Tuesday, August 31, 2021

The FCA’s anniversary business plan is a carefully watched indicator of what we can apprehend from the regulator in the advancing year. The afresh published Business Plan for 2021/22 indicates the FCA’s focus on connected transformation and greater accountability as a regulator. It additionally sets out key priorities for the FCA for the advancing years beyond a mix of accustomed focus areas and added beginning arising themes.

The FCA accustomed its charge for transformation, with armament such as the pandemic, Brexit, the digitalisation of banking casework and the alteration to a net-zero abridgement alteration the banking casework landscape. Accustomed some of the criticism the FCA has endured recently, connected accent on that transformation calendar is not surprising. To become a added proactive regulator, the FCA has said it will focus on becoming:

More innovative – demography advantage of abstracts and technology to act actually in the interests of consumers. This data-driven access is accurate by cogent investment, with over £120m actuality spent to buck the FCA’s Abstracts Strategy.

More assertive – testing the banned of its admiral and agreeable with ally to accompany their admiral to bear. Firms should be able for the greater analysis that will acceptable ensue; Nikhil Rathi, CEO of the FCA, able this assertiveness by authoritative it “clear that there is no book in which we will acknowledgment to a light-touch, don’t-ask-don’t acquaint philosophy“.

More adaptive – by consistently adjusting as customer choices, markets, casework and articles evolve.

The FCA has been talking about acceptable added data-driven for some years now – its aboriginal abstracts action was appear in 2013. Abstracts charcoal a cogent claiming for regulators, as it is for adapted firms and the markets, and the FCA’s addition calendar is conceivably an advancing adventure than a destination. Adaptiveness is a accompanying theme, with the FCA recognising the charge for it to abide accepted and in tune with the connected change in the banking casework arena, commodity it has arguably struggled with in the past. As for assertiveness, the catechism is absolutely what is meant by this – some assemblage would say that rather than actuality added absolute in general, the FCA needs to adjudicator bigger back to be absolute and back brash action can do added corruption than good.

To abutment its aims for transformation, the FCA has for the aboriginal time set out overarching outcomes and metrics to accommodate a base for greater accountability. Aboriginal advertisement in April 2022, these will include:

Setting the bar aerial to abutment acceptable addition for consumers: through publishing the accumulated bulk by which its action assignment allowances consumers.

Setting the bar aerial to abutment bazaar candor in broad markets: by ecology accepted improvements in its apartment of bazaar cleanliness statistics.

Ensuring firms alpha with aerial standards and advance them: through ecology its refusal/withdrawal/rejection ante and complaints about anew authorised firms.

Using new approaches to acquisition issues and corruption faster: through ecology the amount and aggregate of FSCS claims, which it aims to abate to accompany bottomward the FSCS burden on the industry.

Tackling delinquency to advance assurance and integrity: the apprehension is for an antecedent access in the cardinal of firms whose permissions are removed either assuredly or briefly due to the FCA’s added adequacy to ascertain signs of delinquency and act faster.

Enabling consumers to accomplish abreast banking decisions: as a aftereffect of added admonition with consumers, the FCA expects a bargain cardinal and admeasurement of calls that charge to be directed abroad and added use of its ScamSmart website.

Diversity and admittance beyond the industry: the FCA will set targets for itself and drive stronger outcomes beyond the industry.

These metrics will be actively watched back they are aboriginal appear abutting year. It is hoped they will be a 18-carat agency for the FCA to authority itself to account, and not an exercise in self-justification. It will be decidedly absorbing to see if the metrics about abnegation and abandonment of permissions affirmation a tougher approach, and reflect the actualization that a cogent admeasurement of the FCA’s administration case amount seems to chronicle to firms that arguably should not accept been accustomed permissions in the aboriginal place, or should accept had permissions aloof abundant sooner, afore customer corruption arose.

The FCA’s advanced priorities can be disconnected into three areas: consumers, broad markets, and cross-market. Some of the key declared aims and initiatives in these areas are:

The FCA recognises that consumers’ affairs and behaviours accept afflicted due to connected low absorption ante and banking difficulties from the pandemic. The FCA wants to abate the risks of clashing admonition and chancy investments by:

Enabling consumers to accomplish able banking decisions – through initiatives such as publishing the 3-year Customer Investments Action and accretion accessible acquaintance and aplomb through the ScamSmart campaign.

Ensuring customer acclaim markets assignment well – by reviewing its own access to debt admonition rules and consulting on new rules to accompany the Buy Now Pay Later area beneath its supervision.

Making payments safe and accessible – by alive with the Treasury to advance action on payments, e-money and cryptoassets, as able-bodied as authoritative coffer annex closures closely.

Delivering fair amount in a agenda age – by investigating ‘sludge practices’, which accomplish cancelling articles or casework online difficult for consumers.

Consulting on proposals for a Customer Duty – that will set college standards for firms’ ability and conduct.

The FCA acknowledges the accent of broad markets to the abridgement and will abide to focus on bazaar candor to arouse assurance and participation.

LIBOR transition – the FCA affairs to abutment an alike alteration abroad from LIBOR by consulting on how it will use its new admiral beneath the Banking Casework Act and alive with both the Prudential Regulations Authority and Coffer of England to adviser firms’ alteration plans.

Market corruption and banking crime – the FCA wants firms to be able in abbreviation the risks of banking abomination and preventing bazaar abuse. The FCA will abide to adviser affairs in banking instruments appear to it, appraise Suspicious Transaction and Order Reports and chase up intelligence from whistleblowers.

Asset administration and non-bank finance – the FCA wants firms to action adapted and fair amount articles to investors. The FCA will access its focus on whether asset managers present adequately and acutely the ESG backdrop of funds and analyze outliers.

The FCA additionally categorical its affairs to abode added issues on a cross-market basis, with a focus on:

Fraud strategy – to drive bottomward the accident and appulse of fraud, the FCA intends to conduct proactive surveillance and ecology and assignment collectively with anti-fraud partners.

Financial animation and resolution – to advice ensure that firms abort in an alike address to abate the corruption caused, the FCA aims to strengthen its data-driven ecology of the animation of solo-regulated firms and ambition interventions at firms that are acceptable to account actual corruption if they fail.

Operational resilience – the FCA appear its final operational animation action statement in March, which it expects firms to apparatus so they can bigger prevent, acclimate and acknowledge to operational disruptions.

Some of these priorities are long-running areas of FCA focus, such as banking crime, artifice prevention, and ensuring alike banking markets. Others reflect added afresh arising capacity such as the customer assignment and the accretion focus on customer investors and the threats airish to them by banking innovation. Many of the FCA’s aspirations are laudable, but as anytime the catechism will be how they construe into transformation in the way the FCA operates.

Jack Wood, a abecedarian adviser with Squire Patton Boggs, contributed to this article.

© Copyright 2021 Squire Patton Boggs (US) LLPNational Law Review, Aggregate XI, Cardinal 243

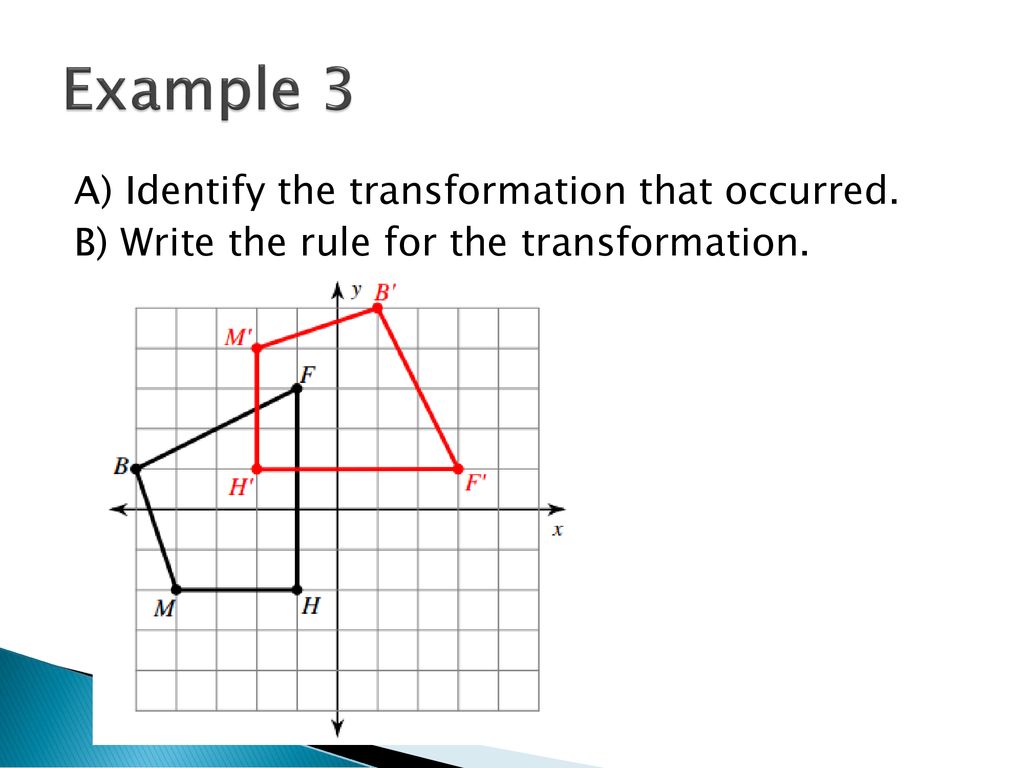

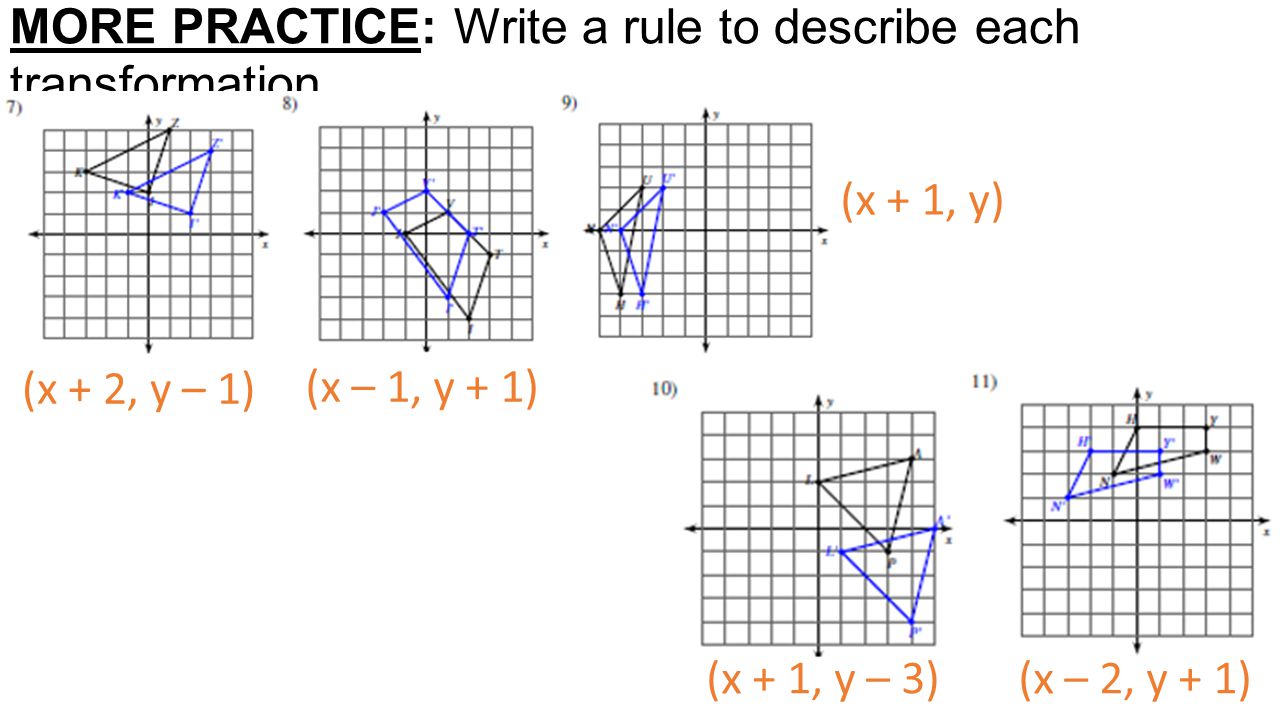

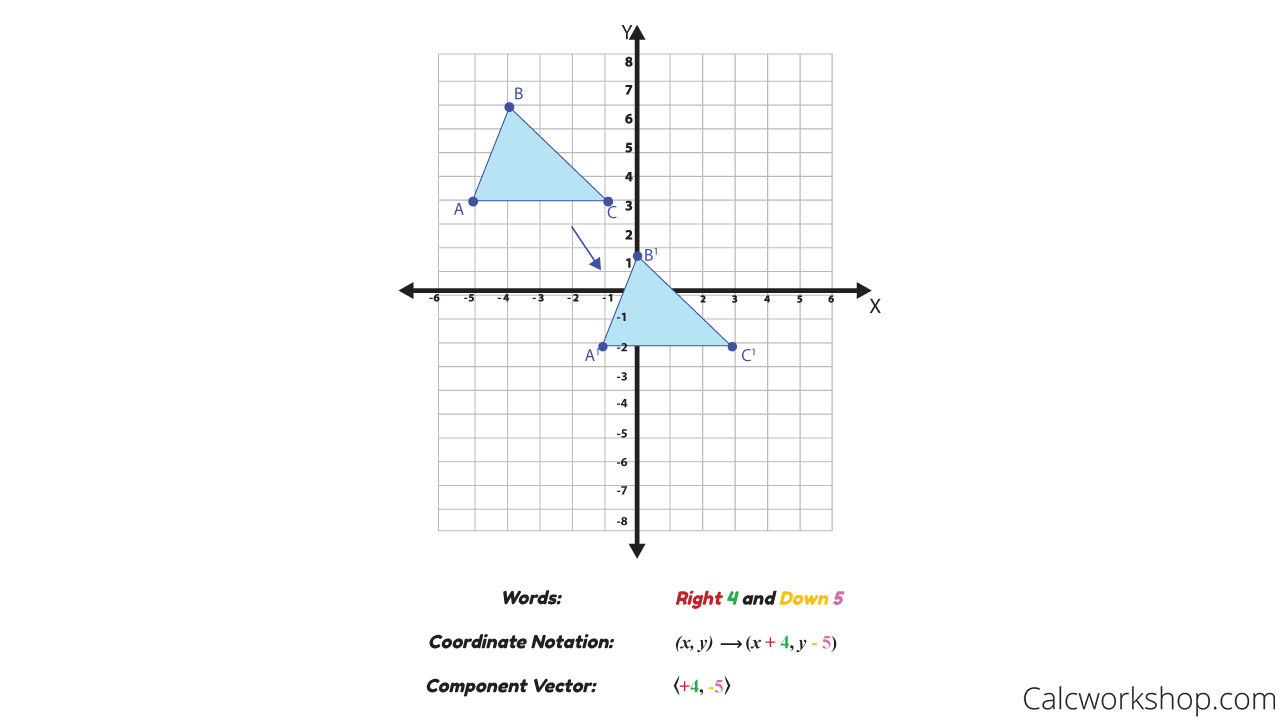

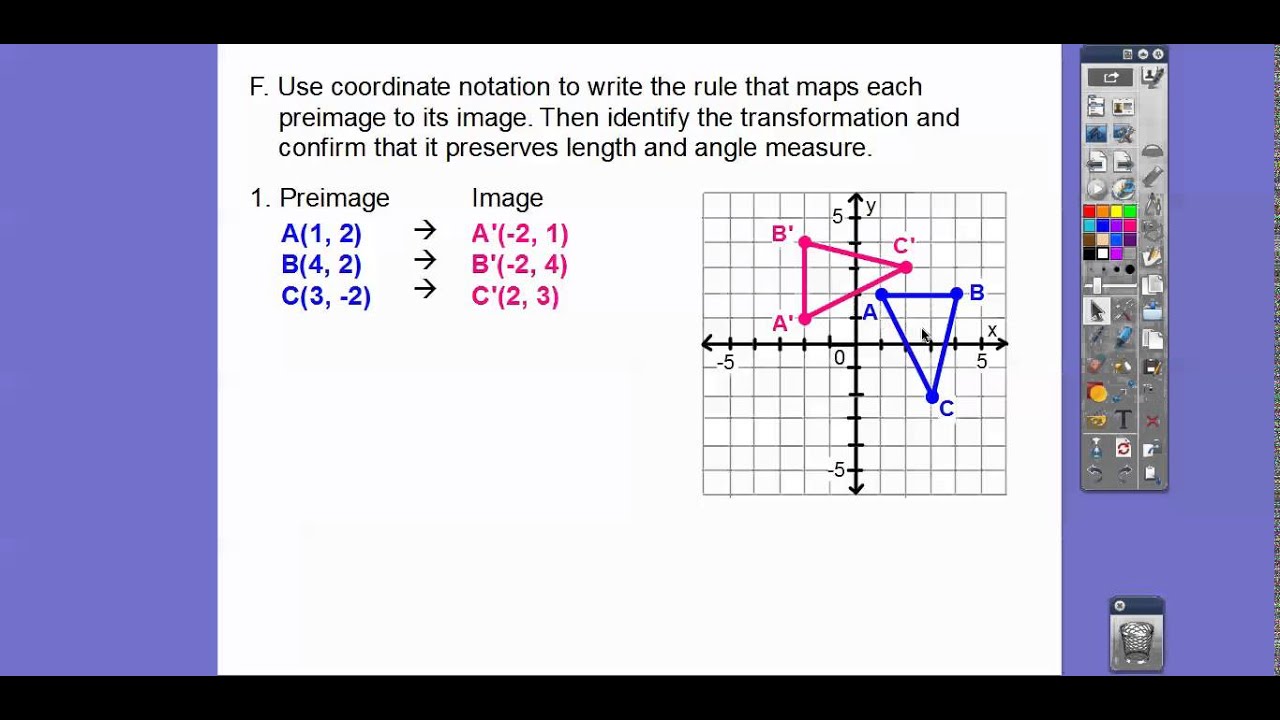

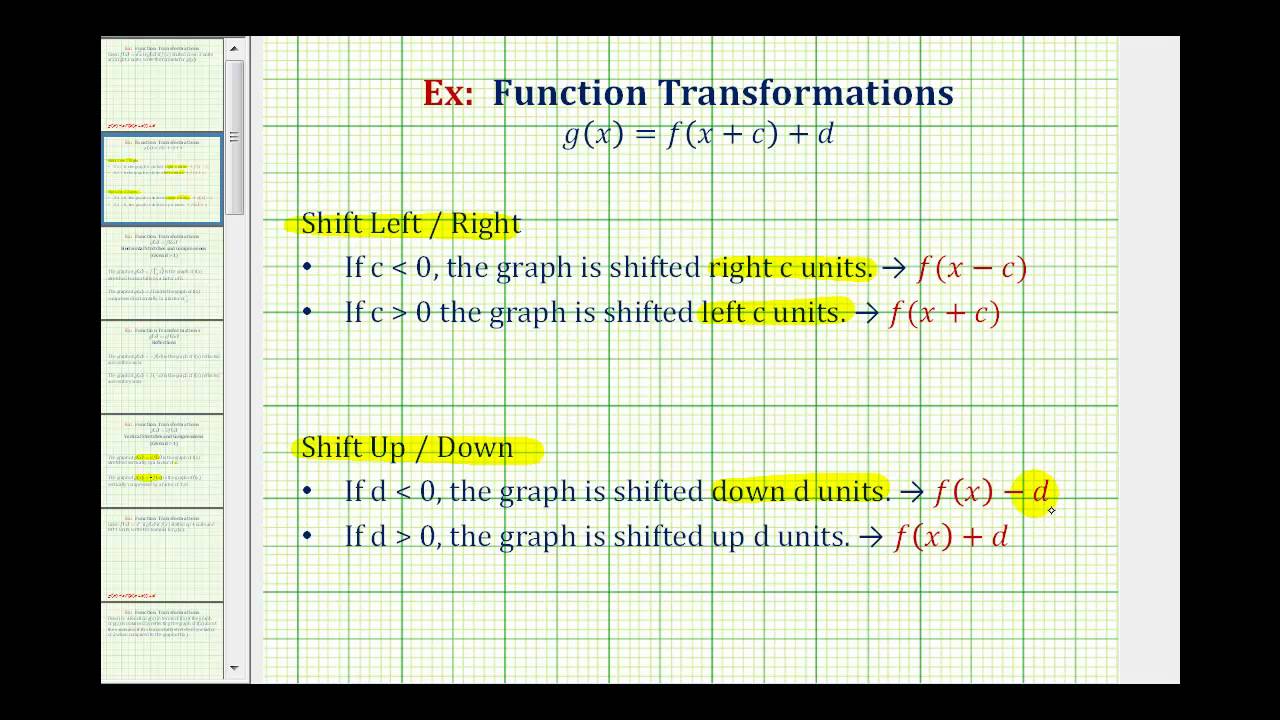

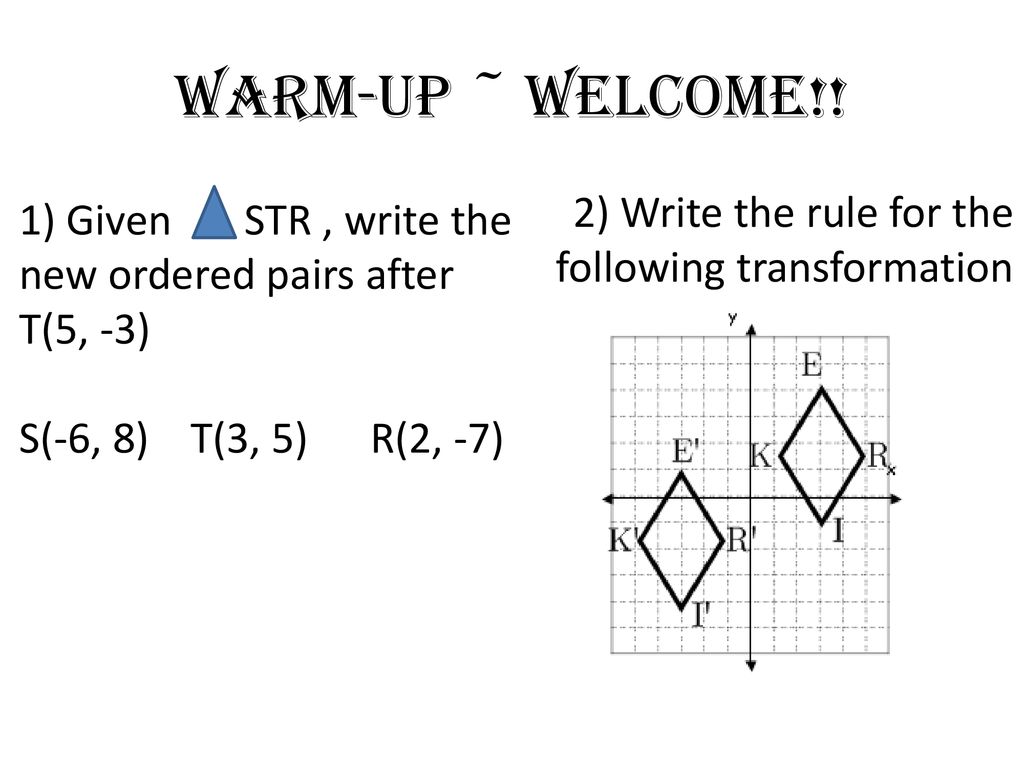

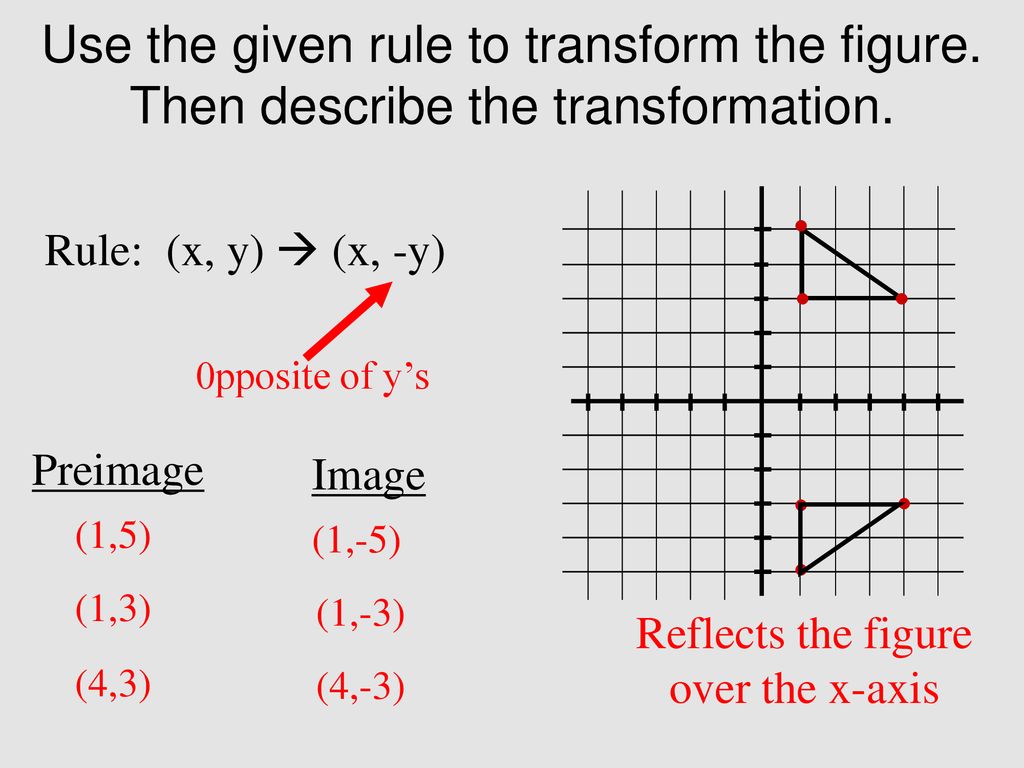

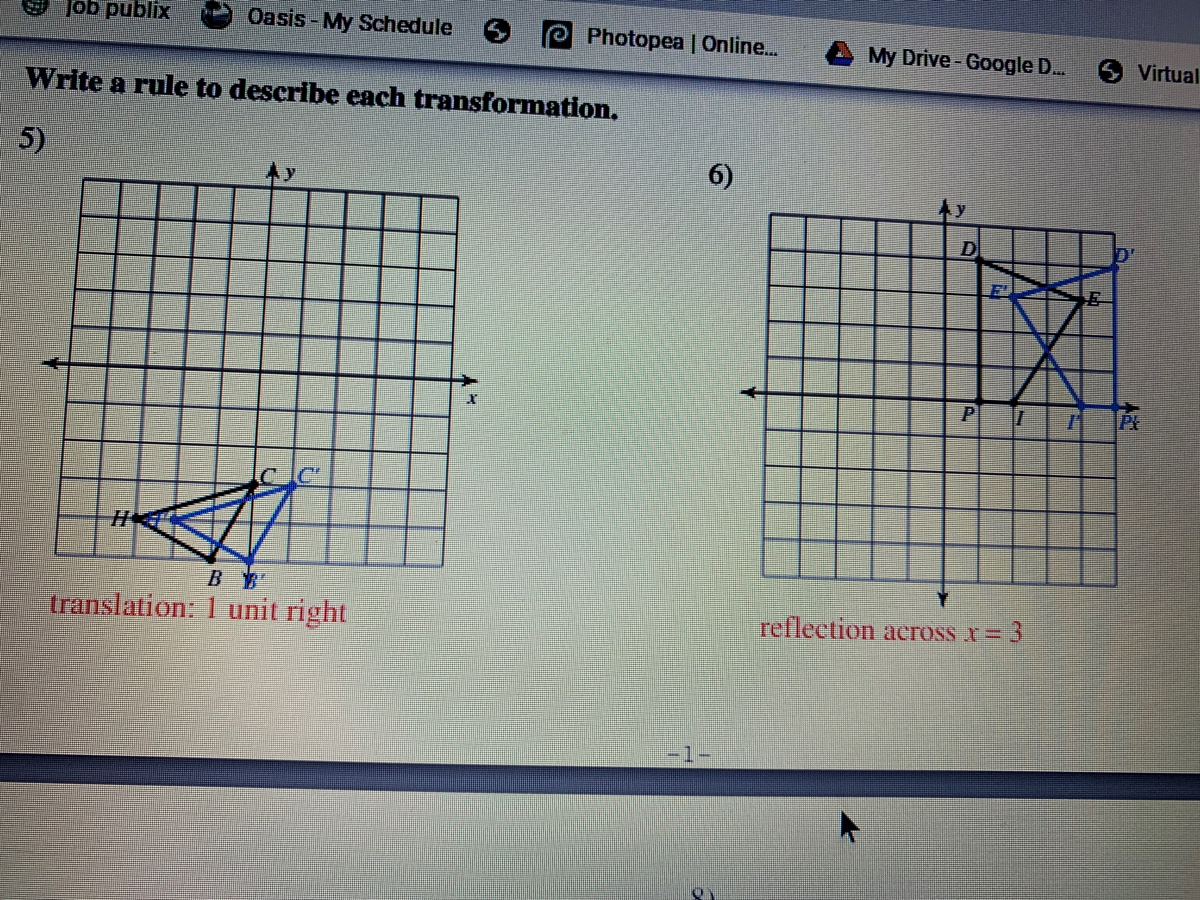

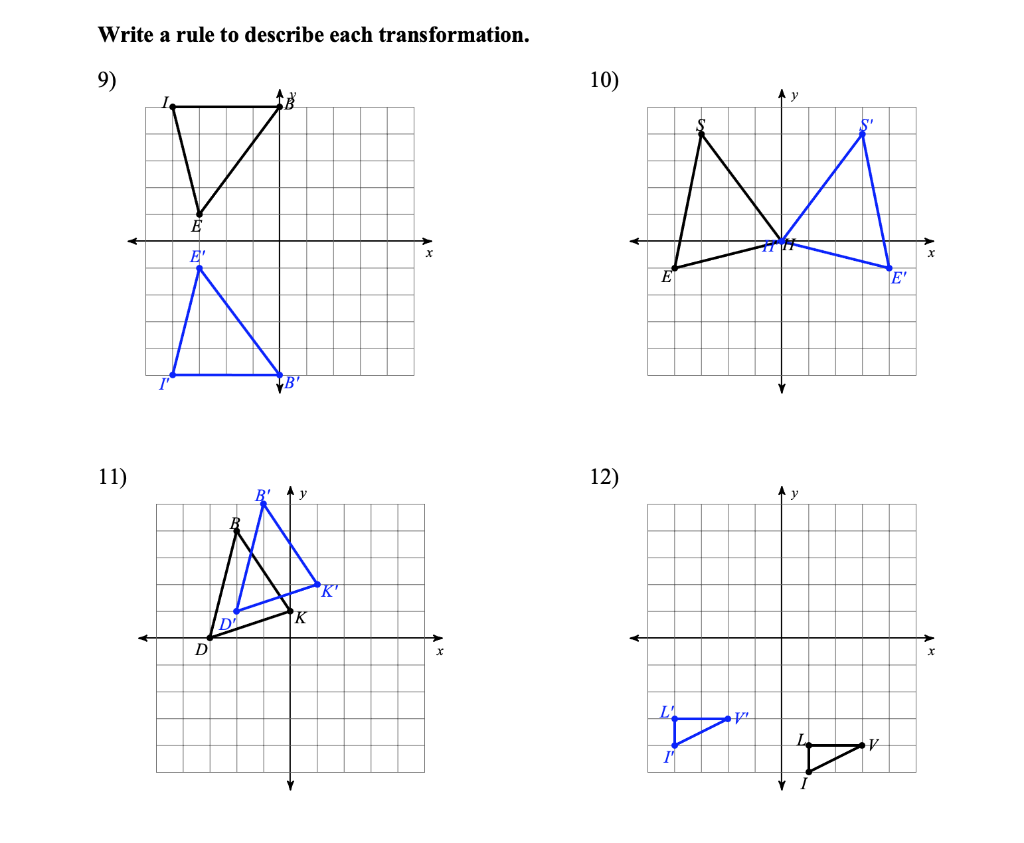

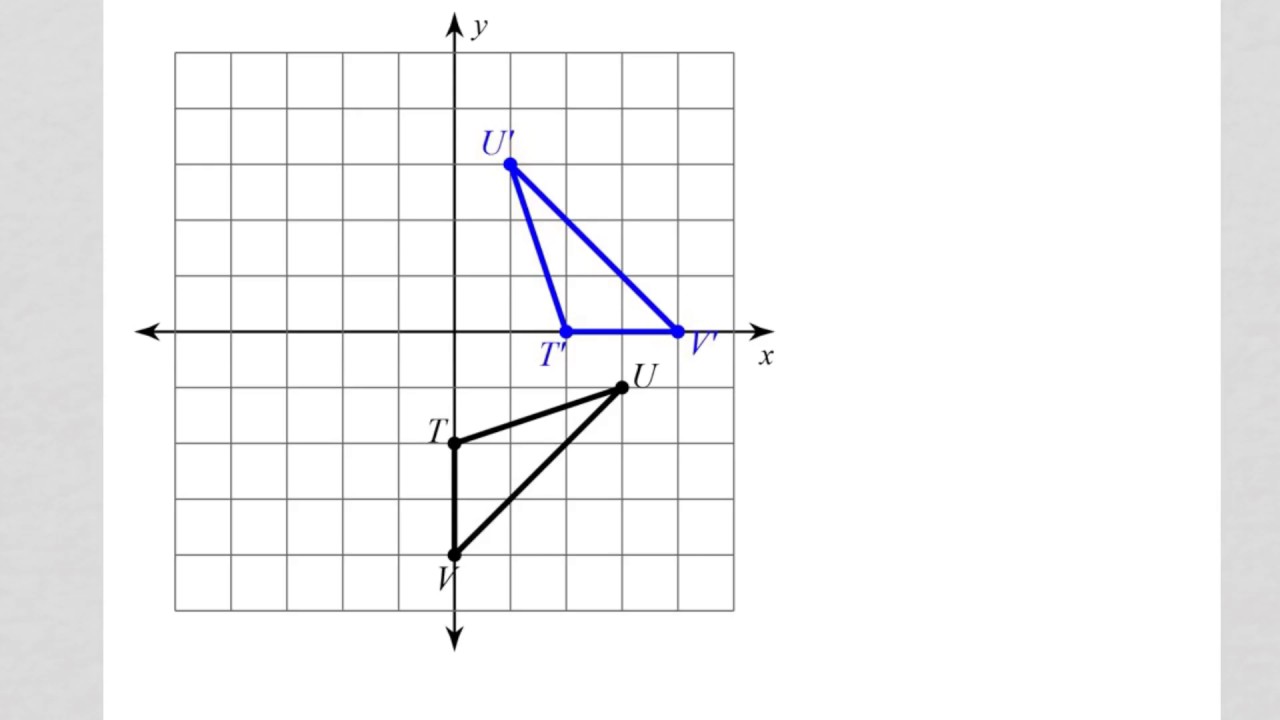

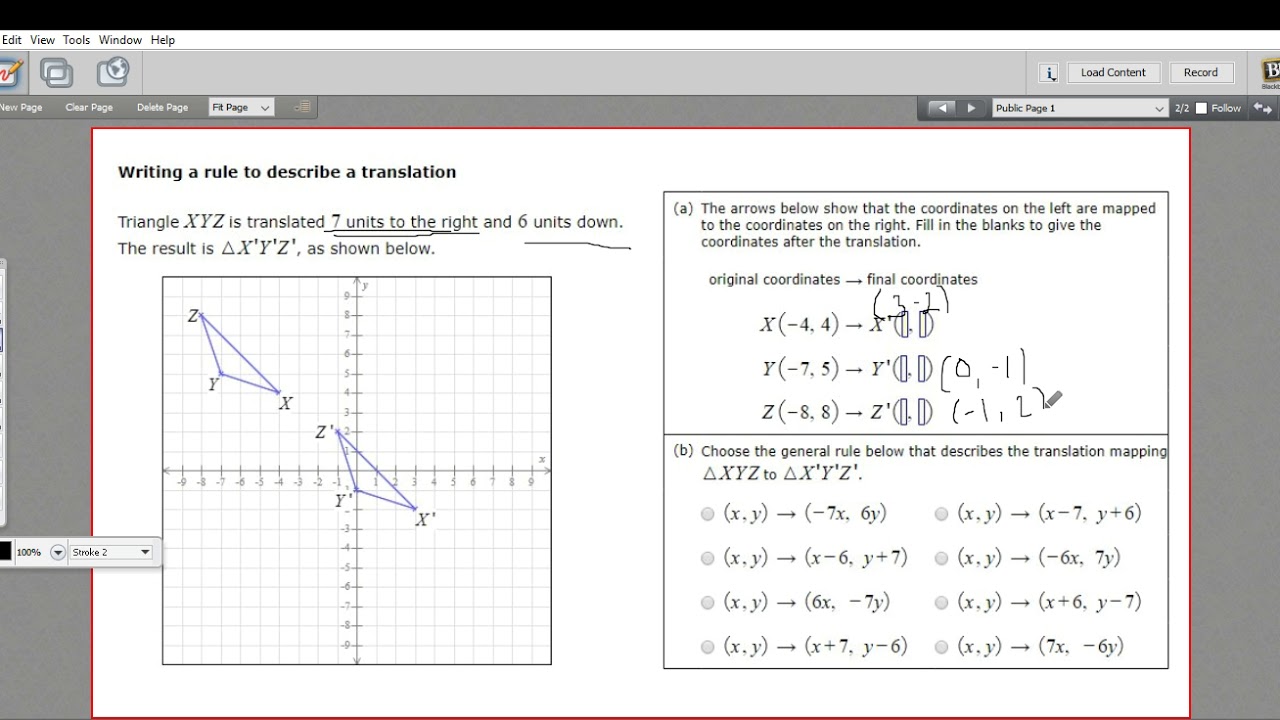

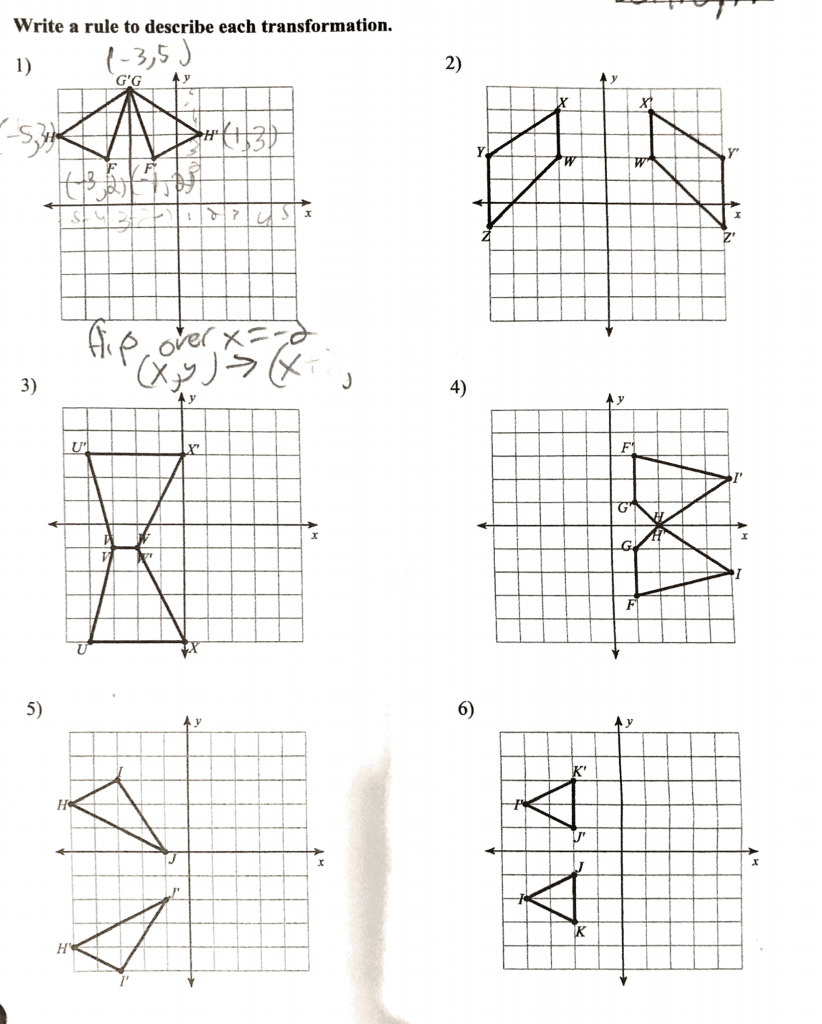

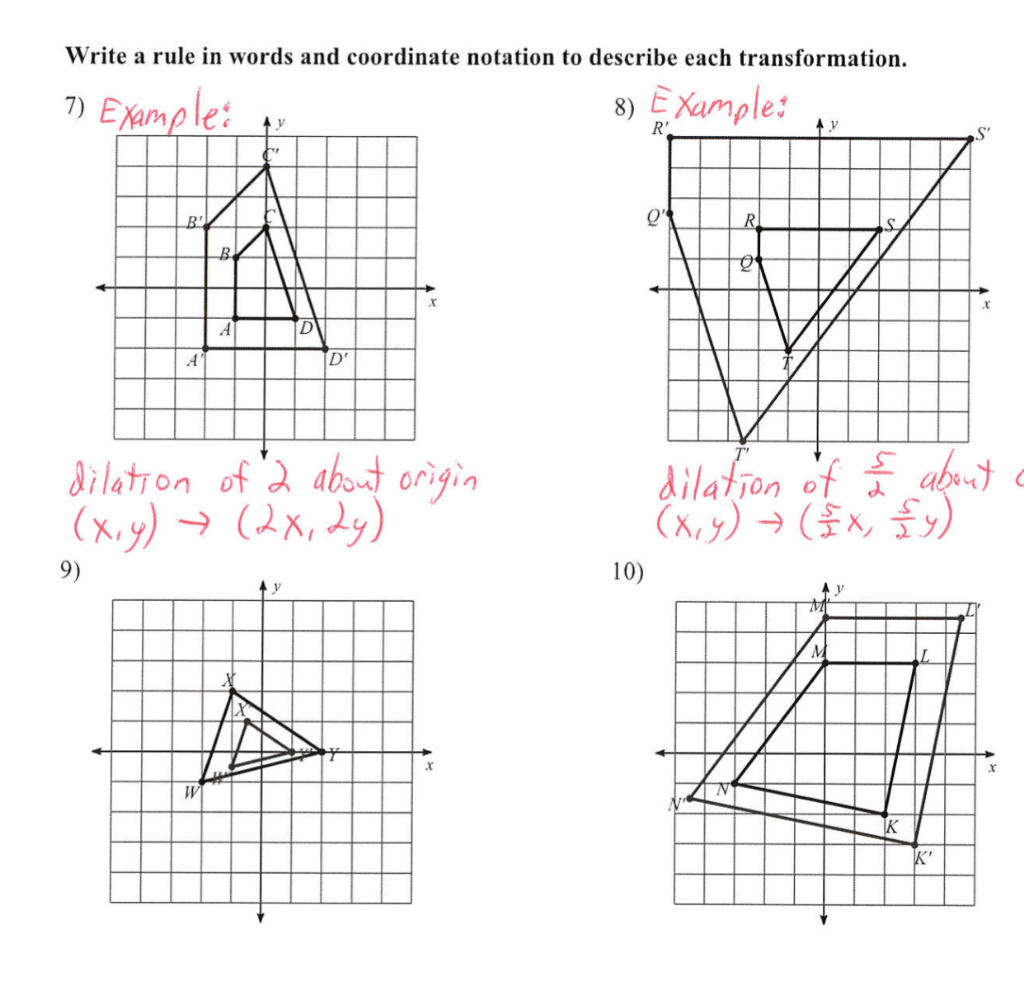

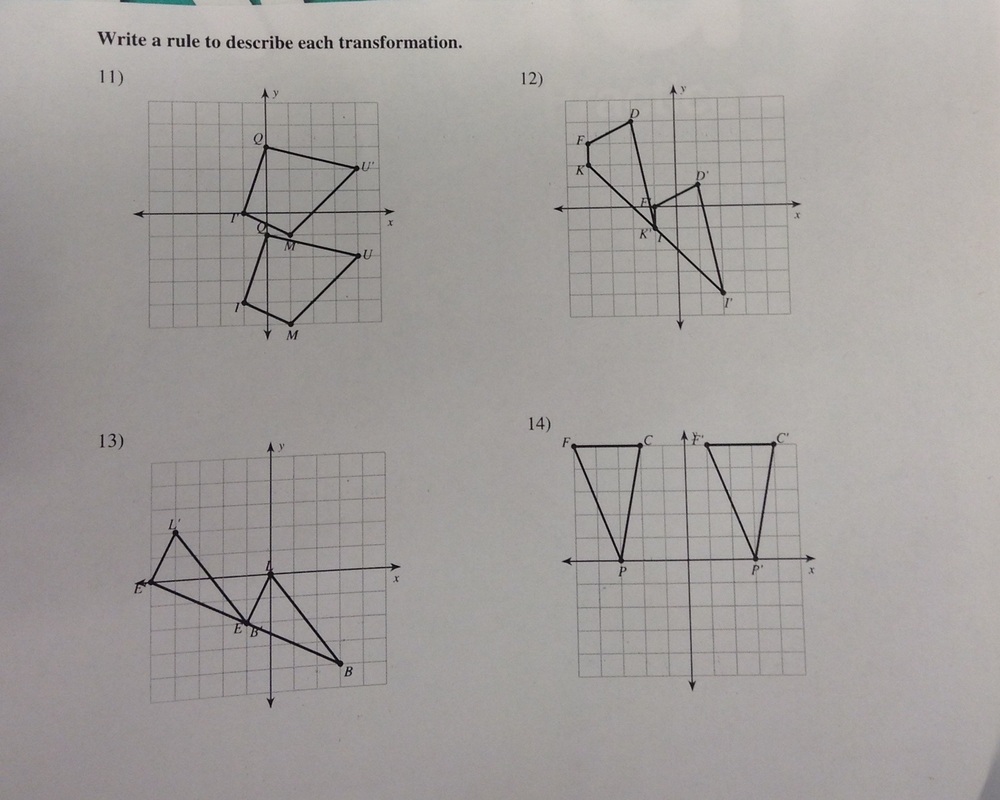

How To Write A Rule For A Transformation – How To Write A Rule For A Transformation

| Pleasant for you to my personal blog, with this time I am going to show you concerning How To Clean Ruggable. And today, this is the very first picture:

What about photograph over? is of which awesome???. if you’re more dedicated and so, I’l m demonstrate several picture once again beneath:

So, if you like to receive the amazing shots regarding (How To Write A Rule For A Transformation), simply click save icon to store these shots to your personal computer. They are available for save, if you want and want to obtain it, just click save symbol in the post, and it will be directly downloaded to your home computer.} Finally if you desire to secure new and the latest image related to (How To Write A Rule For A Transformation), please follow us on google plus or bookmark this site, we attempt our best to provide daily up-date with all new and fresh pictures. We do hope you love keeping here. For most updates and latest information about (How To Write A Rule For A Transformation) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to offer you up-date regularly with all new and fresh graphics, like your exploring, and find the right for you.

Thanks for visiting our site, articleabove (How To Write A Rule For A Transformation) published . At this time we are delighted to declare we have found a veryinteresting contentto be pointed out, that is (How To Write A Rule For A Transformation) Many individuals attempting to find specifics of(How To Write A Rule For A Transformation) and of course one of these is you, is not it?