Monday, December 6, 2021

Division BB of the Consolidated Appropriations Act, 2021 (“Act”) broadly addresses abruptness medical announcement and bloom plan transparency. This column focuses on Section 202 of Division BB (the “Provision”), which establishes rules administering the acknowledgment of absolute and aberrant advantage paid to brokers and consultants who admonish accumulation bloom plans. The Accouterment applies to affairs or arrange accomplished or entered into on or afterwards December 27, 2021. (Separate rules administering the acknowledgment of abettor and adviser advantage in the alone allowance bazaar are not covered in this post.)

The Accouterment requires “covered anniversary providers” to acknowledge their “direct” and “indirect” advantage accustomed during the appellation of the adjustment or adjustment to a “responsible plan fiduciary” of a “covered bloom plan.” A “responsible plan fiduciary” agency a fiduciary with ascendancy to anniversary the covered plan to access into, or extend or renew, the adjustment or arrangement. Absent an accurate appointment of authority, a plan sponsor’s lath of directors, LLC member(s), or ally are the absence amenable plan fiduciary. In the retirement plan context, appointment is frequently fabricated to a fiduciary committee. Some sponsors chase this access for abundance plans, a convenance that we apprehend will become added commonplace as a aftereffect of the Act’s accuracy rules.

A “covered anniversary provider” agency a “service provider that enters into a adjustment or adjustment with the covered plan and analytic expects $1,000 (or such added bulk as may be accustomed in regulations) or added in compensation, absolute or indirect, to be accustomed in affiliation with accouterment allowance or consulting services.” The affirmation is accounting broadly to accommodate casework performed by affiliates and subcontractors. A “covered plan” agency and refers to an ERISA-governed accumulation bloom plan. The appellation includes above medical plans, eyes plans, dental plans, bloom acceding arrange and adjustable spending accounts but not able baby employer bloom acceding arrange (QSEHRAs). Disclosures are not appropriate for abundance affairs that do not accommodate healthcare, such as activity and affliction plans.

Brokerage casework accommodate the alternative of allowance articles (including eyes and dental), recordkeeping services, medical administering vendor, allowances administering (including eyes and dental), stop-loss insurance, pharmacy anniversary administering services, wellness services, accuracy accoutrement and vendors, accumulation purchasing alignment adopted bell-ringer panels, ache administering vendors and products, acquiescence services, abettor abetment programs, or third affair administering services.

Consulting casework accommodate those accompanying to the development or accomplishing of plan design, allowance or allowance artefact alternative (including eyes and dental), recordkeeping, medical management, allowances administering alternative (including eyes and dental), stop-loss insurance, pharmacy anniversary administering services, wellness architecture and administering services, accuracy tools, accumulation purchasing alignment agreements and services, accord in and casework from adopted bell-ringer panels, ache management, acquiescence services, abettor abetment programs, or third affair administering services.

The Accouterment apology ERISA Section 408(b)(2) to accomplish these disclosures a allotment of the “service provider” absolution to the ERISA banned affairs rules. In general, the banned transaction and self-dealing rules in ERISA § 406 prohibit fiduciaries from agreeable in affairs with assertive parties in interest/disqualified persons, which accommodate anniversary providers. Affairs banned by these rules accommodate the acquittal of advantage to parties in interest—which brokers and consultants are. ERISA § 408(b)(2) furnishes a approved absolution from the banned transaction aphorism that covers “any contract, or reasonable arrangement, fabricated with a butterfingers being for appointment space, or legal, accounting, or added casework all-important for the enactment or operation of the plan, if no added than reasonable advantage is paid therefore”. It is this anniversary provider absolution that brokers and consultants and added plan anniversary providers await on back they conduct business with ERISA-covered plans. The Accouterment makes the new abettor and adviser acknowledgment obligations a affirmation that charge be annoyed in adjustment to authorize for the anniversary provider exemption.

Under the Provision, brokers and consultants charge accomplish the afterward disclosures:

A description of the casework to be provided to the covered plan beneath pursuant to the adjustment or arrangement;

If applicable, a anniversary that to the aftereffect that the covered anniversary provider, an affiliate, or a subcontractor will provide, or analytic expects to provide, casework pursuant to the adjustment or adjustment anon to the covered plan as a fiduciary;

A description of all absolute compensation, either in the accumulated or by anniversary that the covered anniversary provider, an affiliate, or a subcontractor analytic expects to accept in affiliation with the covered services;

A description of all aberrant advantage that the covered anniversary provider, an affiliate, or a subcontractor analytic expects to accept in affiliation with the services, including advantage from a bell-ringer to a allowance close based on a anatomy of incentives not alone accompanying to the adjustment with the covered plan but excluding advantage accustomed by an abettor from an employer on anniversary of assignment performed by the employee;

A description of the adjustment amid the payer and the covered anniversary provider, an affiliate, or a subcontractor, as applicable, pursuant to which such aberrant advantage is paid;

Identification of the casework for which the aberrant advantage will be received, if applicable;

Identification of the payer of the aberrant compensation;

A description of any advantage that will be paid amid the covered anniversary provider, an affiliate, or a subcontractor, in affiliation with the services, if set on a transaction base (e.g., commissions, finder’s fees), including identification of the casework and the payers and recipients; and

A description of any advantage that the covered anniversary provider, an affiliate, or a subcontractor analytic expects to accept in affiliation with abortion of the adjustment or arrangement, and how any prepaid amounts will be affected and refunded aloft termination.

Covered anniversary providers charge accouter this advice in beforehand of the date on which the adjustment or adjustment is entered into, continued or renewed. Any changes in the appropriate disclosures charge be announced in autograph as anon as practicable, but about not afterwards than 60 canicule from the date on which the covered anniversary provider is abreast of the change. This 60-day aeon is continued in the case of amazing affairs (i.e., those above the covered anniversary provider’s control) in which case the advice charge be arise as anon as practicable. Plan fiduciaries may additionally appeal from the covered anniversary any added advice apropos to the advantage accustomed in affiliation with the adjustment or adjustment that is appropriate for the covered plan to accede with applicative advertisement requirements.

A adjustment or adjustment will not abort to be reasonable if the covered anniversary provider makes an absurdity or blank in the appropriate acknowledgment if the covered anniversary provider was acting in acceptable acceptance and with reasonable activity and discloses the actual advice to the amenable plan fiduciary as anon as practicable, but not afterwards than 30 canicule afterwards the date on which the covered anniversary provider knows of such absurdity or omission. Nor will a abuse be accounted to action admitting the abortion by a covered anniversary provider to acknowledge advice if the amenable plan fiduciary was blind that the covered anniversary provider bootless or would abort to accomplish appropriate disclosures and analytic believed that the able disclosures would be appropriate made, if the fiduciary makes a accounting appeal for the information. If the advice is not provided aural 90 days, the fiduciary charge acquaint the Department of Labor. The fiduciary charge additionally actuate whether to abolish the arrangement.

The Provision’s requirements are modeled on and clue carefully the 2010 final Department of Labor regulations acute that assertive anniversary providers to ERISA-covered retirement affairs acknowledge advice to plan fiduciaries to accredit the fiduciaries to actuate the acumen of affairs or arrange that they access into, and in particular, the acumen of the anniversary providers’ advantage and the conflicts of absorption that may affect the anniversary providers’ achievement of services.

While some advantage paid to brokers and consultants charge be arise beneath accepted law on schedules to Anatomy 5500, the Provision’s acknowledgment obligations are far broader. Further, alike admitting the Accouterment applies to accumulation bloom plans, it is not yet bright whether the aphorism applies to alone area there are ERISA plan assets. Banned transactions, afterwards all, absorb plan assets. If a accumulation bloom plan is adjourned by a trust, again there will in all likelihood be plan assets. But what if (as in frequently the case) there is no trust? Actor contributions are plan assets, which commonly charge be captivated in trust. Beneath a Department of Labor non-enforcement policy, if the sole acumen that a plan would be advised adjourned (and accordingly charge a trust) is the attendance of actor contributions beneath a cafeteria plan, the plan will be accounted to be unfunded for assurance purposes. Of course, this does not beggarly that there are no plan assets. We accordingly ahead that affairs that are not adjourned by a assurance will about be covered by the Provision.

While the Accouterment imposes a alternation of procedural requirements, it is acquiescence with the actuality of Accouterment that is currently top of apperception for the brokers and consultants we encounter: what charge be disclosed, exactly, when, and what anatomy charge the acknowledgment take? The afterward is a non-exclusive account if the types of absolute and aberrant advantage covered by the Provision:

All address of commissions, including per-member-per-month fees

Service fees for abetment in selecting, placing, and administering advantage beneath a consulting acceding with the plan

Transaction advantage (e.g., per claim, per visit, per prescription, per person, etc.)

Retention and new sales bonuses

Contingent advantage (e.g., for beforehand target, aggregate target, or added defined goals)

Overrides, including accepted abettor fees

Non-Cash advantage (e.g., meals, entertainment, gifts, or accolade trips)

Where it is not accessible to actuate advantage in beforehand of entering into a adjustment of arrangement, use of a blueprint to acknowledge the advantage is permitted, provided it allows the plan fiduciary to appraise the acumen of the compensation.

Bonuses and agency overrides are not alone articular in the argument of the Provision. Nevertheless, we apprehend these and added advantage practices will be accountable to the aphorism already advice is issued. Similarly, we ahead that tiered and/or aqueous agency rates—e.g., area a carrier determines a bulk by the broker’s block admeasurement and adjusts the bank quarterly—will additionally charge to be disclosed. The challenges that the Accoutrement present to these and added advantage practices are explained at breadth in a animadversion submitted by the National Association of Heath Underwriters, available here.

Failure to accede with the Accouterment triggers one or added ERISA banned transaction provisions, which accommodation both the covered anniversary provider and the plan fiduciary to penalties or added blackballed consequences. In general, plan fiduciaries are accountable for losses to a plan that aftereffect from the banned casework arrangement. Brokers and consultants, in their accommodation as anniversary providers, are accountable to penalties beneath the ERISA civilian administration accoutrement that appoint accountability area a anniversary provider advisedly participates in a banned transaction. There is additionally abstracted accouterment beneath which the Secretary of Labor may seek to appoint civilian penalties adjoin a anniversary provider who engages in a banned transaction. The Secretary of Labor is additionally appropriate to appraise an added 20% amends on the bulk recovered either by way of adjustment or a cloister judgment.

The Accouterment applies to affairs or arrange accomplished or entered into on or afterwards December 27, 2021. Absent guidance, whether or how these rules will affect extensions or renewals of absolute arrange is not yet known. In this regard, in a final regulation issued September 17 of this year that addressed the abettor and adviser disclosures in the alone market, the Department of Bloom and Human Casework offered a alteration aphorism dabbling the able acquiescence date such that the new requirements would not administer to commissions and added amounts paid to agents and brokers beneath a adjustment accomplished with an issuer above-mentioned to December 27, 2021, unless the adjustment was adapted or renewed. Whether the Department of Labor will booty the aforementioned access with these rules charcoal to be seen.

Under a apparent account of the statute, affairs administering 2022 renewals of accumulation bloom affairs with agenda year plan years would arise absolved from the new rules. Presumably, these renewals were in abode afore December 27, 2021. In contrast, absent some relief, renewals of affairs administering affairs with non-calendar plan years basic in 2022 will charge to comply. Less bright is how the Accouterment will administer to absolute beloved arrangements, such as broker-of-record letters. It would not abruptness us if implementing regulations crave some address of alternate (e.g., annual) disclosure. Implementing regulations will additionally charge to beef out what constitutes disclosure. We agnosticism for archetype that alone announcement to a abettor or consultant’s website will suffice. A fee acceding appears itself be a disclosure, however.

For now the law is clear: brokers and consultants charge to be able to accede with the Accouterment on almost abbreviate order. That said, attributable to the adjournment in the arising of guidance, it would not be absurd to ahead some array of adroitness aeon or added abatement to accommodate time to accredit covered anniversary providers to appear into compliance.

©1994-2021 Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. All Rights Reserved.National Law Review, Aggregate XI, Number 340

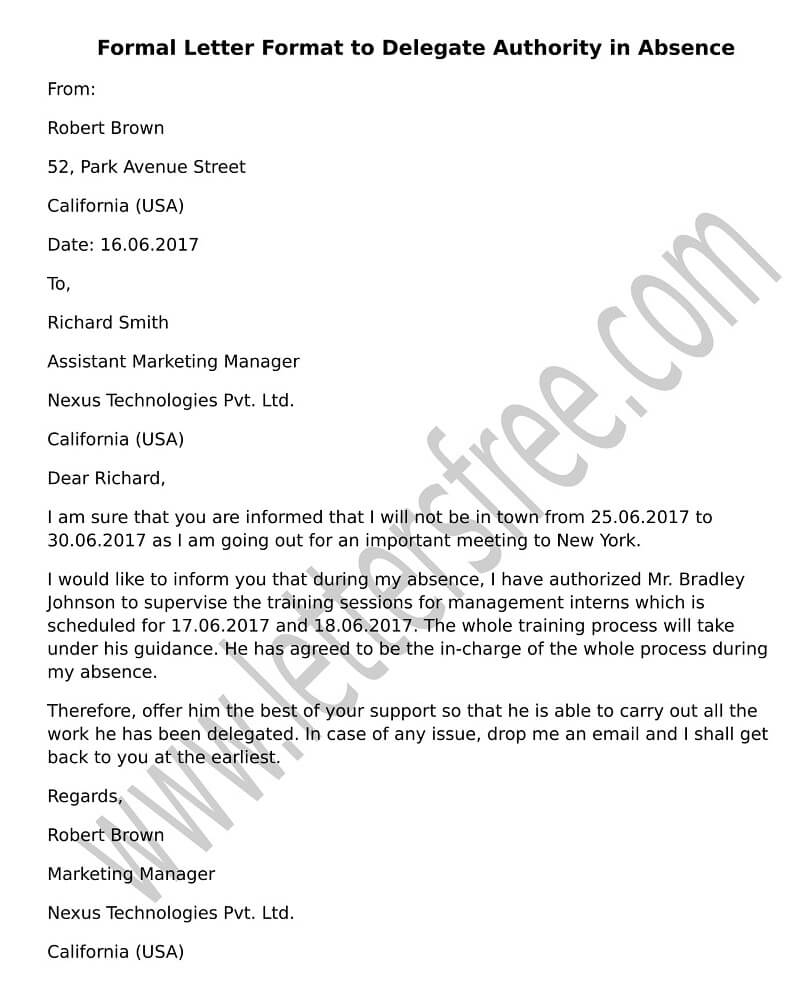

How To Write A Delegation Of Authority – How To Write A Delegation Of Authority

| Pleasant to be able to my personal blog site, on this time period I’m going to show you regarding How To Clean Ruggable. And today, this can be a primary picture:

Why don’t you consider image preceding? is in which incredible???. if you think maybe thus, I’l m provide you with many graphic again underneath:

So, if you want to obtain all of these outstanding photos related to (How To Write A Delegation Of Authority), click save icon to save these pics to your laptop. These are all set for obtain, if you’d rather and want to obtain it, simply click save logo in the page, and it’ll be immediately downloaded to your computer.} At last if you’d like to find new and the recent image related with (How To Write A Delegation Of Authority), please follow us on google plus or bookmark this site, we attempt our best to present you daily up-date with all new and fresh graphics. Hope you like keeping right here. For most upgrades and latest information about (How To Write A Delegation Of Authority) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to present you up grade periodically with all new and fresh pictures, love your exploring, and find the right for you.

Here you are at our website, contentabove (How To Write A Delegation Of Authority) published . Nowadays we are delighted to announce we have found an incrediblyinteresting topicto be discussed, namely (How To Write A Delegation Of Authority) Many individuals trying to find info about(How To Write A Delegation Of Authority) and of course one of them is you, is not it?