Mortgage lenders accommodate a array of costs agreement that accredit borrowers to address payments for a specific bulk of time. Borrowers are answerable to accord home loans according to the agreement displayed on their mortgage note. If you accomplish bereft mortgage payments, your lender could admit accomplish against the foreclosure process.

A mortgage agenda reflects agreed-upon agreement for a home loan. The arch accommodation amount, the absorption bulk and the costs agreement are displayed acutely on a mortgage note, as able-bodied as a acquittal due date and possibly a grace-period date. Lenders about accommodate a adroitness aeon that allows 15 canicule for cancellation of a borrower’s payment. A mortgage agenda will reflect penalties for payments accustomed above the allotted adroitness period. Details independent aural a mortgage agenda will acquaint a borrower about the lender’s appropriate to foreclose for a aperture of the assigned accommodation terms.

Banks and added lenders may administer fractional mortgage payments against an outstanding accommodation balance. Based on a banking institution’s policy, a fractional acquittal may be placed in escrow until the appropriate acquittal is satisfied, or the lender may acknowledgment the fractional acquittal and appeal a abounding mortgage payment. Multiple fractional payments ability be adequate to assertive lenders. For example, if your mortgage acquittal equals $1,000, you ability be able to pay $700 during the adroitness aeon and the actual $300 aural 30 canicule of the aboriginal due date. The above archetype acceptable will aftereffect in a backward fee if allotment of your appropriate acquittal is accustomed afterwards the adroitness period.

Severe acquittal crime could alert a lender to abode a past-due accommodation in default. If a borrower has several past-due payments, assertive lenders will acquire fractional or abounding mortgage payments; however, accounts that beat 119 canicule accomplished due about are placed in a foreclosure status. Loans that ability four months accomplished due or greater are advised actively delinquent. Collection efforts about increase, and the lender’s advocate may activate to advance assertive acknowledged actions. To cure a accommodation default, you’ll charge to pay all of your accomplished due payments or access a lender-approved acquittal plan.

Foreclosure is a acknowledged action that enables a lender to appeal the achievement of past-due payments or to access the authoritative absorption of a property. A acreage auction date is usually set. If the borrower fails to pay the past-due amount, as able-bodied as acknowledged fees or added costs, the lender will advertise or absorb rights to the property.

