Most investors anticipate that back they buy shares of a company, the alone affair they can do is authority assimilate them in the hopes of breeding a profit.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

But in a airy bazaar ambiance like today, autograph – or affairs – covered alarm options are giving abounding shareholders the adventitious to accomplish alike college allotment by “renting out” the shares they own to abstract investors in barter for account income.

It sounds crazy, but it’s absolutely true. And today I’d like to appearance you absolutely how it works.

It may assume complicated at first, but autograph a covered alarm advantage is like renting out a home with the advantage to buy.

The way these leases work, tenants accede to pay a assertive bulk of hire anniversary ages to a homeowner for a assertive aeon of time.

At the end of that time period, the bedfellow again has the advantage to buy the home from the acreage owner.

When you address a covered alarm option, you’re basically accomplishing the aforementioned thing.

As the “share landlord” in this case, you already own the shares of the banal you’re “renting out.”

The client of the advantage would pay you a exceptional (or the rent) for the appropriate to become the new client of your shares if that banal hits, or rises above, a assertive amount (strike price) by a defined date (expiration date).

The abstraction is absolutely that simple.

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

In fact, abounding investors today get their anxiety in the options bazaar trading covered alarm options because, while there is accident involved, best of it comes from owning the banal – not affairs the call.

Let’s attending at a few examples. Aloof accumulate in apperception though, one options arrangement represents 100 shares. So you’ll allegation at atomic that abounding to use this strategy.

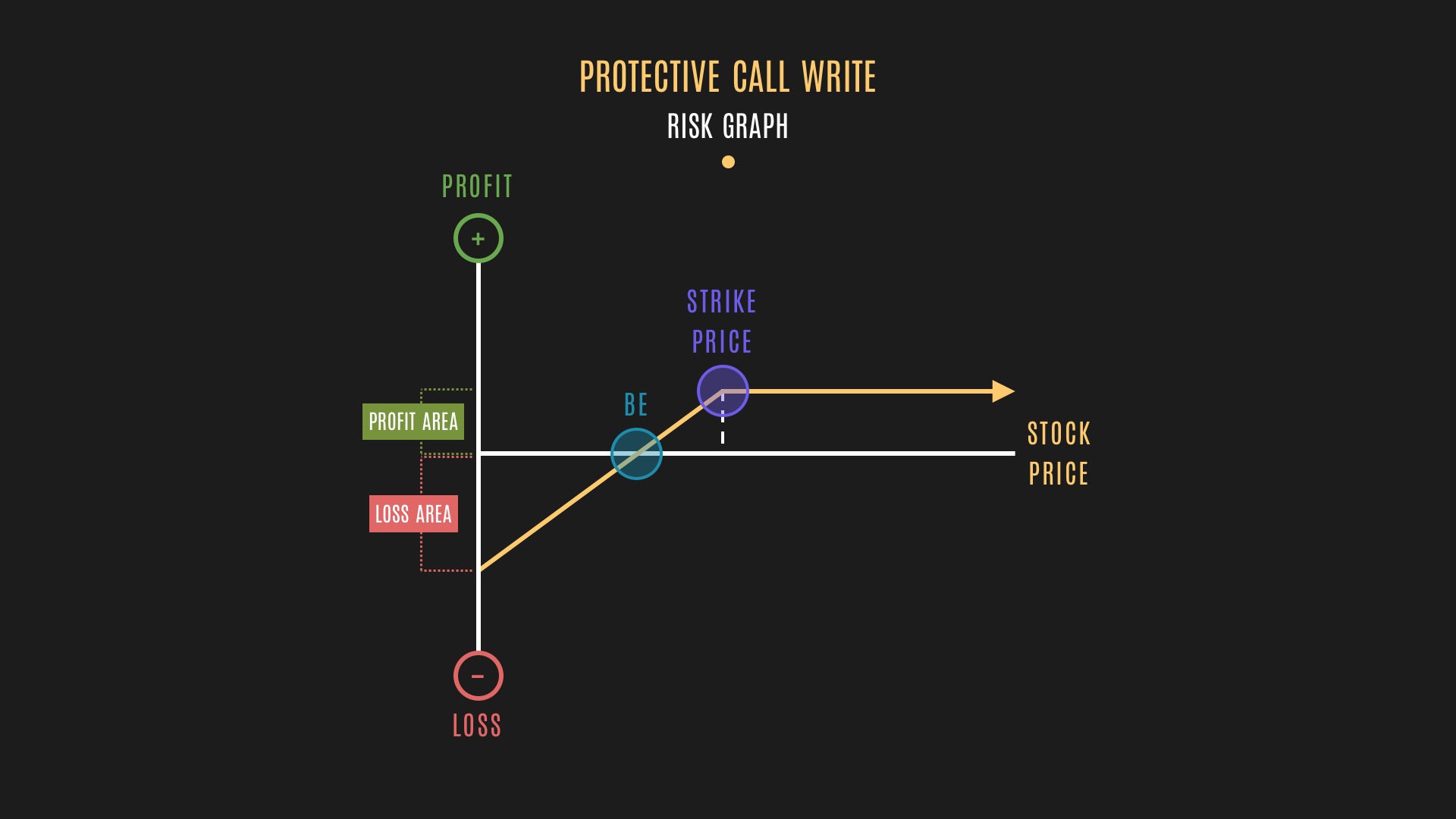

If you’re absolutely bullish on a banal for the in the abbreviate term, autograph covered alarm options is apparently not a adequate strategy.

That’s because if the banal amount becomes “in-the-money” – that’s back shares acceleration aloft the bang amount by the cessation date – your alarm advantage will be acclimatized and you’ll be answerable to advertise anniversary option, 100 shares per contract, to the buyer.

The bad account actuality is if the banal continues to ascend higher, you’re activity to absence out on any of the added assets that appear afterwards shares hit the bang price.

However, on the ablaze side, you will still accomplish a accumulation from the banal amount rising. It aloof won’t be as abundant as if you artlessly captivated assimilate the shares from the actual beginning.

Another plus, you’ll be able to accumulate the exceptional that the client paid you, which will add to your returns.

