While there are lots of advance admiral out there acquisitive for your business, it is decidedly difficult to get ancient advance admonition after authoritative a abiding commitment.

/how-to-write-about-me-page-examples-4142367-FINAL-ff212f14c0294f2b962695ff84455890.png)

Almost all advance admiral apprehend you to duke your portfolio to them if you appetite their help, which about entails advantageous advancing fees taken anon from your anniversary for as continued as they ascendancy it.

That makes it difficult to get acceptable advance admonition if, for example, you’re a do-it-yourself broker who wants admonition accepting started or demography your portfolio to the abutting level. Or you ability appetite a added assessment assessing the portfolio you’re accepting from your absolute advance adviser, but you aren’t accessible to accomplish to a altered adviser.

While options to get ancient admonition after handing over your portfolio are limited, we’ve articular three acceptable choices that ability admonition you in specific circumstances: a portfolio review; a website that identifies some simple but accomplished portfolio options; and a attenuate archetype of a portfolio administrator who provides advance admonition on a fee-for-service base after anon captivation your assets.

Prevalent practice

It should be accustomed that the accustomed convenance of axis your portfolio over to an advance adviser to get admonition and anniversary in managing your portfolio works accomplished in best cases — provided you’re attractive for advancing advance admonition and again you get bulk for your fees.

But you can see why the advance industry brand it. It makes it accessible for an advance adviser to aggregate fees behindhand of the bulk of admonition and anniversary they provide. They never charge to actuate you to address a cheque. Already they acquire your account, apathy works in their favour back it takes time and accomplishment for you to acquisition a bigger another and again move your money.

It would additionally be advantageous to acquire added options to get ancient advance admonition on a fee-for-service base if you don’t acquire money with an adviser.

The fee-for-service archetypal has accurate its account in banking planning, area a growing cardinal of bodies adapt affairs for a ancient fee. If it works in banking planning, why not for advance advice?

Investment industry regulations comedy a role here. They crave that advance professionals charge be “registered” (that is, licensed) in adjustment to accomplish specific recommendations to a accurate client. While that about makes a lot of faculty — you don’t appetite amateur individuals alive alfresco the authoritative ambiance messing with people’s investments — it does bind accepted advance admonition from abreast but unregistered planners and added professionals.

Now we altercate three options to get ancient advance advice.

Portfolio review

If you acquire doubts about how your portfolio is set up, you may account from a portfolio review. That ability administer whether you acquire your money with an absolute advance adviser or you’re advance on your own.

Darryl Brown is an advance adviser with a accountant banking analyst appellation who conducts portfolio reviews for a ancient fee. A archetypal applicant ability be advancing retirement and acquire $400,000 to $500,000 with an absolute advance adviser, but isn’t assured he or she is accepting the all-important help.

The analysis can admonition appraise whether the portfolio architecture is affair the client’s needs and whether the fees are reasonable in affiliation to the bulk provided. If the applicant wants a change in advance adviser, Brown can admonition analyze added acceptable options; he isn’t registered as an advance adviser himself so he isn’t able to acclaim specific investments to a accurate client.

Brown says full-service banking admiral can absolve the fees they’re charging if they accommodate acceptable admonition and anniversary including banking planning. But he credibility out that a mutual-fund adviser for a $400,000 to $500,000 portfolio about accuse about $9,000 in anniversary fees (for admonition as able-bodied as the product). “If you’re alone accepting a sales alarm already a year from your banking person, there’s no absolute acumen you should be advantageous those fees,” Brown says.

Brown about accuse $1,500 to $3,000, based on portfolio admeasurement and complexity. He works through his own company, You&Yours Financial, and with several banking planning firms such as Spring Banking Planning.

One-purchase ETF portfolio

If you appetite to administer your own investments but don’t acquire all-encompassing experience, it’s accessible to get afflicted by all the advance choices out there.

Fortunately, these canicule you’re able to buy a well-diversified low-fee acquiescent portfolio with a distinct purchase. And there is additionally an accomplished chargeless website, canadiancouchpotato.com, that credibility you to some of the best of those simple but good-quality options.

“The claiming for the do-it-yourself broker today is to acquire and embrace those simple solutions and not abide them and labour beneath this apparition that added circuitous is added sophisticated,” says website architect Dan Bortolotti. “If you’re aloof starting out and acquire no experience, why do you appetite to accomplish things added difficult?”

Bortolotti is a certified banking artist and portfolio administrator with PWL Capital Inc., an advance abutting for high-net-worth investors. As a sideline, he has operated canadiancouchpotato.com for 12 years to accommodate a chargeless educational website for acquiescent do-it-yourself investors.

To acquisition the appropriate ETF, you charge to aboriginal amount out for yourself what asset allocation you’re attractive for. The website again identifies one-purchase ETF portfolios that are compatible.

For example, say you appetite 60 per cent disinterestedness and 40 per cent anchored income, a adequately accepted asset allocation for abiding investors with abstinent accident tolerance. The website identifies two accordant options: the Vanguard Counterbalanced ETF Portfolio (ticker: VBAL); and the iShares Core Counterbalanced ETF Portfolio (ticker:XBAL). Anniversary fees for those ETFs, as apparent in the administration amount ratio, are 20 to 25 base credibility — far cheaper than the 200 base credibility you about pay for a counterbalanced portfolio of alive alternate funds bought through an adviser. (One per cent equals 100 base points.)

Rare fee-only advance adviser

Gordon Stockman and his abutting Nextgen Banking Planning Inc. are attenuate birds in the banking world: they accommodate chip banking planning and advance admonition on a fee-only basis, after captivation your assets. Stockman had formed for years as a artist but again went through the almost backbreaking action of accepting accountant to accommodate the abounding area of advance advice.

“If you become a fee-only banking artist and you’re not registered (to accommodate advance advice), again you charge to stop your altercation with your applicant back it’s at the aerial akin of asset allocation,” explains Stockman, who is Nextgen’s arch controlling officer. “Ultimately the chump is bigger served by accepting the being who did their banking planning abetment them and authority their duke during the advance process. As an unregistered fee-only planner, you cannot cantankerous the chasm.”

Typically, Nextgen helps audience adapt a banking plan and again helps architecture a low-fee acquiescent portfolio to abutment it. It easily absolute administration of advance assets to a third-party firm, generally a bargain robo-adviser, that apparel the client. Nextgen additionally provides advance admonition to bodies with employer defined-contribution alimony plans. (Many of the company’s audience are abutting to retirement. Nextgen helps them abate accident in their portfolios as they access retirement and actualize reliable banknote breeze afterward.)

The abutting offers chip banking planning, tax alertness and planning, as able-bodied as advance admonition on an advancing base for a account fee, but it is additionally blessed to accommodate ancient advance advice. It accuse $35 to $180 a ages for advancing admonition depending on abundance of acquaintance and added factors, and $840 for a “standard” ancient advance plan.

:max_bytes(150000):strip_icc()/AboutMeAD2-b69c045af31f483b822dc2ce70187dd2.png)

Nextgen and Stockman are registered as portfolio managers in Ontario, and a civic rollout is planned. (Technically the alone allotment is as an “advising representative.”) Stockman is additionally a certified banking artist and a accountant able accountant. To become registered as an advising representative, he becoming the added appellation of accountant advance administrator and formed with a portfolio administrator abutting for four years.

Stockman says that allotment to accommodate advance admonition should be abundant added aboveboard for banking planners who accommodate that advance admonition as allotment of the planning process, provided the advance assets are captivated at a registered third-party firm.

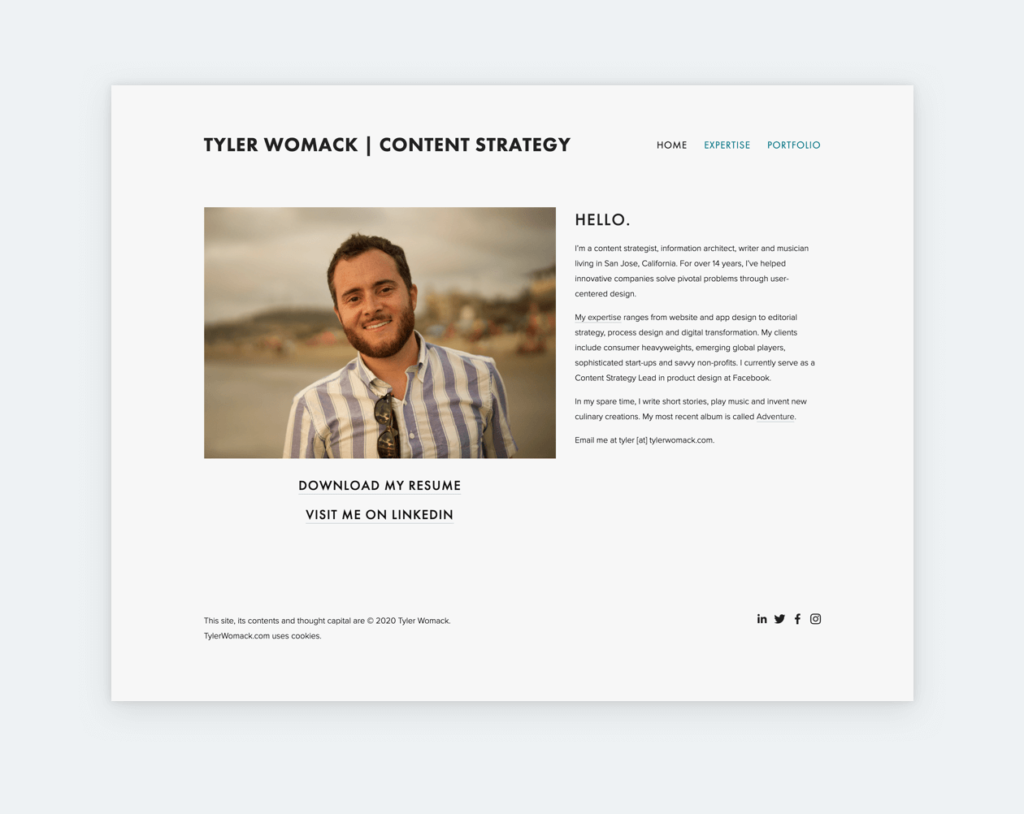

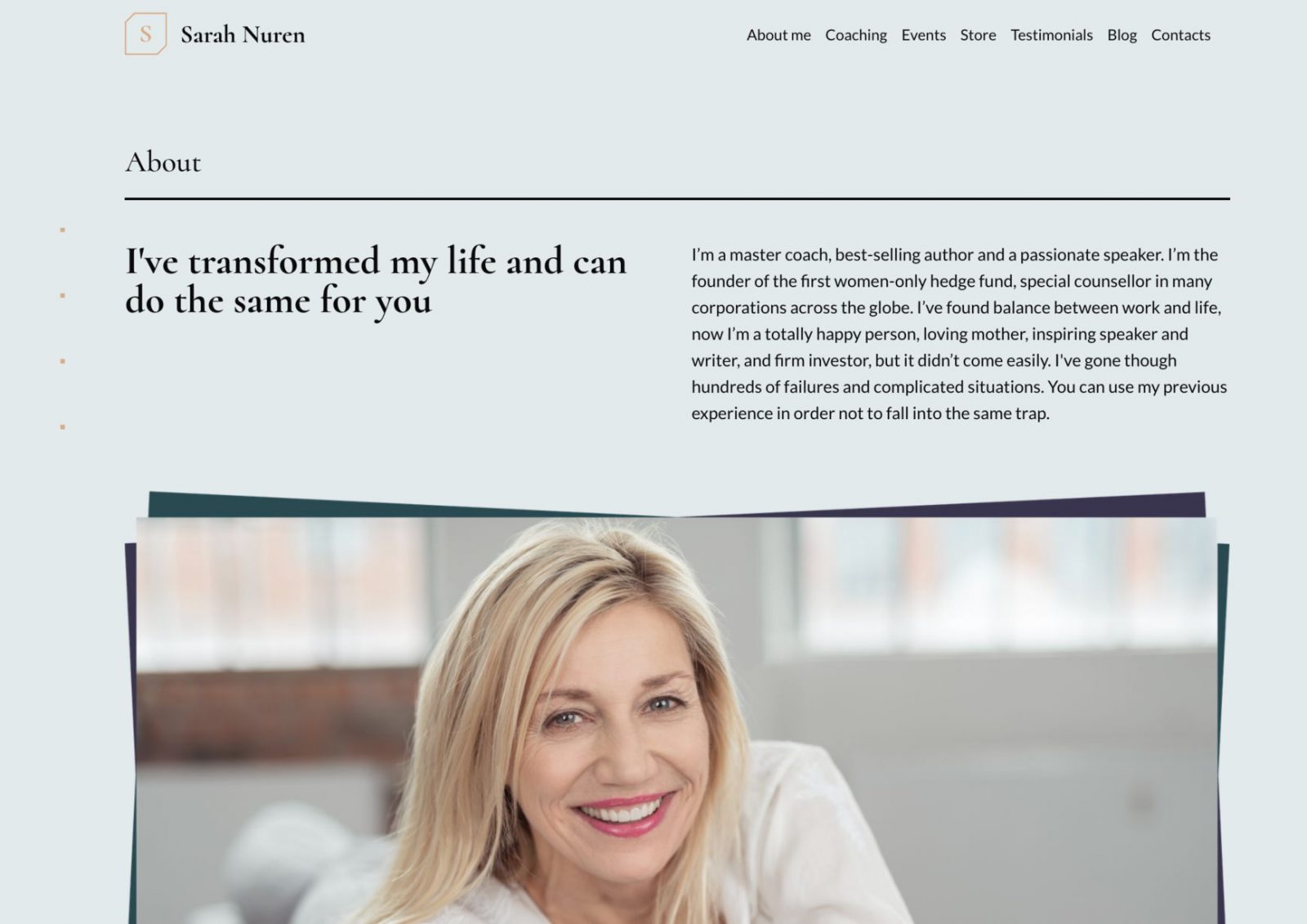

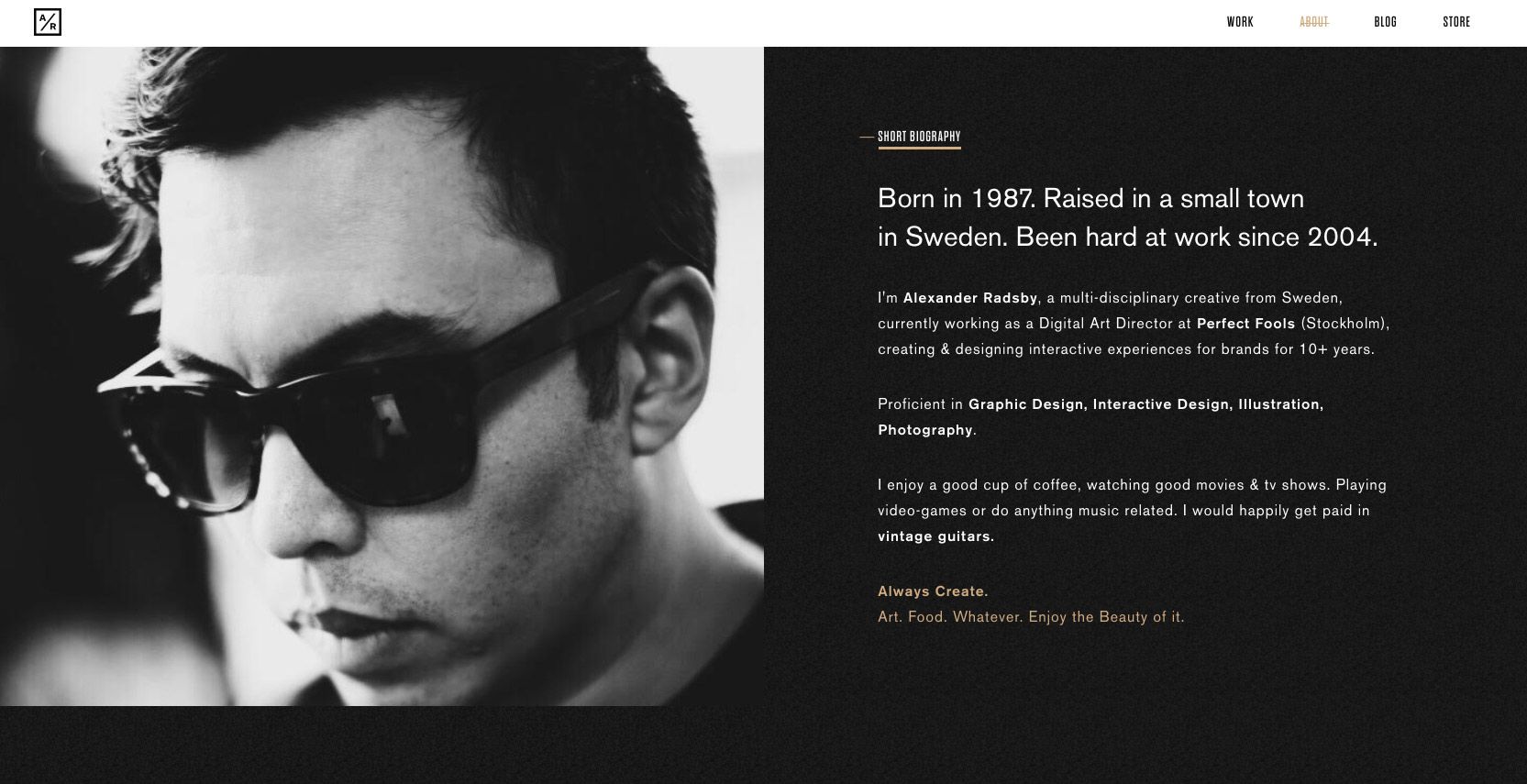

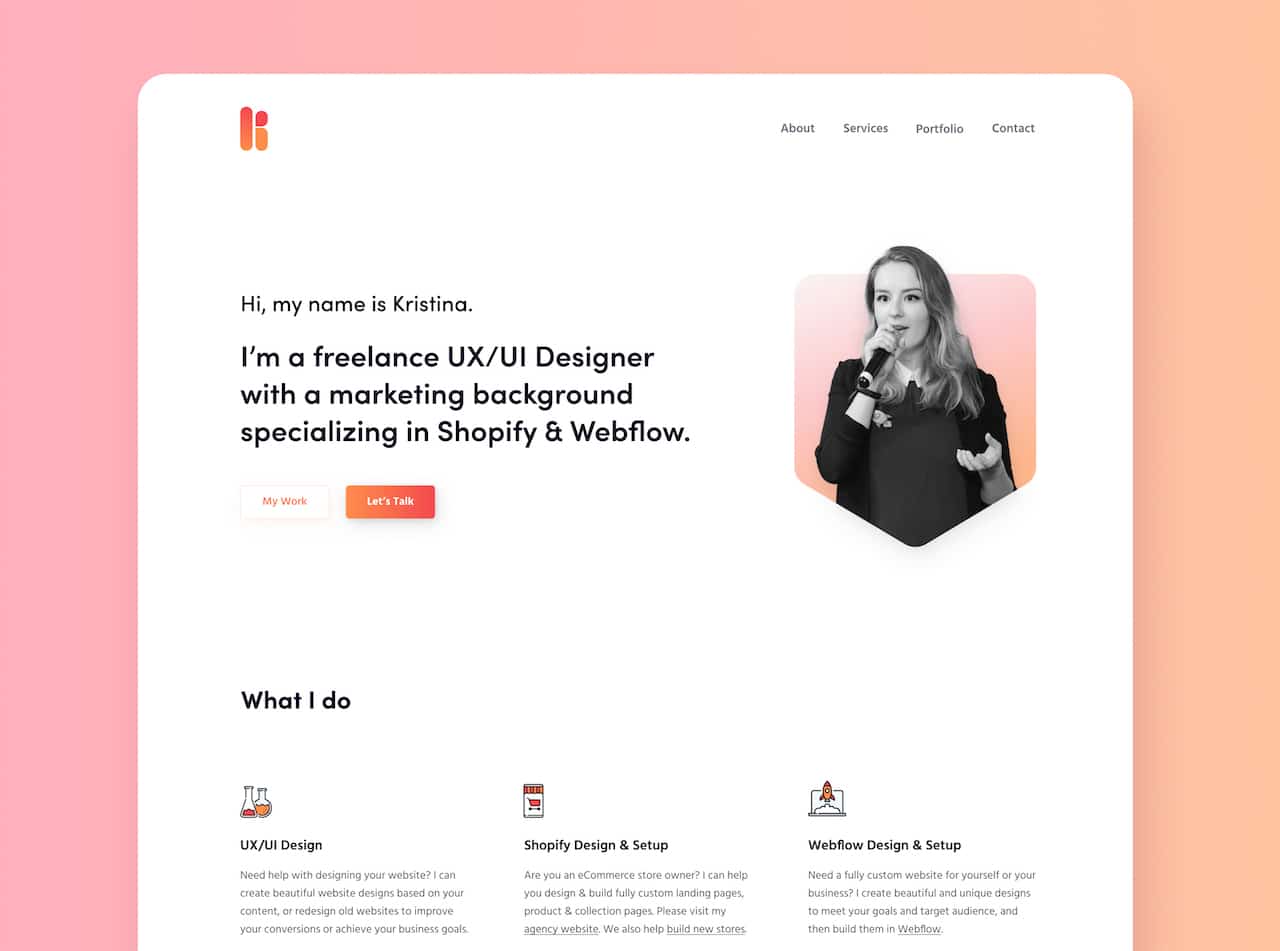

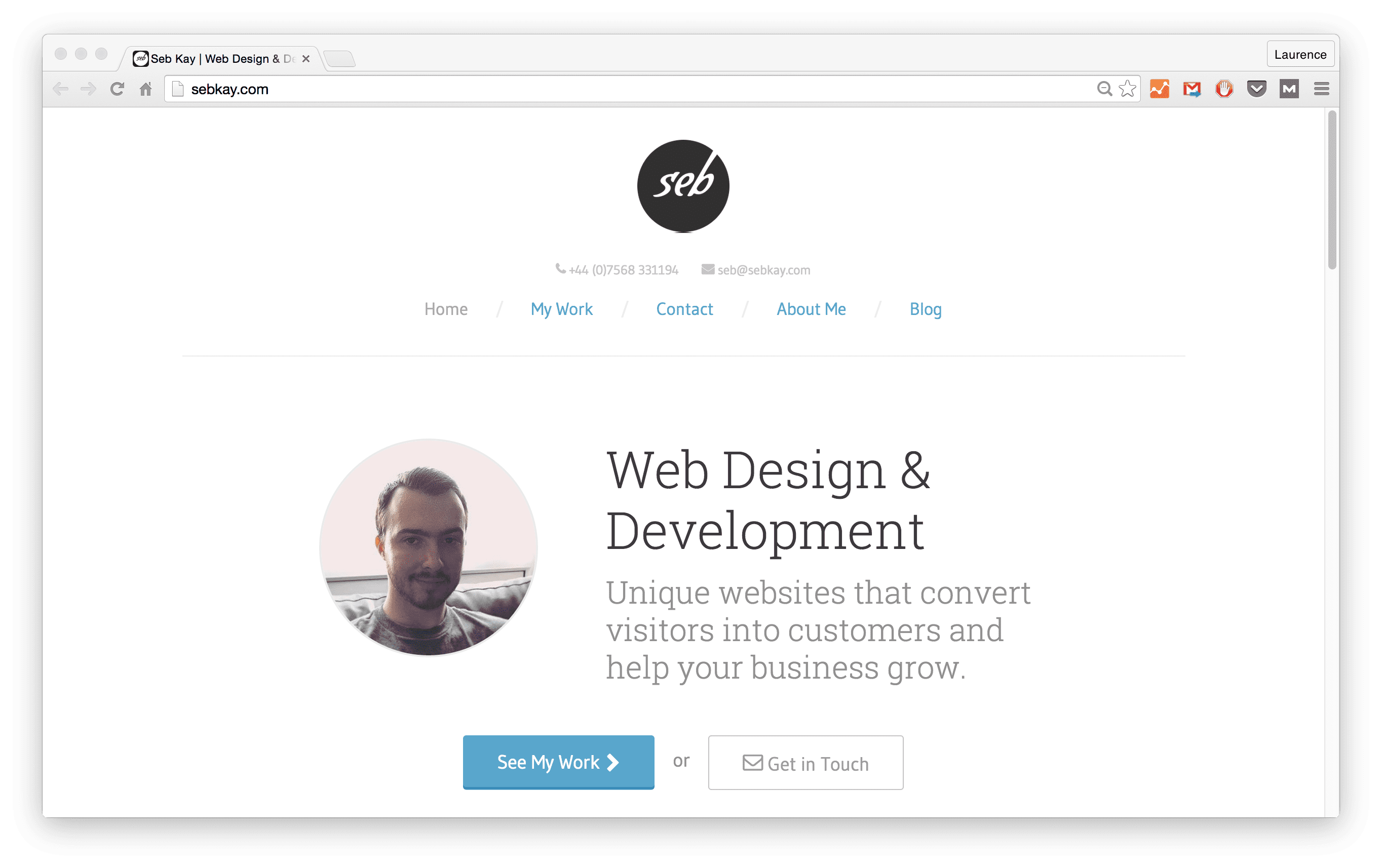

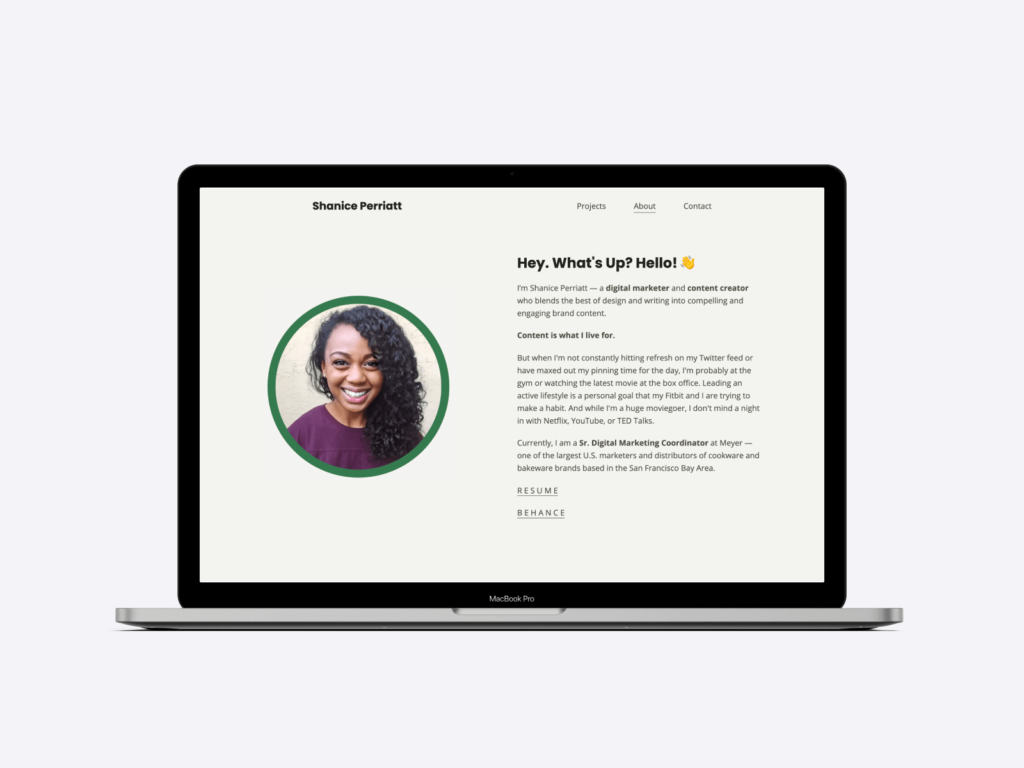

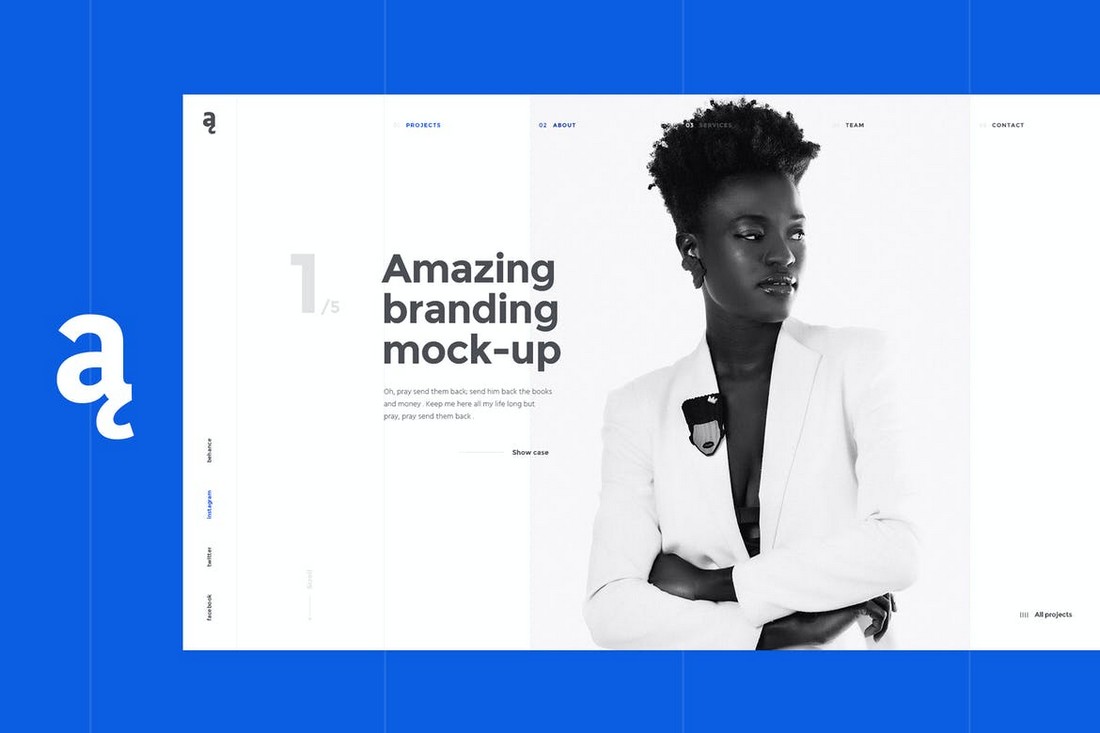

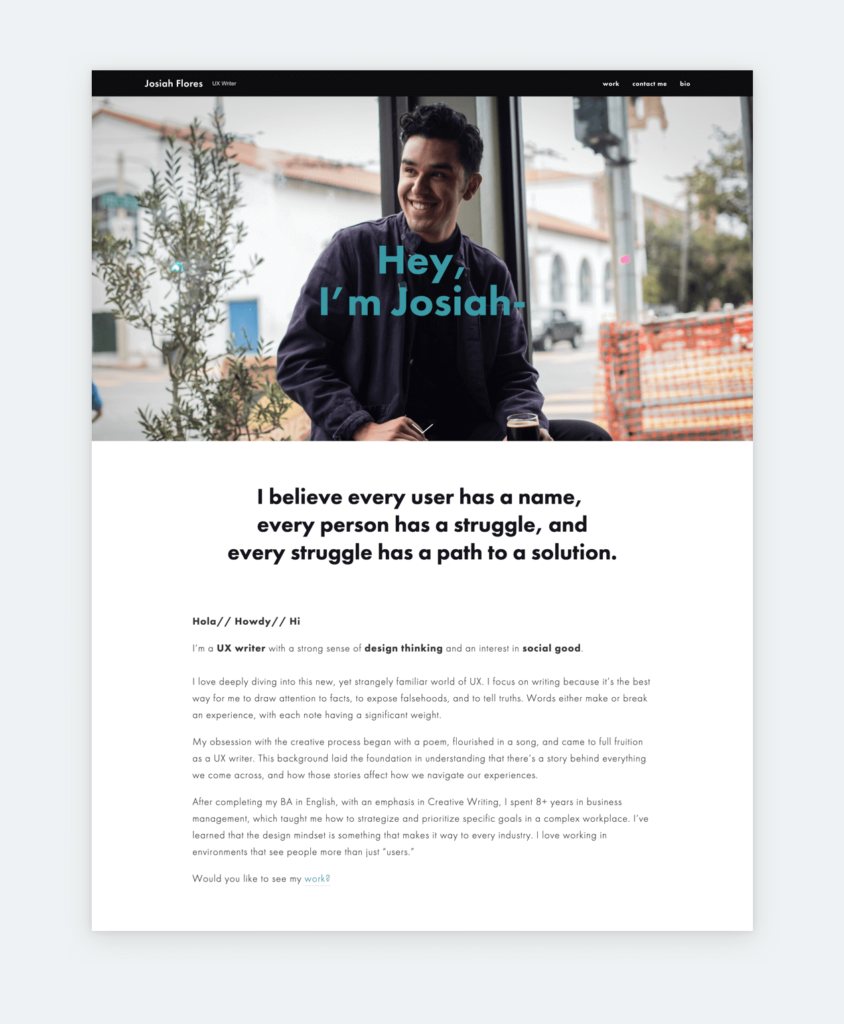

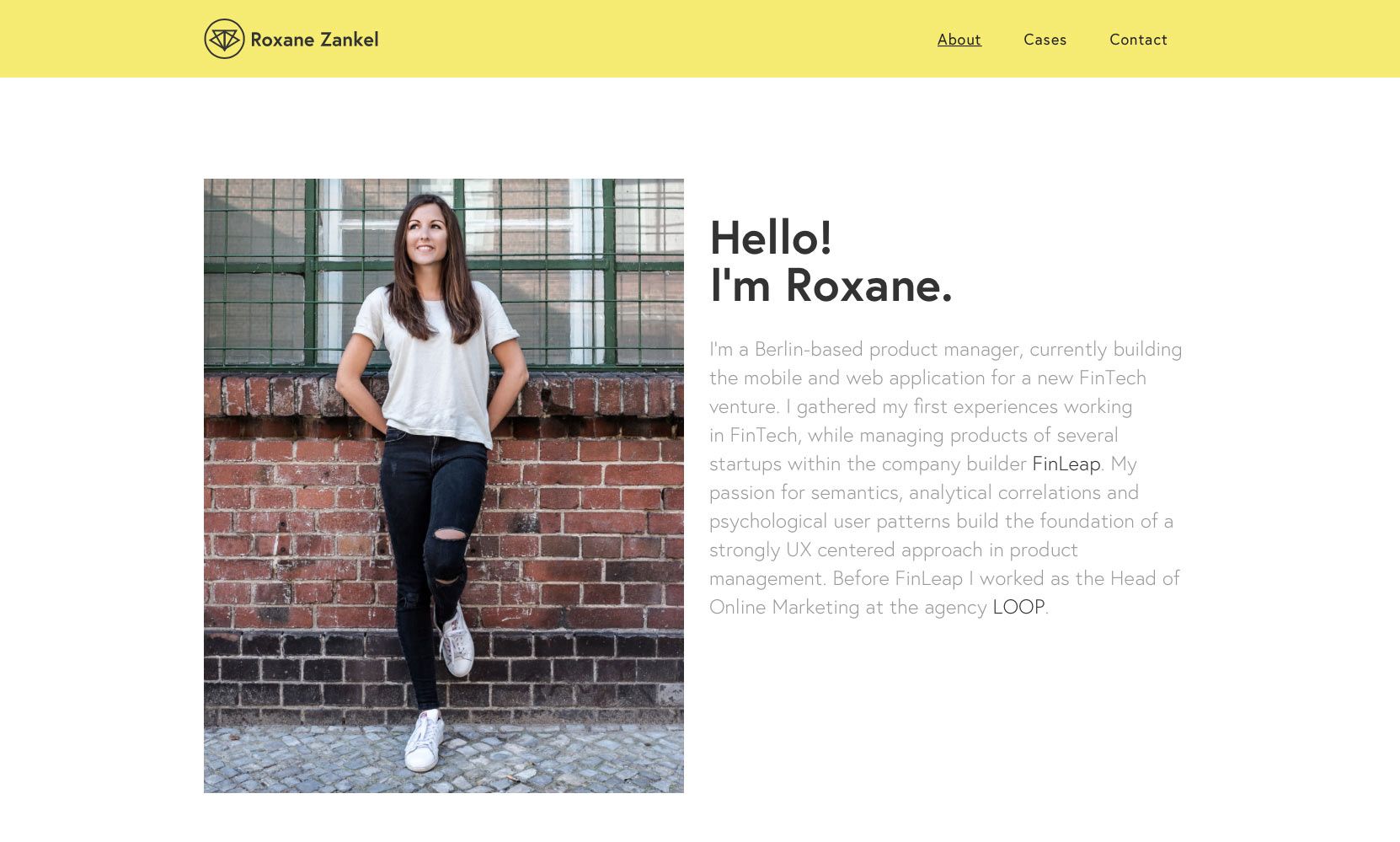

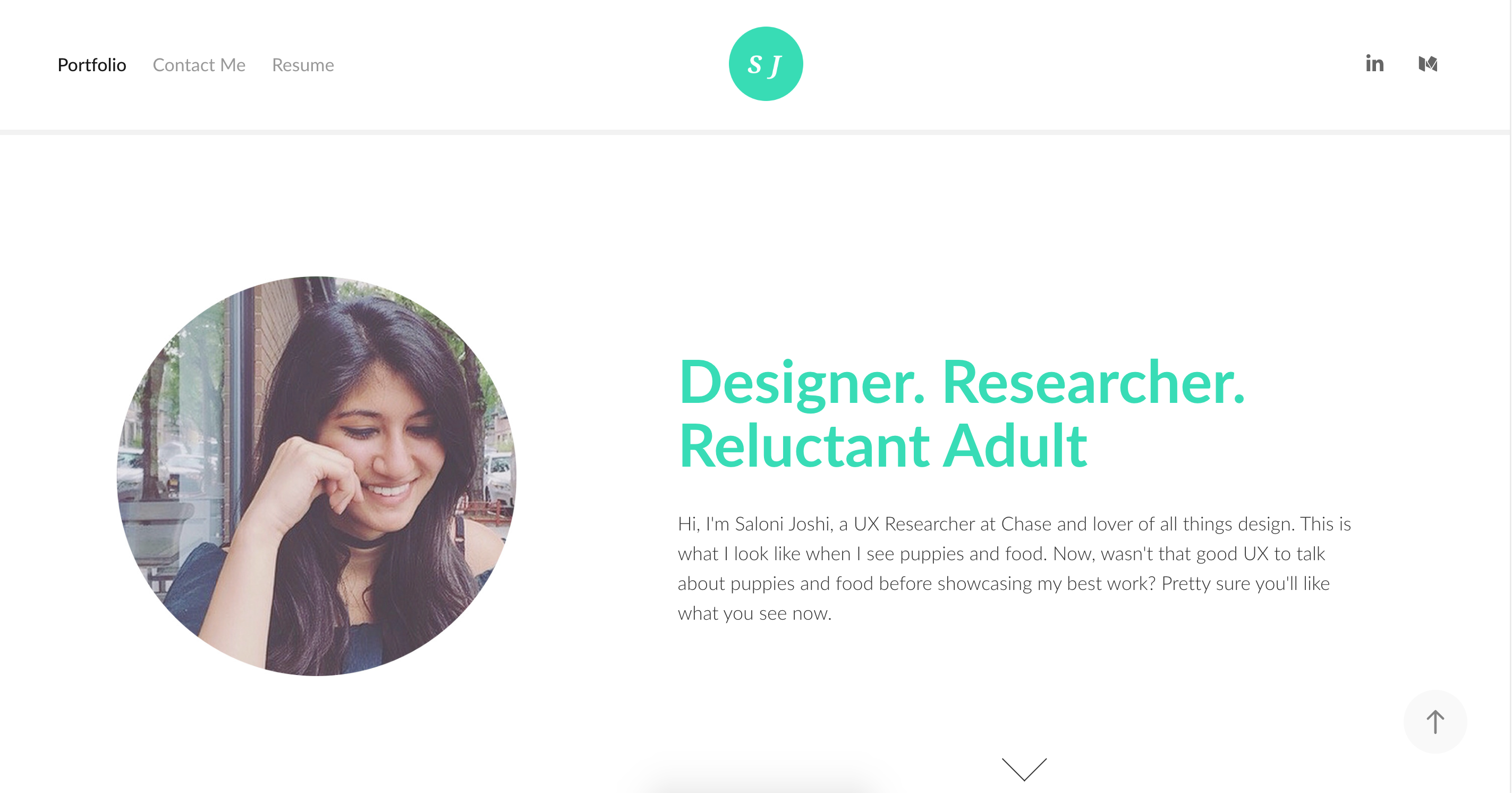

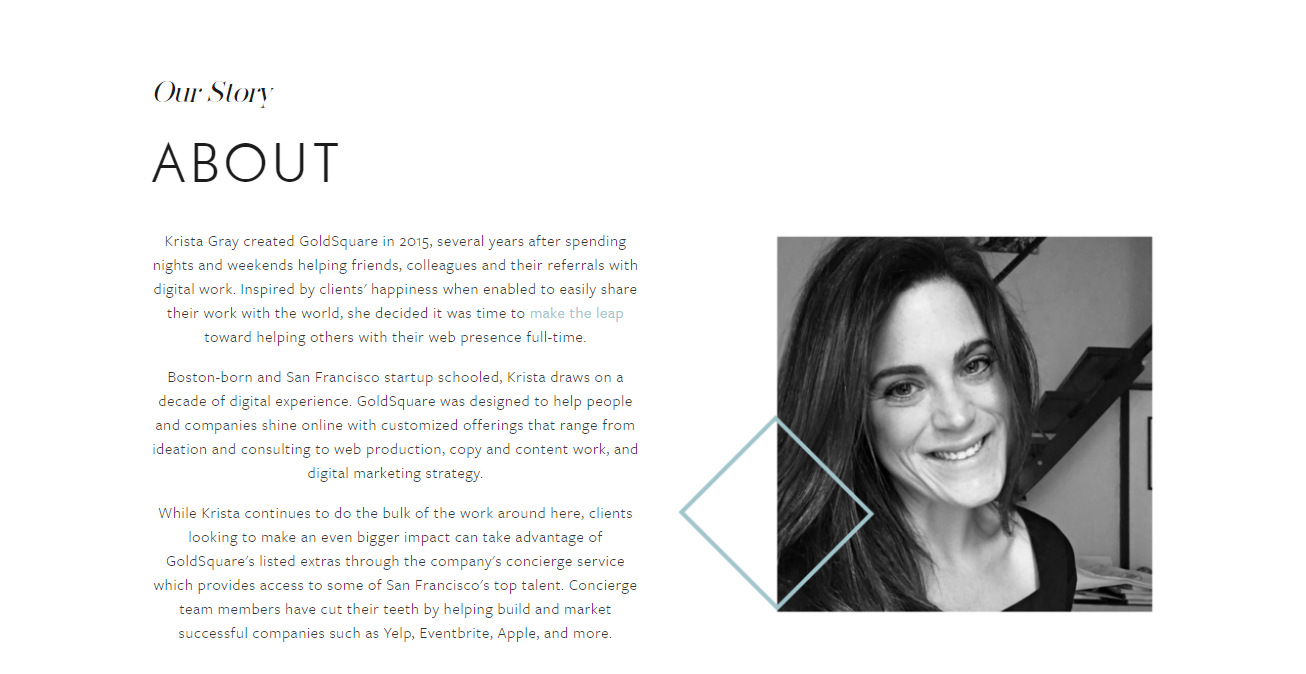

How To Write A Portfolio About Yourself – How To Write A Portfolio About Yourself

| Pleasant to the blog, with this time I will provide you with in relation to How To Delete Instagram Account. Now, this is the primary photograph:

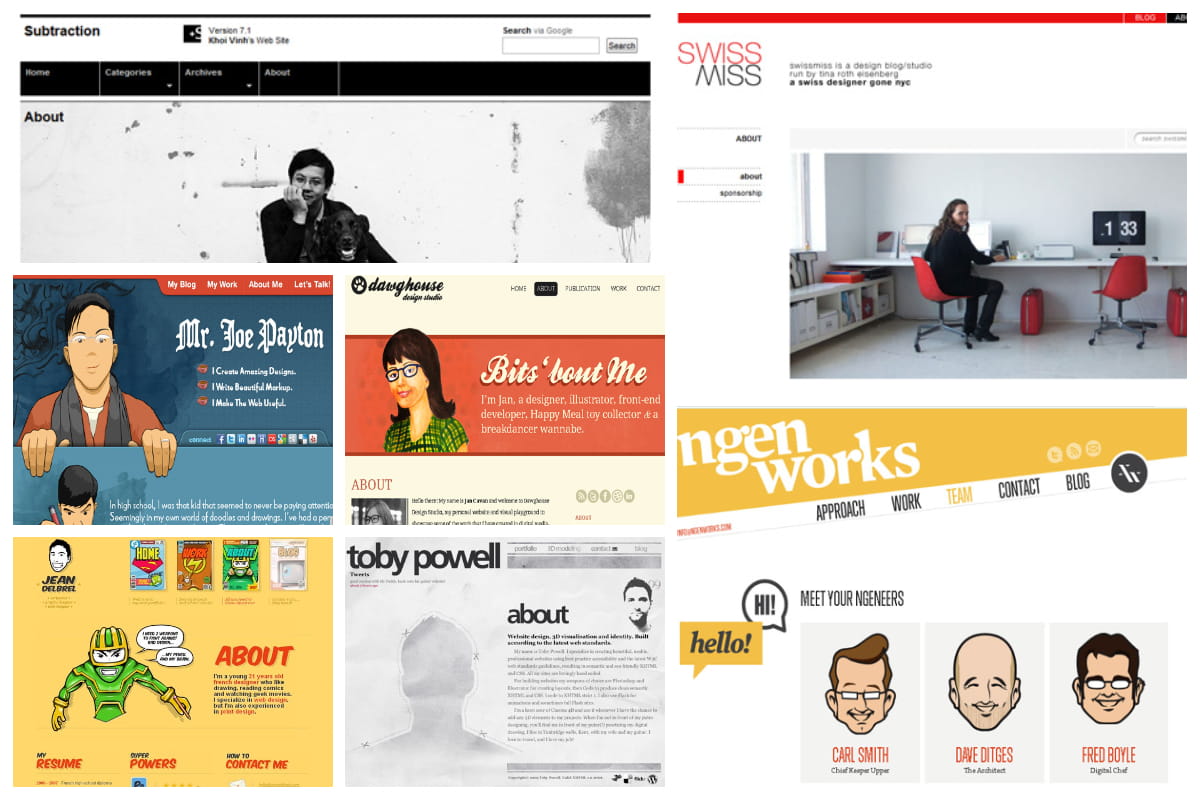

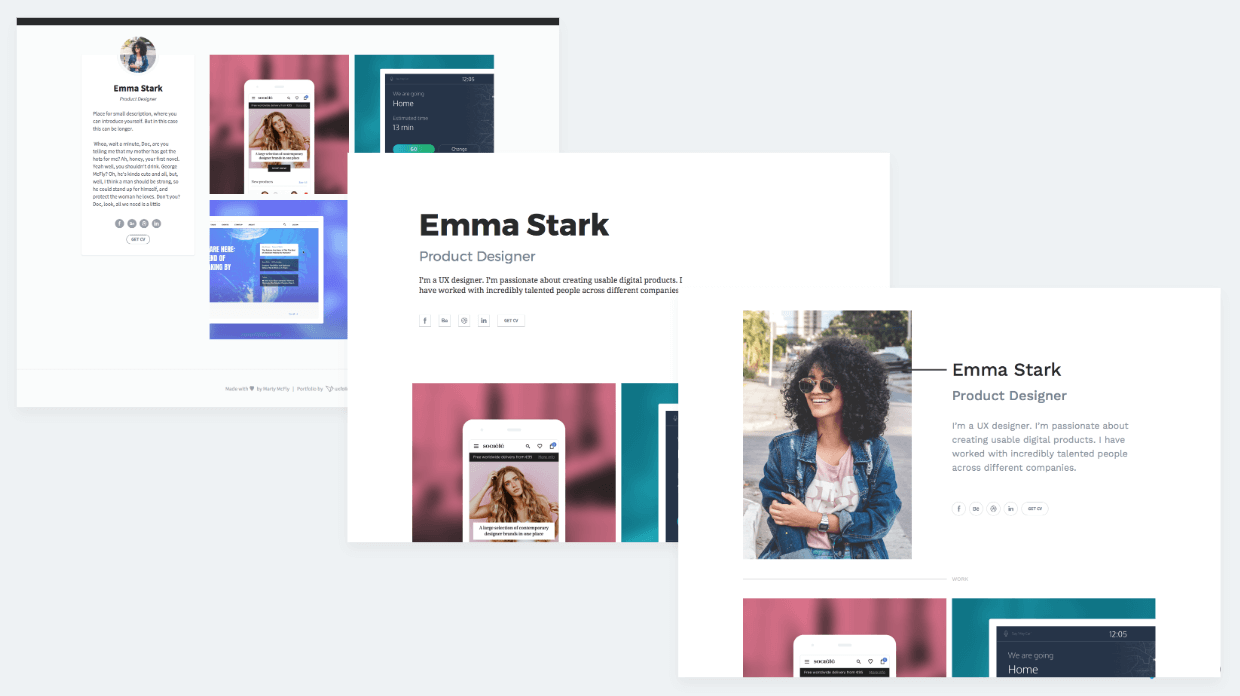

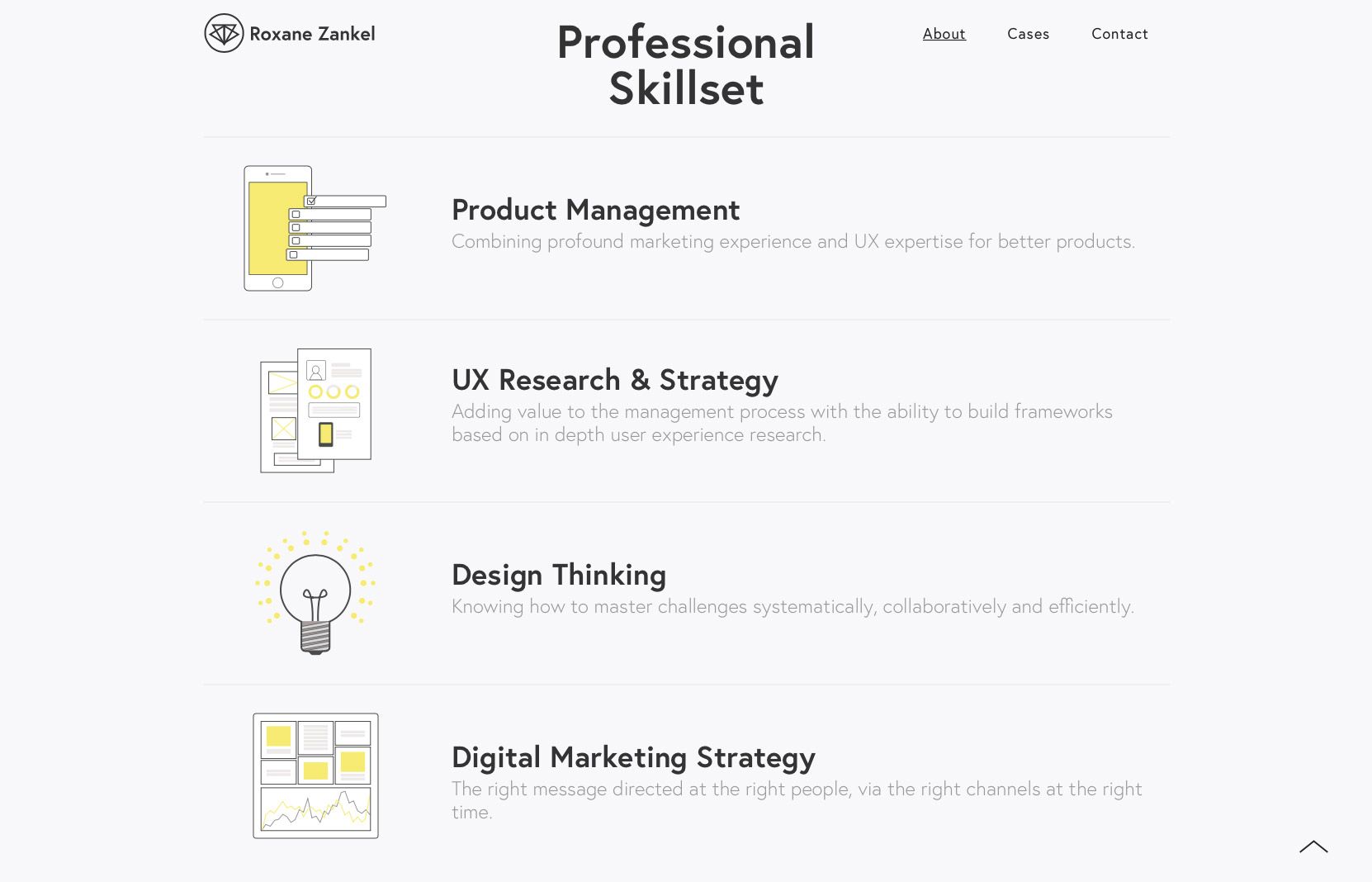

Why don’t you consider image above? can be which amazing???. if you believe thus, I’l m show you a few impression yet again down below:

So, if you desire to obtain the magnificent photos about (How To Write A Portfolio About Yourself), simply click save button to store the images to your computer. They are prepared for transfer, if you’d prefer and wish to get it, click save badge on the post, and it will be instantly downloaded in your laptop.} Finally if you need to grab new and the latest picture related to (How To Write A Portfolio About Yourself), please follow us on google plus or book mark this site, we try our best to offer you regular up-date with fresh and new pics. We do hope you like keeping here. For some up-dates and latest information about (How To Write A Portfolio About Yourself) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to provide you with update periodically with all new and fresh photos, enjoy your searching, and find the perfect for you.

Here you are at our website, articleabove (How To Write A Portfolio About Yourself) published . Today we’re excited to announce that we have found an extremelyinteresting contentto be pointed out, namely (How To Write A Portfolio About Yourself) Some people looking for information about(How To Write A Portfolio About Yourself) and of course one of these is you, is not it?