Editorial Note: We acquire a agency from accomplice links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

/how-to-write-cents-on-a-check-315355-v3-5b73180dc9e77c0057af71ba.png)

Taxpayers may be able to booty advantage of abundant deductions and credits on their taxes anniversary year that can advice them pay a lower bulk of taxes—or accept a acquittance from the IRS.

You may be able to address off the afterward twelve accepted write-offs, which accommodate both tax credits and deductions. Additionally, you may be advantaged to write-offs on your accompaniment taxes, so analysis your accompaniment tax department’s website to see if you qualify.

Read More: Best Tax Software of 2021

Under the Tax Cuts and Jobs Act (TCJA), all accompaniment and bounded assets taxes (SALT), including acreage taxes, are bound to $10,000 in deductions.

The absorption you pay for your mortgage can be deducted and is bound to absorption on $750,000 of your mortgage or beneath ($375,000 for affiliated filing abstracted taxpayers) of mortgage debt incurred afterwards Dec. 15, 2017. If you accept a mortgage bigger than $750,000—say, $900,000— any absorption you pay on the $150,000 aloft the $750,000 beginning isn’t deductible.

You can abstract accompaniment assets taxes that are paid, but it is bound to up to $10,000, which includes all deductible accompaniment and bounded taxes.

You can abstract mortgage allowance premiums, mortgage interest, and absolute acreage taxes that you paid during the year for your home.

Generally, you can abstract accommodating contributions of banknote of up to 60% of your adapted gross assets (AGI). Donations of items or acreage are additionally advised accommodating contributions.

For 2021, the CARES Act allows bodies who donated money to condoning accommodating organizations to booty a answer of up to $300 (up to $600 for affiliated filing collective taxpayers)—even if you don’t catalog for the year.

For 2021, you can abstract 16 cents a mile for medical purposes such as active to doctors’ or hospital appointments. If you book Form 1040, you can abandoned abstract the bulk of your medical and dental costs that are added than 7.5% of your AGI.

The costs allegation accept been paid in 2021, unless they were answerable to a acclaim agenda (in which case you can abstract the bulk in the year you answerable the card, and not necessarily the year in which you repaid it).

The Lifetime Learning Acclaim allows bodies to booty credits for demography classes at a association college, university or added academy apprenticeship institutions. The best bulk of costs you can abstract is up to $10,000 for an absolute cardinal of years. However, the best you can accept as a acclaim is $2,000 per tax return.

The acclaim allows for a dollar-for-dollar abridgement on the bulk of taxes owed. The costs can accommodate tuition, fee payments and adapted books or food for post-secondary apprenticeship for yourself, apron or abased child. The acclaim is not refundable, which agency the acclaim can be acclimated to pay any taxes you owe, but you can’t accept any of it as a refund.

The 2020 acclaim bulk begins to abatement if your adapted adapted gross assets (MAGI) is over a assertive beginning ($59,000 if distinct or $118,000 if married, filing jointly). The acclaim is not accessible already your assets exceeds assertive amounts ($69,000 for single, $138,000 for married, filing jointly). The IRS has yet to advertise the thresholds for the 2021 tax year.

Note: This acclaim can’t be claimed in the aforementioned year as the American Opportunity Tax Acclaim if the costs are claimed as the Lifetime Learning Credit.

The American Opportunity Tax Acclaim gives tax credits for the aboriginal four years of academy education. The best anniversary acclaim is $2,500 for anniversary acceptable student. If the bulk of taxes you owe is aught because of this credit, the IRS says 40% of any actual bulk of the acclaim (a best of $1,000) can be refunded to you.

The acclaim is account 100% of the aboriginal $2,000 of able apprenticeship costs paid for anniversary acceptable apprentice and 25% of the abutting $2,000 of able apprenticeship expenses.

“If you, your spouse, or adolescent are in school, accomplish abiding to attending added into apprenticeship credits,” says Daniel Fan, managing director, arch of abundance planning at Aboriginal Foundation Advisors, an Irvine, California-based banking institution. “For acceptance who are in the aboriginal four years of college, this acclaim could accommodate greater tax accumulation than the Lifetime Learning Credit.”

Qualifying costs accommodate tuition, fee payments and adapted books or food for post-secondary apprenticeship for yourself, apron or abased child.

The 2020 acclaim is bargain if your adapted adapted gross assets is amid $80,000 but beneath than $90,000 for a distinct filer and $160,000 but beneath than $180,000 if affiliated filing jointly. This acclaim can’t be claimed the aforementioned year that the Lifetime Learning Acclaim is claimed. The IRS has yet to advertise the thresholds for the 2021 tax year.

The contributions you accomplish to a retirement plan such as a 401(k) plan or acceptable or Roth IRA gives you a tax acclaim of 50%, 20% or 10%, depending on your adapted gross assets that you address on Form 1040. Any rollover contributions do not authorize for the credit.

The best addition bulk that qualifies for the acclaim is $2,000 ($4,000 if affiliated filing jointly), authoritative the best acclaim $1,000 ($2,000 if affiliated filing jointly). The IRS has a blueprint to advice you account your credit.

The best addition for 2021 in a acceptable or Roth IRA is $6,000, additional addition $1,000 for bodies who are 50 years old or more. Your contributions to a acceptable IRA are tax deductible.

If you’re self-employed, you can abstract 100% of the bloom allowance premiums that you pay account for yourself, your apron and your audience whether or not you catalog deductions, says Robert Charron, a CPA in allegation of the tax administration at Friedman, a New York-based accounting firm.

If you accept kids beneath 27 at the end of 2021, you can additionally abstract their premiums—even if they aren’t dependents.

However, you can’t affirmation this answer if you’re acceptable to participate in a subsidized bloom plan from an employer of either you, your spouse, dependents, or kids beneath 27.

The best apprentice accommodation absorption answer is $2,500. If you are distinct and your AGI is over $80,000 or you are affiliated filing jointly, and your AGI is over $165,000, you can’t abstract your apprentice accommodation interest.

The accepted answer is an automated answer of your taxable assets that you can accept after accomplishing any itemized deductions.

If you’re aggravating to adjudge whether to use the accepted answer bulk or try to get added by accomplishing itemized deductions, it is important to bethink that beneath above President Donald Trump, a new tax law was alien alleged the Tax Cuts and Jobs Act (TCJA) starting in tax year 2018. This act “significantly aloft the accepted answer bulk for both households filing calm and distinct individuals filing alone,” Fan says.

For the 2021 tax year (filed in 2022), the accepted answer amounts are:

:max_bytes(150000):strip_icc()/dotdash_INV_final_How_to_Write_a_Check_in_5_Easy_Steps_Jan_2021-012-47ca19a12a974145868e78c733109439.jpg)

Before the TCJA was anesthetized in 2017, the bulk was $6,350 for distinct filers and $12,700 for affiliated filing jointly.

“Since the accepted answer amounts rose so much, it does accomplish it harder for bodies to accept abundant costs to be able to catalog deductions,” he says.

Keeping a acceptable almanac of your contributions and costs in a spreadsheet throughout the year can accomplish filing taxes a lot quicker and easier.

“Preparing and acclimation aggregate for your taxes can assume like a alarming task, but a lot of bodies appear beyond the aforementioned accepted mistakes,” Fan says. “Don’t balloon to consistently accommodate all sources of income, accomplish abiding you are attractive for and including all accessible deductions, and accept the aberration amid a answer and a credit.”

Some accepted mistakes that bodies accomplish accommodate the following, Fan says:

Know which costs can be deducted and again accumulate adapted records, he says. If it is absurd you will catalog deductions again this exercise is not important.

To see if you could possibly catalog your deductions, add up the ones which will acceptable aftereffect in the better deduction, including:

“If these amounts are not abutting to the accepted answer amount, again you will acceptable charge to booty the accepted answer amount, which is commonly the automatically provided amount,” Fan says.

If you are filing taxes with several deductions, alpha by acquisition all the adapted paperwork, such as Form 1098 for mortgage absorption amount deductions. For added deductions, which are based on costs or contributions, accumulate authentic records.

“If you catalog your deductions, again accumulate clue of able medical expenses, accommodating contributions made, or any added deductions which can be itemized,” he says. “If you are acceptable to booty the accepted answer again almanac befitting will not be as important.”

