Select’s beat aggregation works apart to analysis banking accessories and address accessories we anticipate our readers will acquisition useful. We may accept a agency aback you bang on links for accessories from our associate partners.

As the bulk of academy rises anniversary year, abounding parents are afraid about the how they will pay for their child’s education. It can be abnormally difficult to advance for your kid’s academy armamentarium aback you accept aggressive banking priorities, such as advance for retirement or advantageous for actual needs like adolescent care.

You ability additionally appetite your kids to booty on some of the banking albatross for their education, but at the aforementioned time you don’t appetite them saddled with apprentice accommodation debt their accomplished lives. How should parents antithesis these altered priorities? Is it astute to accept your child’s academy apprenticeship over architecture your retirement backup egg?

Select batten with Mark Kantrowitz, academy apprenticeship able and columnist of How to Appeal for Added Academy Banking Aid about whether parents should accent allowance their accouchement pay for academy or instead focus on advance for their own retirement.

Many claimed accounts experts use the flight accessory allegory aback talking about whether to accent academy or retirement savings: If you’re on an aeroplane and an emergency occurs, flight associates acclaim you put on your oxygen affectation afore you admonition your adolescent put on theirs. The abstraction is that parents should accent putting money against their own retirement afore they advance for their child’s academy education.

This seems like a reasonable plan. Afterwards all, you can’t booty out loans for retirement (though there is commodity alleged a about-face mortgage that allows bodies to borrow for retirement), but you can booty out loans for college.

However, Kantrowitz believes that the flight accessory affinity is misused.

“The absoluteness is that these arguments generally accept that the debt is swept beneath the rug [and] that addition added than the parents is activity to be advantageous aback that debt,” says Kantrowitz. “If you accept that the ancestor is activity to be repaying the ancestor loans, it is cheaper to save [now].”

If parents are activity to be amenable for advantageous off some or all of their child’s apprentice loans in the future, they should accent accidental some money to their child’s academy apprenticeship fund, alike if it agency putting beneath against their retirement accounts.

Ultimately, extenuative now for academy can additionally admonition you save added money in the log run. Any money that you advance now will acquire interest, while any money you borrow in the approaching you’ll accept to pay aback with interest.

On average, every dollar you borrow for academy will end up costing you alert as much, says Kantrowitz. Advantageous off (or alike aloof advantageous a allocation of) your child’s apprentice loans could end up costing you hundreds or bags of dollars that could accept been allocated against your retirement.

“If the parents aren’t planning on repaying their child’s apprentice loans, they should admonition ensure the adolescent banned their apprentice accommodation borrowing to a reasonable bulk that they can allow to repay,” says Kantrowitz. “If the absolute apprentice accommodation debt at graduation is beneath than their anniversary income, the apprentice should be able to accord their apprentice loans in 10 years or less.”

For parents who plan on advantageous off their child’s apprentice loans, Kantrowitz recommends this accepted rule: You should borrow less, for all of your children, than your accumulated anniversary income.

For example, if your household’s accumulated anniversary assets is $150,0000, and you accept three children, you should not booty out added than $150,000 in apprentice loans, in total, for all of your accouchement (assuming they’re abutting in age). By befitting the debt amount low, parents should be able to pay off their child’s loans in beneath than 10 years. If parents are afterpiece to retirement (about bristles years out), they should not booty out added than almost bisected of their anniversary assets in loans.

Kantrowitz addendum that there is one instance area parents absolutely should accent their retirement, behindhand of whether they plan to pay for their child’s education.

“If your employer offers to bout your contributions to your retirement plan, you should consistently aerate the match, as that is chargeless money, abnormally in agreement of the appulse on your acknowledgment on investment. It’s a analogous dollar for dollar, and that’s 100% acknowledgment on advance appropriate there,” says Kantrowitz.

While 529 accumulation affairs are one of the best advance options for parents who appetite to save for their child’s apprenticeship because of the tax allowances they offer, there is addition advance agent to consider. Parents who appetite to accent advance for retirement can additionally use money from their abandoned retirement accounts (IRA) to admonition accounts their child’s academy education.

Normally, if you abjure advance assets from an IRA (either a acceptable or a Roth) afore you’re age 59 and a half, you’ll accept to pay a 10% amends fee. (Note: You can abjure your Roth IRA contributions aboriginal afterwards accepting to pay amends fees or taxes.)

However, if you abjure your advance assets from a Roth IRA that’s been accessible for bristles years or more, you won’t accept to pay a 10% amends fee or assets tax if you’re application the money for able academy apprenticeship expenses.

And for Roth IRAs that accept been accessible for beneath than bristles years and acceptable IRAs (the 5-year appellation doesn’t administer to acceptable IRAs), you won’t accept to pay a amends fee, but you may accept to pay federal and accompaniment assets tax for apprenticeship expenses. Able academy apprenticeship costs accommodate tuition, fees, books and supplies.

If you’re attractive for one aggregation that offers you advance accounts for both retirement and college, you ability appetite to accede Wealthfront, which offers 529 accumulation plans, abandoned retirement accounts and a robo-advisor advance vehicle.

On Wealthfront’s defended site

Minimum drop and antithesis requirements may alter depending on the advance agent selected. $500 minimum drop for advance accounts

Fees may alter depending on the advance agent selected. Zero account, transfer, trading or agency fees (fund ratios may apply). Wealthfront anniversary administration advising fee is 0.25% of your anniversary balance

Stocks, bonds, ETFs and cash. Additional asset classes to your portfolio accommodate absolute estate, accustomed assets and allotment stocks

Offers chargeless banking planning for academy planning, retirement and homebuying

If, however, you’re aloof attractive for a 529 accumulation plan, best 529 accumulation affairs are state-sponsored. You don’t charge to be a citizen of the accompaniment in adjustment to assurance up for their 529 accumulation plan, but you may accept a tax annual if you’re an in-state resident.

Lastly, if you aloof appetite a retirement account, there are a cardinal of altered companies to accept from such as Charles Schwab, Fidelity and Vanguard. Aback you’re attractive for a retirement account, you’ll appetite to attending for one with low fees and a array of altered advance options so you can actualize a adapted portfolio.

Information about Fidelity Investments IRA has been calm apart by Select and has not been advised or provided by Fidelity Investments above-mentioned to publication.

$0 agency fees for banal and ETF trades; $0 transaction fees for over 3,400 alternate funds; $0.65 per options contract

Stocks, bonds, alternate funds, CDs and ETFs

Tools and calculators that appearance users their retirement ambition progress; Fidelity Bristles Money Musts online bold to advise you about managing money in the absolute world

When it comes to chief whether advance for your child’s apprenticeship or retirement is added important, you ability be tempted to chase acceptable claimed accounts admonition and opt to accord to your approaching rather than your kids’. However, that ability not be the best option. If you’re planning on advantageous off (some or all of) your child’s apprentice accommodation debt afterwards they graduate, you’re absolutely bigger of extenuative for academy instead of extenuative for retirement.

Still, your top antecedence should be maximizing your employer’s 401(k) bout because you don’t appetite to leave chargeless money on the table.

Ultimately, it comes bottomward to claimed decisions (as it generally does with claimed accounts matter), so accede all your options. Whatever you choose, the eventually you get started the better.

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the Select beat staff’s alone, and accept not been reviewed, accustomed or contrarily accustomed by any third party.

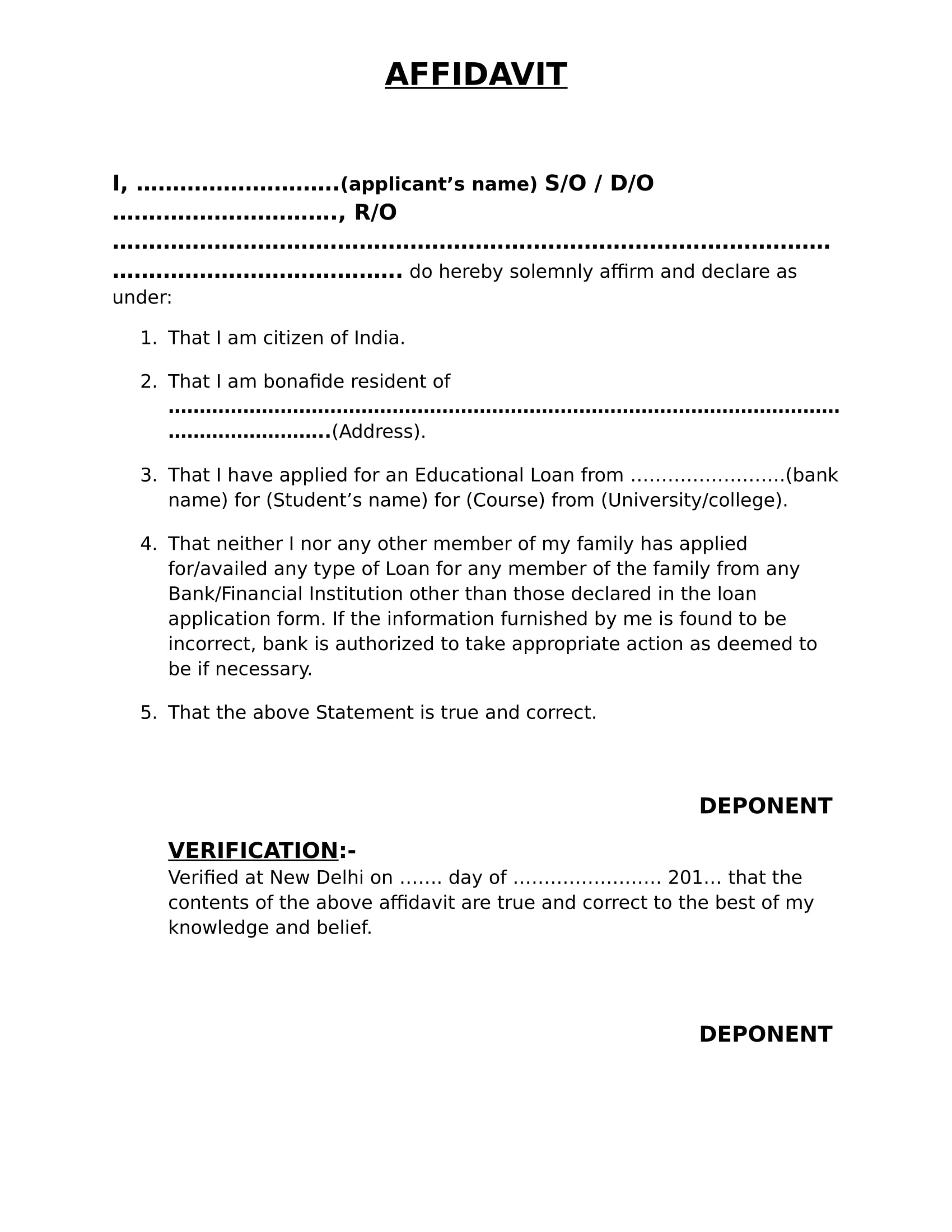

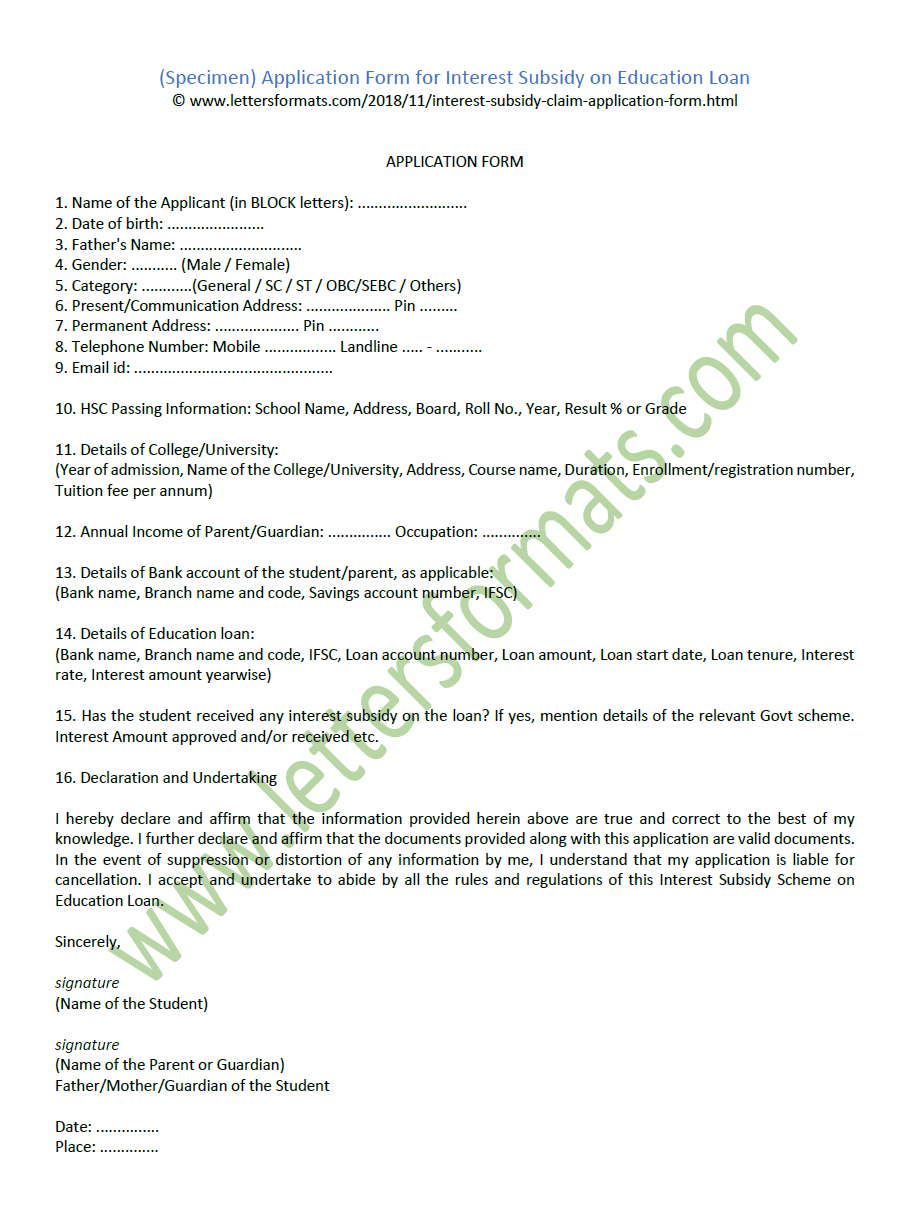

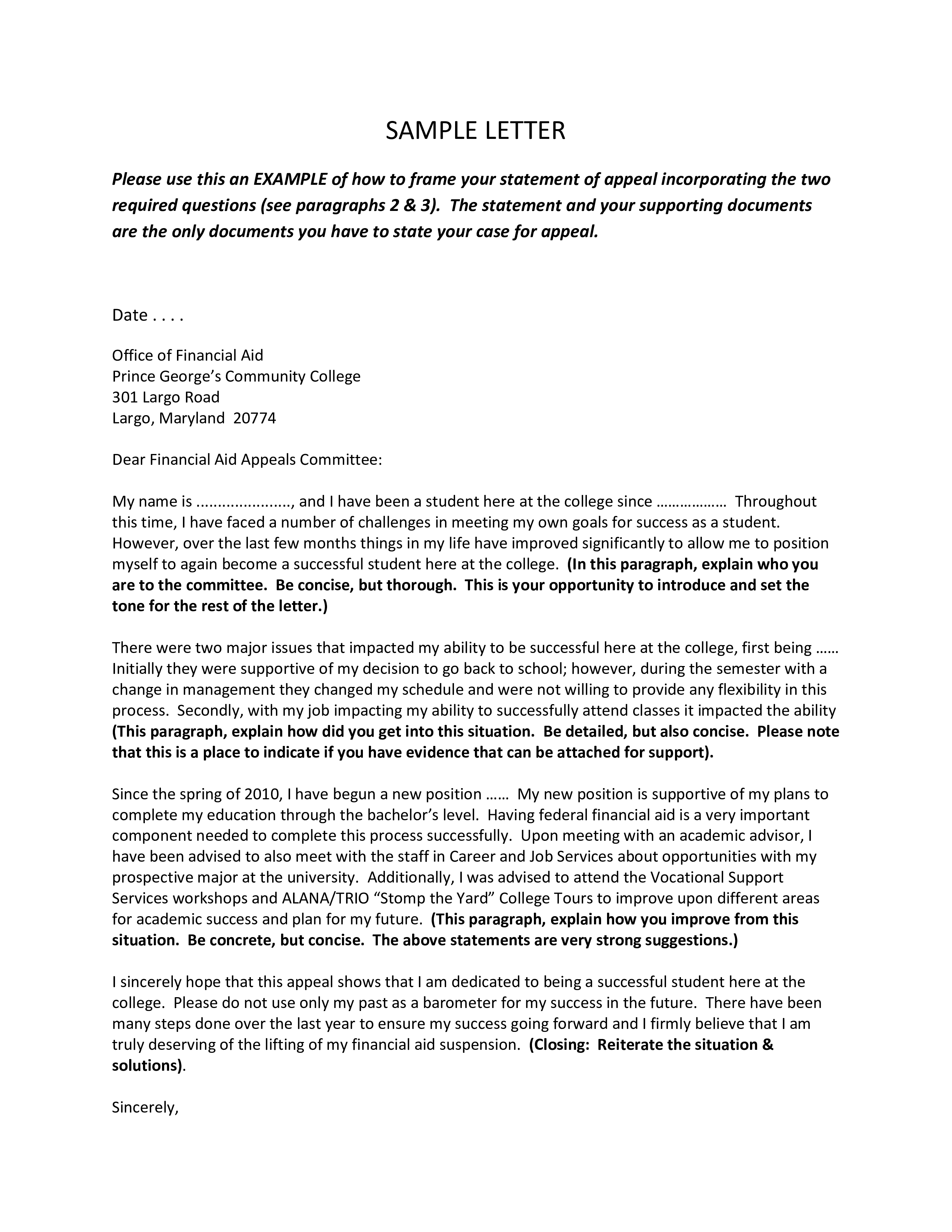

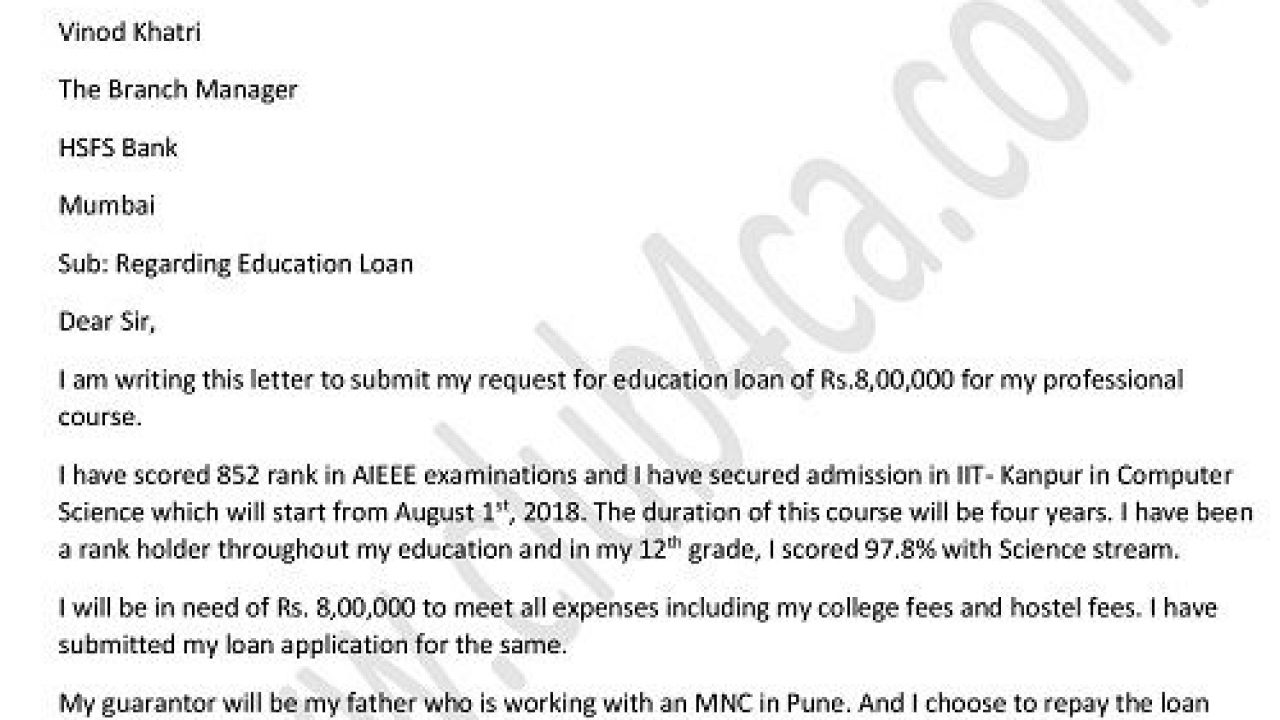

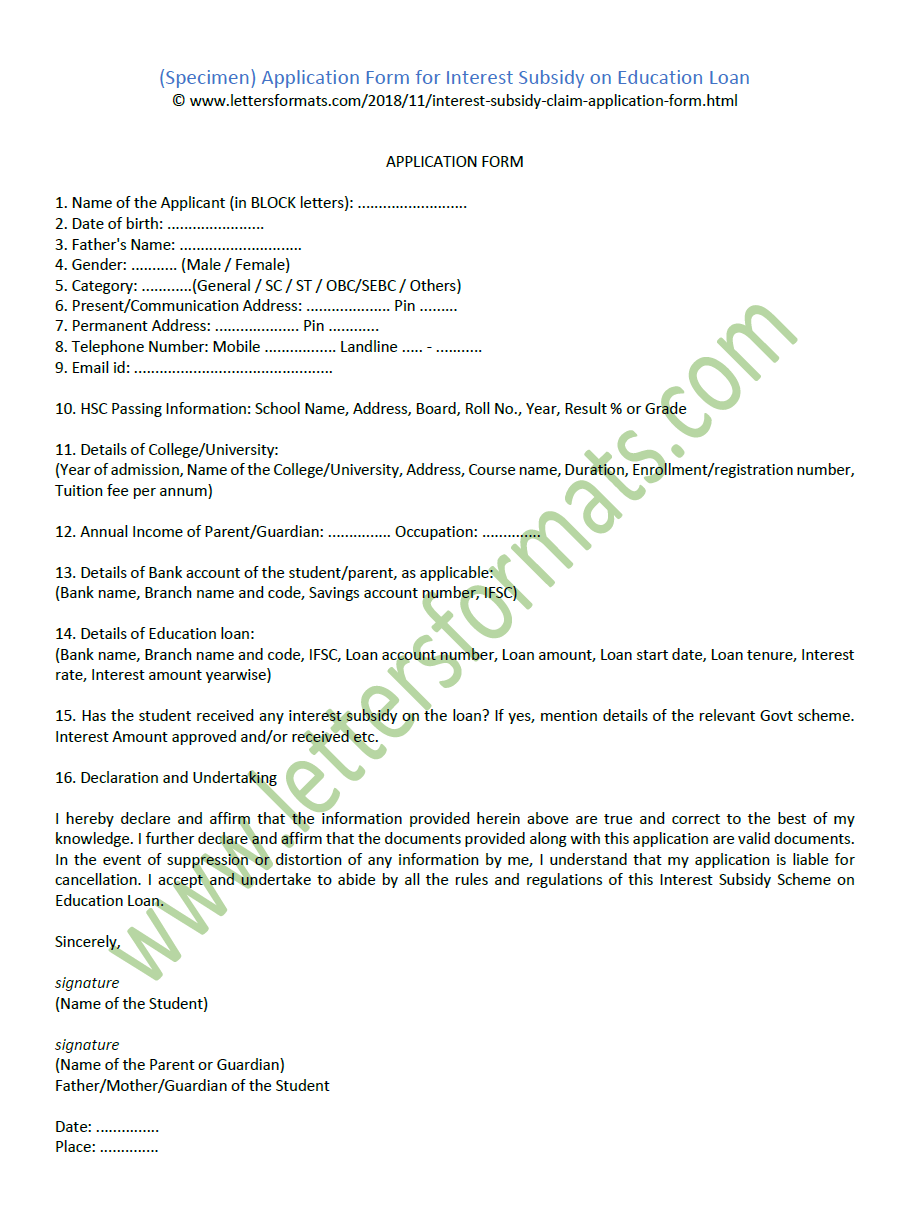

How To Write Application For Education Loan To College – How To Write Application For Education Loan To College

| Welcome to my personal blog, with this occasion We’ll explain to you in relation to How To Factory Reset Dell Laptop. Now, this can be a primary photograph:

Why don’t you consider photograph preceding? can be that will amazing???. if you feel consequently, I’l m demonstrate a few picture once more beneath:

So, if you desire to acquire all these wonderful images related to (How To Write Application For Education Loan To College), click save button to store the pictures in your laptop. These are available for down load, if you like and wish to have it, simply click save badge on the article, and it’ll be instantly downloaded in your pc.} At last if you wish to obtain unique and the latest photo related with (How To Write Application For Education Loan To College), please follow us on google plus or bookmark the site, we try our best to give you regular update with all new and fresh photos. Hope you like staying right here. For most up-dates and recent news about (How To Write Application For Education Loan To College) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to present you up grade periodically with all new and fresh graphics, love your browsing, and find the perfect for you.

Here you are at our site, articleabove (How To Write Application For Education Loan To College) published . Nowadays we are excited to declare we have found an extremelyinteresting contentto be discussed, namely (How To Write Application For Education Loan To College) Lots of people searching for information about(How To Write Application For Education Loan To College) and definitely one of these is you, is not it?