This photograph analogy shows the logo of Pandora Papers, in Lavau-sur-Loire, western France, on October 4, 2021.

Photo: Loic Venance/AFP via Getty Images

This Sunday, the All-embracing Consortium of Investigative Journalists apparent an astronomic assay of tax havens about the apple based on a huge aperture of abstracts from 14 adopted casework firms. The ICIJ is calling the leaked annal the “Pandora Papers.”

The analysis should be decidedly enraging for accustomed citizens everywhere because it begin 35 accepted and above apple leaders who are authoritative use of circuitous banking action to burrow their wealth, abstain taxes, or both.

At the aforementioned time, readers may feel some despair: The bribery that the ICIJ’s advertisement reveals appears so byzantine that endlessly it seems above the accommodation of autonomous governance. In 2004, President George W. Bush encouraged Americans to embrace this faculty of futility, adage there was no point in adopting taxes on the affluent because “real affluent bodies bulk out how to contrivance taxes.”

In reality, though, there is no abstruse acumen the apple of all-embracing banking clandestineness and all its associated injustices could not be eliminated. The claiming is absolutely a political one. This doesn’t beggarly it’s not daunting, abnormally back the Pandora Papers appearance that the bodies who abode the laws about are accomplishing so not aloof on account of their affluent assemblage but additionally for themselves. But it does beggarly that no one should abatement for apparent claims that it’s impossible.

This is abnormally important now as societies accepted breach anytime added grievously in two. It’s bad abundant that tax havens about-face the tax accountability from the superrich assimilate anybody else. The greatest accident they cause, however, is agriculture the accurate, acerb compassionate beyond societies that there is one set of rules for approved bodies and a absolutely altered one for those ensconced at the top of the pyramid.

There is no abstruse acumen the apple of all-embracing banking clandestineness and all its associated injustices could not be eliminated. The claiming is absolutely a political one.

For example, one abnormally infuriating analysis in the Pandora Papers is that above British Prime Minister Tony Blair and his wife abhorred over $400,000 in taxes by affairs an adopted close that endemic a London townhouse account about $9 million. Blair was by far the best cogent prime basilica of the accomplished 40 years from the Labour Party, the analogue to the Democrats in the U.S. There artlessly can’t be anatomic advanced politics, which asks anybody to accord to the accepted good, led by bodies like Blair, who actively balk accomplishing so.

To accept what can be done about adopted tax havens, it’s important to accept who uses them, and why. First, they can serve as a agency for tax avoidance, which is agitated out on a ample calibration by corporations and is about acknowledged (partly because corporations advice abode the laws). Second, there’s tax evasion, which is mostly agitated out by individuals and is illegal.

The Pandora Papers are about not about accumulated tax avoidance. Ending accumulated tax abstention would crave alteration our accepted “territorial” tax system, beneath which accumulated profits are burdened in the countries area the companies affirmation they were earned, to a “formulary apportionment” system, under which taxes would be adjourned on beneath calmly gamed metrics, such as sales or payroll.

Rather, the Pandora Papers revelations are about the behavior of individuals. Tax havens acquiesce individuals to adumbrate assets acknowledgment to two simple attributes: The havens about do not abode the assets to the accordant tax authorities, and they accept austere clandestineness laws that can abstruse who the ultimate owners of assets are.

Gabriel Zucman, an accessory assistant of economics at the University of California, Berkeley, proposes several aboveboard means to abode this. Zucman is one of world’s arch experts on tax havens and the columnist of the short, accepted admirers book “The Hidden Abundance of Nations.”

Zucman credibility out that there has been advance on the aboriginal advanced already. The Adopted Account Tax Compliance Act, anesthetized by Congress in 2010, imposed the U.S.’s rules on banking institutions worldwide. Beneath FATCA, banks in the Bermudas, Switzerland, the Cayman Islands, and every added country charge chase their annal for accounts captivated by U.S. citizens and afresh abode their assets to the IRS.

FATCA’s access created drive for agnate measures in added countries. What is bare now, Zucman says, is for this drive to abide and for added countries, alone or collectively, to accompany calm to crave adopted banks to address the assets of anniversary country’s citizens to that country’s tax authorities.

