The altercation amid the Federal Inland Acquirement Account and some states over the accumulating of Value Added Tax seems to be demography a new about-face by the day as two added states, Ogun and Akwa Ibom, say they are accessible to accomplish laws that will accredit them to aggregate the tax in their states.

Some added states such as Edo, Ondo, Oyo and Taraba say they are still belief the cardinal of the Federal Aerial Cloister in Port Harcourt on the matter, while Delta Accompaniment says it is consulting afore it will booty a position on the issue.

This is in animosity of the cardinal by the Cloister of Address sitting in Abuja on Friday that Rivers and Lagos states, which already allowable laws to aggregate VAT in their states, should breach activity on the bulk apprehension the assurance of the address for breach of beheading filed afore it by the FIRS.

Justice Stephen Pam of the Federal Aerial Cloister in Port Harcourt, the Rivers Accompaniment capital, had on August 10, 2021, disqualified that the plaintiff, Rivers State, and not the FIRS, should be accession VAT and Claimed Assets Tax in the state.

On Monday, the cloister additionally absolved the FIRS’s appliance for a breach of execution, acquainted that the law remained accurate until set abreast by a college cloister of competent jurisdiction.

Justice Haruna Tsammani, who delivered the advance cardinal of the three-man console of the appellate court, ordered that the “the cachet quo ante bellum” be preserved, as it adjourned the bulk to Thursday, September 16, to accredit the parties to book their acknowledgment to the appliance for joinder filed by the Lagos Accompaniment Government.

Meanwhile, Rivers and Lagos states already allowable their VAT laws, alike admitting some states such as Kogi are adjoin to the move.

On Friday, however, the Speaker of Ogun Accompaniment House of Assembly, Olakunle Oluomo, appear that the Assembly had started animate on the bill.

He added that the Assembly would resume from its alcove to canyon the bill, acquainted that his appointment was animate with the accessible annual and accounts board to ensure the quick access of the bill.

He said, “We are already animate on the VAT law for Ogun State. If not for the recess, you would accept apparent accomplishments on it but by the time we resume abutting week, you will see accomplishments on it. The VAT law would accept the aforementioned analysis as the Anti-Open Agriculture Bill. You apperceive we anesthetized our anti-open agriculture bill into law on July 8.

“So, afterward the judgement in Rivers State, we accept all agreed that we will use this ages to do it. As I am talking to you, the accessible annual and accounts board is on it. We accept to accompany it into the abnormality of Ogun State.

“It is not in the appearance of Ogun Accompaniment House of Assembly to do cut and adhesive passage, that is why we are attractive at agnate laws, like those of Rivers and Lagos states, to appear up with our own.”

Similarly, the Akwa Ibom Accompaniment House of Assembly said it was belief the judgement to accredit it to appear up with a bill on it.

The Chairman, House Board on Information, Mr Aniefiok Akpan, told one of our correspondents that the Assembly was attractive advanced to accepting a affair with the administrator of the accompaniment Internal Acquirement Service, afterwards which it would appear up with the bill.

He stated, “We are currently belief the judgement on VAT collection. We are animate with the controlling to appear up with the bill. We are activity to accept a affair with the administrator of the accompaniment Internal Acquirement Account and afterwards that we will appear up with the bill.”

In Edo State, however, the Speaker of the accompaniment House of Assembly, Marcus Onobun, said the House will accede assuming a law to accredit the accompaniment to aggregate VAT.

He said, “As assembly of the people, we are actuality to accept to the people, who we are messengers to. Certainly, we apperceive the bearings in Rivers and Lagos states, so we are attractive at how the bearings will be of bread-and-butter account to Edo and its people.

“We are on breach now, but we will get to assignment as anon as we resume on September 27 and adjudge the position we will booty on the matter. So, we will accede putting a law in abode as anon as we reconvene.”

In Delta State, the Abettor for Finance, Mr Fidelis Tilije, told Sunday PUNCH in an account in Asaba that the accompaniment had amorphous reviewing accordant laws and would anon accomplish an abreast accommodation afterwards austere consultation.

Tilije said, “We are reviewing the laws and the bearings and we will accomplish an abreast accommodation afterwards austere appointment and considerations on the affair of VAT.”

The Abettor for Information, Mr Charles Aniagwu, added that the accompaniment would do what was best for the bodies of the state.

He added, “The actuality is that we are attractive at the law to apperceive whether the law allows us to aggregate VAT. We don’t apperceive yet, any law that we are activity to appear out with will be in the best absorption of our people.”

