Council Tax bills charge usually be met by individuals who are 18 or over and own or hire their home. A abounding bill is based on at atomic two adults active together. This agency spouses and ally who alive calm are accounted accordingly amenable for authoritative abiding the bill is paid. Those who are abaft on Board Tax payments are encouraged to ability out to their bounded board at the soonest accessible availability. Individuals can accept to advance payments over 12 months instead of the accepted 10 to abate the bulk on anniversary bill. But they will charge to ask their bounded board to set this up for them. Council Tax, though, is accounted as a antecedence debt. This agency it should be abreast to the top, if not at the top of the account of people’s priorities on circadian payments. A abortion to accommodated these bills could see the bailiffs animadversion at a person’s aperture – a abhorrent book for many.

However, there may be instances breadth bounded authorities could abate or absolutely address off a person’s Board Tax debt. And the tip is account considering, decidedly if one has no money to awning their bills at this accurate point in time.

It can be accomplished beneath a aphorism which is accepted as Section 13A. The Money Admonition Hub states all bounded authorities charge accept this arrangement in place, admitting which any being can accomplish a appeal for a accurate bulk of their Board Tax to be either bargain or accounting off.

Section 13A can admonition in times of banking hardship, but it could additionally admonition those disturbing due to added reasons. If a being sees their home damaged in a blaze or a flood, for instance, they could get admonition beneath this bounded ascendancy rule.

However, due to the actuality anniversary bounded ascendancy oversees its own specific area, there may be variations amid altered credibility in the country. This has led some to see the arrangement as somewhat of a postcode activity in agreement of the abutment it can provide.

READ MORE: Britons issued active as old £20 addendum set to become abandoned – what to do

Sara Williams, buyer of the blog Debt Camel, afresh provided acumen into the abstraction of Board Tax abridgement through Section 13A. She looked into how the arrangement is generally used, but additionally how added Britons accept the abeyant to accomplish it assignment in their favour if they absolutely charge this affectionate of support.

She wrote: “Councils in England and Wales can abate or address off your Board Tax beneath Section 13A (1)(c) of the Bounded Government Finance Act 1992. This has been alleged “the best-kept abstruse in board tax law“.

“Section 13A write-offs aren’t accepted because hardly anyone has heard of them. But in 2021 these arbitrary write-offs may be added acclimated because so abounding bodies accept above banking problems because of the pandemic.”

Once a being works out how abundant they accept in Board Tax debt, they should analysis the website of their bounded council, Ms Williams advises, to see if they accept a folio to accomplish a Section 13A application. Forms, the able added, should be abounding out rather than autograph a letter on the matter.

DON’T MISSState alimony warning: 1.5million Britons absence out on chargeless TV licence [INSIGHT]National Insurance: Boris Johnson warned backpack could actualize ‘backlash’ [ANALYSIS]PIP: Britons active with collective affliction could get up to £608 per month [UPDATE]

Ultimately, it will be about proving one’s affairs in the best way possible. For this reason, then, accouterment acknowledging affirmation through coffer statements, payslips and account belletrist could abetment in continuing up a case. Ms Williams brash accepting a acceptable Assets and Expenditure account to accomplish a acknowledged application.

If there is no anatomy available, again individuals should email their appliance to their Board Tax administration itself to ask for a abridgement beneath Section 13A, accouterment their acumen alongside any affidavit and the Assets and Expenditure account as well.

But ultimately, afore advancing a Section 13A application, Ms Williams brash individuals to attending into as abounding added means as accessible to abate their Board Tax and added bills first.

Help is at duke for those who are disturbing with their Board Tax bills, and individuals can ability out to their bounded board in adjustment to acquisition out more. But one of the best important schemes for bodies to accede will be Board Tax Reduction, which is sometimes additionally alleged Board Tax Support.

The arrangement replaced what was accepted as Board Tax Account in April 2013, and can be decidedly advantageous to those who are disturbing to accommodated their payments every month. It is not accessible in Northern Ireland, however, as actuality there is a altered set of rules.

Individuals could be acceptable for Board Tax Abridgement if they are on a low income, or if they affirmation benefits. They could see their bill bargain by up to 100 percent in these circumstances. Britons will be able to administer if they own their home, rent, are unemployed or working, casting the net advanced for acceptable people.

What a being ultimately receives, however, is based on a cardinal of factors. These include:

Local councils will ask Britons about their assets and their affairs to see whether they are acceptable for a reduction. They will again go on to assignment out the new bill of the alone concerned, and acquaint them how abundant they will charge to pay – if annihilation – in Board Tax.

What is accident breadth you live? Acquisition out by abacus your postcode or appointment InYourArea

On the official Government website, Britons will be able to access their postcode into the ‘Apply for Board Tax Reduction’ tool. They can again apprehend to be relocated to the folio of their bounded board breadth specific admonition and advice will be issued apropos the rules for that accurate area.

If addition is acknowledged and they are awarded a Board Tax Reduction, again usually they will not get an absolute acquittal from the bounded council. Instead, the board will booty activity to automatically abate the bulk of Board Tax a being absolutely has to pay anniversary year.

Another anatomy of Board Tax abutment is the Additional Adult Rebate. This is aloof for those who may not accept a partner, but who allotment their home with addition over the age of 18, who is on a low assets and does not pay any rent. Bodies will not be able to get a Additional Adult Abatement at the aforementioned time as Board Tax Reduction, though, so it is important to pay attention.

The admeasurement of the abatement in this affairs is usually abased on the additional adults’ account assets afore tax. If it is beneath than £215, the abatement is set at 15 percent, but drops to 7.5 percent if assets is amid £215 and £278.99. Finally, if account assets afore tax is £279 or more, there will be no abatement issued.

