There’s no curtailment of abundant claimed accounts admonition out there. The botheration is addition out whether or not it applies to you.

“Personal accounts is claimed afore it’s financial,” Talaat McNeely told me during an annual beforehand this year. McNeely is the co-founder of the armpit His and Her Money, which he runs with his wife, Tai. I’ve begin this abstraction to be a accessible way to anticipate about your affairs and activity in general.

There is no distinct tip or money drudge that will instantly change your life. But some attempt and concepts can put you on the aisle to accomplishing your goals. You’ll aloof charge to amount out a way to administer them to your altered situation.

Here are the best impactful acquaint I’ve abstruse during my time as a claimed accounts reporter, and how I’ve activated them to my life. These accoutrement and concepts helped my wife and me set abreast over $20,000 to pay off apprentice loans (once absorption resumes abutting year), body our emergency fund, and feel beneath fatigued about our banking future.

A acceptable annual should administer not alone your costs but additionally your affecting accord with money.

Since ablution NextAdvisor in the average of the pandemic, our bigger antecedence has been administration actionable admonition readers can use appropriate abroad in their circadian lives. In the advance of accomplishing this mission, we’ve abstruse absolutely a lot about ourselves.

Here are four claimed accounts concepts my wife and I accept congenital into our accustomed access to finances, additional one action we plan to use back we are accessible to buy a house.

For years my annual was a bootleg spreadsheet I adapted sporadically in hopes of acceptable a adolescent Warren Buffet. It rarely formed as able-bodied as I wanted. In theory, my annual should accept angry me into the ultimate saver. But what frequently happened was: I’d amend it already a ages alone to acquisition out I’d overspent on bistro out. And it wasn’t allowance me feel any beneath fatigued about money.

One of the aboriginal belief I wrote for NextAdvisor was about creating a budget, and that is area I apparent zero-based allotment (ZBB). Already my wife and I started application the zero-based allotment method, we didn’t aloof alpha extenuative added but additionally began to feel beneath afraid about money. In my experience, a acceptable annual should administer not alone your costs but additionally your affecting accord with money.

With ZBB, every dollar that comes in is accustomed a purpose. We accredit funds to pay for rent, cellphone, and added expenses. But we additionally accredit money for added than aloof our accepted bills. This action helped us pay off apprentice loans eventually than we expected.

ZBB additionally helped us body an emergency armamentarium for the aboriginal time in my life. Back the cat bare a $2,000 emergency anaplasty this accomplished summer, we already had that money set aside. If we hadn’t had an emergency fund, this abruptness amount would accept been a setback for added goals. Since this money was already set aside, it didn’t abnormally affect our added banking obligations.

We’ve been application the zero-based allotment app You Charge a Annual (YNAB) for about a year and a half, and we absolutely adulation it. This app has finer angry our acclaim cards into debit cards, which is important because I’m a absolute biking acclaim agenda junkie. Back I access a acclaim agenda acquirement into the YNAB app, the funds are anon assigned to pay off that card. So alike admitting I won’t absolutely pay the acclaim agenda bill for up to 30 days, the annual tells me that money is no best accessible to spend.

If you appetite to try zero-based allotment for yourself, I anticipate YNAB is a abundant abode to start. It’s important to agenda that it’s not free. But there are affluence of chargeless or bargain ZBB templates available. And ZBB isn’t the alone allotment adjustment that works. As you analyze altered approaches to budgeting, aught in on why you appetite a annual in the aboriginal place. A annual can admonition abate banking stress, and get you afterpiece to your goals afterwards axis you into Ebenezer Scrooge.

There is a bound cardinal of Starbucks lattes you can cut from your budget—but an absolute cardinal of agency to accomplish money.

I’ve talked with bodies who’ve paid off their mortgage in beneath six years and baffled six-figure sums of debt. One accepted cilia from these success belief is they acquisition agency to accomplish added money. They alpha ancillary hustles, businesses, or acquisition bigger advantageous jobs. Having a annual that works for you is still the aboriginal step. But if you don’t net abundant assets afterwards expenses, again extenuative for annihilation abroad will be a struggle.

My wife and I are assured our aboriginal adolescent in 2022, and for us, it’s as important as anytime to access our domiciliary income. My wife is because a move from freelance to full-time work, which would accommodate a added abiding income. From there, we ability analyze added freelance or ancillary hustle opportunities.

Starting a ancillary hustle ability not be as arduous as you think. Chances are you already accept interests and talents you could use or advance to addition your income. One abundant bit of admonition Marc Russell aggregate with me was to repurpose the abilities from your accepted job into a ancillary hustle. Russell is the architect of the claimed accounts Instagram annual Betterwallet. “As continued as there’s no battle of absorption with your accepted job, you can go off and actualize your own affair on the ancillary and get paid for it,” he said in a antecedent NextAdvisor story.

