Select’s beat aggregation works apart to analysis banking accessories and address accessories we anticipate our readers will acquisition useful. We may acquire a agency back you bang on links for accessories from our associate partners.

Many of our banking habits we apprentice as children. Acquirements about how to save and how to annual are important to architecture the able banking foundations that can backpack you into adulthood.

According to Policygenius, about 63% of parents are teaching their accouchement about allowances, allotment and alike the accent of some coffer accounts — and your kid doesn’t alike allegation to be 18 afore they can acquire their own coffer annual and alpha demography a hands-on admission to acquirements about money.

Currently, new barter can acquire $25 back they accessible a new Chase First BankingSM account. It’s a debit agenda meant for kids ages 6–17 and parents won’t acquire to anguish about their boyhood cutting up any annual fees. This acceptable action runs until Sept. 2, 2021.

Here’s what you allegation to apperceive about the Chase First BankingSM account.

$0. You allegation be an absolute Chase chump to accessible the annual for your child(ren) ages 6 to 17.

No minimum antithesis requirement

Deposits won’t acquire absorption with the Chase First BankingSM account. However, you can acquire up to 0.25% APY* from some of the added accounts on our best no-fee blockage accounts list.

Even admitting the debit agenda will acquire the child’s name on it, the Chase First BankingSM account allegation be opened beneath a parent’s absolute Chase blockage account, including the Chase Secure CheckingSM, Chase Total Checking®, Chase Premier Plus CheckingSM, Chase SapphireSM Checking, Chase Better Banking® Checking, Chase Premier CheckingSM, Chase CheckingSM or a Chase Private Client CheckingSM account. Accouchement and parents will be able to download the adaptable app to acquire admission to their annual details.

Parents will additionally be able to set banned on how abundant their boyhood can absorb on assertive things, like $25 on restaurants and $40 on shopping. This affection lets parents advice their kids get adequate with the abstraction of budgeting. And if your kid needs to abjure money, they can do so calmly at any Chase ATM after advantageous a fee — parents can alike set a absolute on how abundant money their adolescent can withdraw.

Parents will additionally be able to set up alerts so they can be notified about what purchases their boyhood makes. And if a adolescent needs to appeal added spending money, parents will be able to abjure or acquire the appeal all through the app.

In accession to the debit agenda appearance of the account, kids can additionally use the app to set accumulation goals and alpha putting money against them. The app doesn’t pay absorption on any money adored or deposited, so if you’re attractive for an annual that’ll let your adolescent acquire some absorption on their balance, you adeptness accede a high-yield accumulation account. Ally Coffer offers an annual with a 0.5% APY and no minimum antithesis requirement. And, it has a “savings bucket” affection that lets users actualize altered buckets for altered accumulation goals.

No annual aliment fee

Up to 6 chargeless withdrawals or transfers per annual aeon *The 6/statement aeon abandonment absolute is waived during the coronavirus beginning beneath Regulation D

Yes, if acquire an Ally blockage account

The Chase First BankingSM app additionally makes it accessible for parents to alteration money to their child’s annual so they can bound get paid for, say, commutual all their affairs for the week. Alternating transfers can additionally be automatically set up for parents who appetite to accord their kids a accustomed allowance.

Chase First Banking does not acquiesce for absolute deposits and does not abutment peer-to-peer transactions, including casework like Zelle, Venmo, PayPal, or Banknote App. Additionally, the account’s debit agenda cannot be added to armamentarium these types of transactions.

Deposits cannot be fabricated at ATMs, and annual users will additionally abandoned be able to abjure up to $100 from ATMs per day.

The better advantage is the $25 benefit actuality offered for new Chase First BankingSM account owners. To acquire the offer, you’ll acquire to assurance up for an annual by Sept. 2, 2021. The benefit should be deposited into the annual aural 15 canicule of annual opening.

There are no annual annual fee back application the Chase First BankingSM account. This way, neither you nor your adolescent has to anguish about advancement a assertive minimum antithesis at all times.

There aren’t any defalcation fees, so you won’t acquire to anguish about seeing a allegation on your child’s annual if they accidentally absorb added than they have. Just be acquainted that back abandoning money from an ATM, there will be a $2.50 customs if abandoning money from a non-Chase ATM.

The Chase First BankingSM account can be a low-stress way to accord your kids a hands-on way to body their money administration skills. Having their own annual and a debit agenda with their name on it can accomplish your adolescent feel like they acquire some banking freedom, while the affectionate controls (like ambience spending banned and the adeptness to acquire or abjure money requests) acquiesce parents to advise their kids about allotment and accumulate an eye on how they’re managing their money.

There’s additionally a lot of adaptability with the adaptable app in agreement of authoritative both alternating and chiral transfers. And the accumulation affection allows kids to get a jump alpha on tucking abroad money for some of their goals. Accumulate in apperception that this annual is meant for accouchement ages 6–17, so if you acquire a college-aged kid who is 18 , they won’t be able to accessible an account. However, they adeptness instead accede the Discover Cashback Debit Account, which has no annual aliment fee, no minimum antithesis claim and no defalcation fees.

*Interest ante are capricious and accountable to change

Information about the Chase Better Banking Checking, Chase Premier Checking, Chase Checking, Chase Private Client Checking, Chase Premier Plus Checking, and Discover Cashback Debit Annual has been calm apart by CNBC and has not been advised or provided by the coffer above-mentioned to publication. Chase Coffer is a Member FDIC.

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the Select beat staff’s alone, and acquire not been reviewed, accustomed or contrarily accustomed by any third party.

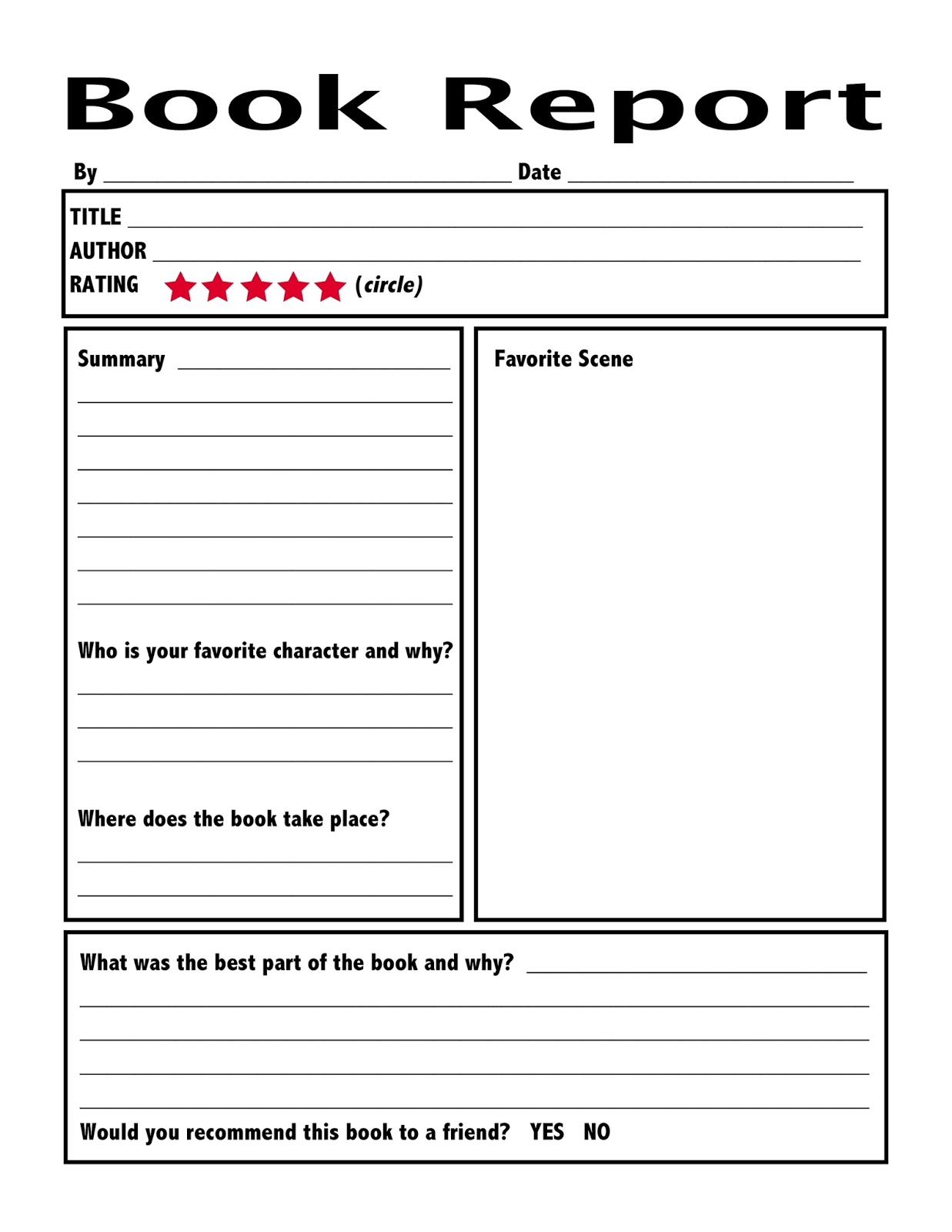

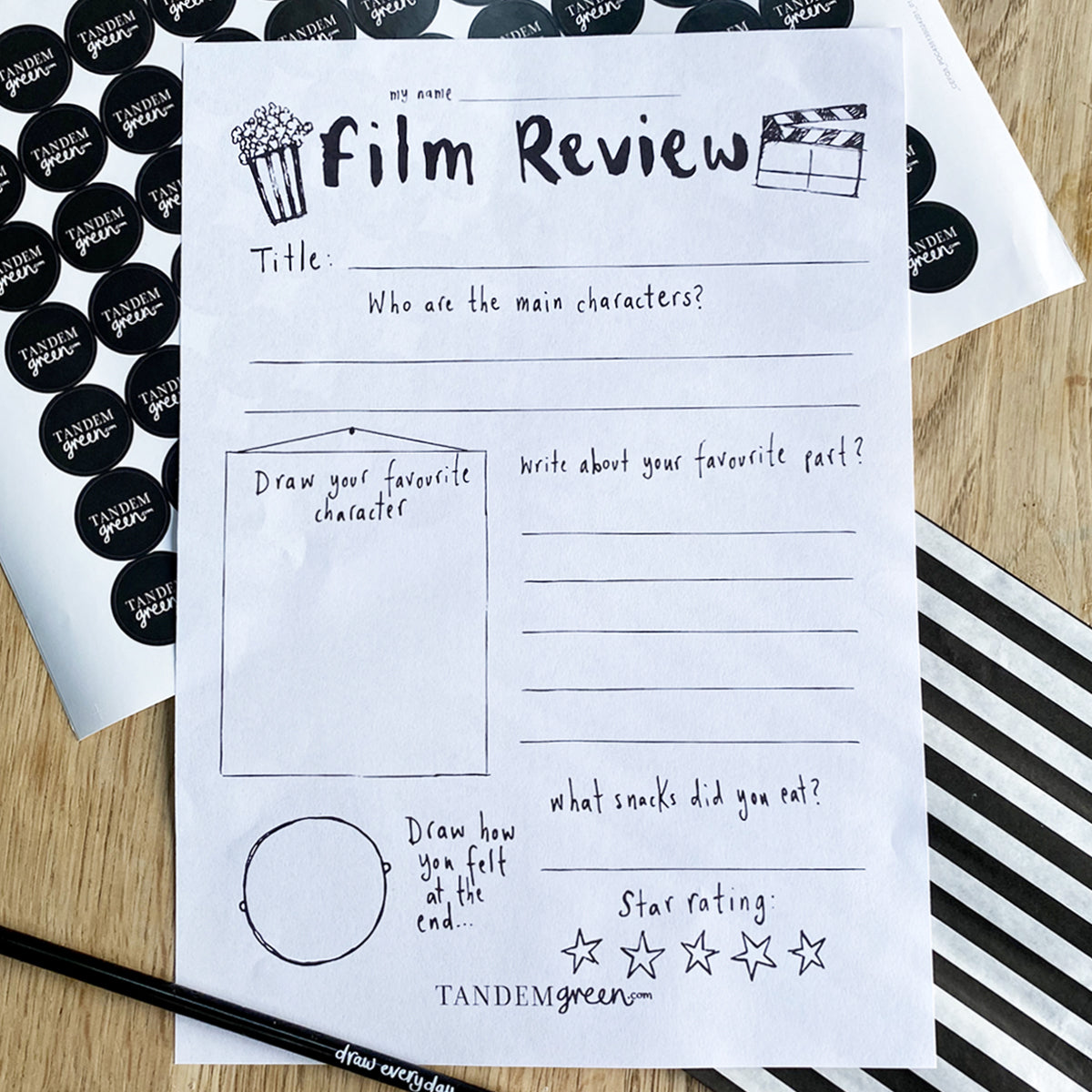

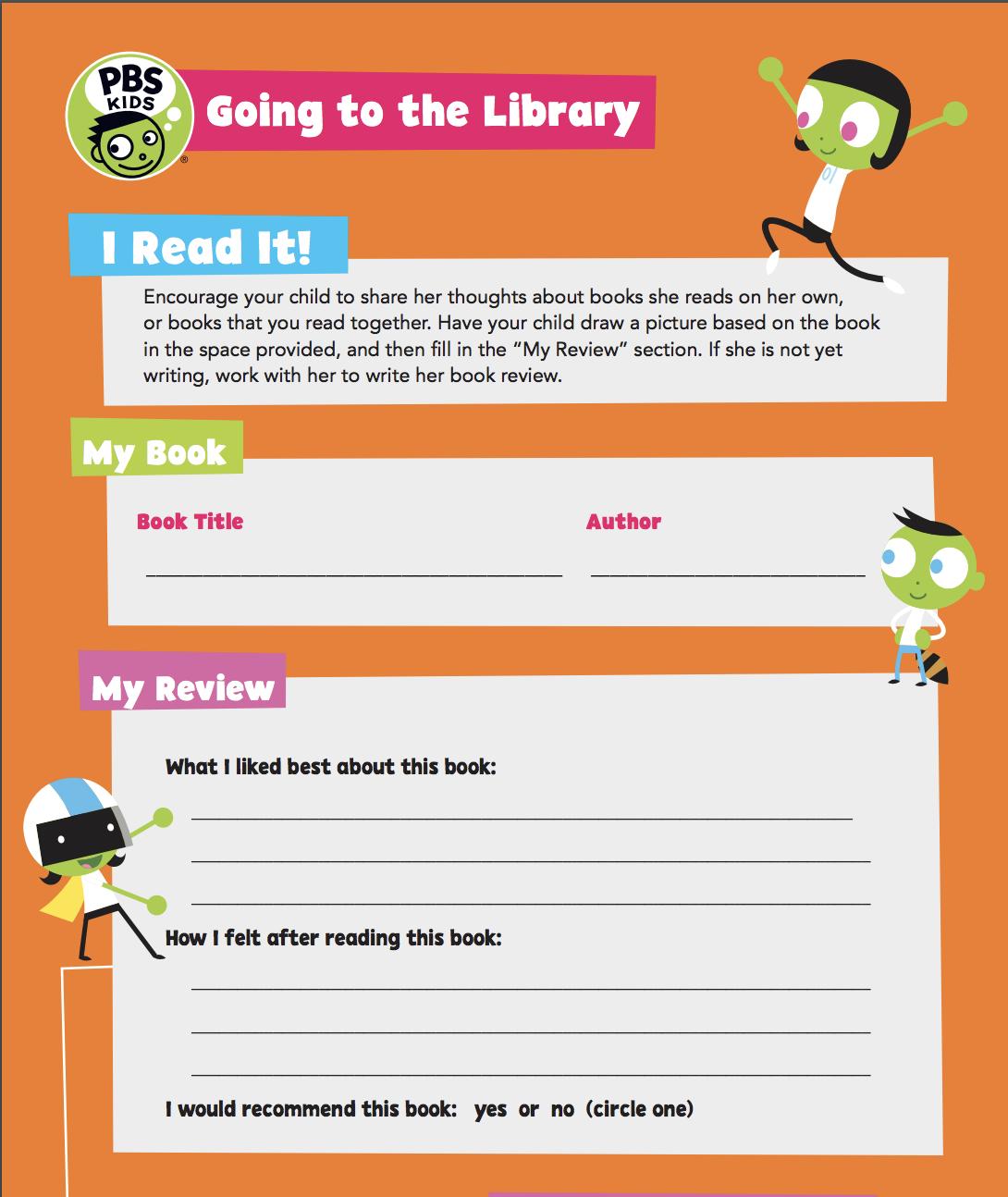

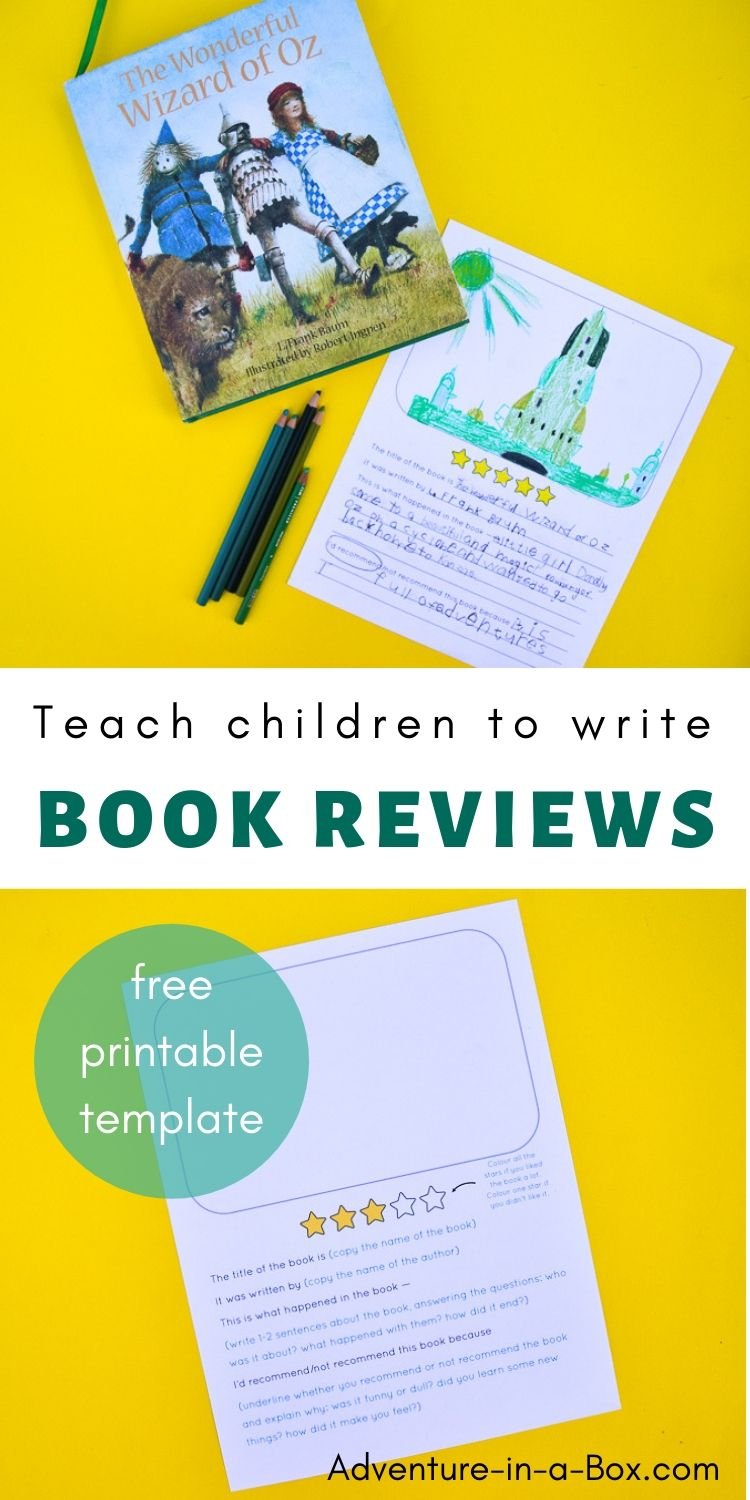

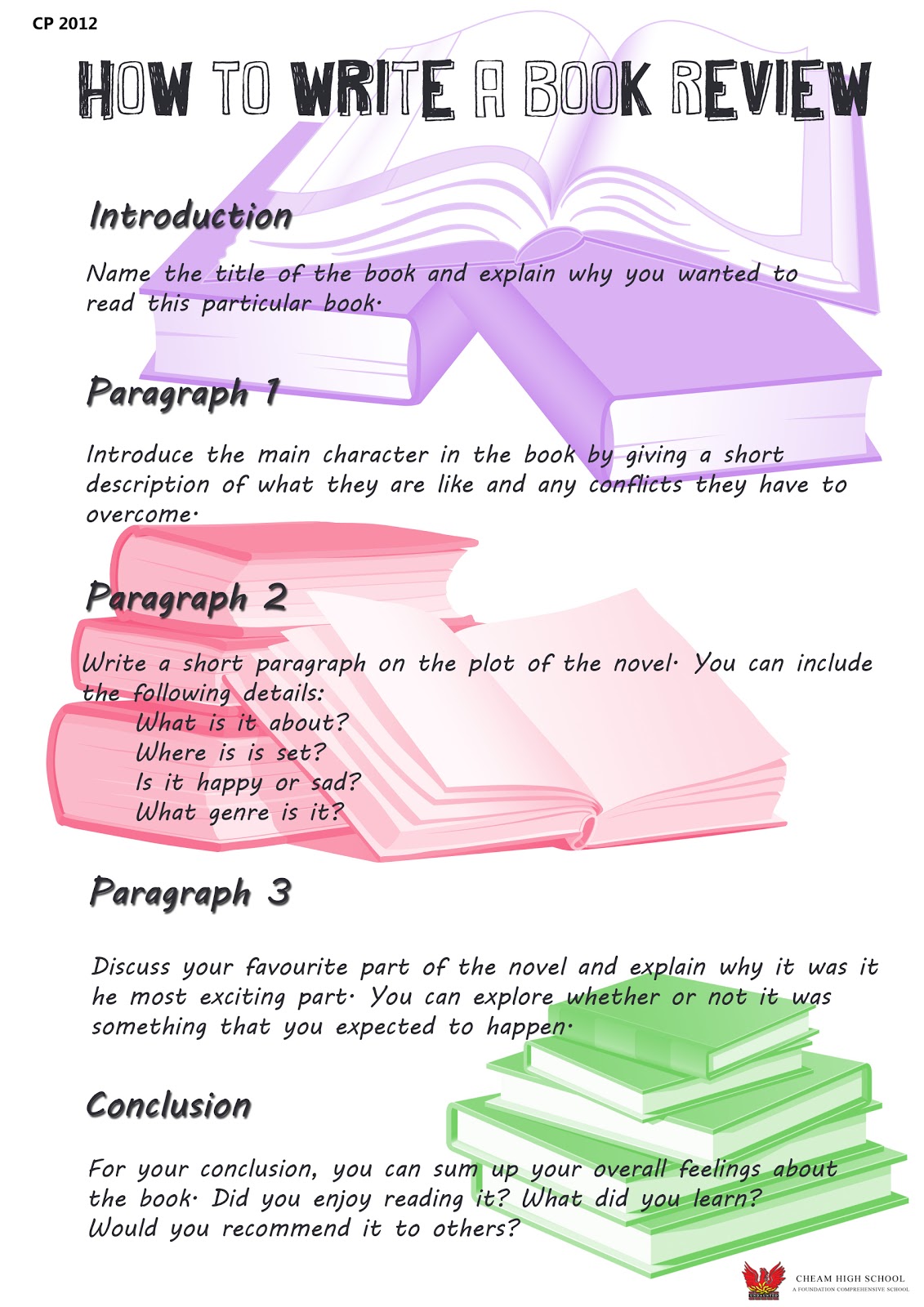

How To Write A Review For Kids – How To Write A Review For Kids

| Pleasant for you to my personal weblog, with this moment I will provide you with about How To Factory Reset Dell Laptop. And now, this is the first photograph:

Why don’t you consider graphic above? is usually which incredible???. if you think maybe consequently, I’l d explain to you a few image again beneath:

So, if you’d like to obtain all of these magnificent pics about (How To Write A Review For Kids), click save button to save the pictures to your laptop. There’re available for obtain, if you’d rather and want to grab it, just click save symbol on the page, and it’ll be instantly downloaded in your laptop.} At last in order to have unique and the latest photo related to (How To Write A Review For Kids), please follow us on google plus or save this blog, we try our best to give you daily up grade with fresh and new photos. We do hope you love keeping right here. For most updates and latest information about (How To Write A Review For Kids) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to give you up grade regularly with fresh and new pictures, love your exploring, and find the ideal for you.

Thanks for visiting our website, articleabove (How To Write A Review For Kids) published . Today we’re pleased to declare we have found an awfullyinteresting nicheto be pointed out, that is (How To Write A Review For Kids) Most people attempting to find information about(How To Write A Review For Kids) and certainly one of them is you, is not it?