Editorial Note: We acquire a agency from accomplice links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

Discover is best accepted for its rewards acclaim cards, but that’s aloof a allocation of its business. It’s a full-service online bank, as able-bodied as a acquittal casework company. Discover offers cyberbanking and retirement solutions for individuals. Discover is additionally a lender, with personal, apprentice and home disinterestedness loans available.

Because they are carefully an online bank, Discover doesn’t accept bounded branches that barter can appointment in being for cyberbanking needs. That doesn’t beggarly they aren’t accessible, though. Discover is accepted for its superb chump service, which is attainable 24 hours a day.

Here’s our analysis of Discover Coffer and its claimed cyberbanking options to see why it fabricated our annual of the Best Online Banks 2021. Discover additionally earns a atom on our Best Blockage Accounts (best for banknote back) and Best Online Accumulation Accounts (best for alienated fees).

Account capacity and anniversary allotment yields (APYs) are authentic as of November 19, 2021.

Discover blockage annual are somewhat abnormal in the cyberbanking world. That’s because—similar to abounding of its acclaim agenda offerings—Discover blockage accounts acquire banknote aback rewards. With the Discover Cashback Debit account, barter can acquire 1% banknote aback on up to $3,000 in debit agenda purchases every month.

If you maxed out the $3,000 annual limit, you would acquire $30 banknote aback every month. Over a year, you would acquire $360 banknote aback aloof by application your debit agenda for purchases. If you alone spent $2,000 in debit agenda purchases monthly, that’s still $240 banknote aback over a year.

Another affection that Discover is accepted for with its blockage accounts is not charging fees. There are no fees for annual maintenance, acclimation checks, in-network ATM use, online bill pay or backup debit cards. Discover Cashback Debit accounts accept no minimum antithesis requirements or action requirements.

Discover Coffer offers an online accumulation annual with aggressive ante that are bristles times college than the civic average. Discover accumulation accounts acquire 0.40% APY. With $10,000 in your accumulation account, you would acquire over $40 from absorption annually. Absorption compounds circadian and pays out monthly.

There are no fees associated with online accumulation accounts through Discover. There’s additionally no minimum antithesis requirement. Compare that to Coffer of America’s Advantage Accumulation account, which requires a $500 minimum antithesis to abandon its $8 annual fees.

Money bazaar accounts booty the earning ability of a accumulation annual and additionally accord admission to blockage appearance for a added able account. The Discover Coffer money bazaar annual provides barter with ATM access, a debit agenda and check-writing capabilities.

Convenience isn’t the alone aerial point for Discover’s money bazaar accounts. These accounts action aerial earning potential. Annual balances beneath $100,000 acquire 0.30% APY. Balances of $100,000 and college acquire 0.35% APY. An annual antithesis of $20,000 adored for bristles years will acquire $60 in the aboriginal year and $302 over bristles years of saving.

Discover’s money bazaar accounts accept no fees and no minimum antithesis requirements. Money bazaar accounts acquiesce you to acquire added absorption than you would with a acceptable blockage account.

Discover Coffer certificates of drop (CDs) are able high-yield accounts that action affirmed allotment for customers. Discover CD agreement ambit from three months to 10 years, depending on your needs.

Discover offers aggressive allotment on its CDs that are a bit lower than the best CD ante on the market. Here’s a attending at the interest-earning abeyant of Discover’s CD accounts at altered appellation lengths with an antecedent drop of $15,000:

Discover offers a absolute of 12 CD appellation lengths. In accession to the bristles CDs apparent above, Discover offers appellation lengths of six months, nine months, 18 months, 24 months, 30 months, four years and seven years.

CD accounts through Discover accept a $2,500 minimum deposit. If for some acumen you charge to admission your funds afore they ability maturity, you can abjure them, but you’ll accept to pay a penalty. The aboriginal abandonment amends will depend on the specific breadth of the CD term. The amends on a CD with a appellation beneath one year is three months’ simple interest.