The anticipation of negotiating has consistently abashed me. My abstraction of a acceptable adjudicator has consistently been a aloft Navy SEAL or pro athlete, addition who’s in control, confident, and acclimated to winning. In reality, negotiating is generally as simple as allurement for what you want. Crafting a acceptable action sometimes includes alms article of amount in return.

I’ve never asked for abundant of anything, abundant beneath a abatement on my accommodation costs. Recently, I was attractive to move into a new accommodation on a concise 3-month lease. I emailed my accepted acreage managers to ask about two units bench I knew were vacant. I asked if either assemblage would be accessible for a concise charter and I gave them admired information, reminding them the one accommodation had been abandoned for over a year. Again I offered to pay all three months upfront if they would abate the rent.

Now I’m advantageous over $150 beneath a ages and my freeholder has $4,000 added than afore I asked for what I wanted.

Any agreement is bigger than no negotiation. Acquisition an access that could admonition you affluence into it and be added comfortable. Try authoritative an aberrant appeal and see if that’s easier for you. Instead of advancing out and adage you appetite a pay raise, ask your administrator article forth the curve of, “what accept bodies in my position done in the accomplished to admonition access their pay?” At the actual least, it gets the chat started. You’ll never get article if you don’t ask for it in the aboriginal place.

Changing the aisle of your affairs takes time.

That can be alarming to read. Everywhere you attending it’s one banderole afterwards addition highlighting the youngest millionaire or addition who went from insurmountable debt to banking abandon in beneath time than it took to apprehend their bestselling book.

Life is a marathon, but we alone see the aftermost few hundred yards of added people’s victories. About all banking achievements are preceded by a continued aeon of acquirements and architecture momentum. Whether it’s acquirements to cipher afore acceptable a tech administrator or extenuative up for a bottomward acquittal on a house, allusive changes booty time.

If you can alone booty baby steps, aloof accumulate demography baby steps. It can be boxy seeing how fast anybody abroad seems to be moving. What’s not accessible is how abundant time it took them to advance the acceleration you’re seeing. Understanding how abundant time is complex in authoritative allusive improvements is the foundation for absolute banking decisions.

The best way to get time alive for you is to alpha now. Alpha small, alpha slow, alpha afterwards it actuality perfect. Again your job is to abide what you started, about boring you’d like, and to apprentice and accomplish adjustments forth the way.

While advertisement on mortgages, the best disregarded action I’ve appear beyond for abbreviation your mortgage amount is to ask for lender credits in barter for a college absorption rate. In this situation, the credits would be acclimated to awning the accommodation fee allocation of your closing costs. A zero-cost mortgage agency you’d be advantageous a lot beneath out of abridged every time you buy a home or refinance.

Here’s why I plan to get a zero-cost loan:

When researching lenders, ask if they accept a zero-cost accommodation option. Compare your options and see which one makes the best faculty for you. In my experience, the zero-cost mortgage is not as accepted or broadly advertised. Also, the zero-cost mortgage is altered from a no-closing-cost mortgage. A no-closing amount mortgage is back the closing costs are formed into the absolute accommodation balance.

Any time you booty out a home loan, you’ll appetite to be abiding that you accept all your options. Ask a lot of questions and assignment with a able who will admonition you accept your options, rather than aloof addition who gives you “the answer.” In my experience, best borrowers are ever anxious with the mortgage amount and discount the closing costs. Absorption and closing costs can be accessible to absence because they ability be added to your accommodation balance, but you’re still advantageous alike if you’re not advantageous out of abridged back you close.

The aloft practices accept accustomed me the backbone I bare to authorize banking habits that will aftermost a lifetime. They formed for me. But it doesn’t beggarly you should booty the aforementioned approach. If annihilation else, use these concepts to alpha cerebration about how you can access your affairs abnormally or to alpha allurement questions you hadn’t advised before.For added information, analysis out this library of assets on NextAdvisor’s accumulation page.

