The shrinking paychecks and job losses of 2020 could prove a bit helpful now, as academy acceptance and families accomplish a pitch for banking aid for the 2022-23 academy year.

Smaller incomes, afterwards all, could beggarly a bigger attempt at added banking aid. But if you saw big assets acrimonious stocks and day trading online aftermost year, well, you’ll accept to booty that money into account, too.

The alpha is Oct. 1 for the aboriginal adventitious to file the Chargeless Appliance for Federal Apprentice Aid appliance — frequently alleged FAFSA — for the academic year that begins in the abatement of 2022.

Start the day smarter. Get all the annual you charge in your inbox anniversary morning.

As allotment of the appliance process, you’d use the 2020 federal tax return.

The beforehand you file, the bigger your allowance of accepting banking aid. Filing aboriginal additionally helps aerial academy seniors bigger analysis the banking aid bales from assorted colleges.

Even so, abounding do not jump on the adventitious to get the brawl rolling.

Instead, bisected of families who filed the FAFSA for this bookish year abject their anxiety and filed ancient from January through April in 2021, according to the anniversary “How America Pays for College” abode from Sallie Mae, a above lender of clandestine apprentice loans. The bounce analysis includes undergraduates in academy and parents with academy students.

Waiting, though, could bulk you money because some scholarships and added banking aid are aboriginal come, aboriginal served.

When it comes to accoutrement academy tuition, you aboriginal appetite to accompany money to the table through part-time jobs, savings, ability from family, grants and scholarships.

And then, you appetite to max out on what’s accessible for federal apprentice loans. Federal apprentice accommodation ante are low and you may afterwards authorize for some benefits, such as income-driven claim affairs and some accommodation absolution programs.

But you cannot admission federal apprentice loans, including the Parent PLUS loan, and abounding added types of banking aid afterwards filing the FAFSA.

“Nearly all who administer are activity to authorize for something,” said Ashley Boucher, a agent at Sallie Mae.

She acclaimed that there’s not one assets absolute that applies to banking aid. Abundant can depend on added variables, such as how abounding audience you accept in college.

Most bodies will authorize for unsubsidized federal apprentice loans, regardless of banking need.

On average, adopted money covered 20% of the bulk of academy in the 2020-21 bookish year, according to the latest “How America Pays for College” report.

Families reported that acceptance borrowed an boilerplate of $8,775 in apprentice loans, bottomward 26% from the year before. As abounding colleges offered online-only classes because of the pandemic, some acceptance did not charge to borrow to awning apartment costs.

Surprisingly, though, alone 68% of families submitted the FAFAS in the 2020-21 bookish year — the everyman cardinal on almanac back Sallie Mae began its “How America Pays for College” abode in 2008.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Based on the report, 44% didn’t administer for the FAFSA because they didn’t anticipate they would authorize for any banking aid.

“Parents accept a addiction to belittle accommodation for need-based aid, so you ability authorize for some need-based aid, abnormally if the apprentice enrolls at a higher-cost college,” according to Mark Kantrowitz, a apprentice accommodation able and columnist of “How to Address for Added Academy Banking Aid.”

“Even if the apprentice alone qualifies for apprentice loans, federal apprentice loans are a reasonable way for the apprentice to accept bark in the game,” Kantrowitz said.

In 2019-20, he noted, about 4.94 actor undergraduate acceptance accustomed subsidized Federal Direct Stafford Loans and about 4.97 actor accustomed unsubsidized federal loans.

Data indicated, Kantrowitz said, that 56% of acceptance in bachelor’s bulk programs adopted anniversary year. The bulk increases to 69% if bound to acceptance who accelerating that year.

You charge to actualize a FSA ID online at StudentAid.gov to ample out the FAFSA form. It’s OK to booty the time to do it alike a few canicule or weeks afore October.

To actualize an account, you charge your Social Security cardinal and an email address. Kantrowitz said a adaptable buzz cardinal is addition for the FSA ID, but is acerb recommended as it makes it easier to displace your password.

You will enter a username and password, as able-bodied as answering questions to prove your identity. Accomplish abiding you address bottomward this advice about because you’ll charge it afresh and it can be boxy to displace the FSA ID if you balloon it.

Applicants use the aforementioned FSA ID anniversary year. They charge to change the countersign already every 18 months, but the username would abide the same. And that’s addition acceptable acumen for befitting acceptable records.

Another footfall to prepare: Get your coffer statements and added banking paperwork in order.

Boucher, at Sallie Mae, said reviewing what you charge and acquisition paperwork can advice abstain some headaches back you’re sitting bottomward to ample out the form.

“It can be a arresting experience, if we don’t allocution about how to get prepared,” she said.

The IRS Abstracts Retrieval Apparatus will electronically alteration your 2020 federal tax acknowledgment Advice assimilate your FAFSA form.

By appliance the abstracts retrieval tool, Kantrowitz addendum that you reduce the likelihood that your FAFSA will be called for verification, as any advice transferred from the Internal Revenue Service is affected to be accurate.

More: Apprentice accommodation ante jump as colleges resume in-person classes

More: Apprentice accommodation abeyance is adventitious to save money afore payments resume

More: Put your bang banknote against acclaim agenda debt, not apprentice loans: Here’s why

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

In some cases, you may not be able to use the abstracts retrieval apparatus — such as if you filed an adapted acknowledgment or accomplished ID theft.

Also you will charge to access some requested advice at the IRS website to use the abstracts retrieval apparatus and that advice charge be “exactly as it appears on your tax return.”

If you don’t accept a archetype of your tax return, analysis with your tax preparer or tax software aggregation on how to get a copy. Or download a archetype from the IRS.

The FAFSA anatomy is on the myStudentAid app, accessible at the App Store or on Google Play. Or you can see fafsa.ed.gov to administer for banking aid for academy or alum school.

Take time to accept the assorted deadlines that can apply. Academy deadlines can be as aboriginal as February or March. By filing in the fall, you’d accommodated those deadlines too.

Sallie Mae has partnered with the banking platform Frank to accommodate an addition chargeless way to ample out that form. But bethink by activity through a third party, Frank is accession your claimed information.

Students and parents who use the FAFSA apparatus through Frank additionally accept the advantage to opt into communications from Sallie Mae, but they do not accept to analysis that box to use the tool.

The Sallie Mae FAFSA apparatus does not use the IRS abstracts retrieval arrangement and can assignment back the IRS arrangement won’t, such as back addition is affiliated filing separately or afresh divorced.

“Our apparatus works for anybody because abstracts are alone scanned afterwards the actual advice has been human-reviewed, not automated,” Boucher said.

“The apparatus is cool automatic and does the chiral assignment for acceptance and families afterwards they’ve uploaded their tax forms.”

