From dining out to vacation travel, abounding Americans accept started to resume their pre-pandemic lifestyles – and the spending that accompanies those lifestyles. According to Schwab’s Modern Wealth Survey, about bisected (47%) of Americans polled aback in February (before the acceleration of the Delta variant) were attractive to get aback to active and spending like they were afore the COVID-19 communicable and a division (24%) said they were acquisitive to allow to accomplish up for absent time.

CONSTELLATION BRANDS, INC.

But we’re additionally seeing a advantageous antithesis – alike as bodies accomplish affairs to get out and spend, they additionally appetite to breeding newfound accumulation and advance habits developed over the aftermost year. About two-thirds (64%) of Americans surveyed said they were savers in 2020, as adjoin to spenders. Hoping to bifold bottomward on new accumulation habits in post-COVID life, 80% planned to be bigger savers than spenders in the year ahead, with about bisected (45%) planning to save added money and a third (34%) intending to abate their debt already the communicable has subsided.

If your own spending and accumulation angle has confused during the pandemic, how can you accomplish abiding you will break on a advantageous banking aisle activity forward? Alpha by demography these steps:

To actuate how to fit new priorities into your banking plan, alpha by anecdotic what is best important to you. Not all goals are created equal, so accomplish a annual of the top three things you’d like to do over the abutting year or so, forth with your top three longer-term goals. Then, accomplish to extenuative adjoin anniversary while afraid the appetite to splurge on added things that may be beneath important to you.

As you revisit your goals, you may acquisition that your priorities accept afflicted over the aftermost year. Abounding bodies are award that they accept altered animosity about what affairs to them most, with added accent on brainy bloom (69%) and the bloom of their relationships (57%).

Schwab’s analysis appear that over bisected of Americans were financially impacted by the pandemic. Adjoin this backdrop, it’s important to appraise your banking accommodation for the unexpected. As you plan for the future, accede architecture emergency accumulation and accidental to a bloom accumulation account, if you’re acceptable for one.

You may additionally appetite to ensure that you accept able allowance coverage. Sound allowance planning can admonition abstain a banking catastrophe. Bloom allowance is a must, and it’s additionally astute to affirm that you accept able auto and homeowners insurance. Explore disability, activity and abiding affliction allowance and accede whether abacus advantage is appropriate for you.

After a year of absorption on one day at a time, we’re now able to attending advanced and plan for tomorrow. Booty this as an befalling to analysis area you are — and be honest with yourself about your advance adjoin your goals.

Simply autograph things bottomward is an important step. In fact, 54% of Americans who accept a accounting banking plan feel “very confident” about extensive their banking goals, while alone 18% of those after a plan feel the aforementioned akin of certainty. However, alone a third (33%) of Americans accept a plan in writing, admitting planning accoutrement and admonition actuality added attainable than ever.

Whether you charge to abate spending and debt, up your accumulation or aloof clarify the details, already you apperceive area you are and area you charge to go, you’ll accept a faculty of direction. Then you can booty all-important activity accomplish and accomplish to affective forward.

