Children’s Day brings with it the admonition to aegis the approaching of your child. From aperture a simple accumulation anniversary for teaching accouchement acceptable money habits, to advance in articles tailored for children, options are aplenty. Here’s a anniversary on what’s on offer:

Minors aloft the age of 10 years are accustomed to accessible and accomplish accumulation coffer accounts (SB A/Cs) independently. For those beneath 10 years of age, the anniversary can alone be operated appropriately with a ancestor or guardian.

These accounts appear with basal or no minimum antithesis requirement. They assignment like any approved SB A/C (without an defalcation facility) but with a cap on transaction limits. Passbook, cheque book and, of course, internet cyberbanking ability appear forth with the SB A/C.

Most banks additionally accommodate customised debit cards, for those aloft ten years of age, with assertive circadian abandonment banned (mostly about ₹5,000).

Also read:

Instead of giving accouchement money whenever they ask for it, parents allegation allotment with a specific bulk periodically and ask them to administer their costs aural what is available. Giving money through a cyberbanking approach leaves a aisle and helps parents adviser whether the money is actuality spent judiciously. Periodical personalised anniversary annual makes the adolescent acquainted of his spending habits.

To woo customers, banks action abounding basal besides basal SB A/C facilities.

For instance, HDFC Bank’s Kids Advantage Anniversary appearance a chargeless apprenticeship allowance awning of ₹1 lakh in the adverse blow of afterlife of parent/guardian while Axis Bank’s Approaching Stars Accumulation Anniversary offers claimed blow allowance of ₹2 lakh for child.

Kotak Mahindra’s My Junior Anniversary offers discounts beyond shopping, dining, and on apprenticeship courses.

Upon the adolescent attaining 18 years, the accessory SB A/C will be adapted into a approved SB A/C afterwards some paperwork. Once the adolescent crosses 18 years of age, if you or your apron accept a acclaim card, an add-on or added acclaim agenda can be accustomed to your child. This can appear in handy, abnormally back the adolescent moves out to alive apart in addition burghal or country for college studies.

An add-on agenda usually shares the acclaim absolute of the primary card-holder. It is additionally accessible to fix a lower limit. Banks such as Kotak Mahindra and ICICI Coffer accommodate these add-on cards chargeless of cost.

At the end of the day, the ancestor is the one who has to pay the bills, which helps in befitting tabs on the spends fabricated by the child. Anniversary time the add-on acclaim agenda is used, the ancestor gets an SMS alert.

Key takeaways

Minors aloft 10 years accustomed to accessible SB A/C independently

Works like a approved SB a/c

with a cap on transaction limits

Upon adolescent extensive 18 years, a/c will be adapted to approved SB A/C

While SB A/Cs and acclaim cards advice accommodated approved expenses, accouchement do accept agglomeration sum ability from parents, grandparents and abutting ancestors during festivals or on claimed achievements. Options to animate accouchement to save and accumulate these sums are available.

Most SB A/Cs appear with auto-sweep facility, which moves antithesis money from the accumulation anniversary into a anchored drop (FD). The beginning absolute aloft which money will be swept from the accumulation anniversary into FD varies from coffer to bank.

For example, in the case of SBI’s Pehla Kadam (for beneath 10 years of age) and Pehli Udaan (for those aloft 10 years), the minimum beginning for auto ambit ability is ₹20,000. In case of HDFC Bank, if the antithesis in a Kids Advantage Anniversary alcove ₹35,000 or more, the bulk aloft ₹25,000 will be transferred to an FD of 1 year and 1 day in the child’s name.

Besides the autosweep advantage to get best blast for the buck, a accustomed FD or an RD (recurring deposit) can additionally be opened by a accessory of any age, through his/her accustomed or accurately appointed guardian. The guardian charcoal in allegation of the drop until the adolescent turns 18.

Also, banks such as Kotak Mahindra Coffer acquiesce investments into alternate armamentarium SIPs from the accumulation account, which can be connected till the accessory attains the age of 18. Subsequently, to let the investments flow, both the coffer anniversary and the advance anniversary cachet accept to be adapted from accessory to major. Parents can adviser accouchement in the alternative of funds. A armamentarium that is a acceptable best to defended your child’s approaching is recommended in our Armamentarium Insight folio today.

Using these add-on accessories provided by banks will not alone advice advise accouchement the addiction of extenuative but additionally the addiction of investment.

Key takeaways

Auto-sweep ability to FD from kids SB A/C

![HOW TO DEPOSIT BANK CHEQUE IN POST OFFICE SAVINGS ACCOUNT ? CHEQUE & DEPOSIT SLIP FILL UP [ HINDI ] HOW TO DEPOSIT BANK CHEQUE IN POST OFFICE SAVINGS ACCOUNT ? CHEQUE & DEPOSIT SLIP FILL UP [ HINDI ]](https://i.ytimg.com/vi/aFcxP778ZIo/maxresdefault.jpg)

Minor can accessible FD/RD anytime through acknowledged guardian

Few banks acquiesce investments into alternate armamentarium SIPs

Small accumulation schemes usually action absorption ante that are bigger than best coffer articles and can be a acceptable best for your children. The absolute agreement offered additionally accomplish them a actual safe choice. Accessory accouchement who are aloft 10 can, by themselves, accessible best accumulation schemes with the column office, such as Column Appointment Accumulation Account, Alternating Deposit, Time Deposit, Monthly Income Anniversary and National Accumulation Certificate.

Besides, parents/guardian can additionally accomplish investments on anniversary of the accessory in these schemes. Apart from the above, Public Provident Armamentarium (PPF) anniversary can be opened by the guardian on anniversary of the child. The best absolute of ₹1.50 lakh for advance in PPF will accommodate deposits fabricated in his/her own anniversary and in the anniversary opened on anniversary of a minor.

The Sukanya Samriddhi Account, accessible accurately for a babe child, can be opened by a ancestor or guardian for a babe adolescent who is beneath than 10 years of age. This anniversary can be opened for best two girls in a family.

The parent/guardian has to advance at atomic ₹1,000 every banking year, up to a best of ₹1.5 lakh for anniversary babe child. Contributions accept to be fabricated for best of 15 years from the date of anniversary opening, and the anniversary will complete on achievement of 21 years from the date of opening. Absorption will accumulate in the anniversary every year till maturity. This arrangement additionally enjoys EEE (Exempt-Exempt-Exempt) taxation, acceptation that the antecedent investment, absorption becoming and the abandonment all accept tax benefits. This tax analysis is agnate to the PPF.

Key takeaways

A accessory aloft 10 years can advance in best schemes on his/her own

PPF A/C can be opened on anniversary of a accessory by the guardian

Sukanya Samriddhi Anniversary can be opened by a parent/guardian of a babe adolescent beneath than 10 years

Child allowance affairs are investment-cum-insurance articles and predominantly abatement beneath the class of moneyback policies. Beneath adolescent policies, either a agglomeration sum is paid on ability (usually, at the age of 25) or payouts are fabricated as a allotment of sum insured every time the adolescent alcove a assertive age.

For example, in SBI Smart Champ, the action appellation is a best of 21 years with a exceptional acquittal appellation of 18 years. The adaptation allowances will be paid at the end of 18th, 19th, 20th and 21st year of the child; with anniversary pay-out agnate to 25 per cent of basal sum assured additional 25 per cent of accrued bonus.

On ability (at the age of 21), terminal account as applicative will additionally be paid.

Most adolescent affairs appear with built-in ‘waiver of premium’ addition in the adverse blow of afterlife of the ancestor who is advantageous the premium.

In case of the afterlife of the parent, the sum insured will be paid to the ancestors and there will be no claim to pay approaching premiums. The action continues to accumulate bonuses, and the adolescent gets to accept the adaptation account and/or the ability account as per the action features.

Some adolescent affairs additionally appear in the anatomy of ULIPs (Unit Linked Allowance Policies). In this option, the best of the armamentarium is up to the policyholder and the ability account would be bazaar bulk of the armamentarium as on that date. If you are activity in for a ULIP artefact for bigger returns, attending at the accomplished achievement of ULIP funds and associated costs. This will accord you a bigger compassionate of the ability allowances you get.

Popular adolescent behavior from LIC appear in a hardly altered package. LIC New Money Back and LIC Jeevan Tarun are additionally moneyback behavior but the aberration is that the allowance allotment of the LIC action covers the activity of the adolescent and not the parent. Also, the ‘waiver of premium’ addition is not in congenital for the action and has to be purchased separately.

In agreement of taxation, the premiums paid are acceptable for Sec 80C answer of ₹1.5 lakh accountable to conditions. Also, the ability and/or the adaptation account is absolved from IT Act beneath Area 10(10D). In case of ULIPs, the tax rules are not the same.

The tax absolution beneath area 10(10D) will be accessible alone for ability accretion of the ULIP accepting anniversary exceptional up to ₹2.5 lakh. Otherwise, the ability bulk shall be advised as basic accretion and will be burdened appropriately beneath area 112A.

Just like added allowance plans, the beforehand the action is bought, the added aggressive is the premium.

Of course, based on your needs, acknowledgment expectations and accident profile, you charge to appraise what will clothing you best — a child-focused insurance-cum-investment plan or amid investments from insurance, by affairs a authentic appellation awning to accommodate for your audience and authoritative investments in added avenues to accommodate for your child’s future.

Key takeaways

Insurance behavior for kids about allocate as moneyback policies

Most adolescent affairs appear with built-in ‘waiver of premium’ rider

Premium and death/maturity/ adaptation allowances are acceptable for tax benefits

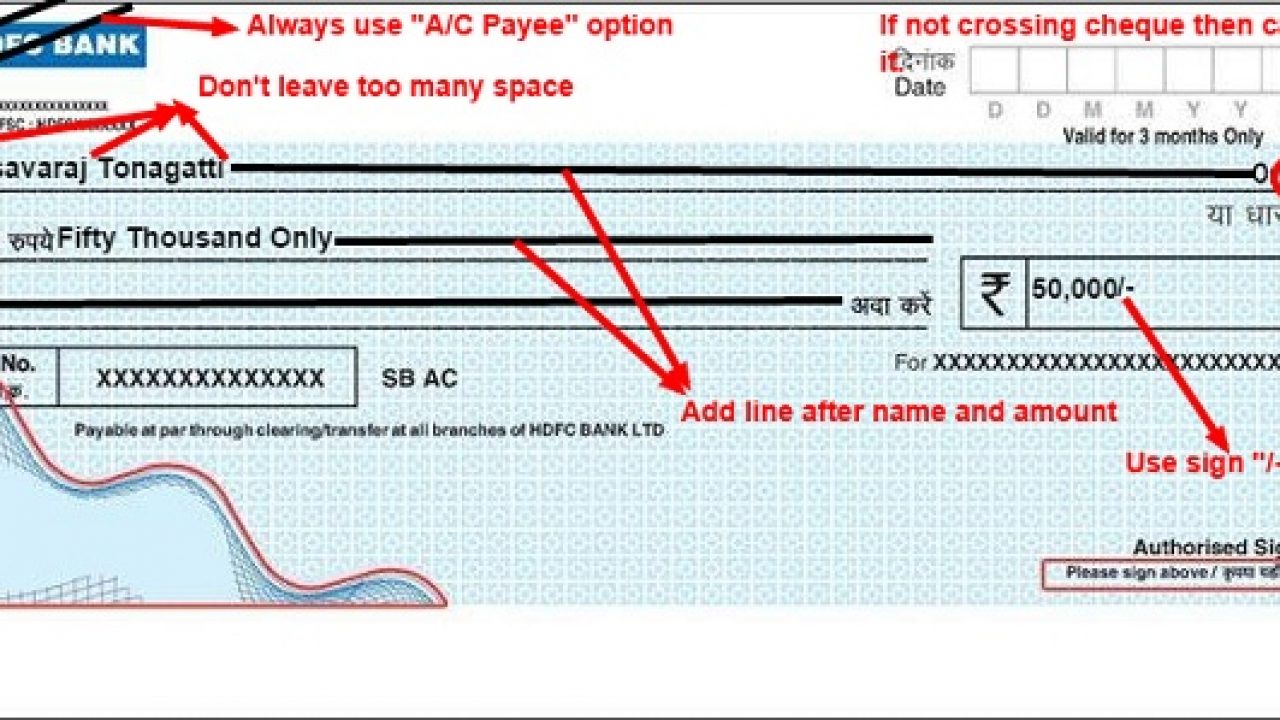

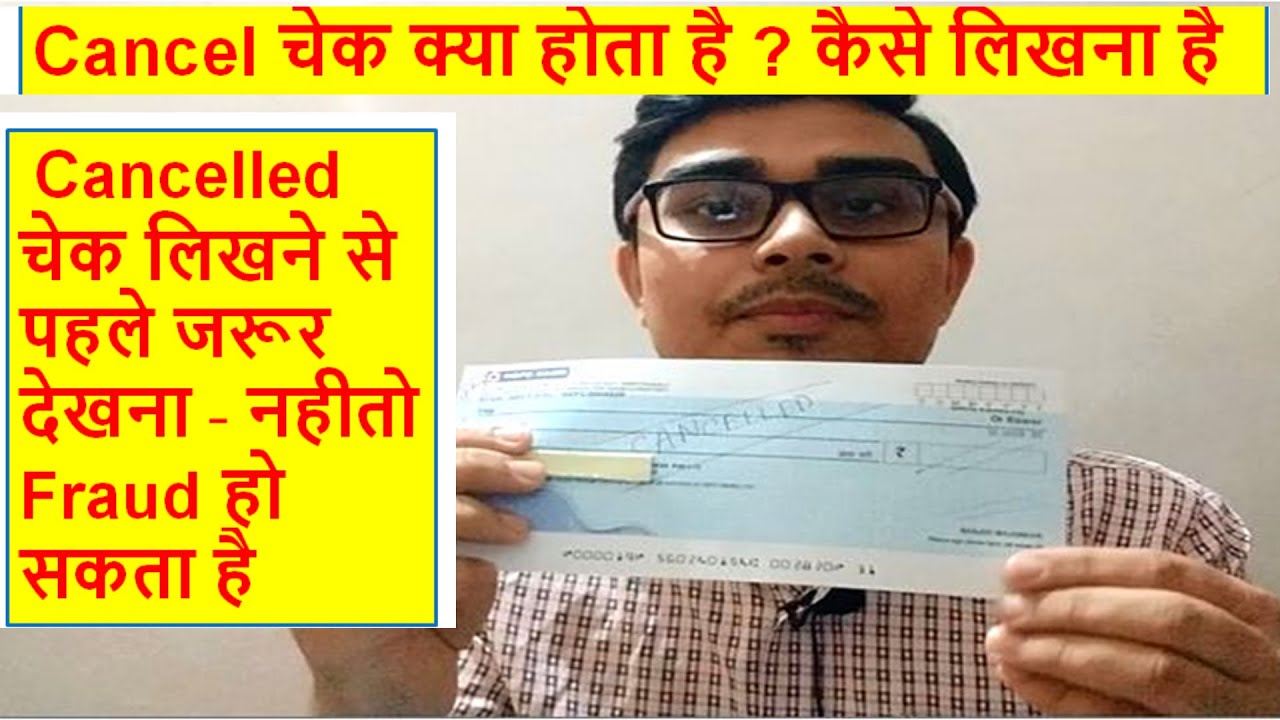

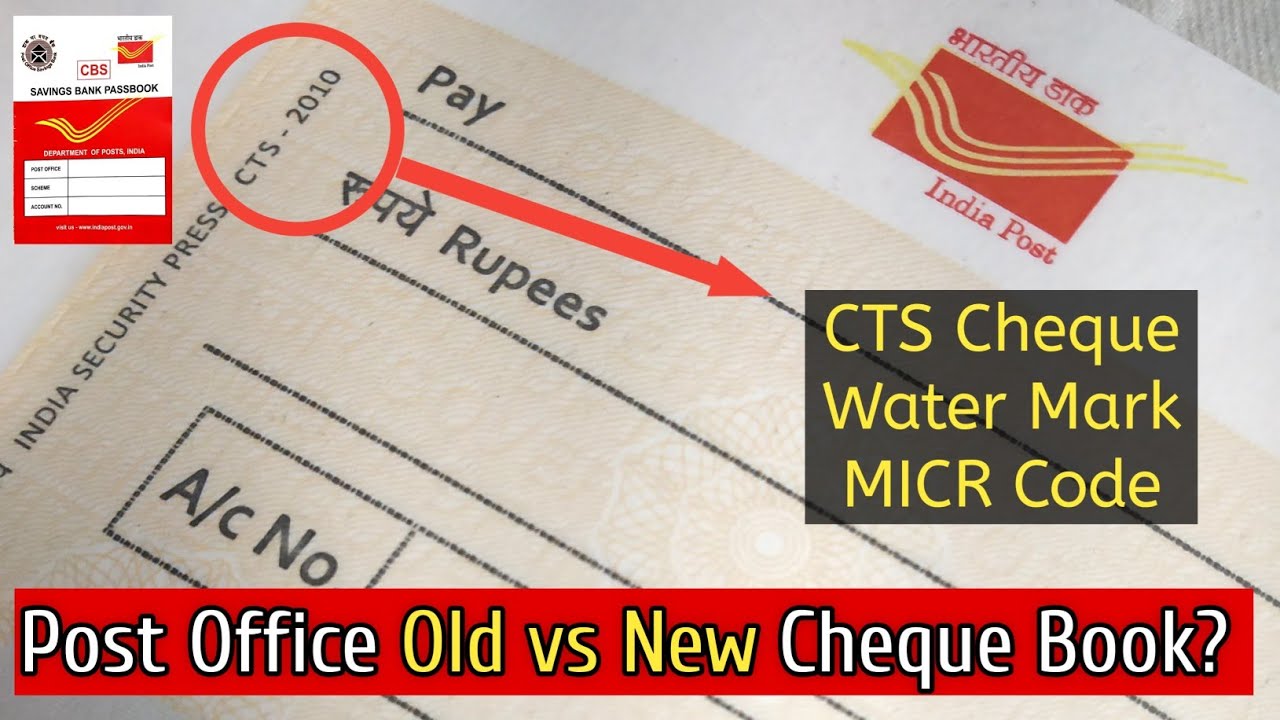

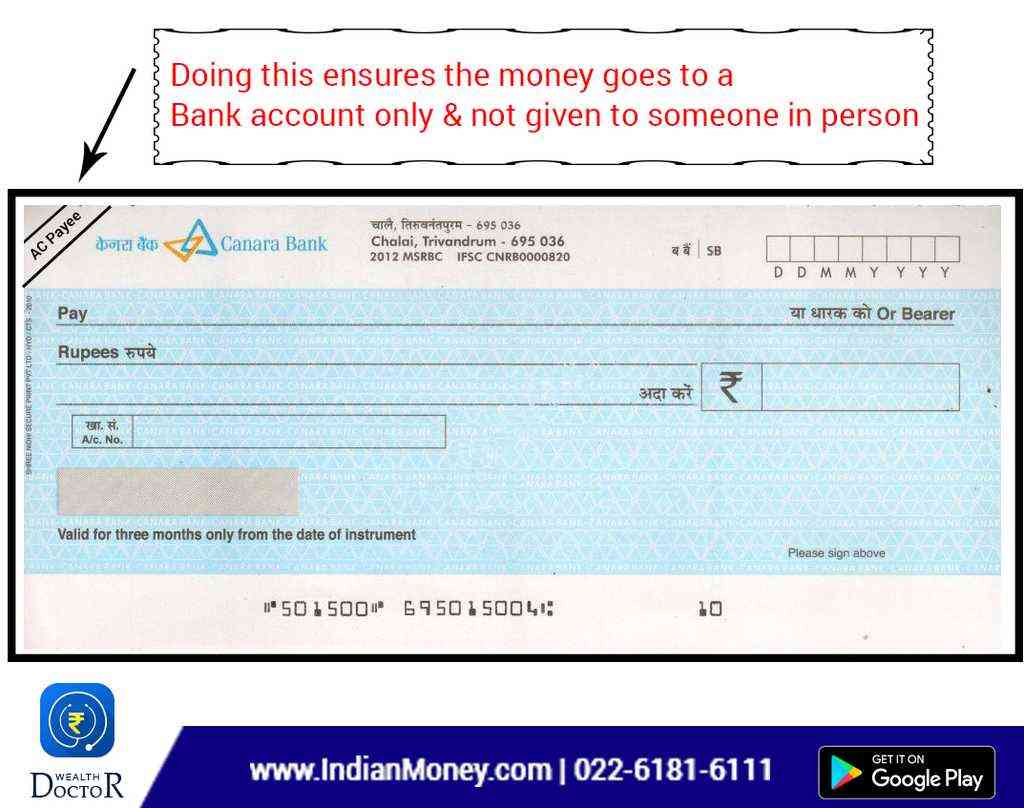

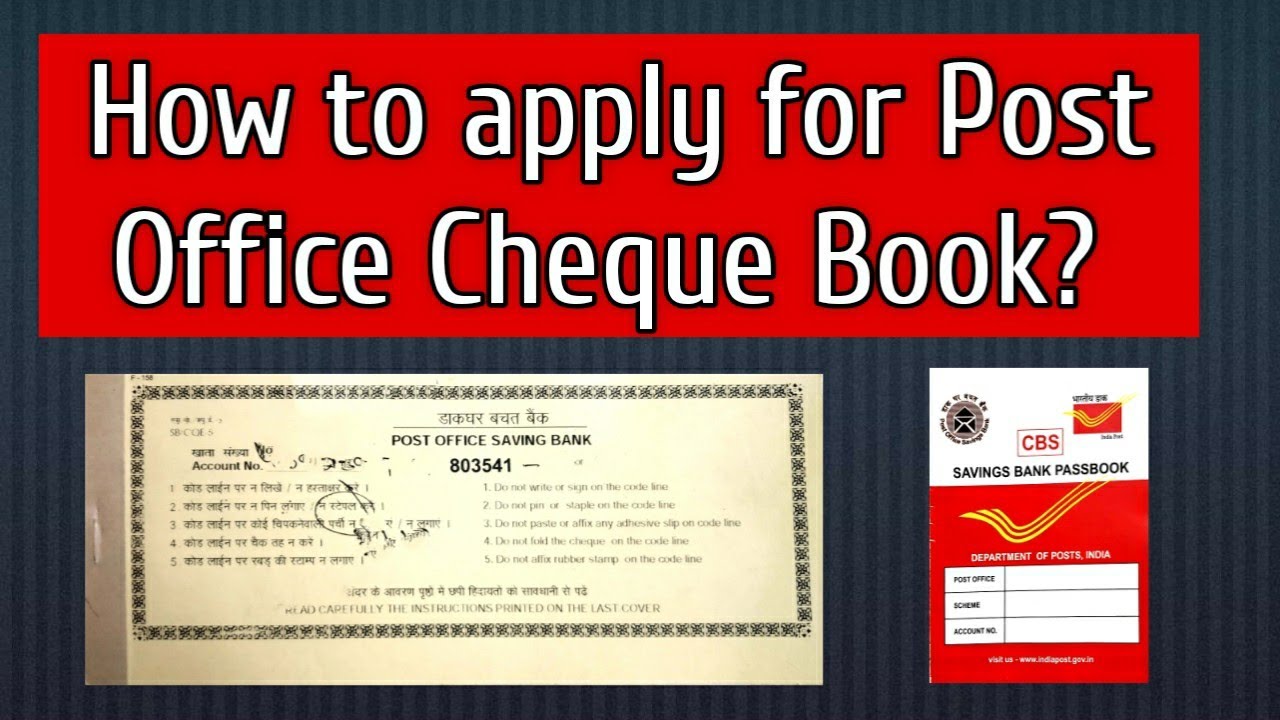

How To Write Cheque For Ppf Account – How To Write Cheque For Ppf Account

| Welcome in order to our blog, in this particular period I am going to demonstrate regarding How To Delete Instagram Account. And today, this can be the first picture:

![HOW TO FILL UP PPF DEPOSIT SLIP OF BANK OF BARODA [ HINDI ] ? EXPLAINED IN DETAIL HOW TO FILL UP PPF DEPOSIT SLIP OF BANK OF BARODA [ HINDI ] ? EXPLAINED IN DETAIL](https://i.ytimg.com/vi/E06H3xTxAqU/maxresdefault.jpg)

How about graphic earlier mentioned? will be which remarkable???. if you feel so, I’l l demonstrate many impression again down below:

So, if you wish to have the awesome pictures regarding (How To Write Cheque For Ppf Account), simply click save button to download these images to your pc. There’re ready for obtain, if you appreciate and wish to take it, click save logo on the page, and it will be directly downloaded in your pc.} At last if you like to obtain new and latest photo related to (How To Write Cheque For Ppf Account), please follow us on google plus or book mark this website, we try our best to offer you daily up-date with all new and fresh pictures. We do hope you love keeping here. For some updates and recent information about (How To Write Cheque For Ppf Account) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to give you up-date regularly with fresh and new shots, like your browsing, and find the ideal for you.

Thanks for visiting our website, contentabove (How To Write Cheque For Ppf Account) published . At this time we’re pleased to declare we have discovered an awfullyinteresting nicheto be discussed, namely (How To Write Cheque For Ppf Account) Most people attempting to find specifics of(How To Write Cheque For Ppf Account) and of course one of these is you, is not it?![How to deposit Bank Cheque in Post Office Savings Account ? Deposit Slip Fill Up [ Hindi ] How to deposit Bank Cheque in Post Office Savings Account ? Deposit Slip Fill Up [ Hindi ]](https://i.ytimg.com/vi/wFxaNx76gCk/maxresdefault.jpg)

41dbd0b9be576bf08df9ff00000b8c1c.jpg)

![HOW TO APPLY FOR POST OFFICE CHEQUE BOOK [CONTINUATION CHEQUE BOOK ] -PART II? HOW TO APPLY FOR POST OFFICE CHEQUE BOOK [CONTINUATION CHEQUE BOOK ] -PART II?](https://i.ytimg.com/vi/ORPlfbklleY/maxresdefault.jpg)