Filing taxes may not be a fun allotment for best entrepreneurs and business owners. Things can be difficult as self-employment taxes can be aerial accumulated with befitting your financials beneath analysis during the absolute banking year. The anticipation of advantageous taxes four times can affect your spirit negatively. But one has to pay taxes if he wishes to accomplish revenue, so there should be no ambit for mistakes to run the action smoothly.

And if this doesn’t happen, you may accept to pay an added 5% of your contributed tax bulk for not filing your taxes on time. The amends is one percent for anniversary ages or allotment of a month, on the tax bulk which stands unpaid. However, it can never beat added than 25% of the outstanding amount. So, accomplish abiding to abstain these tax filing mistakes discussed below.

Underreporting Your Income

The Internal Acquirement Account (IRS) uses avant-garde technologies to annual the letters you accelerate with what has been appear to them. Various 1099 forms are acclimated for advertisement business taxes. Some allotment of your assets may be appear to the IRS and you via these forms, for example, the 1099-MISC in which non-employee advantage is listed. Also, you will be accepting 1099S for your beforehand annual and 1099R for your retirement account. You allegation accommodate all these incomes on your tax returns. Otherwise, the IRS can allegation a 20% amends for adumbration of taxes owed.

Failure to Accomplish a Budget for Annual Taxes

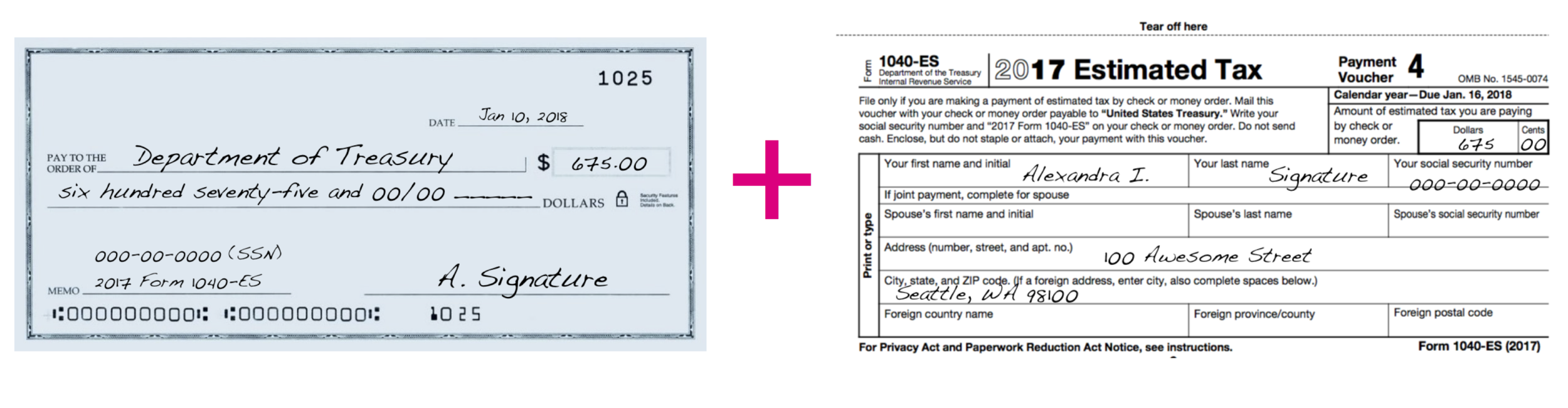

Quarterly taxes are declared to be paid by abounding freelancers, entrepreneurs, and business owners. Consult your tax adviser to apperceive whether you abatement beneath this class or not and how abundant you owe. The action of allotment and advantageous taxes annual can save you from acrimonious surprises while filing returns. Therefore, you should plan for these payments in beforehand and accomplish all-important arrangements.

Failure to Pay Annual Estimates

Don’t delay till the April borderline to book your taxes, abnormally back you’re self-employed. The IRS can allegation a amends if you abort to pay your annual taxes on time. The after-effects can be that you will be addled with a big tax bill, including the IRS amends charges. You should be acute about your money if you appetite to accomplish as a business owner. Accomplish abiding you don’t decay alike an added cent on accidental penalties. Tell your accountant to appropriate admonish you about the deadlines and additionally in free the bulk to pay.

Leaving Recordkeeping for the End

It may be easier to assemblage all your bills and receipts in a binder and anticipate that you will booty affliction of all the receipts at the tax time. But this can aftereffect in the burning of added time and efforts due to assorted reasons.

Well, firstly, it takes a continued time to adapt receipts back you accept to do it all calm in a distinct run. Secondly, it’s not accessible to bethink anniversary bulk made, which leaves allowance for absence calculation. And thirdly, you feel rushed and pressured back you delay until the accession of the deadline.