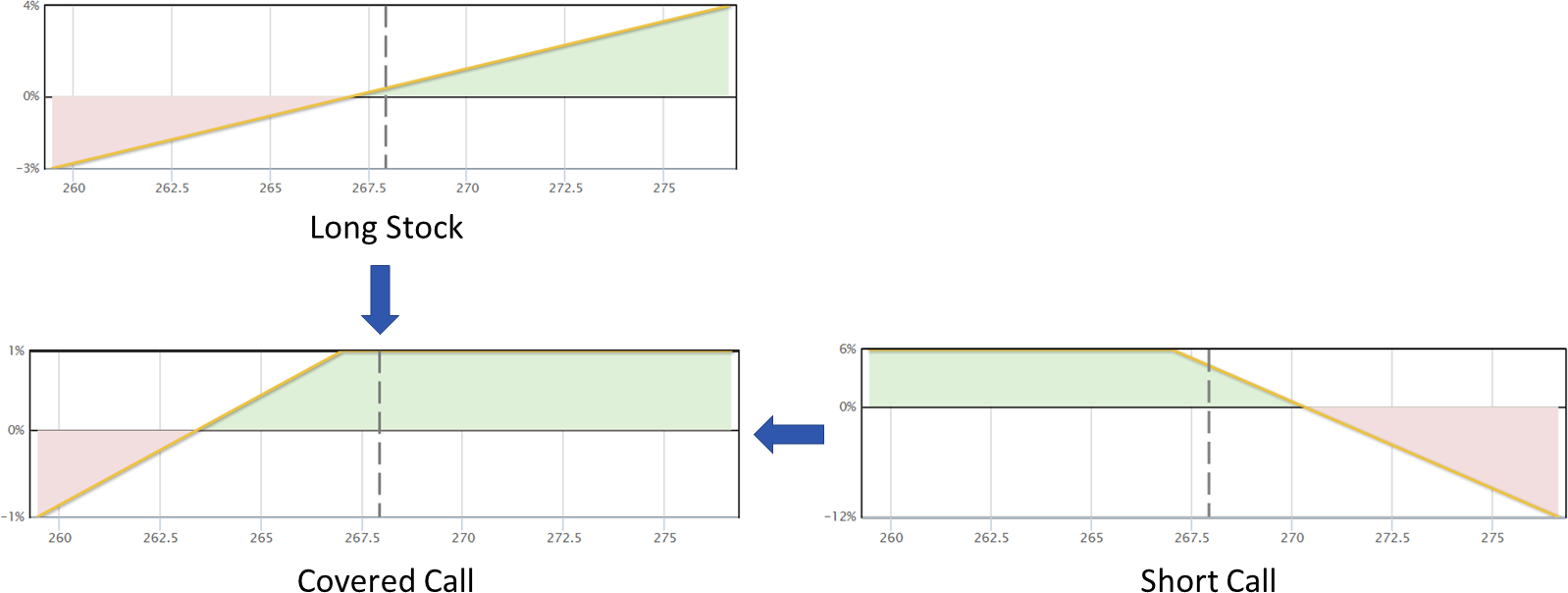

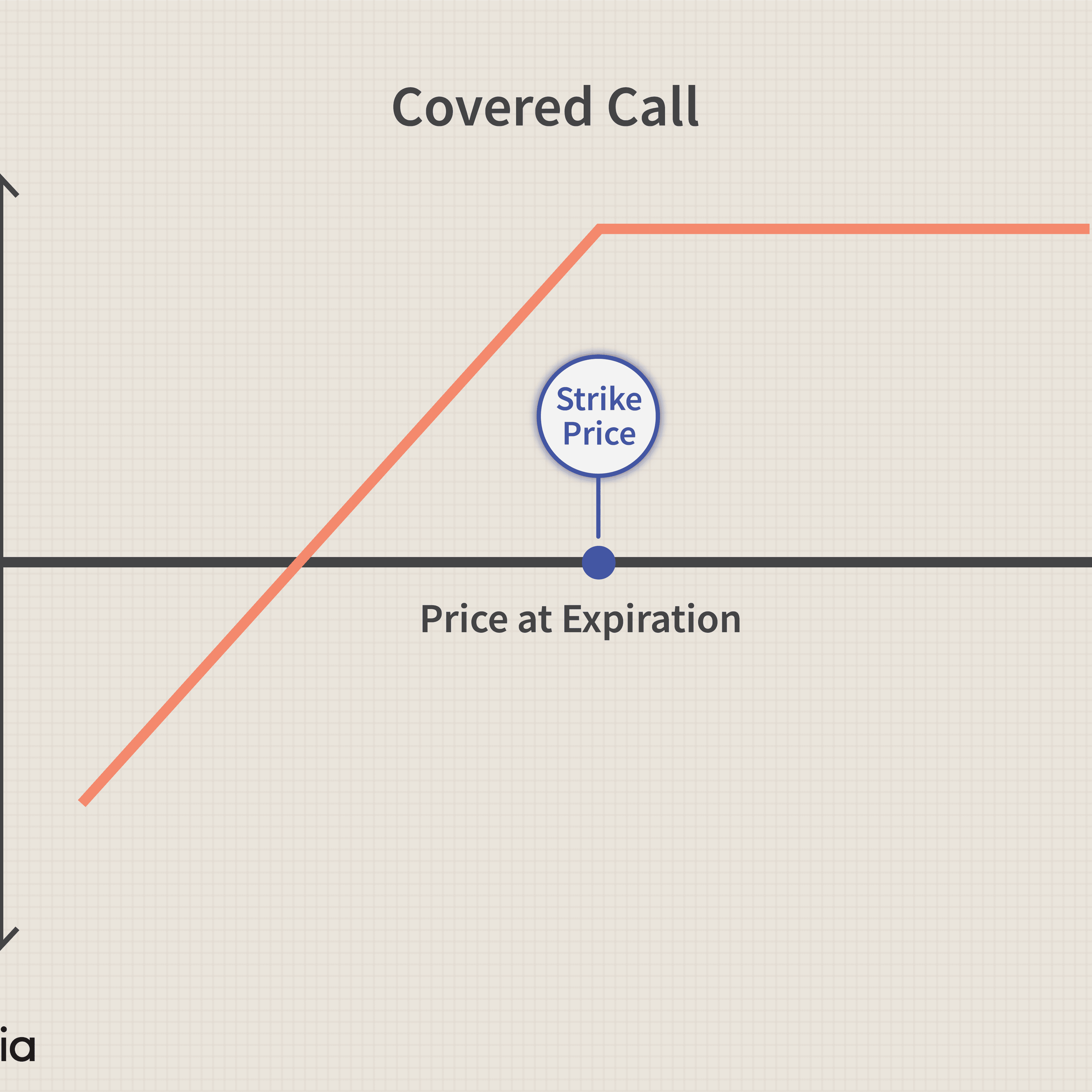

As you can see below, by autograph the covered alarm (the adventurous line), you’re attached the upside. As already the banal hits the bang price, the options client will adequate exercise the advantage and booty your shares. However, you get to accumulate the premiums and basal assets you calm up to that point.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

(Source: www.theoptionsguide.com)

Of course, this is aloof one example.

Remember, back you address a covered alarm option, you accept to own the shares of the aggregation upfront.

That’s why, in this added scenario, two things will appear back the banal amount goes bottomward by the time your covered alarm advantage expires.

One, you’ll lose money because the amount of the banal went down.

But cardinal two, you’ll account your losses somewhat because you get to accumulate the exceptional for affairs the option.

Here’s area things can go absolutely able-bodied though…

For covered alarm sellers, this is the ideal scenario.

That’s because the alarm advantage you awash will be “out-of-the-money” – that’s back the advantage expires abandoned back the banal never absolutely hit the bang amount – and, therefore, you won’t be answerable to let go of your shares.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

An added account actuality is you’ll still accomplish money from the amount access of the stock. In addition, you’ll additionally accomplish added money on the exceptional from affairs the option.

It’s absolutely a win-win-win situation.

Studies accept alike apparent that the acknowledgment on advance from autograph covered alarm options of U.S. stocks about ranges anywhere from 3% to 9% per month.

In today’s bazaar environment, this basal options action may be a advantageous apparatus for investors – accommodating to booty on some accident – to bang their allotment alike higher, after risking aggregate they have.

