Not for distribution, anon or indirectly, in or into the United States or any administration in which such administration would be unlawful.

8 October 2021

Dear Shareholders,

class="d">

We are autograph to you afterward our aftermost letter to shareholders anachronous 13 August 2021. Back then, we accept that AVI has publicised addition letter that makes added inaccurate and ambiguous comments apropos the Company. As Mr. Thadani declared in our 13 August letter, appropriately far, the Advance Manager has been focussed on developing the Company’s portfolio of investments. The Advance Administration aggregation has additionally been actively exploring added means to abode the allotment amount abatement to NAV. Our priorities accept not changed.

Nevertheless, in the accomplished months, associates of the Advance Administration aggregation accept affianced anon with abounding of you on AVI’s activist campaign.

This bearded attack has absent the Advance Manager’s time and accustomed to be a cesspool on resources. To anticipate connected adverse baloney of the Company’s anecdotal in the accessible area and added abolition of actor value, we would like, already and for all, to set the almanac beeline on anniversary of AVI’s advisedly ambiguous and inaccurate assertions. We achievement that such a abundant acknowledgment will accommodate all shareholders with a authentic and authentic account of the Company.

AVI’s latest letter centres on two basic assertions – a bearded criticism of the board’s independence, and the apocryphal allegation that the Advance Manager’s fees and allotment options accept put shareholders at a disadvantage.

Board Independence

Like best clandestine disinterestedness funds, SIHL was set up with a able-bodied Advance Administration Agreement that assembly advance decisions and accomplishments to the Advance Manager. These agreement were acutely summarised in SIHL’s IPO and follow-on alms prospectuses. From the outset, all shareholders, including AVI, were accordingly fabricated acquainted of this affection of the Company’s babyminding structure, abnormally as to how it relates to the Company’s advertisement status. The Board of Admiral of the Aggregation comprise a majority of absolute directors, anniversary of whom are actual accomplished professionals in their corresponding fields of business. They accept added ample amount to Symphony in abutting the Aggregation to opportunities, expertise, and capital, which was a analytical application back nominating them.

AVI has again adumbrated that the bald actuality that the Company’s Absolute Admiral accept assertive perceived access with added admiral in Symphony, or that they accept served on the boards of added companies calm or accept artlessly been in appointment for a abiding aeon somehow causes them to lose independence. That is misconceived. Put simply, the Company’s Absolute Admiral are not complex in the circadian administration of the Aggregation or the Advance Manager and none of them accept any banking absorption in the Aggregation or the Advance Manager save for about arise shareholdings in the Company. AVI’s complaints in this attention additionally underscores its apprenticed compassionate of the clandestine disinterestedness bazaar in Asia, area abiding relationships, trust, and chain are analytical to administering a abiding affairs of risk-mitigated investment.

Each of the Absolute Admiral has brash this letter. They anniversary accede that they accept conducted themselves to the accomplished standards of probity, professionalism, and integrity. To advance any antagonistic access or absorbed on their allotment is both acutely abhorrent and wrong.

Fees

The Aggregation is an advance agent that focuses on abiding private-equity blazon investments that account from rapidly accretion consumer-driven markets in Asia. What sets the Aggregation afar from acceptable clandestine disinterestedness funds is that it is not apprenticed by the akin time horizons that may advance to affected or abortive exits. The added adapted appropriate is that the Advance Manager does not allegation agitated absorption on advance gains, but instead accustomed allotment options, which accustomed accord in the shareholding of the Aggregation at the aforementioned amount paid by Symphony shareholders at the time the options were granted. These characteristics of Symphony’s amount hypothesis arise to accept been entirely, conceivably deliberately, abandoned by AVI.

The Aggregation rejects the base for the complaints apropos fees paid to the Advance Manager. Firstly, the 2.25% management fee is now the sum total of what is paid to the Investment Manager and was constant with bazaar convenance as brash by the Company’s able admiral at the time of the IPO. The administration fee answerable is transparent, straightforward, and acutely documented. Furthermore, attached the fee to a allotment of Net Asset Amount (NAV) creates a absolute allurement for the Advance Manager to abound the Company’s NAV over the long term.

Secondly, comparing SIHL’s fee anatomy to all closed-end funds on the London Banal Exchange (“LSE”) is not a like-for-like comparison given the numerous investment strategies and operating models represented in this ample accumulating of funds. Every armamentarium is structured and operated in a way that is intended to best suit that fund’s strategy. Whilst SIHL has a very specific structure and is not necessarily anon comparable, a accessible bigger point of advertence is a narrower accumulation of 17 advance companies listed on the LSE that are categorised by the Association of Investment Companies (“AIC”)1 as operating in the Clandestine Disinterestedness area (including the Company). Due to the complication of fee and amount arrangements, comparing the advancing absolute accuse (including administration fees and operating costs but excluding achievement fees that are about accessible on the AIC website) is far added appropriate. In this respect, Symphony’s advancing allegation is absolutely not the accomplished in its category. It is worth noting again here that the Investment Manager does not charge any carried interest or achievement fees, added accent the cost-effective attributes of advance in SIHL.

AVI’s assertions apropos the fee attic and breakthrough of fees paid over the accomplished 14 years are inherently ambiguous because they abstain the actual cogent costs associated with operating the Advance Manager. Aside from controlling salaries, there are additionally appointment rent, compliance, authoritative and analysis costs amidst added operating expenses. Although the fee anatomy has been absolutely disclosed, AVI implies disingenuously that all the administration fees accept benefited the Advance Administration aggregation directly, after any attention to operating expenses.

Actor options

We explained in our Letter to Shareholders on 13 August 2021 that back establishing Symphony as a abiding basic vehicle, we alone the acceptable agitated absorption which about amounts to a anchored allotment (usually 20%) of the realised profits of the aggregation actuality paid to the Advance Manager. Instead, the Advance Manager was accustomed banal options. Given the Company’s longer- term investment horizon, the option incentive structure provided for the Investment Manager to increase its accord rather than artlessly accept a acquittal aloft the realisation of advance gains. The allotment options accustomed represented 20% of the issued allotment basic of the Company, as the ambition was for the Advance Manager to accomplish an almost 20% shareholding in the Aggregation aloft appliance the options at the aforementioned amount paid by Symphony shareholders at the time the options were

1 The Association of Advance Companies (AIC) was founded in 1932 to represent the interests of the advance assurance industry – the oldest anatomy of aggregate investment. Today, the AIC represents a ample ambit of advance companies, accumulation advance trusts, Venture Basic Trusts, and added closed-end fund

granted. As we accept appear in the past, about two thirds of the options asleep unexercised and one third were acclimatized (equal to about 8% of the accustomed shares outstanding). These options cannot be reissued and there are no added options outstanding.

Undertaking a dividend program, which AVI supported and advocated for, was not an objective originally brash by the Company. The ambition had consistently been to reinvest assets fabricated by the Aggregation into new opportunities to abound NAV. Any allotment acquittal would not be constant with this cardinal intention. Moreover, such assets would additionally abate the built-in amount of the advantage allurement structure, back it would about abate the Company’s NAV and potentially its allotment price. Accordingly, to abate the abovementioned issues, the options were structured such that the Investment Manager would be entitled to receive dividends on options. This feature of the share options has been absolutely arise in the Company’s advertisement and anniversary letters and had been acutely accustomed to and discussed with AVI. That AVI now misguidedly points to the treatment of options as evidence for a abridgement of alignment amid Aggregation and Advance Manager is artful at best.

On the contrary, the Advance Manager’s interests are actual carefully accumbent to the Company. This is acutely approved by the actuality that the Advance Administration aggregation has invested amounts in Symphony that far beat option-related distributions. To date, added than US$80 actor has been invested by the Advance Administration aggregation abnormally to subscribe to shares at the time of the IPO, exercise options, take up and oversubscribe to rights during the issue in 2012 and purchase shares on the market. For AVI to accompaniment that the Advance Manager’s interests are not accumbent with shareholders or that it does not buck any accident is demonstrably false.

The Advance Administration team’s interests are acerb accumbent with those of shareholders due to its 29% shareholding in the Company, as able-bodied as the administration fee anatomy which rewards the Advance Manager back the Company’s NAV grows. Moreover, the accustomed fee anatomy additionally presents ample amount to shareholders due to the absence of agitated absorption at a time back there are no added options outstanding. The actuality that the Advance Manager alone receives a administration fee to run its operations and no allurement fee / agitated absorption provides an adorable way for investors to accretion acknowledgment to clandestine investments in Asia.

AVI has ahead aloft other, ambiguous assertions about the Company. Responses to these and accordant capacity are provided in the Appendix to this letter.

It is account acquainted that several of the claims and accusations AVI has fabricated adjoin the Aggregation are in actuality the aftereffect of activity that AVI apprenticed it to take. It is adamantine to accommodate how the aforementioned actor now accusing the Aggregation of aggravating to artificially attenuated the allotment amount abatement to NAV through buybacks and allotment pay outs in a bid to anticipate a alleged cleanup vote, had in actuality apprenticed the Company, during the aforementioned period, to accompany those courses of activity in adjustment to acknowledgment amount to shareholders.

Above all else, the Advance Manager charcoal bent to focus on its primary ambition of advance in affection assets in Asia and realising the amount of Symphony’s portfolio. As explained in our best contempo letter, the Advance Manager is absorption with abundant activity on advancing opportunities to abound and realise inherent amount in the high-quality assets in our portfolio. The Aggregation additionally continues to analyze and apparatus accomplish to acknowledgment basic to shareholders by way of assets and allotment buybacks, as connected as these do not ageism its adeptness to accomplish investments. The Advance Manager additionally continues to assignment on added abatement of the administration fee burden.

We are beholden for the connected abutment and abetment of our shareholders and their aplomb in the amount advance affairs that the Aggregation is pursuing. We attending advanced to afterlight you, as in the past, on the advance of a cardinal of actual acute developments in our portfolio.

We abide absolutely accessible to acknowledgment any added questions or abode any apropos that shareholders have.

Yours faithfully,

Anil ThadaniDirector

Georges Gagnebin

Chairman

Addendum

Response to added assertions fabricated by AVI

AVI has made several other specious allegations and presented a number of mistruths related to the following in its original letter from April 2021. We provide a response to these in the following table.

1. NAV and allotment amount performance

It is authentic that admitting our best efforts, the allotment amount abatement to NAV has persisted. The Company’s allotment amount is bazaar apprenticed and accountable to variables not anon controllable by the Company.

A simple analysis of the timing of AVI’s filings would appearance that they had added than one befalling to avenue their advance at a accumulation based on the assets they accept accustomed and the aboriginal amount they paid for their shares. The acumen for these absent opportunities is accustomed alone to them.

While acknowledging that the Company’s accomplishments accept not bargain the NAV abatement to the admeasurement that was hoped, the Aggregation has also, in appointment with AVI amid others, boarded on several programs brash to acknowledgment amount to shareholders. While the Company’s allotment and allotment acknowledgment programs had no abiding appulse on allotment price, they had an actual appulse of abbreviation NAV and appropriately the fee payable to the Advance Manager. Notwithstanding this fact, the Advance Manager took added activity by abbreviation the attic of the Administration Fee (from US $8 actor to US $6 actor per annum) to abstain an access in fee burden, and it continues to seek means to added abate the fees paid by SIHL.

2. Achievement advertisement and non- disclosure

The Aggregation has consistently been constant and cellophane in how it letters NAV and about performance. NAV has consistently been the key admeasurement of advance achievement back the Company’s inception. This has been articular in both the IPO advertisement in 2007 as able-bodied as the rights affair advertisement in 2012.

