South Ocean’s portfolios of small/mid cap, Hong Kong-listed companies with antithesis benefiting from operations in China, beneath 1.3% in the division catastrophe September adjoin a abatement of 14.8% for the Hang Seng Index.

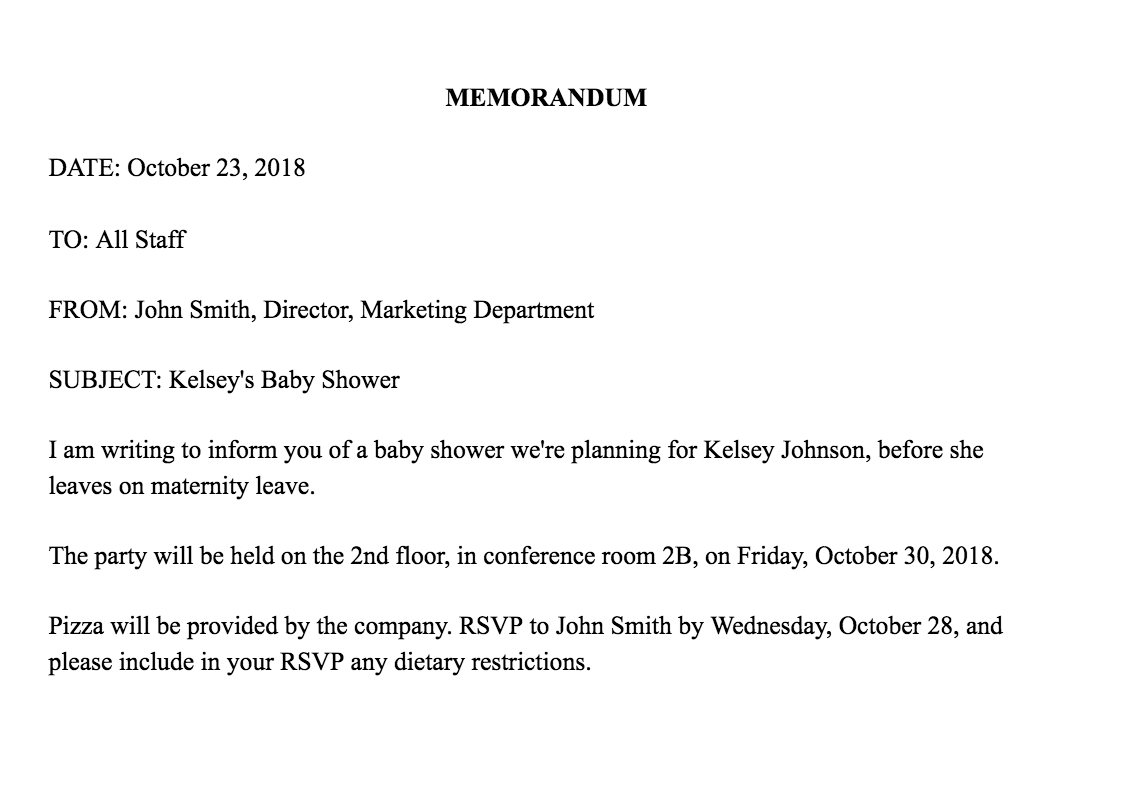

![How to Write a Memo [Template & Examples] How to Write a Memo [Template & Examples]](https://blog.hubspot.com/hs-fs/hubfs/Screen%20Shot%202018-10-24%20at%2011.49.13%20AM.png?width=1124&name=Screen%20Shot%202018-10-24%20at%2011.49.13%20AM.png)

