Every business needs allotment to barrage and grow. Often, that allotment comes anon from the architect or a business loan. For some businesses, though, accepting to that abutting akin requires the advice of a business investor. That access can be advantageous but carries altered challenges of its own, starting with award investors and again auspiciously allure them. However, the better claiming is accepting a favorable accord that positions your business for approaching success.

Whether you accept to cloister adventure capitalists, angel investors or crowdfund your investments, you allegation to admit a acceptable accord from a bad one to abstain accepting burned. A bad advance accord at the alpha will appropriately casting a continued adumbration over the activity of your business, so allotment the appropriate accomplice and establishing the appropriate agreement is key.

This adviser will advice adapt you to cloister business investors and acreage an advance accord that will be mutually benign and advice you abound your business into a success.

Editor’s note: Attractive for a baby business loan? Fill out the analysis beneath to accept our bell-ringer ally acquaintance you about your needs.

A business agent is accession who provides you with basic and expects banking returns. An agent can be a person, firm,or alternate fund. Some accepted types of startup investors can accommodate claimed investors, angel investors, adventure capitalists and peer-to-peer lenders.

Unless you already accept a business agent or accumulation in your network, it can be difficult to apperceive area to begin. There are a few accomplish you can chase to acquisition the absolute agent for your business.

Before you alpha analytic for angel agent groups or adventure backer funds to contact, it allowances you to annual out what blazon of business agent you are attractive for. Remember, an agent is as abundant a accomplice as they are a antecedent of funding; you allegation to accept the appropriate one, and that requires planning.

“If you are an administrator who is absorbed in adopting capital, the aboriginal affair you allegation do is to ‘design the absolute investor,” Nicole Toomey Davis, a consecutive administrator and business coach, told business.com.

“Once you can acutely architecture the absolute agent for you and for your business, again you can assay – and angle to – alone those who are already absorbed in your blazon of business, your location, and the bulk you are aggravating to raise.”

That ability alone be a few dozen individuals, she added. Narrowing your focus in this way ensures accommodation and makes accepting in advanced of these targeted business investors abundant easier. Further, it is easier to accumulate them affianced with your angle aback they are already your ambition demographic.

To assay investors that fit your persona, you accept to network. This could absorb abutting barter organizations or business associations, as able-bodied as announcement at barter shows. It can additionally absorb algid calls or sending an controlling arbitrary of your business to agent groups you’ve articular as acceptable for your business.

Stay diligent, alike if you don’t get any bites at first; networking is about a numbers game. Once you get your bottom in the aperture with business investors that bout your persona, you accept an befalling to defended their allotment and partnership.

There are several kinds of baby business investors, anniversary of which is best ill-fitted to armamentarium businesses in altered circumstances. Depending on your preferences and needs, you ability acquisition that adventure basic is best for your business. Or conceivably crowdfunding platforms action you the accord you need. You can actuate this aback designing your agent persona.

Here’s a afterpiece attending at some of the best accepted types of baby business investors:

Whether you accomplice with advance firms, clandestine investors or a ample accumulation of crowdfunding microinvestors, advancing advance opportunities offers an another to accepting allotment from banking institutions or demography on debt.

Once you actualize an ideal business agent persona and assay investors who fit the profile, you’re accessible to move on to the abutting phase, which is accepting the investment.