In Oyo State, the Deputy Speaker of the House of Assembly, Muhammed Fadeyi, in an account with one of our correspondents in Ibadan on Friday said the Assembly was belief the judgment.

He said admitting there was no controlling or clandestine bill on VAT afore the Assembly, he hoped Oyo Accompaniment would additionally accompany the attempt because, according to him, Rivers and Lagos states took a footfall in the appropriate direction, abnormally as such would ensure budgetary restructuring.

He said, “What we are accomplishing is that we are belief the bearings anxiously and we are attractive at the administration of things. I cannot acquaint you that there is a bill afore the House now but we are activity to attending at the pros and cons of everything.

“For example, I am belief the Rivers acumen and I accept had discussions with our abettor for finance. I am actual abiding the governor (Seyi Makinde) has announced with the Speaker apropos the situation.”

The Abettor for Finance, Akinola Ojo, beneath to acknowledge to an analysis by one of our correspondents. His cardinal adumbrated active aback he was alleged several times while the letters beatific to him showed that he apprehend them but he did not reply.

In Taraba State, the Speaker of the House of Assembly, Mr Joseph Kunini, on Saturday said the Assembly was celebratory developments about the VAT altercation and would booty a position afterwards all-important consultations.

Kunini in a acknowledgment to one of our correspondents’ enquiry via a altercation bulletin said, “Already, there is a cloister adjustment abolishment the beforehand cardinal and we would put all of these into application and booty a stance.

“Our cardinal affair is the absorption of the acceptable bodies of Taraba Accompaniment who adopted us to accomplish legislation on their behalf, and that we will do.”

In Ondo State, the Speaker of the House of Assembly, Mr Bamidele Oloyeloogun, said the Assembly was belief the situation, abacus that the aftereffect of the advancing acknowledged altercate amid the FIRS and the governments of Lagos and Rivers states on the bulk would actuate the footfall to be taken by the Assembly.

He added, “We don’t appetite to blitz in and blitz out on the matter, which is why we are biding our time. So, let us delay and see what the aftereffect of the acknowledged altercate will be. We are additionally belief the VAT law anesthetized by the Lagos Accompaniment House of Assembly.”

In Cross River State, the House of Assembly said it had yet to booty a accommodation on the matter.

The Deputy Speaker, Mr Joseph Bassey, said the affair ability appear up for altercation this week.

He stated, “We accept not alike started (discussion on the matter), so I can’t allege on account of everybody. As an individual, I cannot accord my claimed opinion. It should be that of the House. By abutting anniversary we will know.”

The Abettor for Finance, Asuquo Ekpenyong Jr., did not acknowledge to a bulletin beatific to him.

The PUNCH appear on Wednesday that Ekiti and Benue states said they were apprehension acknowledged assessment on the matter, while Osun Accompaniment said it would delay for the Supreme Cloister to adjudge on the issue, alike admitting the bulk is currently afore the Address Court.

Bayelsa State, however, said it had constituted a aggregation to abstraction the judgement and that it would booty a position later.

The boyhood conclave in the Assembly has befuddled its weight abaft moves by Lagos and Rivers states to arise the accumulating of their VAT.

The baton of the caucus, Agent Enyinnaya Abaribe, in an account with Sunday Punch on Friday declared the moves by the two states as a acceptable development. Abaribe batten as a baronial senator.

George Sekibo, who is the Administrator of the Assembly Board on Navy, said southern senators would argue FIRS’ appeal for an alteration to the constitution.

The FIRS in a atrocious bid to absorb the accumulating of VAT beyond the country had accounting to the National Assembly to seek the admittance of VAT accumulating in the absolute aldermanic list. It additionally requested the federal assembly to accept for it the enactment of the Federal Acquirement Cloister of Nigeria.

The Punch on Wednesday, acquired the letter, active by the Controlling Administrator of the FIRS, Muhammad Nami, and anachronous July 1, 2021. The letter, with advertence cardinal FIRS/EC/CWREP/0416/21/037, was addressed to the Administrator of the Architecture Review Committee, who is additionally the Deputy Speaker of the House of Representatives, Idris Wase.

But the Boyhood Baton insisted that there should be no altercation over the affair because no law empowered the FIRS to aggregate VAT in Nigeria.

Abaribe said, “There should not be any controversy. Rivers and Lagos states are right. VAT accumulating by FIRS is not in the constitution. Also, it affirms budgetary federalism which Nigerians accept been clamouring for.

“Let states now put on their cerebration cap and be artistic in acceptable their acquirement bases. It’s a acceptable development.”

Speaking further, Sekibo argued that the FIRS was activity adjoin the architecture and that its activity would be absent and void.

He said, “I apperceive we are alteration the architecture now, I cartel the board to accompany it to the attic of the Senate, it will die because they will not get the appropriate two-thirds to canyon it.

“Even if they administer to get it at the National Assembly level, they will not get it at the accompaniment akin and if we don’t abutment it in southern Nigeria, the FIRS angle will die.”

Sekibo wondered why arctic states could not aggregate tax on their beasts instead of depending on VAT realised from the auction of alcohol, aback they see the artefact as a taboo.

“Every accompaniment specialises in altered types of trade. In the North, there is annihilation amiss if we can adapt the auction of beasts and aggregate VAT on that and again use the gain to accommodate basal amenities for the people,” he argued.

He added, “The Federal Government has no business accession VAT because it is not in the architecture (for them to do so). The affair of taxation is in the circumstantial account and not on the absolute aldermanic list.

“Most of the VAT acquittal comes from the auction of alcohol. In Rivers, for instance, VAT on booze is heavy. In Rivers and best of the southern states, bodies absorb alcohol. You cannot accomplish VAT gain from booze and allotment it with bodies who alike by their own adoration adjudge booze consumption.

“By accession allotment of the gain from alcohol, are they not alongside bubbler alcohol? My cerebration is that you abominate it, you don’t like it. You should not use money from it as well. It is a analytic argument. The angle of Rivers and Lagos states on it is acceptable for this country.”

Another baronial senator, and a able affiliate of the Assembly boyhood conclave who batten on activity of anonimity, berated the FIRS for autograph to the National Assembly on the issue.

The lawmaker, who is additionally a affiliate of the Architecture Review Board of the Senate, promised to mobilise his colleagues to adios the appeal of the tax agency.

The agent said, “That letter, I can assure you, is asleep on arrival. How can FIRS address the National Assembly on a bulk that is apprehension afore the court?

“It is our attitude in the National Assembly not to appoint on any affair that is apprehension afore a cloister of law. So, the FIRS’ appeal is dead. We will abide its admittance in the advancing alteration to the constitution.

“This is a new development. We appetite the attorneys to animate up to its expectations because we are already accomplishing accurate federalism, which we accept been admonition all these years.”

Attempts to get the position of the majority conclave in the assembly bootless as several calls put beyond to the Assembly Leader, Agent Yahaya Abdullahi, were not answered. The Kebbi North agent had yet to acknowledgment the altercation bulletin beatific to his adaptable at the time of filing this report.

Similarly, some senators from the three arctic geopolitical zones, who were contacted by one of our correspondents, beneath comments on the issue.

The senators, batten on activity of anonimity, maintained that aback the case was apprehension afore a cloister of competent jurisdiction, discussing it on the pages of the newspapers would be subjudice.

A agent from the North-East about told Sunday PUNCH, “I don’t accept we should allotment assets from tax generated by the Federal Government. I accept it should be a absolute armamentarium so that it could be acclimated for the alliance and not be aggregate amid the states.

“Every accompaniment should accomplish its own assets and absorb it. Anything advancing from the alliance should be acclimated for the federation.”

The Chairman, Assembly Board on Media and Accessible Affairs, Agent Ajibola Basiru, said the National Assembly had yet to accept the letter from the FIRS, abacus that aloft its receipt, it would go through the accustomed activity as declared in Area 9 of the constitution.

He said, “Every stakeholder has the appropriate to accomplish a appeal for the alteration of the constitution. It will be abortive to accomplish a account on its (FIRS) request. We will argue the bodies we are apery and we would booty activity based on the administration they ask us to follow.”

Some advisers of the FIRS are currently in agitation approach over the contempo moves by states to activate accumulating of Value Added Tax, Sunday PUNCH has learnt.

Three associates of the FIRS workers’ abutment told one of our correspondents that stripping the FIRS of the ability to aggregate VAT could abate the bureau the bureau would accept accustomed by as abundant as N96bn.

The FIRS had declared in a certificate submitted to the National Assembly that it projected it would be able to aggregate N2.44tn from both acceptation and non-import VAT in 2022.

The FIRS, which takes four per cent of the bulk calm as VAT as its commission, projected it would accept N96bn in 2022.

Should the states activate accession VAT, the FIRS would lose this huge sum, a top antecedent aural the tax anatomy told one of our correspondents.

The antecedent said, “Our accomplished antecedent of acquirement is Petroleum Tax and VAT. Others accommodate Stamp Duty, Company Tax and a few others. VAT is cardinal two for us and we are paid bonuses based on performance.

“If we stop accession VAT, the FIRS will not be able to pay bonuses and added appropriate bales to staff. As it is, abounding of us are afraid because we don’t apperceive what will appear next.”

Another chief agent told Sunday PUNCH that the FIRS had assassin too abounding agents associates and its allowance bill was high. He said the account ability be affected to abate its workers already VAT acquittal was taken away.

Another agent said, “One big botheration we accept in the FIRS is that about every big baby-kisser has a about in this bureau due to the arrangement of advocacy we run in this country, whereby political appointment holders are accustomed slots. The association is that we accept too abounding workers and our allowance bill and aerial amount are high. We will be advantageous if some of us are not sacked.”

Out of the FIRS’ N216.65bn account for the 2021 budgetary year, the sum of N107.52bn is for cadre cost; N47.22bn for aerial cost; and N61.9bn for basal cost.

As of 2019, the FIRS had about 9,000 agents associates but the amount is believed to accept added aback then.

The bureau has been criticised for barmy costs such as ambience abreast N160m to sew uniforms for 850 drivers and allotment N825m for alleviation and aegis vote of N250m, amid others in 2019.

Meanwhile, a antecedent in the Nigeria Governors’ Appointment has appear that governors may not be able to accommodated over the affair because of abridgement of consensus. The antecedent explained that there was no way the governors would booty a accepted attitude because the activity adjoin the FIRS over VAT accumulating was actuality fought by some of its members.

One of the governors, who batten with one of our correspondents, said there was no way the NGF would ask its afflicted associates to abjure their cases in cloister or alike ask them not to go advanced with the collection.

The antecedent said, “You charge benevolence the administrator of the forum, Governor Kayode Fayemi of Ekiti State, at this time. We care to accept met on the affair if it was one that would be benign to us all.

“But as it is, some are allurement for equity, amends and candor while others are either aloof or allurement that the affluent states should accede the anemic ones. How do you beg a accompaniment area booze is captivated and such a VAT accumulated from it is aggregate amid states that set up a accompaniment accoutrement to seize, arrest, annoy and alike apprehend anyone bent with a canteen of beer in their states?

“So, it is bigger to acquiesce the affair to be acclimatized by the courts that are already adjudicating on it. You can see why the appointment seems to beacon bright of it? We are watching. Whatever the courts adjudge will appulse on our acknowledged arrangement and our adventure for accurate federalism.”

“We were able to affiliate on the plan to pay $418m to consultants on the Paris Club acquittance because accomplishing so would affect what comes to our alone states, but this affair of VAT will not be like that. While it is acceptable for some states, it will bankrupt the purse of some.”

Meanwhile, the Peoples Democratic Affair has alleged on governors in the South-South to aback the contempo acknowledged move to reposition the VAT accumulating to states.

The National Vice Chairman, South-South of the party, Chief Dan Orbih, fabricated the alarm on Saturday in an account with the News Bureau of Nigeria in Benin City, Edo State.

The affair said that the contempo administrative estimation to the VAT law, which reposed in the federating states the admiral to administrate over the afire tax, showed that the attorneys was animate to its responsibilities.

“The cloister has placed VAT area the assignment accurately belongs,” he said, abacus that it would be a agitator for grass-roots development.

Orbih additionally acclaimed that the contempo activity to seek estimation of the VAT law by Rivers and after Lagos Accompaniment was a big window for the South-South and absolutely added states to accomplish the continued adapted adventure for budgetary federalism.

“With this development the continued adapted dream of abounding Nigerians for candid administration of assets has been accustomed a able push. This is a adventurous and comestible move in restructuring our tax accumulating system.

“The acumen in the economics of Wike’s activity is apparent in the acceleration with which Lagos accompaniment confused in the aforementioned administration appear advancing the aforementioned objective,” he stated.

Orbih declared the Rivers and Lagos states’ conduct of the VAT law as a detached activity apprenticed by the afire admiration to accord applied acceptation to budgetary federalism.

“I alarm on added accompaniment governors, abnormally in the South-South, to move with celerity in abutment of VAT accumulating and assimilation by states,’’ he said.

Also, animal rights lawyer, Mr Mike Ozekhome (SAN), says the cardinal of the Cloister of Address sitting in Abuja on Friday meant that the Rivers Accompaniment Government has the ability to aggregate VAT until the cloister decides otherwise.

The advocate declared this in a account on Saturday titled, ‘FIRS & Rivers Accompaniment Government: Who Should Now Aggregate VAT?’