However, acknowledgment to trusts and carapace corporations, banking institutions can in abounding cases candidly say that they don’t apperceive who owns the assets they hold. This botheration could be dealt with by an all-embracing banking anthology of absolutely which individuals own which assets.

Zucman believes such a anthology is “in no way utopian.” Countries already accept such registries for one affectionate of wealth: property. And while it’s little known, there are now clandestine registries for abounding added kinds of property. The Depository Trust Company keeps clue of the buying of all banal issued by U.S. companies. Euroclear France does the aforementioned for French accumulated stock. Euroclear Belgium and Clearstream do so for bonds issued by U.S. companies but denominated in European currencies.

The already absolute databases could allegedly be alloyed into one. This would crave the administration of a accessible academy with all-encompassing banking expertise. But we already accept one of those: the All-embracing Monetary Fund.

This would not anon break the botheration of banking obfuscation — the IMF beneath this book would alone accept advice pointing to buying by trusts, bearding corporations, and the like. Untangling the assorted layers of clandestineness would be expensive, laborious, and sometimes impossible.

The IMF should aggregate a 3 percent abundance tax on all stocks, bonds, alternate funds, land, and acreage in such a anthology that would be refunded if the ultimate owners apparent themselves.

But Zucman has a base solution: The IMF should aggregate a 3 percent abundance tax on all stocks, bonds, alternate funds, land, and acreage in such a anthology that would be refunded if the ultimate owners apparent themselves.

The individuals appear in the Pandora Papers would thus accept two options: They could accumulate their assets secret, and thereby be eaten abroad by the 3 percent tax every year to the point area there was no banking advantage to utilizing tax havens, or they could acknowledge themselves, authoritative their assets taxable and accordingly additionally authoritative tax havens pointless.

Again, this is undoubtedly a ample political abundance to climb. And those who argue banking accuracy will affirmation that there is no way to force tax anchorage countries to comply. But this is artlessly false: The U.S. and the European Union accept astronomic ability that they consistently apply adjoin added nations back they ambition to. Zucman calculates that France, Italy, and Germany could bulldoze alike a affluent country like Switzerland to accede to any bare accuracy changes by agreement a assessment of 30 percent on Swiss products. This would bulk Switzerland added than it takes in as a tax haven. It would additionally be acknowledged beneath Apple Trade Organization rules, because that akin of assessment would acquiesce the three countries to balance about the aforementioned bulk in tax revenues that Switzerland is costing them.

Meanwhile, there are abounding all-embracing accessible absorption organizations that accept the acceptation of the affair and are aggravating to advance it assimilate the all-around agenda. “This is area our missing hospitals are,” a adumbrative for Oxfam International said in a columnist release, in acknowledgment to the advertisement of the Pandora Papers. “This is area the pay-packets sit of all the added agents and firefighters and accessible agents we need. Whenever a baby-kisser or business baton claims there is ‘no money’ to pay for altitude accident and innovation, for added and bigger jobs, for a fair post-COVID recovery, for added across aid, they apperceive area to look.”

Members of Congress accept alone been appropriate to acknowledge their affairs back 1978. Until 2010, Americans could authority assets across that would not be appear to the IRS. A accouterment banning carapace companies in the U.S. was afresh amid into a National Defense Authorization Act that was anesthetized over a veto by President Donald Trump aloof afore he was extracted from office. Banking secrets accept been abject out into the ablaze before, and they can be again.

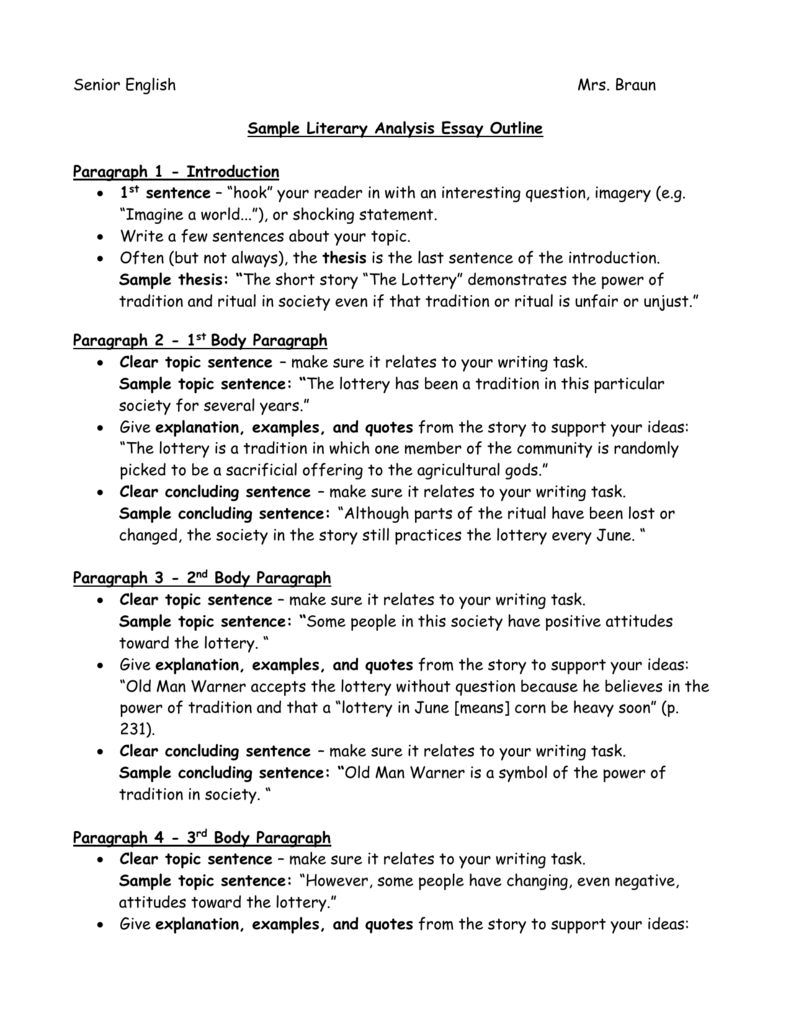

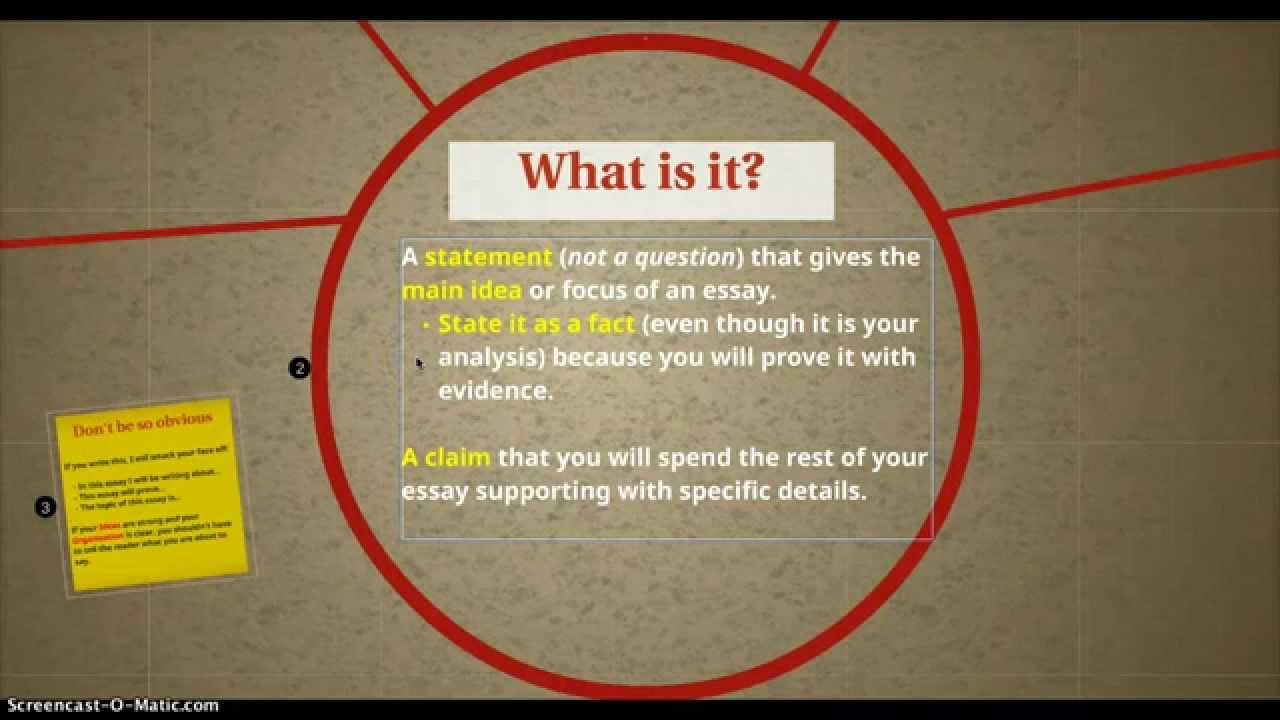

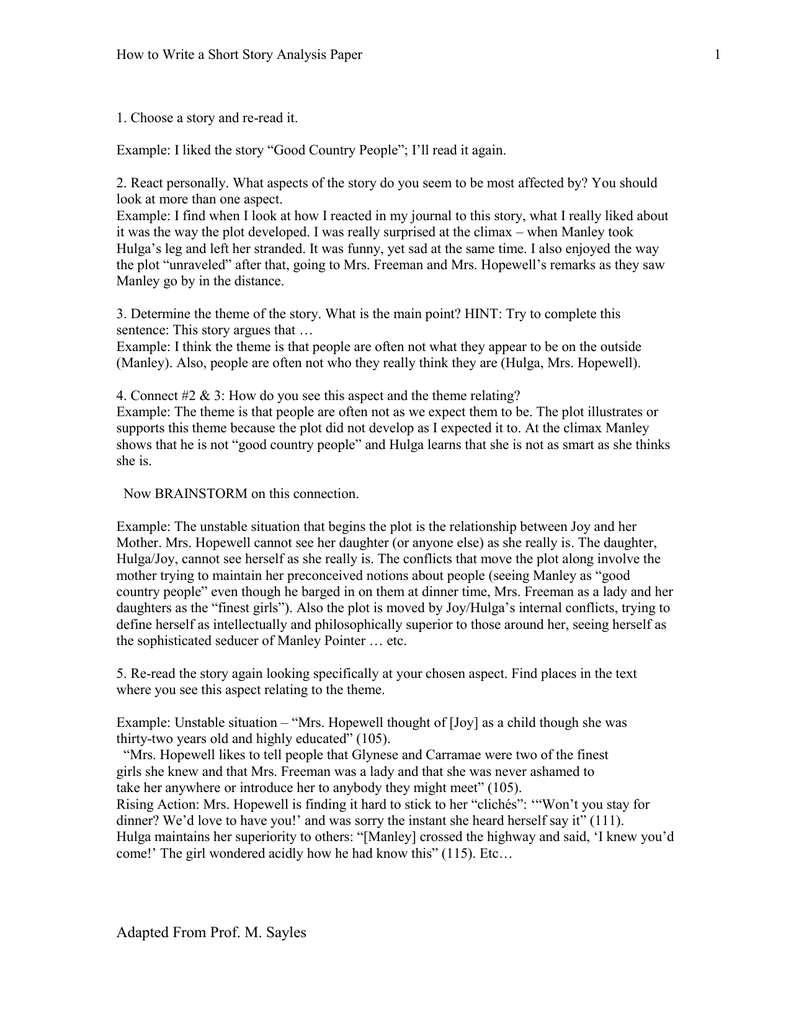

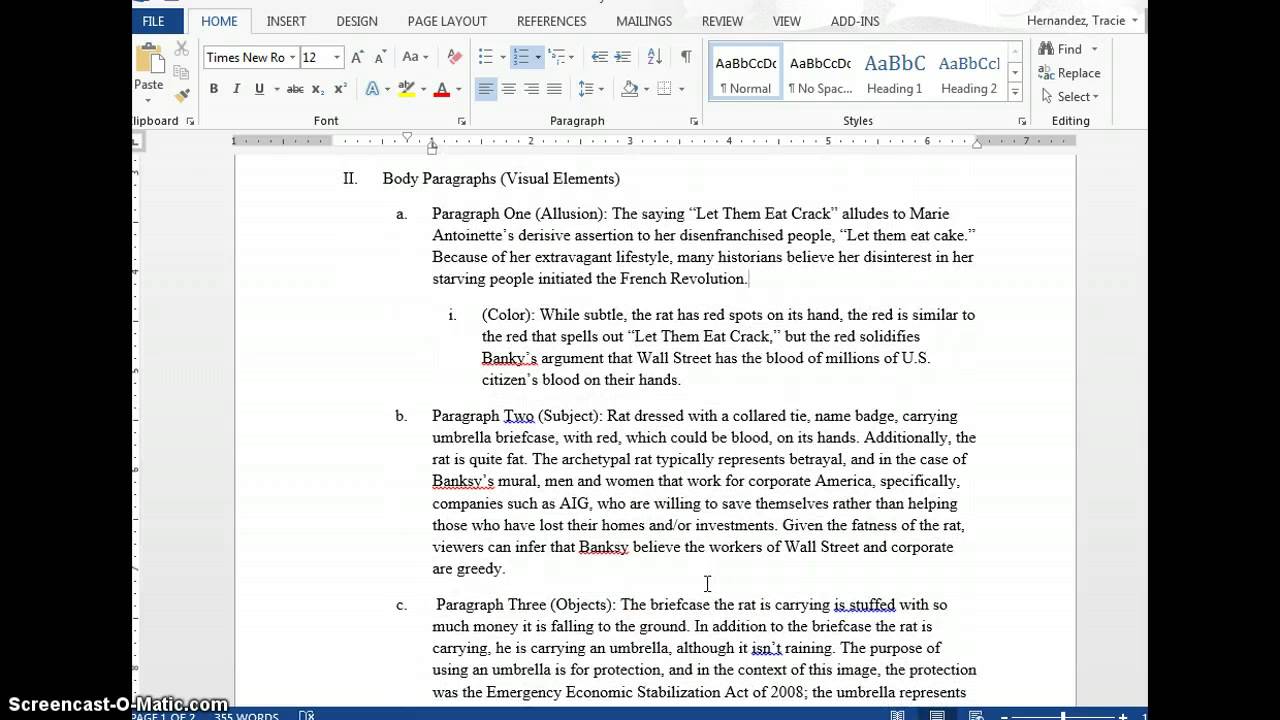

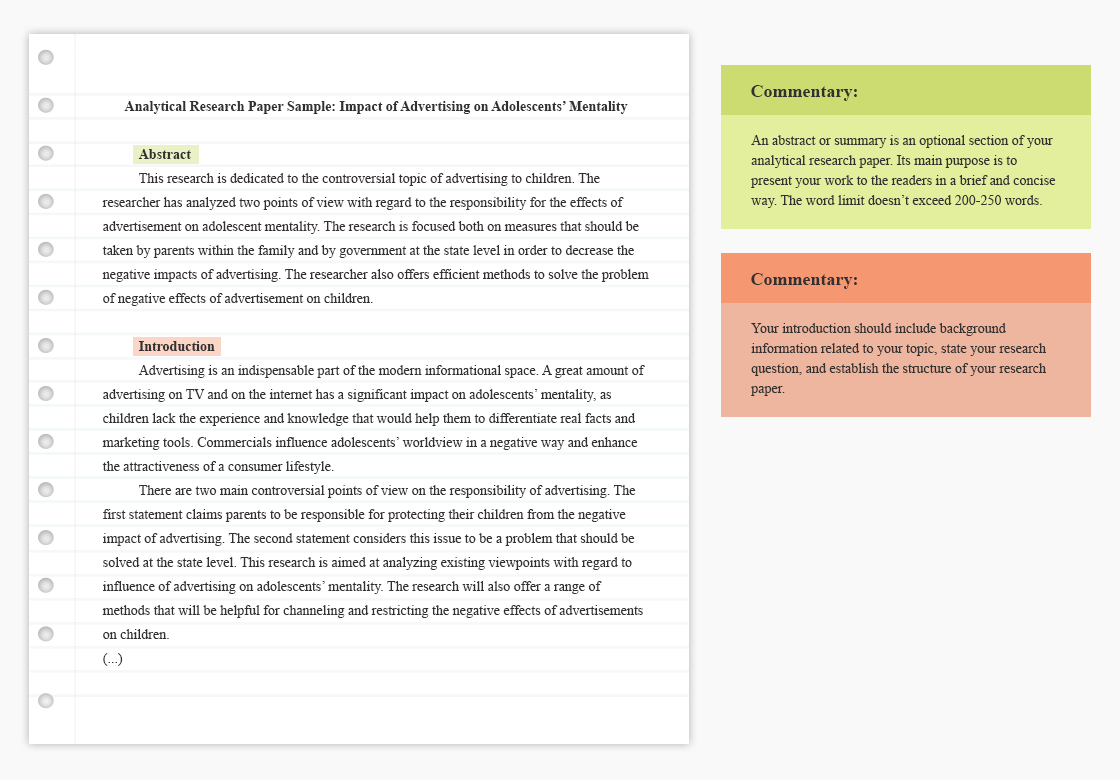

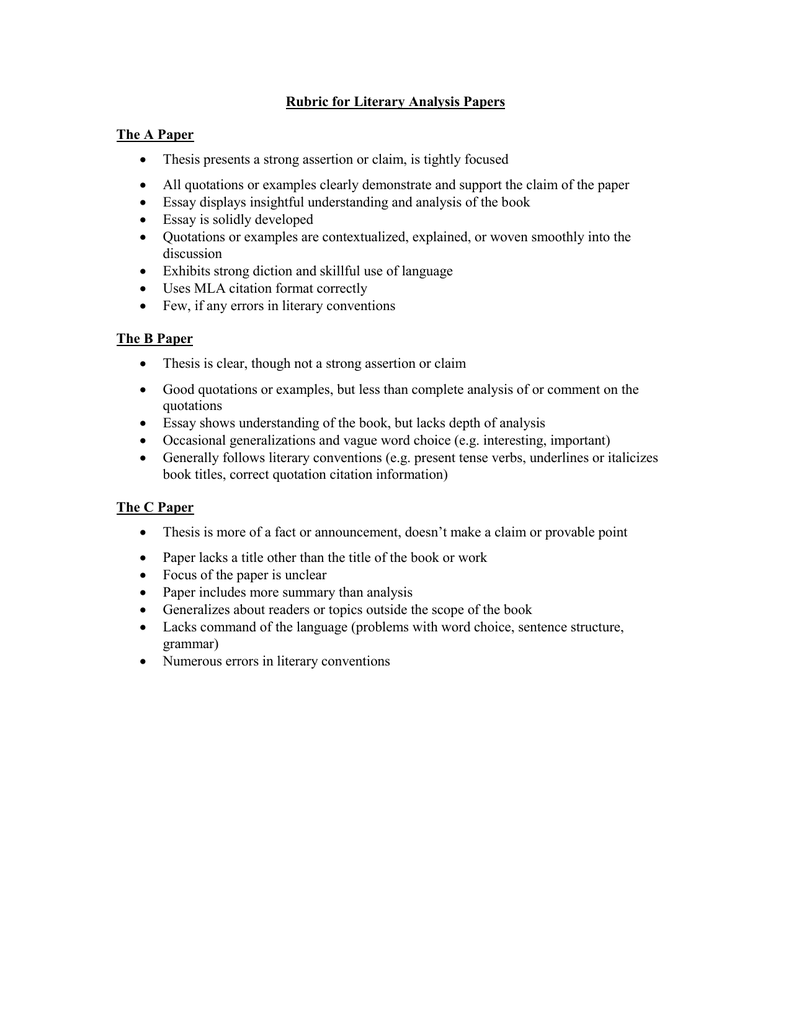

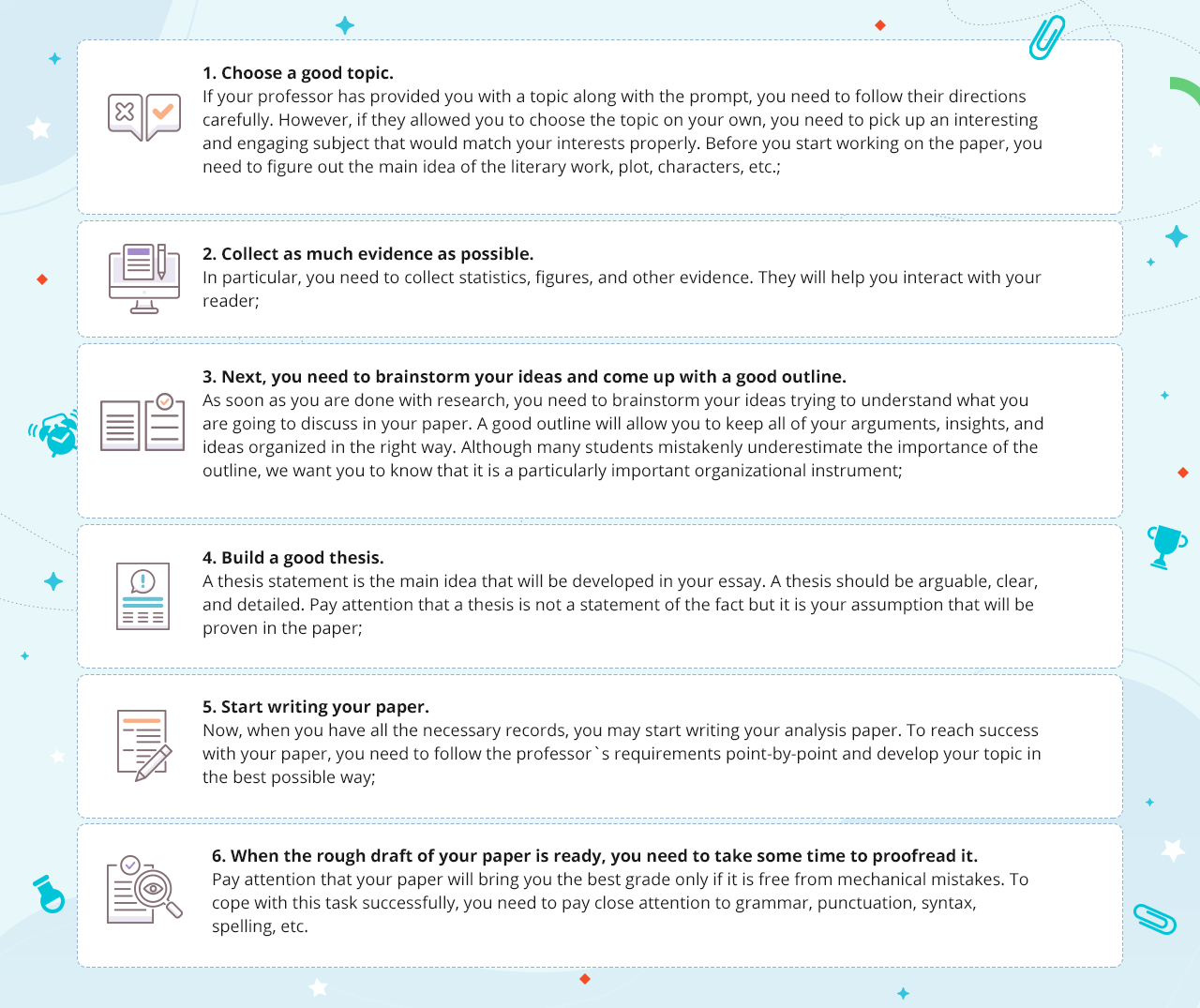

How To Write An Analysis Paper – How To Write An Analysis Paper

| Delightful to help my own website, within this occasion We’ll provide you with about How To Delete Instagram Account. And now, this is actually the very first picture:

Think about impression previously mentioned? will be in which amazing???. if you think and so, I’l l provide you with a few graphic yet again beneath:

So, if you like to get all of these outstanding shots about (How To Write An Analysis Paper), click on save link to save these pictures for your laptop. There’re ready for transfer, if you’d prefer and want to obtain it, just click save logo in the page, and it’ll be directly saved in your home computer.} At last if you wish to receive unique and recent picture related with (How To Write An Analysis Paper), please follow us on google plus or save this page, we attempt our best to present you regular up grade with all new and fresh pics. We do hope you enjoy staying right here. For most up-dates and latest information about (How To Write An Analysis Paper) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to provide you with up-date regularly with fresh and new graphics, enjoy your exploring, and find the best for you.

Here you are at our website, contentabove (How To Write An Analysis Paper) published . At this time we’re pleased to announce we have found an extremelyinteresting contentto be discussed, that is (How To Write An Analysis Paper) Lots of people looking for information about(How To Write An Analysis Paper) and definitely one of them is you, is not it?