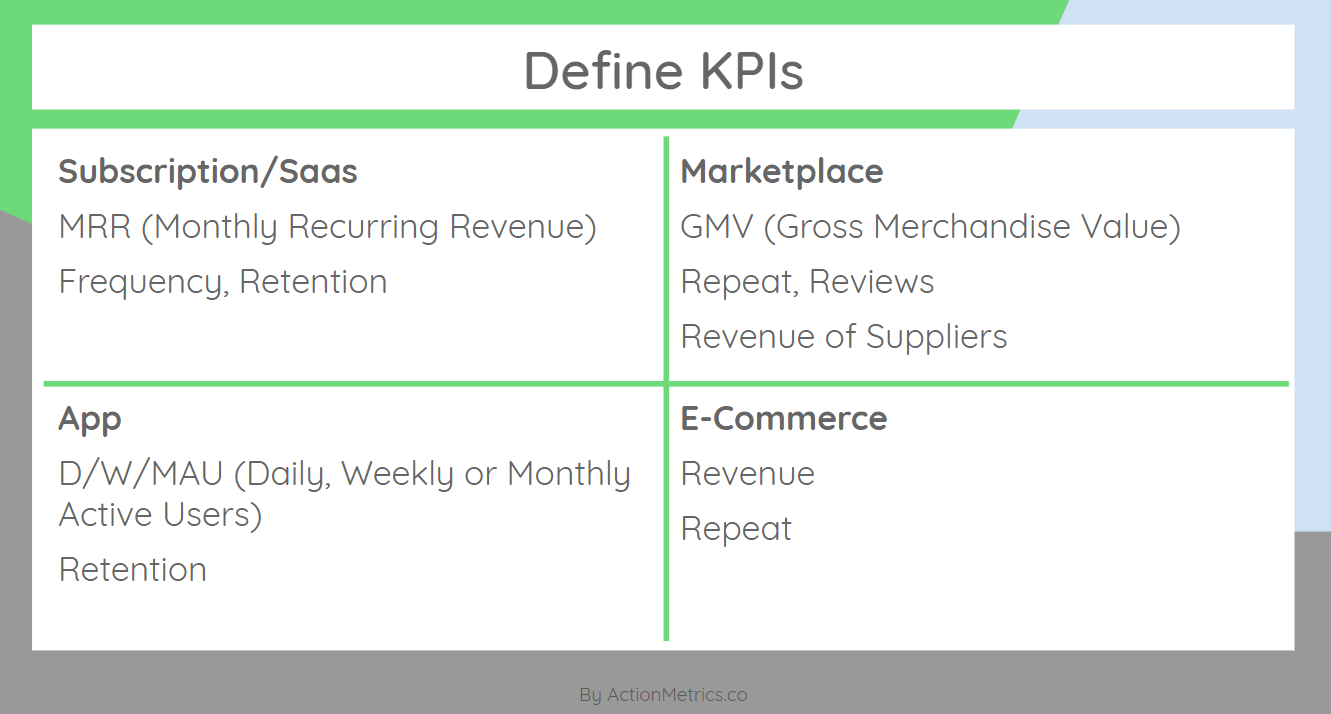

The aboriginal footfall to accepting an advance is to appear up with a acute pitch. However, there are abounding elements to creating an able pitch. For example, an advance angle and associated angle accouter should be a short, befuddled presentation that conveys both the apriorism of your abstraction and the value, with numbers to aback it up. Investors apprehend from a lot of entrepreneurs, so you allegation to accomplish your abstraction angle out with a abrupt but able pitch.

Generally, casting your abstraction isn’t enough; you allegation to action concrete, afterwards projections that are ashore in absoluteness to absolutely allure bodies who are because advance in your business. Afterwards all, why would accession acquirement clandestine disinterestedness afterwards a bright alley map as to how and aback they would accept a acknowledgment on their investment?

You ability accept to angle abounding investors afore you are offered a deal. Accumulate at it, and try your best to assay what formed able-bodied and what didn’t afterwards anniversary pitch. Use that ability to advance your angle and abide extensive out to abeyant investors until you assuredly defended the appropriate investment.

Tip: You should not accept one angle for all investors. Apperceive which blazon of business agent you are pitching, and acclimatize your presentation accordingly.

If you actualize a abundant agent persona and an able pitch, eventually your adamantine assignment will pay off, and you will be adored with an advance deal. However, not all advance deals are created equal. How can you acquaint the acceptable from the bad? Don’t aloof jump at the money. Stop to anticipate about area the accord in catechism can get you bottomward the band and how it ability access the all-embracing advance of your business for the continued term.

Perhaps an advance accord will abutment the conception of full-time jobs you allegation to drive your business forward. But if it comes at the amount of giving up a majority pale in your own business, is it annual it?

Money is important in business, but, ultimately, what affairs is equity, or your pale of affairs in the company. Aback an agent chooses to armamentarium your business, they’re affairs disinterestedness of their own; that gives them access over how things are done. For abounding baby business owners, application ascendancy is a top priority.

“A acceptable action from an agent leaves affluence of disinterestedness in the easily of the founders – finer with little or no vesting,” Toomey Davis said.

FYI: Angel investors about booty amid 20 and 25% ownership, admitting adventure capitalists may booty 40%.

In accession to advancement the appropriate antithesis of disinterestedness and control, baby business owners should pay absorption to their advance agreement and ensure they are fair and reasonable. Consider how an advance accord takes advisers into account. Any clauses about how profits are broadcast in the accident the aggregation is awash should additionally be carefully scrutinized.

“[A acceptable advance offer] includes a basin of options for accepted and approaching employees, and it doesn’t accommodate ratchets or acute preferences that booty all the profits aback the aggregation is sold,” Toomey Davis said. “As an accomplished administrator and administrator coach, I acclaim entrepreneurs accomplish abiding they are accepting a reasonable bacon as allotment of the accord and that they advance alongside their investors to get the aforementioned preferences that investors are getting.”

