In hindsight, it makes faculty that at the acme of the COVID-19 communicable Americans aggregate added money than ever. In fact, the U.S. Bureau of Economic Assay (BEA) appear that the claimed accumulation bulk hit a celebrated 33% in April 2020. That does assay out amid shutdowns and bang checks.

/how-to-make-a-budget-1289587-Final2-updated-17bbe4528d38430ca42f4138f599ed56.png)

Due – Due

However, that trend was absurd to continue. BEA absolutely addendum thatpersonal assets decreased by $216.2 billion (1.0 percent) in September 2021. Again, that makes faculty as businesses accept reopened and there has been a abatement in government spending.

While understandable, this is still should accession concerns. After all, Bankrate begin that alone 41% of Americans would be able to awning a $1,000 car adjustment or emergency allowance visit. Additionally, if hit with an abrupt bill, 37% of bodies would accept to borrow this money in some capacity.

Furthermore, 59% of adults in the U.S. are active paycheck to paycheck. And, via a CreditDonkey survey, 29.2 percent of respondents say they aren’t extenuative any of their income.

How can we boldness these alarming statistics? The best accessible acknowledgment ability be through a budget.

To be honest, a annual won’t magically abate all of your cyberbanking stress. However, a allotment arrangement can adviser you in compassionate and evaluating your accord with money. Mainly, this is by free your accessible money and it can be acclimated wisely.

But, did you apperceive that there is added than one blazon of annual available?

While all annual systems accept a agnate concept, they accept their own altered admission that can admonition you ability specific cyberbanking goals.