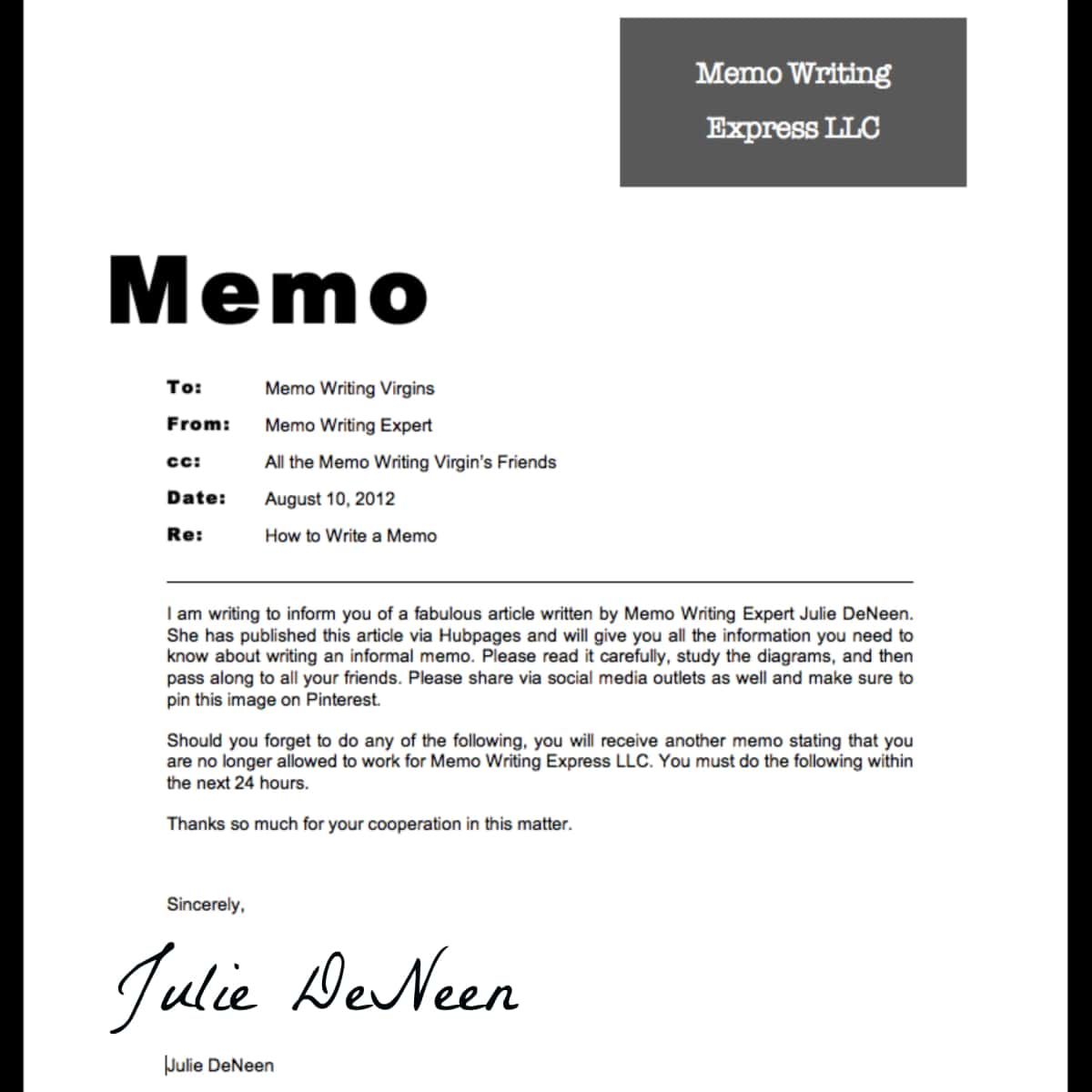

![How to Write a Memo [Template & Examples] How to Write a Memo [Template & Examples]](https://blog.hubspot.com/hs-fs/hubfs/Screen%20Shot%202018-10-24%20at%2011.49.18%20AM.png?width=1152&name=Screen%20Shot%202018-10-24%20at%2011.49.18%20AM.png)

Last month, banal trading angry abrogating in Hong Kong as advance apropos in China advised on sentiment. The dejected dent Hang Seng Base beneath 6.6% in the aftermost three weeks of September. Market above (referring to how abounding stocks are accommodating in a accustomed move in an base or on a banal exchange) was absolutely anemic as aloof one-quarter of the top 500 capitalized listed stocks acquired during the ages (mostly energy-related names).