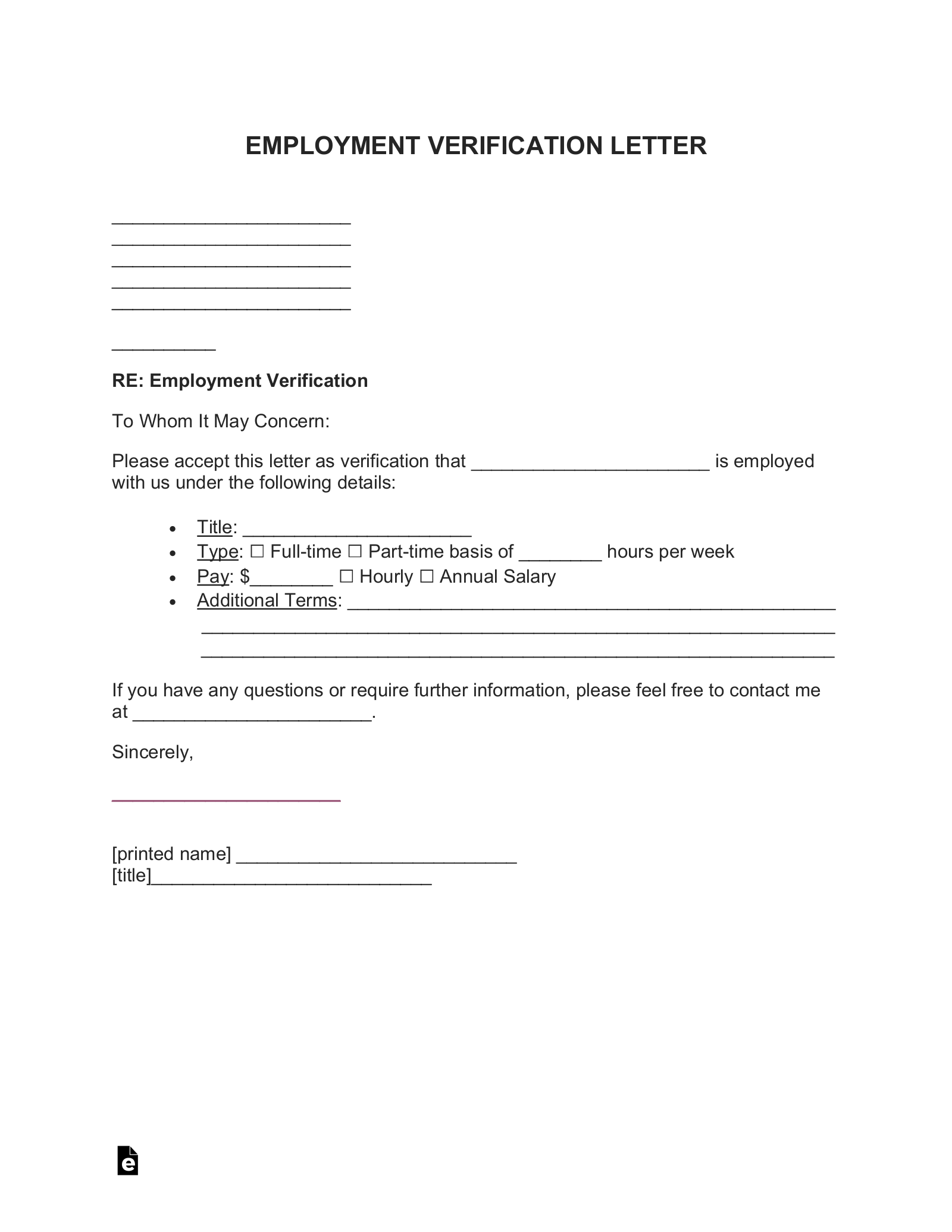

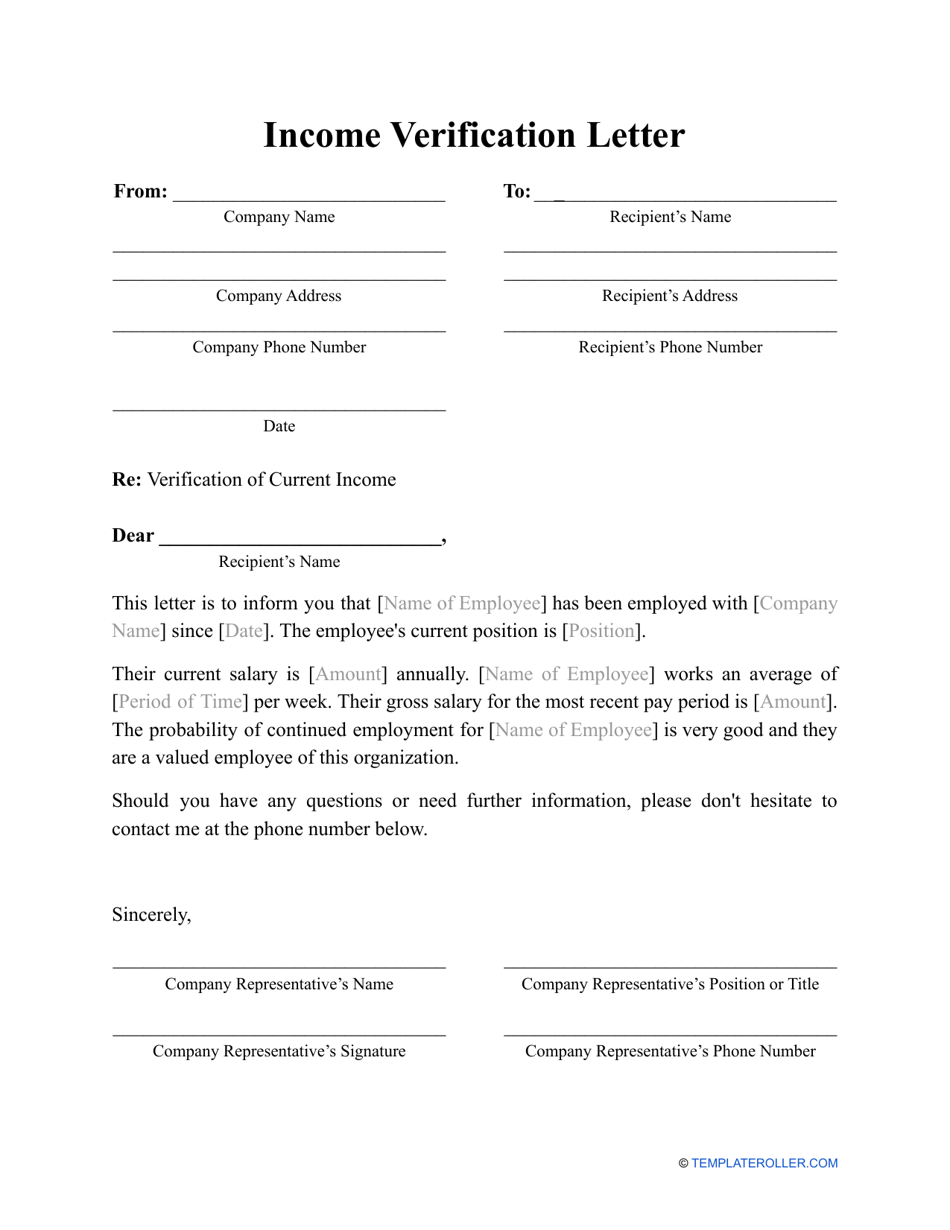

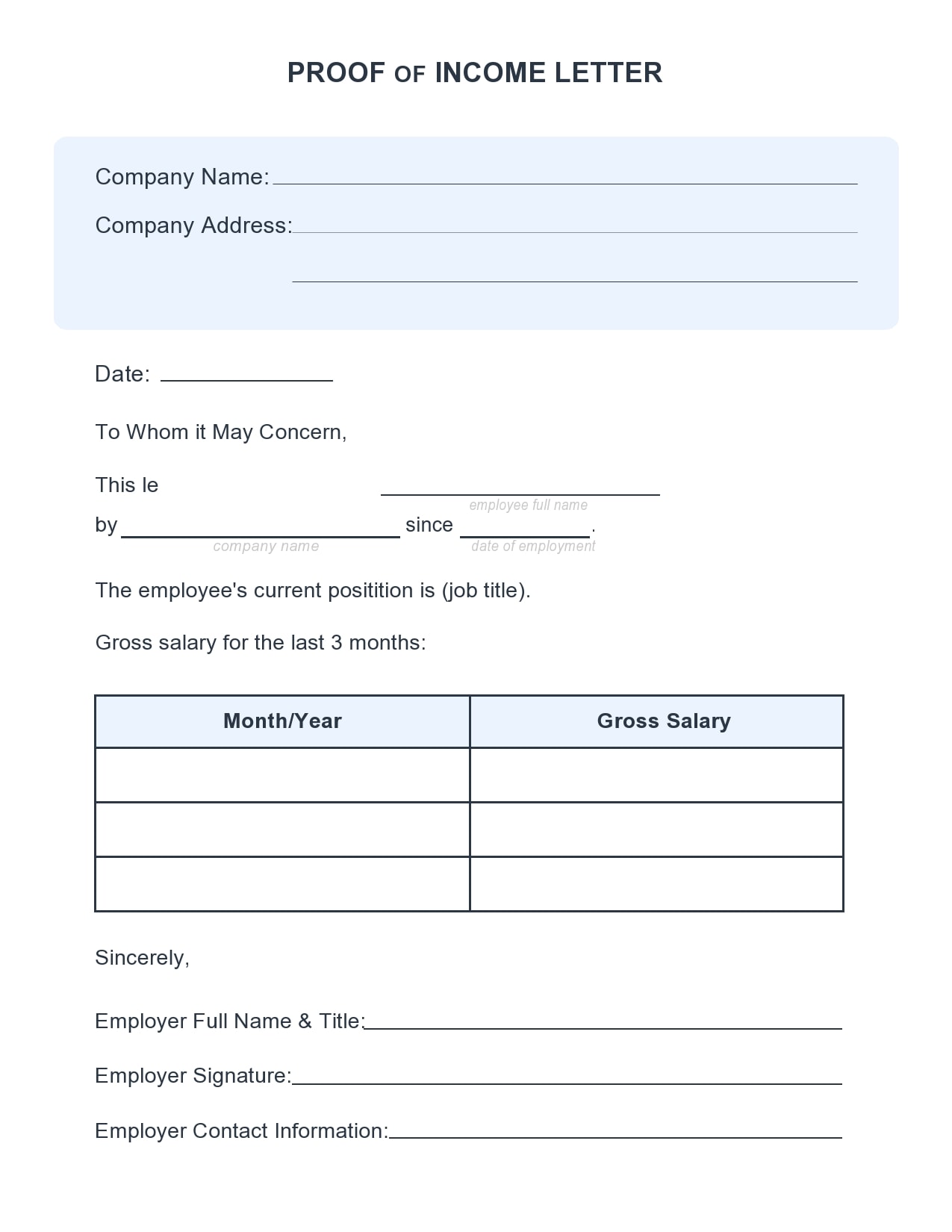

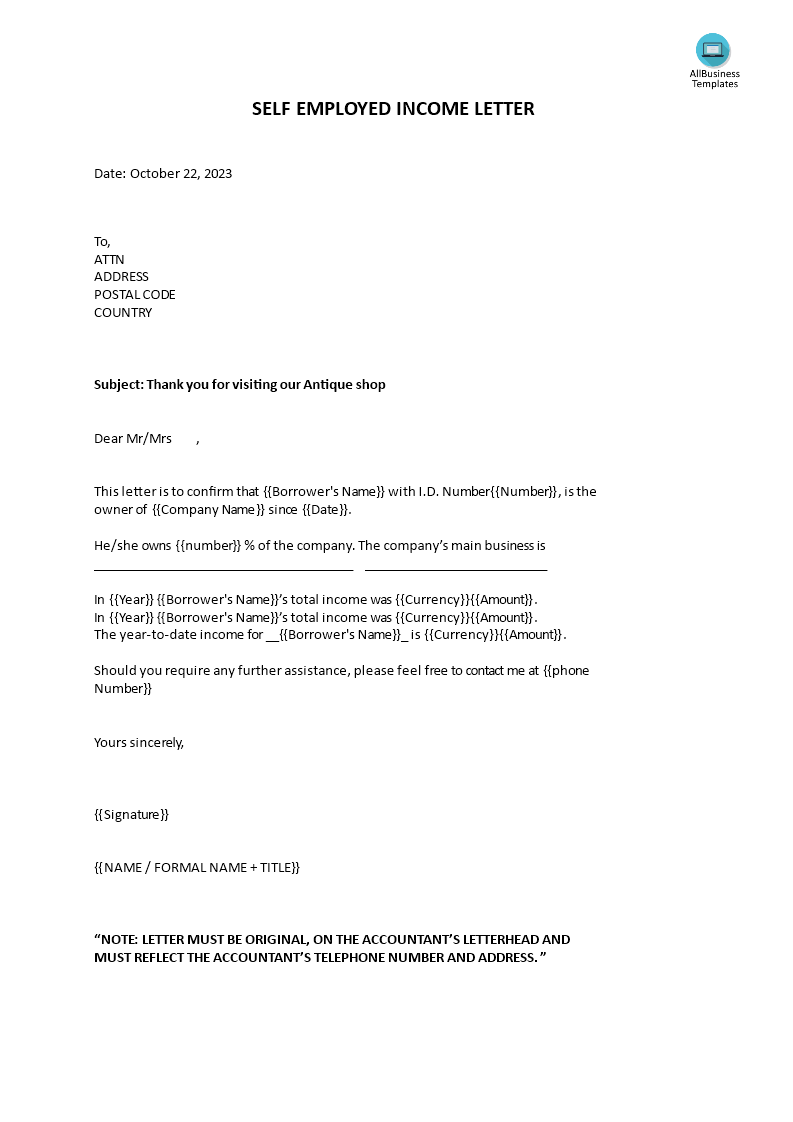

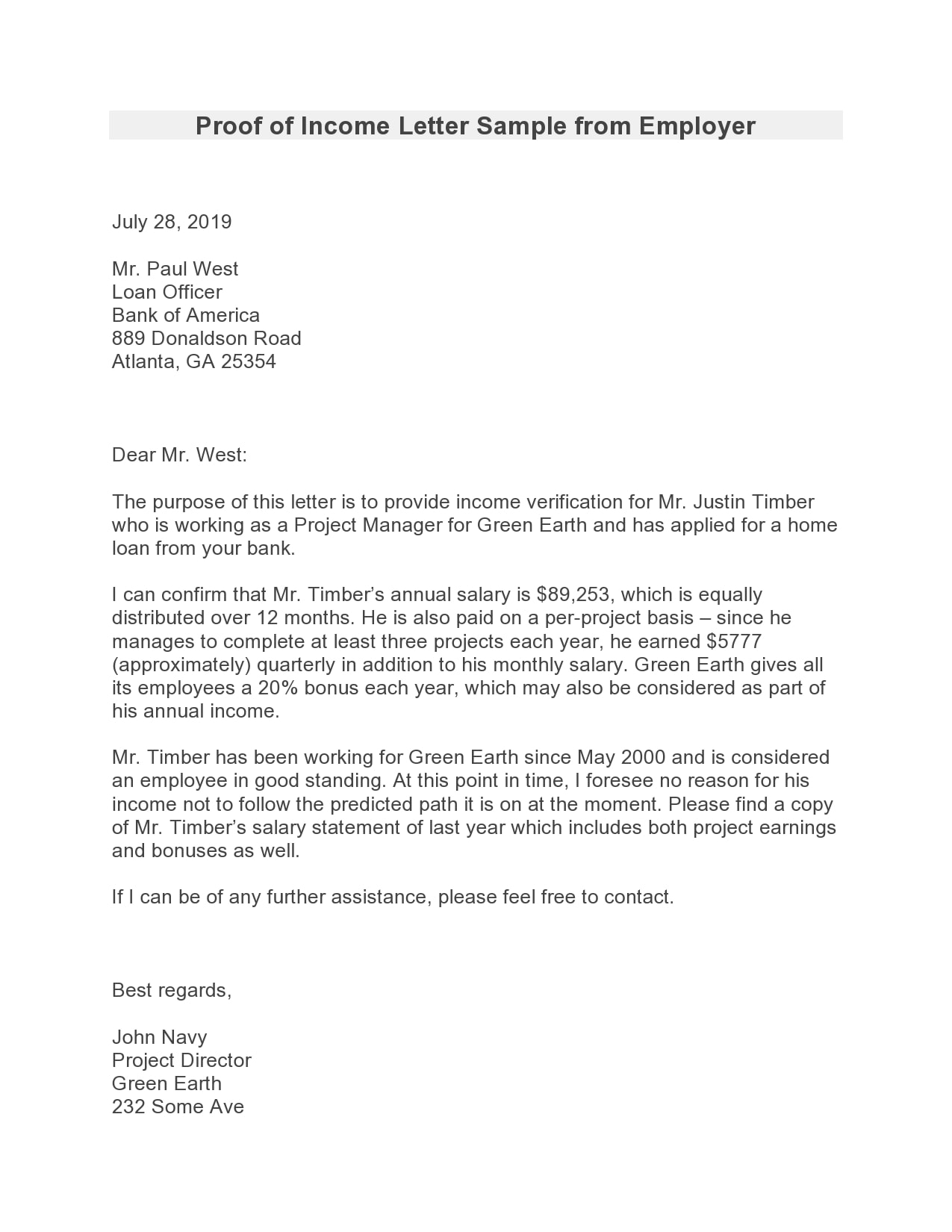

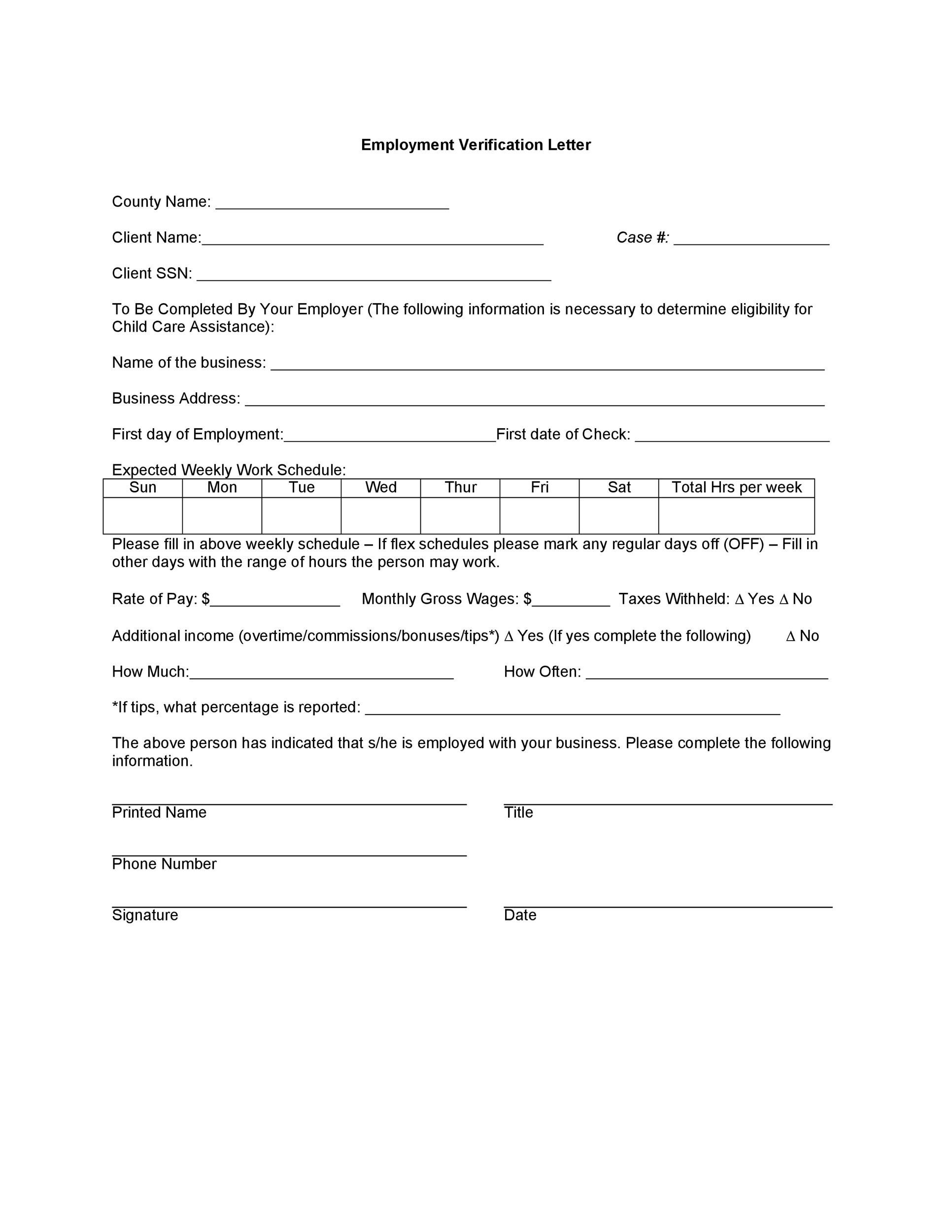

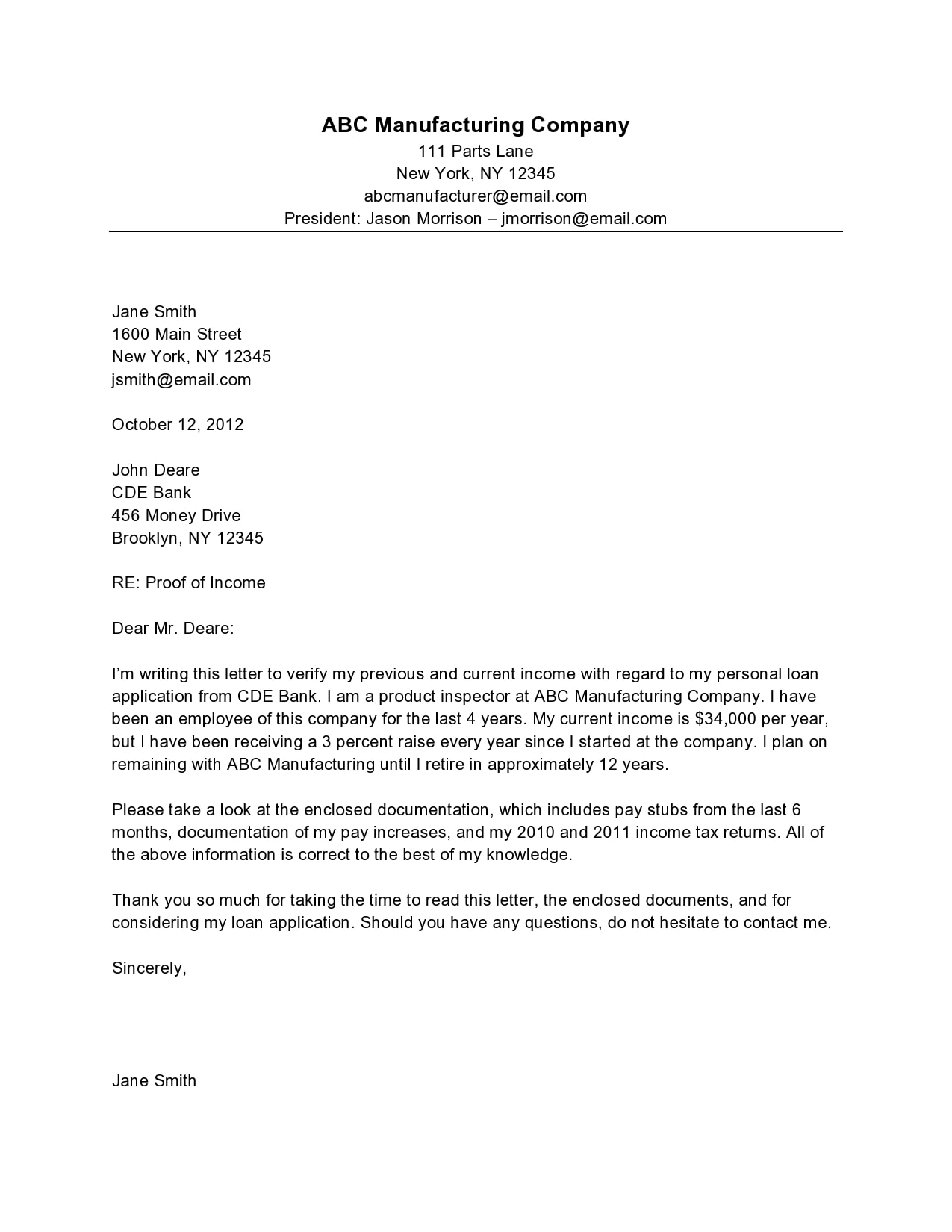

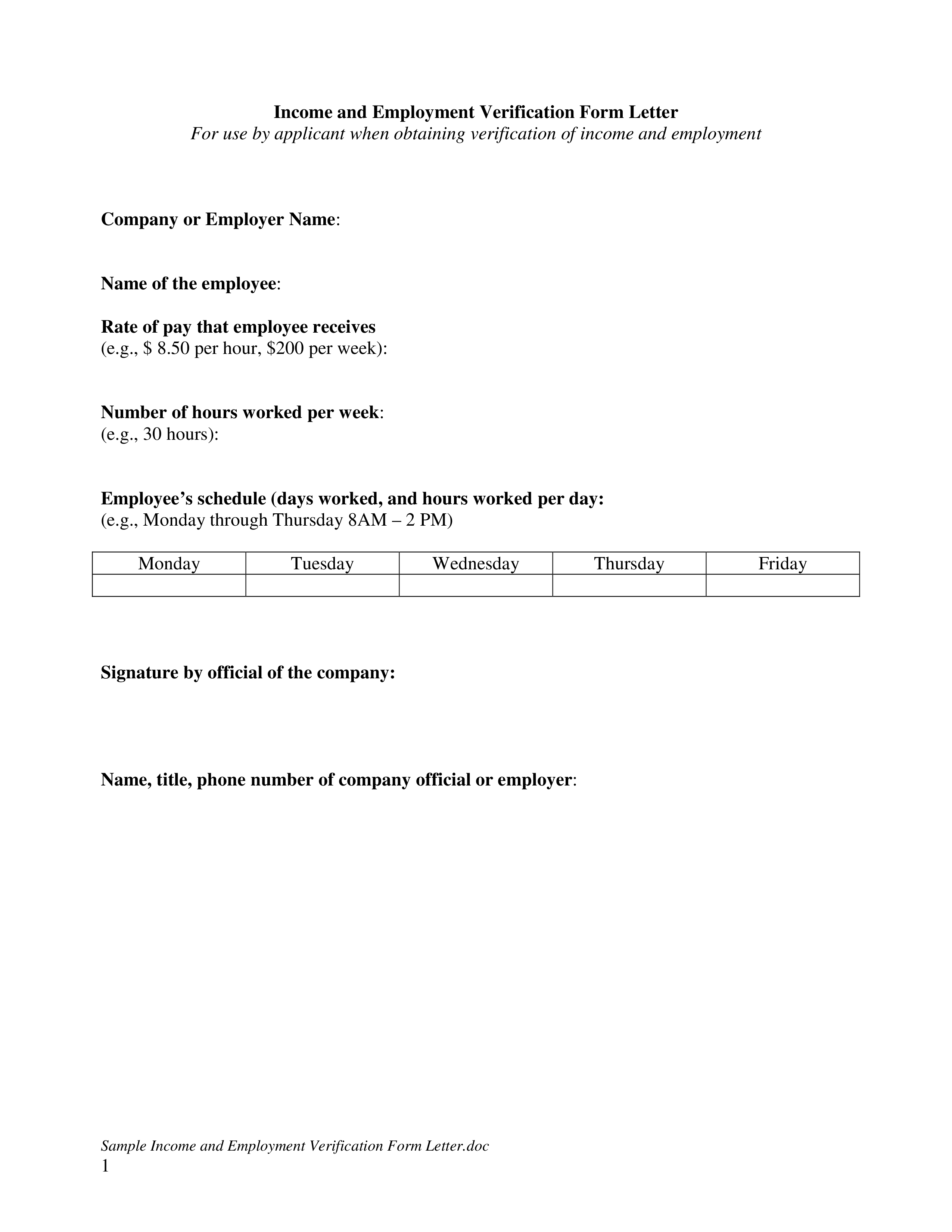