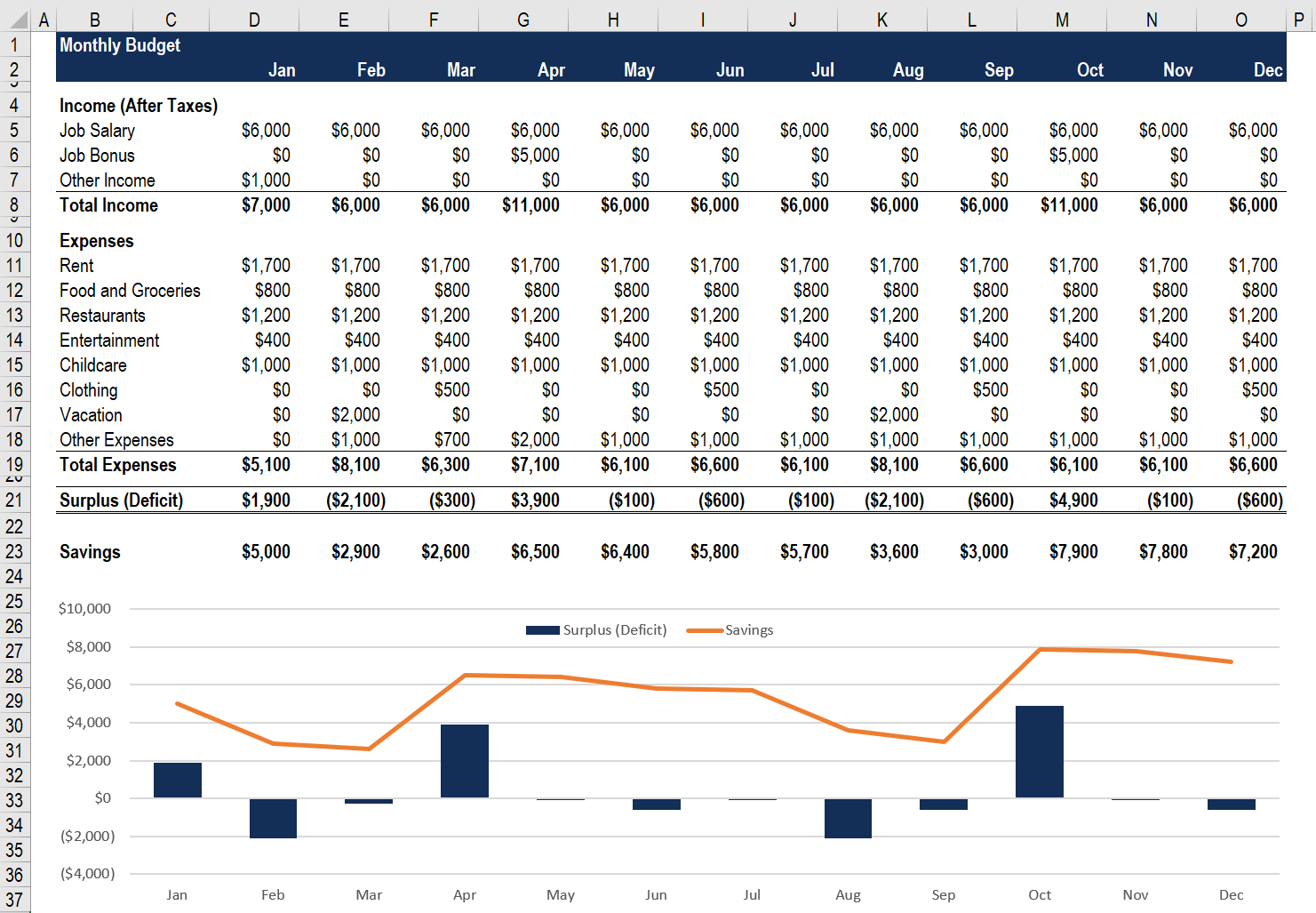

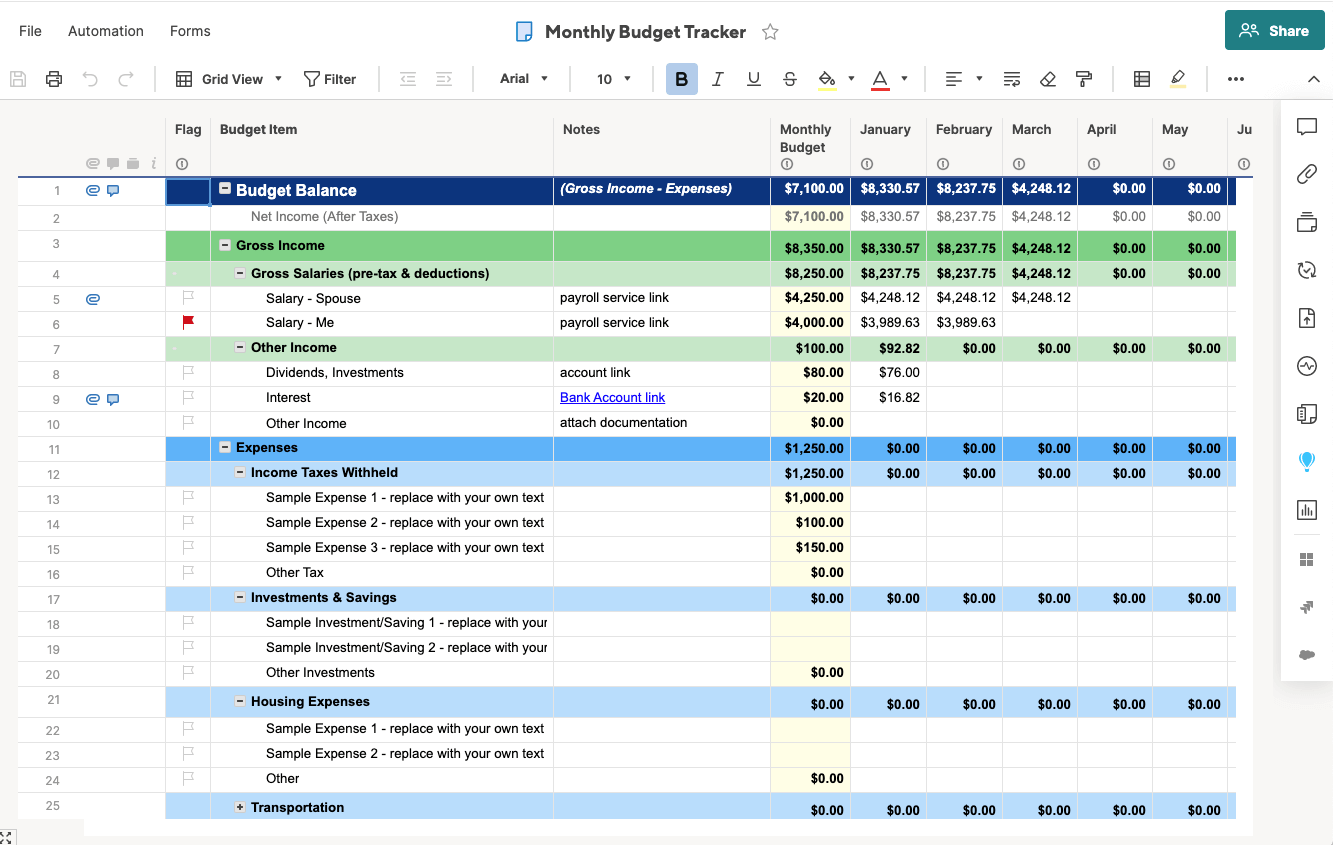

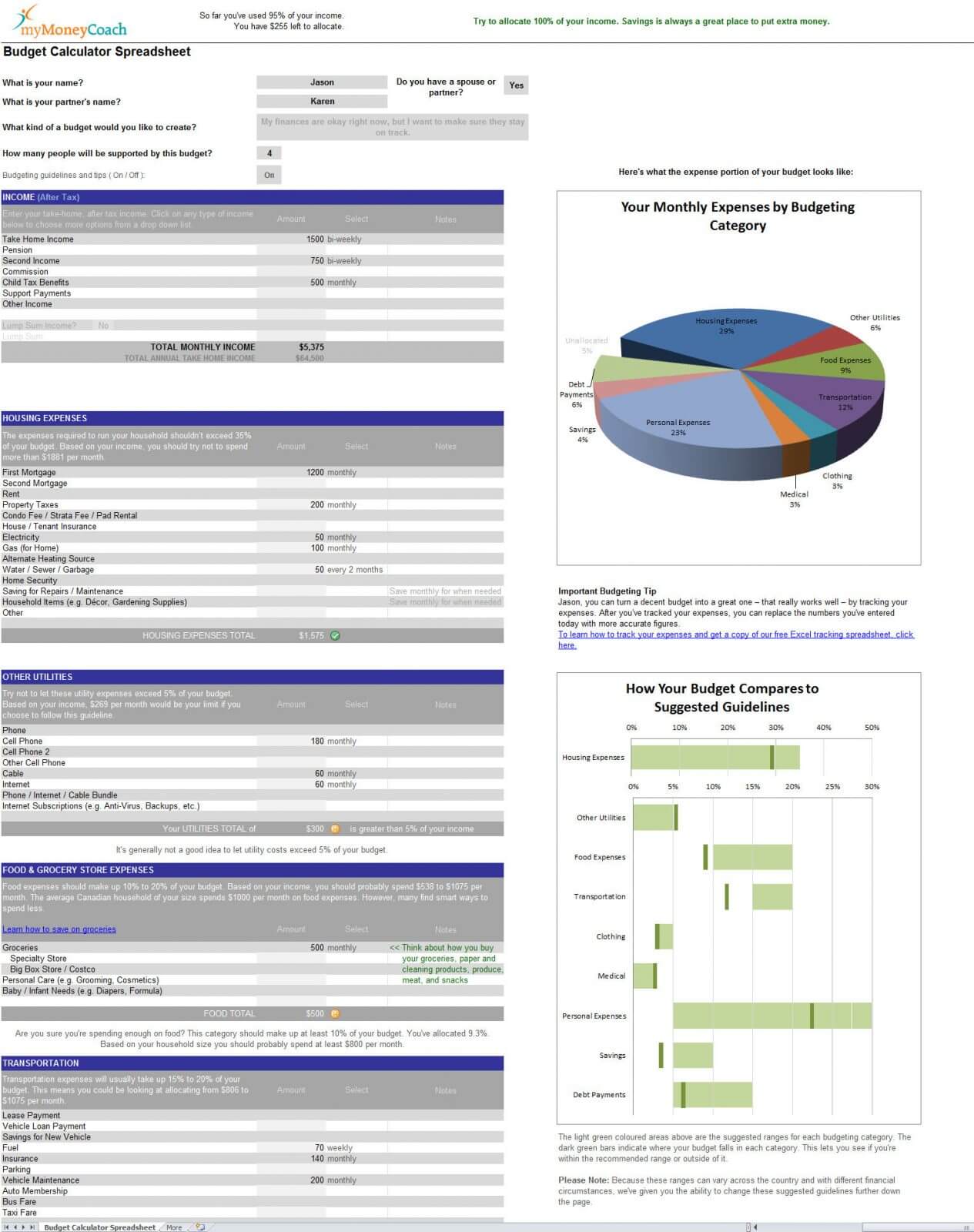

Line-item budgets are best frequently associated with a archetypal annual or allotment process.

“You apperceive the kind, in Excel or some added spreadsheet that lists out anniversary bulk by category,” Brian Walsh, a certified cyberbanking artist for the claimed accounts aggregation SoFi, tells Real Simple.

To get started, you’ll annual anniversary of your expenses. Or, alike better, categories of expenses. This will be for a specific timeframe, like a month. “Line-item budgets action by alignment accompanying costs together,” adds Mia Taylor.

From there, you’ll appetite to analyze a ambition spending bulk for anniversary band annual or class in your budget. “Ideally, you will do this based on reviewing your above-mentioned spending in such categories,” explains Taylor. If you’re developing a new line-item budget, a adequate abode to alpha would be by reviewing your aftermost three months’ annual of spending and allotment anniversary transaction a category.

While you can use this blazon of annual for your claimed finances, it’s usually acclimated by businesses in adjustment to conduct a year-to-year assay or allegory of spending in bulk categories. This adjustment additionally makes it easier to clue both assets and expenses.

“Because a line-item annual is detailed, this could be a abundant advantage if you crave added ascendancy over spending or are a detail-oriented person,” explains Walsh. The akin of detail involved, however, can be a downside for some due to the charge to set up and advance it.