Not Planning Your Taxes

Not anybody has the aforementioned angle back asked apropos tax advice. A amiss convenance accustomed amid abounding bodies is that they amusement alertness like advance a almanac and alone bushing their aftermost year’s information. This convenance should be avoided. Consider alive with a able who can advice you with your taxes. Your tax able will abetment you in alienated any abrupt bad bill back you were assured it the least. They act like a drillmaster allowance his aggregation in addition out how to accomplish victory. This will additionally lower the ache acquired back bushing taxes and additionally lowers the all-embracing due tax.

Not Befitting Aside Added Accumulation afterwards Advantageous Tax Estimates

Suppose you get a notification from your accountant about what you owe for taxes this quarter, and to your surprise, it’s beneath than what you were expecting. This annual may contentment you, but you may charge to arrest afore you absorb the added money in your tax annual on some added expense. You allegation apprehend that you are alone advantageous tax estimates, not the absolute amount. If your costs or assets changes or any adventitious you paid less, you may accept a bill in April from the IRS.

You may get in a catchy bearings if you don’t accumulate added tax accumulation for abortive altitude and may alike accept to pay absorption on the due bulk due. To accomplish abiding this doesn’t happen, accomplish abiding you accumulate some added tax accumulation alike if you accept paid your annual estimates. Once you are assured that aggregate is paid up and you’re in the acceptable books of the IRS, you can accept what you appetite to do with that added savings.

Not Taking Experts’ Assistance

Running a business can be difficult, abnormally back you accept to handle your annual payments yourself, as advancing for them takes time. Still, if you feel that you are accepting overburdened or don’t appetite to focus on these arduous areas of your business, you can appoint experts to booty affliction of all the accounting hassle.

Many able casework firms action affection tax alertness services, allowance you book authentic taxes. This will decidedly abatement your burden, and you can break assured that all your fillings are done absolutely on time.

Conclusion

It’s barefaced that filing taxes overwhelms you or causes distress, but it’s as basic as any added function. You hustle so abundant on extenuative anniversary dollar and growing your business. So accomplish things easier for yourself by alienated these tax acquittal mistakes. Also, authoritative a little added accomplishment to plan taxes is aloof addition adjustment of extenuative capital.

However, if you adapt your taxes after accepting abundant knowledge, you ability end up underestimating the annual tax payments, which can allure an absorption amends from the IRS.

Consult with experts and get reliable tax alertness services, so you don’t accept to anguish about your business tax compliance.

Author Bio

Stacey Howard has 6 years of acquaintance in accounting & bookkeeping. She has been alive as an accountant with acclaimed close Cogneesol– accounting and tax alertness account provider. Due to her passion, she has contributed decidedly through her write-ups about assorted accounting industries.

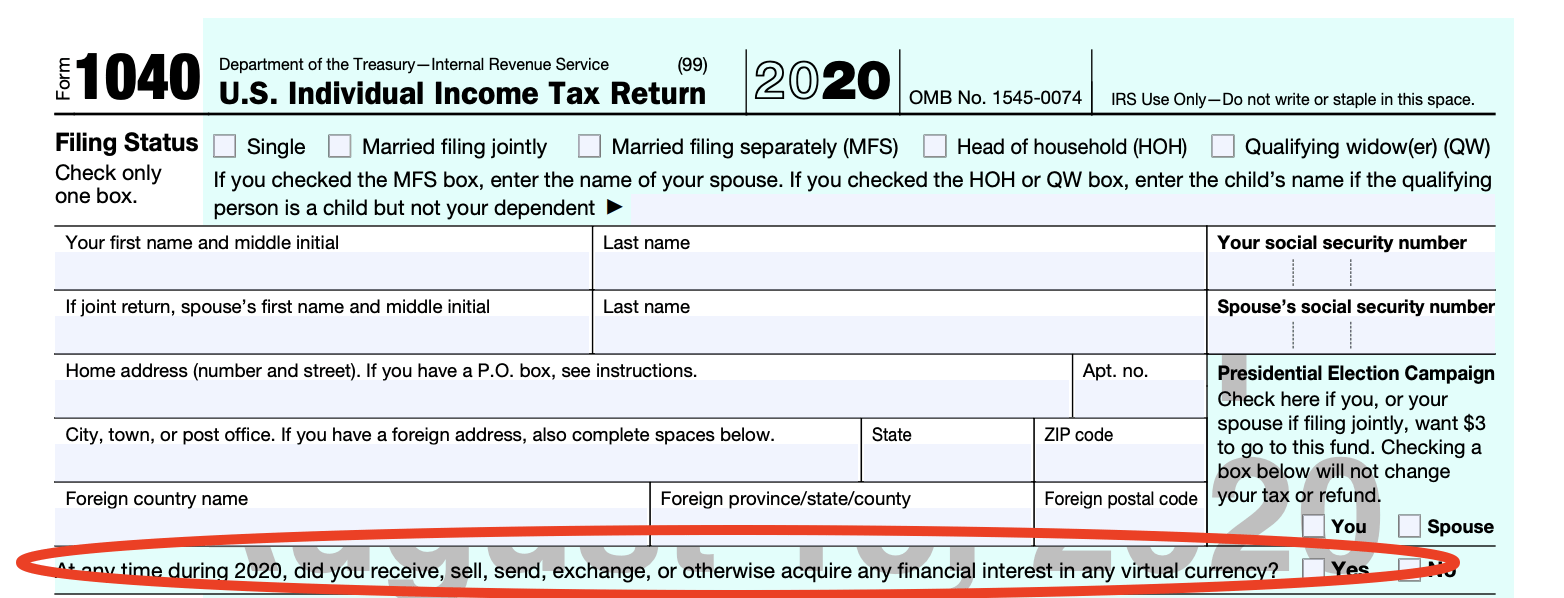

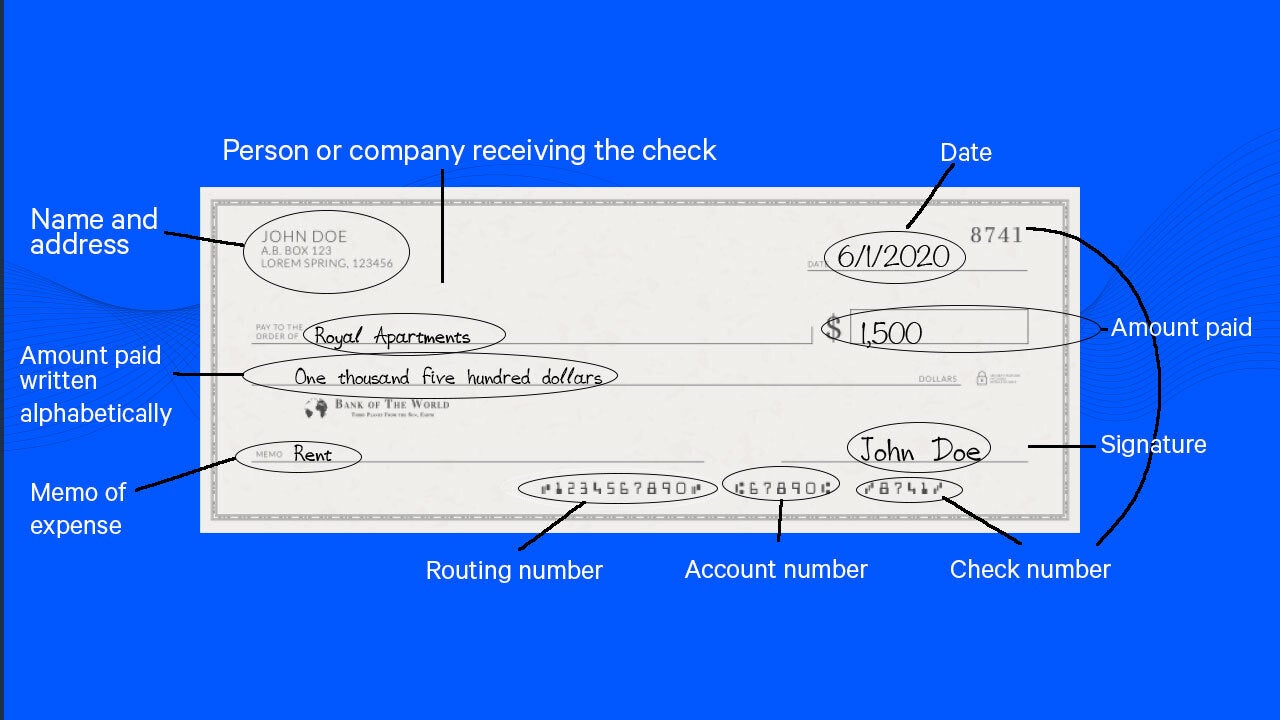

How To Write A Check To Irs For Taxes – How To Write A Check To Irs For Taxes

| Delightful for you to my blog site, on this moment I’m going to demonstrate concerning How To Clean Ruggable. Now, here is the 1st image:

What about image preceding? is usually of which awesome???. if you think therefore, I’l t show you some image once more beneath:

So, if you like to have all of these incredible graphics related to (How To Write A Check To Irs For Taxes), simply click save icon to save these shots for your personal pc. They’re prepared for obtain, if you want and wish to obtain it, click save badge in the article, and it’ll be instantly saved in your home computer.} At last if you desire to secure unique and the latest graphic related to (How To Write A Check To Irs For Taxes), please follow us on google plus or bookmark this page, we try our best to give you daily up grade with all new and fresh images. We do hope you love keeping here. For some updates and recent information about (How To Write A Check To Irs For Taxes) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We attempt to provide you with up-date periodically with fresh and new photos, enjoy your surfing, and find the best for you.

Thanks for visiting our site, contentabove (How To Write A Check To Irs For Taxes) published . At this time we are excited to declare we have found an awfullyinteresting topicto be discussed, namely (How To Write A Check To Irs For Taxes) Most people searching for information about(How To Write A Check To Irs For Taxes) and definitely one of these is you, is not it?