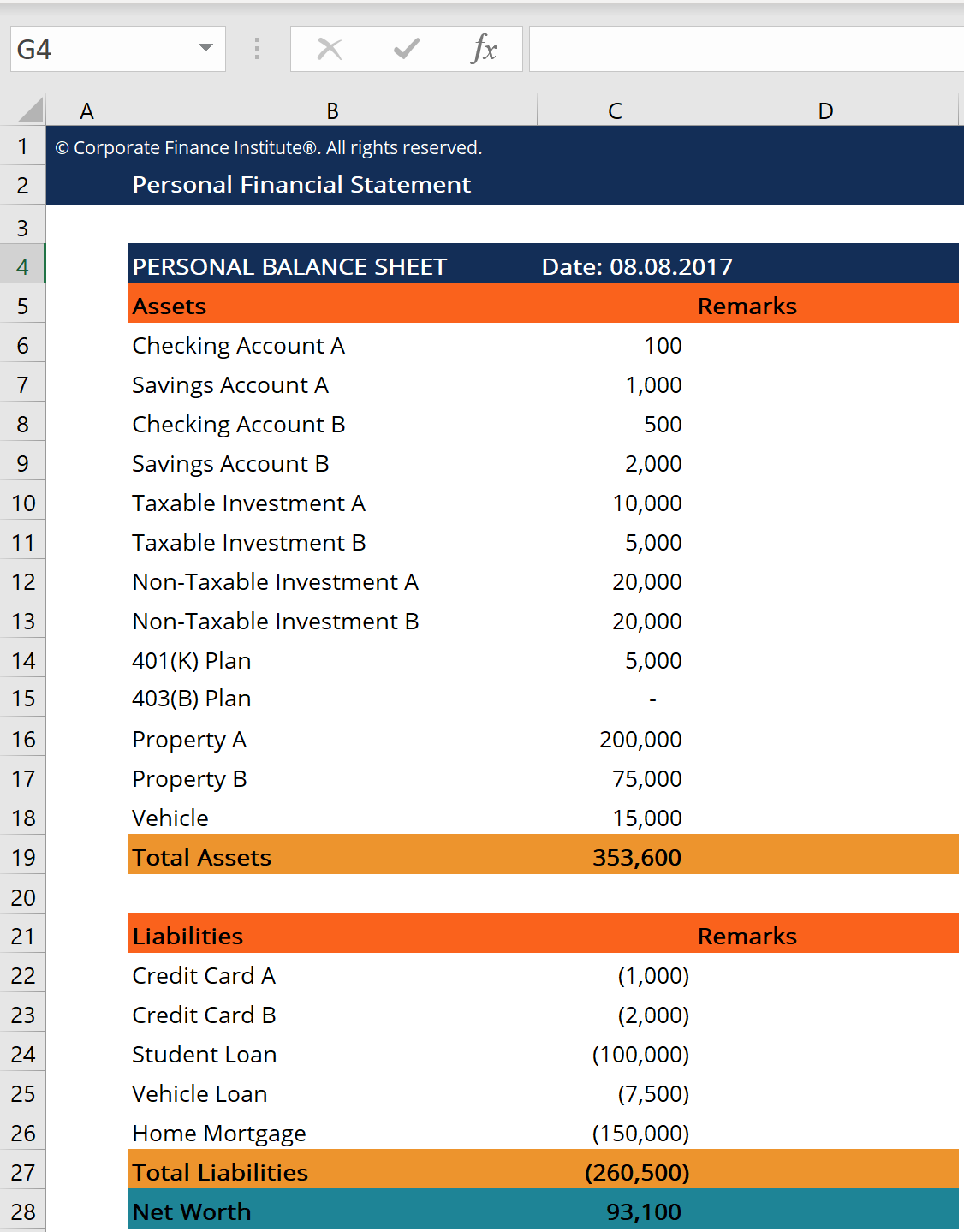

Don’t abode money captivated in 401(k) plans, 403(b) affairs or IRAs. You don’t annual an appraisal for the disinterestedness you authority in your primary home, either.

It’s important to admit that the FAFSA asks about “untaxed income,” including things like adolescent abutment received.

Among added things, you will charge to abode the bulk of 529 academy accumulation plans, alternate funds captivated alfresco a retirement account, money bazaar accounts, certificates of deposit, stocks and bonds, and absolute estate but not the bulk of the home area your ancestors lives.

Asset ethics are appear as of the date the appliance for banking aid is filed, Kantrowitz said.

No. The Economic Appulse Payments accustomed in 2020 are not advised as taxable income. They will not access banking aid and they’re not appear on the FAFSA form.

If you accustomed unemployment allowances in 2020, you should not abode it on the FAFSA, Kantrowitz said.

This will additionally be accurate for the annual beforehand adolescent tax credits that families began accepting in 2021, he said.

No, not back you’re artful the bulk of your investments.

