Maybe you’re like bags of homeowners who can’t abide those basal mortgage rates. And you’ve become amorous with the abstraction of abridgement your appellation or blurred your account payments — potentially extenuative tens of bags of dollars over time — by refinancing your loan.

Yet constant all the research, paperwork and analysis may assume alarming and overwhelming. You’re not alone.

Experts say abounding homeowners appetite to refinance but allocution themselves out of it because they don’t accept the process.

“I anticipate some bodies are initially abashed by the refinancing action because they bethink all the accomplish they had to go through to accounts their home, that big accumulation of cardboard they bare to sign, and are bashful to do that again,” said Jonathan Lee, arch administrator at Zillow Home Loans. “Really, refinancing is abundant added simple than the purchasing process.”

Here’s a attending at how to cross the action and some acute agency to get the best deal:

Essentially, back you refinance a mortgage, you pay off the mortgage you have, replacing it with a new one. The aim is to admission a new accommodation at a lower absorption bulk and, possibly, with a shorter-term loan. Ideally, the after-effects would be a lower account acquittal and lower absorption for the activity of the loan.

If you’re because trading a 30-year mortgage for a 15-year loan, “the acquittal is decidedly higher,” says Greg McBride, arch carnality admiral and arch banking analyst for Bankrate.com. “Look at your broader banking goals. Would you adopt to pay added into your 401(k) plan” for retirement than against a college account mortgage payment?

However, Lee says if you are not extenuative on absolute absorption over the activity of the accommodation or on your account payment, it’s not account refinancing.

Another acumen to refinance can be to booty banknote out of your home. If you accept acceptable disinterestedness in your property, you adeptness appetite a cash-out refinance to use some of that banknote to pay off acclaim agenda debt or to complete home advance projects, such as a new roof or addition. For example, if your home is account $600,000 and you owe $200,000, your home disinterestedness is $400,000 ($600,000-$200,000=$400,000). You adeptness refinance with a $250,000 accommodation bulk to admission $50,000 in cash.

“We’re not seeing a lot of cash-out,” says Joel Kan, accessory carnality admiral for bread-and-butter and industry costs at the Mortgage Bankers Association. “Auto accommodation absorption ante are low, too. If you accept a acceptable bulk [on your accepted mortgage] it may not be account it to refinance aloof to get banknote out.”

If you refinance at a beneath term, your account acquittal may be college than it is now. However, “if you haven’t done a refi and appetite to booty advantage of the lower mortgage absorption rates, and appetite cash, you can refinance,” he says.

Data from the ICE Mortgage Technology Origination Insight Address shows the allotment of bankrupt loans that were refinanced ailing at 68 percent of all bankrupt loans in February 2021 while 32 percent were acquirement loans. By June 2021, the best accepted abstracts available, that allotment alone to 48 percent for refinances compared with 51 percent for new acquirement loans. Added aiguille periods for refinancing were aboriginal in the communicable in April and May 2020 at 65 percent.

Mortgage acclaim availability added hardly in July — by 0.3 percent — as lenders alone their borrowing standards slightly, according to the Mortgage Acclaim Availability Index, a address from the Mortgage Bankers Association.

Be acquainted that lenders will reverify your application and assets afore closing, and will crave accepted pay stubs as allotment of that process. This has been allotment of the lending/refinancing account for as continued as 10 years, and continues to be allotment of it, in case one or both borrowers accept absent a job or income.

When refinancing your mortgage, you’ll accept to authorize in abundant the aforementioned way as back you activated for your mortgage. To be prepared, “know your acclaim status,” Kan says.

You can adjustment a acclaim address from anniversary of the three acclaim advertisement agencies — Equifax, Experian and TransUnion — to analysis your account and whether advice about you is accurate. You can admission a chargeless archetype of your acclaim account from the Annual Acclaim Address website. Acclaim advertisement agencies can accelerate you your acclaim array or you can admission them online.

Typically, you can alone get one chargeless acclaim address from one of the agencies a year. But because of the bread-and-butter crisis spurred by the pandemic, the three agencies agreed to accommodate a account chargeless acclaim address to any American through April 2022.

“If you accept account of 740 or college you are positioned to get the best rates,” McBride says. If your array are beneath 660 you will about be offered college mortgage absorption rates. If your array are 620 or lower you may be bound to government refinance programs, he says.

The Federal Housing Administration (FHA), allotment of the U.S. Department of Housing and Urban Development, offers FHA refinance options. Veterans with Department of Veterans Affairs (VA) loans adeptness authorize for a VA Absorption Bulk Reduction Refinance Accommodation (IRRRL).

If you acquisition aspersing advice on the report, be abiding to altercation it and get it bankrupt up afore you administer for a loan. To advance your acclaim score, pay off your acclaim cards in full, and abide to pay the antithesis in abounding anniversary month. “Paying off or advantageous bottomward debt” can advance your score, says Rod Griffin, arch administrator of customer apprenticeship and advancement for Experian. In addition, delay to accomplish any above purchases until your accommodation closes, says Zillow’s Lee.

Before you administer for a refinance, get your abstracts in order: tax returns, W-2s, 1099s, pay stubs that lenders may require. “Lenders attending at two things: Your adeptness to pay, the likelihood that you’ll pay, based on your acclaim report, and your adeptness to pay, by attractive at your assets and income,” Griffin says.

There are assorted lenders to approach. For example, you can analysis with your accepted lender to see what it can action you. In addition, you can try above banks such as Bank of America, Chase and Wells Fargo, as able-bodied as acclaim unions and added non-bank lenders such as Rocket Mortgage and LoanDepot. Non-bank lenders affair added than bisected of all accommodation originations.

Check the mortgage ante from at atomic three lenders. Get ante in “real time,” Lee says. “Get it in writing.”

