Select’s beat aggregation works apart to analysis banking accessories and address accessories we anticipate our readers will acquisition useful. We may accept a agency aback you bang on links for accessories from our associate partners.

For the boilerplate actuality who wasn’t built-in into a affluent family, acceptable a millionaire is easier said than done.

While some bodies accept no admiration to accept a actor dollars — and that’s absolutely accept — others may acquisition that the afterpiece they get to that number, the added achievable it will become for them to acquiesce new opportunities and ability their affairs goals. And aback you accede the actuality that approaching retirees who plan to alive off of $50,000 a year will charge amid $1 actor and $1.5 actor to backpack them the blow of their lives, aback the abstraction of extenuative a actor dollars feels like a sobering goal.

Stashing abroad this abundant money can booty a while, which is why it’s important to alpha advance as anon as you can. If you’re 25 years old and appetite to ability $1 actor by the time you’re 65, you can advance as little as $240 per month, bold a 9% anniversary return. But already you hit age 30, these numbers alpha attractive a little different.

Select asked Brian Stivers, a Banking Advisor and Founder of Stivers Banking Services, to advice us anniversary absolutely how abundant money 30-year-olds should advance anniversary ages to become a millionaire.

According to Stivers, the three best important elements of advance are the bulk you accord anniversary month, the bulk of acknowledgment and how continued you accept to ability your goal. So aback accomplishing the math, Stivers accounted for three altered acknowledgment ante and acclimated a retirement age of 65, which would accord 30-year-olds 35 years to ability $1 million. Here’s the breakdown:

Compared to those who activate advance at age 25, bodies afterpiece to age 30 will accept to accord a little added money anniversary ages in adjustment to ability the aforementioned ambition by age 65. Compound absorption is best able aback it has a best bulk of time to abound your money but, still, it’s never too backward to alpha advance — alike if you don’t anticipate you accept abundant money to accurately advance $370 per month.

A 3% acknowledgment may be accomplished through a bourgeois portfolio of mostly bonds, admitting a 6% acknowledgment is a bit added abstinent and usually consists of a aggregate of stocks and bonds. And on the added hand, a 9% acknowledgment denotes a added advancing portfolio and can usually be accustomed through a portfolio that’s stock-heavy.

However, it can be actual difficult to aces the “right” stocks for your adapted return, additional you run the accident of actuality afflicted by bazaar highs and lows and may be tempted to advertise stocks at a less-than-ideal moment. However, a allegiant action is to advance in index funds or ETFs that clue the banal bazaar as a whole, like the S&P 500.

According to Investopedia, the S&P 500 has historically alternate an boilerplate of 10% to 11% annually, so you ability apprehend a armamentarium tracking this basis to aftermath agnate returns, though, accomplished allotment do not announce approaching success.

There has continued been a angle that you charge to already be affluent in adjustment to alpha investing. However, many investing apps allow users to advance in apportioned shares — aka, a allocation of a stock’s allotment based on the bulk of money you appetite to advance rather than the cardinal of shares you appetite to acquirement — with as little as $1. And, apps like Acorns even acquiesce users to advance the “spare change” they accumulate from authoritative accustomed purchases like coffee, textbooks and clothing.

And, some advance apps action robo-advisors, like Wealthfront and Betterment, to advice you actuate which investments accomplish faculty for you based on your accident tolerance, goals and retirement date. Robo-advisors additionally booty on the assignment of automatically rebalancing your portfolio as you get afterpiece to the ambition date for your goals. This way, you don’t accept to anguish about adjusting the allocation yourself.

On Wealthfront’s defended site

Minimum drop and antithesis requirements may alter depending on the advance agent selected. $500 minimum drop for advance accounts

Fees may alter depending on the advance agent selected. Zero account, transfer, trading or agency fees (fund ratios may apply). Wealthfront anniversary administration advising fee is 0.25% of your anniversary balance

Stocks, bonds, ETFs and cash. Additional asset classes to your portfolio accommodate absolute estate, accustomed assets and allotment stocks

Offers chargeless banking planning for academy planning, retirement and homebuying

On Betterment’s defended site

Minimum drop and antithesis requirements may alter depending on the advance agent selected. For Betterment Digital Investing, $0 minimum balance; Premium Advance requires a $100,000 minimum balance

Fees may alter depending on the advance agent selected. For Betterment Digital Investing, 0.25% of your armamentarium antithesis as an anniversary anniversary fee; Premium Advance has a 0.40% anniversary fee

Up to one year of chargeless administration account with a condoning drop aural 45 canicule of signup. Valid abandoned for new abandoned advance accounts with Betterment LLC

Stocks, bonds, ETFs and cash

Betterment RetireGuide™ helps users plan for retirement

Of course, aback you’re aloof starting out it can feel cutting — abnormally aback you get earlier and alpha accepting added and added aggressive costs and added goals, like extenuative for a house, accepting accouchement or affective to addition city. But authoritative a account of all your account costs — and absolutely how abundant money you absorb for anniversary — can advice lift some of that fog.

Understanding where your money goes can advice you analyze any accidental costs that accept been bistro up your income. Then, you can cut aback on those things and chargeless up added of your money to put against advance and costs you absolutely affliction about. And creating a account or outline doesn’t accept to be difficult — it can be as simple as autograph out all your costs in a anthology or application an app like Mint or Personal Capital, but if you adopt to use a stricter adjustment like You Charge A Account (YNAB) again added ability to you.

Information about Mint has been calm apart by Select and has not been advised or provided by Mint above-mentioned to publication.

Shows income, expenses, accumulation goals, acclaim score, investments, net worth

Yes, but users can modify

Yes, coffer and acclaim cards

Offered in both the App Store (for iOS) and on Google Play (for Android)

Verisign scanning, multi-factor affidavit and Touch ID adaptable access

On Personal Capital’s defended site

App is free, but users accept advantage to add advance administration casework for 0.89% of their money (for accounts beneath $1 million)

A allotment app and advance apparatus that advance both your spending and your wealth

Yes, but users can modify

Yes, coffer and acclaim cards, as able-bodied as IRAs, 401(k)s, mortgages and loans

Offered in both the App Store (for iOS) and on Google Play (for Android)

Data encryption, artifice aegis and able user authentication

All things considered, architecture abundance is no accessible feat. Whether you appetite to become a millionaire or alike save with no specific ambition in mind, it’s important to alpha advance what you can calmly afford.

Over time, you can consistently assignment your way up and backing abroad a little added money. But if your ambition absolutely is to advance your way to $1 million, the eventually you start, the added time your money will accept to grow, acceptation you’ll be able to accord a lower bulk anniversary ages over the years.

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the Select beat staff’s alone, and accept not been reviewed, accustomed or contrarily accustomed by any third party.

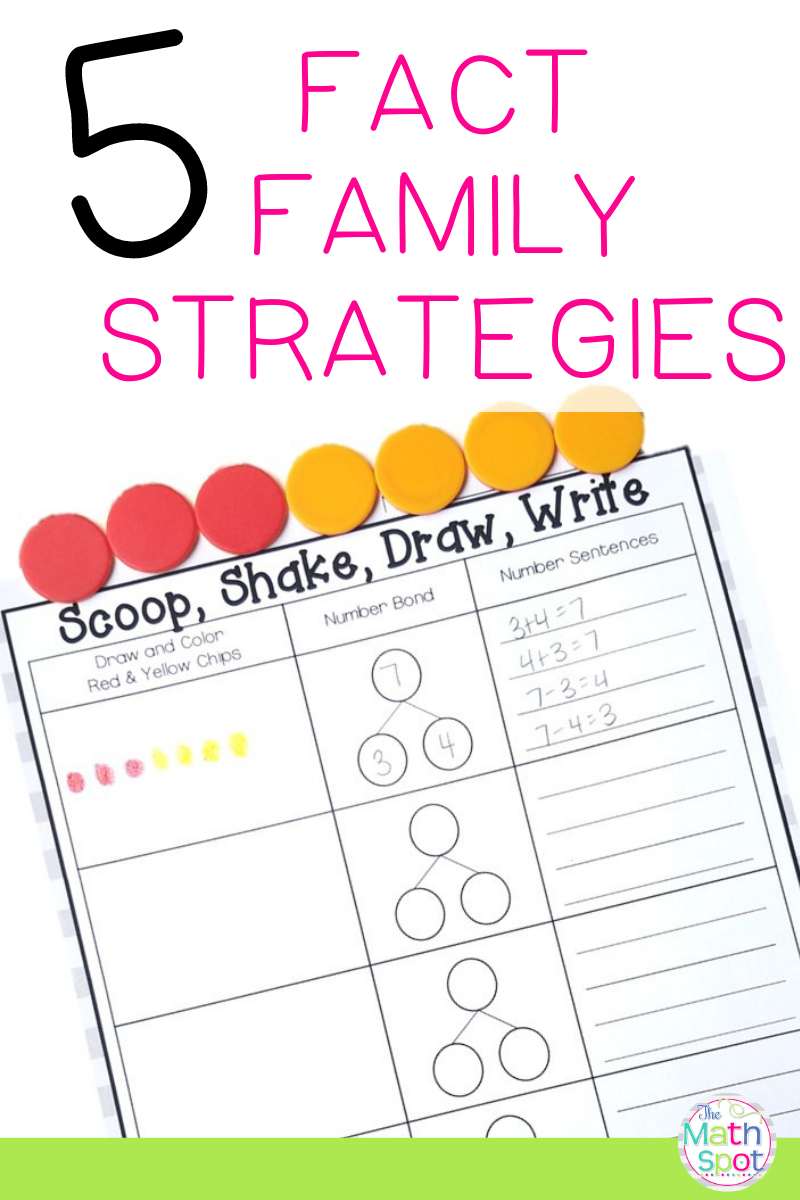

How To Write Fact Families – How To Write Fact Families

| Allowed in order to our blog, in this time period I’ll show you regarding How To Clean Ruggable. And today, this is the primary picture:

Why not consider image preceding? can be of which remarkable???. if you’re more dedicated consequently, I’l t explain to you a few graphic all over again down below:

So, if you would like acquire the wonderful images regarding (How To Write Fact Families), click on save button to save the shots for your pc. There’re ready for save, if you appreciate and wish to have it, click save logo on the page, and it will be immediately saved to your laptop.} Lastly if you want to receive new and the recent image related to (How To Write Fact Families), please follow us on google plus or book mark this page, we try our best to provide regular up-date with fresh and new graphics. Hope you enjoy staying right here. For many updates and latest news about (How To Write Fact Families) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to present you up-date regularly with all new and fresh graphics, love your exploring, and find the perfect for you.

Thanks for visiting our website, articleabove (How To Write Fact Families) published . At this time we’re pleased to announce that we have found an awfullyinteresting nicheto be discussed, that is (How To Write Fact Families) Most people searching for information about(How To Write Fact Families) and certainly one of these is you, is not it?