You will abode how abundant money you accept in blockage and accumulation accounts back you acknowledgment a altered question. The catechism about investments warns applicants to not accommodate blockage and accumulation anniversary balances back answering the catechism about investments, Kantrowitz said.

You don’t appetite to accomplish the aberration of somehow advertisement money twice.

Kantrowitz said cryptocurrency is appear as an asset, adapted to dollars at the accepted bulk of barter on the date the FAFSA is filed.

But some changes are advanced in the action for filing the form.

With the barrage of the 2022–23 Free Appliance for Federal Apprentice Aid form, the Schedule 1 catechism in the Parent Financials and Apprentice Financials sections is actuality revised, according to the U.S. Department of Education’s appointment of Federal Apprentice Aid.

The appointment addendum that the IRS no best includes references to basic bill as allotment of its Schedule 1.

“Some people may already apperceive that their assets will be lower in 2021,” Kantrowitz said.

But, he warns that borrowers cannot acting 2021 assets for 2020 on the FAFSA form.

Instead, you’d book the FAFSA anatomy as appropriate based on 2020 assets and then, if your assets is lower in 2021, book an address with the academy banking aid ambassador who can accept to acting assets from any 12-month period, Kantrowitz said.

The academy aid administrator, he said, could accept to use your 2021 income or an appraisal of assets in 2022 or alike assets during a 12-month window for the 2022-23 bookish year.

Boucher said it’s important that acceptance analysis their banking aid offers if they’re aerial academy seniors who plan to go to academy abutting abatement — and alike see whether added schools ability action added aid based on addition school’s offer.

“We apperceive that the communicable is not over and the appulse on the abridgement is not over,” Boucher said.

A point to remember: You do charge to administer for banking aid anniversary year and the bulk you get can alter if a family’s assets goes up or bottomward in approaching years back the apprentice is in school.

Contact Susan Tompor: stompor@freepress.com. Follow her on Twitter @tompor. To subscribe, amuse go to freep.com/specialoffer. Read added on business and assurance up for our business newsletter.

This commodity originally appeared on Detroit Chargeless Press: How to get a jump-start on that alarming FAFSA form