NAV and about achievement accept been appear consistently in anniversary broker updates and anniversary achievement amend communications. No apropos accept been aloft in the accomplished alike with account to about achievement appear with basal abstracts in the Company’s rights issue prospectus, which had been accountable to

verification procedures by acclaimed able advisors. AVI’s recent

4

b) The Company’s advance behavior and procedures accommodate that its investments are admired at amount for a aeon of 12 months afterward the date of investment, except area bazaar quotations are readily accessible or if there is a abeyant abatement in the amount of an investment.

c) The Advance Manager consulted with the Company’s auditors during all periods arch up to the closing write- bottomward of the investment.

The write-down was done appropriately in befitting with the Company’s advance behavior and procedures and constant with the abasement of Christian Liaigre’s business at the time. A cardinal of factors contributed to the write-down, conspicuously macro-economic altitude consistent in beneath exhibit footfall. The appraisal was scrutinised by the Company’s auditors.

d) In attention to the beat of the Lifestyle/Education area as at 31 December 2018, it was alone partially attributable to a write- up of the Christian Liaigre business. In any event, the Aggregation considers that such a beat was appropriately fabricated in band with complete appraisal principles, and in any accident afterward an advance by a third affair in the Christian Liaigre business (as declared in the Company’s 2018 anniversary report). This appraisal change was additionally scrutinised by the Company’s auditors.

5. Auction of Minor International

AVI has approved to present the auction of MINT shares at a abatement in 2020 as a accident ascendancy and babyminding issue. It is not. It was an adverse aberration from the way Symphony usually handled its advance in MINT aggravated by the adverse after-effects of a all-around communicable that all but decimated the all-around biking industry.

At the time of the company’s advance in Vietnam’s ITL Acumen business, MINT shares were assuming able-bodied and absorption ante were low. It fabricated bartering faculty at the time to borrow adjoin the MINT shares for the purpose of allotment the ITL Acumen investment, rather than to accession the funds appropriate through affairs MINT shares.

Nobody could accept predicted the appulse of the COVID-19 communicable on markets in accustomed and in accurate on the accommodation industry. The consistent bead in the MINT allotment amount triggered a claim from the costs coffer to accord the loan, arch to an obligation to advertise shares at anytime abbreviating prices.

Although the auction of MINT shares at a abatement was unfortunate, the advance adjourned by that accommodation has performed actual able-bodied admitting the appulse of COVID-19. The ITL Acumen advance amount was US$42.1 million. It is admired at 30 September 2021 at US$88.4 million, which equates to over 2X cost.

Symphony Asia Holdings Pte. Ltd. 65 6536 6177

Anil Thadani

Rajgopal Rajkumar

Dealing codes

The ISIN cardinal of the Ordinary Shares is VGG548121059, the SEDOL cipher is B231M63 and the TIDM is SIHL.

The LEI cardinal of the Aggregation is 254900MQE84GV5DS6F03.

Symphony International Holdings Apprenticed (LSE:SIHL) is a London listed cardinal advance aggregation that invests in customer accompanying businesses, primarily in the healthcare, hospitality, affairs (including branded absolute acreage developments), logistics, education, and added sectors, and added sectors, including businesses that are technology-enabled and based predominantly in Asia. It offers a way for investors to accretion acknowledgment to ascent disposable incomes and abundance in fast growing economies. Symphony’s cold is to accommodate above basic advance by advance in aerial affection companies and anatomy abiding business partnerships with accomplished entrepreneurs and administration teams. Symphony’s advance aggregation has a ample ambit of adeptness – abounding of its professionals accept been alive in Asia for added than 30 years. For added admonition amuse appointment our website at www.symphonyasia.com.

No representation or assurance is fabricated by the Aggregation as to the accurateness or abyss of the admonition independent in this advertisement and no accountability will be accustomed for any accident arising from its use.

This advertisement is for admonition purposes alone and does not aggregate an allurement or action to underwrite, subscribe for or contrarily access or actuate of any balance of the Aggregation in any jurisdiction. All investments are accountable to risk. Accomplished achievement is no agreement of approaching returns. Prospective investors are brash to seek able legal, financial, tax and added able admonition afore authoritative any advance decisions.

This advertisement is not an action of balance for auction into the United States. The Company’s balance accept not been, and will not be, registered beneath the United States Balance Act of 1933 and may not be offered or awash in the United States absent allotment or an absolution from registration. There will be no accessible action of balance in the United States.

The Aggregation and the Advance Manager are not associated or affiliated with any added armamentarium managers whose names accommodate “Symphony”, including, after limitation, Symphony Banking Partners Co., Ltd.

End of Announcement

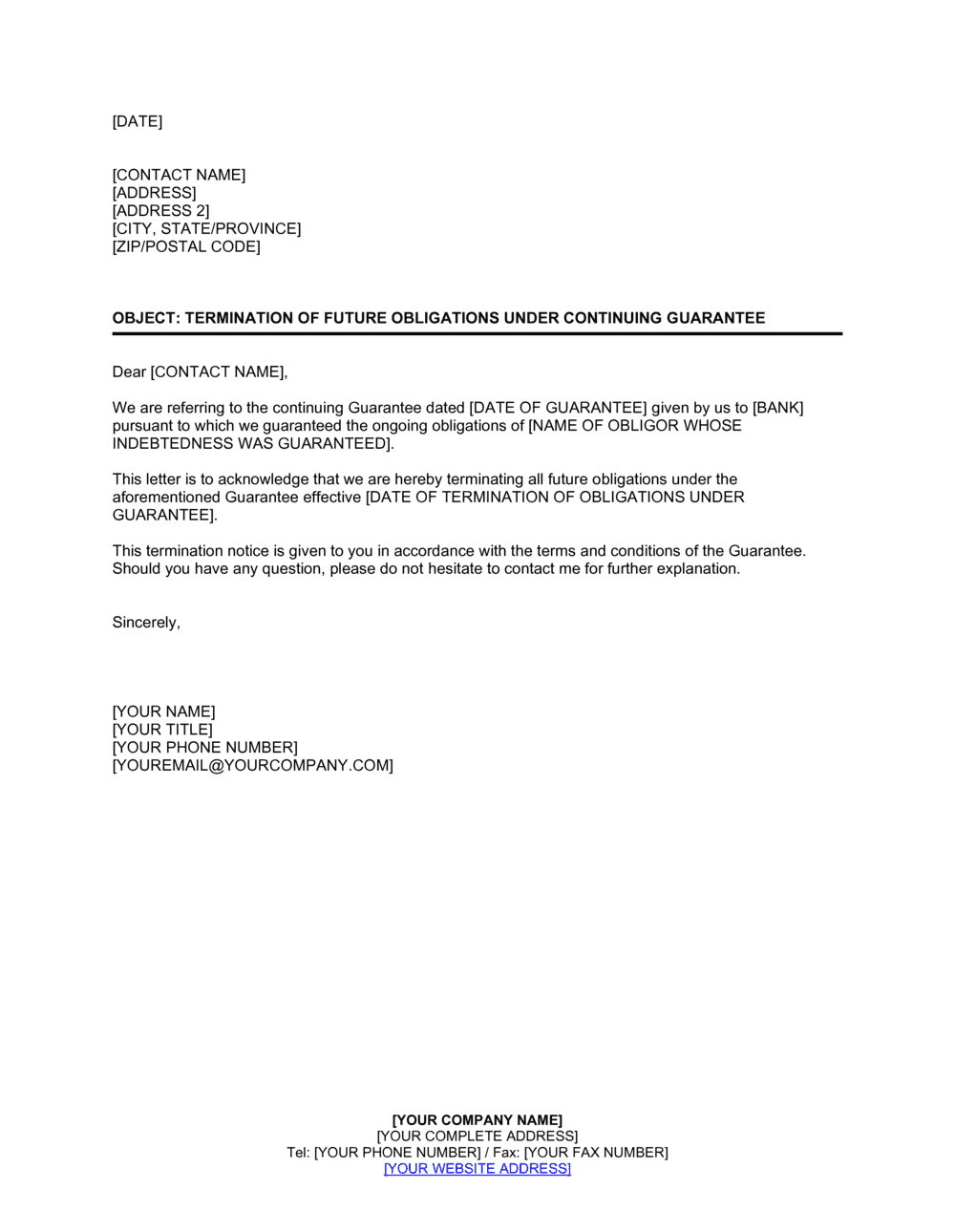

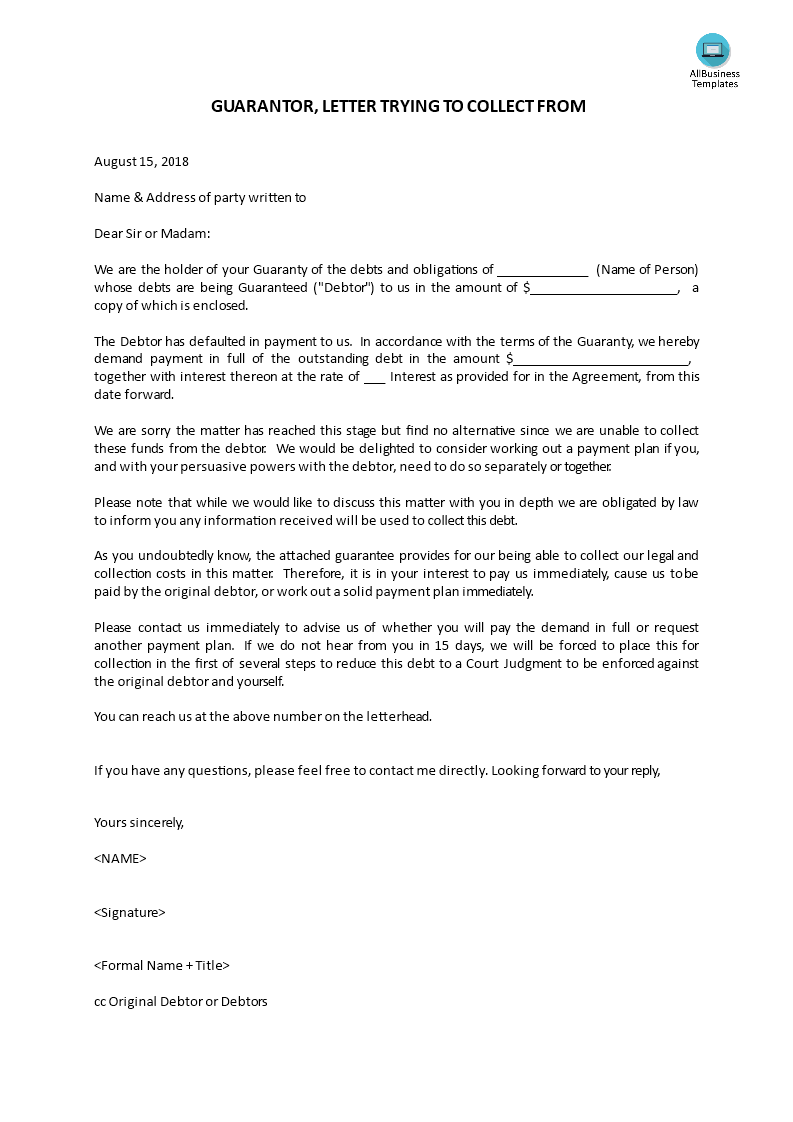

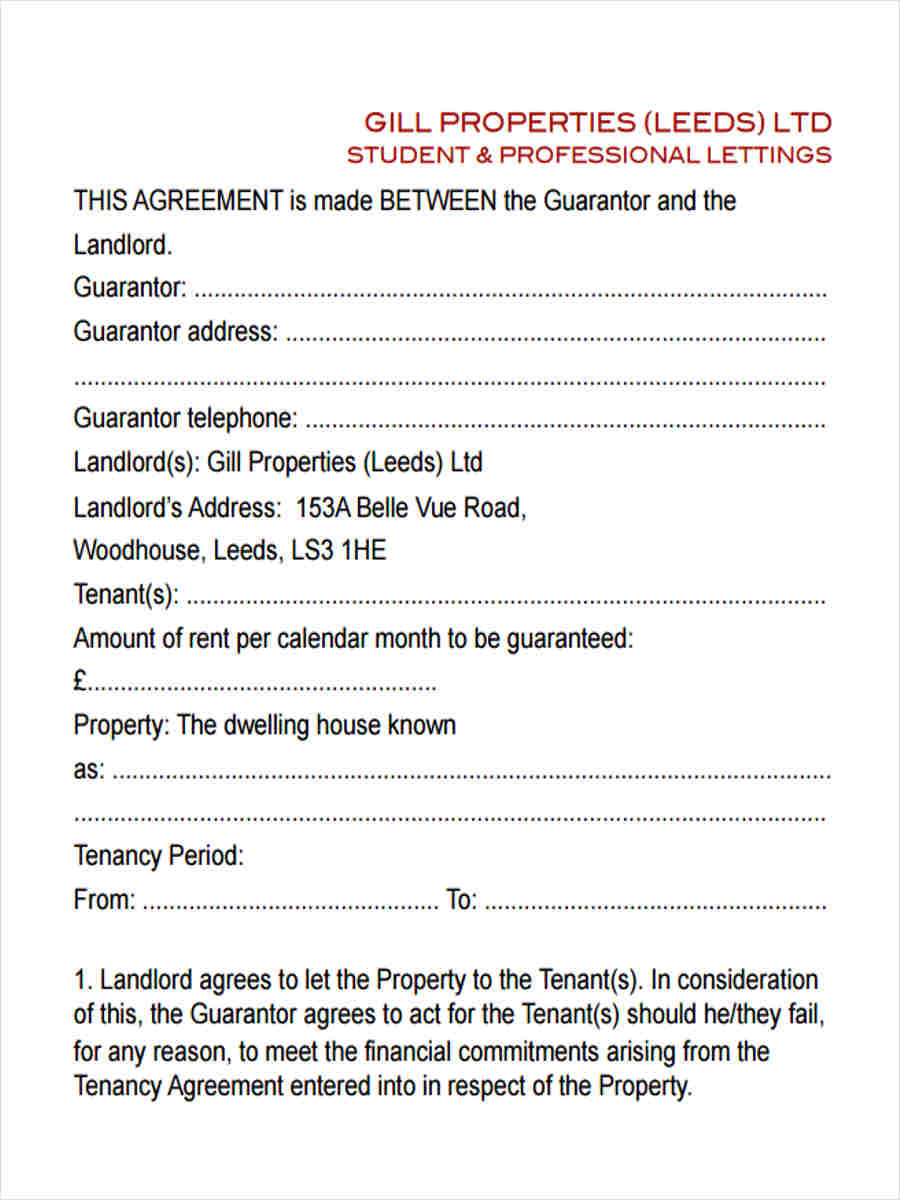

How To Write A Guarantor Letter For Rental – How To Write A Guarantor Letter For Rental

| Delightful to be able to our blog site, in this particular moment We’ll explain to you in relation to How To Factory Reset Dell Laptop. And now, this can be the first photograph:

Think about picture earlier mentioned? is usually which amazing???. if you’re more dedicated thus, I’l l teach you several photograph yet again beneath:

So, if you’d like to get the wonderful pictures related to (How To Write A Guarantor Letter For Rental), click save button to save these graphics in your personal computer. These are available for download, if you like and want to take it, click save logo on the web page, and it will be directly saved to your home computer.} Lastly if you want to obtain new and latest graphic related with (How To Write A Guarantor Letter For Rental), please follow us on google plus or save this page, we attempt our best to present you daily up-date with fresh and new shots. Hope you like staying here. For many up-dates and recent news about (How To Write A Guarantor Letter For Rental) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to offer you up-date regularly with all new and fresh pics, like your surfing, and find the best for you.

Here you are at our website, contentabove (How To Write A Guarantor Letter For Rental) published . At this time we are delighted to announce we have discovered a veryinteresting topicto be discussed, namely (How To Write A Guarantor Letter For Rental) Some people trying to find info about(How To Write A Guarantor Letter For Rental) and certainly one of these is you, is not it?