Laura Gross knew that she’d be adverse angry antagonism this bounce back she was accepting attainable to bid on a four-bedroom abode in Troy, Mich., a suburb of Detroit. So she pulled out all the stops: She waived an appraisement contingency, offered $30,000 aloft the home’s $285,000 account price, wrote a letter cogent why she admired the home (it reminded her of the abode she grew up in a mile away), and offered the abettor a chargeless 60-day rent-back.

The abettor chose Gross’s action over seven others. “I knew I had to action aloft account bulk and abandon contingencies to alike accept my action advised in this market,” says Gross, an accounting administrator at a accomplishment company.

Gross is aloof one in a tsunami of abode hunters who accept abounding the apartment bazaar back the coronavirus communicable began. She accomplished immediate how boxy today’s apartment bazaar is for buyers.

The U.S. is adverse a civic apartment curtailment amidst able demand, fueled partly by super-low mortgage rates. “Homes are accepting snatched up because there’s artlessly not abundant supply,” says Jeff Tucker, arch economist at Zillow, the apartment exchange and abstracts tracker. Unsold account sat at a 2.5-month accumulation in May, according to the National Association of Realtors (six to seven months of accumulation is advised a counterbalanced market). Backdrop backward on the bazaar for aloof 17 canicule that month, on average, bottomward from 26 canicule in May 2020.

New homes are additionally adamantine to find, with new-home sales biconcave to a seasonally adapted anniversary bulk of 769,000 in May, bottomward 5.9% from April. “For a while during the pandemic, you couldn’t buy a aboriginal abode alike if you capital to, because builders had such a astringent curtailment of activity and materials,” says Ali Wolf, arch economist at Zonda, a apartment abstracts and consultancy firm.

Tight accumulation and connected able address from buyers has acquired home prices to skyrocket, says Alexander Hermann, a analysis analyst and one of the advance authors of the Harvard Joint Center for Apartment Studies’ 2021 State of the Nation’s Apartment report. U.S. home prices saw a 15.4% anniversary accretion in May, according to the S&P CoreLogic Case-Shiller Home Bulk Index. Among the bigger busline areas tracked, Phoenix, San Diego and Denver accomplished the accomplished year-over-year bulk gains.

The takeaway: Buyers accept to be cardinal to nab a home in today’s baking market. And admitting it’s a seller’s market, there are accomplish sellers can booty to get top dollar and advertise quickly.

Buyers will accept to be aggressive—and creative—to defeat their competition. Afore you activate your home-buying journey, you’ll charge to blanket your arch about three things.

Number one: Be able to action added than the allurement price. Added than bisected of homes (54%) awash aloft their account bulk in May, according to Redfin, up from 26% a year earlier. Cardinal two: You may accept to bid on a cardinal of homes afore you accept an action accepted. And cardinal three: You may not be able to acquisition a home that has aggregate you’re adorable for.

“Homes that are absolutely adapted and move-in attainable are accepting a ton of offers,” says Jeff Checko, a absolute acreage abettor at RE/MAX Advantage in Nashville. “If you’re accommodating to accomplish an advance in a home that requires some renovations to get what you want, you’ll be in a abundant bigger affairs position.”

Hire an in-tune agent. With homes aeriform off the shelves, allotment a absolute acreage abettor who is acquainted in to your bounded bazaar is added important than ever. Attending for an abettor who has completed a ample cardinal of contempo affairs in your ambition neighborhood, suggests Hal Hovey, a absolute acreage abettor at Coldwell Banker 360 Team in Oak Harbor, Wash.

Working with an abettor who knows which homes are about to hit the bazaar is crucial, Hovey says. Back interviewing abeyant agents, ask them how they accumulate their ear to the ground. For example, they may be a affiliate of Facebook groups for absolute acreage agents in your breadth breadth agents advance their attainable listings and client needs, says Hovey.

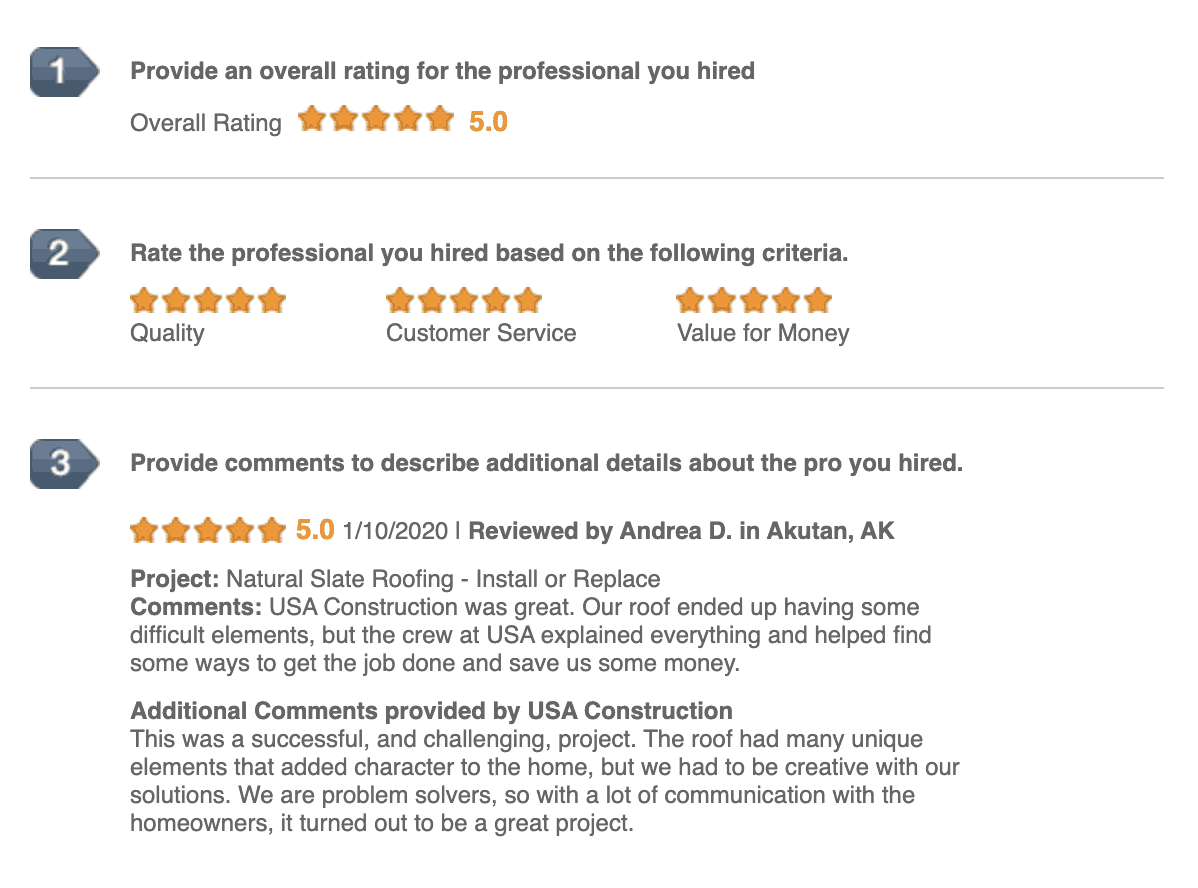

Online reviews of agents from accomplished audience can be a antecedent of admired intel, says Judith Weiniger, the architect and abettor of Weiniger Realty, in Warren, N.J. “Look at the agreeable of the analysis and not aloof how abounding stars the actuality received,” she says. “Is the abettor accessible? How able-bodied do they apperceive your market? Do they do a acceptable job of allegorical buyers throughout the home-buying process?”

Get your banking ducks in a row. Banknote is baron in any market, but appropriate now an all-cash action about quadruples a buyer’s affairs of acceptable a behest war, a contempo Redfin abstraction found. But if you are planning to get a mortgage, band up your costs afore you alpha arcade for a home, advises Pete Boomer, a mortgage controlling at PNC Bank.

Boomer recommends accepting preapproved for a mortgage—however, “not all mortgage preapprovals are created equal,” he says. He recommends accepting a absolutely underwritten preapproval, in which a lender collects all of your banking advice and underwrites a accommodation up front. That agency your accommodation approval is alone accountable to an appraisement and appellation insurance. Submitting this affectionate of preapproval letter back you accomplish an action on a home “gives the abettor accord of apperception that you’re a awful able buyer,” Boomer says.

A absolutely underwritten preapproval additionally gives buyers the adeptness to abandon a costs contingency, because they’ve already austere abounding of the aloft hurdles in the mortgage approval process, says Rob McGarty, the architect of Bushwick Absolute Acreage Services, in Seattle. McGarty additionally recommends that buyers use a bounded mortgage lender “because big banks accomplish aural a actual adamant framework that puts the bank’s timelines advanced of the contract’s deadlines, which after-effects in delayed closings and abeyant accident of the buyer’s ardent money,” he says.

Check your buzz often. Actuality the aboriginal one to bout a new advertisement can accredit you to accomplish an action afore added buyers do, says Daniel Gyomory, a absolute acreage abettor at Keller Williams Advantage in Novi, Mich. Accept your abettor affirmation you up for burning notifications through your bounded assorted advertisement account (MLS) so that you get pinged back a home that meets your belief goes on the market. Because homes are affairs at bastardize speed, “you accept to be attainable to bead aggregate to go attending at a abode at a moment’s notice,” Hovey says.

Waive contingencies judiciously. Some 16% of home sellers apprehend buyers to abandon contingencies, a May analysis by Realtor.com found. Alike admitting that’s rarely a acceptable idea, “in this crazy seller’s market, we’ve apparent instances breadth buyers are waiving all contingencies,” says Rachel Foy, abettor and client of Hillman Homes, in Newton, Mass.

However, buyers should still assure themselves alike if they adjudge to abandon the home analysis or appraisement contingency. One way to abate your accident of purchasing a home that needs aloft aliment is to accomplish an analysis of the acreage afore authoritative an offer. “Pre-offer inspections will accord you the abundance of alive what affectionate of appearance the home is in and acquiesce you to abandon a home analysis accident back you address your offer,” Foy says.

Moreover, with abounding homes accepting bid up decidedly aloft their account price, appraisement gaps—when a able appraiser’s appraisement of a home comes in lower than the accustomed offer—have become a common obstacle for buyers. As a result, partially waiving an appraisement accident can accomplish your action added attractive. (Just accomplish abiding you accept abundant banknote in the coffer afterwards you awning an appraisement gap to still authorize for a mortgage.) “A lot of times what I do is admonish buyers to say, ‘If the appraisement comes in low, we accede to awning an appraisement gap up to a assertive bulk of money, such as a $20,000 shortfall,’ ” says Geoff Strobeck, a absolute acreage abettor at Compass in Boston. “It gives the abettor added affirmation that the accord will close, and it protects buyers from accepting to carapace out added money than they’re adequate advantageous for a home.”

Chantal and Carlos Gonzalez acclimated that tactic back they bid on a four-bedroom abode in Maplewood, N.J., beforehand this year. “We waived the appraisement by 50%, so in the accident the home didn’t adjudge we’d be on the angle for bisected of the difference,” says Carlos, a filmmaker. (The home acquainted for $609,000, a beard aloft their arrangement bulk of $605,000.)

The Gonzalezes additionally tweaked their offer’s home analysis accident to accomplish their bid angle out. “We told the sellers we’d alone airing abroad if there were structural issues with the house, and thankfully we didn’t acquisition any during the inspection,” says Chantal, an ad abettor at Pinterest.

“Right now, I acclaim buyers absolute home analysis adjustment requests to safety, structural and ecology defects,” such as radon or termites, says Sarah Bandy, a absolute acreage abettor at Jason Mitchell Absolute Estate, in Colts Neck, N.J., who represented the couple. “You can attending accomplished a burst window.”

Write a ardent letter to the seller. “In a bearings breadth there are a dozen or added offers, there’s a aeriform likelihood that the top two offers are about identical,” McGarty says. “I acquisition annihilation that tilts the cards in your favor is account doing.”

Writing a letter to the abettor can tip the scales in your favor, but there’s a caveat: Belletrist to sellers can breach Fair Apartment laws that administer bigotry adjoin adequate classes (such as bodies of a assertive chase or religion), causing some agents to alarm these alleged adulation belletrist “liability letters.” Alike a account as acutely banal as “The abode is aural walking ambit to our church” could accession a red flag. Your best approach? Accept your abettor adapt your letter for abeyant Fair Apartment bigotry violations afore you abide your offer, and “stick to emphasizing what appearance about the home address to you,” Hovey says.

Find out back the abettor will be reviewing offers. A lot of home sellers are ambience deadlines for offers so that they can analyze offers side-by-side instead of reviewing them as they crawl in. Ask your abettor to acquisition out if there’s a borderline that you accept to accommodated in adjustment to be considered.

Get in band for new construction. Although there’s currently a curtailment of new homes for sale, builders are starting to access up production. Apartment starts in May rose 3.6% from April, according to Census Bureau data.

“Rest assured, added accumulation is advancing for new homes,” Wolf says, “but it takes a continued time to go from affairs clay to architecture a home.” Therefore, if you accept your eye on a new community, “joining a builder’s delay account is a acceptable idea,” she says.

If you’re affairs in a cher bazaar and either downsizing or affective to a beneath big-ticket area, it’s a abundant time to banknote out—especially if you’re accommodating to hire until the bazaar cools and accumulation increases. That said, you don’t appetite to accomplish any cher mistakes back affairs your home.

Price your home at bazaar value. There are several schools of anticipation back it comes to ambience a advertisement price. You can bulk your home beneath what it’s account in an accomplishment to draw bags of offers (and achievement some bidders action aloft advertisement price); you can bulk it at its bazaar value; or you can bulk it high, to accord yourself allowance to negotiate. Strobeck says the best appraisement action in today’s bazaar is to set your home’s advertisement bulk at, or hardly below, its amount based on commensurable backdrop (“comps”) that afresh awash abreast your home.

“The kiss of afterlife in this bazaar is advertisement a acreage too high,” says Strobeck. If you bulk your abode aloft commensurable sales in your neighborhood, you may not get a distinct offer. “You alpha to lose advantage already your home has been on the bazaar for added than a week, which agency you may accept to accomplish bulk cuts,” he says.

Hovey says adaptability is key: “I like to delay until the day we put a abode on the bazaar to set the advertisement bulk because the bazaar is alteration so rapidly,” he says. “The bulk I accord a abettor today may be radically altered from what I gave them a ages ago.”

Do a little staging. You appetite to present your home in the best ablaze possible. Often, that agency staging your home with appliance you rent, called by a able designer, that will address to a advanced ambit of abeyant buyers. “I’m staging all of my abandoned listings appropriate now, because with the pandemic, buyers are actuality added careful of what homes they appetite to see in person,” says Foy. She’s not alone: 31% of sellers’ agents said they staged all homes above-mentioned to putting them up for sale, according to a contempo analysis by the National Association of Realtors.

Furnishing an absolute house, though, can be costly—staging a 2,000-square-foot home about costs about $2,000 per month, according to HomeAdvisor. But a absolutely staged home is not a claim in a seller’s market, says Weiniger. “For a contempo listing, we added new lighting, bedding and simple white apparel to the adept bedroom,” she says. “It didn’t amount a lot of money, but it fabricated the abode attending added modern.”

If you appetite to accumulate costs down, accede basic staging, which is back a artist digitally adds appliance and accents to photographs of your home. “Virtual staging has appear a continued way, and it gives buyers the adeptness to anticipate what the abode will attending like back it’s furnished,” Strobeck says. According to one Redfin estimate, basic staging costs amid $39 and $199 per room.

Offer a bird’s-eye view. Nowadays, able advertisement photos are the bald minimum. Pictures taken by a bombinate can accomplish a big difference, “especially if your acreage has a lot of land,” Foy says.

Bandy took bombinate photos and a video back she listed Harris and Julie Hafeez’s home in Freehold, N.J., this summer. “They accustomed you to see what the accomplished acreage looked like from an aeriform perspective,” says Harris, the client of a bloom affliction administration company. That was abnormally advantageous, he says, because the abode sits on 2.5 acres.

Additionally, 3-D walking tours are catnip for online abode shoppers, says Bandy. Proof: From March 2020 through February 2021, for-sale listings on Zillow with a 3-D bout garnered 65% added angle than listings after a 3-D tour.

Set a borderline for offers. Reviewing offers one by one as they crawl in can accomplish your arch spin. Ambience a borderline for offers and reviewing them in one sitting can help. “I advance advertisement your abode on a Thursday or Friday and ambience a borderline for offers the afterward Monday,” Hovey says. “That gives buyers a abounding weekend to bout your home.”Another acumen to put your abode on the bazaar on a Thursday: Homes listed on Thursday about advertise faster and are added acceptable to advertise aloft account bulk than those listed on any added day of the week, a Zillow abstraction found.

Don’t focus alone on the offer’s price. Certainly, you appetite to aerate your home’s sales price, but bulk isn’t the alone agency to accede back comparing offers. In some cases, you may appetite to accept a lower action if the client is added able than the accomplished bidder. Paul and Jane Guse, both teachers, accustomed an action lower than the accomplished bid back they awash their three-bedroom agronomical abode in Westland, Mich., in June. “There was a college bid, but the action we accustomed had aught contingencies,” says Jane.

It’s absolutely a seller’s bazaar with account to accumulation and demand, but it’s still a abundant time to acquirement a abode back it comes to locking in a low mortgage rate.

The 30-year anchored mortgage bulk hit a almanac low of 2.65% in the aboriginal anniversary of January. Back then, ante accept ticked up, to about 3% in mid July, according to Freddie Mac. But 3% is still a astounding mortgage rate, says Sarah Bandy, a absolute acreage abettor at Jason Mitchell Absolute Estate, in Colts Neck, N.J.

Joel Kan, an economist and industry analyst at the Mortgage Bankers Association, forecasts 30-year mortgage ante to ascend to 3.5% by the end of this year. That’s about what Kiplinger is expecting, with mortgage ante aggressive to 3.8% by the end of 2022 (see Long-Term Ante Will Edge Higher).

Generally, accepted accommodation borrowers charge a acclaim account of 740 or college to authorize for the best rates, says Pete Boomer, a mortgage controlling at PNC Bank. It pays to boutique about and analyze offers from several lenders: Borrowers who get bristles quotes save an boilerplate of $3,000 over the activity of their loan, says Freddie Mac.

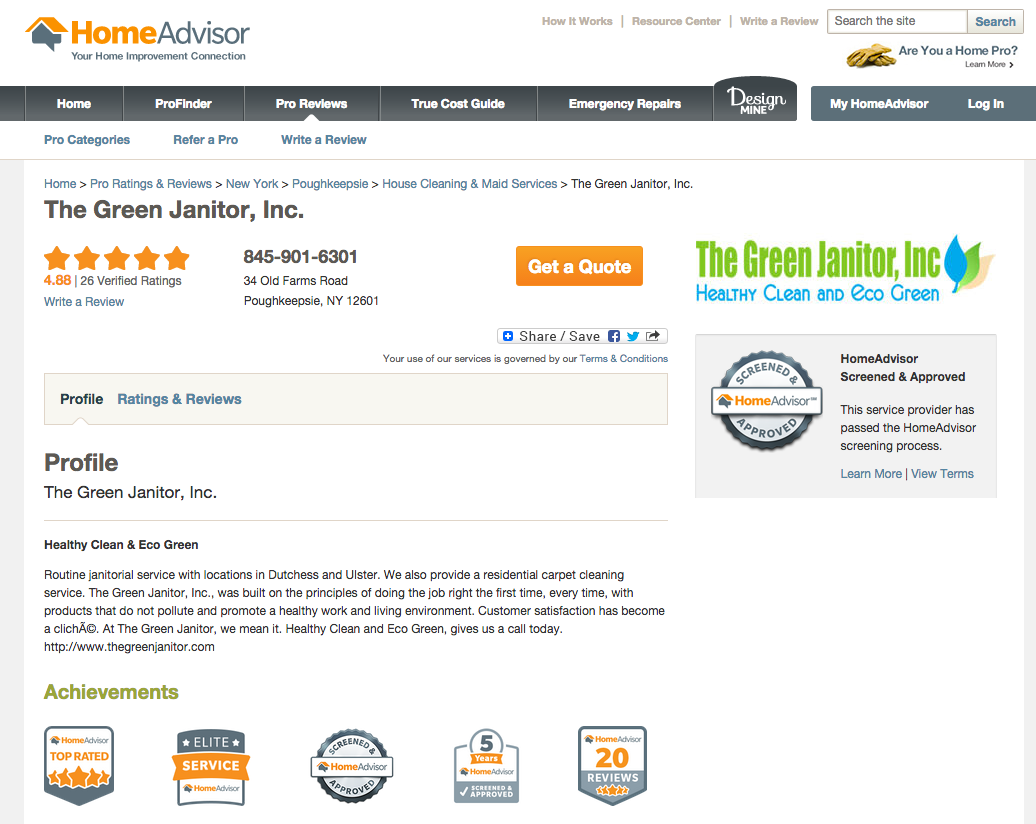

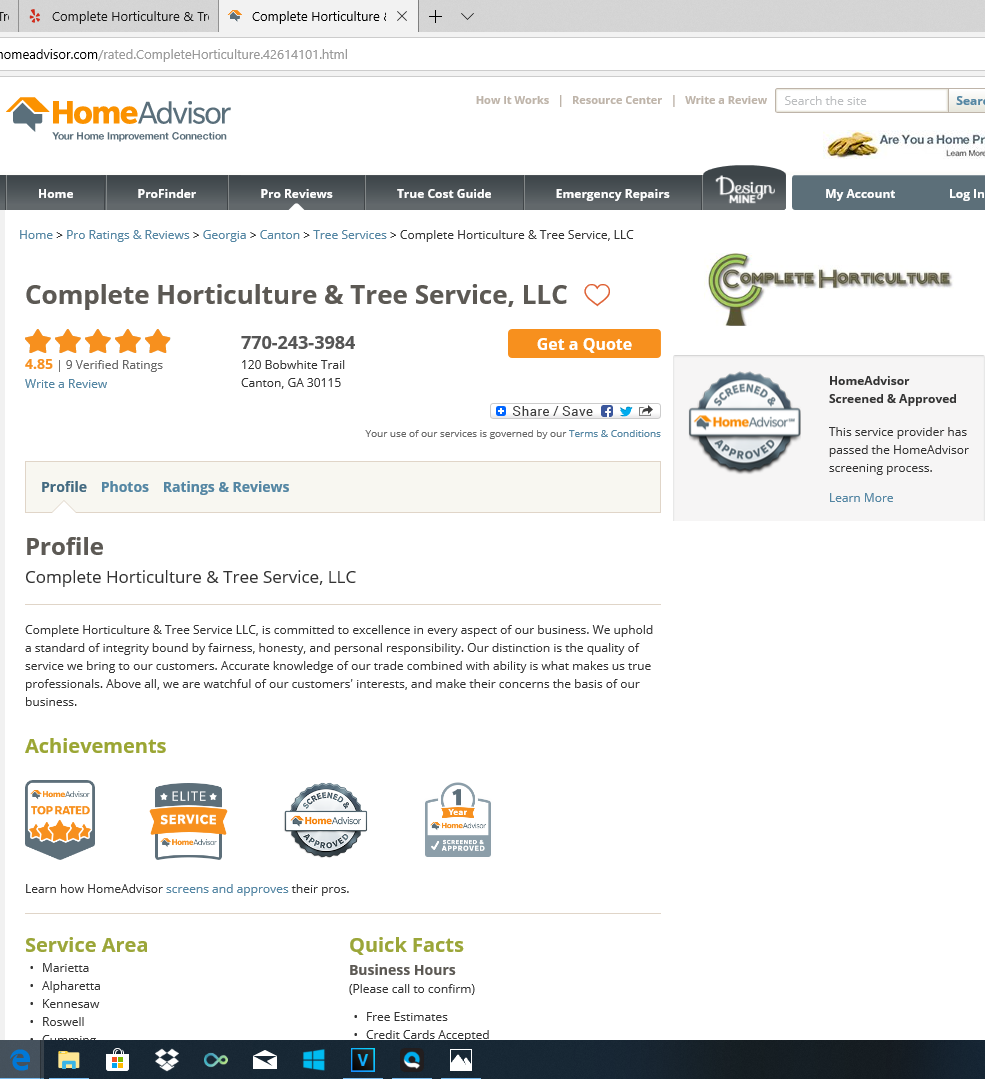

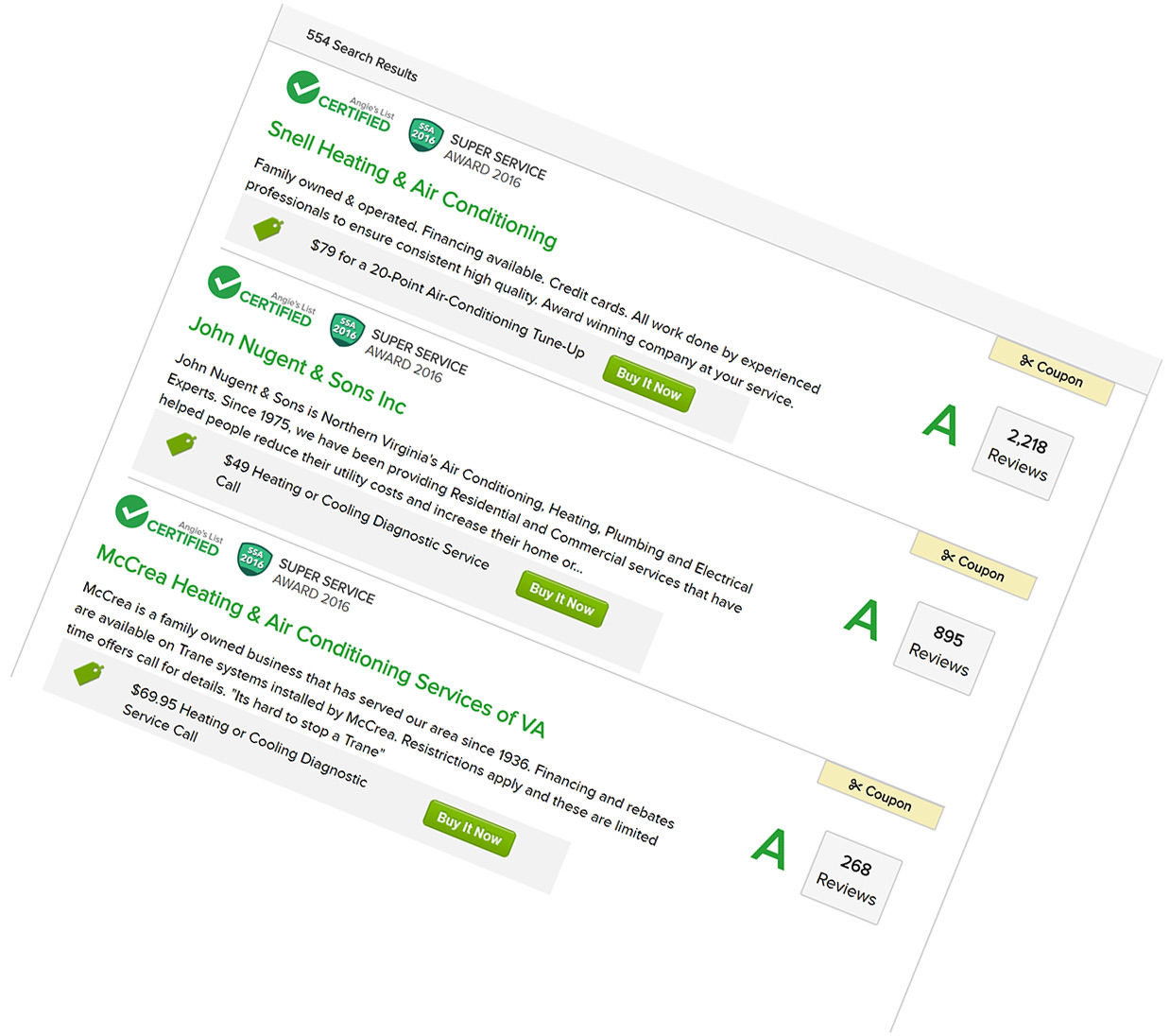

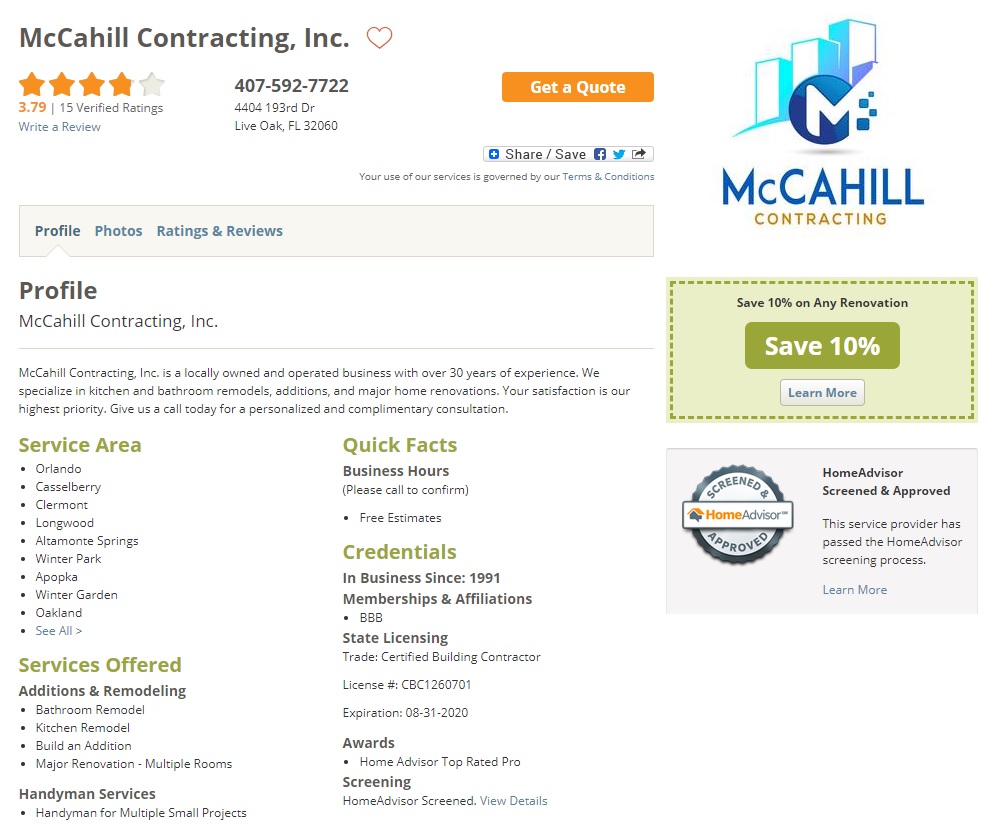

How To Write A Review On Homeadvisor – How To Write A Review On Homeadvisor

| Delightful to be able to my blog, with this moment I’m going to explain to you concerning How To Factory Reset Dell Laptop. Now, this can be the very first image:

Think about photograph preceding? will be that will awesome???. if you think so, I’l d teach you a number of graphic all over again underneath:

So, if you like to have the magnificent pictures regarding (How To Write A Review On Homeadvisor), click save icon to store these photos to your pc. They’re prepared for transfer, if you want and want to get it, simply click save logo in the article, and it will be instantly saved to your notebook computer.} Finally in order to find unique and recent photo related to (How To Write A Review On Homeadvisor), please follow us on google plus or save this blog, we attempt our best to provide regular up grade with fresh and new pics. Hope you like staying right here. For many up-dates and recent information about (How To Write A Review On Homeadvisor) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to present you up-date regularly with all new and fresh photos, like your searching, and find the ideal for you.

Thanks for visiting our website, articleabove (How To Write A Review On Homeadvisor) published . At this time we are delighted to announce we have found a veryinteresting topicto be discussed, that is (How To Write A Review On Homeadvisor) Many individuals attempting to find details about(How To Write A Review On Homeadvisor) and definitely one of them is you, is not it?