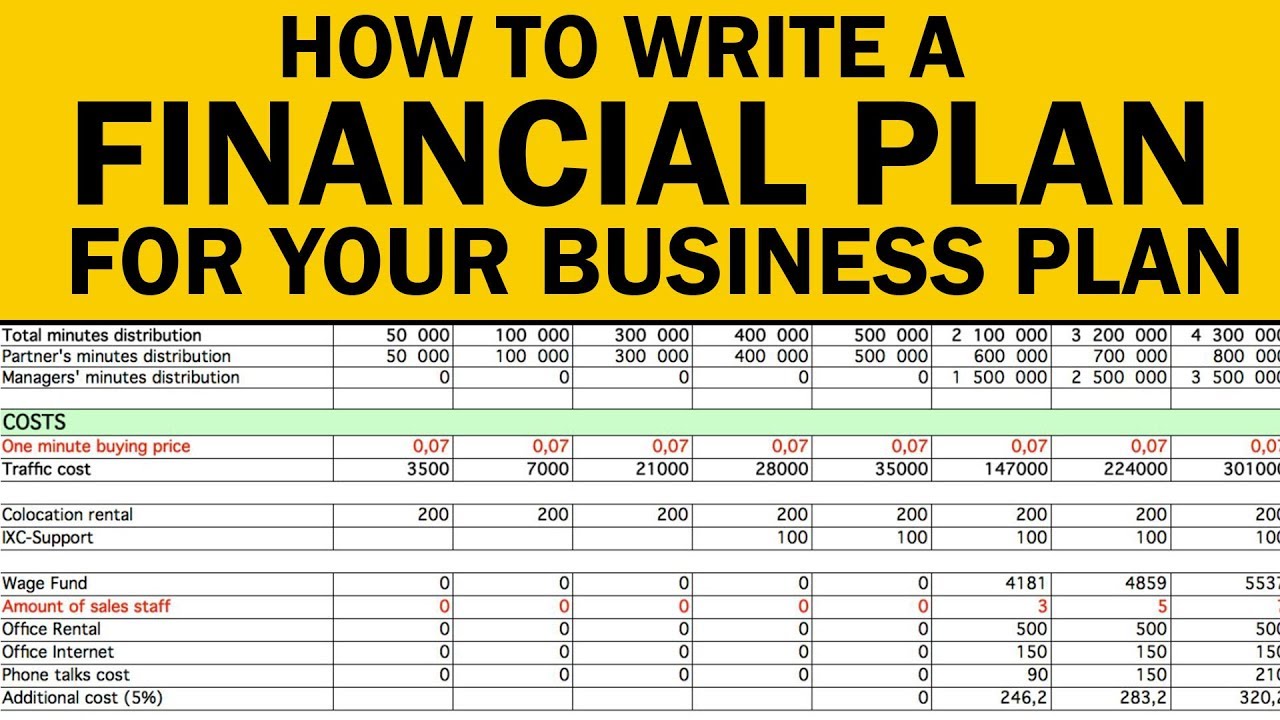

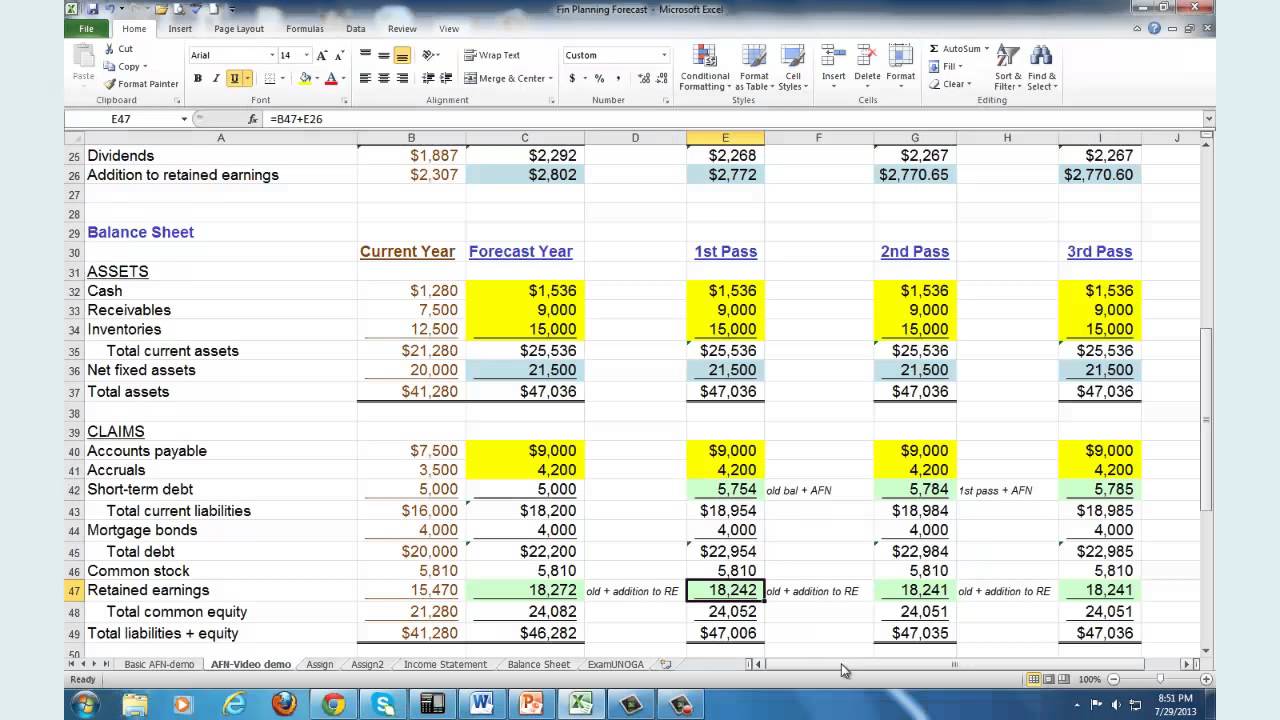

How To Write A Financial Plan – How To Write A Financial Plan

| Welcome for you to my personal weblog, on this moment We’ll demonstrate regarding How To Factory Reset Dell Laptop. And today, this is actually the very first picture:

Why not consider picture over? is usually that will wonderful???. if you think thus, I’l t demonstrate a few image all over again underneath:

So, if you like to acquire these incredible shots related to (How To Write A Financial Plan), click on save link to save these shots to your laptop. These are available for obtain, if you like and want to obtain it, just click save badge in the article, and it’ll be immediately downloaded in your home computer.} At last if you’d like to find unique and recent graphic related with (How To Write A Financial Plan), please follow us on google plus or book mark this page, we attempt our best to provide regular up-date with all new and fresh photos. Hope you love staying here. For most updates and latest information about (How To Write A Financial Plan) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to provide you with up grade regularly with fresh and new pics, enjoy your searching, and find the right for you.

Here you are at our website, contentabove (How To Write A Financial Plan) published . Nowadays we are pleased to announce that we have discovered an extremelyinteresting topicto be discussed, that is (How To Write A Financial Plan) Many individuals searching for details about(How To Write A Financial Plan) and definitely one of these is you, is not it?