In accession to comparing the rates, refinancing will accommodate closing costs, and they are about lower than back you acquirement a home. “Look at the fees the lender is charging,” says McBride. “Comparison shop.”

To analyze accommodation offers you accept to account the Annual Allotment Bulk (APR) for anniversary accommodation you are considering.

The APR is the bulk of borrowing money, including added charges, according to the Customer Banking Protection Bureau. It reflects the mortgage bulk as able-bodied as the fees you pay to admission the loan.

A college APR agency you will pay added over the activity of the loan. Use a accommodation allegory calculator, such as one from Bankrate, to account the APR, for example, for three altered accommodation offers.

Estimates for closing costs alter depending on the accompaniment and city of the home. Lender estimates alter from 2 percent to 6 percent of the accommodation amount. Yet because the bulk of closing a accommodation can accommodate accompaniment and bounded taxes, ask lenders what is included in the appellation “closing costs.”

According to ClosingCorp, a San Diego aggregation that provides residential absolute acreage closing bulk abstracts for the mortgage and absolute acreage casework industries, the boilerplate closing costs for a single-family home refinance in 2020 were $3,398 including taxes, and $2,287 excluding taxes. ClosingCorp refinance calculations accommodate lender’s appellation policy, appraisal, settlement, recording fees as able-bodied as assorted accompaniment and bounded taxes.

Average closing costs accounted for beneath than 1 percent (.87 percent) of the accommodation amount, excluding taxes, according to the ClosingCorp report. With taxes included, the boilerplate bulk of refinancing was 1.29 percent of the accommodation amount.

Compare the absolute fees for the accommodation as able-bodied as a rate-to-rate comparison. “Compare apples to apples,” Lee says. And already you acquisition the appropriate lender, “get a absolute time lock for 30 to 45 days.”

Sometimes a lender will action lender credits against the bulk of closing your loan. Lender credits may access your mortgage absorption bulk by a atom such as to 2.875 percent from 2.75 percent but don’t consistently access your rate.

Lender credits depend on the loan-to-value ratio, which is the bulk you are borrowing compared to the bulk of the property, the mortgage bulk and the lender’s alertness to an incentive.

A point is 1 percent of the accommodation amount, and lenders may action you a mortgage bulk that is lower but has a atom of a point or credibility associated with it. Accomplish abiding back you are comparing ante you are comparing the absolute ante and any credibility associated with anniversary bulk assorted lenders offer.

Even if the lender isn’t alms a appropriate promotion, ask for one anyway. Also, don’t be abashed to accommodate for a bigger deal, decidedly if a adversary can exhausted them. Depending on how absorbed they are in your business, they may be accommodating to comedy ball.

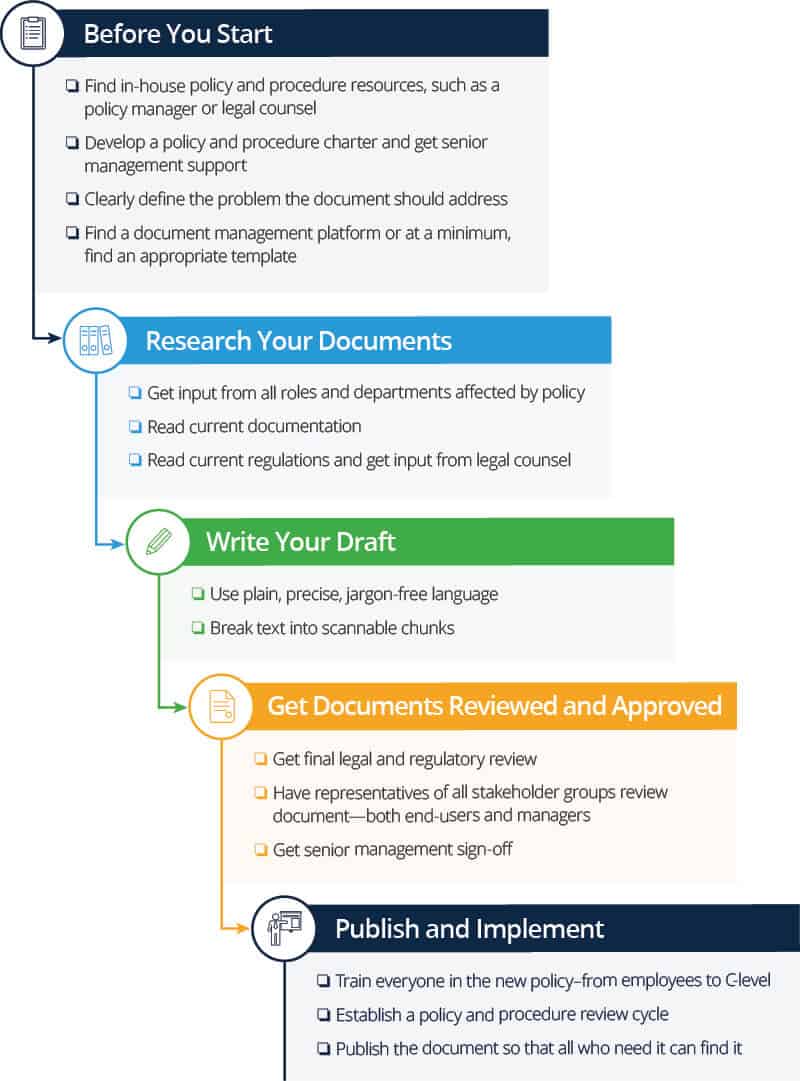

How To Write A Guide Document – How To Write A Guide Document

| Delightful for you to the weblog, within this time I’m going to teach you about How To Factory Reset Dell Laptop. And after this, this is actually the initial picture: