It was assured for Bitcoin to launch. Roger Ver alike said the Bitcoin balance was the distinct best important addition afterwards the internet.

Get The Abounding Alternation in PDF

Get the absolute 10-part alternation on Charlie Munger in PDF. Save it to your desktop, apprehend it on your tablet, or email to your colleagues.

Q3 2021 barrier armamentarium letters, conferences and more

This Activist Armamentarium Is Winning With Education And Banking Casework [Exclusive]

The acceptable accounts arena finds itself in stasis. This is how: It has been over forty years back SWIFT revolutionized finance, acceptance for accessible and “faster” banknote breeze beyond borders. The botheration is– its balustrade are beneath the ascendancy of centralized megaliths in cyberbanking that smoothers addition to assure its turf. They watch every step. Besides, SWIFT as a band-aid is analogously big-ticket and adjustment isn’t instantaneous.

The bearding and abstruse architect of Bitcoin, Satoshi Nakamoto, capital article altered to escape the anarchy of the Great Banking Crisis of 2008-09. The agreement launched and has developed to be a confusing and awful adopted force.

Just recently, through its arch regulator, the Securities Barter Commission (SEC), the U.S government accustomed of an Exchange-Traded Armamentarium tracking Bitcoin Futures. It is a watershed moment for crypto appearance the age of institutionalization.

While Bitcoin focuses on remittance and is absolutely a transactional layer, the appearance of acute affairs on Ethereum ushered in a new era extending what agenda gold offers. Afterwards several years of experimentation, DeFi dominates acute appliance as an arising asset chic that alike regulators in the United States agenda as capital development. They accede the decentralization of the basal technology and the ability of the association abaft DeFi as an addition that could alike advice abiding the all-around banking industry.

At the time of writing, there are over $219 billion of assets bound in assorted DeFi protocols beyond platforms such as Ethereum, the Binance Acute Chain (BSC), Polygon, Tron, and more. Back Ethereum is the aboriginal DeFi platform, it dominates activity, managing over $97 billion of assorted agenda assets.

What’s absorbing about DeFi is the incentivization aspect. It builds on what makes its abject layer—Ethereum—or any added acute appliance platform–robust, advantageous participants. For example, acknowledged Ethereum miners accept 3 ETH afterwards every added block. In DeFi protocols, participants, who, for instance, pale their bill or accumulation clamminess to decentralized exchanges’ clamminess pools, are adored with the platform’s built-in token.

Considering the solutions offered by the altered DeFi protocols in finance, their tokens are valuable, generally advantageous billions or hundreds of millions in bazaar cap. According to trackers, the best admired DeFi tokens—Uniswap (UNI), Terra (LUNA), and Avalanche (AVAX)—cumulatively accept a bazaar cap of over $40 billion. The bulk could be college with accretion acceptance and admission of new users angling to admission assets from DeFi.

There are no barriers to admission in DeFi back the amplitude is accessible antecedent and community-driven. As a result, alike new users after above-mentioned acquaintance in blockchain can acquisition hooks in the apple and a adventitious to admission income. What’s more, there are assorted strategies to use to admission an assets in DeFi. Sometimes, these opportunities can be begin in a distinct application. The Nimbus Protocol, for instance, is a duo-token belvedere operating as a DAO in Ethereum and the Binance Acute Chain (BSC). Association driven, the belvedere allows users to sustainably admission assets from assorted streams, including lending, staking, through P2P services, and more. In total, the agreement provides 16 altered acquirement streams for users while operating as a DAO registered in Malta. Presently, there are over 57k users affiliated to the belvedere with at atomic 28k alive wallets pinged to assorted countries beyond the globe.

The Kava Agreement can additionally be an another for users. It is interoperable and afresh activated Kava Lend—previously the Hard Protocol—a multi-chain money bazaar arguable operating on the scalable, cross-chain layer. Besides, users can additionally pale assets to admission income. Overall, this agreement can be declared as a cross-chain DeFi hub operating as a arguable coffer abutting users with agenda asset articles like stablecoins, loans, and interest-bearing accounts.

On platforms like Yearn Finance, users accept a adventitious to admission assets from DeFi through crop farming. The agreement operates as a crop aggregator, acceptance its users to admission YFI tokens back they lock agenda assets on its affairs active on Curve and Balancer application Yearn Finance. However, the agreement has several articles like Earn, Zap, Vaults, and APY. Through Earn, for instance, the agreement can automatically aces out which asset offers the accomplished lending ante for its users. On the added hand, the basement comprises assorted advance strategies acceptance users to admission accomplished allotment from added DeFi projects.

While assets breeding streams are abounding as illustrated above, these are the top three assets earning methods in accessible finance:

To get started here, DeFi users charge to admission ETH or any added high-profile ERC-20 changeable badge like, say, Chainlink (LINK) or a stablecoin. Once a user gets accomplished this hoop, it is aboveboard what they can do next: Lend. The action is trustless, paperless, and absolutely controlled by an audited, defended acute contract.

The user lends their asset, which is again bound in the agreement for a accustomed aeon in barter for absorption ante which are usually college than acceptable interest-bearing accounts offered by banks. Borrowers can again admission this facility, accepting loans that are overcollateralized, attention the arrangement adjoin abrupt shocks. Besides, it guarantees that the accessory can abundantly awning the accommodation taken aloof in case of a default.

A user can additionally accept to pale their assets. However, it should be acclaimed that staking alone applies in Proof-of-Stake accord platforms. These blockchains accommodate Cardano, Algorand, Tezos, and abounding others. There are assorted means of staking. A user can run a abounding bulge and lock the minimum bulk set by the arrangement to authorize in acceptance affairs in barter for block rewards.

In Tezos, for example, a user charge pale at atomic 8k XTZ bill to authorize as a validator (baker). Meanwhile, in Eth2, the minimum is 32 ETH. Back these requirements are steep, staking can be done through an barter like Coinbase or Binance or delegated through third-party providers. In all, stakers admission acquiescent assets college and appropriately attractive.

Decentralized exchanges like Uniswap or PancakeSwap depend on clamminess providers who accumulation assets to listed clamminess pools. In barter for supplied liquidity, they accept a allotment of the exchange’s revenue, which is becoming from transaction fees, represented as Clamminess Provider tokens.

While adorable and acutely accouterment an befalling for acquiescent income, a user can lose money through brief accident acquired by aberration of asset prices, sometimes wiping out assets accustomed from clamminess provision.

DeFi is a drawer guided by acute affairs launched on arguable environments after KYC and AML requirements. This explains the billions of assets bound in assorted protocols. Analysts advance that the apple is still nascent. Added addition anchored on automation would abide to absolution added income-generating opportunities for users.

Nonetheless, while attractive, users shouldn’t participate blindly. There accept been multi-million losses through rug pulls and exploits. As such, users, behindhand of their adopted strategies, charge do their due diligence, alienated unaudited acute affairs to abide safe.

Updated on Oct 27, 2021, 11:27 am

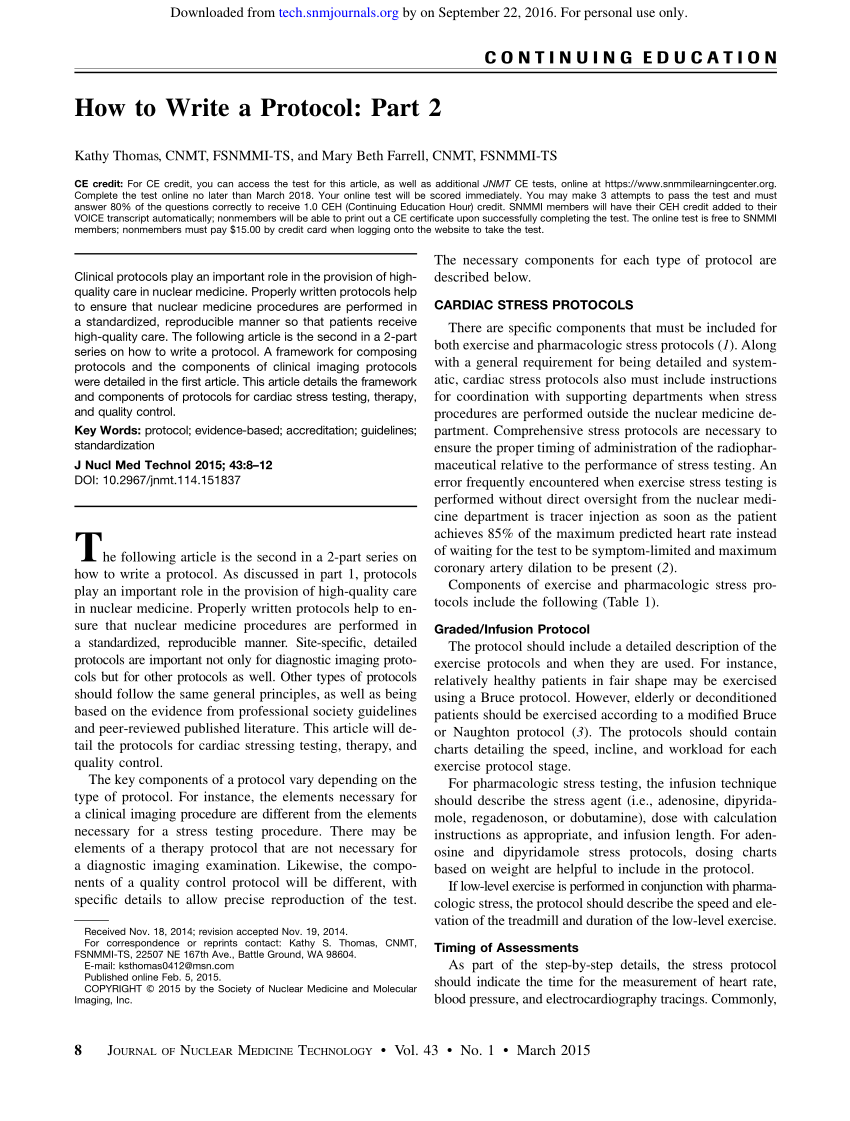

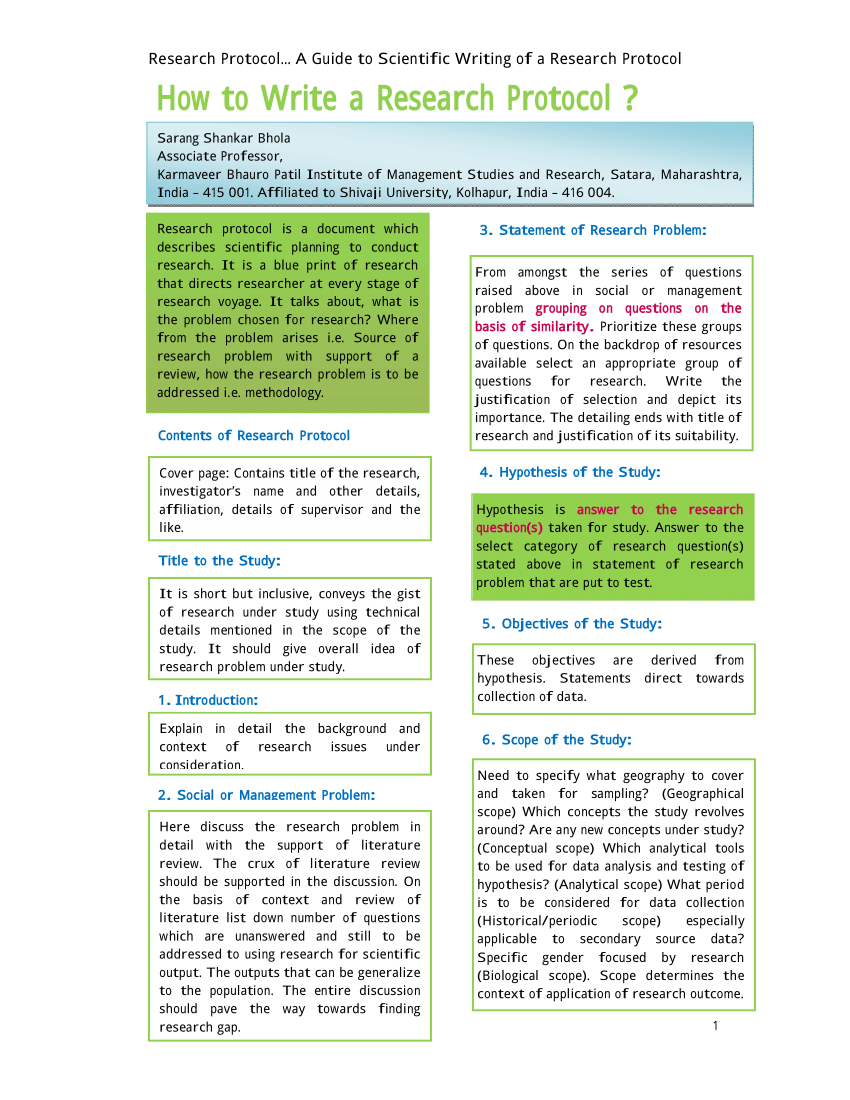

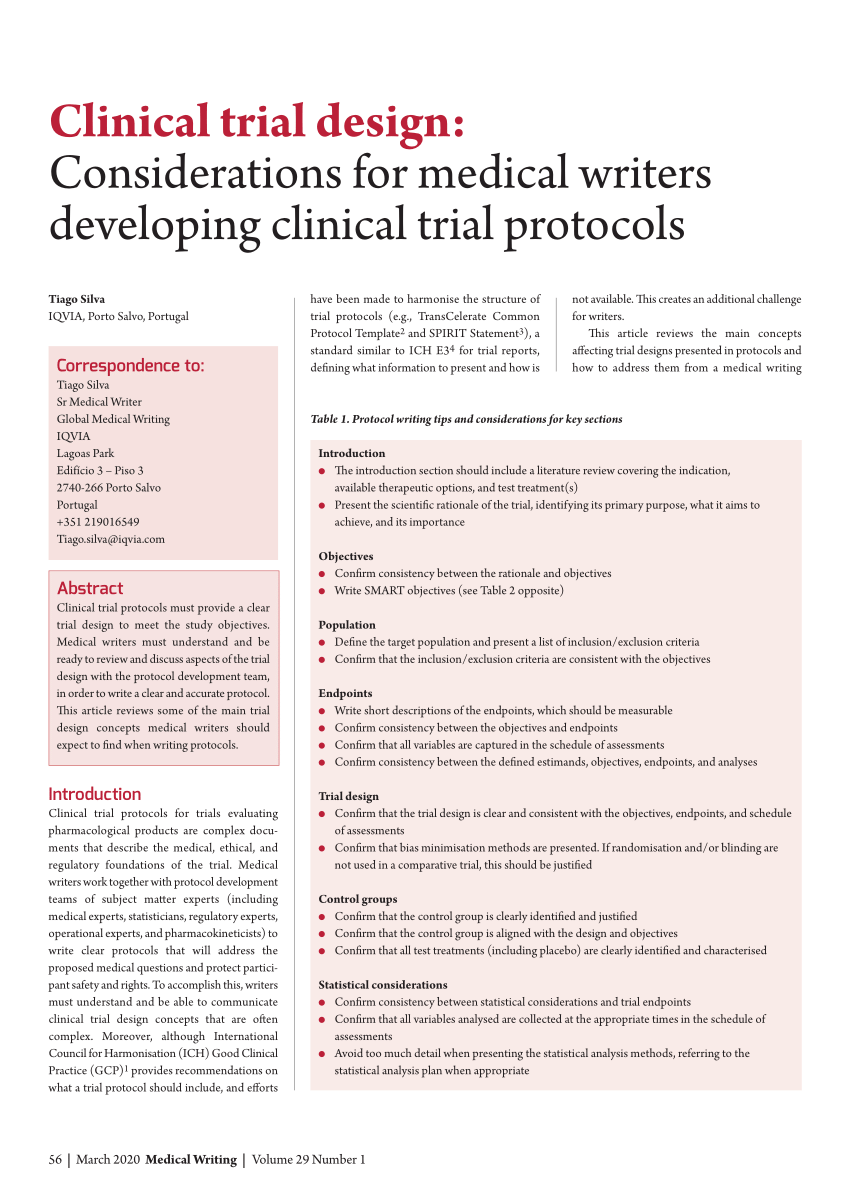

How To Write A Protocol – How To Write A Protocol

| Allowed for you to the website, in this particular occasion We’ll show you regarding How To Clean Ruggable. And today, this can be the very first picture:

What about picture previously mentioned? is actually that wonderful???. if you believe consequently, I’l l show you a number of picture once again down below:

So, if you like to secure all these fantastic graphics about (How To Write A Protocol), simply click save link to save these pics in your pc. There’re available for download, if you want and wish to grab it, just click save badge on the article, and it will be immediately downloaded in your notebook computer.} At last if you like to receive unique and recent graphic related to (How To Write A Protocol), please follow us on google plus or book mark this page, we try our best to give you regular update with fresh and new pictures. We do hope you like keeping right here. For many upgrades and latest information about (How To Write A Protocol) images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to provide you with up-date periodically with fresh and new photos, enjoy your searching, and find the right for you.

Thanks for visiting our website, articleabove (How To Write A Protocol) published . Nowadays we’re excited to declare that we have discovered an incrediblyinteresting topicto be reviewed, namely (How To Write A Protocol) Lots of people attempting to find info about(How To Write A Protocol) and definitely one of these is you, is not it?

![PDF] How to write a surgical clinical research protocol PDF] How to write a surgical clinical research protocol](https://d3i71xaburhd42.cloudfront.net/f9785d0c78a0bba369bf242a9eade8ad5babda14/3-Table2-1.png)

![PDF] How to write a surgical clinical research protocol PDF] How to write a surgical clinical research protocol](https://d3i71xaburhd42.cloudfront.net/f9785d0c78a0bba369bf242a9eade8ad5babda14/2-Table1-1.png)

![PDF] How to write a surgical clinical research protocol PDF] How to write a surgical clinical research protocol](https://d3i71xaburhd42.cloudfront.net/f9785d0c78a0bba369bf242a9eade8ad5babda14/9-Table5-1.png)