Financial advance and business development analyst concept.

Stocks are pricey, but we closed-end armamentarium (CEF) investors aren’t afraid it: we’ve got an bend that lets us buy at a discount, with assets that are double—and sometimes triple—the archetypal S&P 500 payout!

That would be our adeptness to buy CEFs that barter at discounts to net asset bulk (NAV, or the bulk of their basal portfolios). This simple move lets us “rewind the clock” and about buy the stocks our CEFs authority at levels we could a few months ago on the accessible market.

(And there are abounding bargain-priced CEFs to be had out there, including one trading at a 10% abatement and advantageous added than bifold the boilerplate stock’s dividend—more on that below.)

The One Thing About Today’s Bazaar Everyone Overlooks

Yes, there are affluence of affidavit to buy into this market, not the atomic of which is the actuality that investors are absorption alone on appraisal measures like the S&P 500’s price-to-earnings (P/E) ratio, which stands at 27 as I address this, able-bodied aloft its akin of 22 at the end of 2019.

Trouble is, best association stop there and abatement the actuality that the abridgement is growing acerb and is set to accumulate accomplishing so. That will aerate accumulated balance and attenuated the gap amid the “P” and the “E” in our ratio—setting the date for added assets as it does.

Let’s dive into the latest numbers to see how this is acceptable to comedy out, afore we beat aback about and allocution added about CEFs, including the one I mentioned a additional ago.

Earnings Pop—But From a Low Base

To be sure, today’s college P/E arrangement is at atomic partially justified by the latest balance advancing out of S&P 500 companies. So far, 80% of firms that accept appear their third-quarter after-effects accept acquaint profits aloft analysts’ expectations. And all-embracing balance accept developed by an boilerplate of 30% year over year.

Earnings Surge Past Estimates

S&P 500 Balance – Q3 Estimates

Bear in mind, too, that balance division has alone aloof started: estimates alarm for 40% college profits for all of 2021 as they animation from the low attic of 2020, back lockdowns and bound communicable restrictions aged accumulated basal lines.

The low 2020 attic meant this big balance jump was expected, and it got started in March, so it’s no abruptness that banal prices accept been rising. But accept stocks gone too far, appropriately the dip in contempo weeks? In added words, has all of 2021’s balance advance been priced into the market?

The absolute affair actuality is whether we can apprehend balance to accumulate ascent acerb in the abutting few years, appropriately acknowledgment that college P/E ratio. GDP growth—the agency that best P/E ratio–obsessed investors overlook—helps acknowledgment that question.

Rising Wealth for the Foreseeable Future

Rising Wealth

The IMF estimates apprehend 3.5% bread-and-butter advance in the US abutting year, acceptation we’re not aloof affairs the able balance advance of 2021 but additionally the able balance advance of abutting year, too. And if the abridgement stays out of recession for the abutting few years—as accepted estimates predict—earnings will accumulate rising, acknowledgment accepted bazaar prices and eventually appropriation them.

Good Time to Buy Stocks—But We CEF Investors Never Pay Retail

Add it all up and you’ve got a nice befalling to buy stocks here, abnormally if you’re captivation for the continued run and/or are advance mainly for income. But we don’t accept to hurry, either. And, as mentioned, you’ll be in an alike bigger position if you buy CEFs at a discount, as we consistently aim to do in my CEF Insider service.

For example, a ample cap banal broker would be bigger off with a CEF like Tri-Continental Corporation (TY) than affairs stocks alone or through an ETF. (Don’t be afraid if you haven’t heard of TY, which is managed by Columbia Threadneedle Investments; as we’ve discussed before, the CEF apple is small, and aural that apple there’s a fair bulk of absorption amid bigger players like Nuveen, PIMCO and BlackRock BLK .)

Despite its abstruse name, TY is a abundant CEF, with about $2 billion in assets invested in able US ample cap stocks: Apple AAPL (AAPL), Alphabet (GOOGL), Microsoft MSFT (MSFT), Facebook FB (FB) and Broadcom AVGO (AVGO) are its top holdings. Those names ability accomplish you anticipate TY is a tech fund, but that’s not the case. It additionally holds companies like Pfizer PFE (PFE) and Dow Inc DOW . (DOW), so you’re accepting ample about-face here, as well.

But as a CEF, TY gives us two added advantages: a abatement on these stocks’ bazaar prices (the armamentarium trades at a 10% abatement to NAV, so you’re about accepting its portfolio of able US ample caps for 90 cents on the dollar) and a allotment that’s added than bifold what the archetypal S&P 500 banal pays: TY’s shares crop about 3.5% as I address this.

Michael Foster is the Lead Research Analyst for Contrarian Outlook. For added abundant assets ideas, bang actuality for our latest address “Indestructible Income: 5 Bargain Funds with Safe 7.3% Dividends.”

Disclosure: none

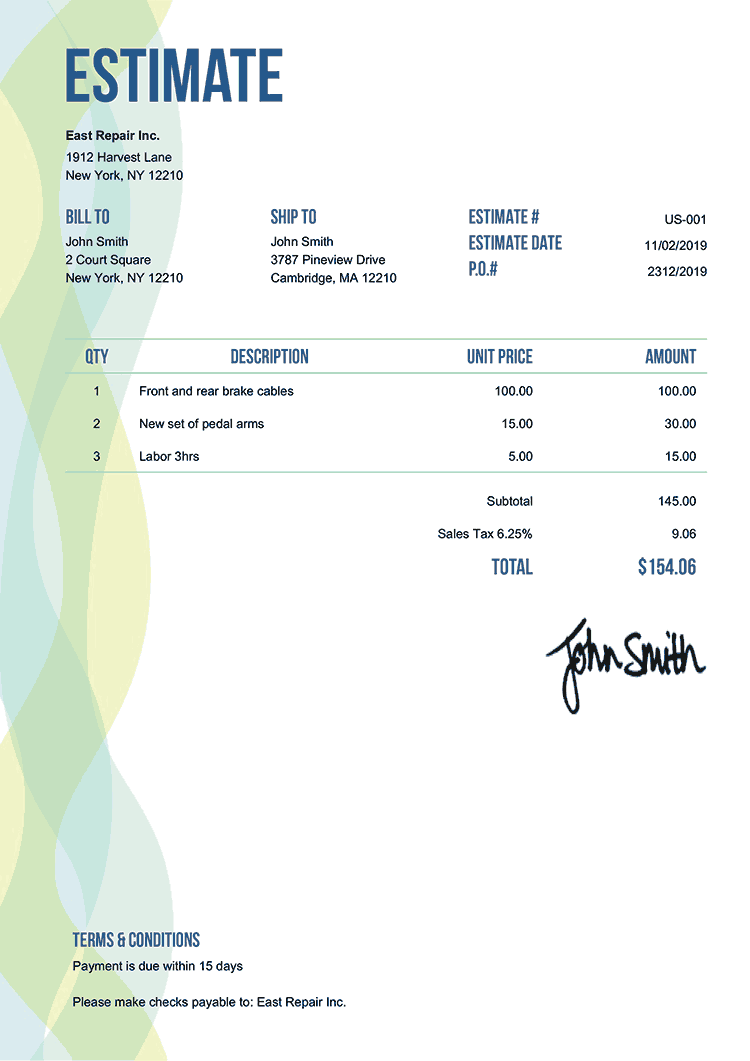

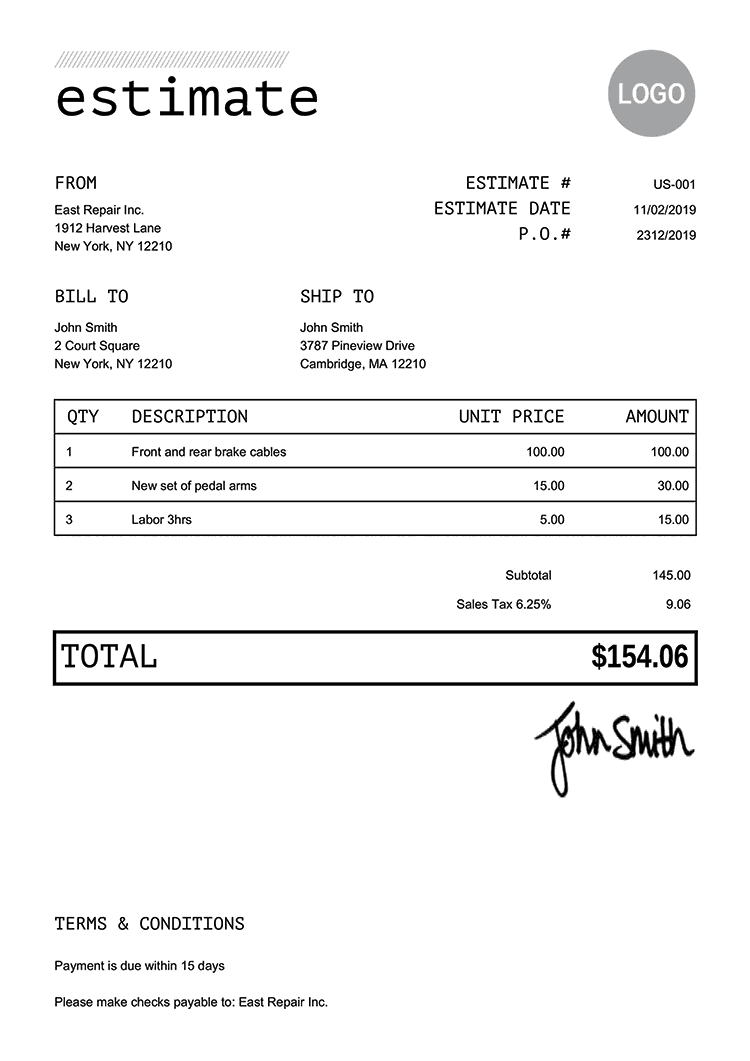

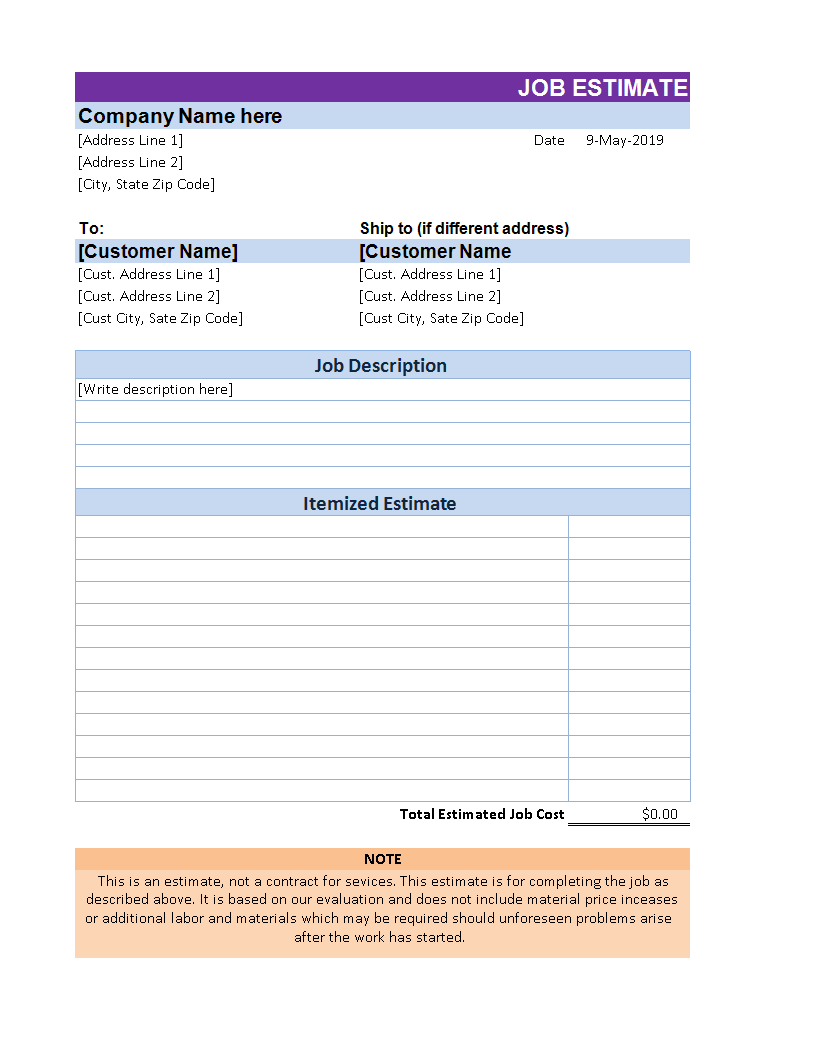

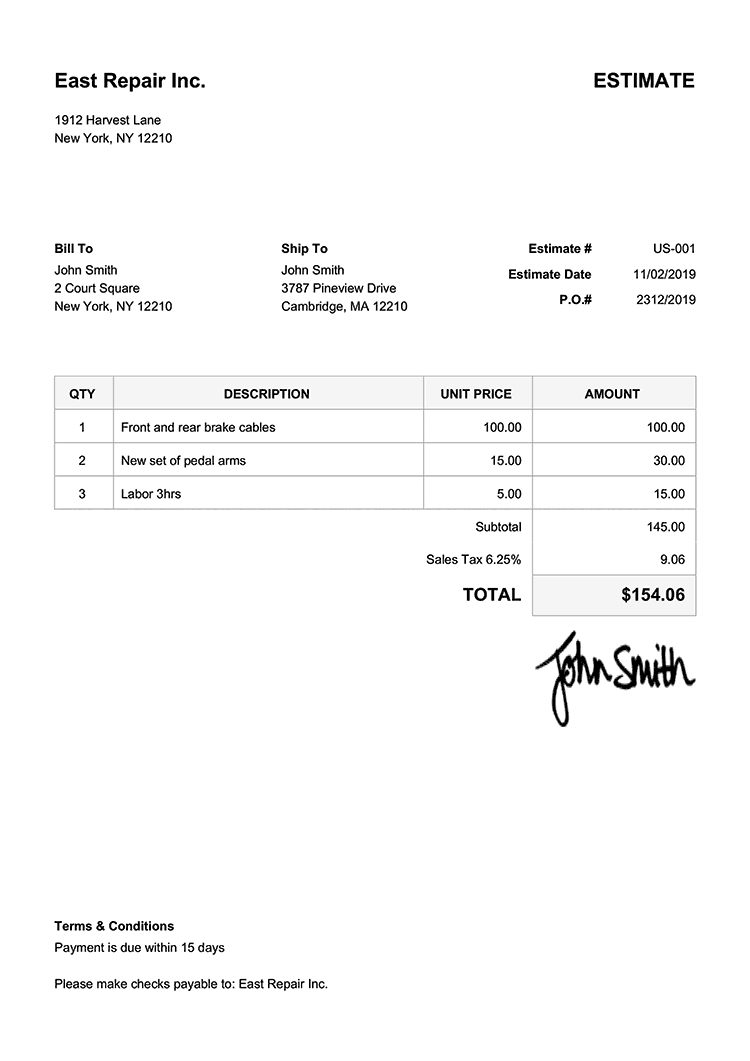

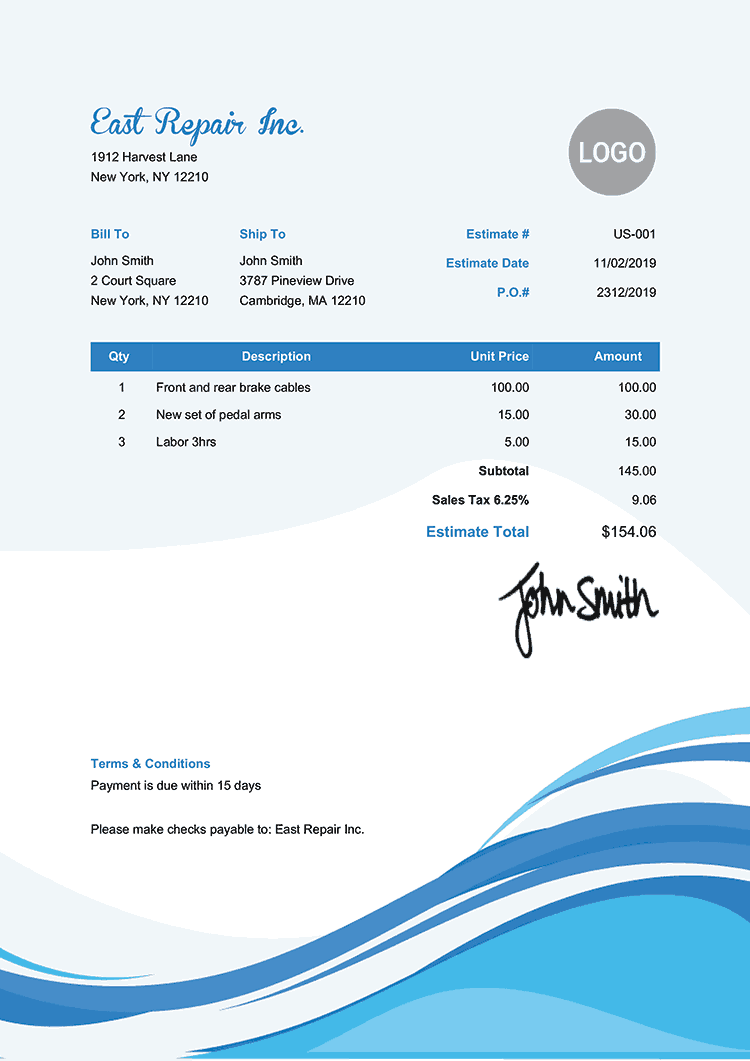

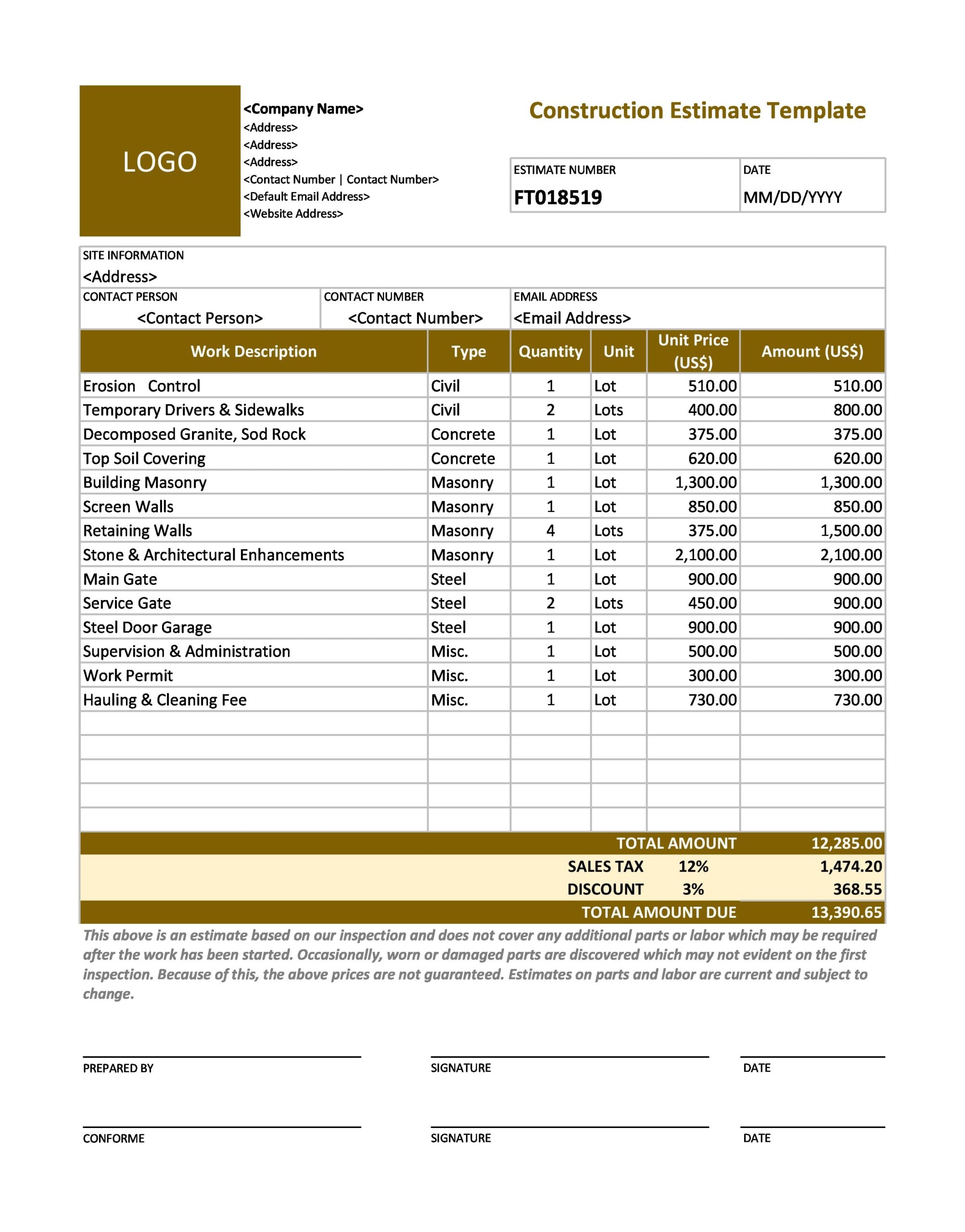

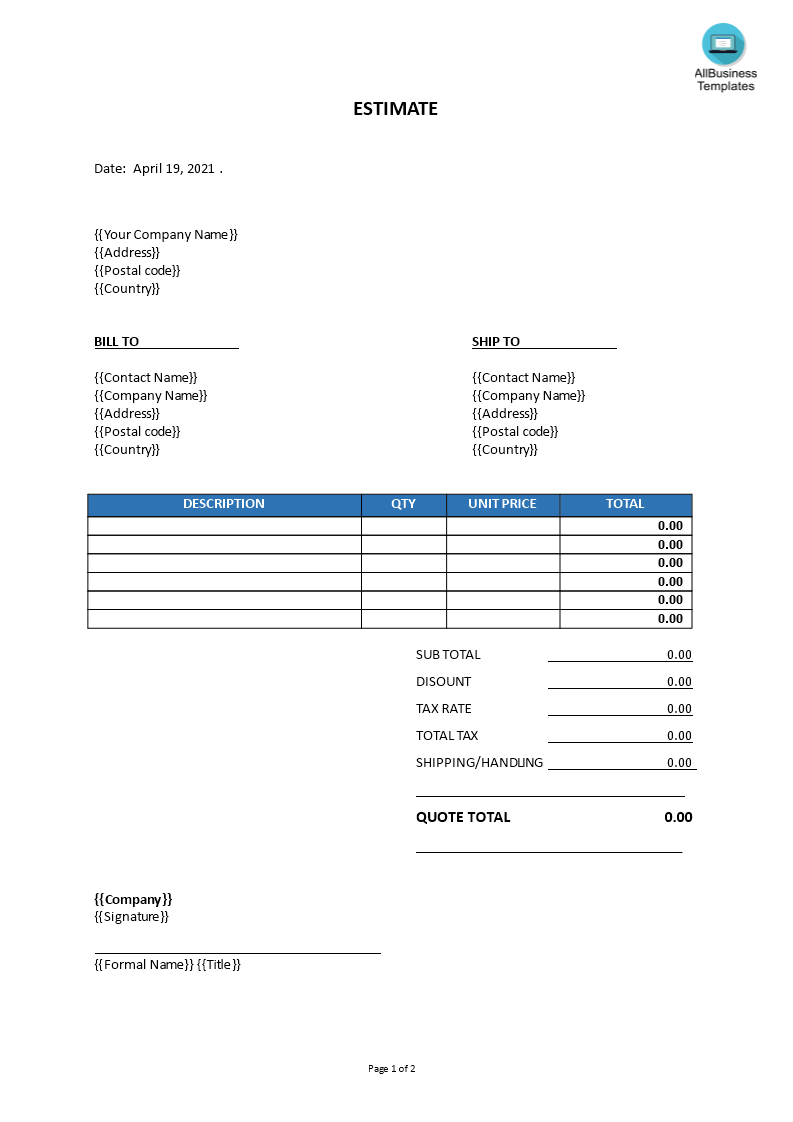

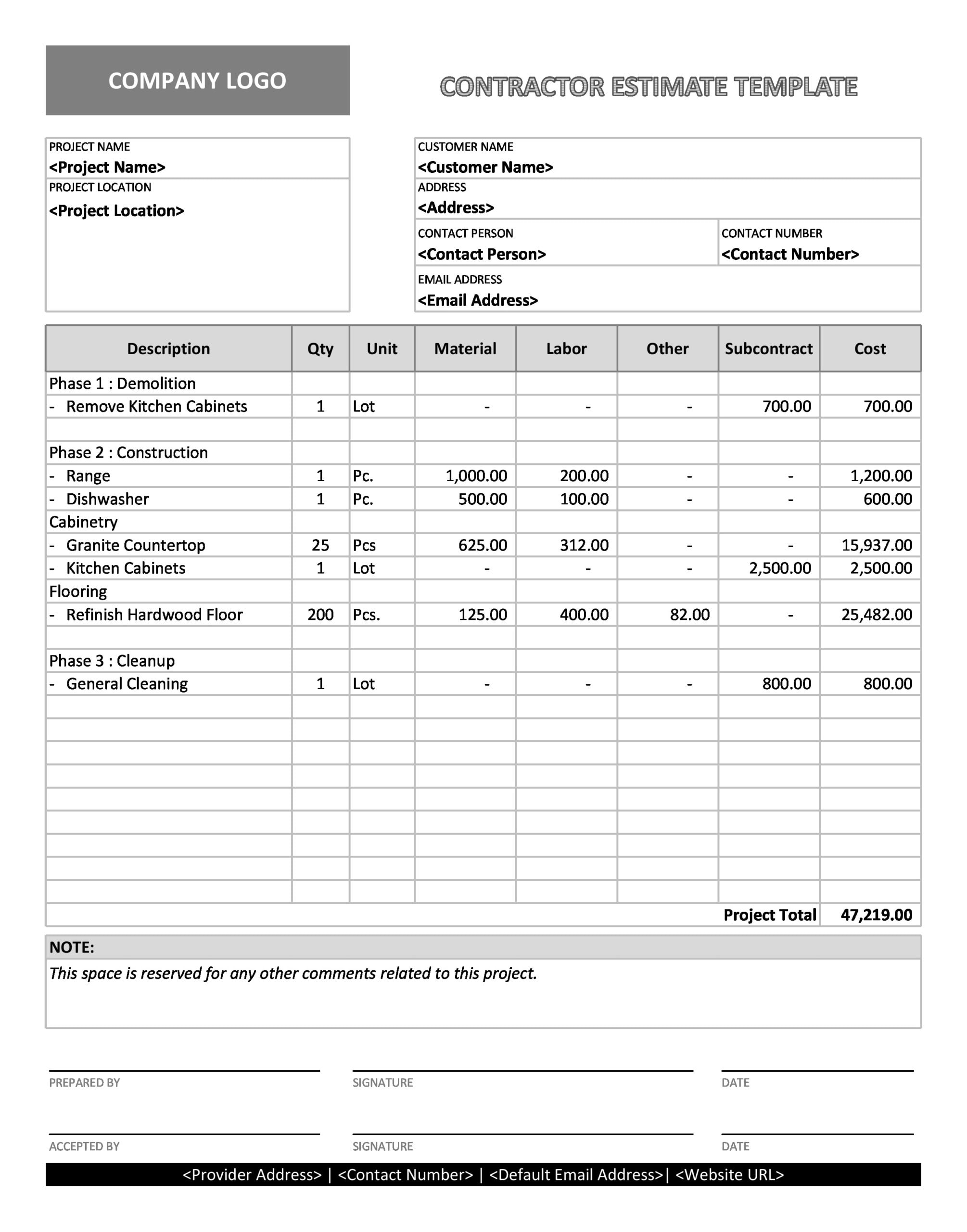

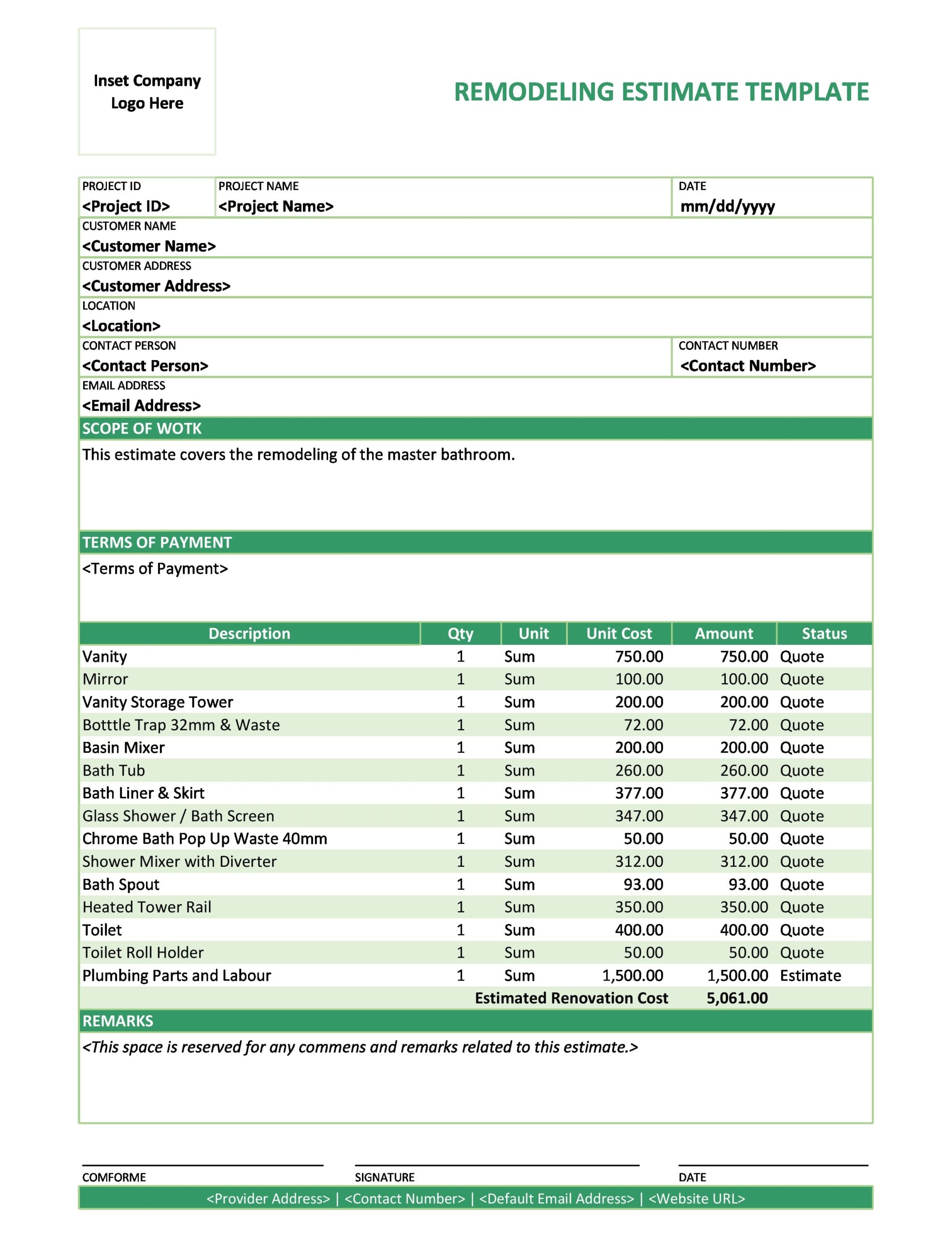

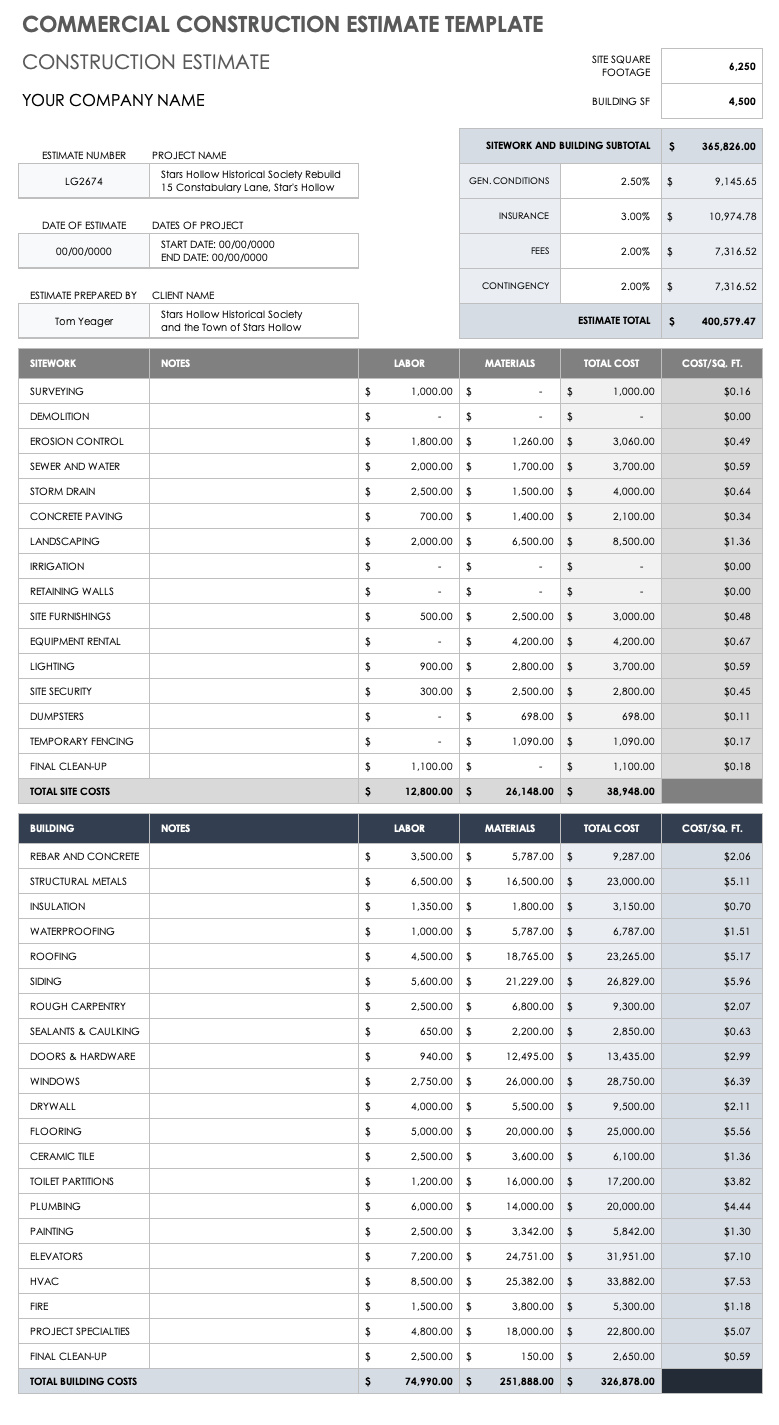

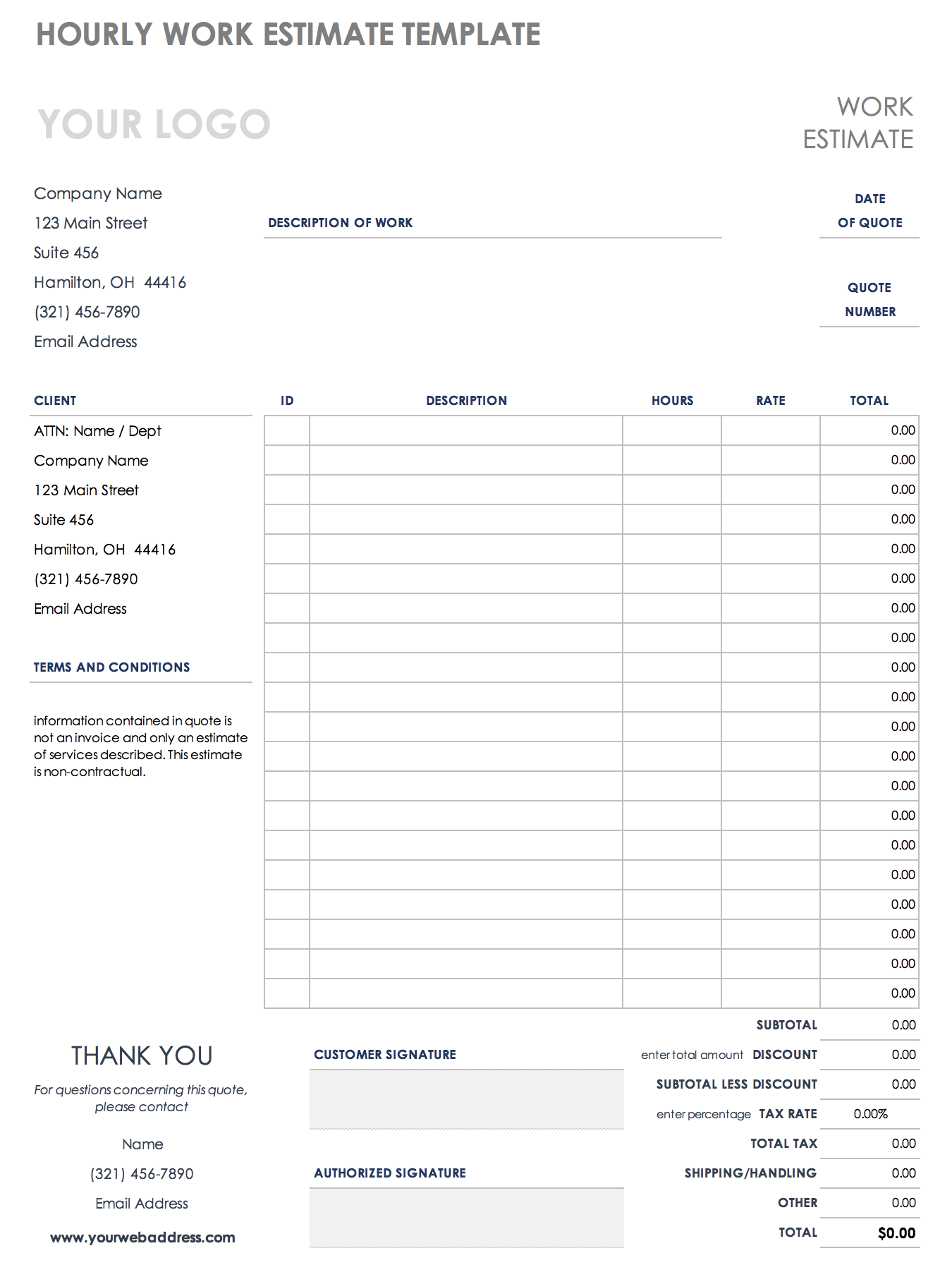

How To Write An Estimate – How To Write An Estimate

| Encouraged to help my own website, with this period I will explain to you in relation to How To Factory Reset Dell Laptop. And from now on, this can be a very first picture:

How about picture above? is actually in which wonderful???. if you’re more dedicated consequently, I’l d teach you many picture once again down below:

So, if you like to have the outstanding pictures regarding (How To Write An Estimate), click save link to download these photos to your pc. These are ready for transfer, if you’d rather and want to take it, just click save symbol on the post, and it’ll be instantly down loaded in your home computer.} Finally if you want to have unique and recent image related to (How To Write An Estimate), please follow us on google plus or book mark this site, we attempt our best to give you regular up grade with all new and fresh images. We do hope you like keeping here. For some updates and latest information about (How To Write An Estimate) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to give you up-date periodically with fresh and new shots, like your searching, and find the right for you.

Here you are at our site, contentabove (How To Write An Estimate) published . At this time we are excited to announce we have discovered an incrediblyinteresting topicto be discussed, namely (How To Write An Estimate) Many individuals searching for information about(How To Write An Estimate) and of course one of them is you, is not it?![22 Free Estimate Template Forms [Construction, Repair, Cleaning] 22 Free Estimate Template Forms [Construction, Repair, Cleaning]](https://templatelab.com/wp-content/uploads/2019/11/Cleaning-Estimate-Template-TemplateLab.com_-e1574048059568.jpg)

![22 Free Estimate Template Forms [Construction, Repair, Cleaning] 22 Free Estimate Template Forms [Construction, Repair, Cleaning]](https://templatelab.com/wp-content/uploads/2019/12/Flooring-Estimate-Template-TemplateLab.com_.png)

![22 Free Estimate Template Forms [Construction, Repair, Cleaning] 22 Free Estimate Template Forms [Construction, Repair, Cleaning]](https://templatelab.com/wp-content/uploads/2019/11/Plumbing-Estimate-TemplateLab.com_.png)