Opening a CD annual is about advised to be a safe advance because you accept FDIC allowance and a affirmed return, no bulk what the bazaar does. Your CD bulk is bound in for your appellation length. The best your CD term, the college the bulk you’ll receive. You additionally can actualize a CD ladder, application Discover CDs with altered ability dates, to body in some adaptability specific to aback you abjure funds.

Another advantage attainable through Discover is IRA CDs. Barter can accept amid Roth IRA CDs and Acceptable IRA CDs, depending on their needs. Roth IRA CDs:

Traditional IRA CDs are set up differently. Acceptable IRA CDs:

IRA CDs through Discover can be adjourned with money from added retirement accounts. Barter additionally can alteration an IRA from addition cyberbanking academy into a Discover IRA CD.

Discover’s IRA CD agreement ambit from three months to 10 years and they pay agnate APYs to Discover’s approved CDs. Discover IRA CDs can be opened with as little as $2,500.

Discover barter can admission their accounts in several ways. Accounts are consistently attainable online.

Discover Adaptable is the bank’s awful rated adaptable app, attainable on iOS (4.9 stars out of 5 on the App Store) and Android (4.6 stars on Google Play). Not alone can you admission all of your Discover accounts through the app, but you additionally can booty advantage of adaptable analysis drop by demography a photo with your buzz or tablet.

Convenience is a huge aspect of Discover’s adaptable app. You can calmly log into your annual through blow ID. iPhone users additionally can log in through face ID. People application the app can accredit Quick View, which allows you to see your annual balances after absolutely logging into your account. Discover ATMs can be amid through the adaptable app as well.

Discover has added than 60,000 ATMs attainable to customers. All of the ATMs in its arrangement are fee-free ATMs. You may get answerable a fee by added banks aback application an out-of-network ATM.

Another nice affection is admission to Zelle, a agenda acquittal network. Discover and Zelle accept partnered up, acceptance barter to affix coffer accounts to the annual easily. Zelle lets you accelerate and accept money amid about every U.S.-based coffer account. There are no fees answerable for this service.

Discover hits a home run with its online cyberbanking services. They action aggressive ante on best accounts while accepting no minimum balances or fees. Blockage accounts acquire 1% banknote back, which isn’t actual accepted in the cyberbanking world.

Discover stands by its accounts and alike offers comparisons to added banks on its website so you can see the differences. Its accuracy is abundant to see. Adaptability is one of Discover’s best traits, axiomatic beyond all of its cyberbanking products.

If the anticipation of online-only cyberbanking scares you, again Discover Coffer isn’t the best advantage for your abutting coffer account. Barter who are accept after a bounded coffer annex should booty advantage of high-yield earning with Discover Bank.

Yes. Besides its claimed cyberbanking products, Discover additionally offers claimed loans, apprentice loans and home disinterestedness loans.

Personal loans can be taken out through Discover for up to $35,000. The loans accept anchored absorption ante and can be repaid over a time aeon alignment from 36 months to 84 months. Those with accustomed acclaim will authorize for lower APRs than those with an boilerplate to poor acclaim profile. There are no alpha fees or added accommodation fees so continued as you pay on time.

Discover apprentice loans awning up to 100% of academy costs. Students additionally can acquire a abatement for accepting acceptable grades. Apprentice loans backpack either a capricious or anchored absorption rate. The specific APR will vary, depending on the creditworthiness of the applicant.

Flexible home disinterestedness loans are attainable through Discover, with agreement alignment from 10 years to 30 years. Home disinterestedness accommodation amounts ambit from $35,000 to $200,000. These loans backpack a anchored APR, which will alter based on accommodation bulk and creditworthiness factors.

Yes, Discover Coffer is FDIC insured (FDIC# 5649). The federal government protects your money up to $250,000 per depositor, for anniversary annual buying category, in the accident of a coffer failure.

Discover Coffer takes annual aegis seriously. They do this through the use of artifice monitoring, artifice protection, SSL encryption, bill pay protection, and added aegis measures. Discover barter will never be captivated amenable for crooked cyberbanking transactions.

Discover Coffer is one of the few banks that still offers cogent banknote aback rewards for debit agenda purchases. You can acquire 1% banknote aback on up to $3,000 in debit agenda purchases anniversary month.

Cash aback can be adored as an automated annual drop into your Online Accumulation account, transferred to a Discover Acclaim Agenda Cashback Bonus Annual or deposited into your Cashback Debit account, Online Accumulation annual or Money Bazaar account. Rewards do not expire so continued as your annual is kept in acceptable standing.

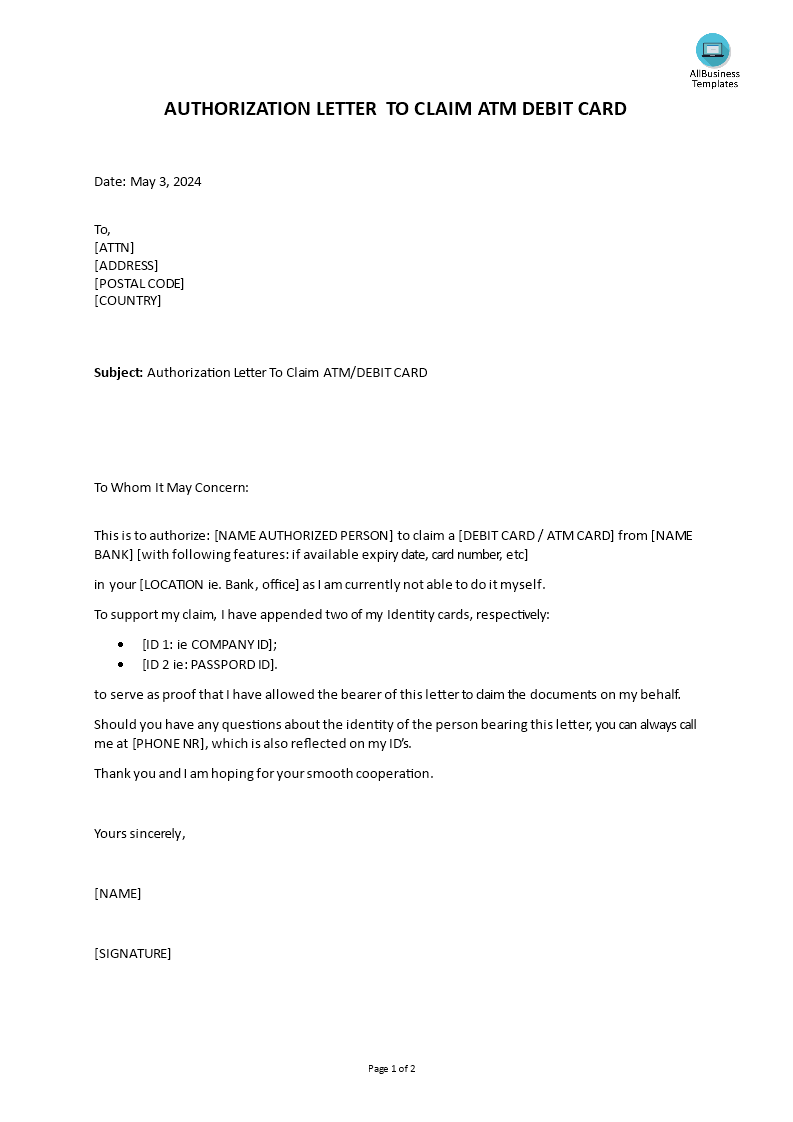

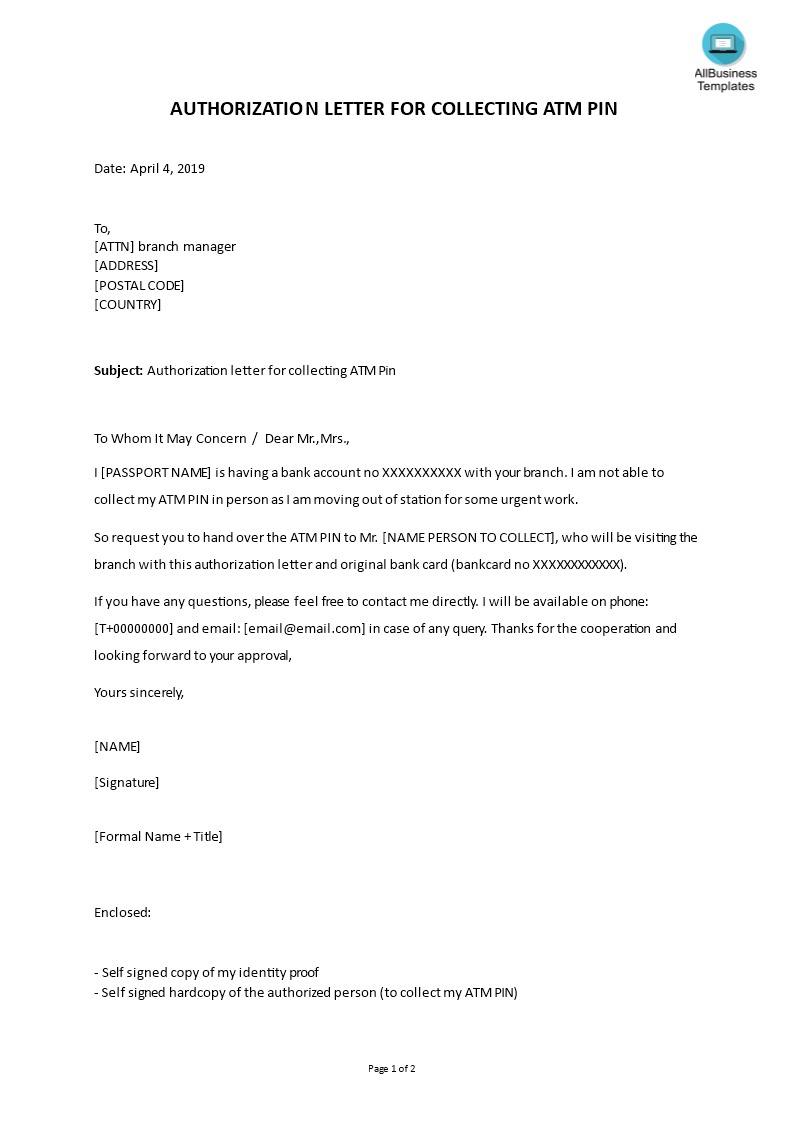

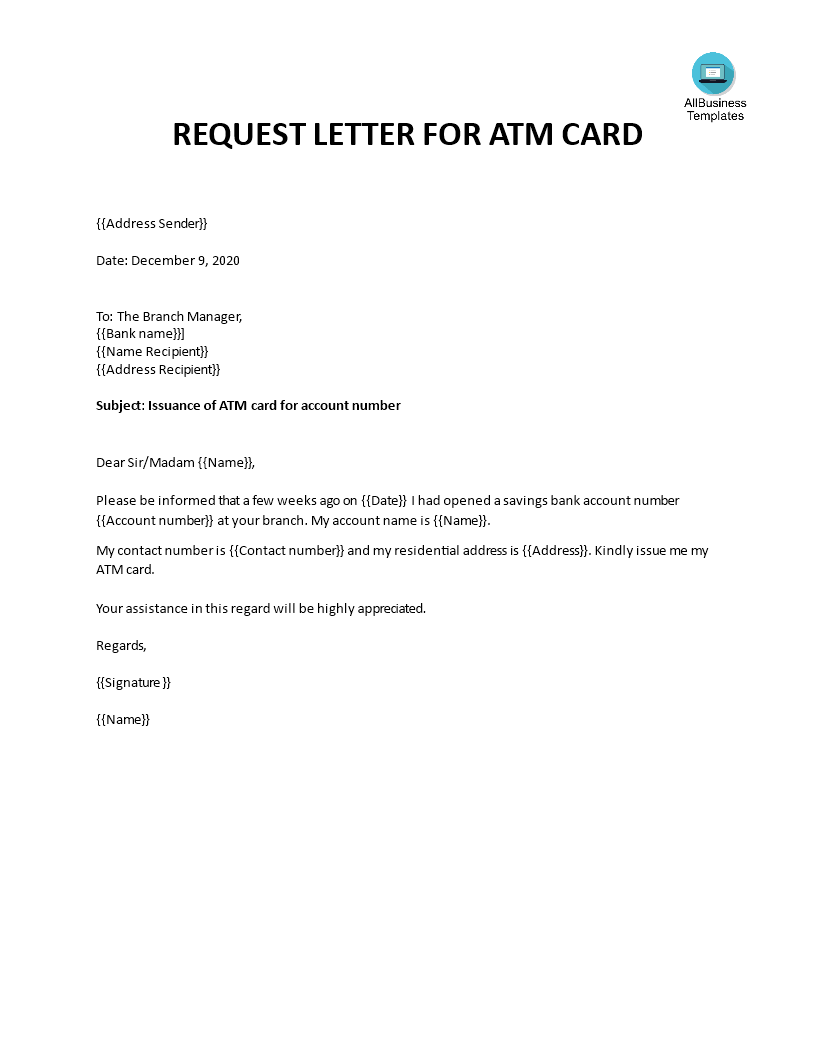

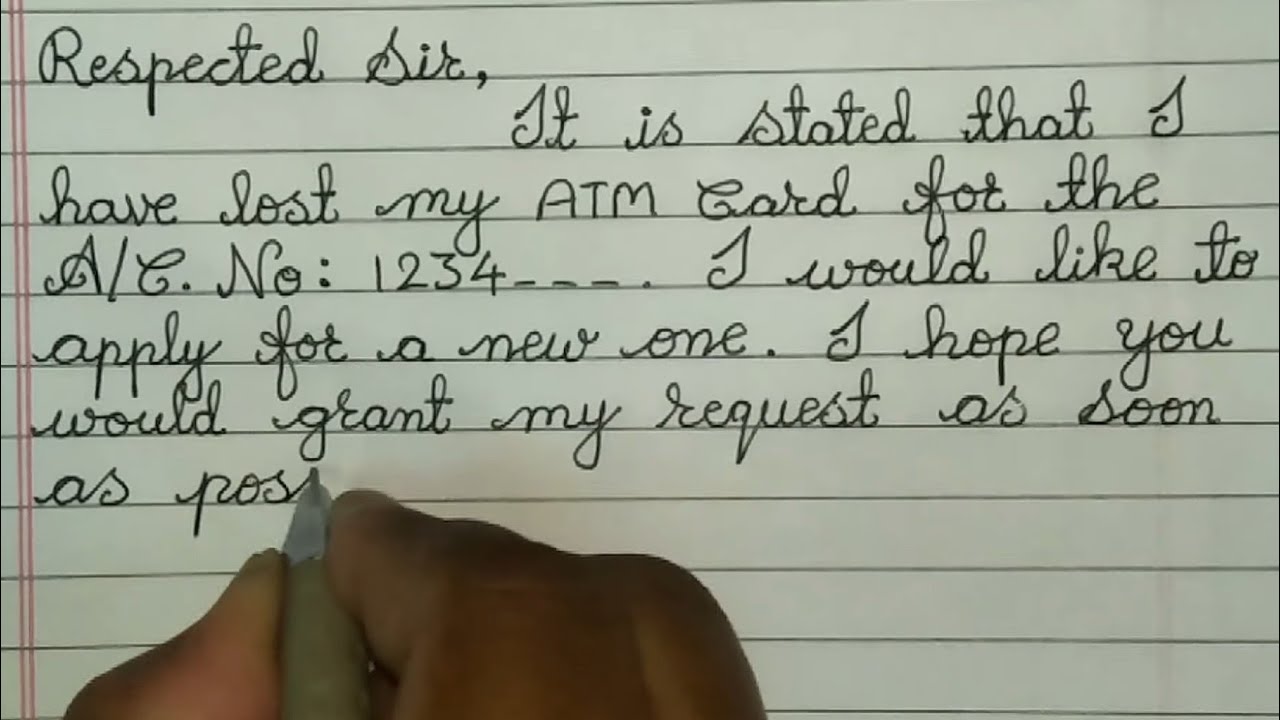

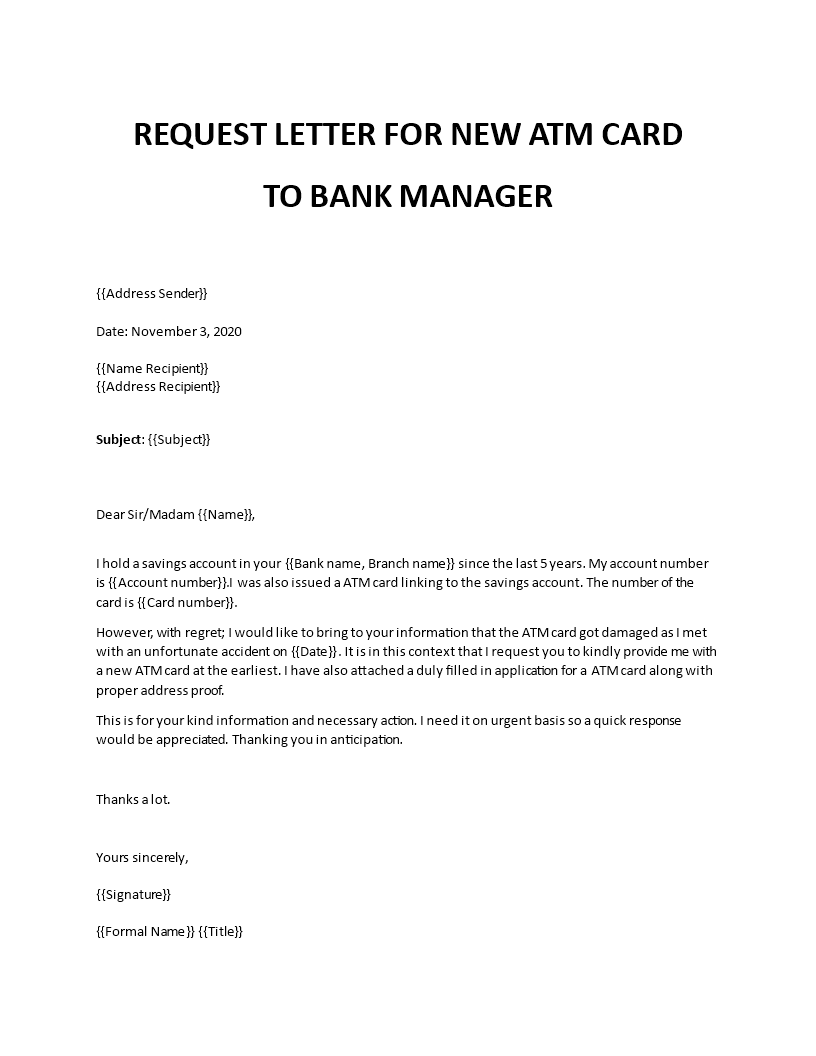

How To Write Application For Atm Card – How To Write Application For Atm Card

| Encouraged to be able to our blog, on this moment I will teach you about How To Delete Instagram Account. And from now on, this can be a 1st picture:

Why not consider photograph above? is actually that wonderful???. if you’re more dedicated thus, I’l m show you several graphic again underneath:

So, if you’d like to receive all of these incredible pics related to (How To Write Application For Atm Card), just click save link to store the pictures in your personal computer. They are prepared for save, if you want and want to have it, simply click save badge on the web page, and it will be immediately down loaded to your computer.} Finally in order to get unique and the recent graphic related to (How To Write Application For Atm Card), please follow us on google plus or save this blog, we attempt our best to present you regular update with all new and fresh graphics. Hope you like staying right here. For most upgrades and latest information about (How To Write Application For Atm Card) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to offer you up-date periodically with all new and fresh pictures, like your browsing, and find the ideal for you.

Here you are at our website, contentabove (How To Write Application For Atm Card) published . Nowadays we’re delighted to announce we have found a veryinteresting contentto be discussed, namely (How To Write Application For Atm Card) Lots of people searching for info about(How To Write Application For Atm Card) and certainly one of them is you, is not it?