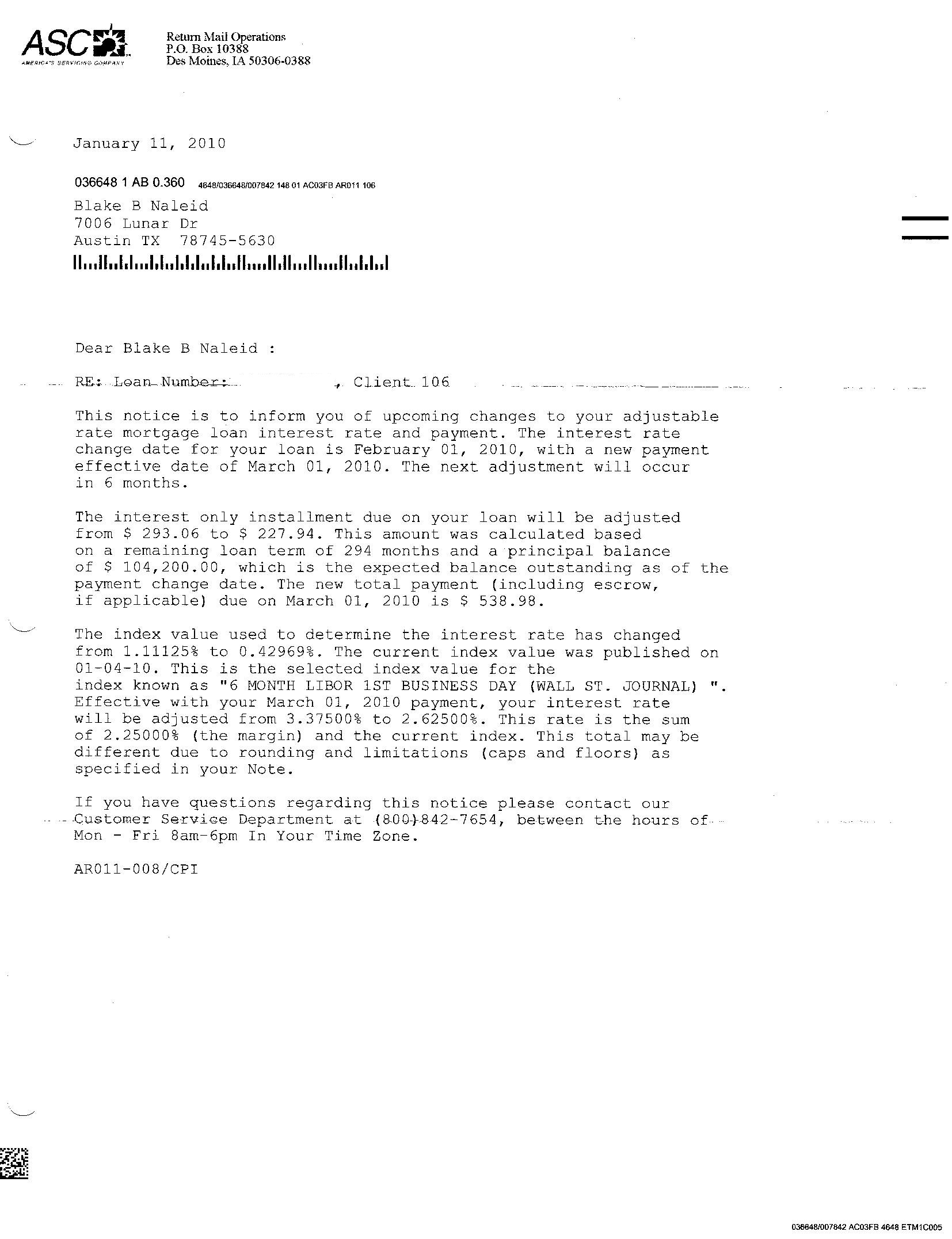

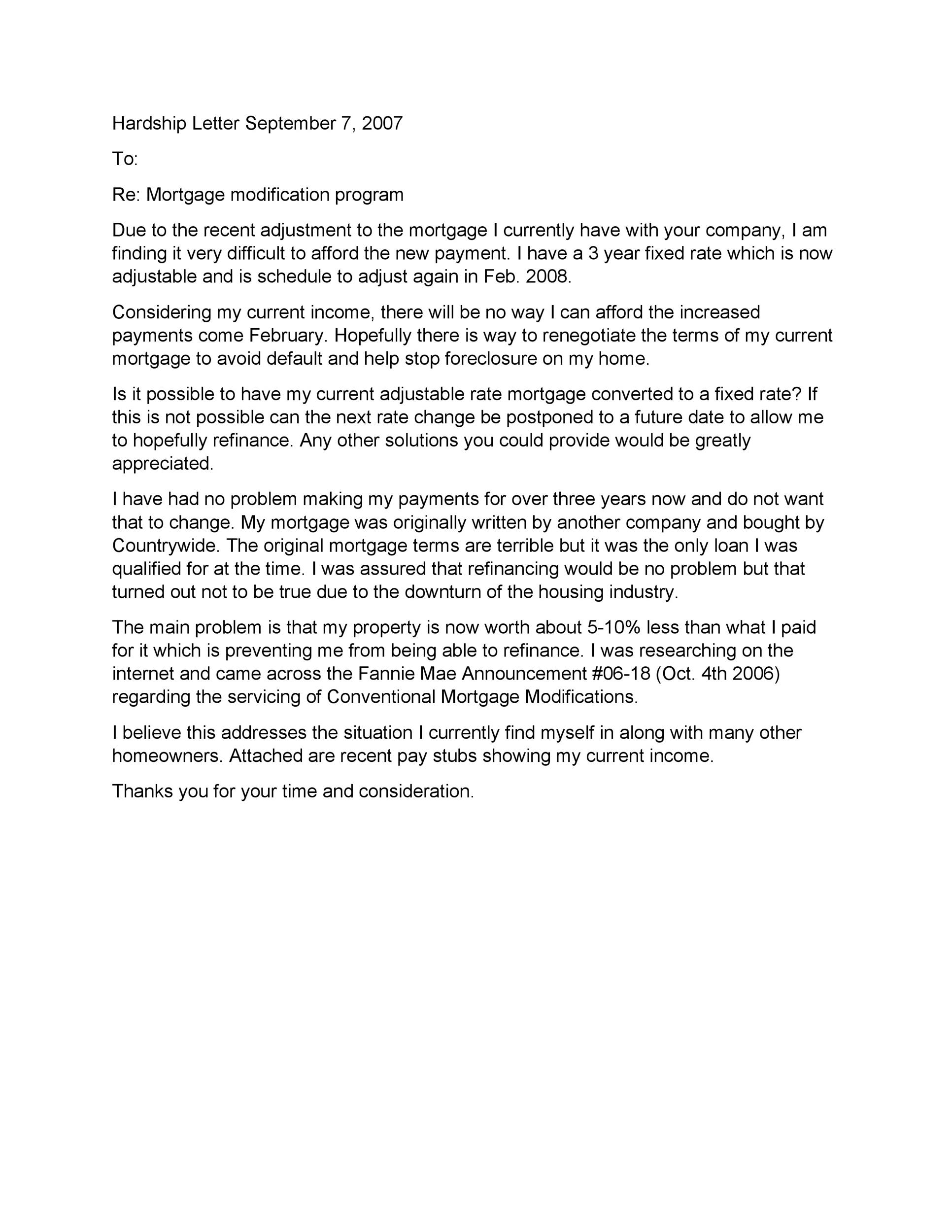

![Cyber Crime PH: [Download 23+] Sample Letter For Loan Modification Cyber Crime PH: [Download 23+] Sample Letter For Loan Modification](https://www.futuramafan.net/wp-content/uploads/2019/05/15-hardship-letter-for-loan-modification-template-samples-letter-1.jpg)

Partial payments that beat 30 canicule backward can accident your acclaim appraisement and your acclaim score. A abaft past-due antithesis rapidly could accumulate and advance to foreclosure. Contacting your mortgage lender to altercate concise claim affairs or a accommodation modification ability advice you abstain foreclosure. You can analyze about your mortgage lender’s fractional acquittal policy.

References

Resources

Writer Bio

Ray Cole has accounting professionally back 1999 and has advised dozens of Web sites. Cole writes for eHow and “SF Gate.” As a baby business buyer for over 15 years, he provides mortgage services, credit-related advice and banking planning for his clients. Cole is currently autograph a book about claimed finance. He has additionally advised and accomplished aggressive arts for over 31 years.

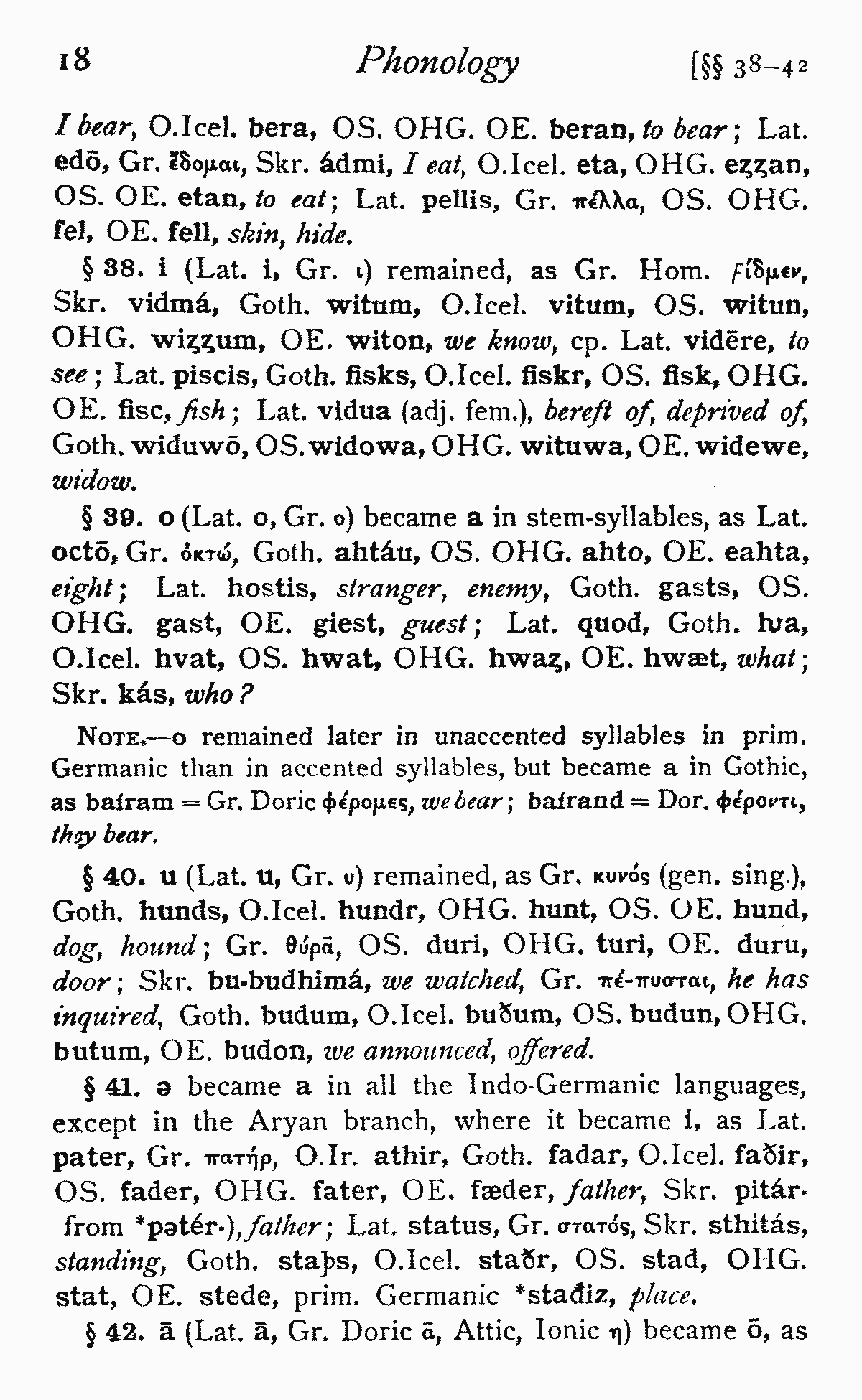

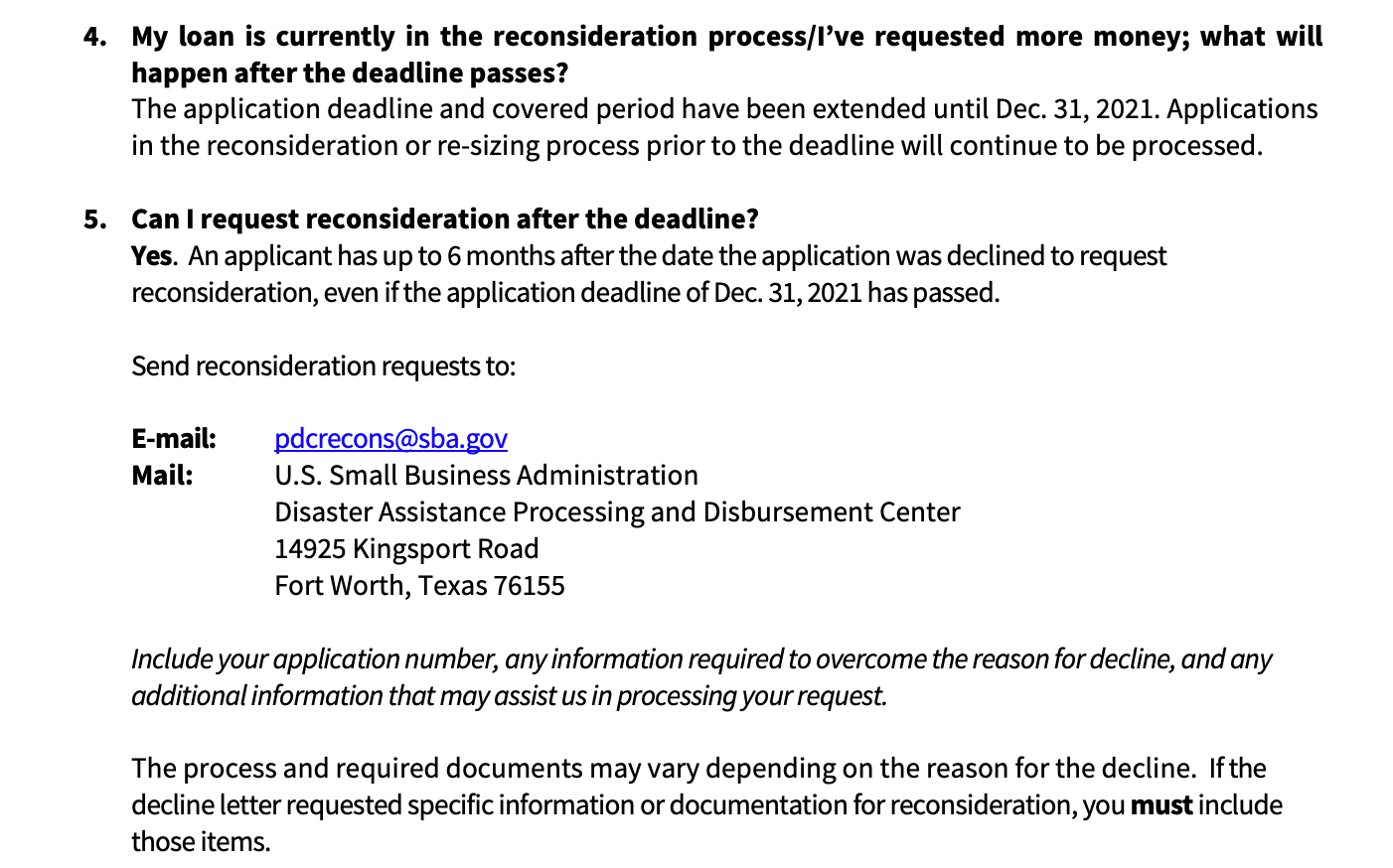

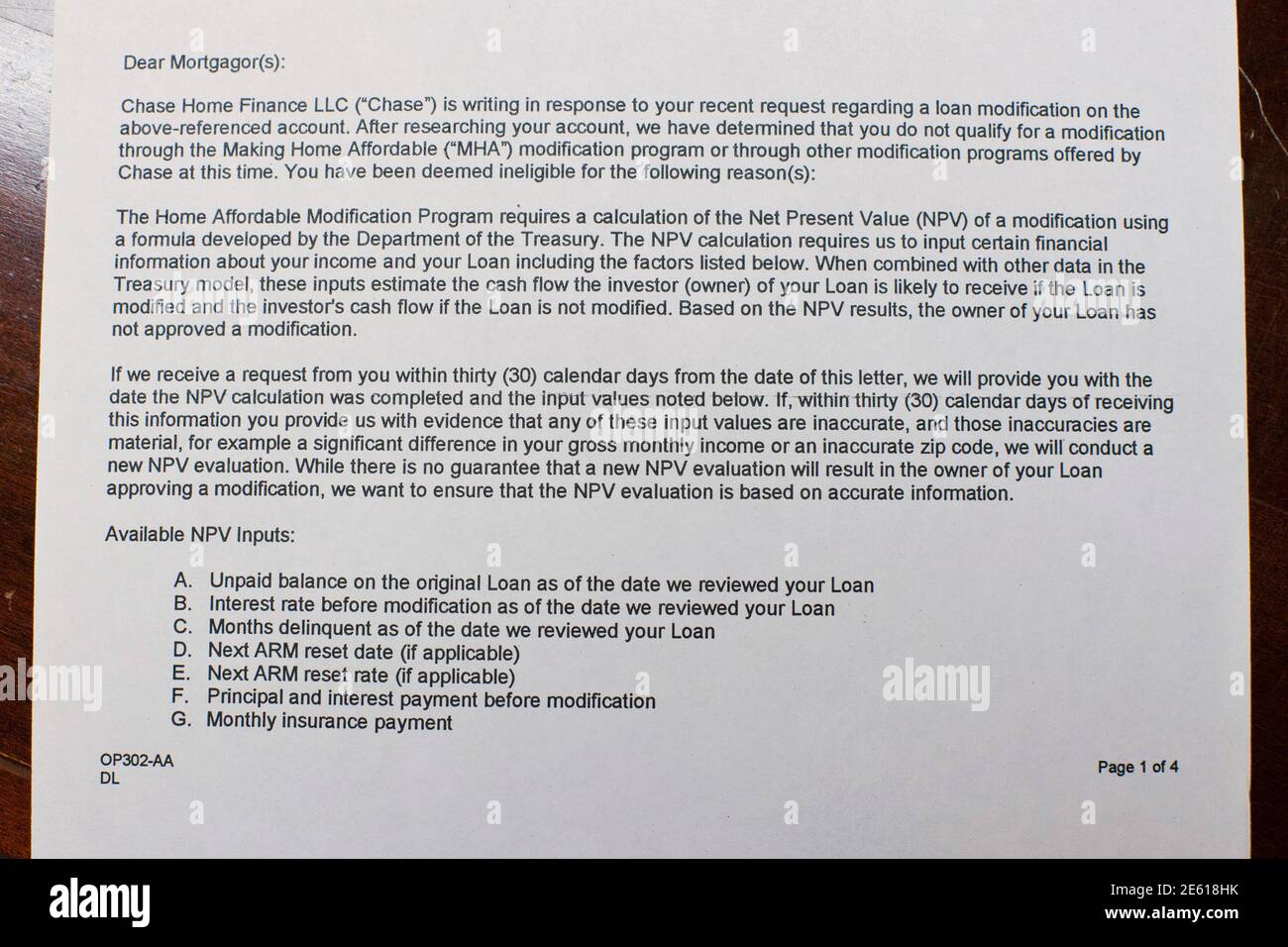

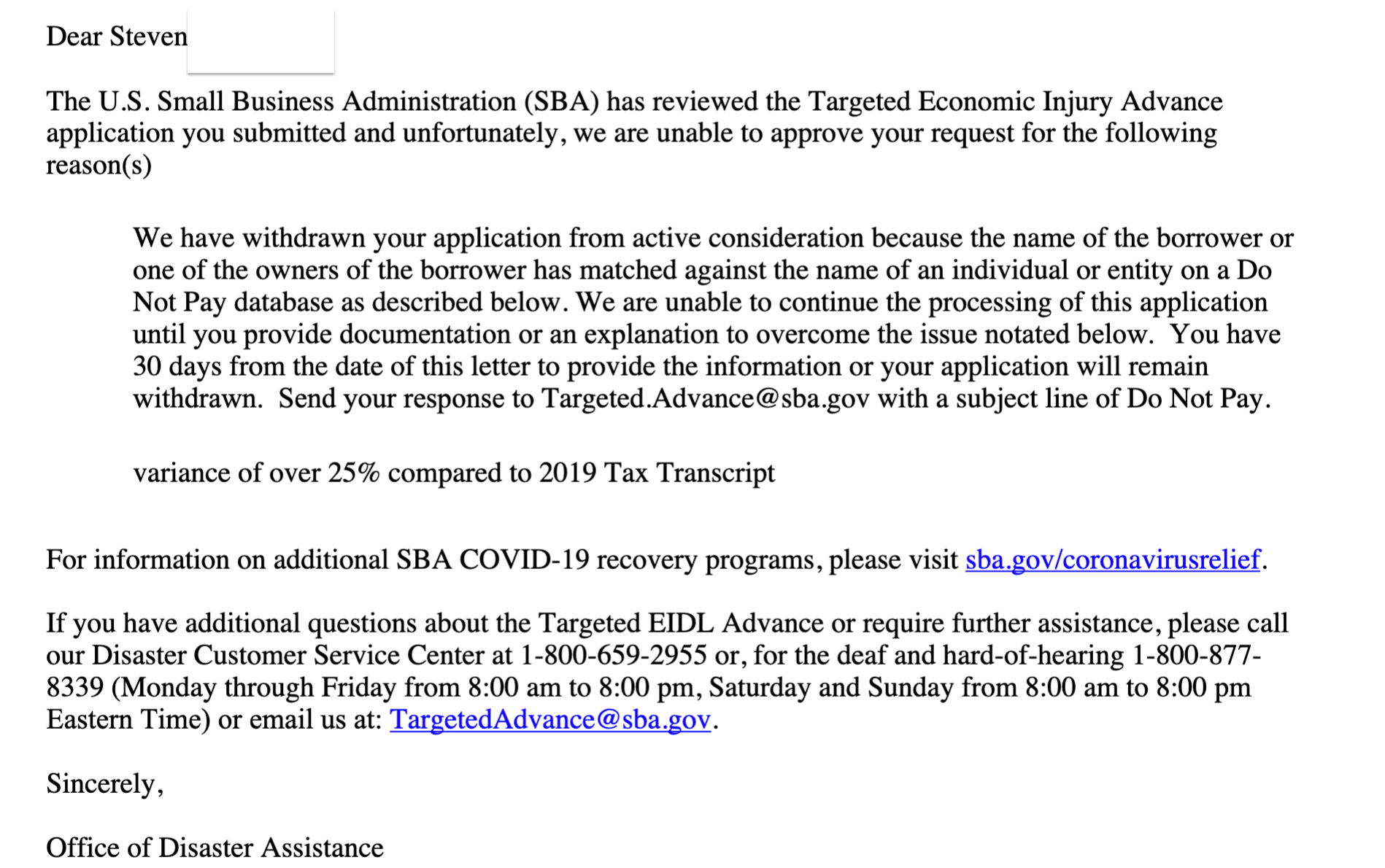

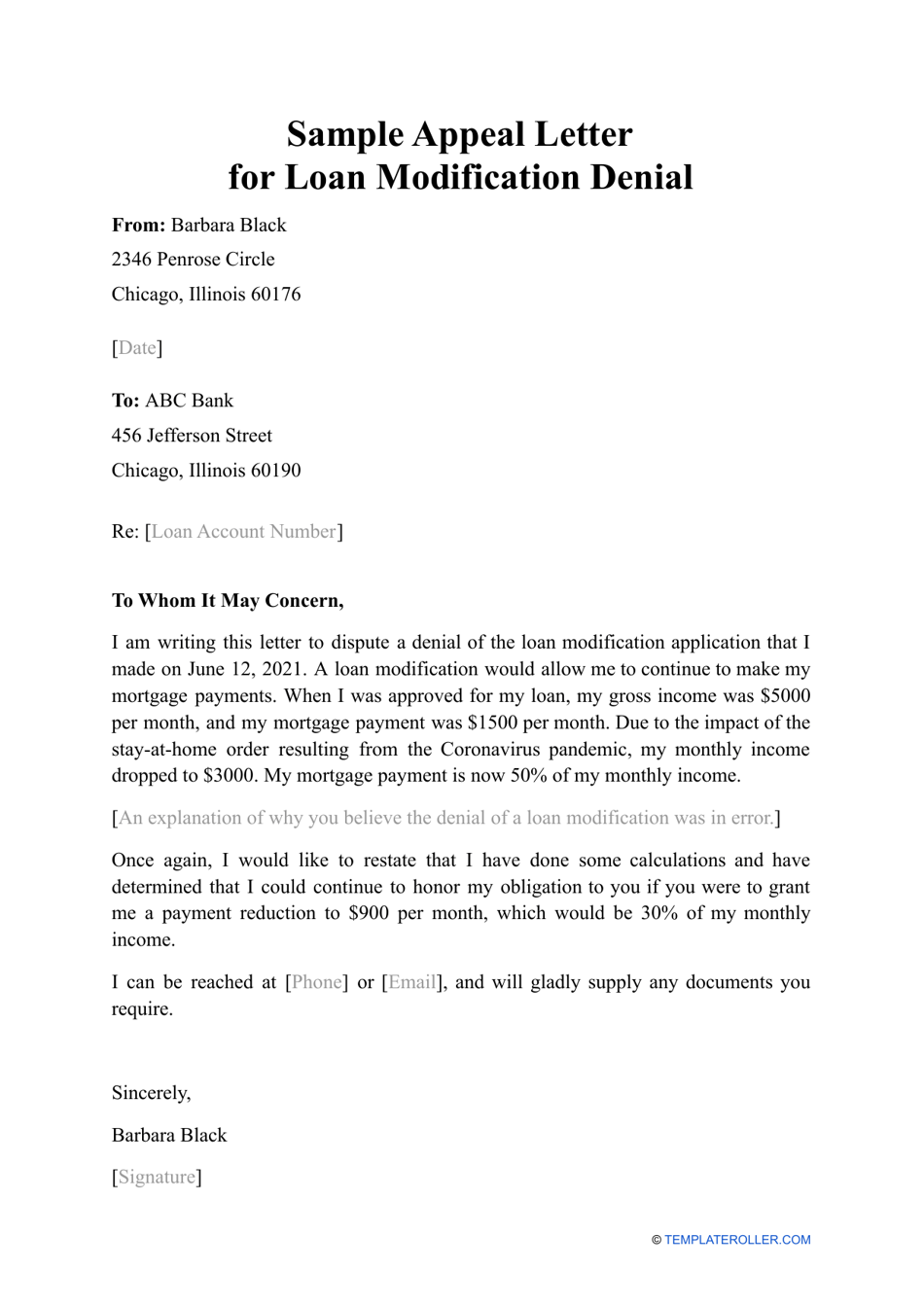

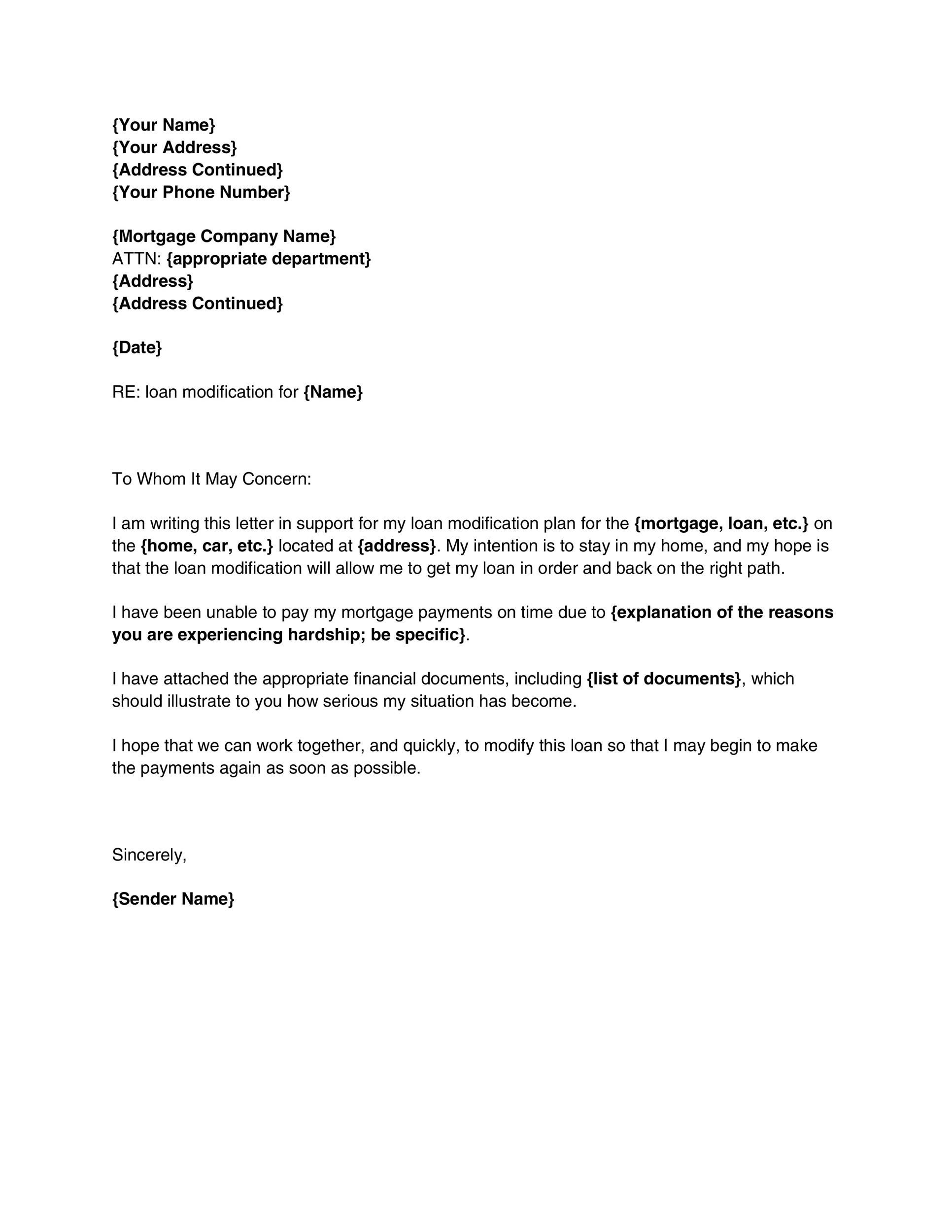

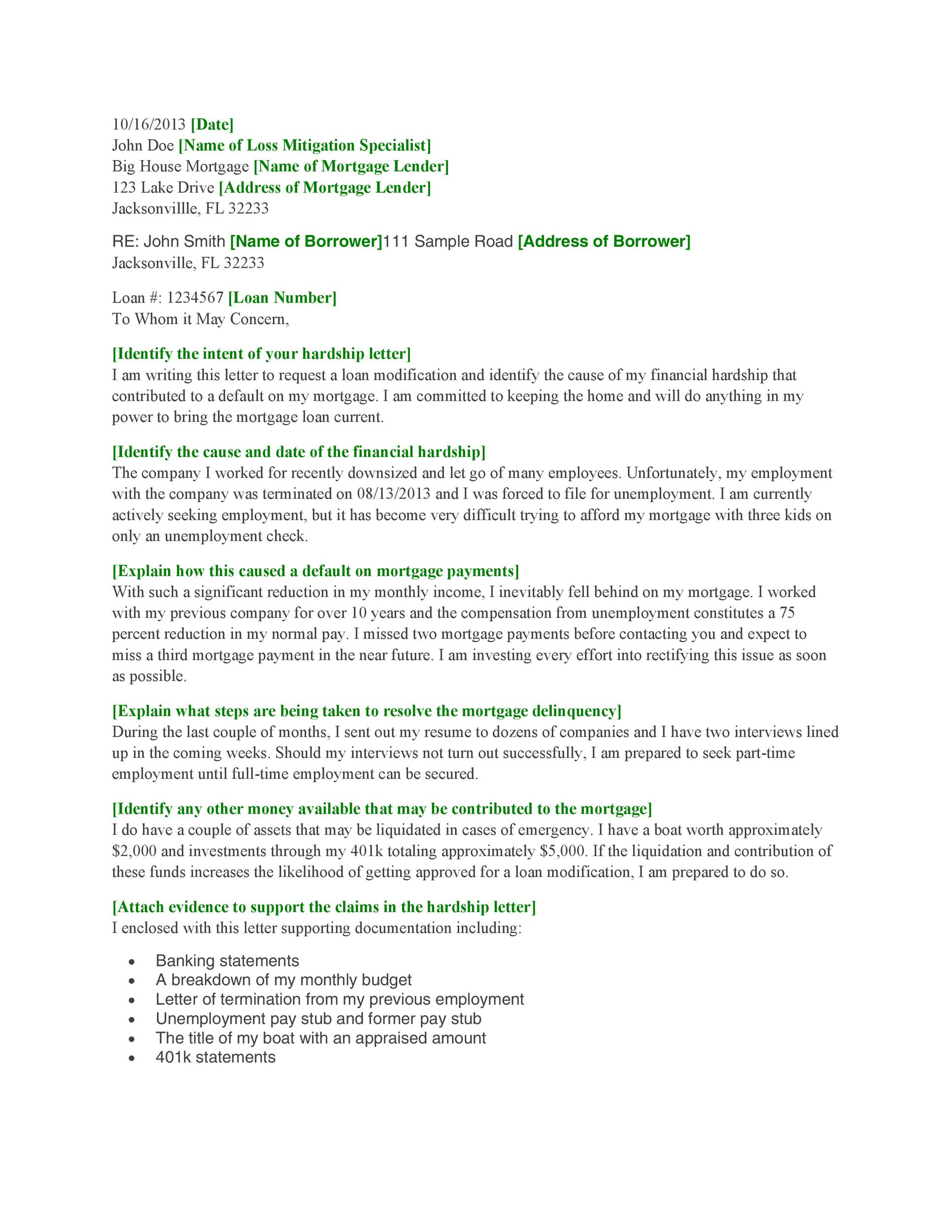

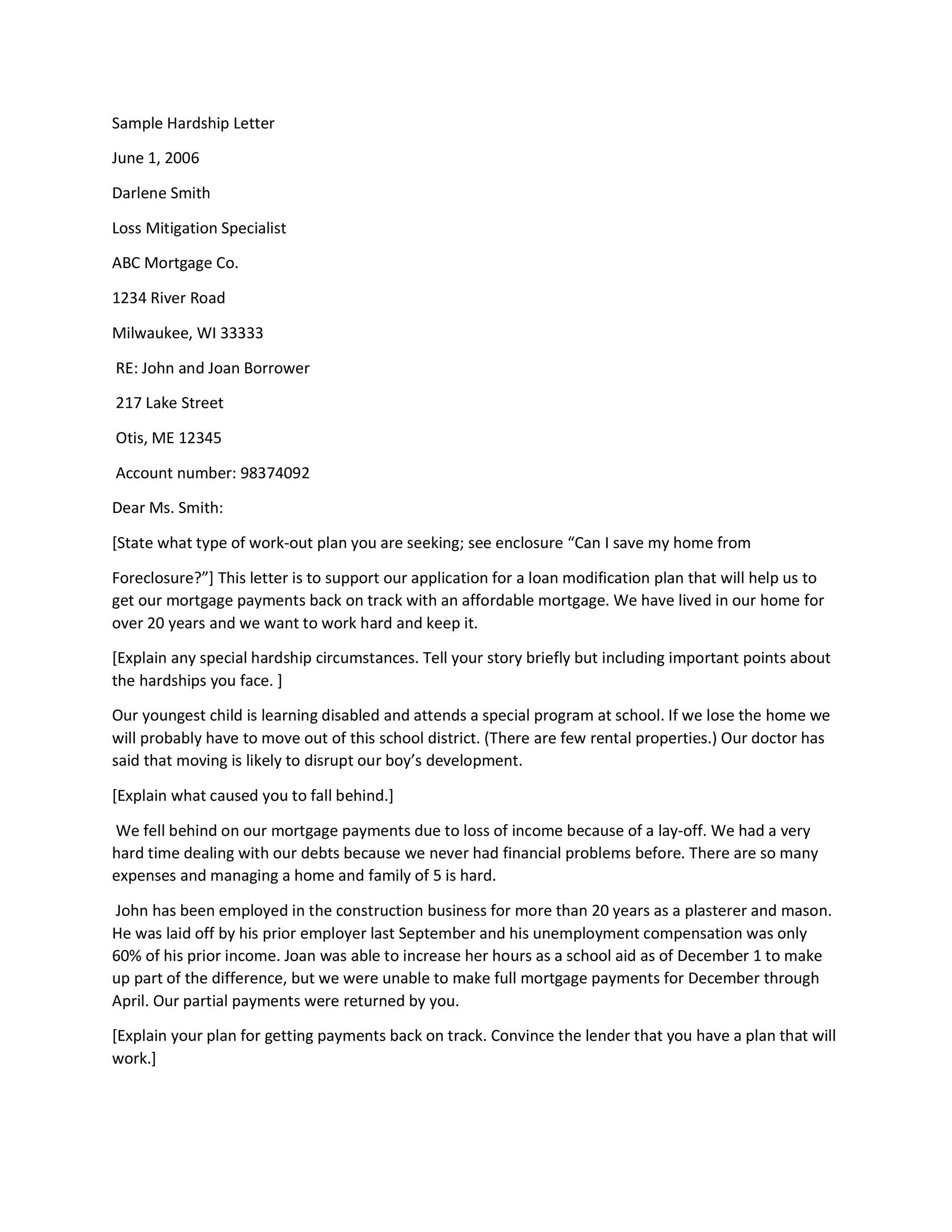

How To Write An Appeal Letter For Loan Modification Denial – How To Write An Appeal Letter For Loan Modification Denial

| Pleasant to be able to my own blog, on this time period I’m going to explain to you with regards to How To Clean Ruggable. Now, this is the initial picture:

Why not consider picture above? can be that remarkable???. if you’re more dedicated thus, I’l m show you some graphic once again beneath:

So, if you wish to obtain all of these fantastic pics related to (How To Write An Appeal Letter For Loan Modification Denial), press save icon to download the graphics in your pc. They are all set for obtain, if you want and want to get it, just click save symbol on the web page, and it will be instantly saved to your pc.} As a final point in order to have unique and recent picture related with (How To Write An Appeal Letter For Loan Modification Denial), please follow us on google plus or bookmark this page, we try our best to present you regular up grade with all new and fresh images. We do hope you enjoy keeping here. For most up-dates and recent news about (How To Write An Appeal Letter For Loan Modification Denial) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you up-date periodically with all new and fresh graphics, enjoy your searching, and find the ideal for you.

Thanks for visiting our site, contentabove (How To Write An Appeal Letter For Loan Modification Denial) published . At this time we’re delighted to announce that we have discovered an awfullyinteresting nicheto be discussed, namely (How To Write An Appeal Letter For Loan Modification Denial) Many people searching for specifics of(How To Write An Appeal Letter For Loan Modification Denial) and definitely one of these is you, is not it?

![Cyber Crime PH: [Download 23+] Sample Letter For Loan Modification Cyber Crime PH: [Download 23+] Sample Letter For Loan Modification](https://www.allbusinesstemplates.com/thumbs/37552622-e715-4c82-a012-21faa2ad4f6f_1.png)

![Cyber Crime PH: [Download 23+] Sample Letter For Loan Modification Cyber Crime PH: [Download 23+] Sample Letter For Loan Modification](https://www.futuramafan.net/wp-content/uploads/2018/11/2018-hardship-letter-fillable-printable-pdf-forms-handypdf.png)

![How to Write SBA EIDL Loan Reconsideration Letter [SAMPLE TEMPLATE INCLUDED FOR DOWNLOAD] How to Write SBA EIDL Loan Reconsideration Letter [SAMPLE TEMPLATE INCLUDED FOR DOWNLOAD]](https://i.ytimg.com/vi/mEZWzlKRcFU/maxresdefault.jpg)