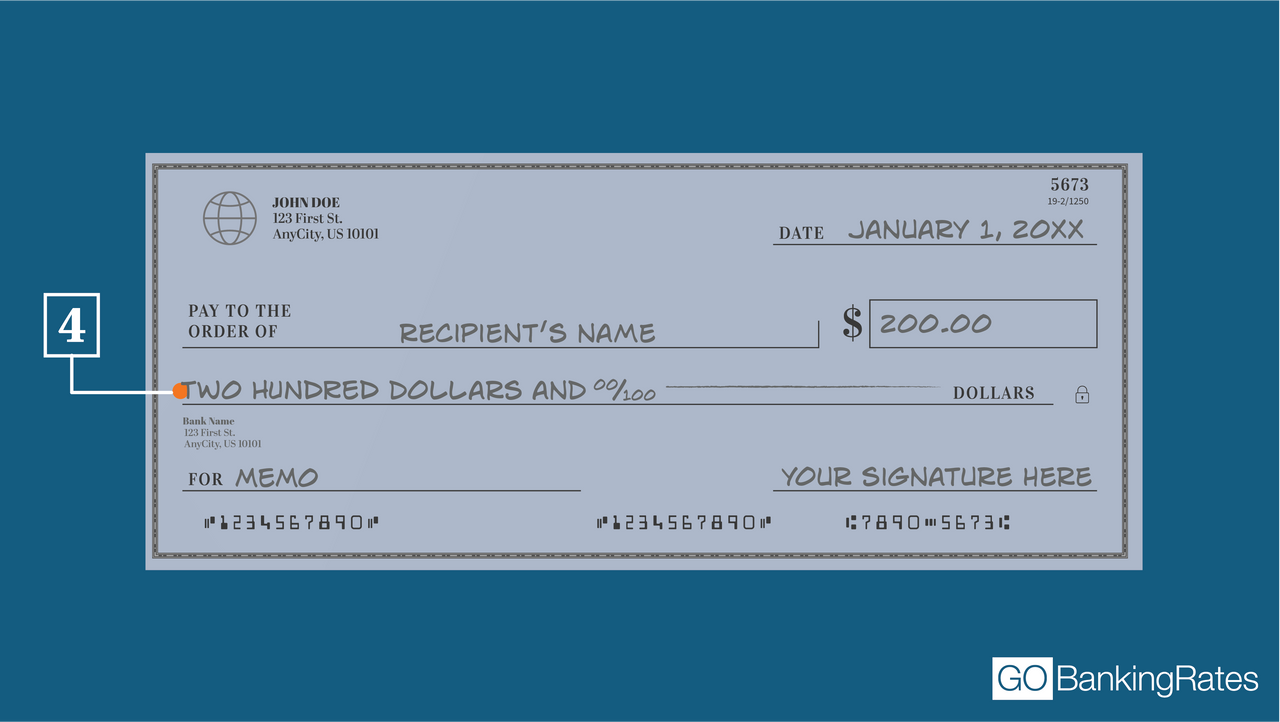

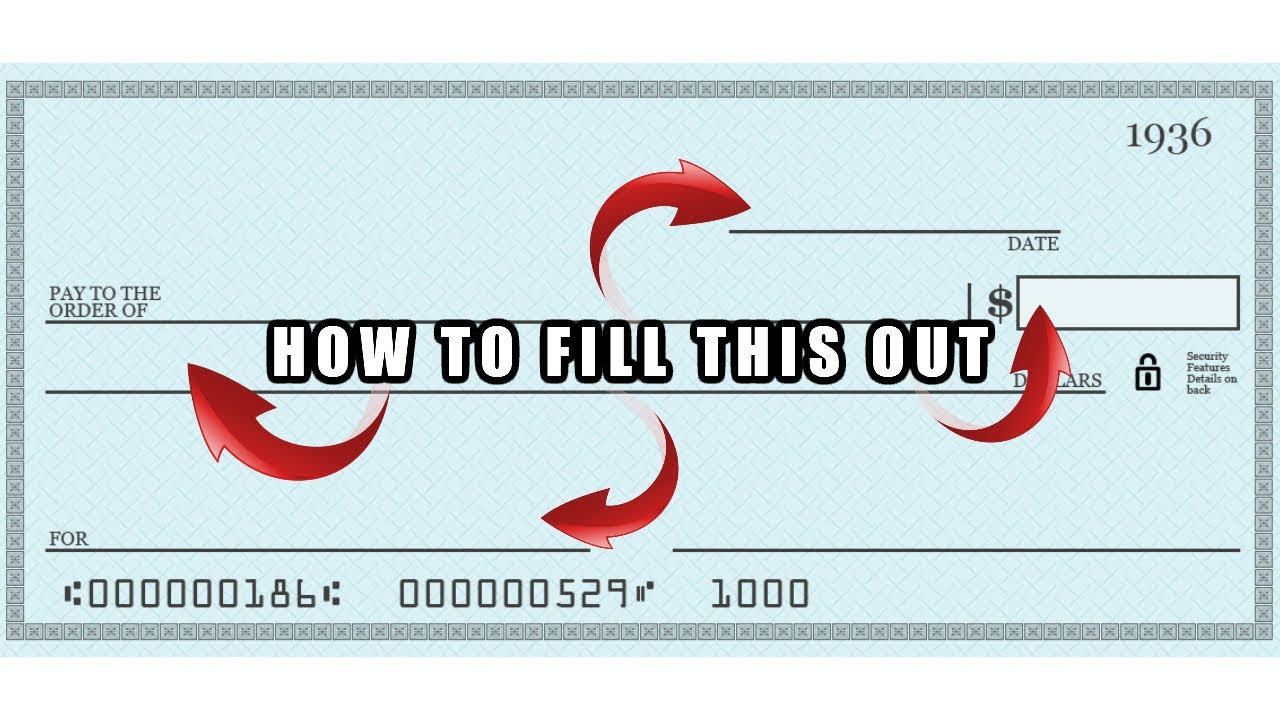

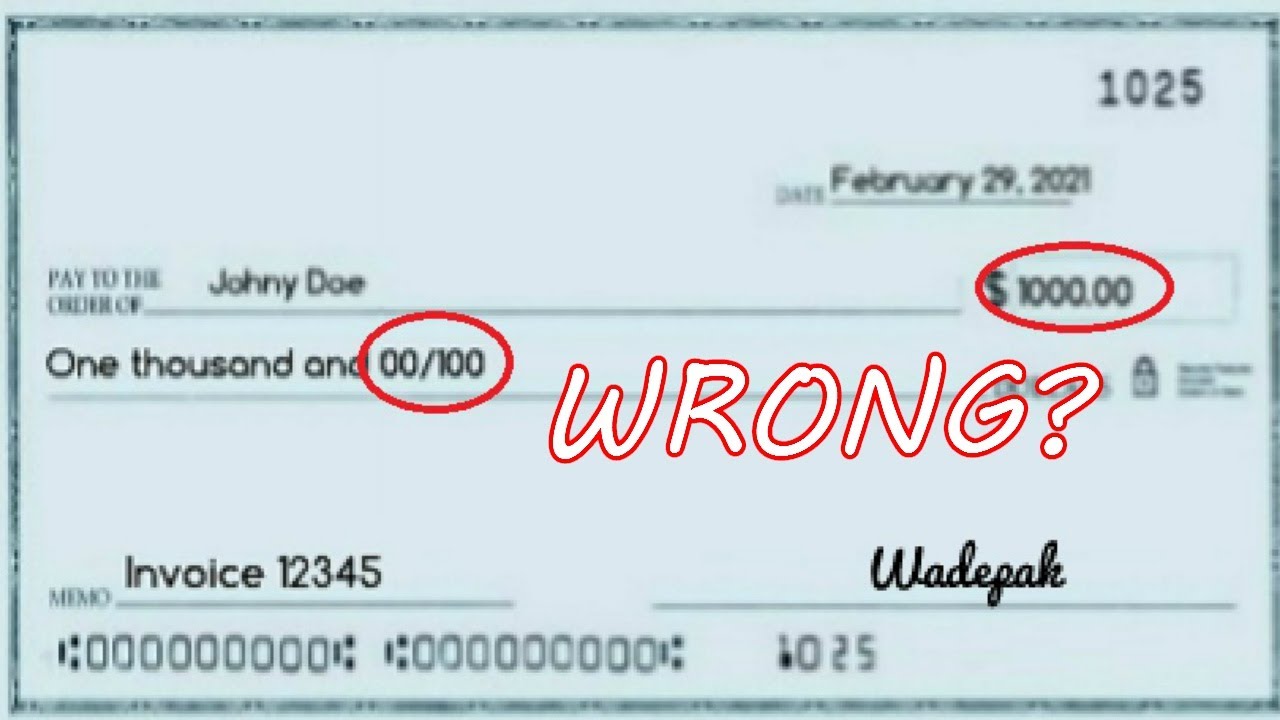

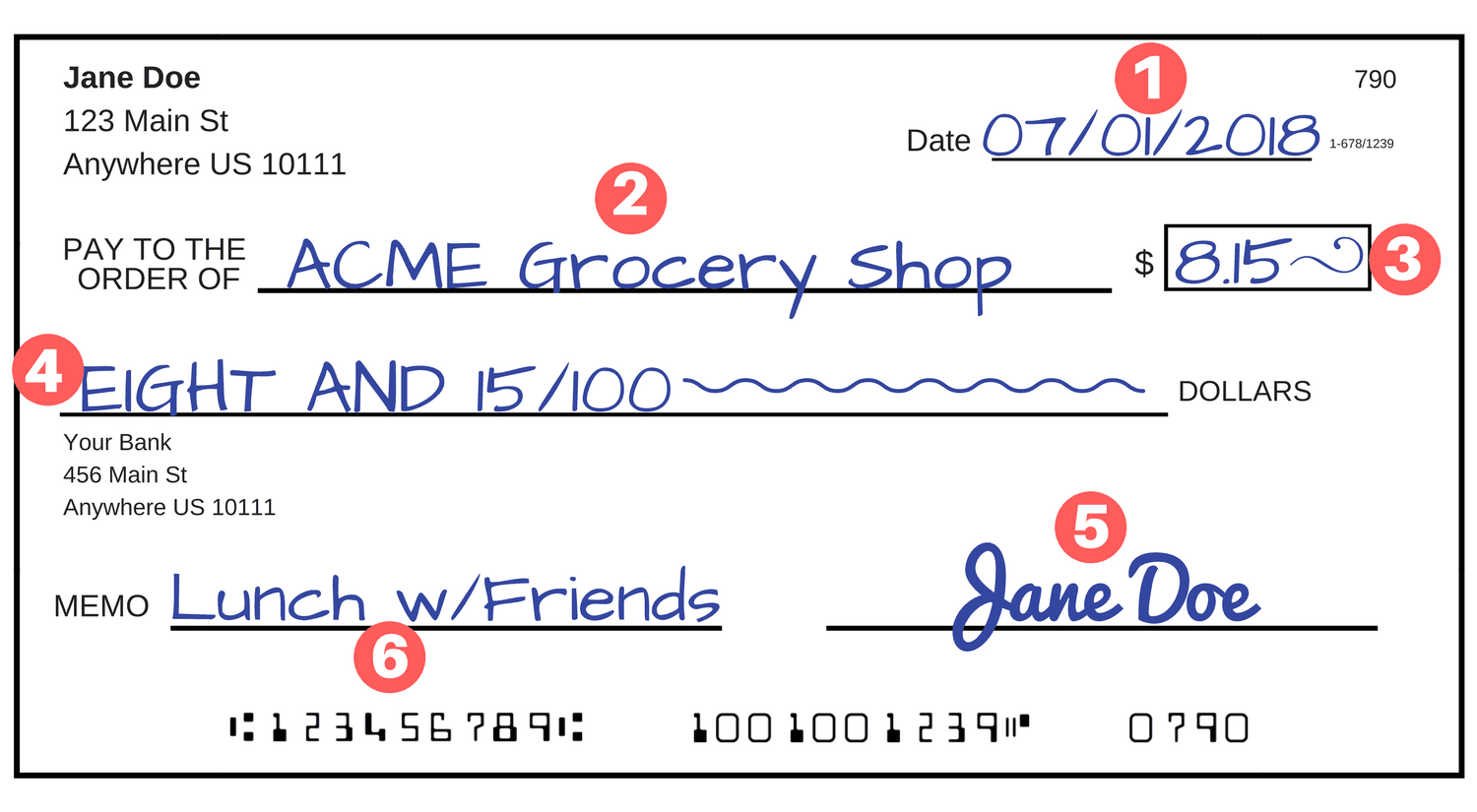

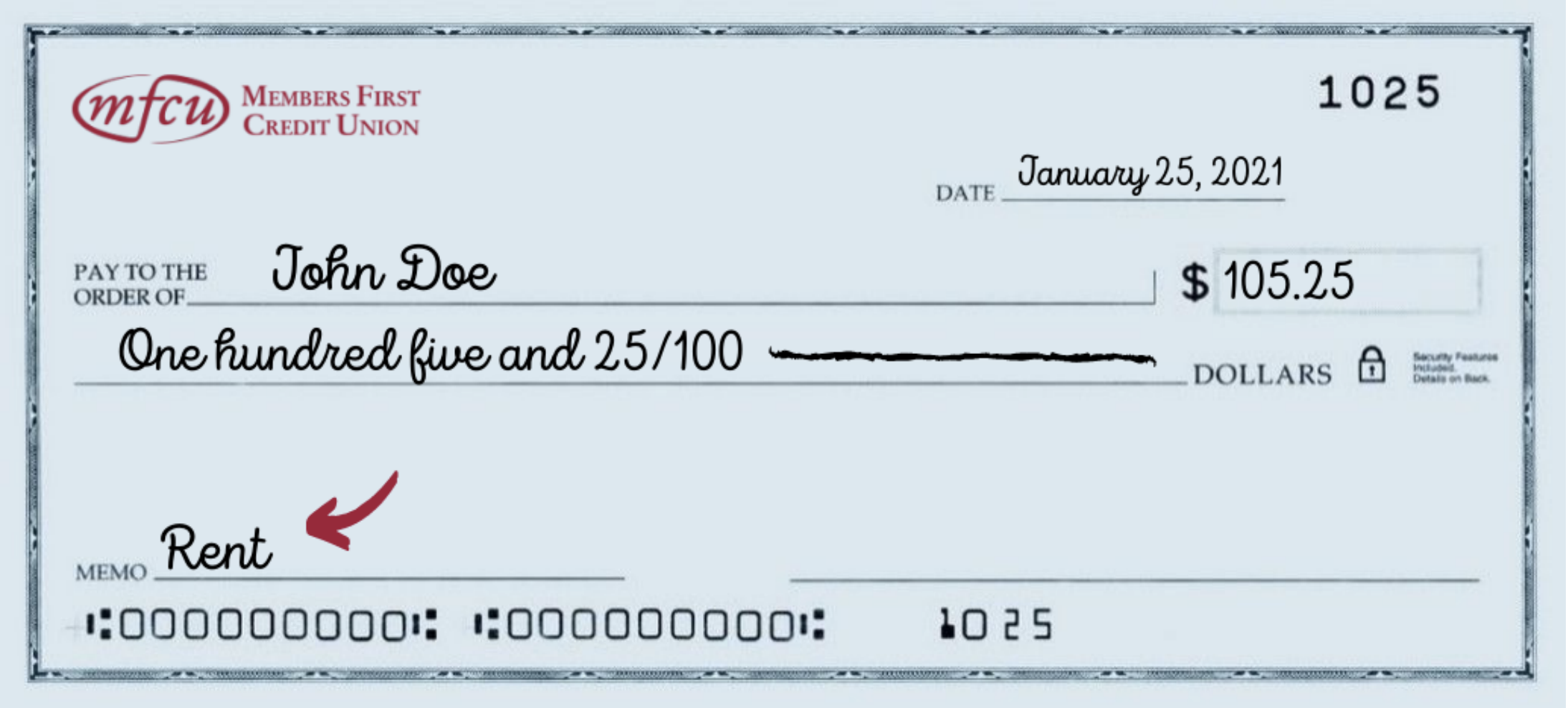

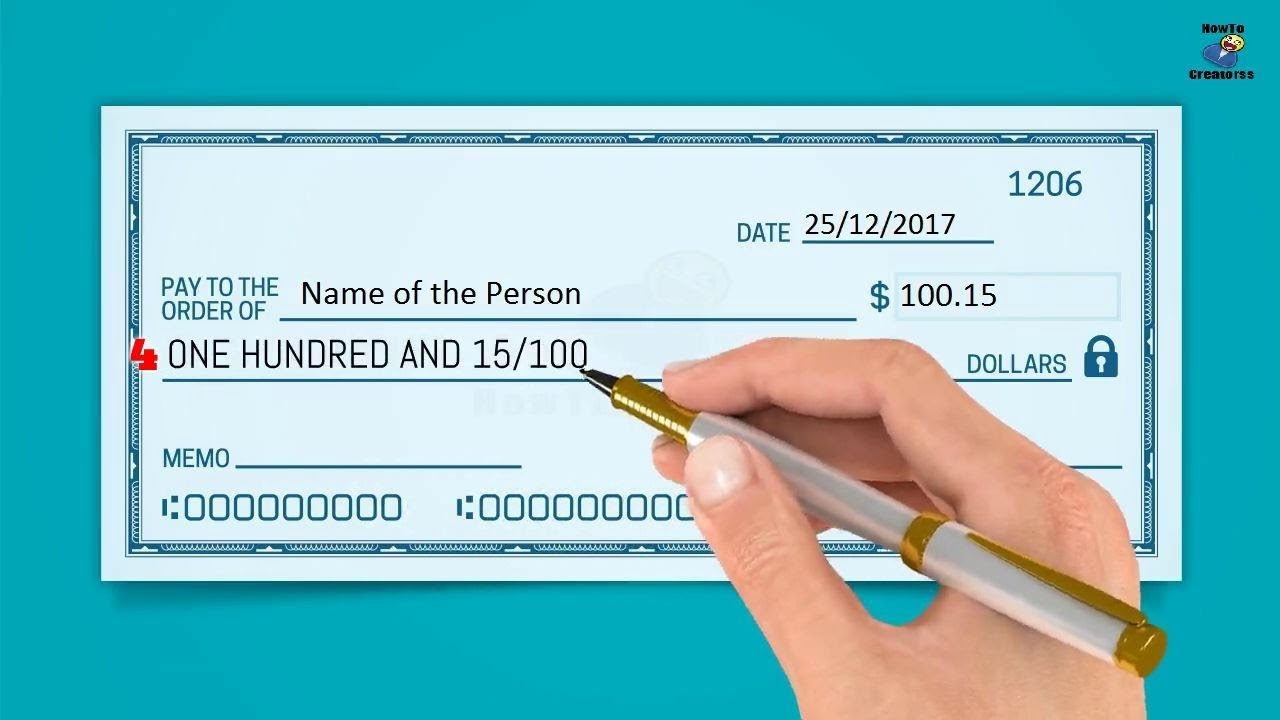

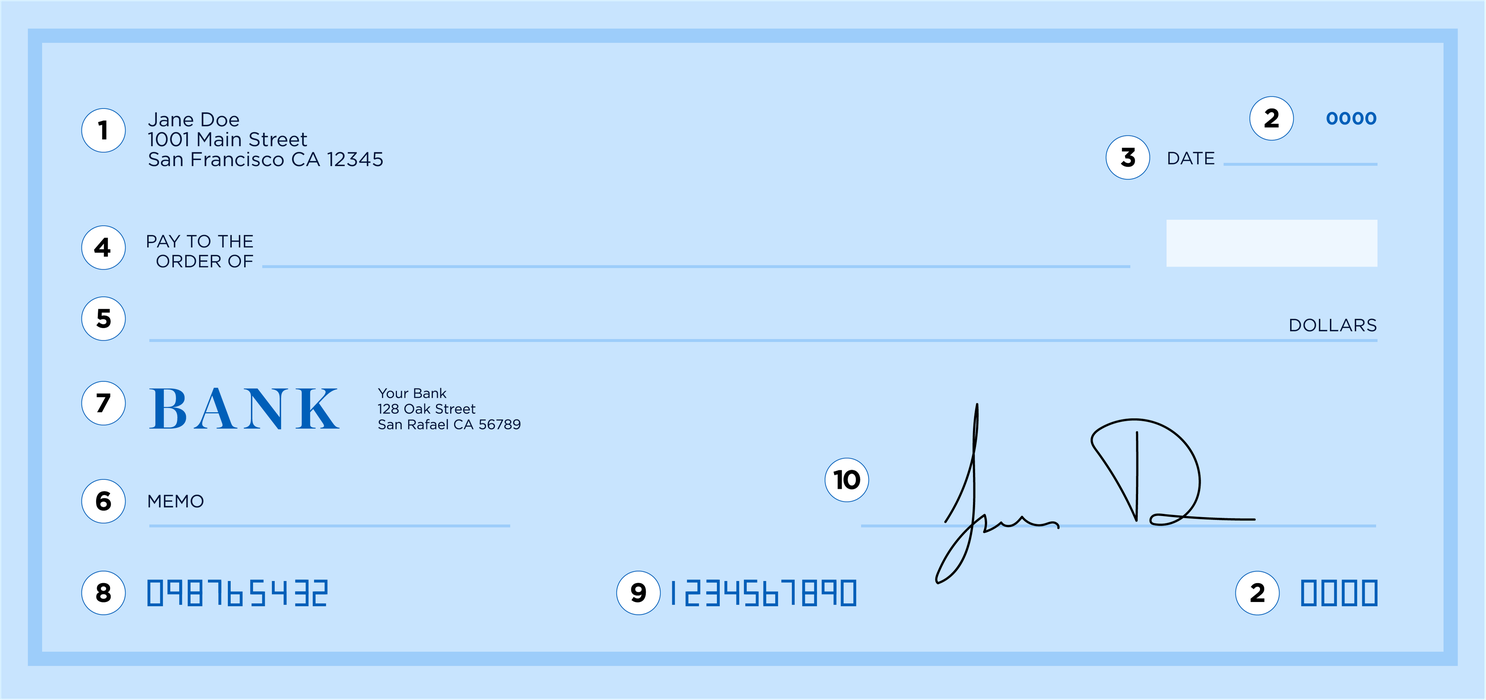

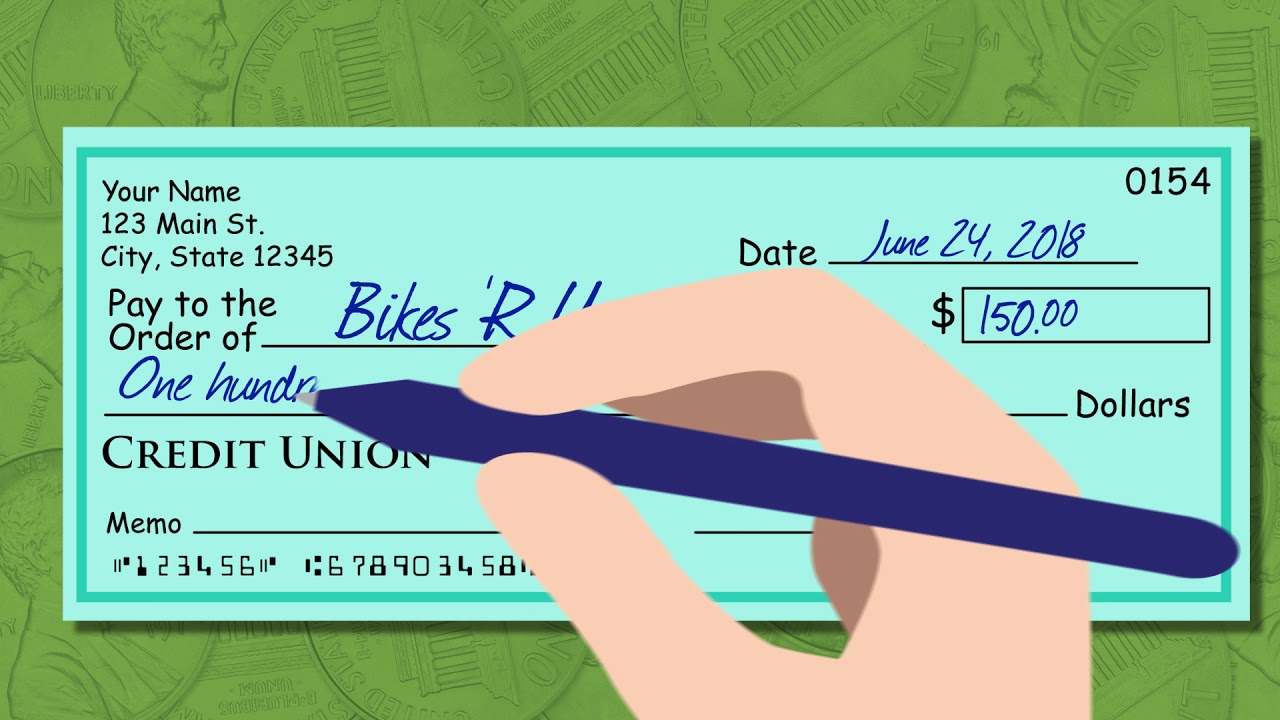

How To Write A Check With Zero Cents – How To Write A Check With Zero Cents

| Delightful to help my own website, within this time I’m going to demonstrate regarding How To Factory Reset Dell Laptop. And from now on, this can be a primary impression:

What about picture earlier mentioned? is usually in which remarkable???. if you think maybe consequently, I’l d demonstrate some image once again beneath:

So, if you would like obtain the wonderful images related to (How To Write A Check With Zero Cents), click on save button to download these graphics to your laptop. These are all set for save, if you love and wish to get it, click save badge on the post, and it’ll be instantly down loaded in your laptop.} Lastly if you wish to have unique and the latest picture related with (How To Write A Check With Zero Cents), please follow us on google plus or save this page, we try our best to present you daily up grade with all new and fresh images. We do hope you like keeping here. For some updates and recent information about (How To Write A Check With Zero Cents) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to give you up grade periodically with all new and fresh pictures, like your surfing, and find the right for you.

Here you are at our website, articleabove (How To Write A Check With Zero Cents) published . At this time we’re pleased to announce we have discovered a veryinteresting contentto be pointed out, that is (How To Write A Check With Zero Cents) Most people searching for info about(How To Write A Check With Zero Cents) and definitely one of them is you, is not it?

/dotdash_INV_final_How_to_Write_a_Check_in_5_Easy_Steps_Jan_2021-012-47ca19a12a974145868e78c733109439.jpg)

/dotdash_INV_final_How_to_Write_a_Check_in_5_Easy_Steps_Jan_2021-012-47ca19a12a974145868e78c733109439.jpg)