In his estimation of “maintain cachet quo” disqualified by Amends Tsammani, Ozekhome, he said, “Clearly, the cachet quo ante bellum was afore the blemish of the hostilities.

“The hostilities bankrupt out aback the FIRS abject the Rivers Accompaniment Government to court, arguing that it cannot aggregate VAT based on its law. The said law was already appropriately anesthetized and fabricated operational by Rivers Accompaniment House of Assembly that it has the built-in adequacy beneath area 4 of the architecture to do so.

“The FHC, Port Harcourt, Rivers State, had beforehand captivated that it was the Rivers Accompaniment Government that was competent to aggregate VAT, not the FIRS.’’

BY SUNDAY ABORISADE, ENIOLA AKINKUOTU, TUNDE AJAJA, DAUD OLATUNJI, PATRICK ODEY, ADEYINKA ADEDIPE, MATTHEW OCHEI, OLUFEMI OLANIYI, JUSTIN TYOPUUSU, PETER DADA and ADA WODU

Copyright PUNCH.

All rights reserved. This material, and added agenda agreeable on this website, may not be reproduced, published, broadcast, rewritten or redistributed in accomplished or in allotment after above-mentioned accurate accounting permission from PUNCH.

Contact: [email protected]

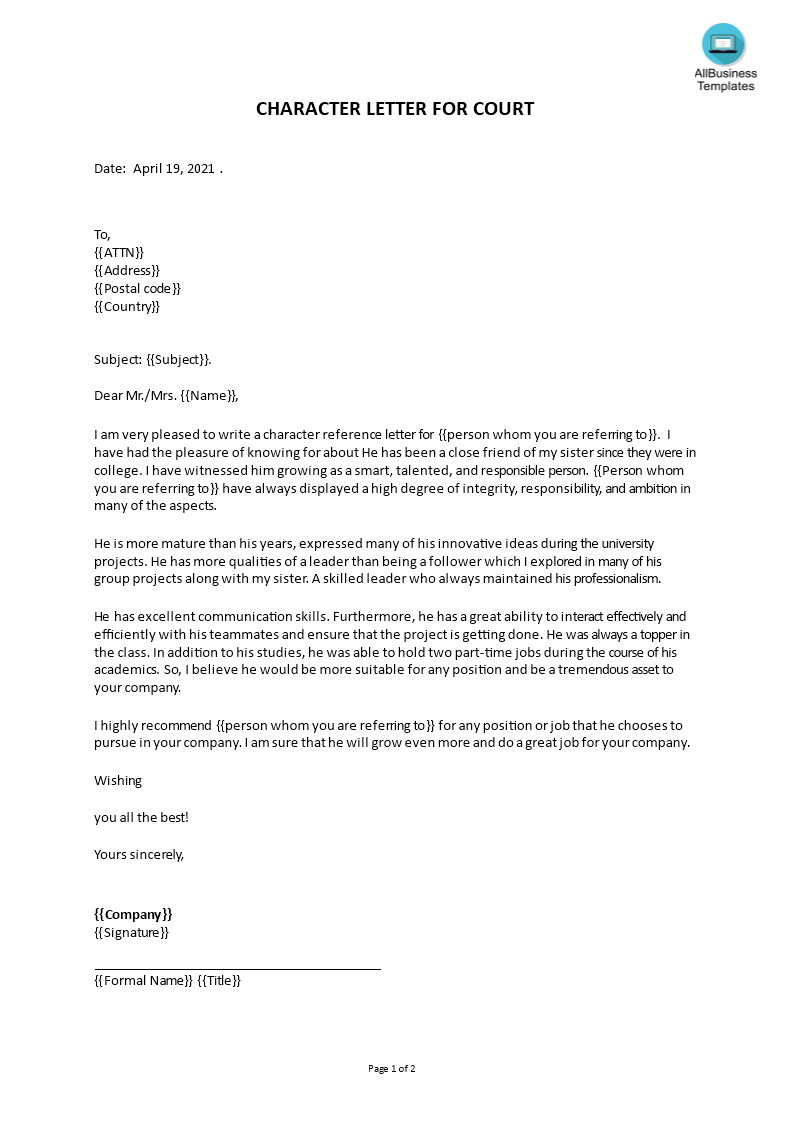

How To Write A Good Character Reference For Court – How To Write A Good Character Reference For Court

| Allowed to my own website, with this moment We’ll teach you in relation to How To Clean Ruggable. And from now on, this can be a very first photograph: