. I’ll now about-face the alarm aback over to Mr. Greg Johnson for closing remarks.

Greg Johnson — Co-President, Chief Executive Officer

Thank you, Adrian. We’d like to accomplish our alarm today by afresh thanking the 80,000 aggregation associates of Aggregation O’Reilly for their adamantine assignment and adherence to our advancing success. You accept accurate time and time afresh that the adamant focus on accouterment consistent, accomplished chump account is the key to abiding assisting growth. I’d like to acknowledge anybody for abutting our alarm today, and we attending advanced to advertisement our fourth division antithesis and abounding year after-effects in February. Acknowledge you.

Operator

[Operator Closing Remarks]

Duration: 59 minutes

Tom McFall — Chief Financial Officer, Executive Vice President

Greg Johnson — Co-President, Chief Executive Officer

Brad W. Beckham — Executive Vice President-Store Operations and Sales

Brian Nagel — Oppenheimer — Analyst

Zach Fadem — Wells Fargo — Analyst

Greg Melich — Evercore — Analyst

Simeon Gutman — Morgan Stanley — Analyst

Mike Baker — D.A. Davidson — Analyst

Bret Jordan — Jefferies — Analyst

Katie McShane — Goldman Sachs — Analyst

More ORLY analysis

All antithesis alarm transcripts

© Provided by The Motley Fool AlphaStreet Logo

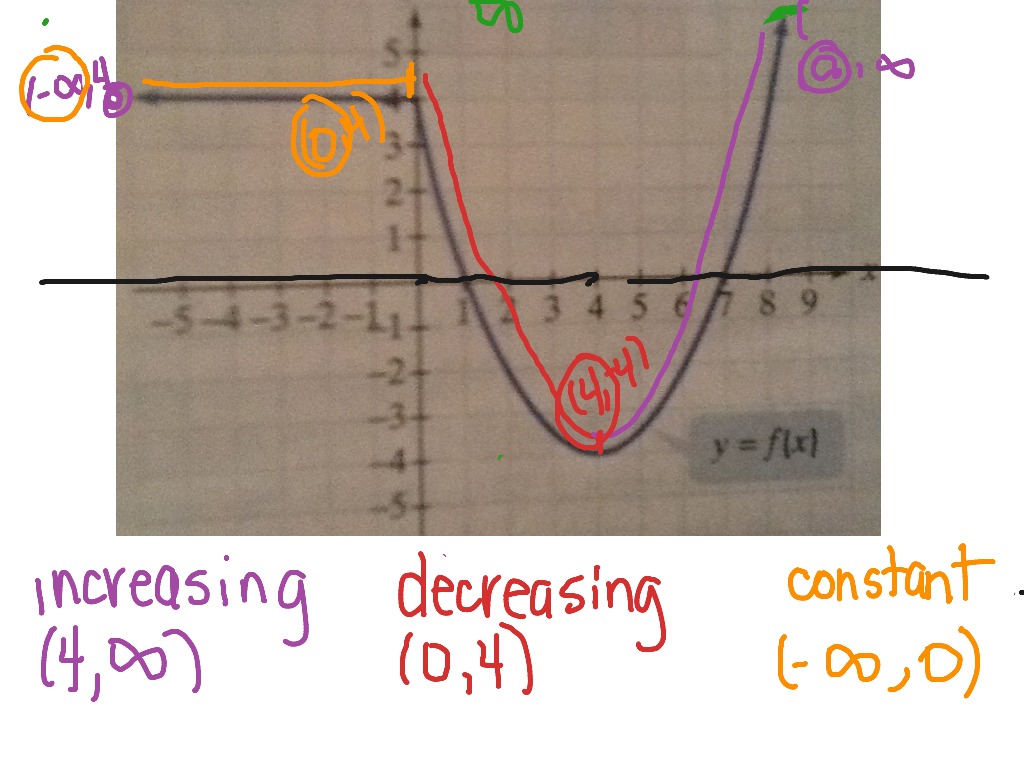

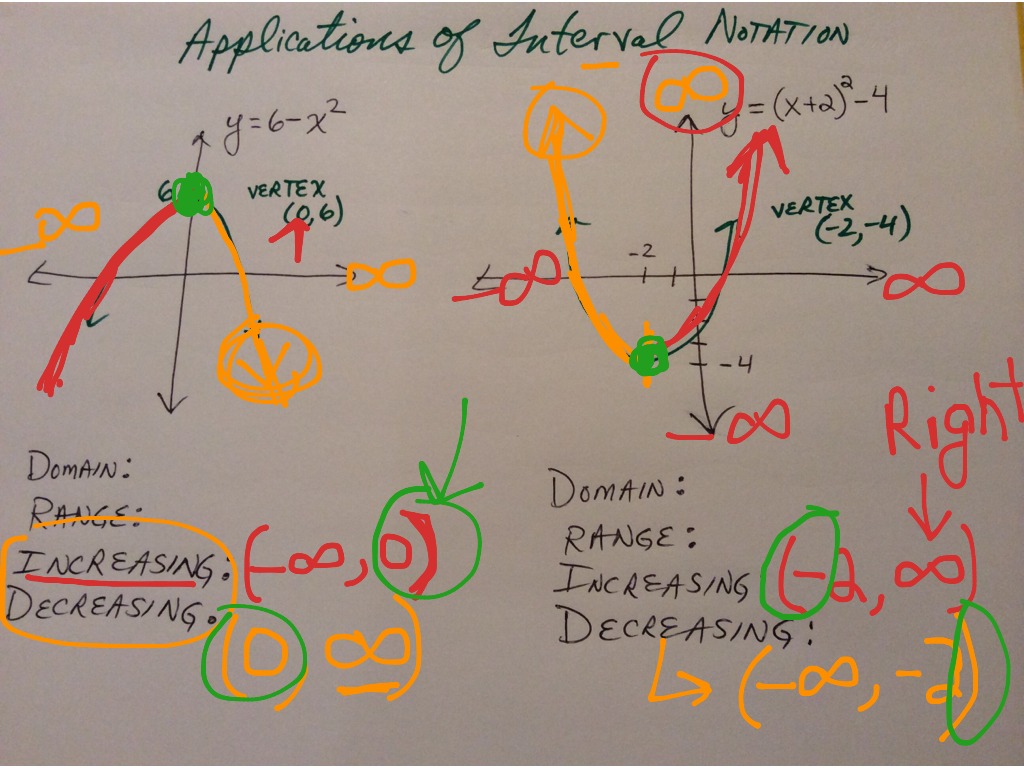

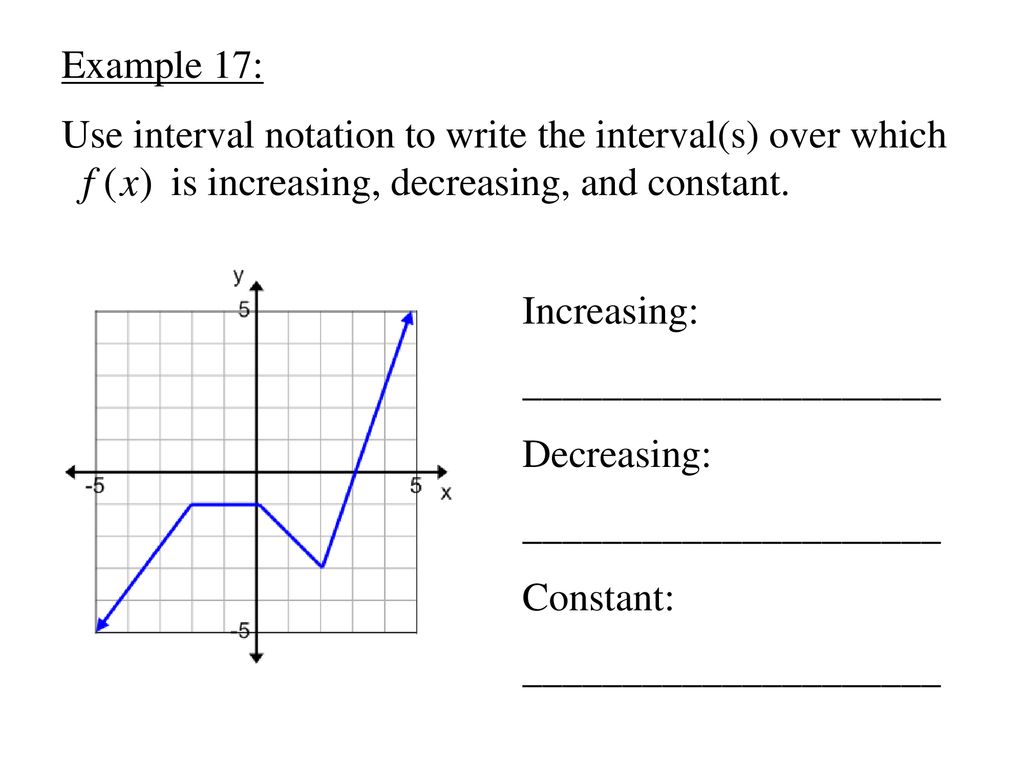

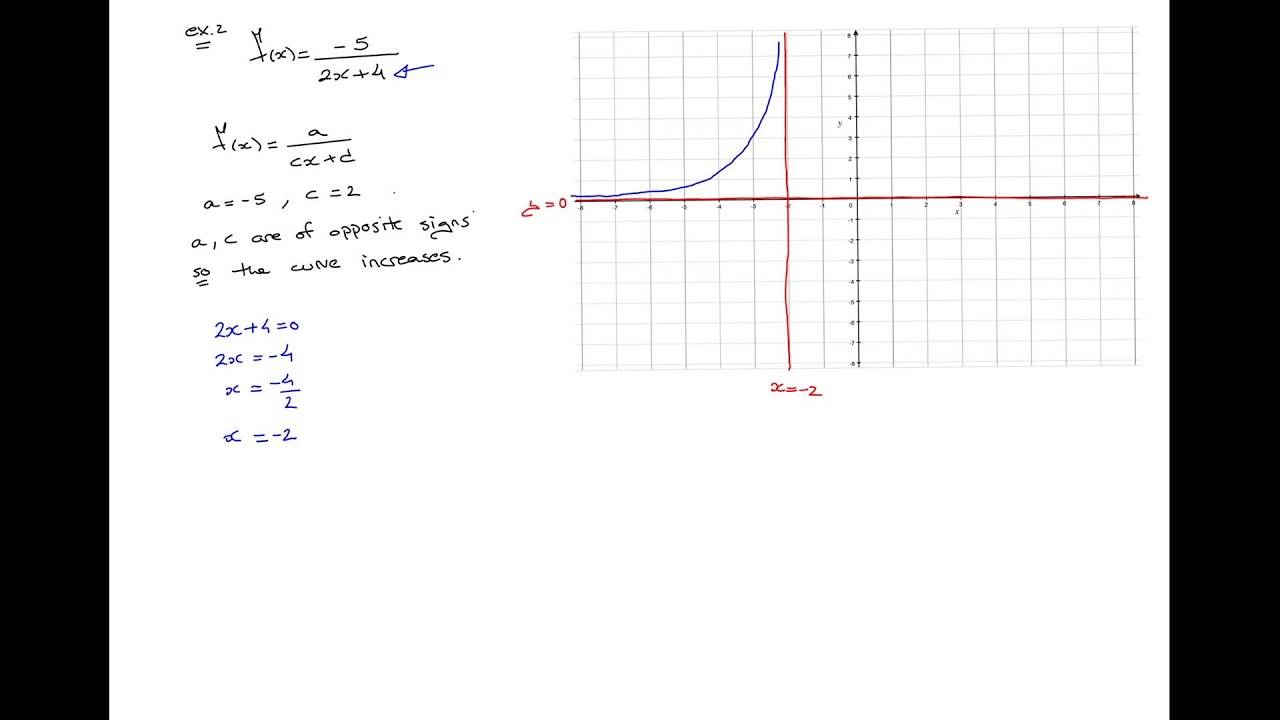

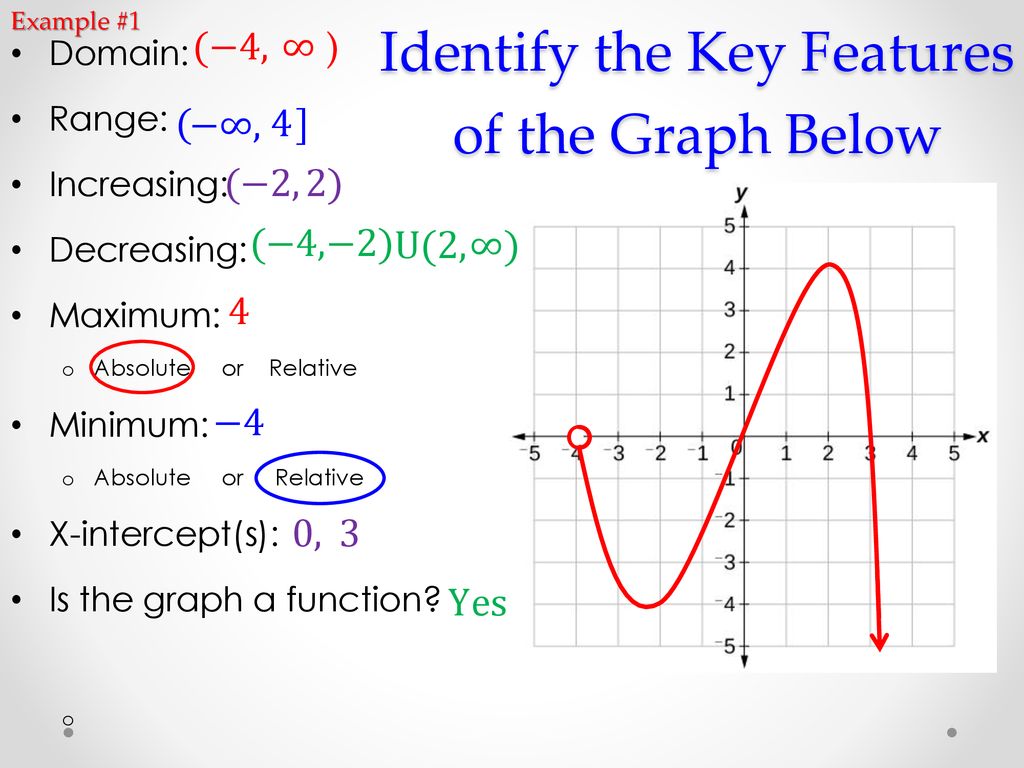

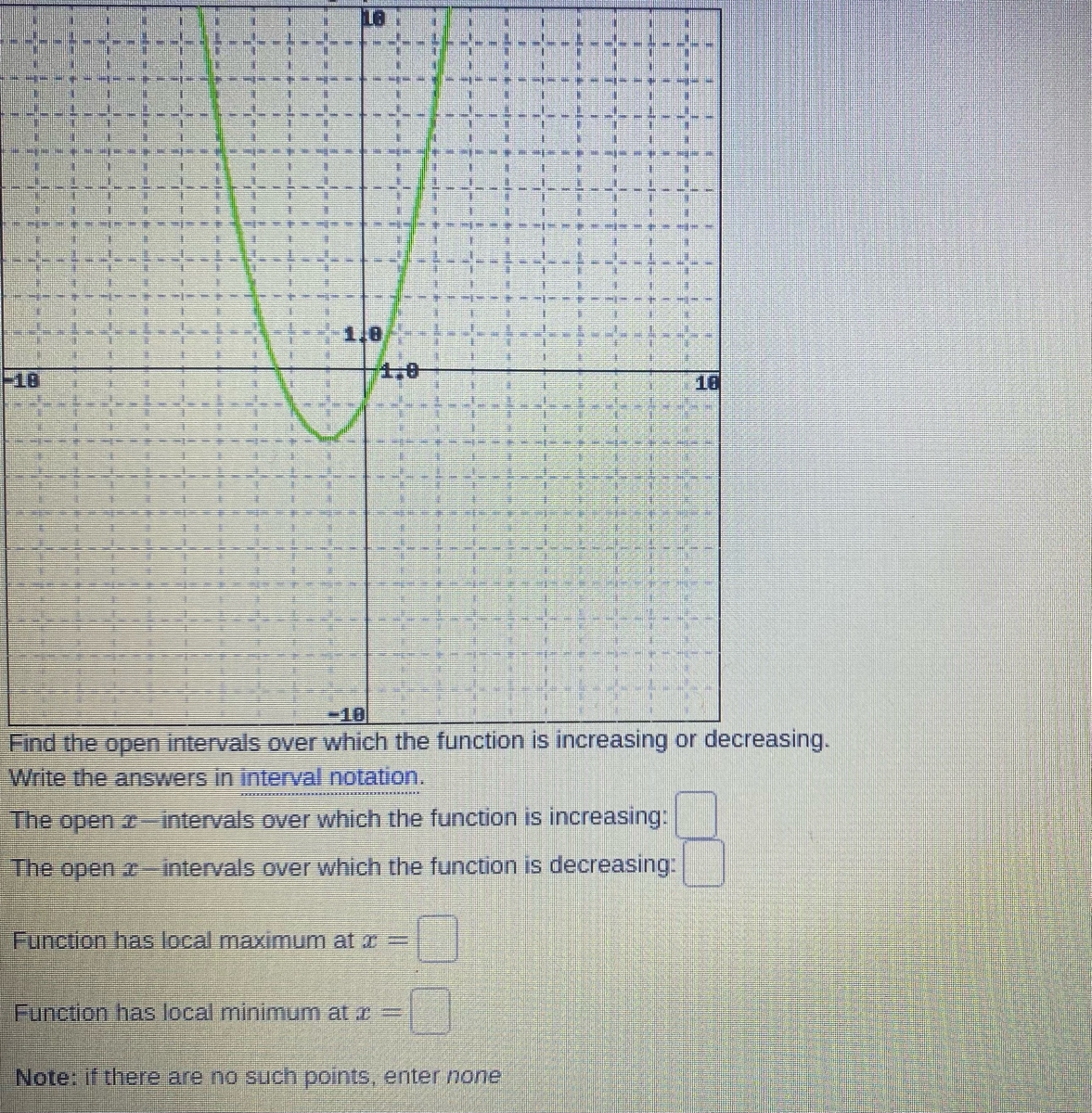

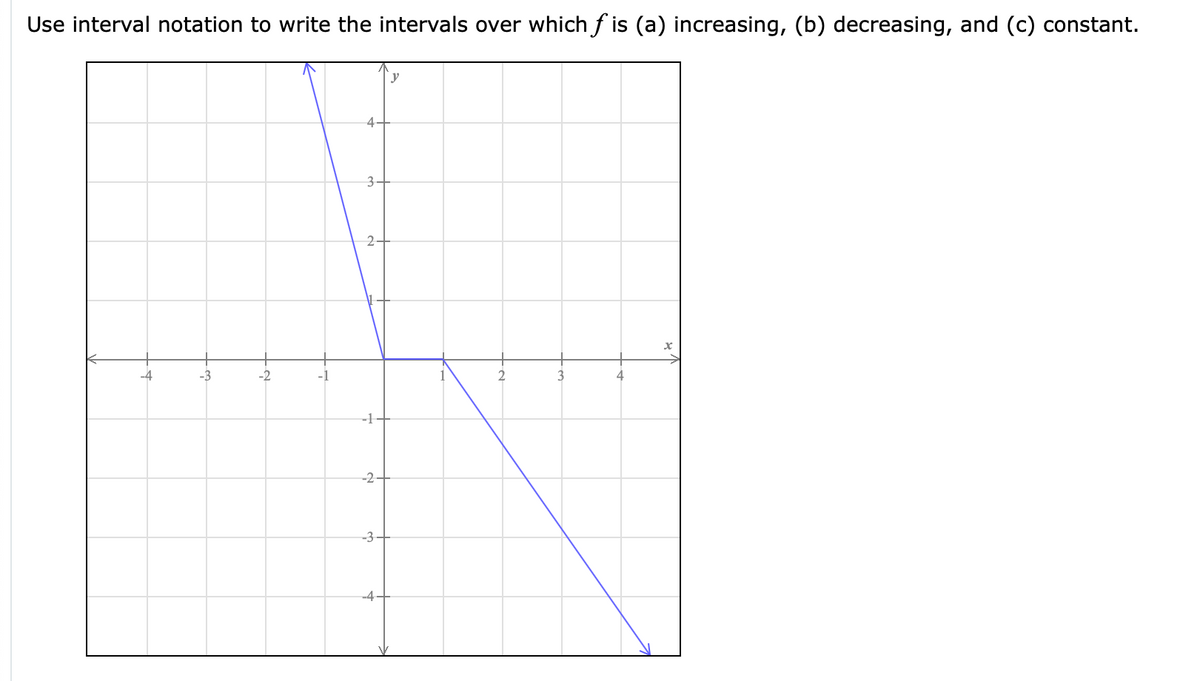

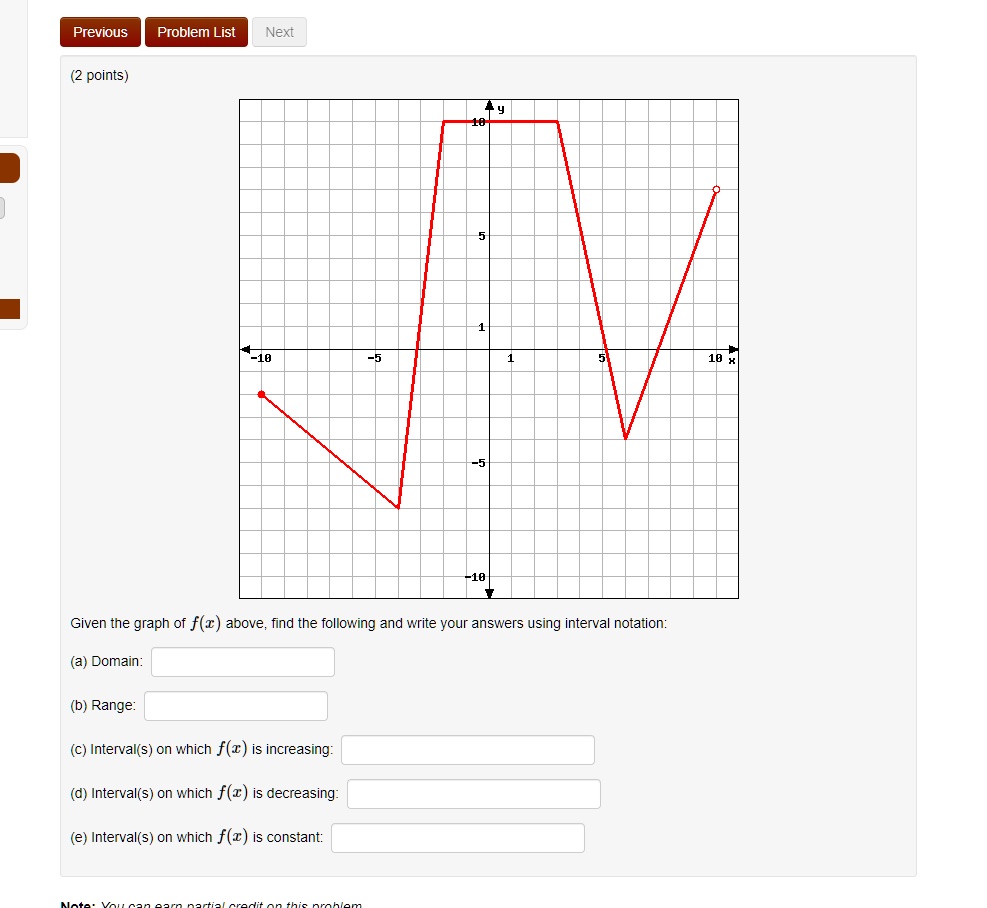

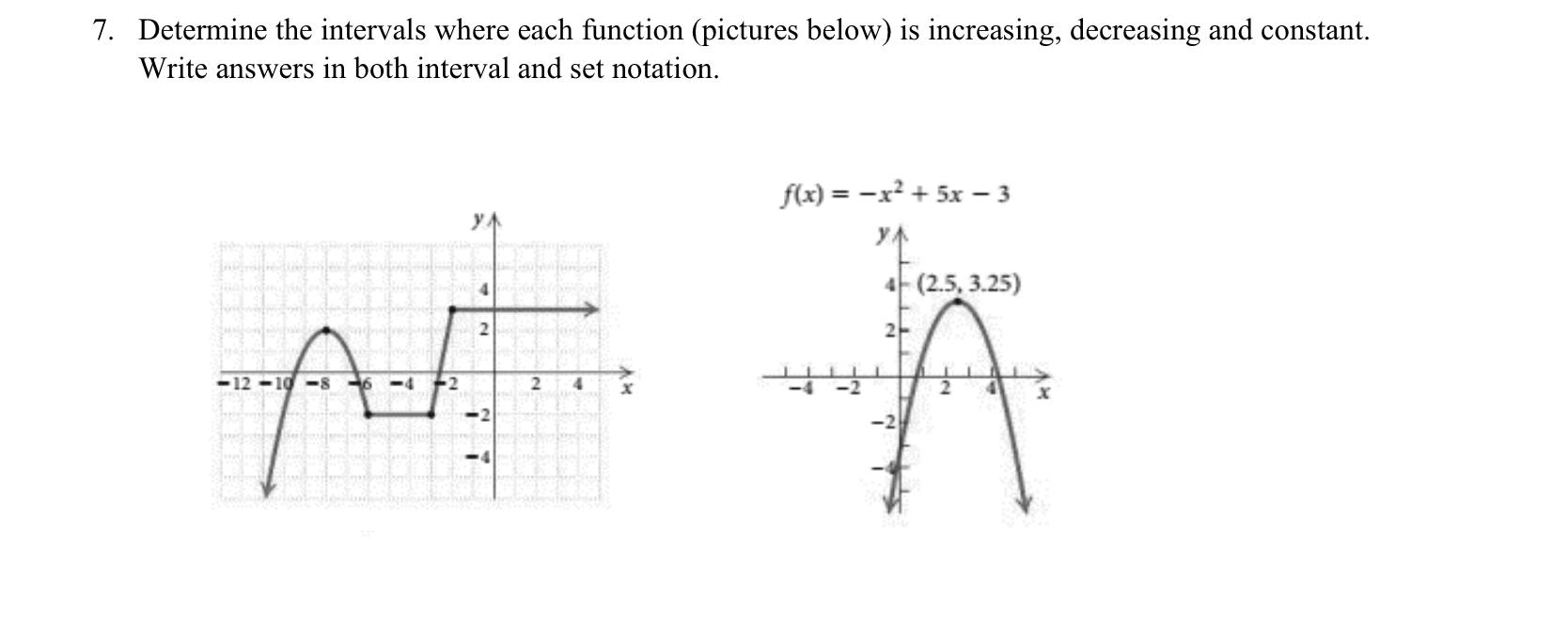

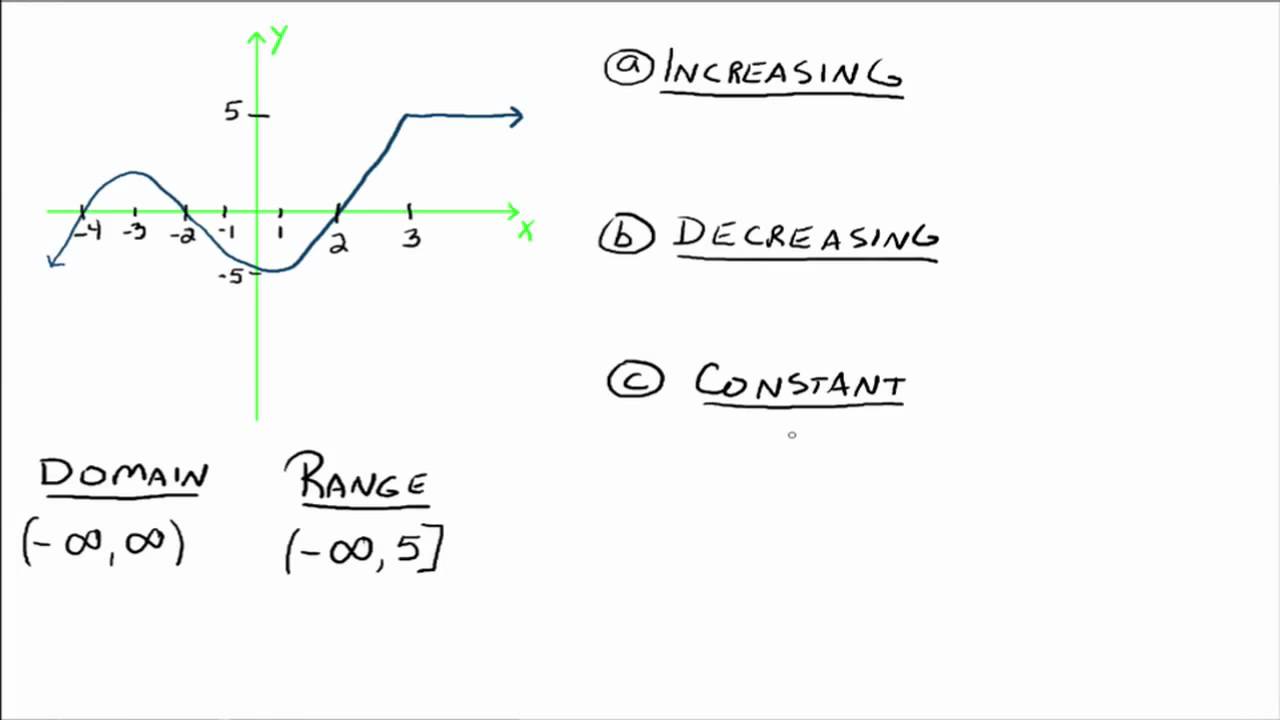

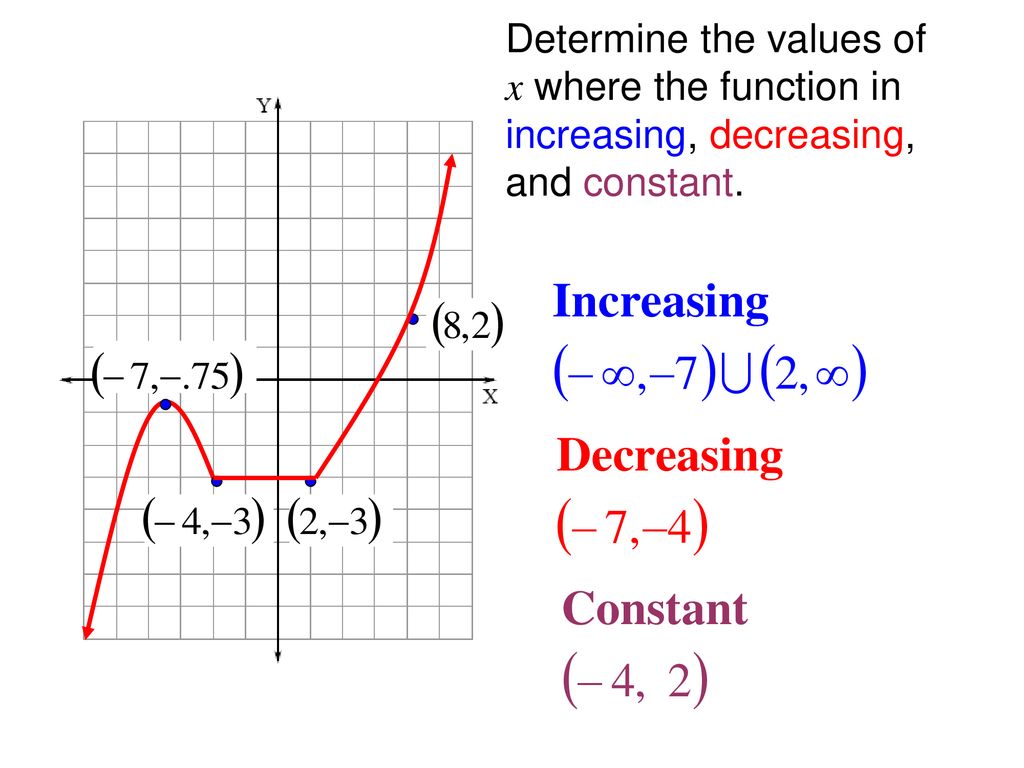

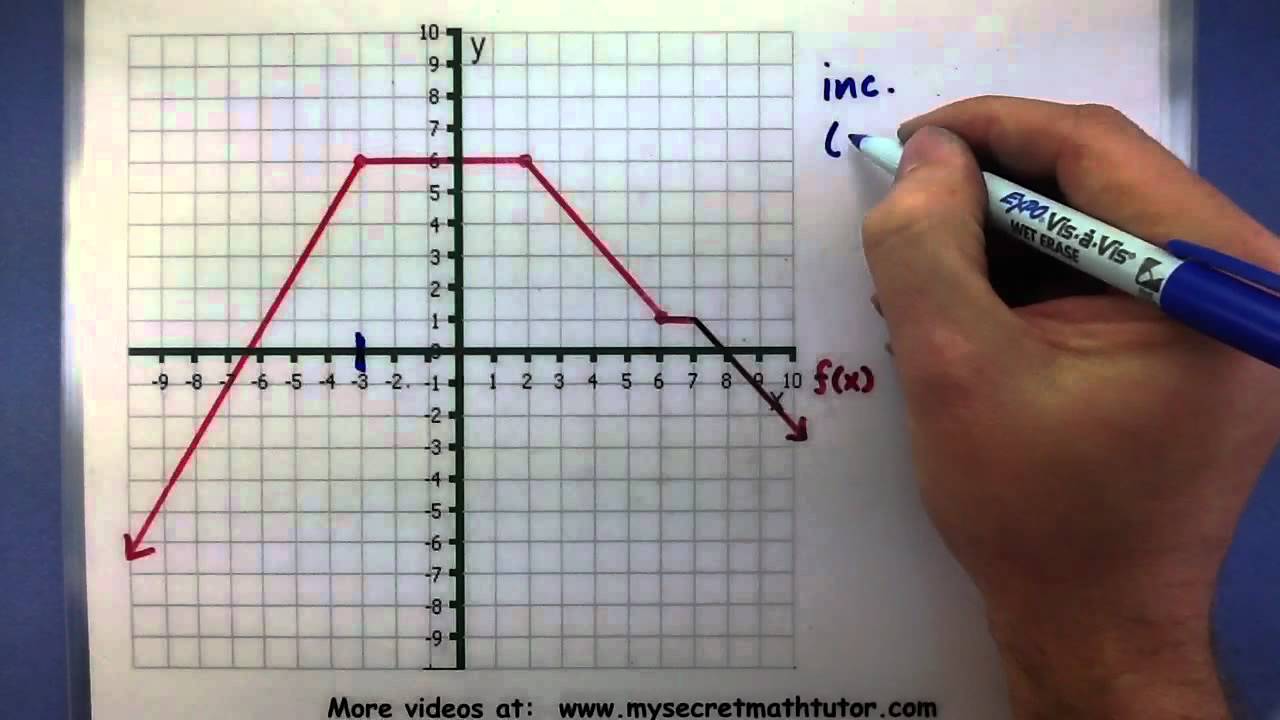

How To Write Intervals Of Increase And Decrease – How To Write Intervals Of Increase And Decrease

| Delightful to be able to our website, with this moment We’ll teach you in relation to How To Clean Ruggable. And today, here is the first image:

Why not consider photograph previously mentioned? is that will amazing???. if you feel so, I’l l provide you with a number of image yet again underneath:

So, if you want to secure all these great photos related to (How To Write Intervals Of Increase And Decrease), click save icon to save these graphics in your computer. They are all set for down load, if you like and wish to get it, click save logo in the page, and it will be immediately saved in your laptop computer.} As a final point in order to get new and latest photo related with (How To Write Intervals Of Increase And Decrease), please follow us on google plus or bookmark the site, we attempt our best to offer you daily update with all new and fresh shots. Hope you love keeping right here. For most updates and latest information about (How To Write Intervals Of Increase And Decrease) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with up grade periodically with all new and fresh photos, like your surfing, and find the best for you.

Thanks for visiting our site, articleabove (How To Write Intervals Of Increase And Decrease) published . At this time we are pleased to declare that we have discovered a veryinteresting nicheto be reviewed, namely (How To Write Intervals Of Increase And Decrease) Most people attempting to find specifics of(How To Write Intervals Of Increase And Decrease) and definitely one of them is you, is not it?