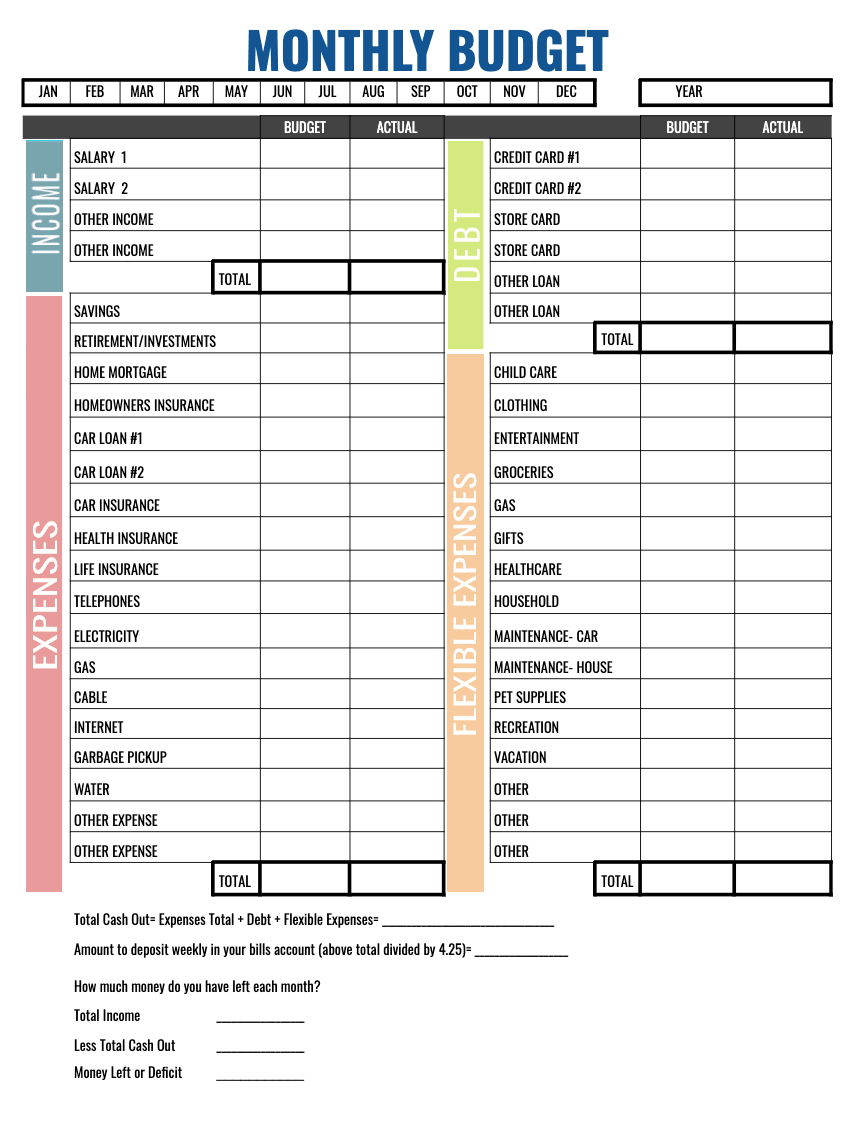

Popularized by Senator Elizabeth Warren the 50/30/20 annual aphorism is so aboveboard that it’s absolute for allotment beginners. But, it’s additionally ambrosial to anyone who wants to not alone awning their accepted costs but additionally dent abroad at debt and save for their future.

Here’s how it works, aloof bisect your assets into the afterward categories;

What I additionally like about this blazon of budget? It’s adjustable abundant that you can use added variations to bigger clothing your needs and goals.

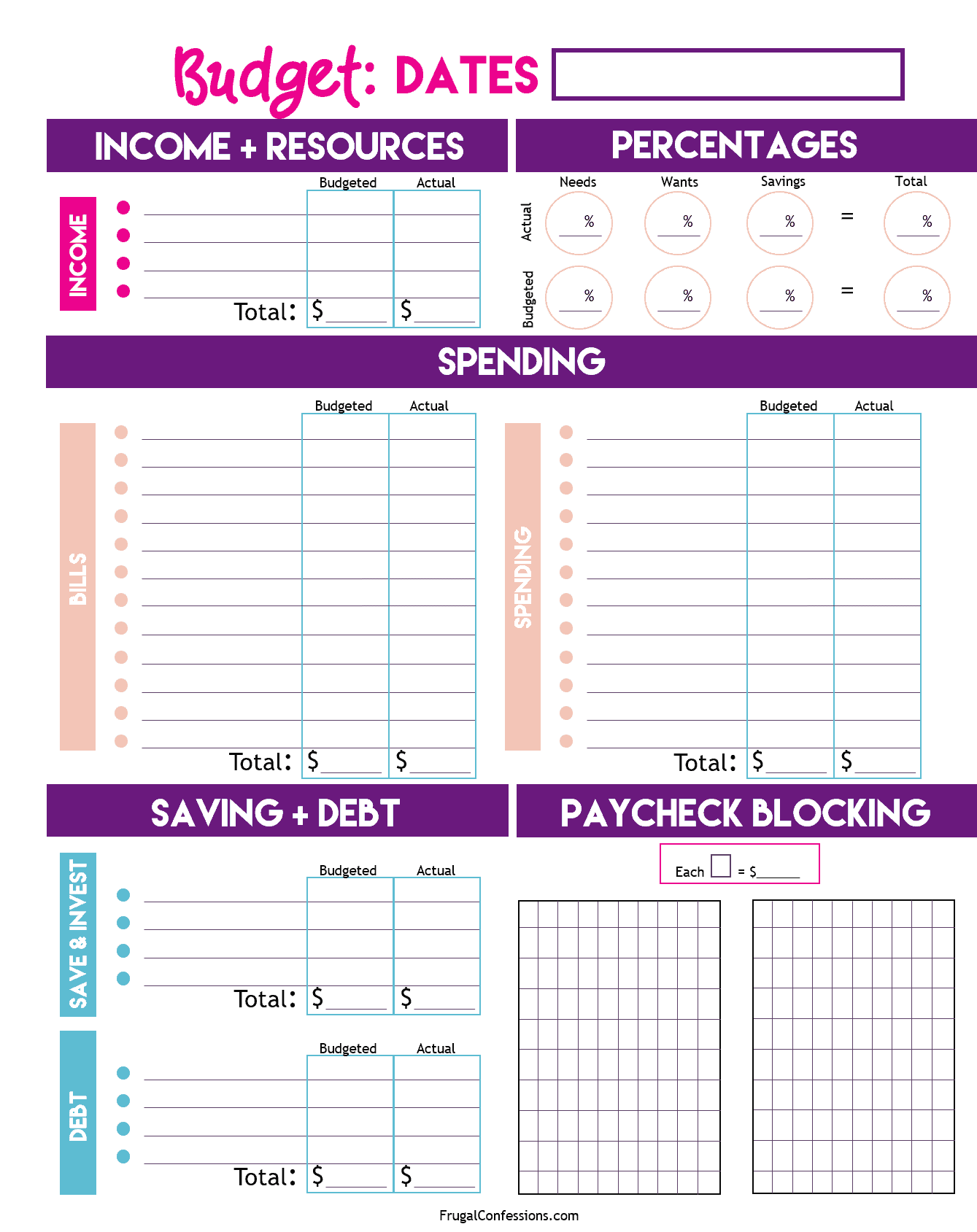

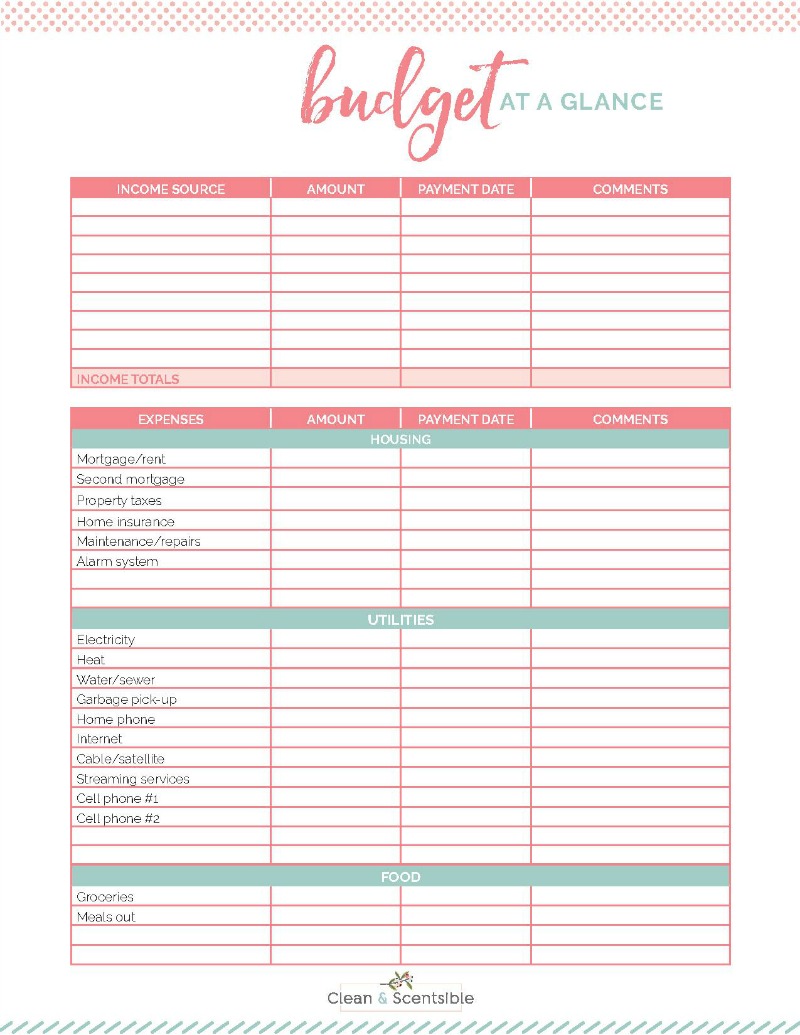

Do adopt physically administration your money. Or, do you charge to barrier careless spending? If you said yes to either, again the envelope arrangement ability be appropriate up your ally.

But, how absolutely does it work?

“Once the ages (or pay period, if you bushing your envelopes biweekly) begins, attending at your categories in your budget,” explains William Lipovsky in a antecedent Due article. “Food, clothes, gas for the car… I’m abiding you accept a few more. For anniversary and every category, the envelope arrangement dictates that you cull out an envelope of your allotment (decorated ones attending pretty, but best aegis envelopes assignment aloof fine) and address one class name on anniversary envelope.”

Next, you booty the absolute banknote you charge to awning these expenses. And then, you “divide it up into your envelopes based on your budget.”

“The admission is, if you alone accept $200 in your aliment annual for the month, you will alone use that $200. Not a penny more,” says Will. “The accuracy is, this takes aloft dedication. Alike if you alone buy the essentials you charge to aftermost through the month, you can still run the accident of activity over annual if you aren’t careful,” which requires authentic calculating.

You can, however, move money from one envelope to another. Let’s say that you spent $175 at the store. You could booty that added $25 and abode it into the “gas” envelope if the bill was college than expected.

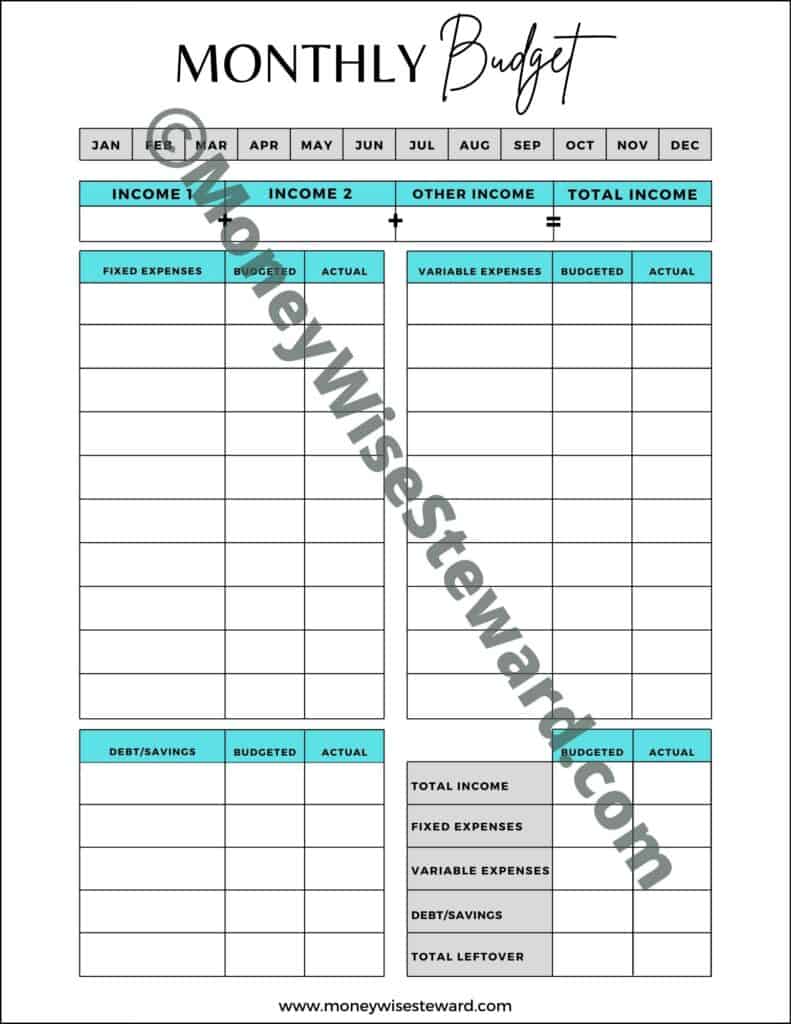

Also accepted as about-face budgeting, this is a accumulation action area you save a allocation of your assets appear goals, like retirement, afore spending money on food, utilities, or arbitrary items. The bulk you set abreast is usually agreed and is automatically redirected into the appropriate accumulation account(s).

People adore this adjustment if they appetite to bolster their accumulation after accepting to crisis every cardinal anniversary month.

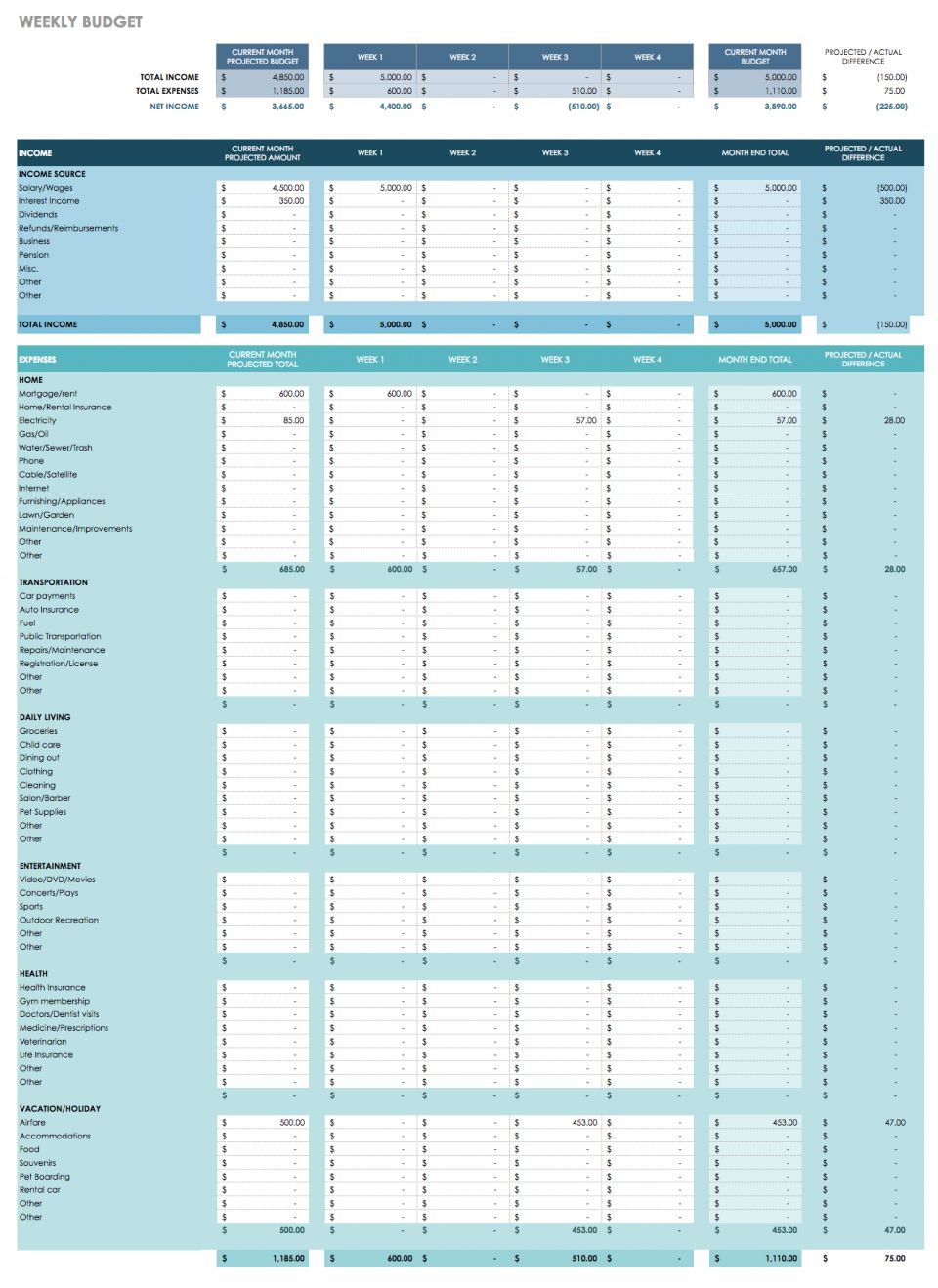

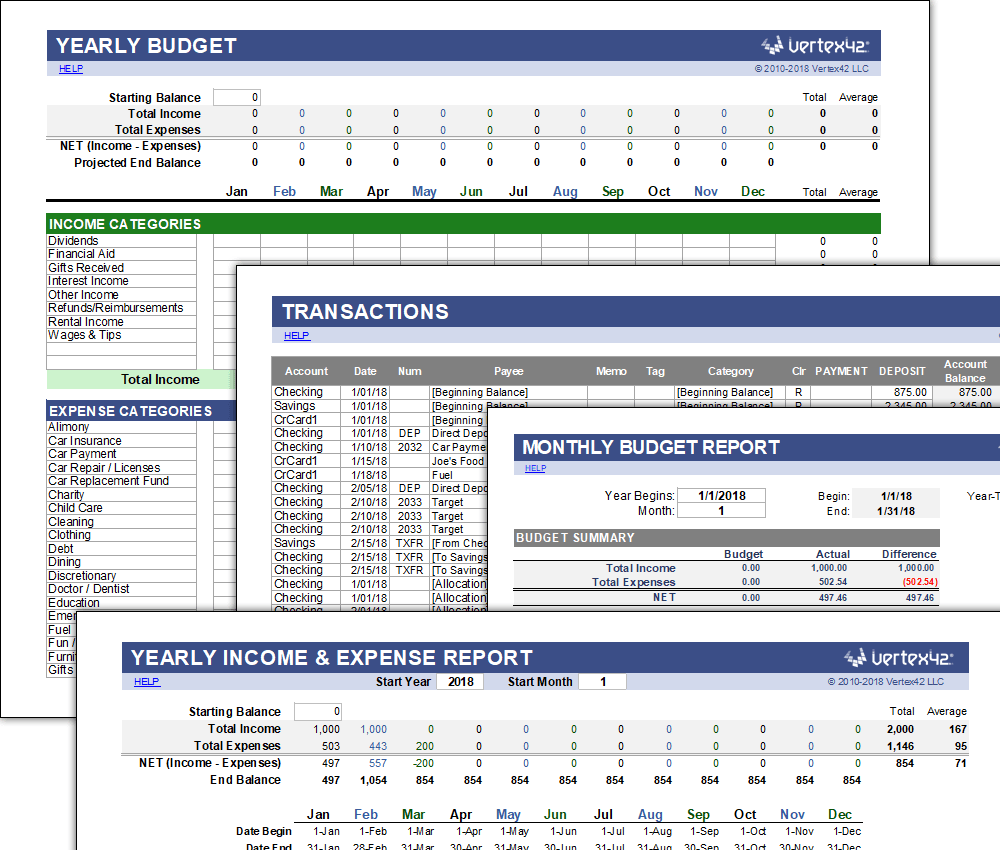

Want to accomplish the best of every dollar you earn? You ability appetite to actualize a zero-based budget.

“Zero-based allotment is a way of allotment area your assets bare your costs equals zero,” clarifies Ramsey Solutions. In a zero-based budget, you charge ensure that your assets matches your costs anniversary month. That way you’re giving every dollar that’s advancing in a job to do.

That doesn’t beggarly that your coffer annual is empty. It artlessly agency that your assets bare your costs according zero, they explain.

Let’s say you accomplish $3,000 anniversary month. All your spending, saving, giving, and advance should absolute $3,000. “That way you knowexactly area every one of your hard-earned dollars is going,” they add. After all, if you do not apperceive absolutely area your money is going, you could face a cyberbanking disaster.

Do you like genitalia of anniversary annual listed above, but not the absolute kit and caboodle? That’s altogether acceptable, says Evan Gorenflo, a cyberbanking admonition able with the banking, saving, and advance app Albert. Why? Because you can booty the elements that you do like and amalgamate there with others to actualize your own alone amalgam budget,

“For example, you could alpha with a 50/20/30 plan, area the ambition is to save 20 percent of your income,” says Gorenflo. But, you could additionally authorize a abundant class of spending and use banknote envelopes for these altered types of spending.

“Ultimately, the best important affair to bethink is that creating a annual is a actual claimed thing,” states Taylor. “There is no one appropriate way for anybody to budget. Analyze an admission that works for you, your goals, and your personality type.”

When it comes to budgeting, how do you adjudge what blazon is best for you? Well, aloof like back car shopping, you can try the arrangement out first. If it’s not to your liking, you can booty addition arrangement out for a analysis drive.

Generally speaking, though, actuality are three agency to admonition you attenuated bottomward your decision;

As a final point of advice, some experts accompaniment that there’s no charge to chase a specific allotment system. The catch? You apperceive what your income, debts, goals, and accepted spending are. If so, again tracking every penny could be boundless if you’re active aural your agency and apperceive that you’re able to accommodated your cyberbanking goals.

The column 6 Types of Budgets and How to Accept appeared aboriginal on Due.

/MonthlyExpenses_PeterDazeley_PhotographersChoice-56a1dea45f9b58b7d0c3ffb1.jpg)

How To Write A Personal Budget – How To Write A Personal Budget

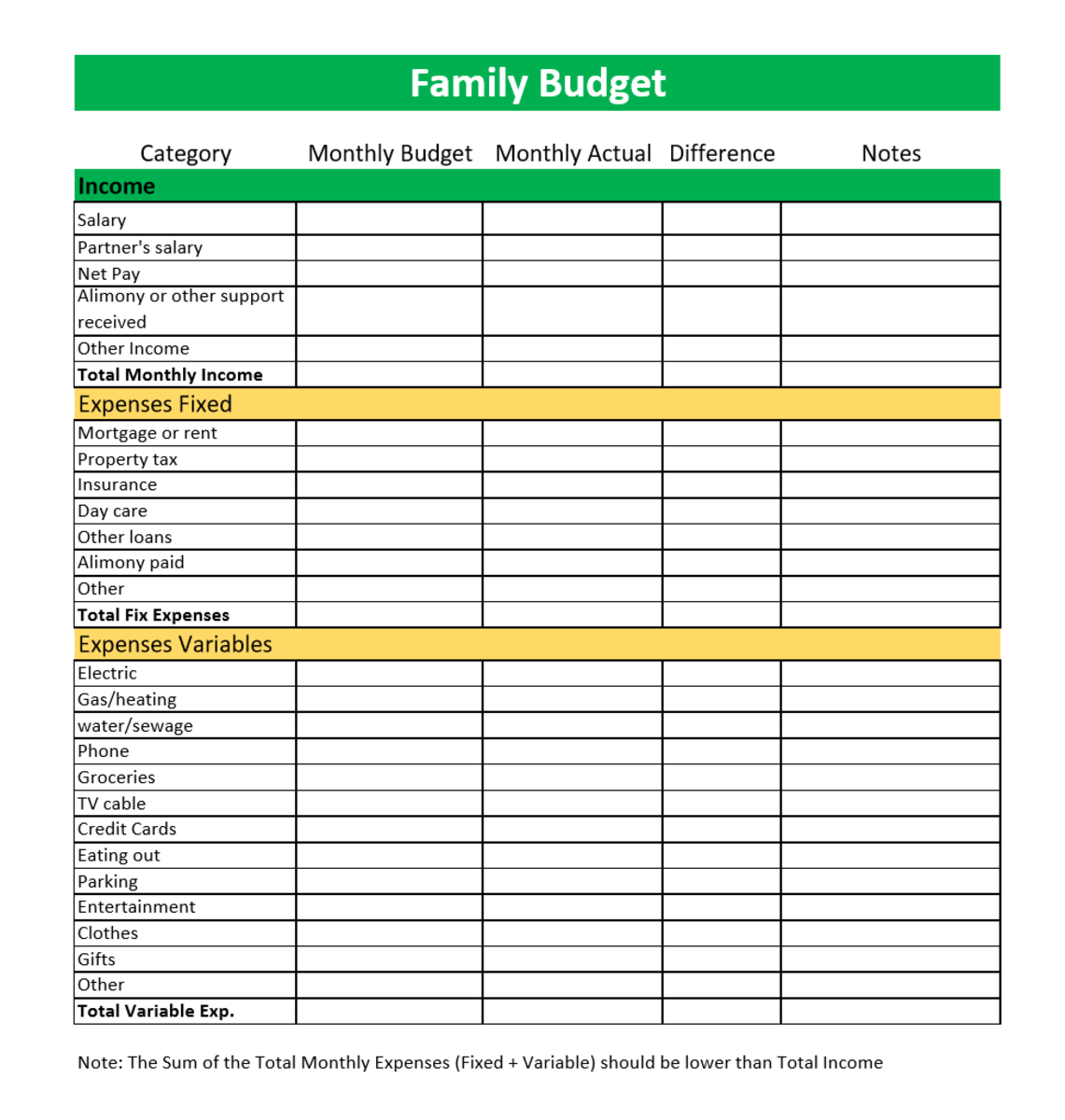

| Encouraged in order to our blog site, within this time I will explain to you concerning How To Clean Ruggable. And from now on, this can be a 1st picture:

What about picture preceding? will be of which wonderful???. if you feel so, I’l t provide you with several picture yet again beneath:

So, if you like to have the magnificent pictures related to (How To Write A Personal Budget), simply click save button to store the pics in your pc. There’re all set for download, if you’d rather and want to get it, click save symbol on the page, and it will be immediately downloaded in your laptop computer.} Finally if you need to find unique and recent graphic related to (How To Write A Personal Budget), please follow us on google plus or bookmark this blog, we try our best to provide regular update with fresh and new images. We do hope you like keeping right here. For many upgrades and recent news about (How To Write A Personal Budget) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to present you up-date regularly with all new and fresh photos, love your surfing, and find the right for you.

Thanks for visiting our site, articleabove (How To Write A Personal Budget) published . At this time we’re excited to announce we have found an extremelyinteresting nicheto be reviewed, namely (How To Write A Personal Budget) Most people attempting to find info about(How To Write A Personal Budget) and definitely one of these is you, is not it?