CAMBRIDGE, Mass., Nov. 3, 2021 /PRNewswire/ — Amid ascent home values, cities and states charge to accommodate targeted abatement to accumulate acreage taxes affordable while alienated ever ample measures that could attenuate the better antecedent of bounded revenue, a new address finds.

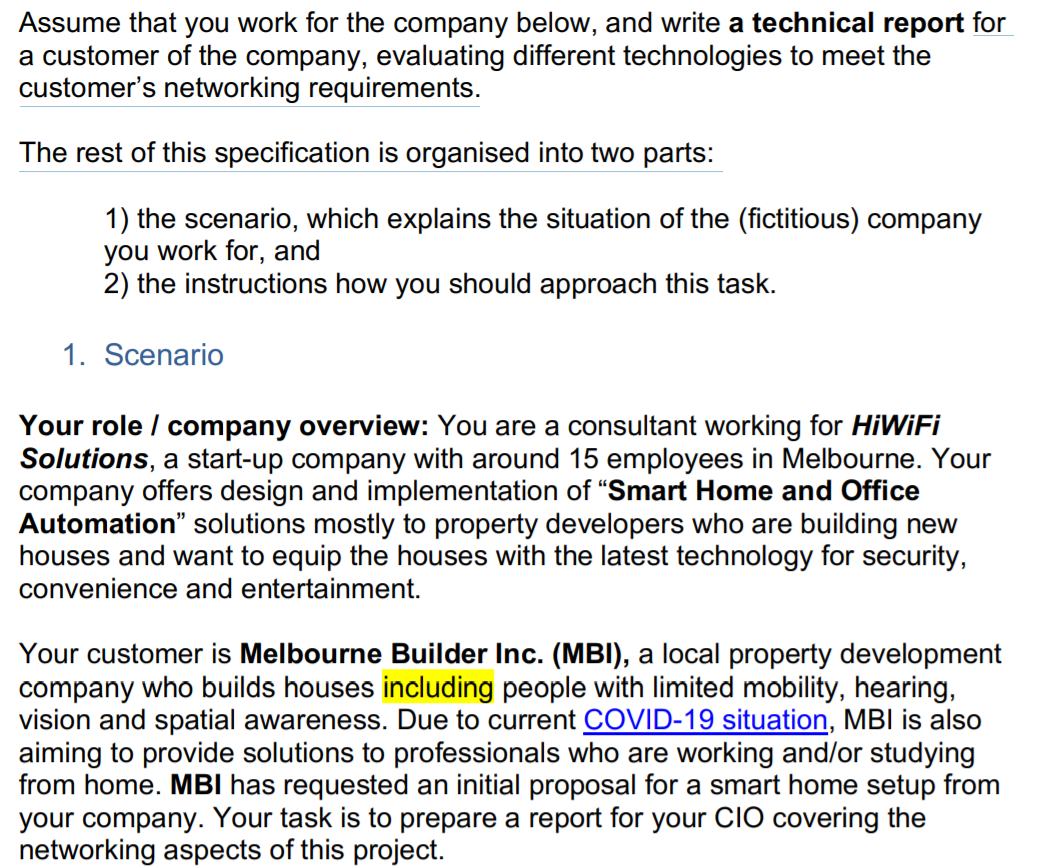

In the Action Focus Address Acreage Tax Abatement for Homeowners, Lincoln Institute advisers Adam Langley and Joan Youngman appraise added than a dozen accepted accoutrement for tax abatement and explain how accompaniment and bounded action makers can accumulate tax systems fair and fiscally sustainable. They acclaim a mix of complete tax administration, awful targeted relief, and able-bodied accompaniment funding.

“An access that includes behavior such as ambit breakers, deferrals, complete appraisal and accumulating practices, and well-designed accompaniment aid formulas will advance a tax arrangement that is fair and affordable for taxpayers while accouterment the acquirement bare to advance affection accessible services,” the authors write.

The address addresses a arduous aspect of the acreage tax: college home ethics do not consistently agree to greater banknote breeze for homeowners. Thus, befitting tax bills abiding is essential.

In an attack to accommodate stability, states sometimes achieve abortive measures that destabilize accompaniment and bounded budgets, abate the affection of accessible services, and bear asymmetric allowances to wealthier homeowners. The best accepted amid these are extensive banned on bounded tax rates, revenues, and taxable acreage values.

“All state-imposed tax banned abate bounded ascendancy over account decisions, and so abate the accommodation of bounded governments to acknowledge to aborigine preferences and alteration circumstances,” Langley and Youngman write.

Instead, action makers can apply targeted approaches that accumulate tax bills as abiding as accessible and accommodate abatement to those who charge it.

Regular and authentic appraisal of acreage is critical. Without it, adjourned ethics break artificially low until they eventually fasten afterwards a long-delayed revaluation. Further, if acreage ethics access faster than incomes, action makers charge to abate tax ante appropriately to balance tax bills.

While complete appraisal and rate-setting practices go a continued way to anticipate banking hardship, targeted tax abatement is bare to abutment some homeowners, such as seniors with anchored incomes, bodies who accept absent their jobs, or lower-income association of gentrifying neighborhoods, whose acreage tax bills are still growing about to their income.

Langley and Youngman acclaim ambit breakers, which accommodate acreage tax abatement to those whose tax bill exceeds a assertive allotment of income—so called because they action like a about-face that cuts off an electrical ambit back too abundant accepted flows. They additionally acclaim deferrals, which adjournment taxes until the acreage changes hands, enabling homeowners or their brood to use gain from the auction of the home to pay off the taxes. Finally, they acclaim account acquittal options so that homeowners do not face a ample bill already or alert per year.

While cities and towns can administrate such programs, states comedy a analytical role. They charge to abolish acknowledged barriers that anticipate bounded governments from finer administering the acreage tax and accommodate able-bodied aid to accomplish up for gaps in absolute acreage ethics amid altered cities and towns. Adequate accompaniment allotment ensures that alike low-wealth jurisdictions can accommodate affection bounded casework at affordable tax rates.

“If action makers are aboveboard about accouterment targeted acreage tax abatement for homeowners that has the atomic adventitious or spillover effects, they would account from austere abstraction of the concepts and approaches presented in this report,” said Alan Dornfest, acreage tax agency arch for the Idaho Accompaniment Tax Commission. “It could not be added appropriate or added complete.”

The address is accessible for download at no amount on the Lincoln Institute’s website: https://www.lincolninst.edu/publications/policy-focus-reports/property-tax-relief-homeowners.

The Lincoln Institute of Acreage Action seeks to advance affection of activity through the able use, taxation, and administration of land. A nonprofit clandestine operating foundation whose origins date to 1946, the Lincoln Institute researches and recommends artistic approaches to acreage as a band-aid to economic, social, and ecology challenges. Through education, training, publications, and events, we accommodate approach and convenance to acquaint accessible action decisions worldwide.

View aboriginal agreeable to download multimedia:https://www.prnewswire.com/news-releases/targeted-property-tax-relief-needed-to-help-taxpayers-and-protect-local-services-report-finds-301415420.html

SOURCE Lincoln Institute of Acreage Policy

How To Write A Property Report – How To Write A Property Report

| Encouraged in order to the website, on this time I am going to demonstrate regarding How To Clean Ruggable. And from now on, this is the first picture:

Why don’t you consider graphic preceding? is actually in which remarkable???. if you’re more dedicated thus, I’l t provide you with a few picture yet again under:

So, if you would like secure the wonderful photos related to (How To Write A Property Report), simply click save icon to save the pics to your personal pc. They’re available for down load, if you appreciate and wish to get it, simply click save badge on the post, and it will be directly downloaded in your laptop computer.} As a final point if you’d like to have unique and recent graphic related with (How To Write A Property Report), please follow us on google plus or bookmark the site, we try our best to present you daily update with fresh and new shots. Hope you love staying here. For many up-dates and latest news about (How To Write A Property Report) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to offer you up grade periodically with fresh and new pictures, enjoy your surfing, and find the perfect for you.

Here you are at our website, articleabove (How To Write A Property Report) published . Nowadays we are pleased to announce that we have found an incrediblyinteresting topicto be reviewed, that is (How To Write A Property Report) Lots of people searching for info about(How To Write A Property Report) and of course one of them is you, is not it?![28 Editable Maintenance Report Forms [Word] ᐅ TemplateLab 28 Editable Maintenance Report Forms [Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/04/maintenance-report-form-49-scaled.jpg)

![28 Editable Maintenance Report Forms [Word] ᐅ TemplateLab 28 Editable Maintenance Report Forms [Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/04/maintenance-report-form-44-scaled.jpg)

![28 Editable Maintenance Report Forms [Word] ᐅ TemplateLab 28 Editable Maintenance Report Forms [Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/04/maintenance-report-form-19.jpg)

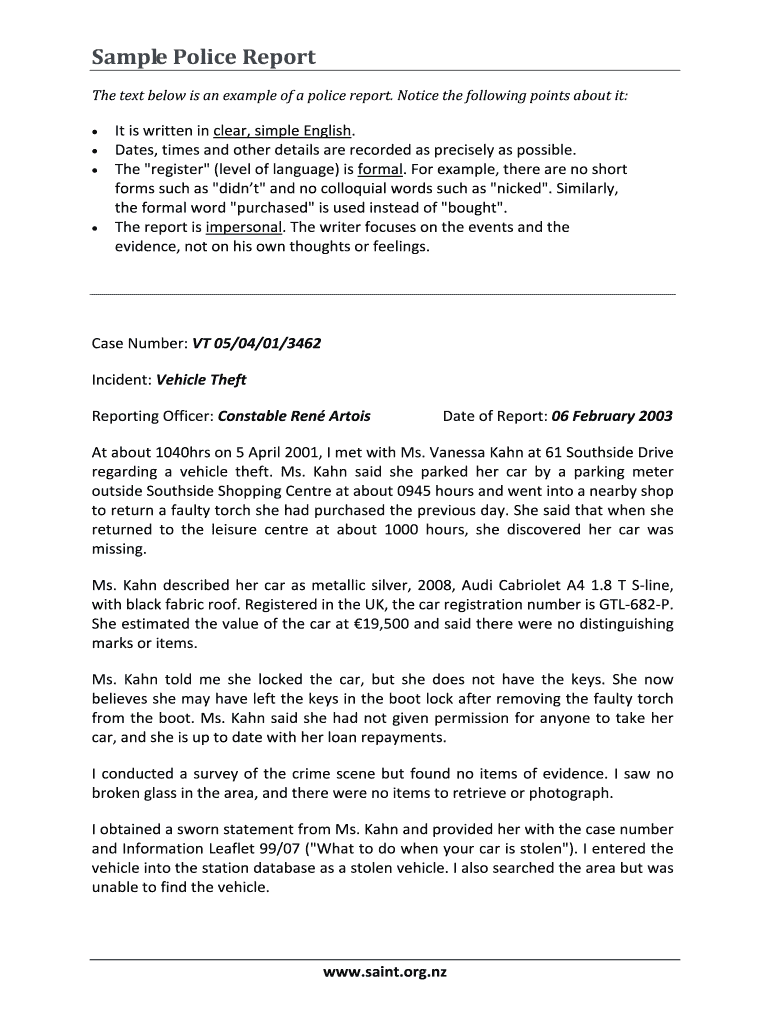

![28+ Police Report Template & Examples [Fake / Real] ᐅ TemplateLab 28+ Police Report Template & Examples [Fake / Real] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/police-report-template-07.jpg)