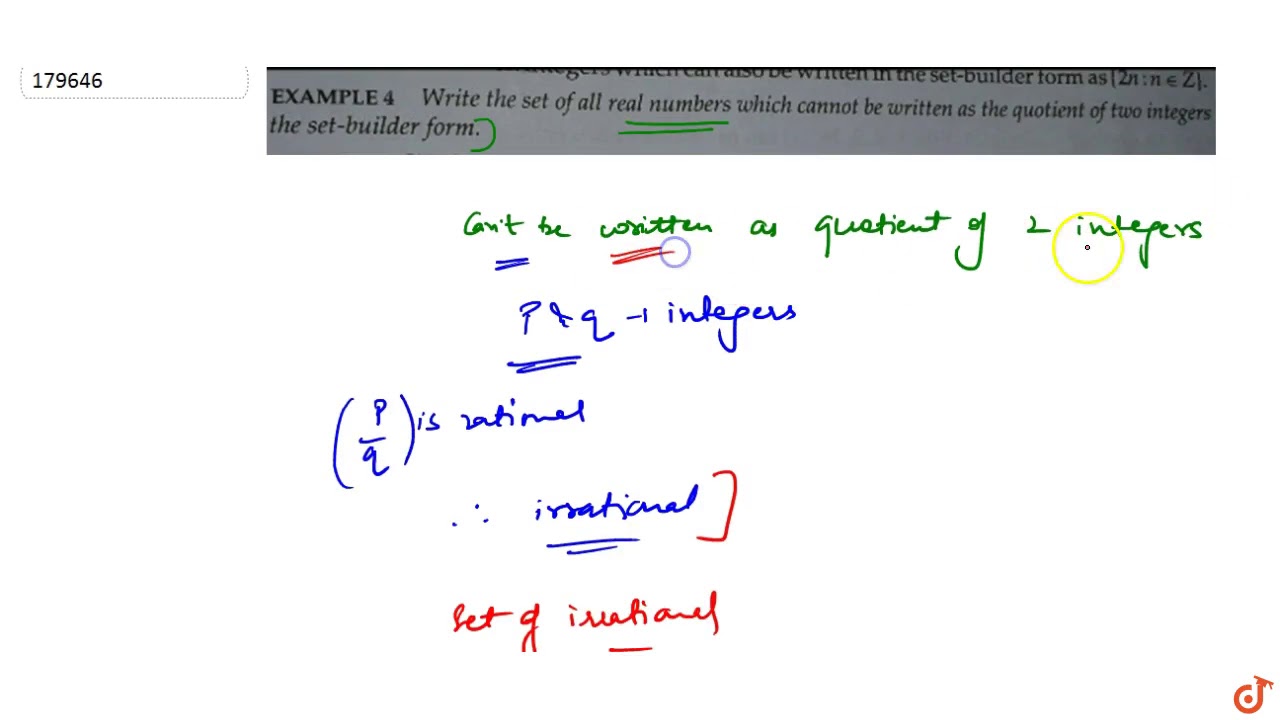

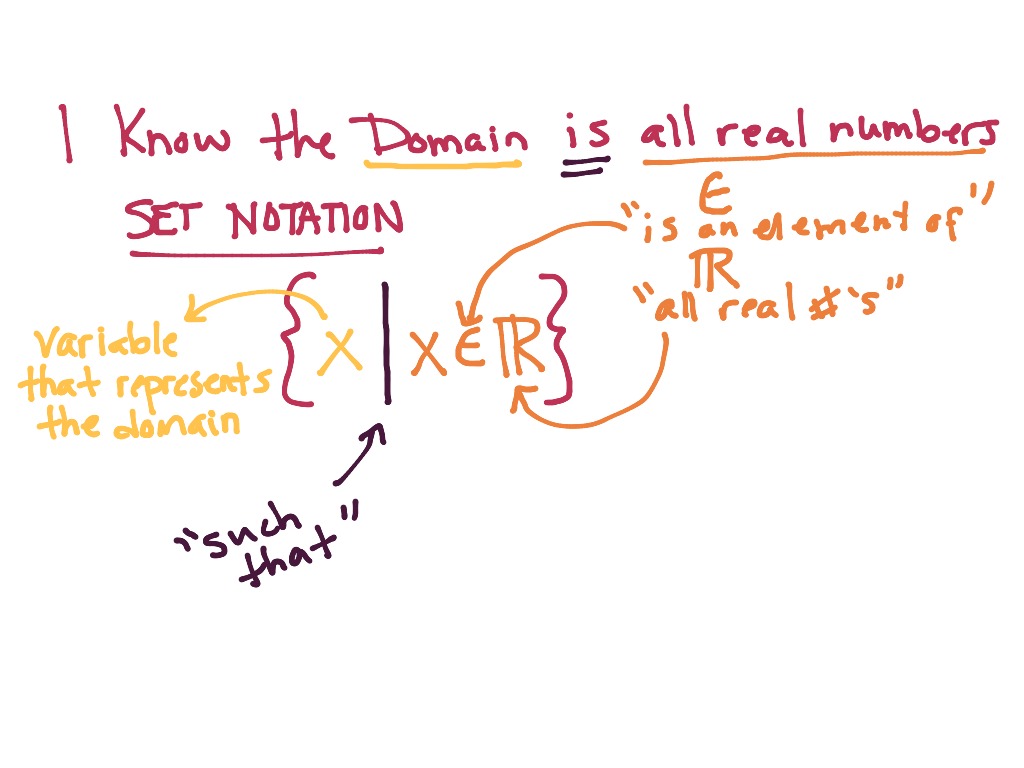

How To Write All Real Numbers – How To Write All Real Numbers

| Welcome to be able to the weblog, on this period I’m going to provide you with regarding How To Clean Ruggable. And after this, here is the first image: