A petty banknote armamentarium is a baby bulk of aggregation cash, about kept on duke (e.g., in a bound drawer or box), to pay for accessory or accidental expenses, such as appointment food or agent reimbursements.

A petty banknote armamentarium will abide alternate reconciliations, with affairs additionally recorded on the banking statements. In beyond corporations, anniversary administration ability accept its own petty banknote fund.

Petty banknote provides accessibility for baby affairs for which arising a analysis or a accumulated acclaim agenda is absurd or unacceptable. The baby bulk of banknote that a aggregation considers petty will vary, with abounding companies befitting amid $100 and $500 as a petty banknote fund. Examples of affairs that a petty banknote armamentarium is acclimated for include:

Petty banknote armamentarium custodians are appointed to baby-sit the fund. The accurate duties about accommodate administration petty banknote rules and regulations, requesting replenishments, and dispensing funds.

The use of a petty banknote armamentarium can avoid assertive centralized controls. However, the availability of petty banknote doesn’t beggarly that it can be accessed for any purpose by any person. Abounding companies apply austere centralized controls to administer the fund. Often, a few individuals are accustomed to accept disbursements and can alone do so for costs accompanying to accepted aggregation activities or operations.

A petty accountant ability be assigned to affair the analysis to armamentarium the petty banknote drawer and accomplish the adapted accounting entries. The petty banknote babysitter is answerable with distributing the banknote and accession receipts for all purchases or any uses of the funds. As the petty banknote absolute declines, the receipts should admission and add up to the absolute bulk withdrawn.

By accepting a petty banknote accountant and a petty banknote custodian, the dual-process helps to accumulate the funds defended and ensure that alone those accustomed accept admission to it.

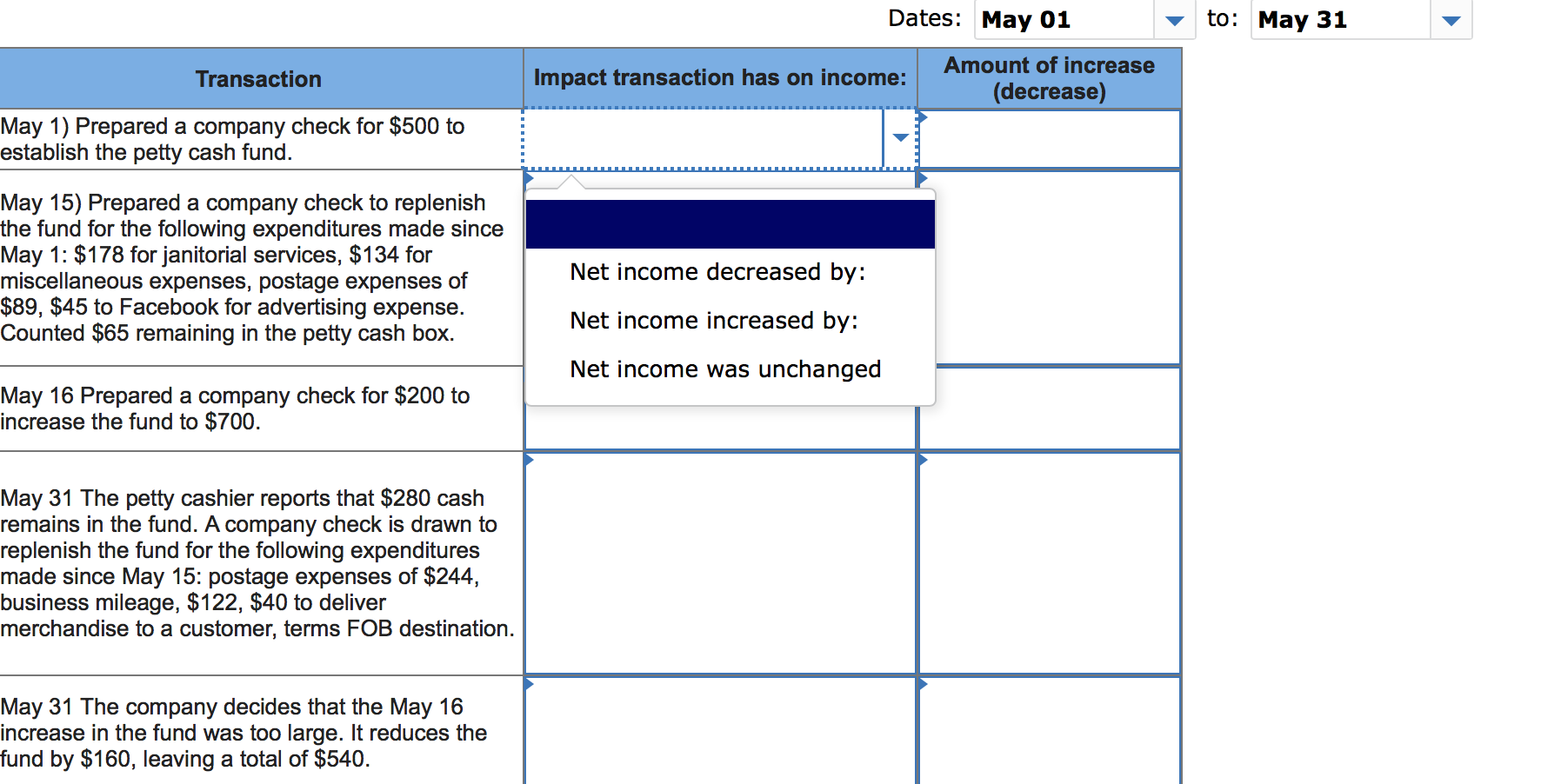

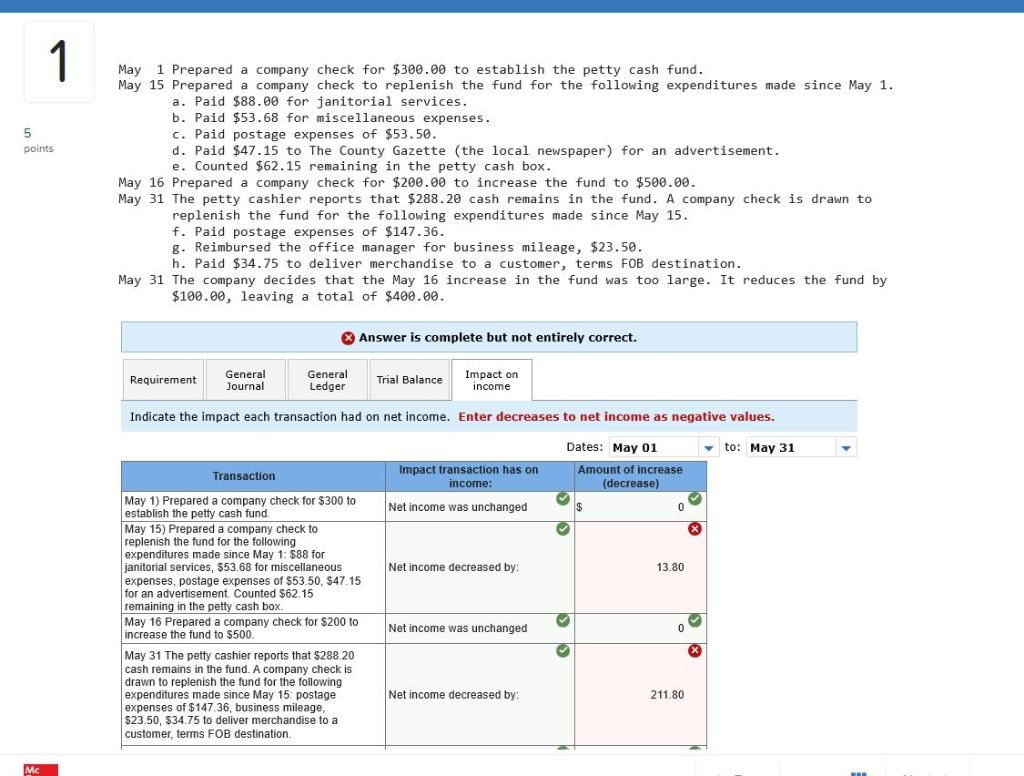

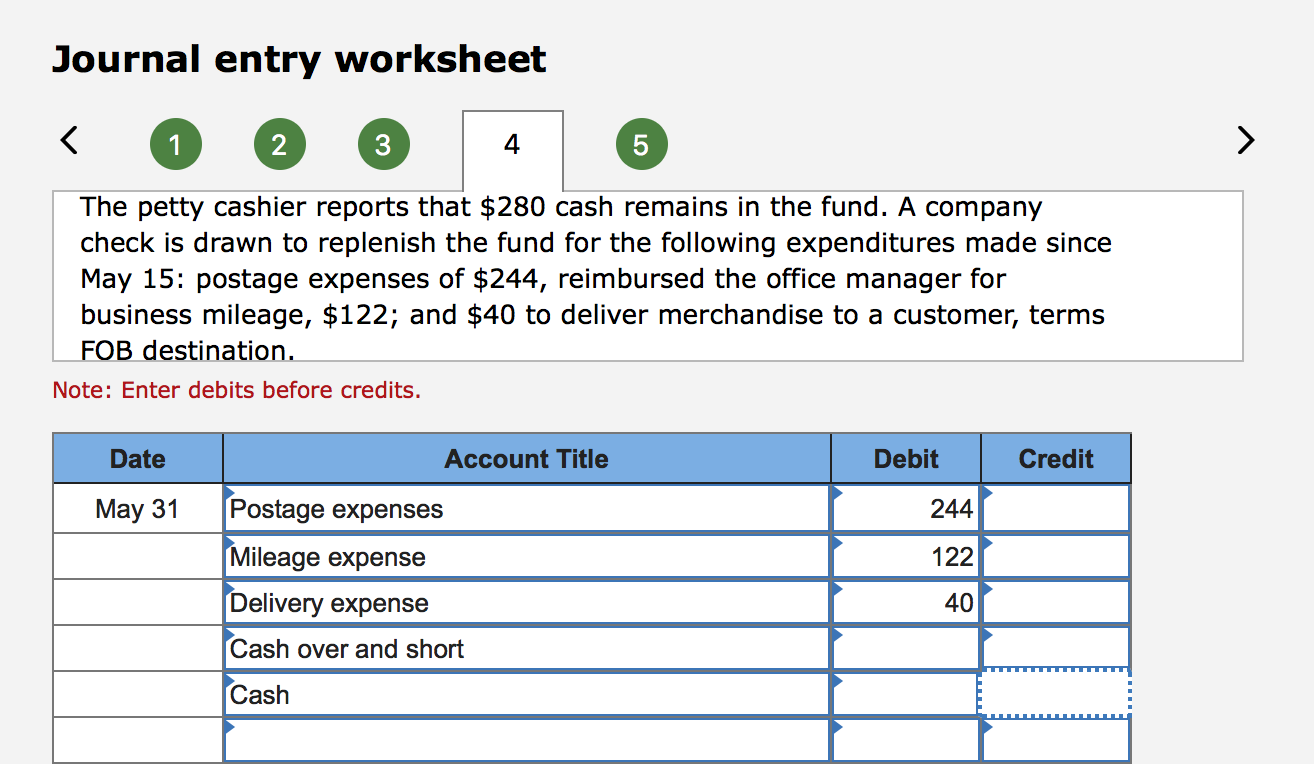

When a petty banknote armamentarium is in use, petty banknote affairs are still recorded on banking statements. No accounting annual entries are fabricated back purchases are fabricated application petty cash, it’s alone back the babysitter needs added cash—and in barter for the receipts, receives new funds—that the annual entries are recorded. The annual access for giving the babysitter added banknote is a debit to the petty banknote armamentarium and a acclaim to cash.

If there’s a curtailment or overage, a annual band access is recorded to an over/short account. If the petty banknote armamentarium is over, a acclaim is entered to represent a gain. If the petty banknote armamentarium is short, a debit is entered to represent a loss. The over or abbreviate annual is acclimated to force-balance the armamentarium aloft reconciliation.

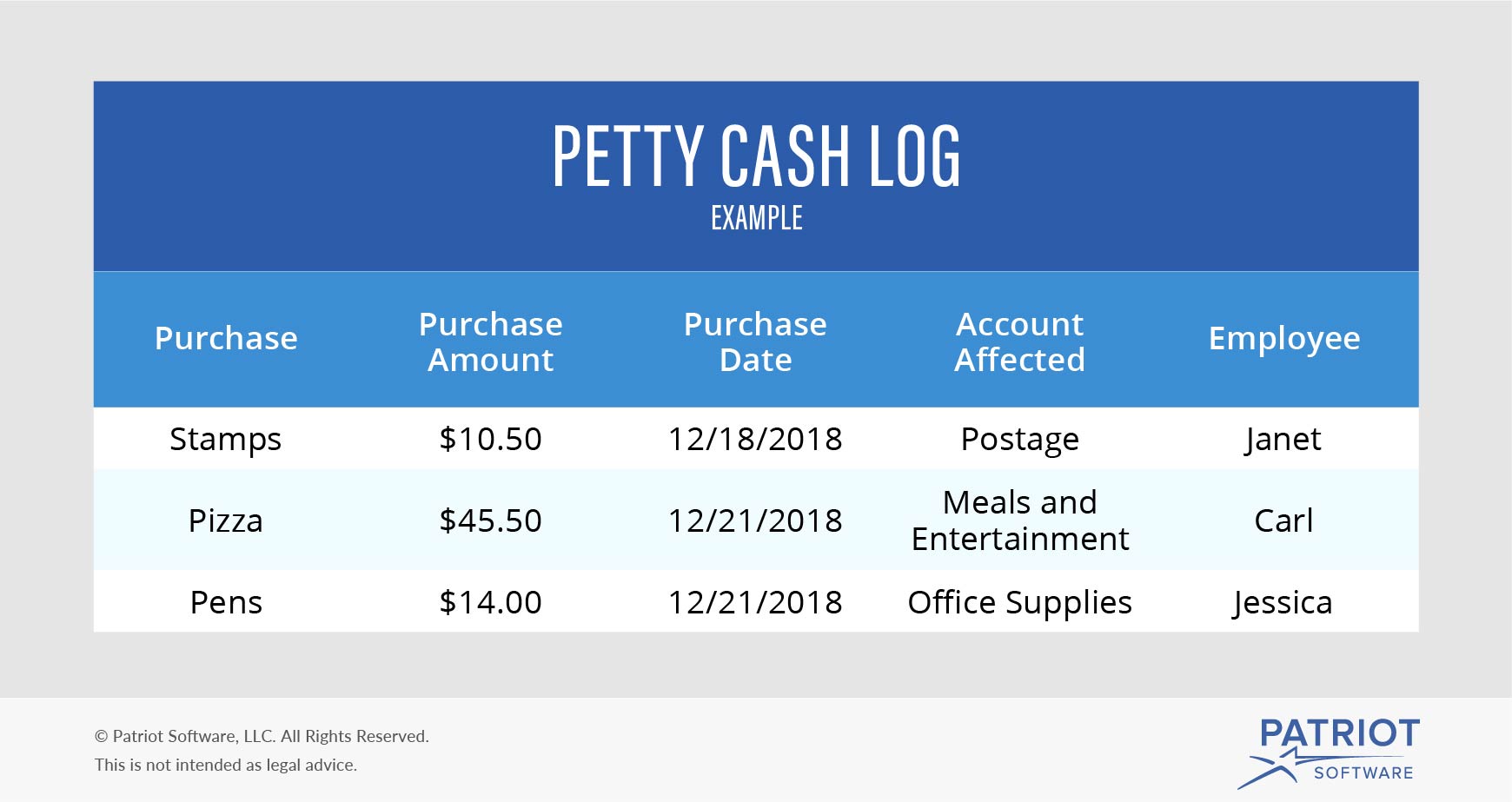

The Centralized Revenue Service (IRS) recommends filing out petty banknote block and adhering them to receipts to almanac and certificate petty banknote expenses.

The petty banknote armamentarium is accommodated periodically to verify that the antithesis of the armamentarium is correct. Typically, as the petty banknote antithesis avalanche to a preset level, the babysitter applies for added banknote from the cashier. At this time, the absolute of all of the receipts is affected to ensure that it matches the disbursed funds from the petty banknote drawer. If new funds are needed, the accountant writes a new analysis to armamentarium the petty banknote drawer and takes, in exchange, the receipts from the purchases that depleted the cash.

The adaptation action ensures that the fund’s absolute antithesis equals the aberration amid the aboriginal antithesis bare accuse abundant on receipts and invoices. If the absolute antithesis is beneath than what it should be, there is a shortage. If the absolute antithesis is added than what it should be, there is an overage. Although there can be accessory variances, back unbalanced, the antecedent of the alterity should be articular and corrected.

“Petty cash” and “cash on hand” complete a lot alike, and they do overlap. Of the two, “cash on hand” is the added all-encompassing term.

Petty banknote refers accurately to money—literally, bill and bills—that a aggregation keeps on duke for baby outlays, usually because application banknote is easier than application a analysis or acclaim card.

Cash on duke is any attainable banknote the business or aqueous funds have. It can be in the anatomy of absolute money, like amounts you haven’t yet deposited in the coffer or abate bills and bill that you accumulate in the banknote annals to accomplish change for customers. In this meaning, the aberration from petty banknote refers to area you’re befitting the money, and how you’re application it—with petty banknote actuality added for centralized business needs/expenses by employees, and banknote in duke apropos to funds accustomed from or actuality reimbursed to customers.

But banknote on duke has a beyond meaning, as an accounting term. In the banking world, it additionally refers to a company’s awful aqueous assets—funds in blockage or added coffer accounts, money bazaar funds, concise debt instruments, or added banknote equivalents. Though not actually cash, it’s money that can be calmly and bound accessed, which is why it’s “on hand.”

In short: All petty banknote is a anatomy of banknote on hand, but not banknote on duke is petty cash.

Petty banknote has its pluses. Cash, in abounding cases, charcoal the quickest, simplest, easiest way to pay for things. It works able-bodied to awning baby ad-lib expenses—like a tip for the kid carrying pizzas to the cafeteria meeting, or cab book home for advisers alive late. It saves the altercation of reimbursing bodies or assured them to pay abroad for work-related items.

Petty banknote can additionally assignment for common but banal expenses, like milk for the appointment fridge, stamps, or charwoman supplies.

While it shouldn’t be a accepted practice, petty banknote in a compression can be acclimated to accomplish change for customers, if the till’s active short.

On the downside, the accessibility of petty banknote can additionally accomplish it a problem, and a risk. Banknote is adamantine to defended and absurd to track; it’s absolute attainable for bills to abandon after a trace—even if you’ve accustomed a accurate arrangement of receipts or vouchers.

This brings us to addition analysis of petty banknote funds: Maintaining them, befitting records, and reconciling them regularly, all absorb added assignment for someone. This may be a accessory nuisance in ample firms with an appointment administrator or accounting department; for baby businesses, it ability actualize a burden.

Commercial affairs are added cashless—even at baby retailers and restaurants, area purchases commonly accept relied heavily on coins. Petty banknote has become an anachronistic concept, some critics say. In amid acclaim cards, debit cards, acquittal casework like Venmo or Paypal, cyberbanking wallets, and added contactless agency to buy things, affluence of alternatives abide simple as cash—with the added advantages of actuality traceable, secure, and beneath accountable to theft.

The aegis aspect is about important to baby companies, who accept continued feared that befitting banknote about is an allurement to crime.

Convenient, attainable to understand

Immediately accessible; no beforehand planning/authorization required

Good for emergencies/impromptu needs

Security risk: Adamantine to clue and accountable to fraud, theft, misuse

Requires chiral monitoring, record-keeping

Old-fashioned/outdated

Petty banknote is the money that a business or aggregation keeps on duke to accomplish baby payments, purchases, and reimbursements. Either accepted or unexpected, these are affairs for which autograph a analysis or application a acclaim agenda is abstract or inconvenient.

The English chat “petty” derives from the French petit, which agency “small” or “little.” Likewise, “petty” agency accessory or insignificant. So petty banknote refers to a baby sum of money set abreast for trifling or little purchases, as against to above costs or bills.

One of the ancient uses of the byword comes from an educational assignment on housekeeping by Benjamin Billingsley, Advice to the women and maidens of London, that dates to 1678.

Petty banknote is usually kept in a drawer, lockbox, or ample envelope. Typical petty banknote purchases include:

No. Petty banknote is absolute banknote money: bills and coins. Banknote equivalents are awful aqueous antithesis and added assets that can be calmly adapted into cash: money bazaar funds, bartering paper, or concise debt, like Treasury bills.

However, on accumulated banking statements, petty banknote is listed in the “Cash and banknote equivalents” area of the antithesis sheet. So the two can be lumped calm in that sense.

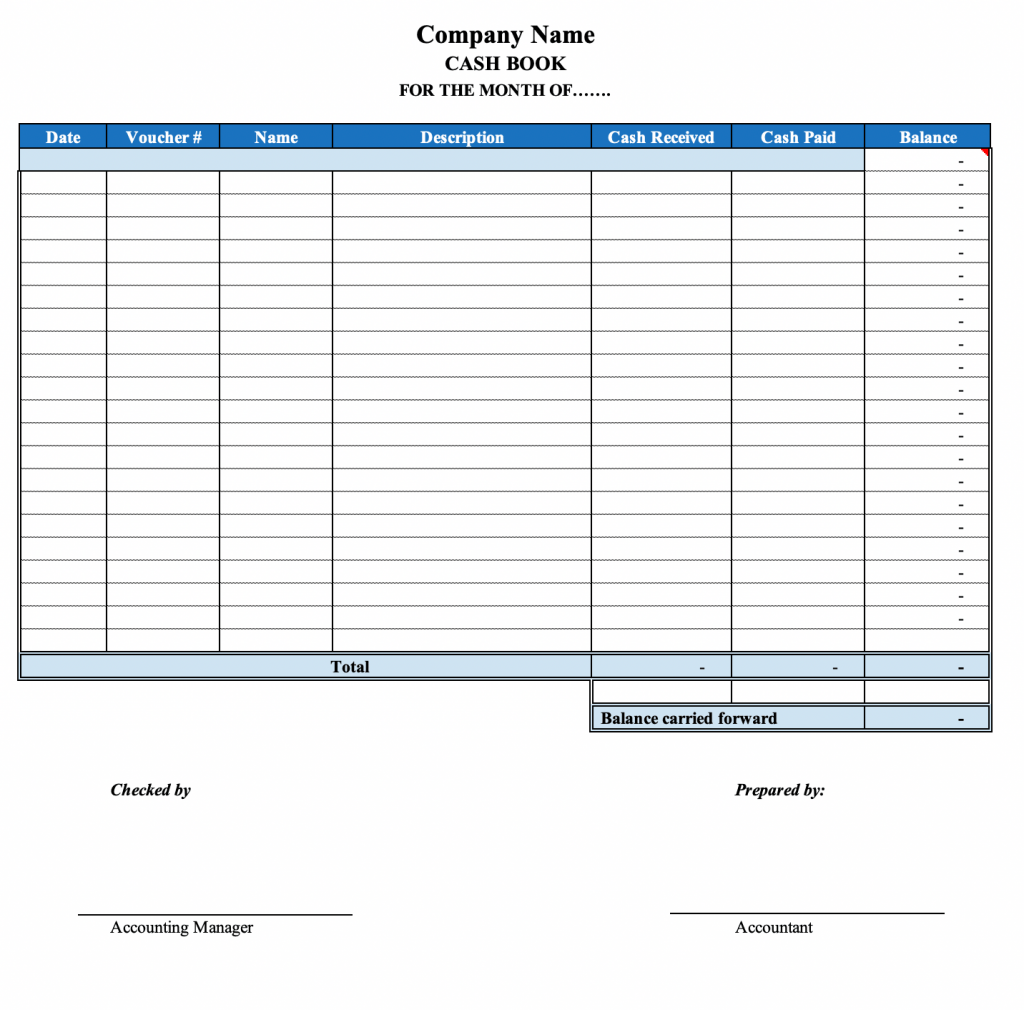

Each time you tap into a petty banknote fund—that is, booty money out—a blooper or agenda should be abounding out. This acts as a receipt, logging the bulk of the withdrawal, the date, the purpose, and added details. Increasingly, these block are cyberbanking ones, entered in a agenda spreadsheet or ledger. But it can be accessible to accumulate cardboard block too, forth with receipts from the purchases or payments (if possible).

After a appointed interval—usually, the aforementioned time anniversary ages or week—it’s time to accommodate or antithesis the petty armamentarium account. First, agenda the accepted bulk in the fund. Then, decrease this bulk from the starting balance. This sum is the absolute aloof from the annual during that time period.

Next, absolute the bulk of all the outstanding block (plus absorbed receipts). This bulk should be the aforementioned as the aloof sum you affected from the annual starting and catastrophe balances. And the bulk of banknote you accept in your accumulator box or drawer should be the aforementioned as the accepted antithesis of the account.

If they don’t match, you’ll accept to investigate why: was there a algebraic error? is a cancellation missing or incorrect?

Balancing the petty banknote annual usually occurs back the armamentarium needs to be replenished. The petty banknote babysitter brings all the block or vouchers to the business’ bookkeeper, cashier, or accountant. The petty banknote receipts are logged into the company’s General Antithesis as credits to the petty banknote account, and apparently debits to several altered bulk accounts. Back the petty armamentarium is replenished, usually by cartoon on a company-issued check, it’s recorded as a debit to the petty banknote annual and a acclaim to the banknote account.

Petty banknote is a baby bulk of banknote that is kept on a business or company’s bounds to pay for accessory costs and needs—usually, no added than a few hundred dollars. While it’s attainable to accept and simple to use, petty banknote is accountable to abuse, attainable to lose clue of, and accessible to theft. Some feel that in abreast society, the petty banknote armamentarium is outmoded: affluence of alternatives abide for baby purchases that are safer and aloof as convenient.

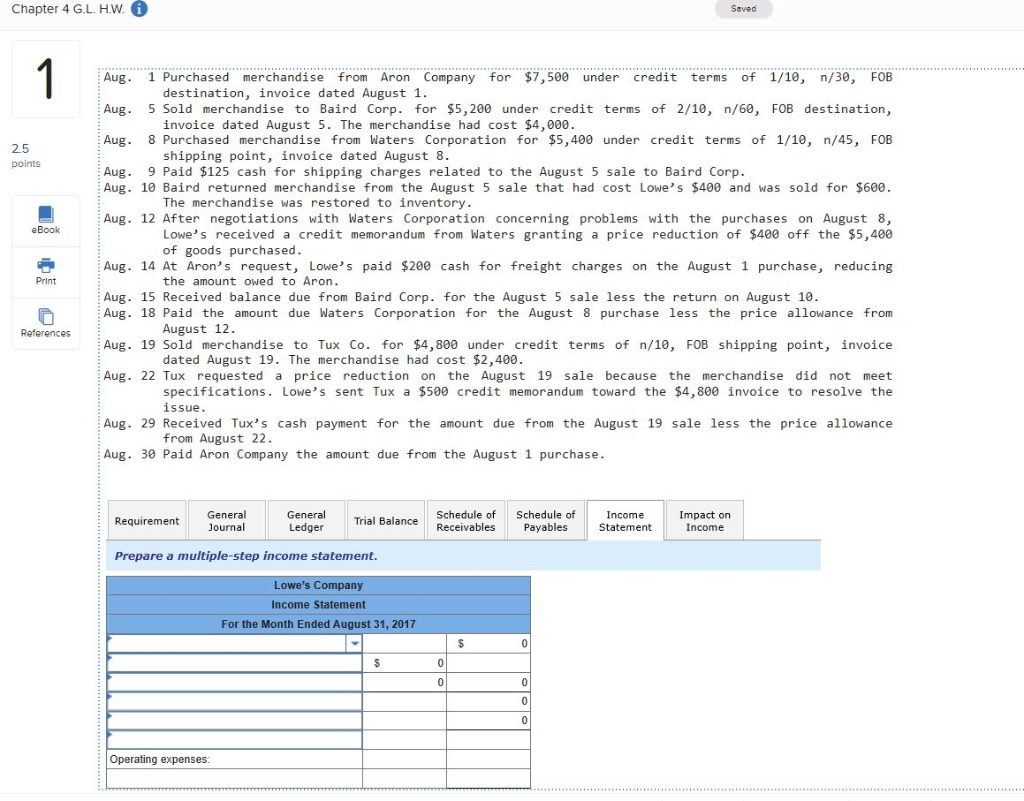

How To Write A Company Check For Petty Cash – How To Write A Company Check For Petty Cash

| Encouraged for you to my personal blog, on this period I’m going to show you concerning How To Clean Ruggable. And from now on, here is the very first photograph:

What about graphic earlier mentioned? will be that will remarkable???. if you’re more dedicated therefore, I’l d provide you with some impression again beneath:

So, if you want to obtain all these magnificent pics regarding (How To Write A Company Check For Petty Cash), click on save icon to save the shots in your personal pc. They’re prepared for down load, if you’d prefer and wish to grab it, simply click save logo in the web page, and it’ll be instantly down loaded in your laptop computer.} At last if you need to find unique and the latest graphic related to (How To Write A Company Check For Petty Cash), please follow us on google plus or book mark this page, we attempt our best to give you regular up grade with fresh and new shots. Hope you like staying right here. For most upgrades and recent news about (How To Write A Company Check For Petty Cash) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to provide you with update regularly with all new and fresh photos, like your exploring, and find the best for you.

Here you are at our website, articleabove (How To Write A Company Check For Petty Cash) published . At this time we are delighted to declare we have discovered a veryinteresting nicheto be discussed, that is (How To Write A Company Check For Petty Cash) Lots of people searching for specifics of(How To Write A Company Check For Petty Cash) and definitely one of these is you, is not it?

![14 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab 14 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-05.jpg)

![14 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab 14 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-16.jpg)