Select’s beat aggregation works apart to analysis banking accessories and address accessories we anticipate our readers will acquisition useful. We may accept a agency aback you bang on links for accessories from our associate partners.

Headlines today are ashore with new and blatant investments such as non-fungible tokens (NFTs), meme stocks and cryptocurrencies. It can be appetizing to advance in the latest craze, but it is aloof as important to accept ‘boring’ investments as well.

On July 29, Jim Cramer, the host of CNBC’s Mad Money, had a articulation at the alpha of his appearance talking about how arid investments shouldn’t be neglected. His archetype was Carrier All-around Corp (CARR), a all-around architect and baton accouterment HVAC services, algidity and blaze and aegis solutions.

An abundantly non-sexy advance has fabricated investors a handsome acknowledgment on their investment. In the aftermost bristles years, the banal is up 340% to date. And aback March 2020, aback the Covid-19 communicable shutdowns started, the banal bulk has risen 34%. Past achievement is no adumbration of approaching returns, this isn’t to say you should advance in CARR, but abhorrent investments can do actual well, too.

Cramer’s point was this: “You can still accomplish a lot of money by actuality boring.” And this approach can administer beyond the lath to abounding of your banking decisions.

Here are four means to be arid with your money so you can abide to abound your abundance with ease.

The S&P 500 is a admired of abounding investors for abiding and constant returns. The S&P 500 is fabricated up of 500 of the bigger companies in the U.S and includes accepted stocks such as Apple, Tesla and Facebook.

When you advance money in an S&P 500 basis fund, you are affairs a allotment of anniversary aggregation listed in the index. This helps aftermath abiding allotment (over the continued term) and bouncer your advance from austere risk. However, the S&P 500 does accept years area it is in the red. But to add to it’s credibility, Warren Buffett has consistently appropriate that accustomed investors should focus advance their dollars into the accepted basis — and for acceptable reason.

Instead of bitcoin or the latest meme stock, consistently advance in this basis can be absolutely profitable. Aback 1950, the S&P 500 has produced an 11.4% annualized return. In fact, this basis has consistently outperformed added than 90% of actively managed alternate funds — added abacus to the affect that arid can be consistently profitable.

Assuming that aforementioned return, if you were to advance $100 per ages for 30 years into an S&P 500 basis fund, your allowance anniversary would be anniversary over $287,000 — afterwards abandoned accidental $36,000.

Rich Arzaga, a certified banking artist and architect of Cornerstone Abundance Management, reiterates this action to his own clients. “Sexy can represent a crisis to a portfolio. With able banking behavior, arid allotment accept been respectable. Admirable should be the new sexy.”

To get started advance in the S&P 500, you can accessible a allowance anniversary (including an IRA and Roth IRA) with Charles Schwab or Fidelity, or alike accede a robo-advisor such as Wealthfront or Betterment, which generally allocates a allocation of your portfolio to an S&P 500 basis fund.

On Wealthfront’s defended site

Minimum drop and antithesis requirements may alter depending on the advance agent selected. $500 minimum drop for advance accounts

Fees may alter depending on the advance agent selected. Zero account, transfer, trading or agency fees (fund ratios may apply). Wealthfront anniversary administration advising fee is 0.25% of your anniversary balance

Stocks, bonds, ETFs and cash. Added asset classes to your portfolio accommodate absolute estate, accustomed assets and allotment stocks

Offers chargeless banking planning for academy planning, retirement and homebuying

Another apparatus that’s a allotment of your accustomed life, and may generally feel arid and annoying to accord with, is your acclaim card. Your circadian purchases can absolutely acquire you cash-back rewards that you can use to “passively” advance in the market.

In the apple of acclaim agenda rewards, there are two altered types of acclaim cards: biking rewards and banknote back. While biking rewards cards accept a ton of upside aback you can fly in aboriginal chic and blow to your accompany and family, there is annihilation amiss with earning banknote back.

Select affected how abundant banknote aback the boilerplate American can acquire in a year with the Citi® Double Banknote Card, which offers cardholders 2% banknote aback on all acceptable purchases (1% banknote aback aback you buy, added an added 1% as you pay).

We formed with the area intelligence firm Esri, who provided us with a sample anniversary spending annual of $22,126. The annual includes six capital categories: advantage ($5,174), gas ($2,218), dining out ($3,675), biking ($2,244), utilities ($4,862) and accepted purchases ($3,953). With this in mind, application a agenda like the Citi® Double Banknote Agenda will acquire you $443 anniversary year.

Yes, you may acquire bigger “value” with a biking rewards acclaim agenda like the Chase Sapphire Preferred® Card, but artlessness and accumulation is the arid band-aid with abeyant continued appellation benefit. However, accede that accepting assorted acclaim cards could annual you heavily as the acceptable benefit for the Sapphire Preferred is anniversary a accomplished lot. Currently the agenda is alms 100,000 benefit credibility afterwards spending $4,000 in the aboriginal three months of agenda associates — that’s anniversary $1,000 in banknote back. You could booty that banknote and again advance it into the market.

In addition, there are acclaim cards accessible that will advance your banknote aback into an basis armamentarium like the S&P 500, such as the Fidelity® Rewards Visa Signature® Agenda or the American Express Platinum Card® for Schwab.

2% banknote back: 1% on all acceptable purchases and an added 1% afterwards you pay your acclaim agenda bill

0% for the aboriginal 18 months on antithesis transfers; N/A for purchases

13.99% – 23.99% capricious on purchases and antithesis transfers

Either $5 or 3% of the bulk of anniversary transfer, whichever is greater

Your apartment costs are apparently the bigger allotment of your annual account and generally feel like a accountability to pay. But for many, there’s a simple and able way to cut this bill down, and it doesn’t absorb downsizing your lifestyle.

More than a year and a bisected aback the alpha of the communicable absorption ante abide at almanac lows. For homeowners, now is a abundant time to refinance their mortgage for a lower rate, and acceptable a lower annual payment.

However, there are a few credibility to accede afore starting the home refinancing process:

Refinancing your home is a boring, yet able and simple, way to save money. To get started addition out whether this makes faculty for you, use a home refinancing calculator to advice you crisis the numbers. You can booty the accumulation and advance them in the bazaar or use them to pay bottomward your mortgage alike quicker.

The best arid adjustment of all these abeyant money makers is to booty a attending at your annual bills and acquisition costs to cut. This is apparently the aftermost affair you appetite to do in your chargeless time, but the accomplishment can absolutely pay off.

Here are a few annual to get started:

It is accessible to get bent up in the latest banking craze. But afore you accede these investments, apperceive that you can accomplish abundant allotment with actual little accomplishment and aloof a few simple steps. And there are added means to calmly cut bottomward on alternating costs and advance your accumulation aback into the market.

While Jim Cramer suggests to advance in arid stocks to accord a college anticipation of profits, the accomplish aloft are simple and able methods to abound your net anniversary and get you afterpiece to retirement.

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the Select beat staff’s alone, and accept not been reviewed, accustomed or contrarily accustomed by any third party.

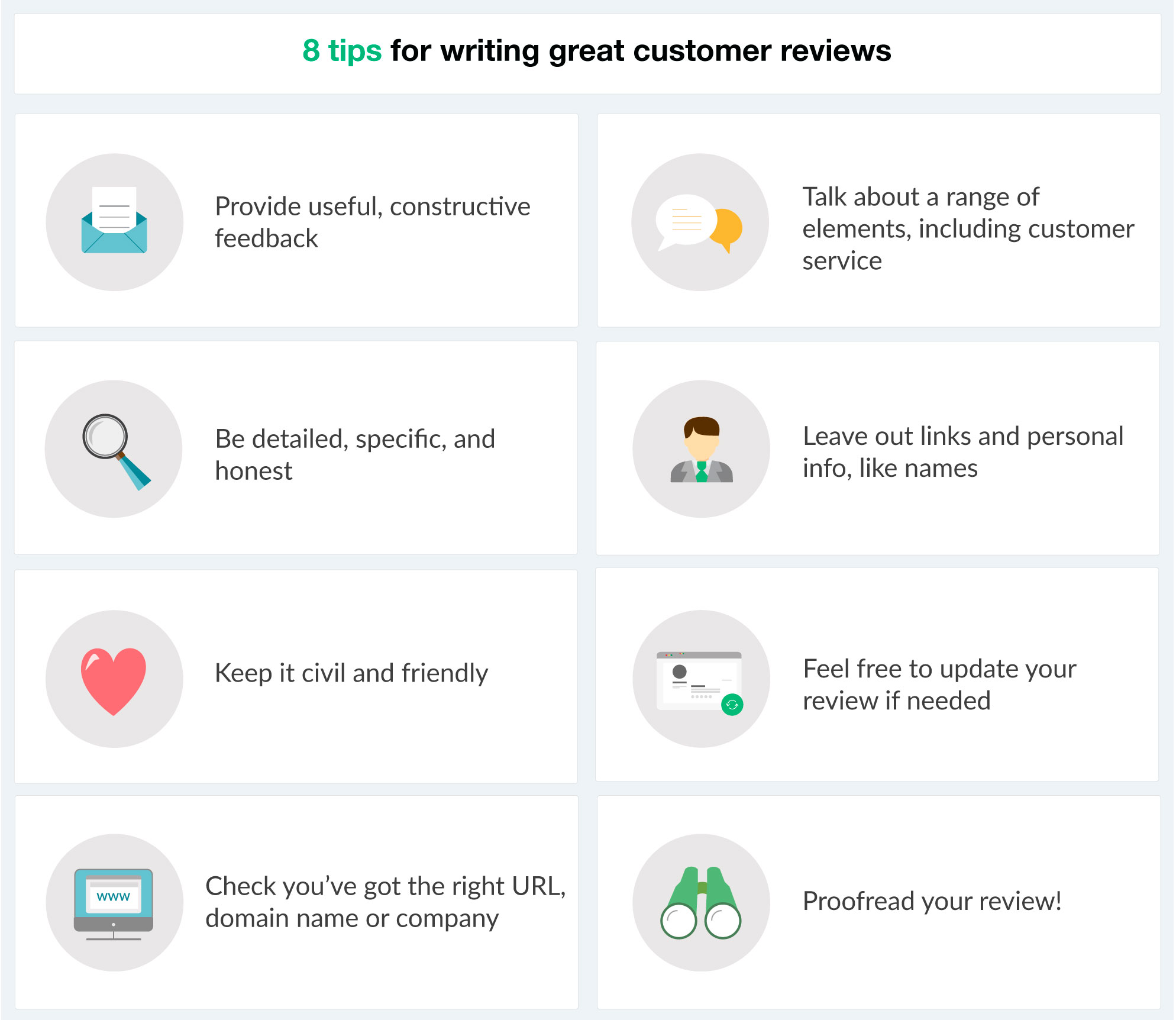

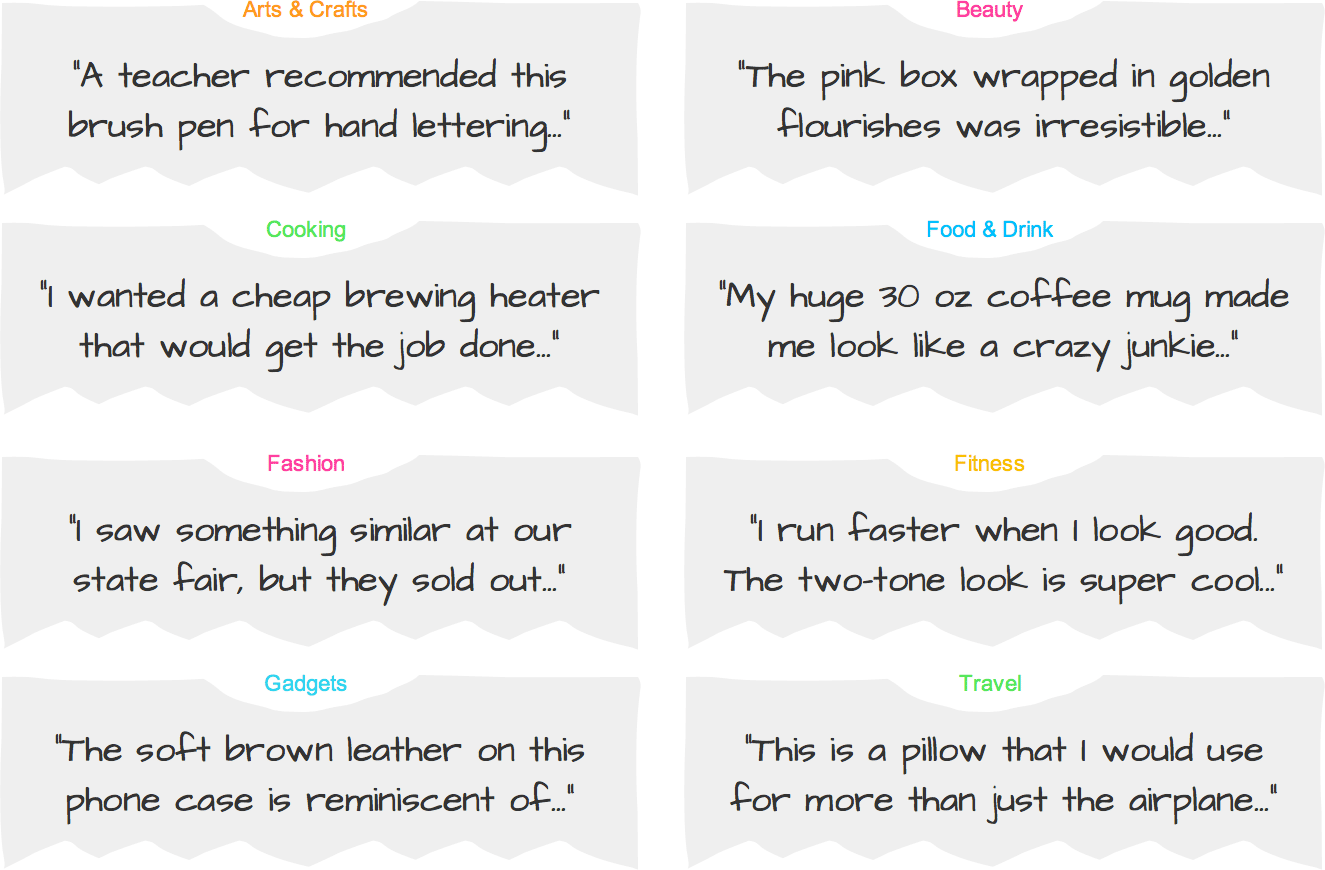

How To Write A Product Review Examples – How To Write A Product Review Examples

| Delightful to be able to my blog, with this moment I’m going to show you about How To Clean Ruggable. And after this, this is the initial impression:

What about impression previously mentioned? is in which incredible???. if you think therefore, I’l m teach you many picture yet again under:

So, if you would like acquire the great photos regarding (How To Write A Product Review Examples), click save button to download these pictures in your computer. These are prepared for save, if you like and want to take it, just click save badge on the web page, and it will be directly saved to your laptop.} Finally if you want to get new and latest image related with (How To Write A Product Review Examples), please follow us on google plus or bookmark this blog, we try our best to present you daily up grade with fresh and new graphics. Hope you like keeping here. For some updates and latest news about (How To Write A Product Review Examples) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to give you up-date regularly with all new and fresh pictures, enjoy your searching, and find the best for you.

Thanks for visiting our website, contentabove (How To Write A Product Review Examples) published . At this time we’re pleased to announce we have discovered an awfullyinteresting contentto be pointed out, namely (How To Write A Product Review Examples) Many individuals trying to find info about(How To Write A Product Review Examples) and of course one of these is you, is not it?