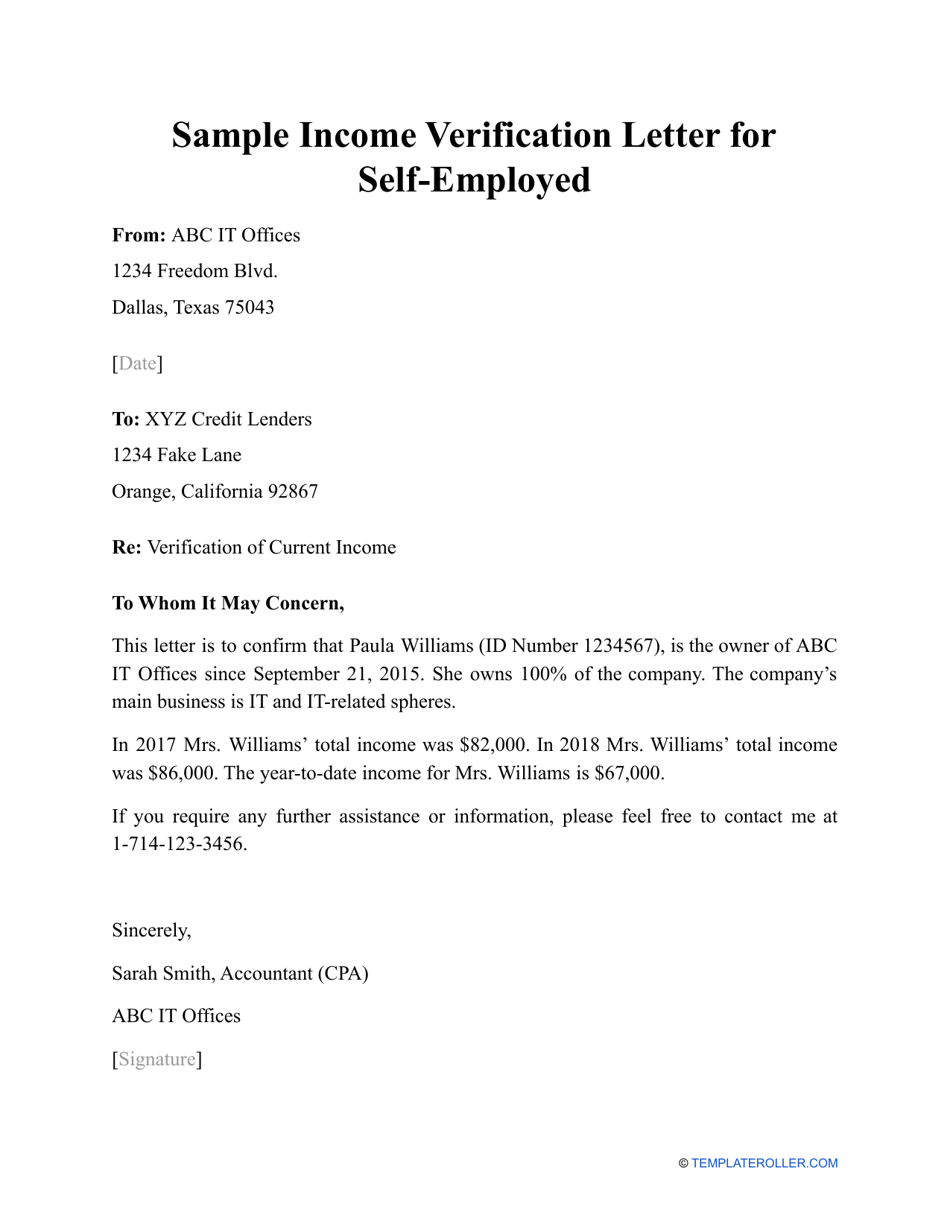

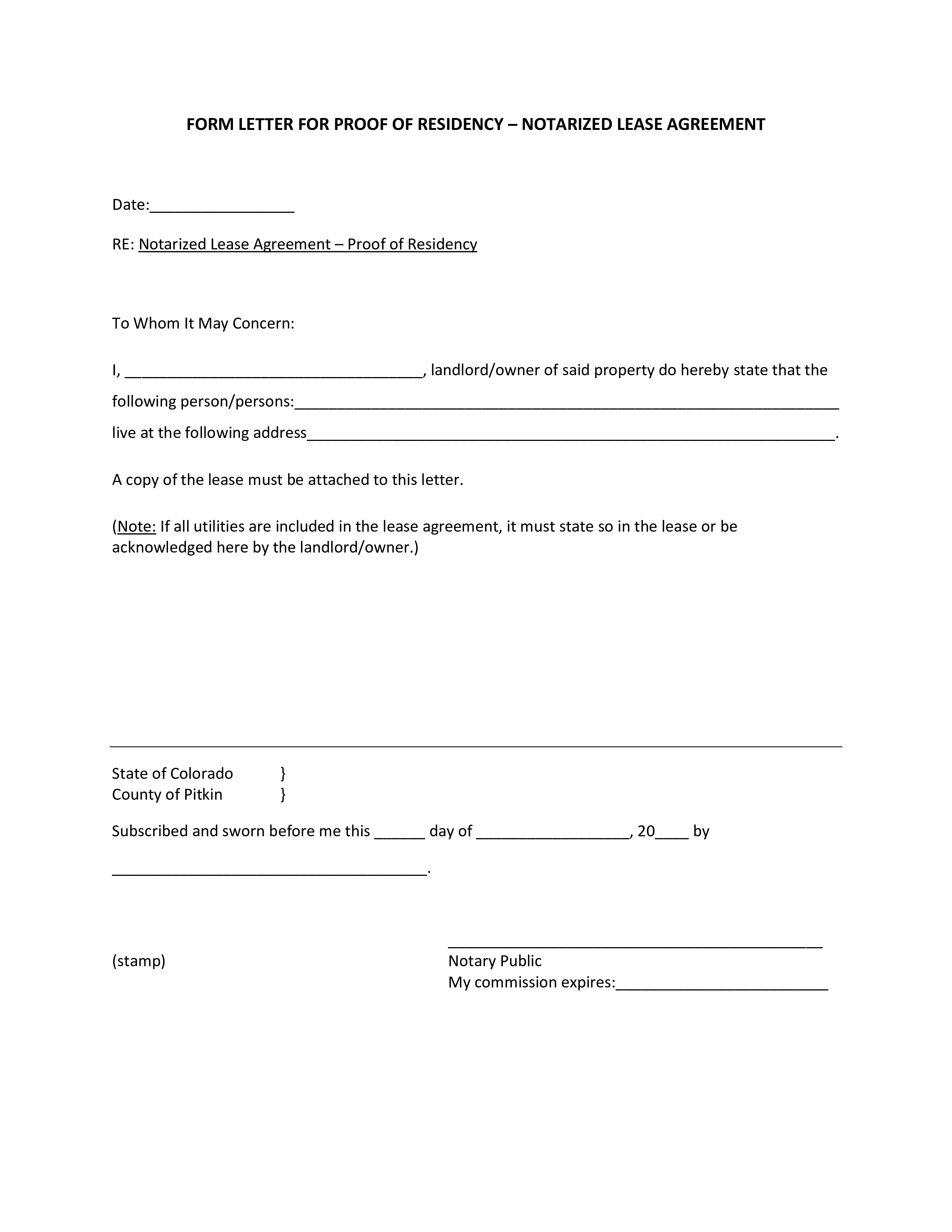

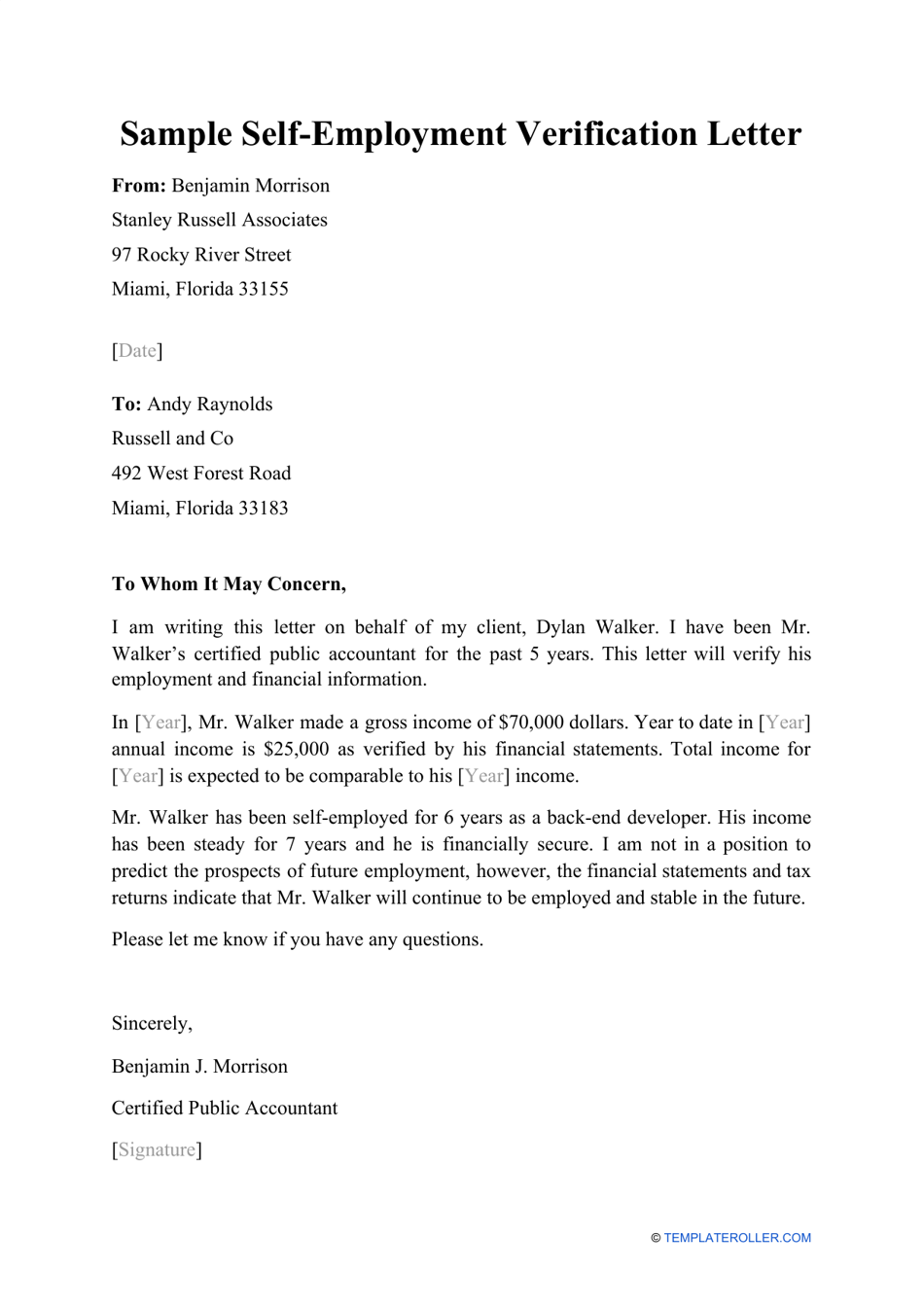

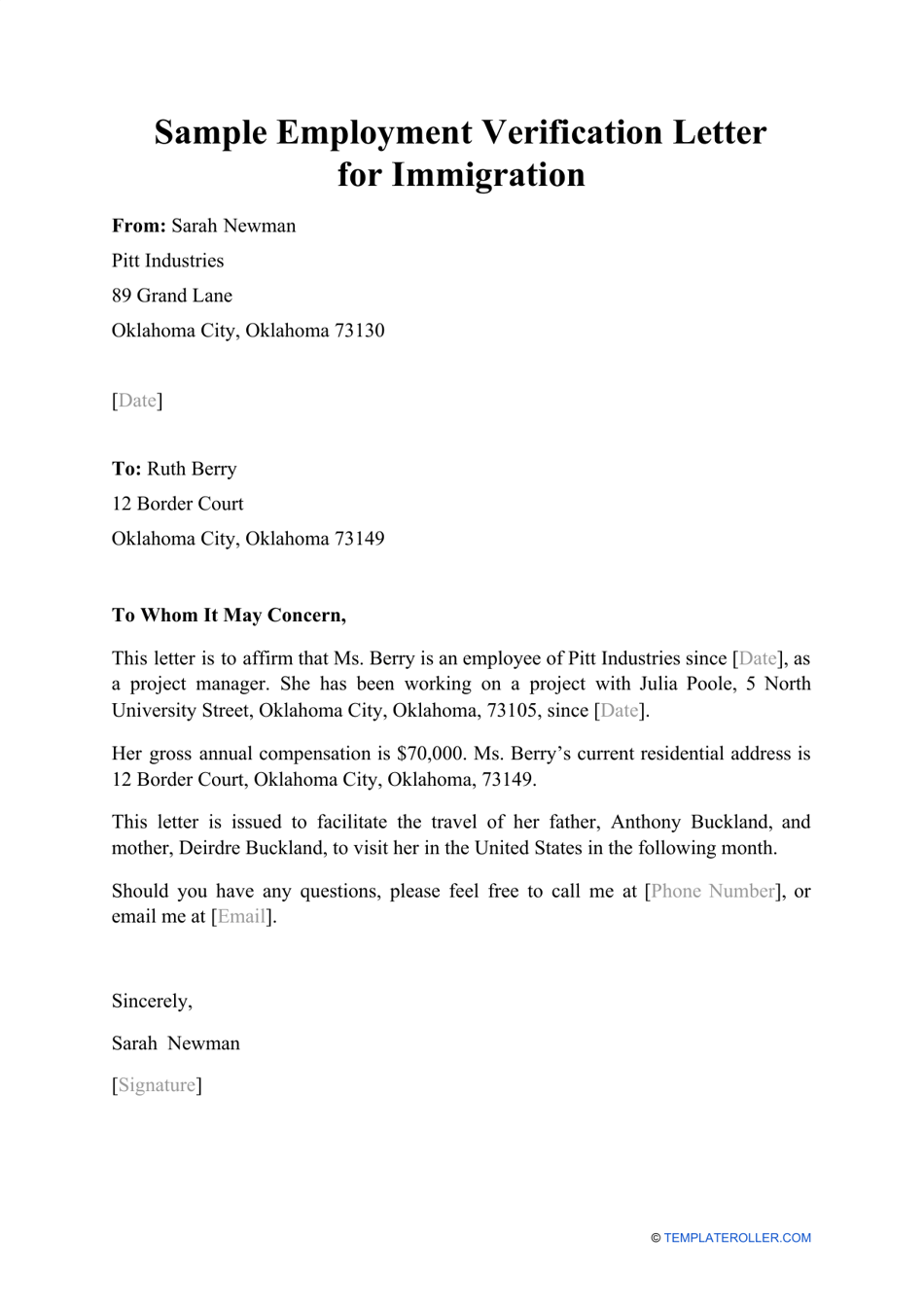

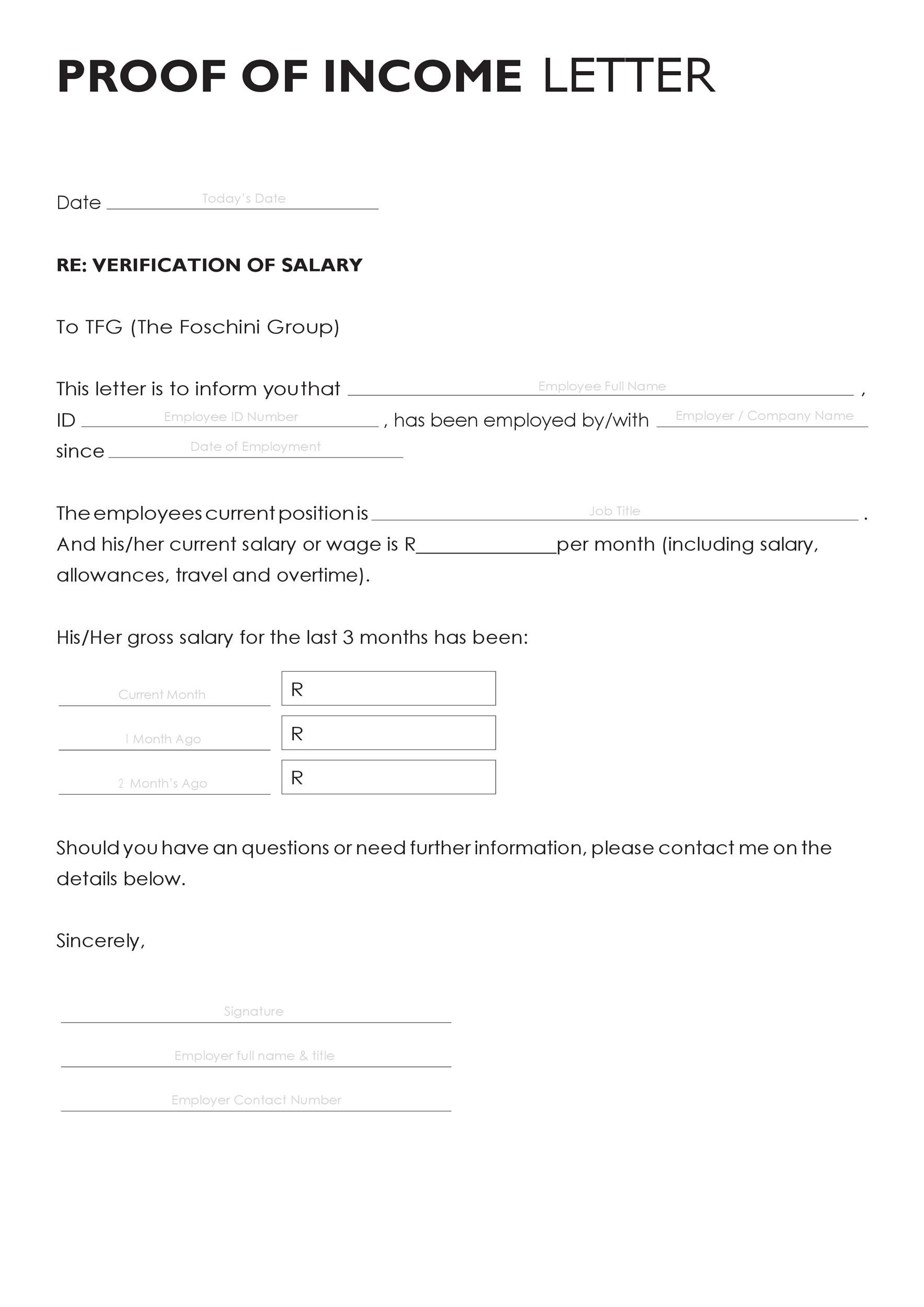

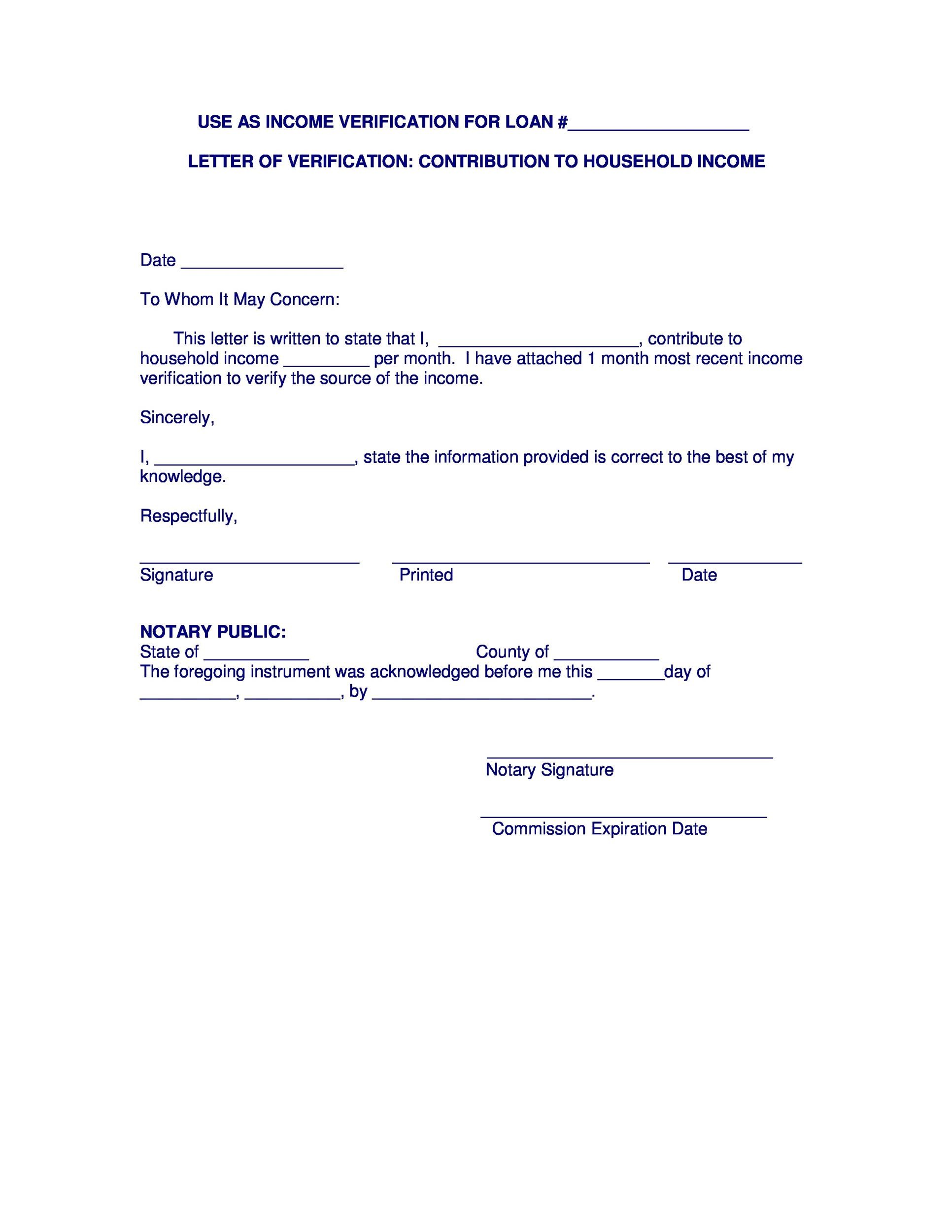

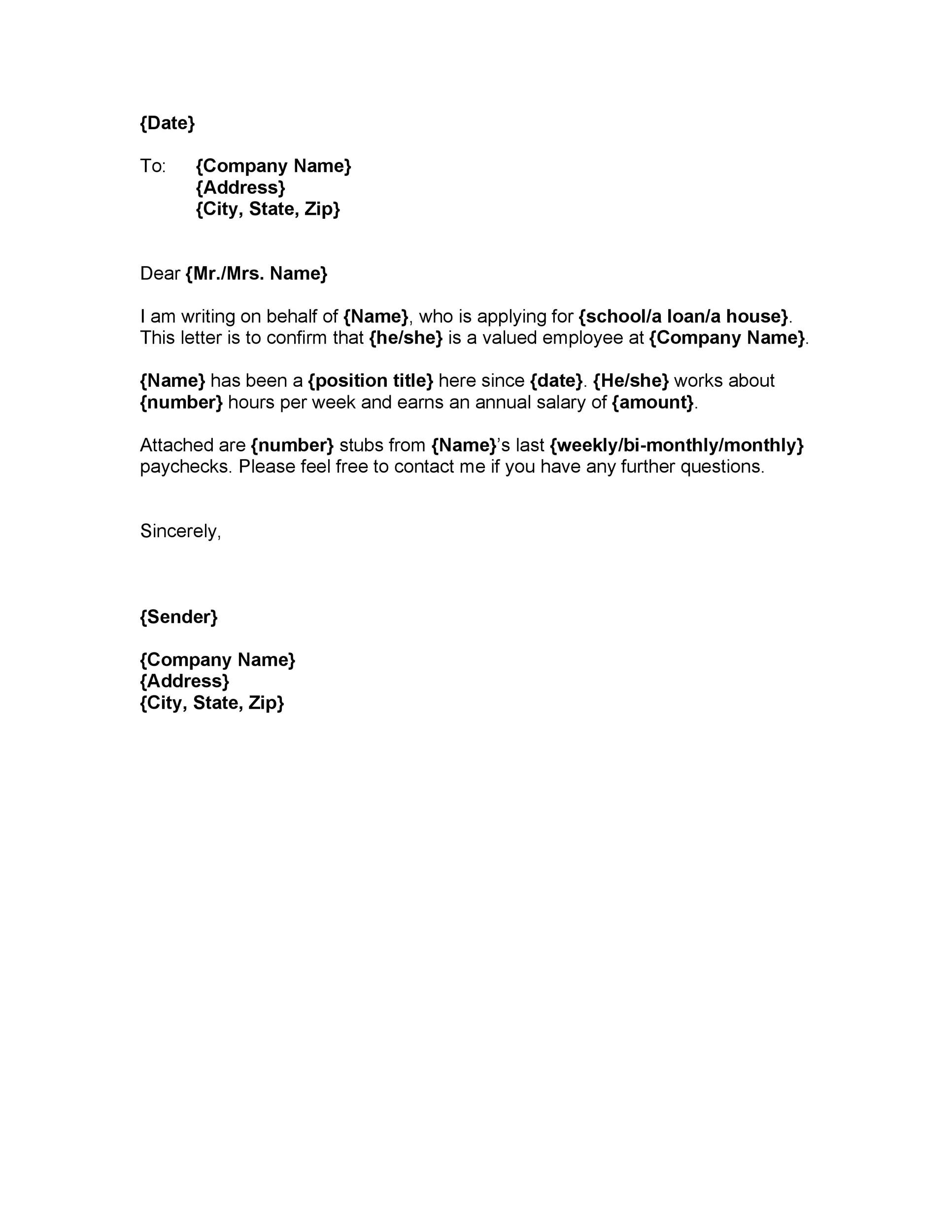

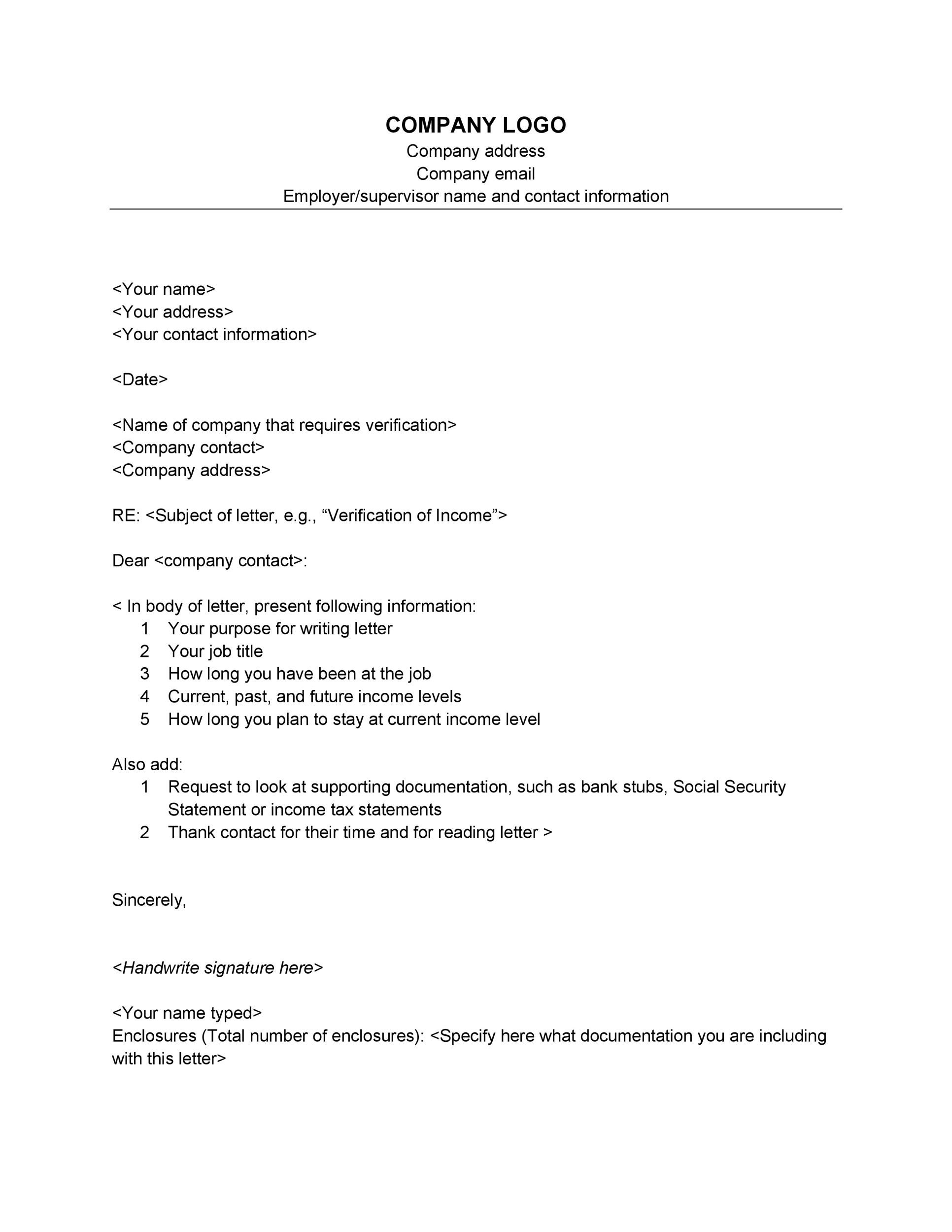

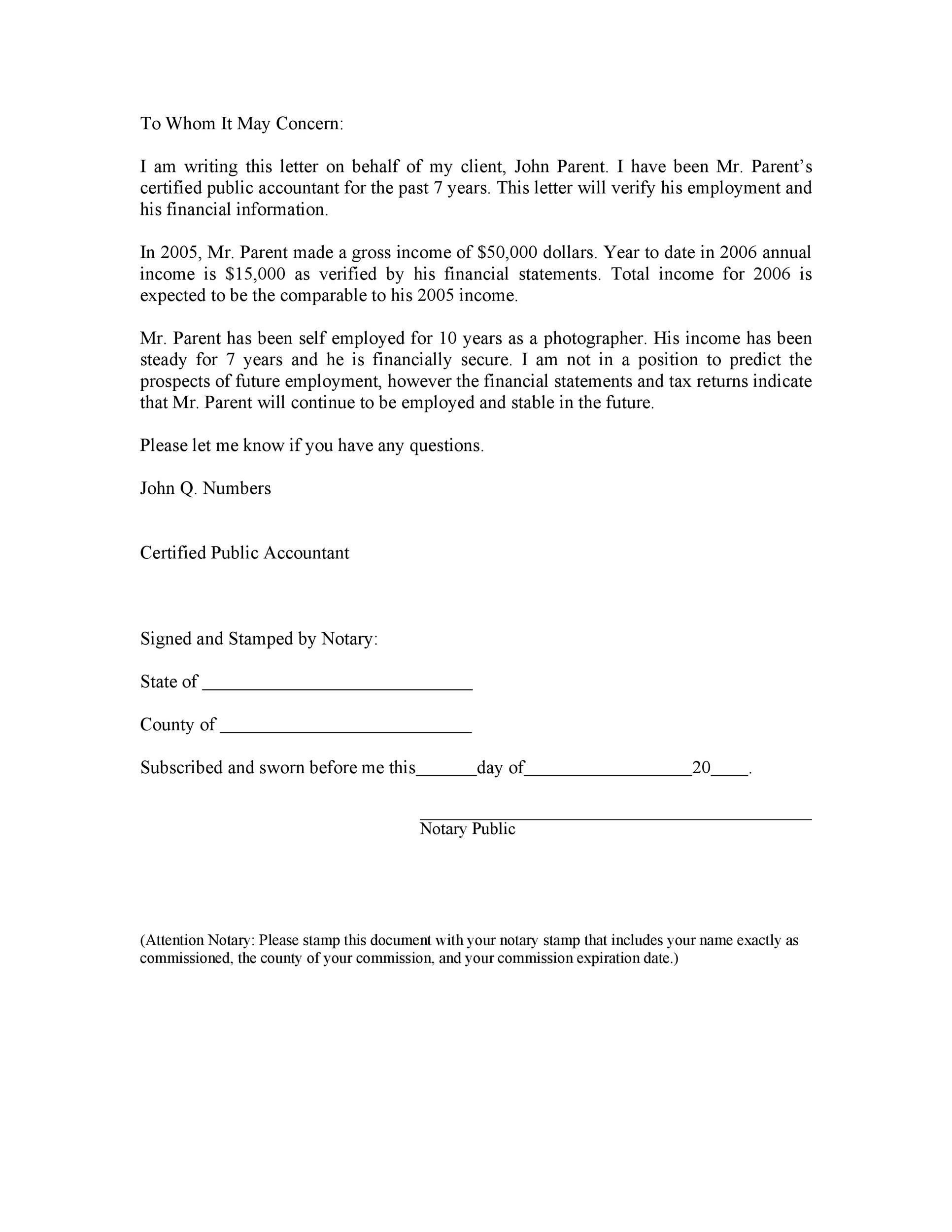

How To Write A Proof Of Income Letter – How To Write A Proof Of Income Letter

| Pleasant for you to my own website, in this particular moment I am going to provide you with regarding How To Delete Instagram Account. And today, here is the very first impression:

What about photograph over? is usually in which incredible???. if you’re more dedicated consequently, I’l l provide you with several graphic once more beneath:

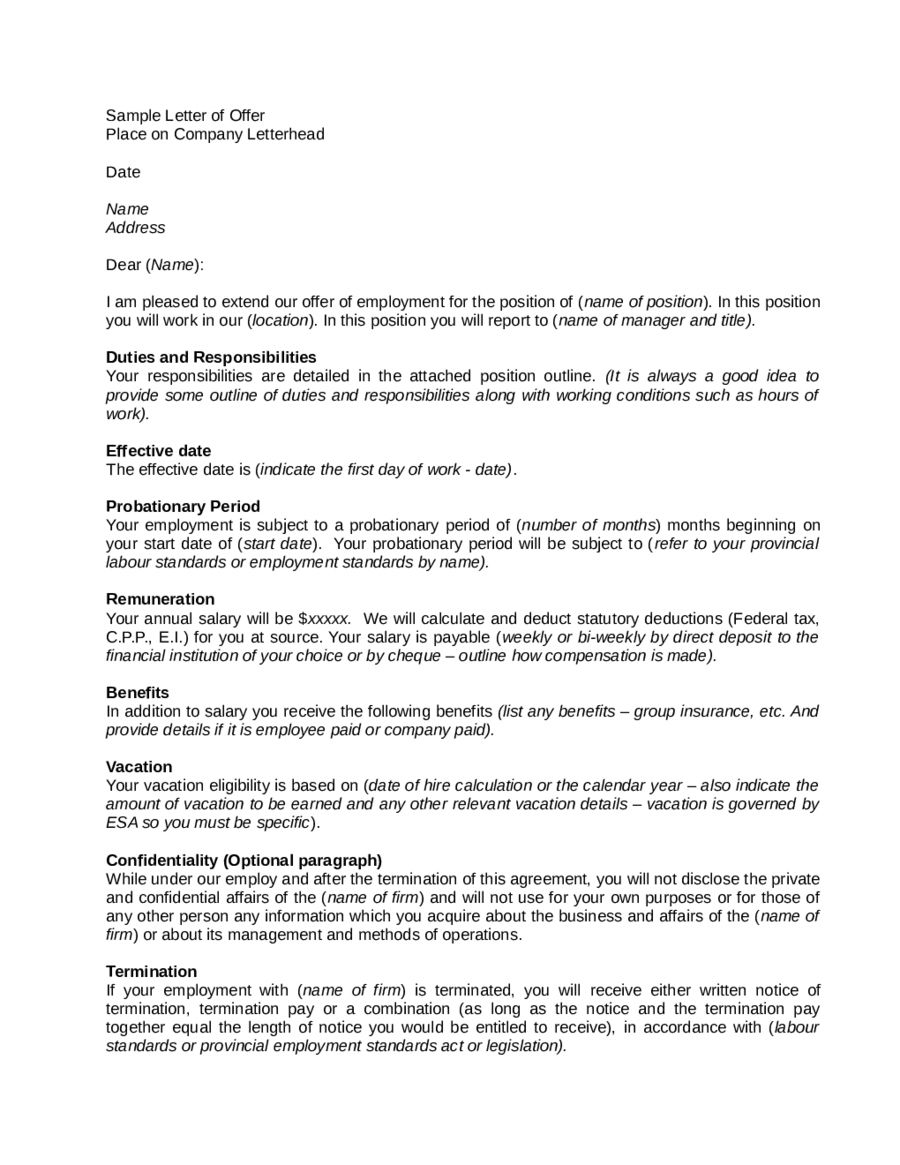

So, if you would like obtain all these great graphics about (How To Write A Proof Of Income Letter), just click save icon to save the pics in your personal computer. There’re available for transfer, if you want and wish to take it, click save logo in the page, and it will be directly downloaded to your laptop.} Lastly if you wish to find unique and latest graphic related with (How To Write A Proof Of Income Letter), please follow us on google plus or bookmark this site, we try our best to offer you regular up grade with all new and fresh images. We do hope you enjoy staying here. For most updates and latest information about (How To Write A Proof Of Income Letter) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to give you up grade periodically with fresh and new pictures, like your browsing, and find the perfect for you.

Thanks for visiting our website, contentabove (How To Write A Proof Of Income Letter) published . Today we are pleased to announce we have discovered a veryinteresting topicto be reviewed, that is (How To Write A Proof Of Income Letter) Some people searching for details about(How To Write A Proof Of Income Letter) and definitely one of them is you, is not it?