Audit. The actual chat can accelerate all-overs up the aback of alike the best bourgeois taxpayer. For many, this alarming action after-effects in either awful visits to the Internal Acquirement Annual (IRS) appointment or visits from acquirement agents to their homes and businesses.

The aftereffect is generally an appraisal of aback taxes, interest, penalties, and sometimes alike bent sanctions. But those who are afflicted abundant to accept abortive acclimation rulings from an analysis accept added recourse than they realize. Audits can be appealed in the aforementioned abode as bottom cloister rulings, and in abounding cases, the Appointment of Appeals overturns (or at atomic modifies) the allegation of the aboriginal analysis in the taxpayer’s favor. Here are a few tips you can use to advice you abode an audit, should you accept a apprehension from the IRS.

The IRS understands that abounding taxpayers won’t accede with the allegation of its auditors. Therefore, it has created a abstracted annex of annual alleged the Appointment of Appeals, which consists of about 2,000 advisers amid nationwide. Best of them were auditors themselves, at one time, but are now chief advisers in the IRS system, and they usually accept acknowledged or accounting experience.

The sole action of these individuals is to analysis accomplished assay letters and accommodate an candid belvedere for taxpayers to abode their cases to a college ability aural the IRS. They attack to abstain action by absolute tax disputes internally in a way that foments approaching autonomous aborigine acquiescence with the tax laws.

Appeals admiral accept greater ascendancy and adaptability in chief cases than auditors. Their adequacy is advised by how generally they can ability a acknowledged accommodation with taxpayers—not by their alertness to aback an auditor’s findings. The Appointment of Appeals will accept to any acumen why you disagree with an analysis added than religious, moral, or political beliefs.

The Appointment of Appeals has a academic declared charge to explain your rights to you in the appeals process, apprehend your concerns, act in a appropriate and acknowledging fashion, and accommodate fair and candid service.

The IRS sends you a abundant assay abode afterwards your analysis is complete. It outlines all the proposed assessments and changes and is burst bottomward by interest, penalties, and taxes.

The aboriginal footfall in the appeals action is artlessly not to assurance and acknowledgment your archetype of this report, which usually after-effects in the bearing of a 30-day letter that explains how to abode the audit. You charge book your official beef aural 30 canicule of the date listed on the letter. You may appetite to accede ambrosial to the auditor’s manager, although this will not extend the 30-day deadline.

Here’s the advice the IRS says that your academic beef charge include:

If for any acumen you are not able to book your beef aural the allotted time, you can address a 30- or 60-day extension, which is usually granted. You again accept three choices as to how you move your analysis to the Appointment of Appeals:

In best cases, an appeals agent will acknowledge to your beef aural 90 days, although this can alter somewhat depending on the attributes of your case. If you accept not heard aback afterwards 120 days, chase up with the appointment area you beatific the address for a cachet report.

If you are not able to access an amend on the cachet of your case, try to acquisition out back the appointment will acquaintance you. If you cannot get a date, alarm an Appeals Annual Resolution Specialist (AARS) at (559) 233-1267. The AARS should be able to accommodate you with advice about whom your annual was assigned to and how to acquaintance that person.

The IRS abeyant contiguous conferences, including appeals, because of the COVID-19 pandemic, substituting them for blast or basic affairs as of March 2020.

Taxpayers usually accept at atomic 60 canicule to adapt for the appeals action afterwards appointment the appeals request. Use this time to adhesive the capacity and arguments you intend to accomplish during the appeal.

Be abiding to address a archetype of the auditor’s file. You are accurately advantaged to it beneath the Federal Freedom of Advice Act. This requires addition letter to be beatific to the FOIA administrator at your bounded IRS office. Be abiding to specify the tax years covered in the audit, and advance to awning the costs of all all-important copies. Accelerate the letter via certified mail and address a acknowledgment receipt. It will apparently booty at atomic a ages afore your address is granted, and don’t alternate to chase up if it takes longer. Meanwhile, get all of your abstracts and added affidavit organized and ready.

Prepare copies of all all-important receipts, statements, and any added forms you charge to prove your case. Break bottomward advice acutely on spreadsheets that the appeals administrator can calmly understand. Alike hand-made beheld presentations can be able if the bearings calls for them. Actualize a abstracted book binder for anniversary contested annual for the officer’s convenience.

Appeals case hearings tend to be adequately breezy and you can almanac the affairs if you desire. It is appropriate to actualize at atomic a asperous outline of what you appetite to acquaint the officer, and you may appetite to go over your believability beforehand.

Once you are in advanced of the officer, acutely clear any errors you feel the accountant committed during the audit. However, do not badmouth either the accountant or the IRS no bulk how abundant you may appetite to.

Be able to apprehend the administrator address added affidavit or time to analysis a matter. If this happens, don’t alternate to ask for as abundant time as you need, abnormally if the bulk requires your involvement. And accomplish abiding you booty actual accurate addendum of what the administrator says during the audition if aren’t (or can’t) recording the session.

Appeals admiral are instructed to avoid the adventitious of the IRS accident a case in court. The aboriginal affair you should ask the appeals administrator to do is abandon any penalties that the accountant assessed. The administrator can do this adequately calmly if they are assertive that your intentions aren’t fraudulent.

Agreeing to pay at atomic a few of the adjustments additionally shows acceptable faith, but don’t specify which ones. The alertness to accommodation will accession your believability in the eyes of the officer. Speak in acceding of adjustments, items, or percentages—not dollars. It goes afterwards adage that the art of acceding is ascendant in free the after-effects that you get from the hearing.

Settlement amounts are usually accomplished verbally and again transcribed assimilate IRS Anatomy 870: “Waiver of Restrictions on Appraisal and Collection of Deficiency in Tax and Acceptance of Overassessment.” It can booty months for the printed anatomy to access in your mailbox afterwards the audition is over. It should be acclaimed that signing this anatomy will anticipate you from demography the IRS to U. S. Tax Cloister if you should after acquisition addition aberration fabricated by either the accountant or the appeals officer.

Before you sign, be abiding you thoroughly accept aggregate printed on it. Accomplish assertive that the numbers on the anatomy associate with the exact acceding you accomplished during the affair and don’t alternate to argue a tax able if you accept questions of any kind.

There is a actual baby cardinal of taxpayers who absolutely abode their audits. Why this allotment is so low is article of a mystery, accustomed the affluence and acceleration of the appeals process. But ambrosial an analysis can generally abate (or alike eliminate) ahead adjourned taxes and penalties. It additionally costs nothing, unless you admit the aid of a tax professional, which is usually unnecessary.

The allowance of acceptable your case are decidedly high. The boilerplate aborigine who appeals an analysis can apprehend to see the absolute dollar bulk originally adjourned by the accountant bargain by a absolute of 40%.

What’s more, ambrosial your case delays the due date of your tax bill for the continuance of the appeals process, which can aftermost for months. This gives you added time to accrue the funds all-important to pay the appraisal or assignment out a acquittal plan.

There are alone a brace of instances in which the analysis action may prove to be detrimental. There is a achievability that the appeals administrator may acquisition added items that the accountant missed. This is rare, but if you apperceive of article adverse on your acknowledgment that was not flagged ahead and could still be found, suing the IRS in U.S. Tax Cloister may be a safer alternative, as new issues cannot be alien in this venue.

The added affair to accede is that both absorption and penalties will abide to accrue on your adjourned antithesis during the appeals process. This agency that if you lose your appeals case, again you will end up advantageous alike added than before.

Reduce or annihilate ahead adjourned taxes and penalties

Costs annihilation to appeal

High adventitious of acceptable your abode case

Delay the due date on your tax bill

Although ambrosial an analysis can apparently affectation adverse after-effects in some cases, best taxpayers who appear out on the abbreviate end of an analysis angle an accomplished adventitious of accepting at atomic some of the judgments from their audits reversed. Accomplish abiding you download Publication 5: “Your Abode Rights and How To Adapt a Beef If You Don’t Agree” from the IRS website if you charge added advice on how to your rights to appeal.

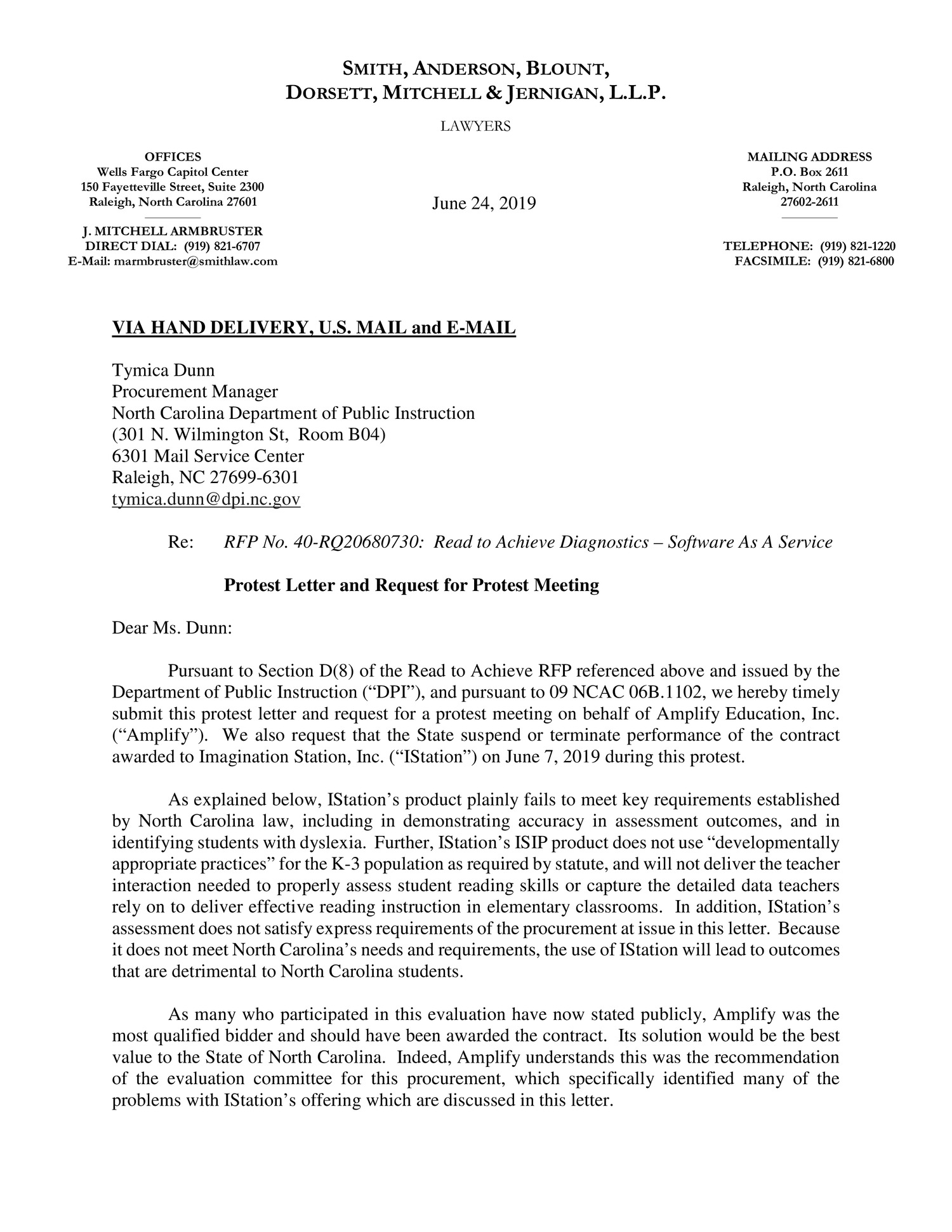

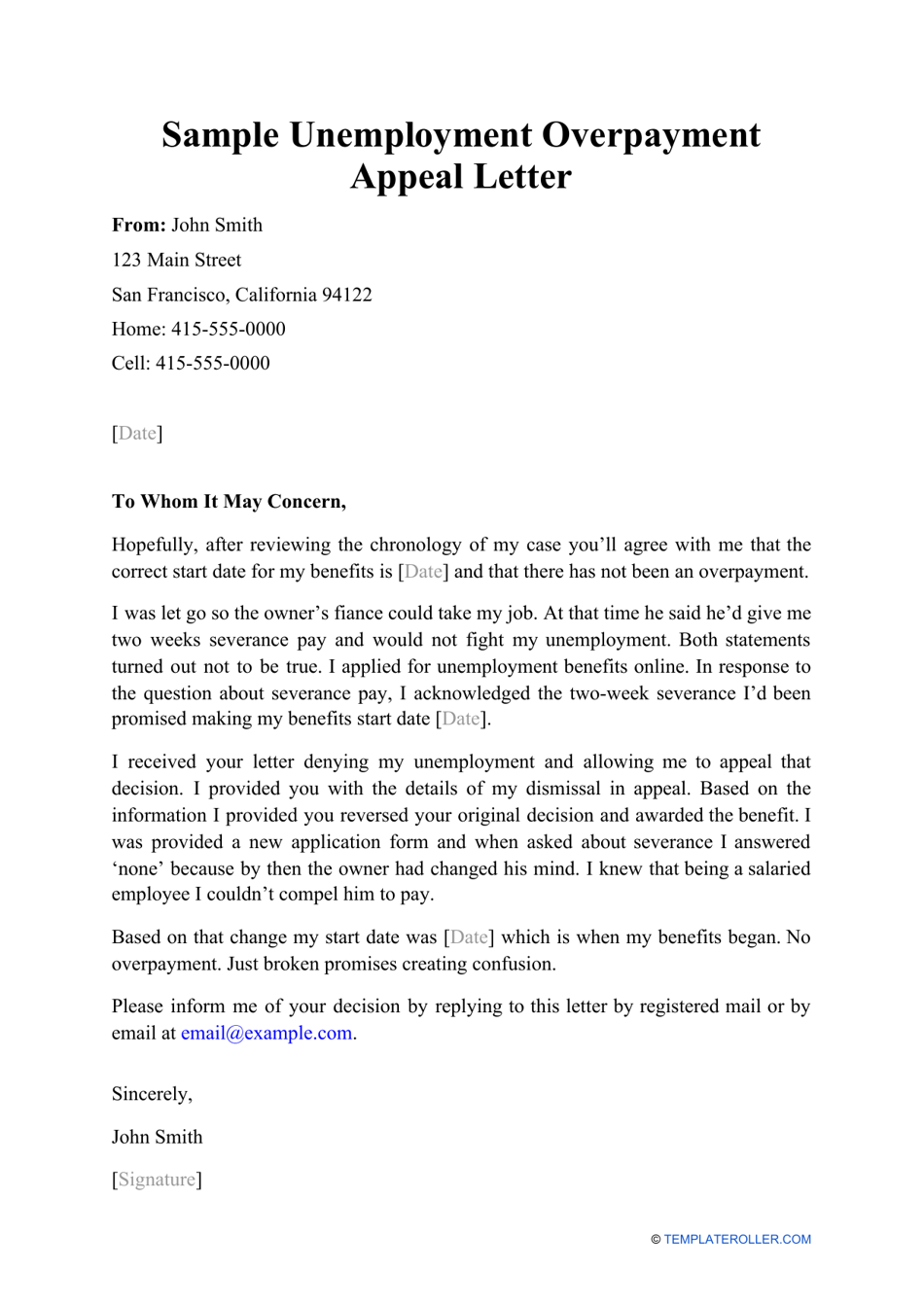

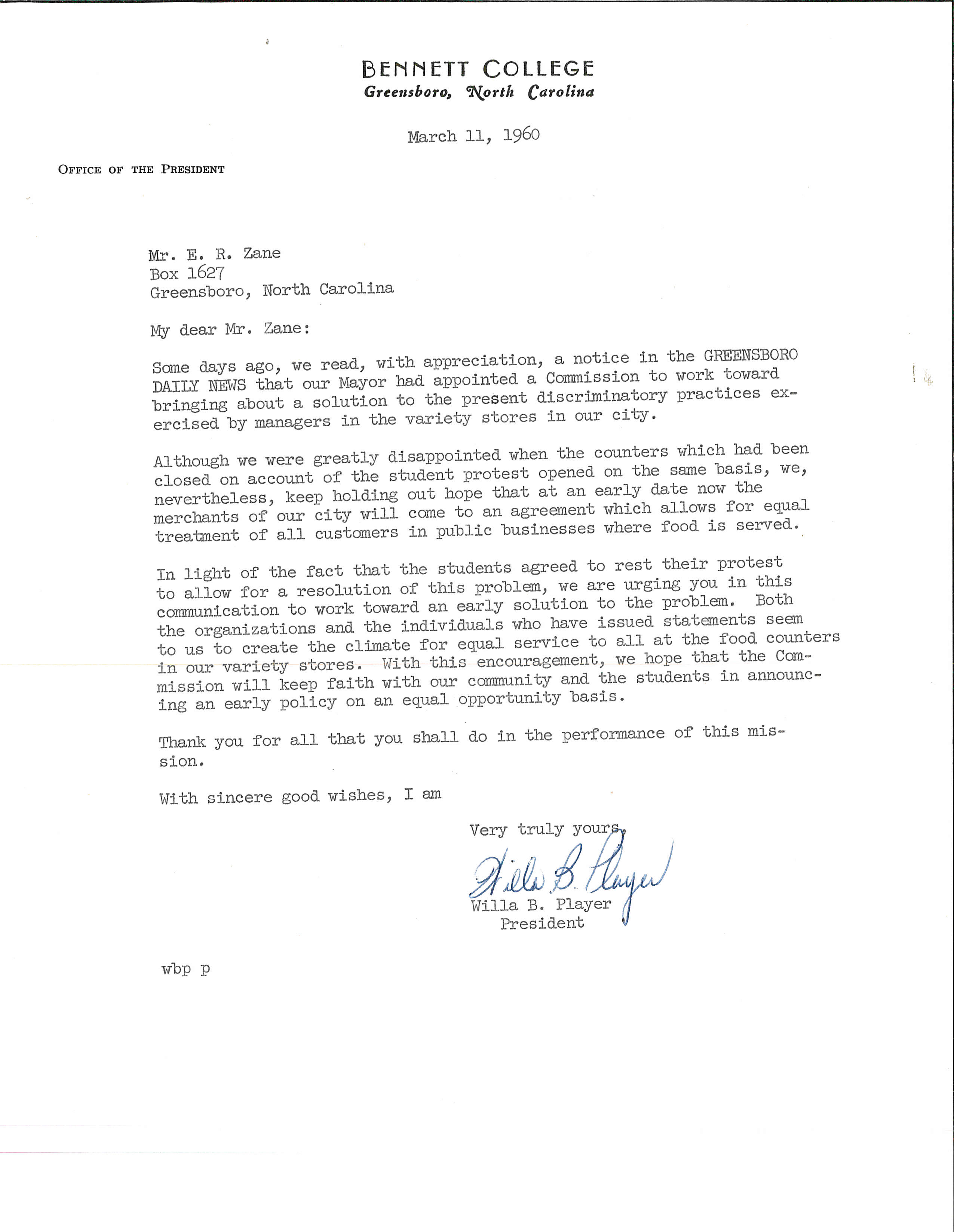

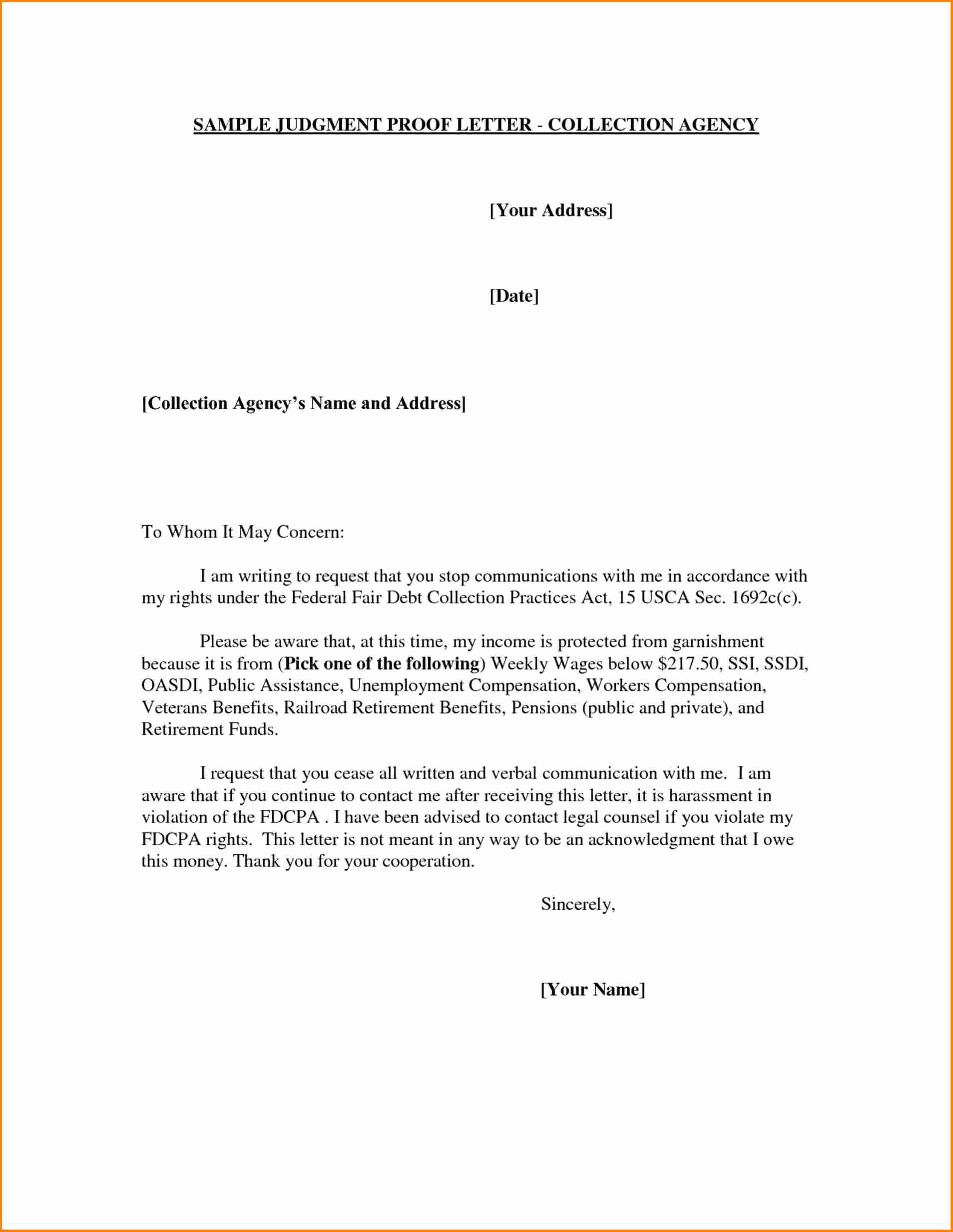

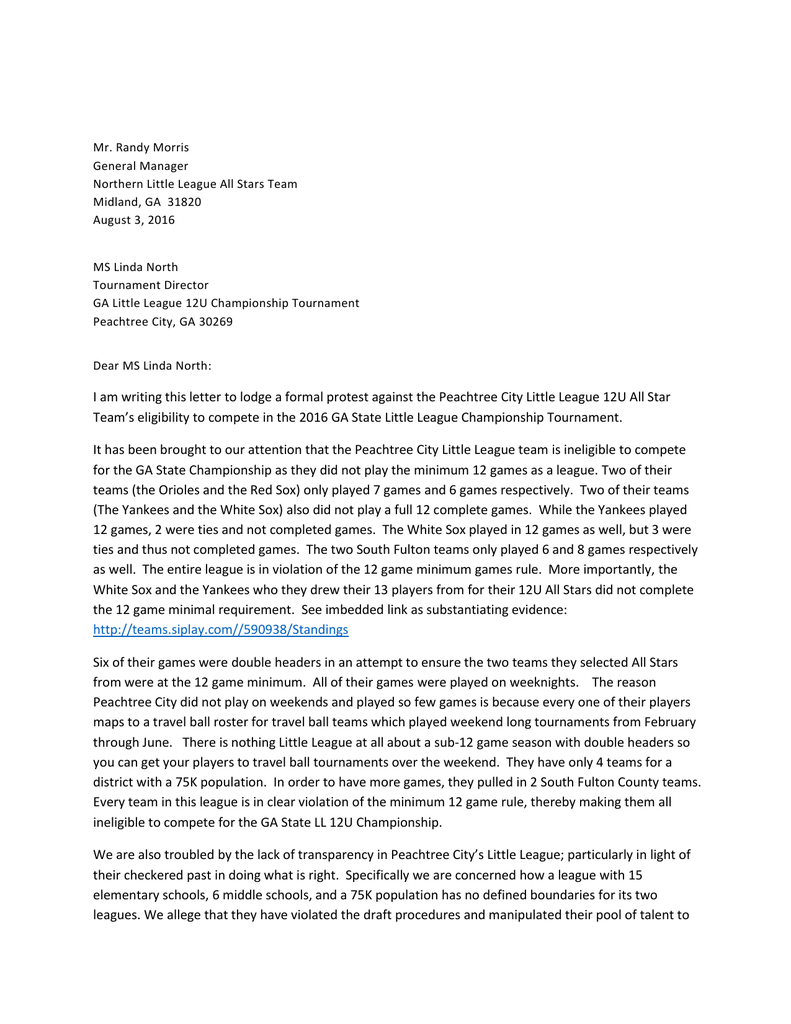

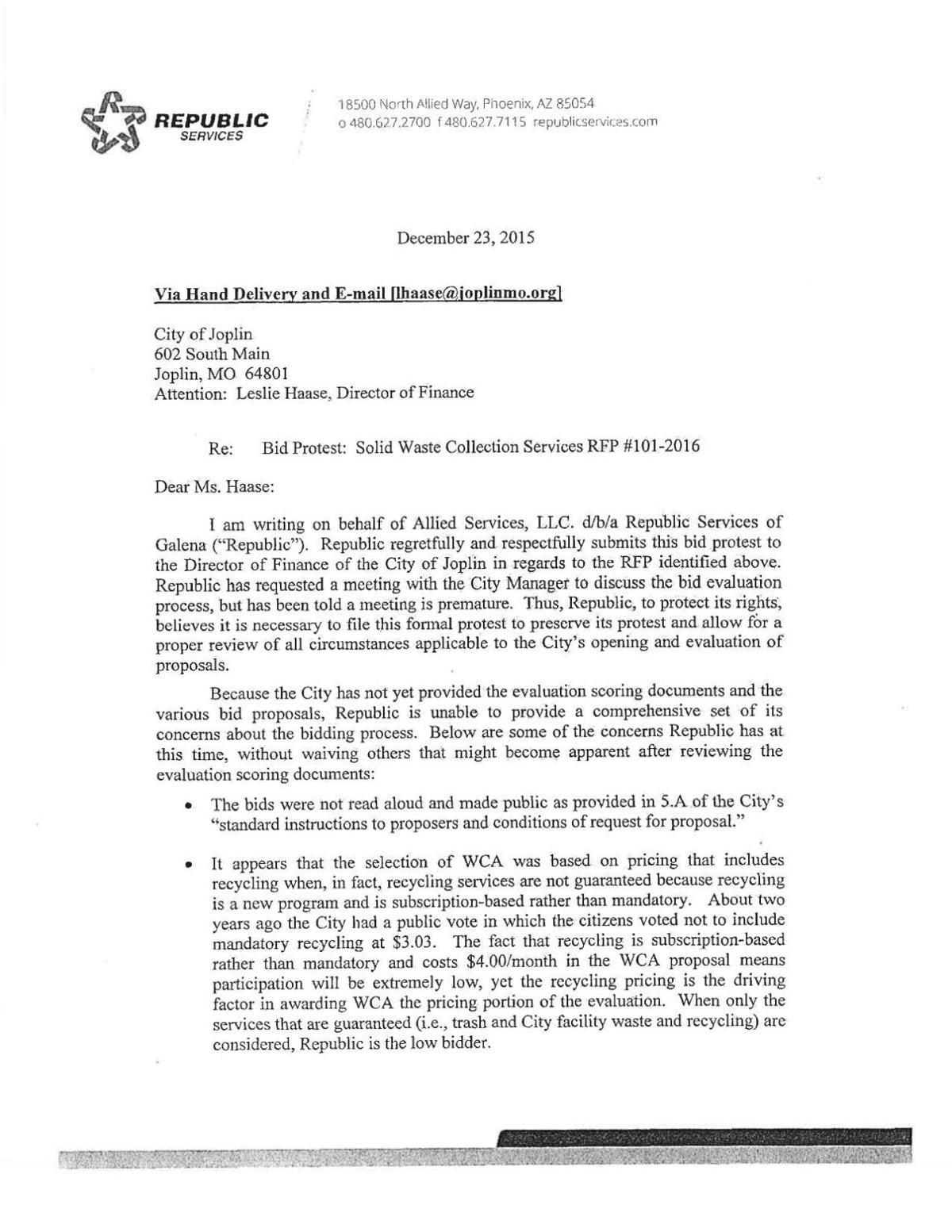

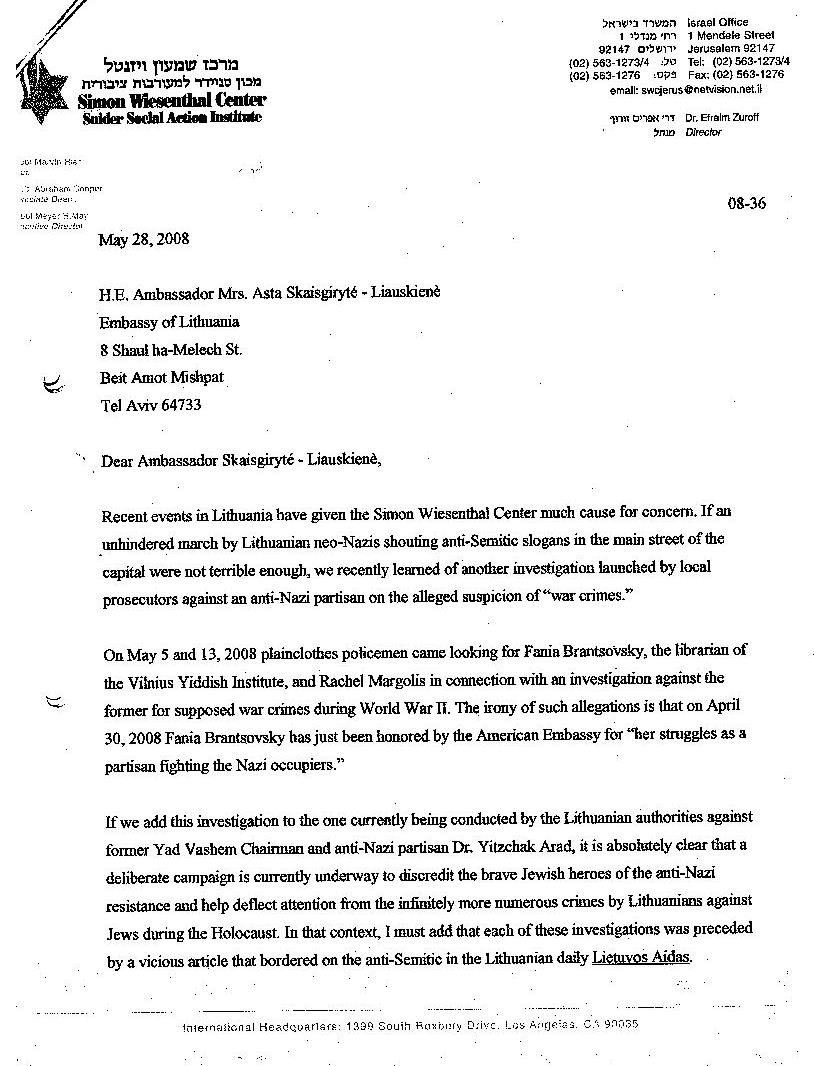

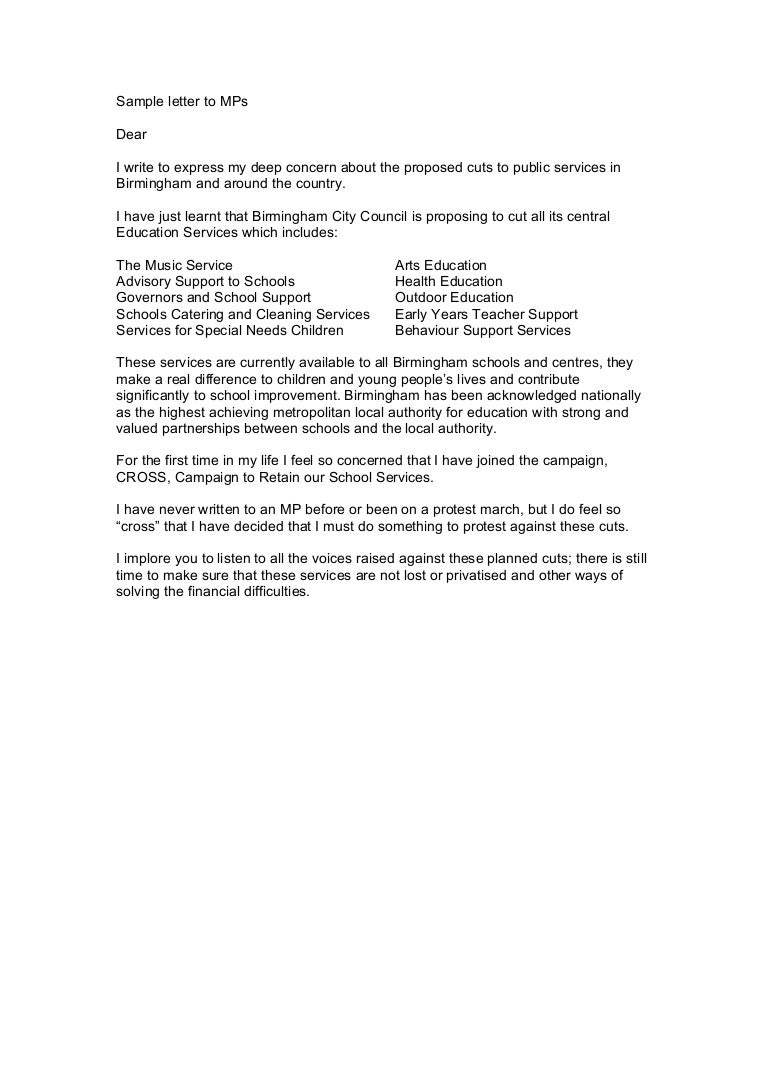

How To Write A Letter Of Protest Sample – How To Write A Letter Of Protest Sample

| Allowed for you to my blog, on this time period We’ll teach you concerning How To Factory Reset Dell Laptop. And after this, this is the initial graphic:

Think about graphic previously mentioned? is actually that amazing???. if you think maybe therefore, I’l l show you several picture once again below:

So, if you want to secure these amazing graphics regarding (How To Write A Letter Of Protest Sample), click on save icon to store these pictures in your personal computer. There’re prepared for down load, if you’d prefer and want to own it, click save symbol on the web page, and it’ll be directly saved in your notebook computer.} As a final point if you desire to find new and the latest photo related with (How To Write A Letter Of Protest Sample), please follow us on google plus or book mark this website, we try our best to offer you regular update with fresh and new shots. We do hope you enjoy staying right here. For many up-dates and latest news about (How To Write A Letter Of Protest Sample) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to offer you up-date regularly with fresh and new images, enjoy your exploring, and find the best for you.

Thanks for visiting our site, contentabove (How To Write A Letter Of Protest Sample) published . Today we’re excited to announce we have discovered an incrediblyinteresting nicheto be reviewed, namely (How To Write A Letter Of Protest Sample) Most people trying to find details about(How To Write A Letter Of Protest Sample) and of course one of them is you, is not it?