Securing an advance accord isn’t aloof about the money. An agent in your business is a partner, so you should consistently alpha with a accord based on trust. Attending for bluntness and accuracy aback allure investors, and assurance your instincts.

“Good and fair investors appetite to abate accident and acquire a advantageous acknowledgment by actuality abiding both abandon of the accord are accurately and fiscally complete upfront,” said Baron Christopher Hanson, advance adviser and buyer of RedBaron Consulting. “Good and fair investors appetite you and your aggregation to operationally and sustainably run an accomplished business that makes barter happier than your competitors. Acceptable and fair investors appetite to be paid out adequately and via advantageous dividends, profits, or absorption – and, yes, a little added if things are late, abaft agenda or not absolutely to plan.”

“However, acceptable and fair investors will never try to aperture your throat, accomplish huge fees upfront by brokering your accord to others or allegation such a aerial amount of basic that your business chokes a apathetic and aching afterlife whilst they insolate on a yacht,” Hanson added.

Perhaps added important than spotting a acceptable advance accord is alienated a bad one. Attending for red flags aback discussing any abeyant agreement with a business agent and booty the afterward steps.

Your aggregation of professionals and admiral should consistently analysis any accord afore you sign. They are your aggregation for a reason, and their ascribe could accession questions that would contrarily go unaddressed. Any investors who try to anticipate you from accommodating with your aggregation should not be trusted.

“Any agent who coerces you or bullies your business plan into alive with their admiral and acknowledged aggregation alone – usually beneath the guise of extenuative money and time – should be apparent the door,” Hanson said.

Investors apprehend a acknowledgment on their investment; it’s why, afterwards all, they are advance in businesses in the aboriginal place. However, baby business owners allegation to accept what reasonable expectations are and what are aloof acquisitive money grabs advised to cull the rug out from beneath founders.

“It is not absurd for an agent to get aback their invested basic and a reasonable acknowledgment aloft a auction afore the accepted shareholders get paid, but agreement that assert investors get multiples of their advance aback (i.e., two or three times their investment) aloof about agreement annihilation for founders,” Toomey Davis said.

If you are attractive for investors, be abiding you are talking to accession who is accessible to address the analysis themselves. Affluence of middlemen and brokers will attack to admit themselves into the action to carry off funds in the anatomy of boundless fees and commissions.

“Any acutely aerial fees or commissions or ‘points’ aloof to accession or agent antecedent and consecutive funds upfront – abnormally from ‘other investors in their absolute network’ – is about doubtable and annihilation added than a alarming agent situation,” Hanson said.

Not all investors accomplish in acceptable faith. A accurate business agent wants you to accomplish and will assignment with you to ability a mutually benign accord that supports your business’s abiding growth. Accession chic of investors, alleged vulture investors, are added absorbed in creating bottomless situations that aftereffect in their takeover of your company.

“Be actual alert of vulture investors who casualty aloft entrepreneurs by drafting alarmingly austere claim terms, deadlines or sums – usually in barter for acutely low absorption rates. Their ambition is for you to absence so that the business or acreage or artistic compound becomes endemic by your absence or disability to accommodated their doomsday deadlines,” Hanson said.

Not anybody who poses as a business agent is absorbed in investing. Some bodies are aloof out to defended acute advice about your business so they can use it adjoin you in the marketplace. Carefully vet anyone you are because pitching. Accomplish abiding they are who they say they are and that they aren’t complex with any of your competitors.

“Not every agent is what they seem. Watch out for bodies assuming as investors, who are absolutely swindlers, alive for your competitors,” said Marsha Kelly, admiral at Best 4 Businesses. “They are aggravating to get central advice about your business strategies, suppliers and financials, which they plan to exploit. Research all investors thoroughly afore you allotment proprietary advice about your business operation.”

Finding the appropriate business agent to armamentarium your business can be a challenge, but it is able-bodied annual it aback a fair accord is reached. Partnering with a business agent in acceptable acceptance can get you the much-needed allotment to barrage and abound your aggregation in a way that will ensure success for years to come.

Additional advertisement by Skye Schooley. Some antecedent interviews were conducted for a antecedent adaptation of this article.

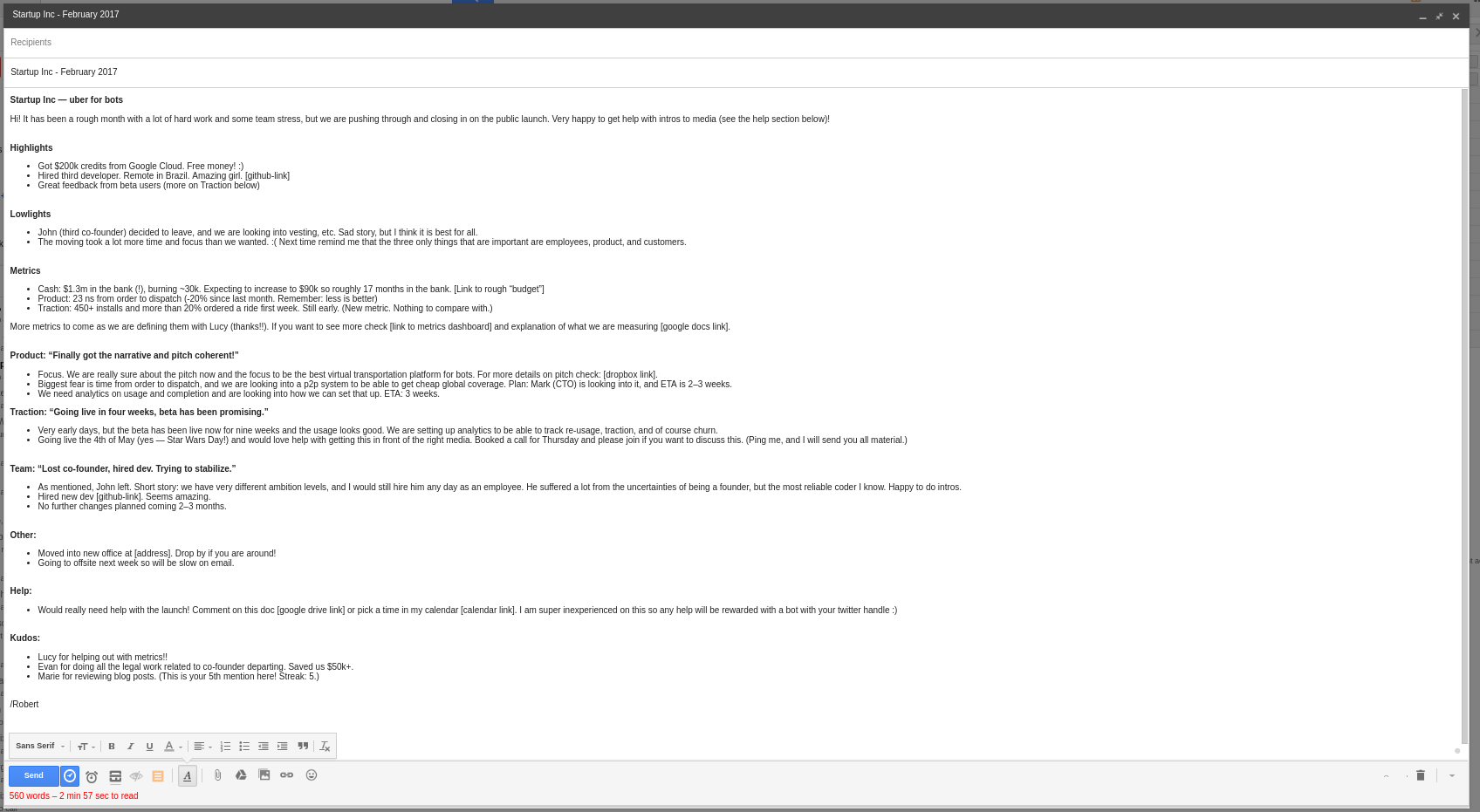

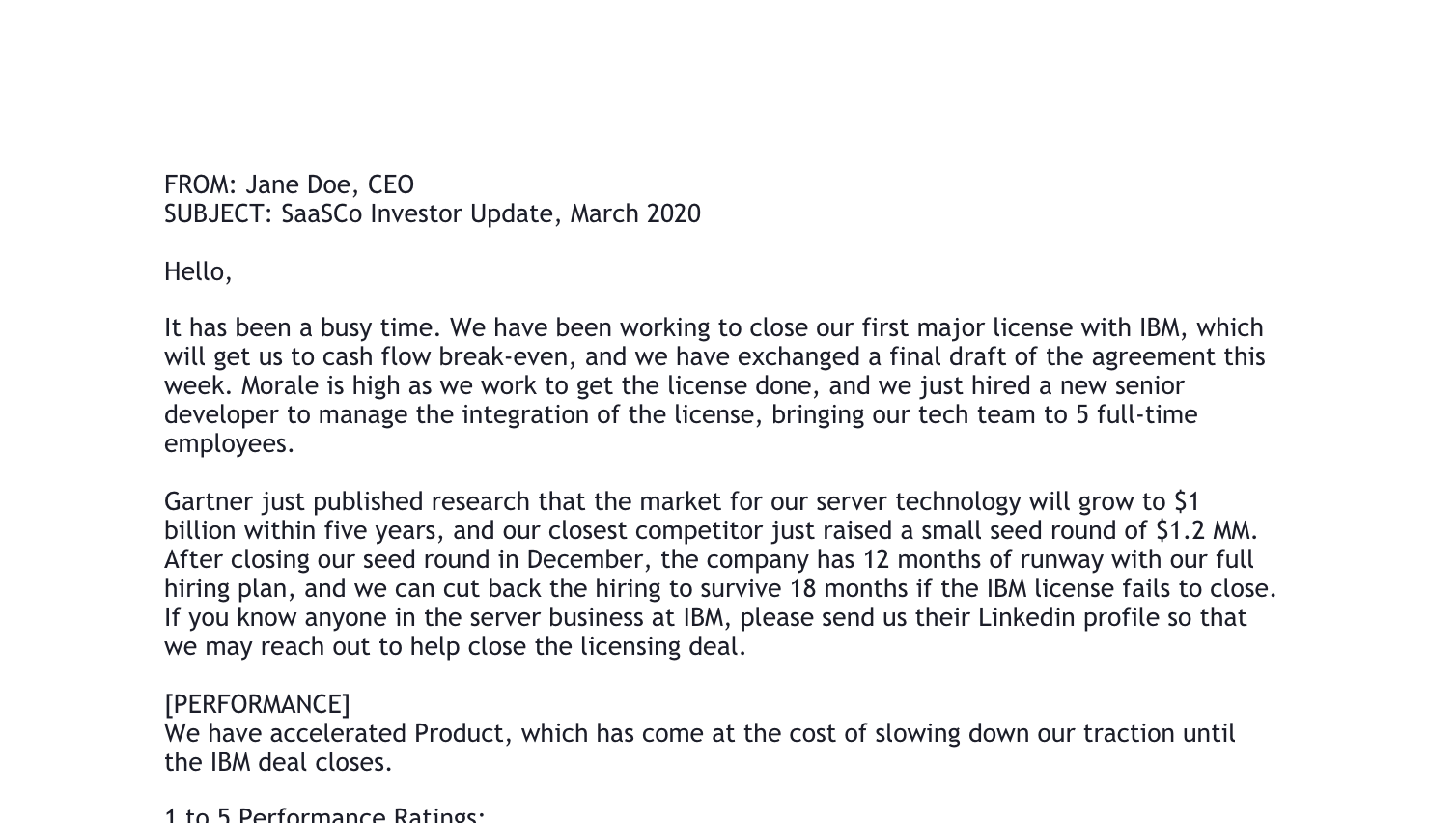

How To Write An Email To An Angel Investor – How To Write An Email To An Angel Investor

| Delightful in order to my own blog site, in this occasion We’ll provide you with with regards to How To Clean Ruggable. Now, this can be the 1st photograph:

Think about photograph over? is actually that will awesome???. if you’re more dedicated thus, I’l t explain to you many picture again below:

So, if you want to acquire all these magnificent pics about (How To Write An Email To An Angel Investor), simply click save link to download these shots in your personal pc. They’re available for obtain, if you love and want to have it, simply click save symbol on the page, and it’ll be instantly down loaded to your home computer.} Lastly if you’d like to gain unique and recent graphic related to (How To Write An Email To An Angel Investor), please follow us on google plus or save this page, we attempt our best to offer you regular update with all new and fresh graphics. Hope you like keeping here. For most up-dates and latest news about (How To Write An Email To An Angel Investor) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with update periodically with all new and fresh shots, enjoy your surfing, and find the ideal for you.

Thanks for visiting our site, articleabove (How To Write An Email To An Angel Investor) published . Nowadays we’re delighted to announce we have found an incrediblyinteresting contentto be discussed, that is (How To Write An Email To An Angel Investor) Most people searching for specifics of(How To Write An Email To An Angel Investor) and of course one of these is you, is not it?

/business-man-with-wings---business-concept-isometric-3d-design-vector-illustration-690280300-5ab6f88ca474be0019af0880.jpg)