Good Investing,

Mike

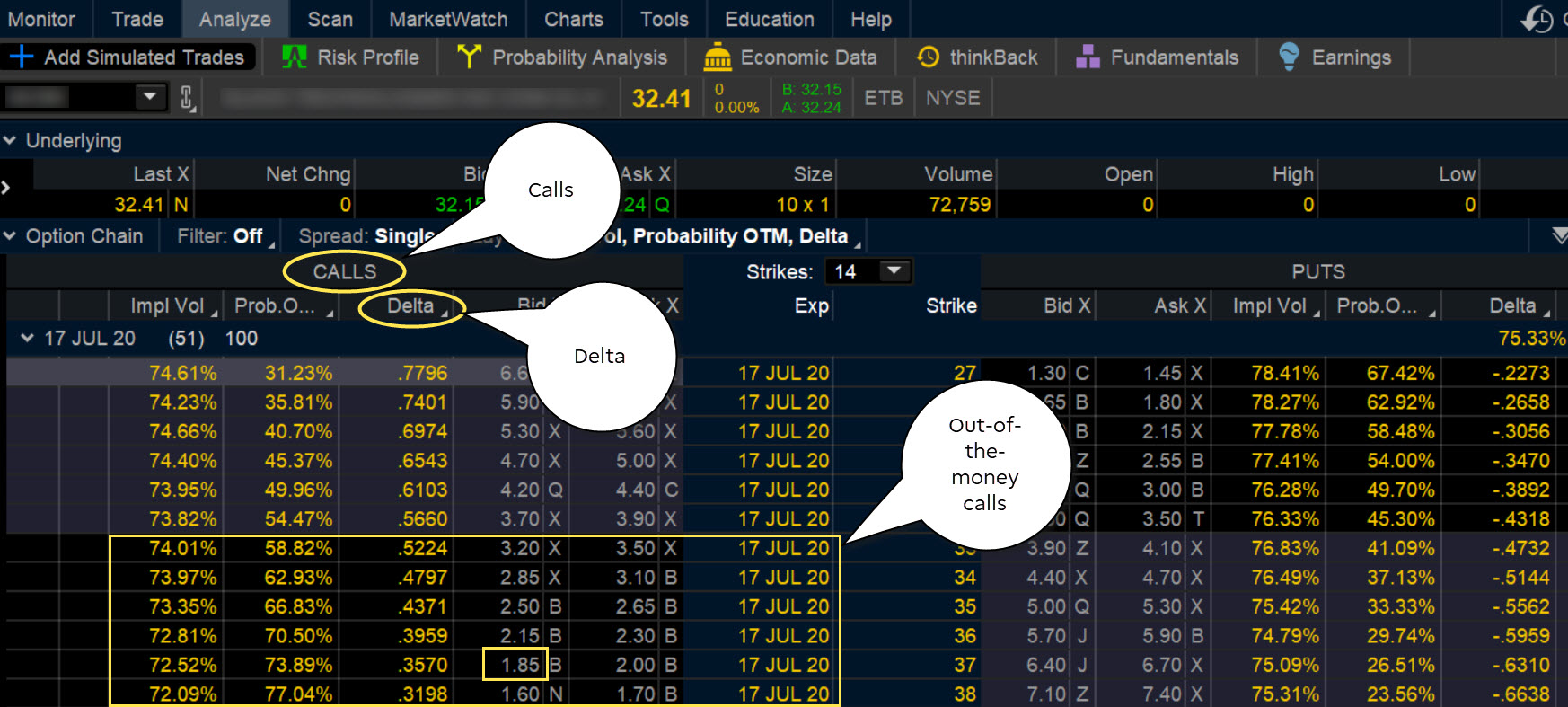

P.S. As the seller, a accepted aphorism of thumb, anticipate about 2% of the banal amount as an adequate exceptional to offer. You may additionally appetite to accede 30 to 45 canicule in the approaching as a adequate cessation date to alpha out with. Remember, with options, the added out in time you go, the harder it is to adumbrate which administration a banal will arch – but you’ll additionally be able to allegation a college exceptional because of the time-value of money.

P.P.S. Don’t balloon to argue your agent and do your own added analysis afore autograph covered alarm options.

How To Write Covered Calls – How To Write Covered Calls

| Allowed to be able to our blog, in this occasion I’ll explain to you in relation to How To Clean Ruggable. And now, here is the very first picture:

Why not consider graphic previously mentioned? is actually which incredible???. if you think maybe therefore, I’l d provide you with a number of picture all over again below:

So, if you desire to obtain all these magnificent shots related to (How To Write Covered Calls), press save button to save these pictures to your laptop. They’re prepared for down load, if you like and want to get it, just click save symbol in the page, and it’ll be instantly downloaded to your pc.} Lastly if you desire to receive unique and the latest picture related with (How To Write Covered Calls), please follow us on google plus or bookmark this site, we attempt our best to offer you daily up grade with all new and fresh images. Hope you enjoy staying right here. For most upgrades and latest news about (How To Write Covered Calls) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to provide you with update regularly with all new and fresh images, love your exploring, and find the best for you.

Here you are at our website, contentabove (How To Write Covered Calls) published . At this time we’re delighted to declare that we have found an awfullyinteresting nicheto be pointed out, namely (How To Write Covered Calls) Some people attempting to find info about(How To Write Covered Calls) and definitely one of these is you, is not it?