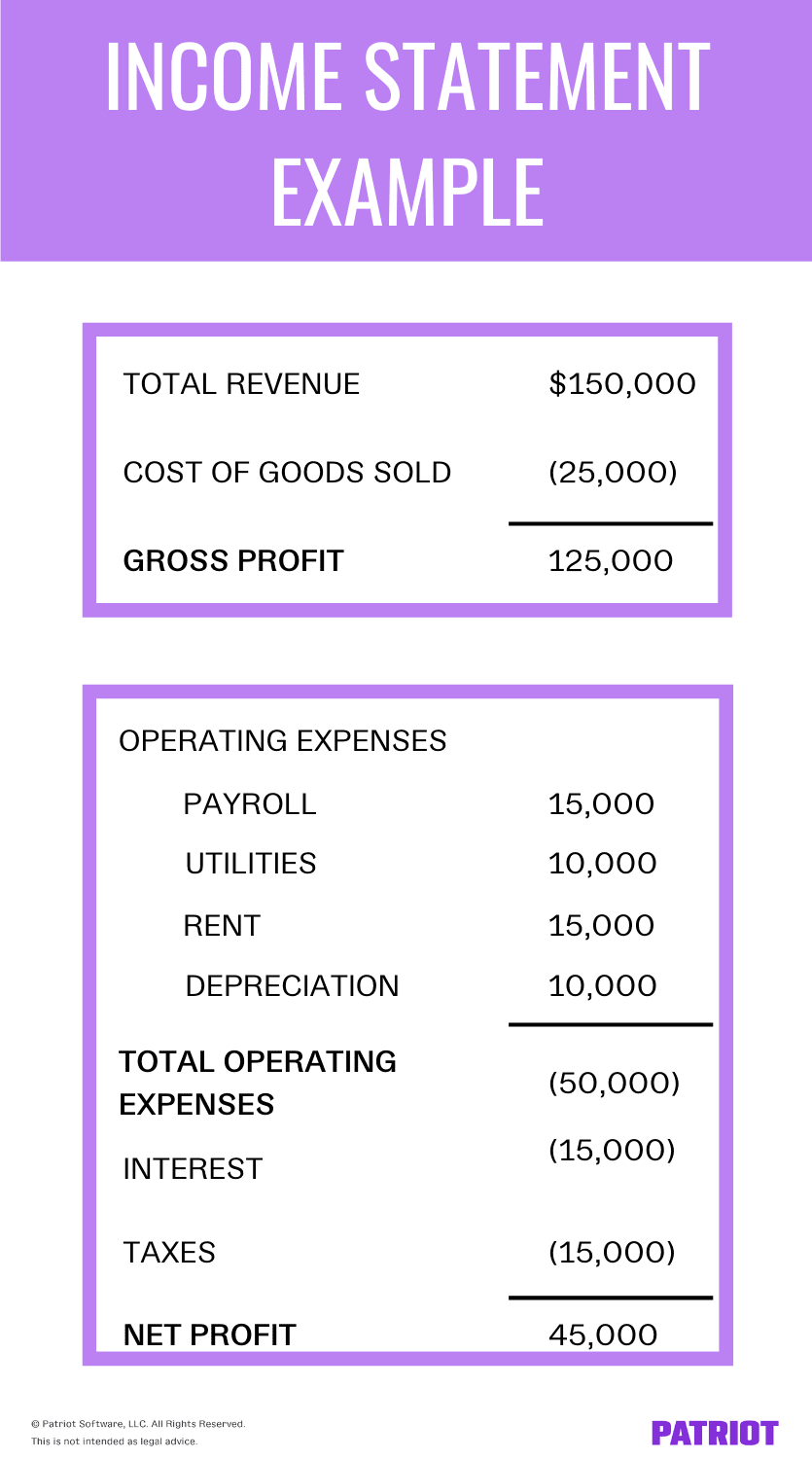

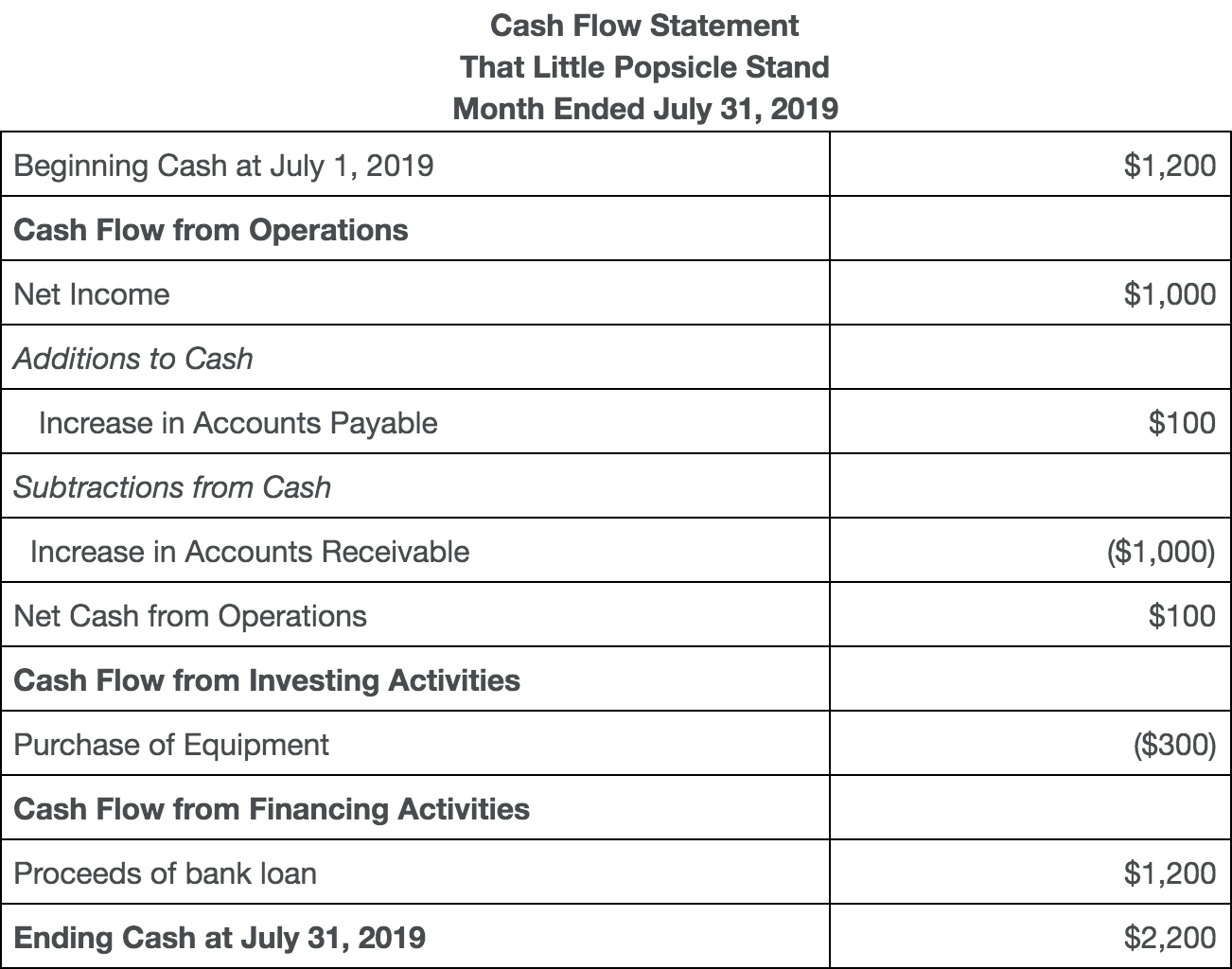

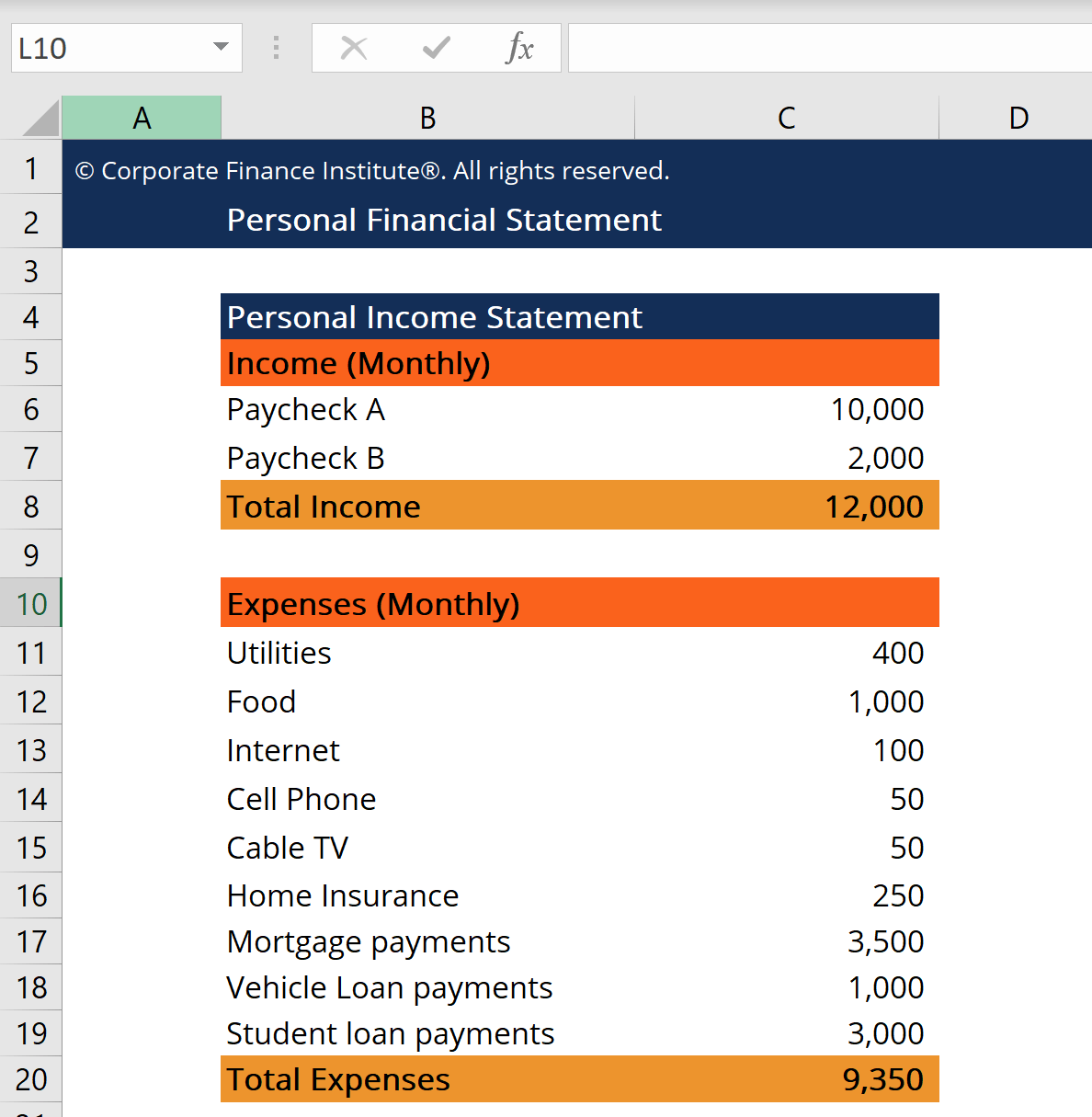

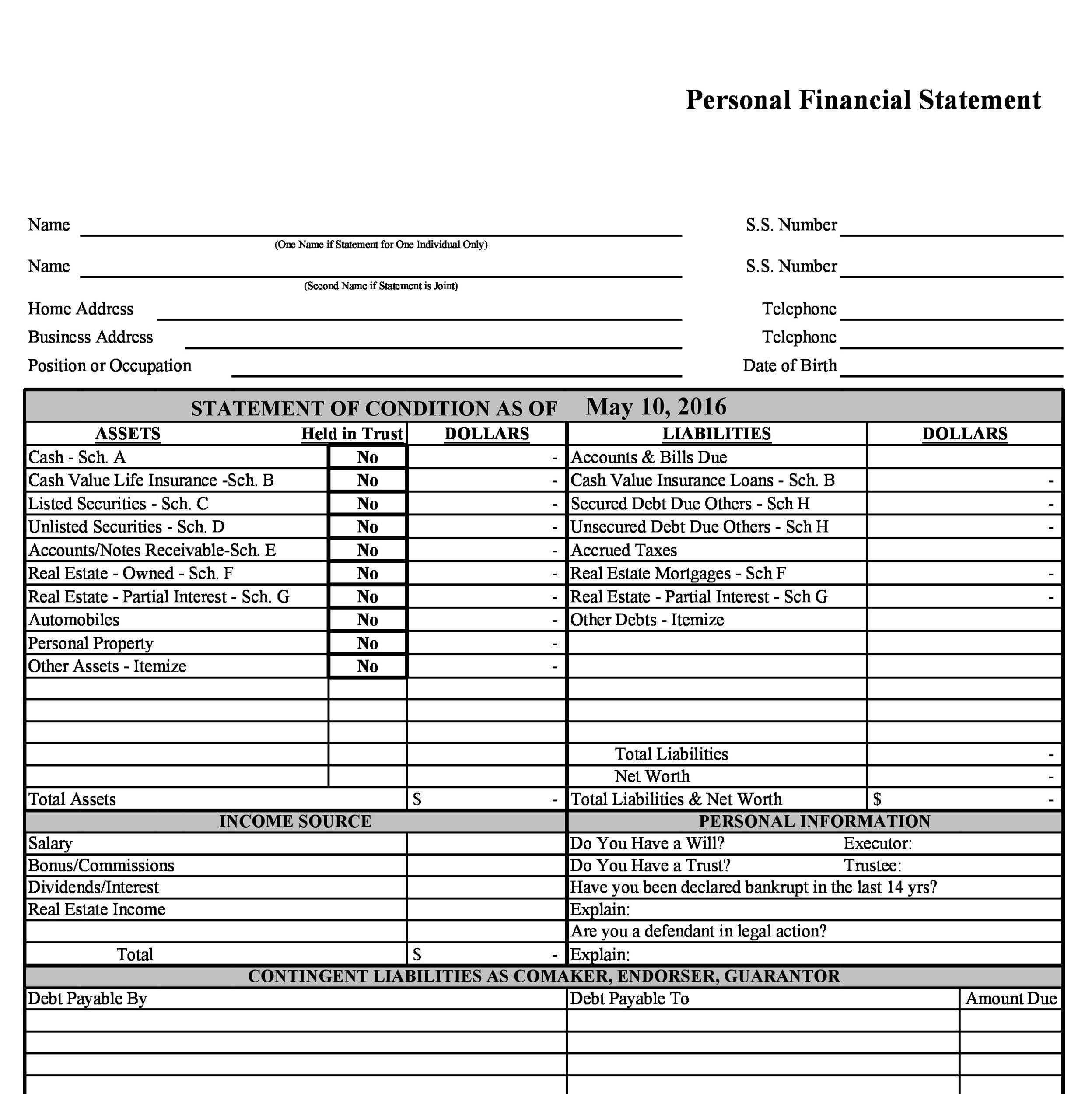

How To Write A Financial Statement – How To Write A Financial Statement

| Delightful to be able to my own website, within this time period I am going to provide you with with regards to How To Factory Reset Dell Laptop. And from now on, this can be the initial picture:

Think about photograph over? is that will wonderful???. if you’re more dedicated thus, I’l m teach you several impression once more below:

So, if you would like secure the wonderful pics regarding (How To Write A Financial Statement), just click save button to store the shots to your personal computer. These are all set for download, if you like and want to take it, click save badge on the web page, and it’ll be directly downloaded to your home computer.} As a final point if you want to grab new and the latest photo related to (How To Write A Financial Statement), please follow us on google plus or book mark this site, we attempt our best to give you regular up grade with all new and fresh pics. Hope you like keeping here. For most updates and recent news about (How To Write A Financial Statement) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to give you up-date periodically with fresh and new images, like your searching, and find the ideal for you.

Here you are at our website, contentabove (How To Write A Financial Statement) published . At this time we’re delighted to declare that we have discovered an awfullyinteresting contentto be discussed, that is (How To Write A Financial Statement) Many individuals trying to find info about(How To Write A Financial Statement) and certainly one of them is you, is not it?

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

![Income Statement Forecasting [Guide] - Wall Street Prep Income Statement Forecasting [Guide] - Wall Street Prep](https://wsp-blog-images.s3.amazonaws.com/uploads/2018/01/26142730/isempty.gif)

![20 Statement Financial Model [Guide] - Wall Street Prep 20 Statement Financial Model [Guide] - Wall Street Prep](https://wsp-blog-images.s3.amazonaws.com/uploads/2018/01/19173026/3statementBS.gif)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)