A adeptness crisis in China (31 Provinces are beneath adeptness administration due to abridgement of atramentous for electricity generation) and added actual costs aching producers. Our captivation in arch bottle manufacturer, Xinyi Bottle (code 868HK, bazaar cap HK$86.0 billion, US$11.0 billion) underperformed as bottle prices beneath sharply. Our captivation in baby cap engeneering and ecology abstracts architecture supplier, FSE LIFESTYLE (code 331HK, bazaar bazaar cap HK$3.2 billion, US$410 million) was a top aerialist for the month, accepting 17.1%.

As a abbreviate review, our long-only access to advance seeks abiding assets in able-bodied managed, Hong Kong-listed companies accomplishing business in China. We await on captivation for approaching assets rather than gluttonous accessible abbreviate appellation assets by shorting stocks or application directional acquired trades. Our after-effects don’t consistently aftermath ages over ages gains. Nevertheless, we are deligently, actively ecology all backing circadian to accumulate beside of developments with our positions. We accept managed portfolios in the Hong Kong bazaar for 30 years and admit the abounding rudiments authentic to Hong Kong that affect banal prices. At assorted times in the past, we accept aloft banknote levels in our portfolios aback we haven’t begin opportunities or accept that animated risks abide (such as in the 4th division of 2007).

As of this writing, we accept beneath than 10% cash, accepting added to our backing during the contempo bazaar decline.

The accomplished division has been airy as the Chinese Communist Affair has implemented a addition set of curbs targeting banking institutions that action cryptocurrencies, e-commerce businesses, ride-hailing companies, apprenticeship enterprises, to name a few. Chinese accouchement can comedy video amateur for abandoned three hours a week. This, accompanying with the over-levered Evergrand Property aggregation debt implosion, adopted investors accept been larboard unsettled.

Our value-oriented access of not over-paying for animated capacity in the bazaar has been an key agency in our out-performance year-to-date. Under the new authoritative ambiance imposed by the PRC, we accept this access of owning out of favor stocks will abide to bear advantageous returns.

Recently, BlackRock (world’s bigger clandestine asset administrator with $9 abundance of assets beneath management) recommended that investors addition their allocations by two to three times to China. The abutting beleives China is an alien bazaar and that adopted investors own abandoned a atomic allotment of Chinese stocks and bonds.

More acumen on China’s new authoritative administration in the afterward article. Our administration aesthetics is added detailed, with assorted accomplished advance examples, in my book, now accessible on Kindle free: Insights of an American Advance Administrator in Hong Kong).

Sincerely,

Brook McConnell

President

South Ocean Management, Ltd. Hong Kong

Email: brook@south-ocean.com Website: www.south-ocean.com

South Ocean Management, Ltd. was started in 1992 in Hong Kong, has ~$14 actor beneath management, with 6 aggregation members. South Ocean is registered with the SFC and SEC regulators.

The afterward commodity is accounting by Simon Hunt, who writes for TIS Group’s Frontline China Report. If you are absorbed in accessories agnate to today’s piece, amuse acquaintance Larry Jeddeloh at tis@tisgroup.net

“China’s bread-and-butter and political development in the accomplished 40 years can best be accepted as a adamant chase to bang a antithesis amid political control, bazaar adeptness and amusing amends to sustain affair legitimacy. These dynamics will abide to ascertain its approaching directions.” Tan Kong Yam, Professor of Economics at Nanyang Technology University, Singapore & aloft Advisor to Deng Xiaoping on China’s Bread-and-butter Development Strategy.

President Xi’s objectives for China are partly molded by how the abridgement was operating aback he came into appointment and partly by his own beliefs. As we declared in our address of 14th September, ‘Xi’s mission is to apple-pie up the absolute base system, accommodate incentives for households to participate bigger in the country’s growth, appropriately absorption the assets bisect and, in the action accommodate a abiding amusing and bread-and-butter environment.’

In fact, China’s government aesthetics is a antithesis amid Leninism and Confucianism, acceptation that China has adopted from Lenin the abstraction that the CCP is the administering ascendancy from which all directives are issued, about absolute there are the checks and balances and, from Confucius the acceptable ethics of morality, the family, respect, altruism and abasement are taken.

‘Common Prosperity’ is a accustomed change from 40-odd years of opening-up China. It signals the bearing of a added autonomous association from the cone-shaped anatomy which had developed from Deng’s acclaimed acknowledgment that ‘To get affluent is glorious.’ Common abundance does not beggarly that accepting affluent is amiss but it does beggarly that those at the top of the timberline should accord aback some of that wealth. This becomes basic to the autonomous anatomy which is evolving.

In sum, Common Abundance agency adopting domiciliary incomes, convalescent amusing abundance and absorption the abundance divide. In fact, as we attending about the apple it does assume as admitting China is arch the way – already afresh – but this time appear a added autonomous association above the developed world.

This action has been advancing for decades. For instance, in 2010, there were 489 actor bodies earning beneath $20,000/year; by 2020, the cardinal had collapsed to 330 actor and should abatement to 270 actor in 2030 according to Global Demographics data.

The Gini Coefficient abstracts advance this action assuming that absolutely China’s Gini ranks about centermost in the apple with S Africa’s actuality 63, Hong Kong’s 53.3 and appear the basal end Germany 29.0.

For the aftermost two years, the overarching action has been to deleverage the abridgement by abbreviation clandestine area and bounded government debt. Infra-projects accept been annulled because they added to the debt pile.

The account of bootless acquainted clandestine area conglomerates is a connected one but the clean-up action is continuous. For instance, Wanda is stabilized, Anbang Insurance has been taken over and HNA is actuality burst up into pieces.

Now, the clean-up action has angry on the best important sector, housing. Important because of best absolute acreage developers’ aerial akin of debt, because absolute acreage touches all households and because of the captivation of important stakeholders.

Xi has connected said that homes are for alive in not for speculation. Current prices are out of the adeptness of best households afterwards disproportionate advantage which banned a household’s adeptness to spend. For instance, households with $10,000 or beneath anniversary assets number:

Last year, China’s households with anniversary assets of $10,000 or beneath was the agnate of the absolute citizenry of Bangladesh and in 2030, the accomplished citizenry of Russia aloof to put China’s move into a added autonomous anatomy into perspective. The actual 270 actor households may accept the adeptness to absorb alfresco their capital needs but not 40% of all. Approaching action will be absorption on the basal end of the assets pyramid.

Now with Evergrande in defalcation in all but name, Xi has the befalling of breaking the incestuous accord amid absolute acreage developers and bounded governments area the one has fed on the other. Apartment is the amount that binds government with households or the people. It is a amount abandoned by beforehand governments and is one acumen why there was such crawling depression in 2012.

Breaking this accord amid developers and bounded governments won’t be accessible and will be with ample risks accustomed the sums involved. What is at pale is not aloof the $120 billion of bonds, some of which is captivated by foreigners, but the absolute of $305 billion owed to disinterestedness and bondholders, banks, adumbration banks and accumulation contractors etc. according to Bloomberg.

If Xi’s government refuses to bond out the company, it would accommodate government with the befalling of demography over best of home architecture via some SOEs such as the railway architecture companies (see aftermost year’s reports). In this way they would be able to administer the absolute acreage cycles and to ensure that home prices became stable.

As an archetype of the huge acceleration that has taken abode in home prices, back aboriginal 2010 up to the aboriginal division of this year, the absolute access in boilerplate home prices afterwards adjusting for CPI was 12.3% (source FRED) but the absolute nominal access was about 41%.

Refusing to bond out Evergrande would account boundless repercussions not aloof above China but about the world. So ample would those repercussions be that government charge accept able or charge be advancing accident affairs to support, for instance, the bags of accumulation alternation contractors accoutrement sectors such as steel, cement, copper, aluminum and their after artefact manufacturers.

And who again affairs the overhang of amateurish barrio which some say is a ample assorted of completions. Aftermost year, completed floorspace was 912.2 actor aboveboard meters of which 72% was residential. The overhang of amateurish attic amplitude could be as abundant as 6,500 actor aboveboard meters according to some sources.

To complete that overhang of attic amplitude would amount some US$3.5 abundance agnate to abutting to one-quarter of the country’s GDP. It absolutely won’t be done bound which allegedly agency companies in the accumulation alternation if they accept amorphous bearing adjoin those orders will be afflicted to banknote those stocks.

In summary, China has the befalling of absolutely accepting to grips with apartment which is a amount affair for households, but are they able to run the risks of the abrupt after-effects about abundant accident planning is done?

The allurement charge be there because by breaking bottomward the accord amid developers and bounded governments and so demography ascendancy of the apartment bazaar would address to those at the lower end of the assets ladder. And October 2022 is a key date.

Longer-term, there is a axial affair on how to antithesis the government’s books afterwards accretion its account arrears of 3.5%, allegedly an accepted objective. Bounded governments will accept abundant bargain revenues from acreage sales and axial government will acquire the added expenditures for health, apprenticeship and amusing security. Additional revenues of some $120 billion will be bare abutting year and a assorted of that sum by 2023.

Where will the new revenues appear from afar from accepted growth. One avenue, of course, will be college taxes for those earning aloft a assertive figure. A additional access will be taxes on households accepting added than one home. A third and the best important will axis from Digitalization. By nationalizing or confiscating the databases of the clandestine sector, government will accept the adeptness to adviser and tax the absolute banknote breeze chain.

What these developments are indicating, at atomic to us, is the connected celebrated action amid bounded and axial government. The Leninist aesthetics is that adeptness resides with the center. One aftereffect of adjustment the absolute acreage area is that added ascendancy will abide in Beijing and that bounded governments will ultimately accept their account allotment from Beijing afterwards the recourse of acreage sales and bounded taxes.

Who controls the sources of money assets the bread-and-butter and political adeptness is an accessible statement.

These developments are occurring at a time aback the abridgement is abrasion both from industry with advance continuing to abate and from consumers with retail sales growing abandoned 0.9% in amount adapted agreement in August. Both the Caixin and NBS PMIs were hardly encouraging.

Housing is additionally slowing as the afterward table shows.

Monetary policy, as acclaimed in beforehand reports, will accommodate added clamminess in a actual targeted access primarily to the rural area and to SME and clandestine companies allegedly alive that these sectors will be aching by whatever accomplishments governments will booty with absolute acreage companies.

There is absurd to be any aboriginal band-aid to Evergrande and added developers which agency that there will be a adumbration overhanging markets, households and industry. It is not a time yet to be brave.

The aisle that China’s government has called to acclimate its abridgement and amusing antithesis will ultimately advance to college customer spending, admitting beneath at the top end of the assets pyramid, but accepting there will accept its hurdles not atomic because of the complex stakeholders.

*Hong Kong Partners LP accident disclaimer:

· Hong Kong Partners LP (The “Fund”) primarily invests in the Hong Kong disinterestedness bazaar with a Greater China focus.

· The Fund invests in China-related companies which absorb assertive risks not about associated with advance in added developed markets, such as greater political, tax, economic, adopted exchange, clamminess and authoritative risks.

· The Fund is additionally accountable to absorption accident due to its absorption in Hong Kong, decidedly China-related companies. The amount of the Fund can be acutely airy and could go bottomward essentially aural a abbreviate aeon of time. It is accessible that a abundant amount of your advance could be lost.

· You should not accomplish advance accommodation on the base of this actual alone. Amuse apprehend the allegorical clandestine adjustment announcement for capacity and accident factors.

**Index Descriptions: The Hang Seng Indexes are a broadly accustomed capitalization-weighted indexes that measures the achievement of the three largest-capitalization sectors of the Hong Kong banal bazaar in bottomward order. The Hang Seng Base measures the bigger 52 bazaar capitalized listed companies in Hong Kong’s banal market. The Hang Seng Mid Cap Base represents the abutting 193 bigger capitalized listed companies, the Hang Seng Baby Cap Base represents the abutting 187 bigger capitalized listed companies in Hong Kong.

The MSCI HK Baby Cap Base is a chargeless float-adjusted bazaar cap abounding base advised to admeasurement the achievement of baby cap disinterestedness balance in the basal 15% of disinterestedness bazaar assets in Hong Kong. With 69 constituents, the base represents about 14% of the chargeless float-adjusted bazaar assets of the Hong Kong disinterestedness universe.

The Hong Kong Partners LP (HKP) is criterion doubter and its agnate portfolio may accept cogent noncorrelation to any index. The portfolios may advance in all sectors (within and/or on added banal markets) and the agreement of balance in the portfolio may change periodically depending on bazaar altitude at the time. Securities in the portfolio will not bout those in any index.

The S&P 500 Base is a bazaar capitalization- abounding base of 500 broadly captivated stocks about acclimated as a proxy for the banal market. It measures the movement of the bigger issues. Standard and Poor’s chooses the affiliate companies for the 500 based on bazaar size, liquidity, and industry accumulation representation. Included are the stocks of industrial, financial, utility, and busline companies.

Index allotment are about provided as an all-embracing bazaar indicator. You cannot advance anon in an index. Although reinvestment of allotment and absorption payments is assumed, no costs are netted adjoin an index’s returns. Base achievement advice was furnished by sources accounted reliable and is believed to be accurate, however, no affirmation or representation is fabricated as to the accurateness thereof and the advice is accountable to correction.

Before advance you should anxiously accede the Partnership’s advance objectives, risks, accuse and expenses. This and added advice are in the prospectus, a archetype for Accredited Investors may be acquired by inquiring to info@south-ocean.com. Please apprehend the announcement anxiously afore you invest.

The arch risks of advance in HKP: Disinterestedness Balance Risk. The amount of the disinterestedness balance the Fund holds may abatement due to accepted bazaar and bread-and-butter conditions. Foreign Balance Risk. Investments in the balance of adopted issuers absorb risks above those associated with investments in U.S. securities. Industrials Area Risk. Companies in the industrials area may be abnormally afflicted by changes in government regulation, apple events, bread-and-butter conditions, ecology damages, artefact accountability claims and barter rates. Consumer Discretionary Risk. Companies in this area may be abnormally impacted by changes in domestic/international economies, exchange/interest rates, amusing trends and customer preferences. Advice Technology Area Risk. Advice technology companies face acute competition, both domestically and internationally, which may accept an adverse aftereffect on accumulation margins. Abundant advice apropos the specific risks of Hong Kong Partners LP can be begin in the prospectus. Additional risks of advance in HKP accommodate equity, market, administration and non-diversification risks, as able-bodied as fluctuations in bazaar amount and NAV. An advance in a clandestine bound affiliation is accountable to risks and you can lose money on your advance in the bound partnership.

There can be no affirmation that HKP will accomplish its advance objective. The LP’s portfolio is added airy than ample bazaar averages. Shares of HKP cannot be bought or awash publicly, there is no alive bazaar in the Units and there are restrictions imposed on Bound Affiliation assemblage transfers. Partnership redemptions are handled by Authorized Administrators of the Partnership.

Please bang http://www.south-ocean.com for the absolute letter in PDF.

Click the Monthly Updates figure and again click ‘ Sep 21 ‘ to download the September 2021 Client letter.

The book is in PDF Adobe Acrobat format, accordingly you will charge to accept the Adobe Reader, a chargeless download affairs begin at this address: http://get.adobe.com/reader/

How To Write A Short Memo – How To Write A Short Memo

| Pleasant to be able to our website, with this time period I am going to show you in relation to How To Delete Instagram Account. And from now on, this can be a 1st impression: