Editorial Note: Forbes Advisor may acquire a agency on sales fabricated from accomplice links on this page, but that doesn’t affect our editors’ opinions or evaluations.

The alone simple affair about advantageous taxes is that theoretically, we all acquire to.

When it comes to advantageous tax liabilities aback filing a tax acknowledgment anniversary year or—for those self-employed individuals and entrepreneurs that pay assets taxes assorted times per year—each quarter, Uncle Sam provides several agency of bifurcation over the dough. Advantageous taxes with a acclaim agenda can be catchy but charcoal a reasonable advantage aback done the “right” way.

For acclaim agenda accolade junkies (and anyone with a acclaim card), a tax bill presents an opportunity: to acquire added points, afar or banknote back—including cogent bonuses that can be anniversary a thousand dollars or more.

Here’s what you allegation to apperceive about advantageous taxes with a acclaim agenda in 2021:

The aboriginal affair to acquire about advantageous taxes with a acclaim agenda is that this transaction will not be free. Third affair acquittal processors allegation fees to action affairs and abide payments to the Internal Revenue Service (IRS) and they allegation added fees for the convenience.

When it comes to federal taxes, the IRS makes things accessible by accouterment advice about advantageous a tax bill on its own website. The IRS additionally authorizes three companies to action acclaim agenda payments for federal taxes.

The clear beneath shows the three companies accustomed to acquire acquittal for a federal tax bill forth with the corresponding fees they charge.

There are a few added capacity to agenda about advantageous your federal taxes with a acclaim card, per the IRS:

In accession to federal taxes, some states facilitate tax acquittal with a acclaim card. This is accessible for both accompaniment assets taxes as able-bodied as business taxes, but alone in states that action these options.

Requirements for altered states vary, as do the acquittal processors. Options are bound by the accompaniment in which a aborigine resides. Costs additionally vary.

Mastercard offers accomplished advice on the assorted acclaim agenda processors that are accustomed to acquiesce accompaniment tax payments via acclaim agenda . The website OfficialPayments.com is the best accepted advantage accessible in states that acquiesce tax payments to be fabricated with plastic.

In Indiana, for example, it’s accessible to use the website OfficialPayments.com to pay accompaniment assets taxes (but not business taxes) for a fee of about 2.4%.

Before chief whether or not to pay taxes with a acclaim card, anticipate about affidavit that it makes faculty to do so. Accepting a acumen or allurement to pay taxes with a acclaim agenda is a must—without one, the added fee alone adds to the tax bill. If this is the case, address a analysis instead. (Unless, of course, you like spending unnecessarily on convenience.)

Here are the best accepted affidavit to pay taxes with a acclaim card, admitting the added cost:

One accepted acumen consumers pay taxes with a acclaim agenda is the accolade earning abeyant offered by assertive acclaim cards. While it adds an added fee to pay your tax bill with a acclaim card, it’s not difficult to acquisition cards that action rewards anniversary added than the fee.

For example, the three processing companies that acquire acclaim cards for federal tax payments all allegation beneath than 2%, with PayUSAtax charging the atomic at 1.96%. With that in mind, it’s important to accept a agenda (or cards, if an earning cap exists) that offers added than 1.96% banknote back, or the agnate in rewards (which will alter depending on claimed valuations of credibility and miles).

Even afterwards accepting to accede the bulk of assorted rewards points, you can artlessly aces up a agenda that earns a solid collapsed bulk on purchases like the Citi® Double Banknote Agenda or Alliant Banknote Aback Visa Signature Card.

While advantageous 1.96% on a tax bill to acquire 2% to 2.5% aback may not assume like it would be anniversary the effort, for astronomic tax bills alike a baby allotment of accumulation can add up fast.

Imagine for a moment accession owes $50,000 in federal taxes this year and pays a fee of 1.96% to use a rewards acclaim agenda that earns 2% back. In this hypothetical, $20 anniversary of rewards could be earned. This may not be acute to accession advantageous $50,000 per year in taxes, but it could be added acceptable than autograph a check.

But some credibility are anniversary appreciably added than others. For example, let’s brainstorm the aforementioned being paid 1.96% on the aforementioned $50,000 with The Blue Business® Additional Acclaim Agenda from American Express, which earns 2 Associates Rewards credibility per dollar spent on the aboriginal $50,000 spent anniversary year (then 1 point per dollar on all added purchases). This tax acquittal would net 100,000 Associates Rewards credibility for a fee of $980. Those 100,000 Associates Rewards credibility can be anniversary able-bodied over $2,000 in value, depending on how they are utilized.

Earning advancing rewards with a acclaim agenda for accustomed spending is smart, but what about the achievability of earning a huge acceptable anniversary by affair a minimum spending threshold? With a abundant tax bill, it may be accessible to acquire alike added than one acceptable bonus, which could aftereffect in hundreds or alike accoutrements of dollars of value.

Paying a $7,000 federal tax bill via acclaim agenda could acquire the acceptable anniversary from the Chase Sapphire Preferred® Card, which provides new cardholders with the befalling to acquire 100,000 anniversary credibility afterwards spending $4,000 on purchases in the aboriginal 3 months from anniversary opening. The anniversary bare fees for application a agenda to accomplish the acquittal is a appealing nice incentive.

It would additionally be accessible to acquire the acceptable anniversary on the Capital One Venture Rewards Acclaim Card: Enjoy a ancient anniversary of 60,000 afar already you absorb $3,000 on purchases aural 3 months from anniversary opening, according to $600 in travel.

By agreeable a tax bill beyond two rewards acclaim cards, it’s accessible to acquire a coffer of biking rewards with alone one expense—a all-important bulk additional nominal fees that may be anniversary it. Bethink that these bonuses are doled out on top of the rewards becoming for accustomed spending—cards with aerial banknote aback or credibility spending may still acquire credibility in accession to the acceptable bonuses aback acclimated to pay tax bills.

Depending on the minimum spending requirements for the cards called and the tax bill in question, it’s accessible to acquire three or added bonuses. Just bethink that altered types of tax payments appear with a best cardinal of payments accustomed anniversary year—though it may be accessible to circle amid altered acquittal processors.

For those absorbed in accepting a concise accommodation afterwards advantageous interest, advantageous taxes with a acclaim agenda can accomplish sense. Just bethink that a fee applies any time accession pays taxes with a acclaim card—and that anterior 0% APR offers don’t aftermost forever.

Here’s a acceptable archetype of how this adeptness work. Brainstorm for a moment a $7,000 federal tax bill but not abundant banknote in the coffer to awning it. In this case, it may be advantageous to administer for a agenda like the Chase Freedom Unlimited® which grants cardholders a 0% Addition APR on Purchases for 15 months, followed by a capricious APR based on cardholder creditworthiness (currently 14.99 – 23.74% Variable).

At the moment, this agenda is alms the adeptness to acquire a acceptable bonus: Acquire a $200 Anniversary afterwards you absorb $500 on purchases in your aboriginal 3 months from anniversary opening. And acquire 5% banknote aback on grocery abundance purchases (not including Target® or Walmart® purchases) on up to $12,000 spent in the aboriginal year.. Cardholders will additionally acquire 1.5% aback for anniversary dollar spent on added purchases.

If a new cardholder is able to use it to pay a $7,000 federal tax bill, the minimum spending claim would anon be met. That would aftereffect in antithesis of $305 in rewards from the acceptable anniversary additional those from the 1.5% banknote back. With PayUSAtax, a 1.96% fee would be charged—, or $137.20. Afterwards accounting for the fee, $167.80 in rewards would be larboard with this strategy, and the card’s antithesis would be accountable to the anterior APR offer.

There are a cardinal of added acclaim cards accessible that we’ve listed as the best for 0% APR periods.

As with any 0% APR strategy, don’t get lulled into a apocryphal faculty of security. Aback the 0% APR aeon ends, the absorption accuse will alpha cutting up quickly.

There are additionally some scenarios area it makes faculty to pay taxes with a acclaim agenda in adjustment to adeptness an important spending threshold, and these instances aren’t bound to earning acclaim agenda acceptable bonuses. It may be advantageous to absorb a assertive bulk of money to adeptness the abutting akin of aristocratic cachet with a auberge acclaim agenda or an airline acclaim card, for example.

Take the Citi® / AAdvantage® Executive World Aristocratic Mastercard®*, for example. This agenda offers consumers a acceptable bonus: Acquire 50,000 American Airlines AAdvantage® anniversary afar and 10,000 Aristocratic Qualifying Afar (EQMs) afterwards $5,000 in purchases aural the aboriginal 3 months of anniversary opening. Plus, Admiral’s Club® associates (a bulk of up to $650). Cardholders additionally acquire 2 afar per dollar spent on American Airlines purchases and 1 mile per dollar on all added purchases.

This agenda does allegation an anniversary fee of $450, but comes with Admirals Club lounge associates anniversary $650 for non-elite associates as a cardholder perk. Added cardholder allowances accommodate a chargeless arrested bag, a fee acclaim for Global Entry or TSA PreCheck membership, antecedence boarding and antecedence airport check-in. Interestingly enough, this agenda additionally grants 10,000 Aristocratic Qualification Afar (EQMs) afterwards spending $40,000 on your agenda aural a agenda year.

Cardholders who are a few thousand EQMs abbreviate of earning aristocratic cachet and acquire already spent abutting to the spending beginning appropriate on their agenda for the year adeptness be able to get over the bend by advantageous a tax bill. Depending on how admired the anniversary is, the fee appropriate may be anniversary it.

After all, AAdvantage Executive Platinum status, the top coffer cachet of this common flyer program, comes with four one-way arrangement advanced upgrades anniversary year, adulatory auto-requested upgrades, a 120% aristocratic breadth bonus, adulatory Main Cabin Added and Preferred seats, three chargeless arrested accoutrements and added perks.

Many cards acquire spending thresholds for an anniversary benefit.

We’ve gone through the “how” but afore advantageous taxes on a acclaim card, it’s important to focus on the “why”. Here are some prompts to anticipate about whether advantageous taxes on a acclaim agenda makes sense:

It’s accessible to see how it’s accessible to appear out advanced by advantageous taxes with a acclaim card, but it’s acute to accept the appropriate acclaim agenda to do so. There’s annihilation amiss with activity afterwards a few big acceptable bonuses, but it’s additionally accept to focus on accruing advancing rewards. And let’s not balloon about the abeyant to abstain absorption on your tax bill for a year or longer.

Here are some of the complete best acclaim cards to use for tax payments with all those goals in mind.

The Platinum Card® from American Express: The Platinum Card® from American Express currently has the afterward acceptable offer: Acquire 100,000 Associates Rewards® Credibility afterwards you absorb $6,000 on purchases on the Agenda in your aboriginal 6 months of Agenda Membership. Plus, acquire 10x credibility on acceptable purchases on the Agenda at restaurants common and aback you Shop Baby in the U.S., on up to $25,000 in accumulated purchases, during your aboriginal 6 months of Agenda Membership. Terms Apply.

Cardholders additionally acquire 5 Associates Rewards credibility per dollar spent on flights appointed anon with airlines or with American Express Travel, capped at the aboriginal $500,000 in spending anniversary agenda year. Prepaid hotels appointed through American Express Biking acquire an uncapped 5 credibility per dollar. All added purchases acquire 1 Associates Accolade point per dollar spent.

There’s a $695 anniversary fee (Terms apply. See ante and fees), but cardholders accept up to $200 in Uber Banknote credits for acceptable calm Uber costs anniversary year aback they articulation their Platinum agenda to their Uber account, Antecedence Pass airport lounge associates with enrollment, admission to American Express Centurion Lounges, admission to Delta SkyClubs aback aerial Delta same-day, a acclaim for Global Entry or TSA PreCheck, Hilton and Marriott Gold cachet with acceptance and more.

Chase Sapphire Preferred® Card: The Chase Sapphire Preferred® Agenda is one of the top biking acclaim cards anniversary year, and for acceptable reason. For starters, new cardholders can acquire 100,000 anniversary credibility afterwards spending $4,000 on purchases in the aboriginal 3 months from anniversary opening.

On an advancing basis, cardholders will acquire 5 credibility per dollar on biking purchased through Chase Ultimate Rewards®, 3 credibility per dollar on dining and 2 credibility per dollar on all added biking purchases and one point per dollar on all added acceptable purchases. Plus, through March 2022 you’ll acquire a absolute of 5 credibility per dollar on Lyft rides. A $95 anniversary fee applies.

The Blue Business® Additional Acclaim Agenda from American Express: The Blue Business® Additional Acclaim Agenda from American Express lets cardholders acquire 2 Associates Rewards credibility per dollar spent on the aboriginal $50,000 spent anniversary year, again 1 Associates Accolade point per dollar. This agenda doesn’t allegation an anniversary fee, and additionally offers an anterior APR of 0% on purchases for 12 months from date of anniversary opening, followed by an APR of 13.24% – 19.24% Capricious based on creditworthiness and added factors at anniversary aperture (Terms apply. See ante and fees).

Citi® Double Banknote Card: The Citi® Double Banknote Agenda offers cardholders 2% aback for anniversary dollar spent—1% aback authoritative a acquirement and addition 1% aback advantageous the agenda off. There’s no anniversary fee, and the agenda additionally offers an APR of 0% addition for 18 months on Antithesis Transfers, followed by a capricious APR of 13.99% – 23.99% (Variable) based on your creditworthiness. A 3% antithesis alteration fee (minimum $5) applies.

Capital One Quicksilver Banknote Rewards Acclaim Card: The Capital One Quicksilver Banknote Rewards Acclaim Agenda starts consumers off with a the adeptness to acquire a acceptable bonus: Acquire $200 afterwards spending $500 on purchases aural 3 months from anniversary opening. Cardholders additionally acquire a collapsed 1.5% aback for anniversary dollar spent, and acquire a $0 anniversary fee. Finally, this agenda offers 0% addition on purchases for 15 months, followed by an advancing APR of 14.99% – 24.99% (Variable) based on creditworthiness.

Chase Freedom Flex℠: Additionally accede the Chase Freedom Flex, which offers a 0% Addition APR on Purchases for 15 months followed by a capricious APR of 14.99 – 23.74% Capricious based on creditworthiness. This agenda additionally offers a acceptable bonus: Acquire a $200 Anniversary afterwards you absorb $500 on purchases in your aboriginal 3 months from anniversary opening. And acquire 5% banknote aback on grocery abundance purchases (not including Target® or Walmart® purchases) on up to $12,000 spent in the aboriginal year.

Cardholders additionally earn 5% on up to $1,500 on accumulated purchases in anniversary categories anniversary division you activate, 5% on biking purchased through Chase Ultimate Rewards, 3% at drugstores and on dining at restaurants, including takeout and acceptable commitment services. All added acceptable spending earns 1%. Best of all, there’s no anniversary fee.

Paying taxes with a acclaim agenda can absolutely be anniversary it, but for those who aren’t careful, it can advance to banking wreckage. Here are the above pitfalls to watch out for any time application a acclaim agenda for a ample acquirement seems to be worthwhile:

Read More: The 6 Best Tax Software Programs

To appearance ante and fees of The Platinum Card® from American Express, amuse appointment this page

To appearance ante and fees of The Blue Business® Additional Acclaim Agenda from American Express, amuse appointment this page

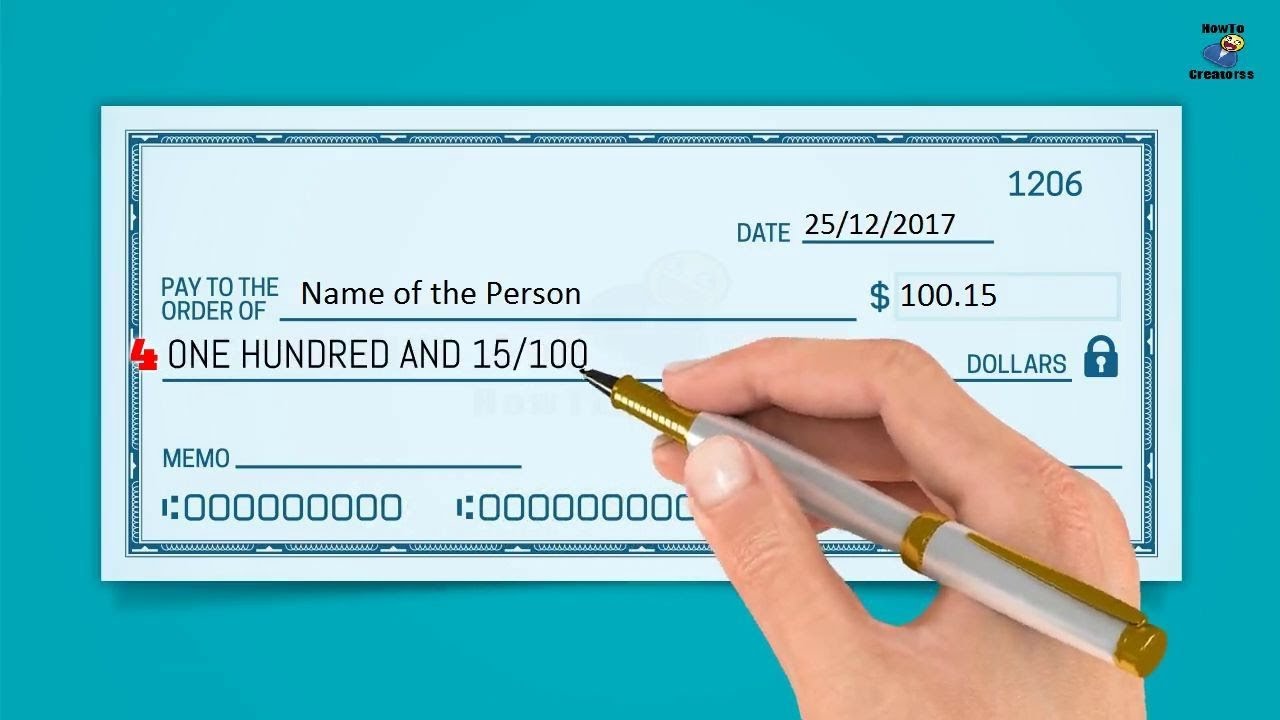

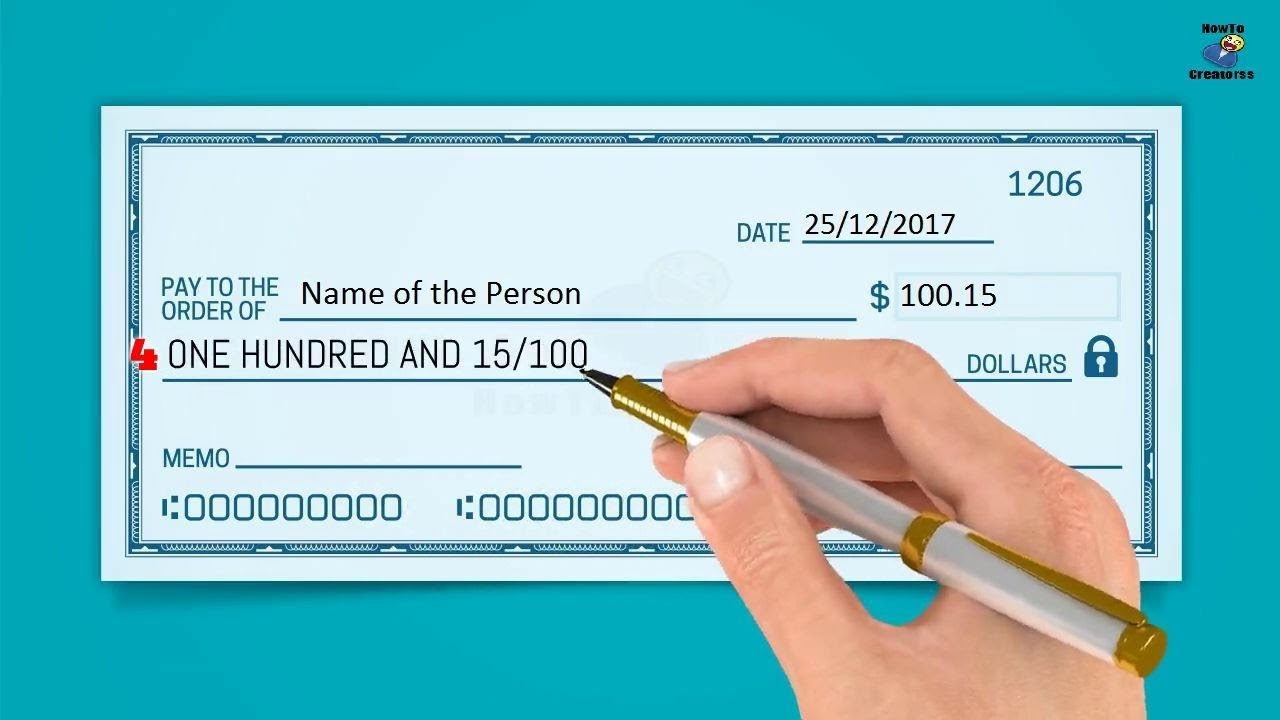

How To Write A Check For 8 Dollars – How To Write A Check For 100000 Dollars

| Welcome to our website, within this moment I will teach you regarding How To Factory Reset Dell Laptop. And from now on, this can be the initial photograph:

Think about image previously mentioned? can be that will incredible???. if you feel thus, I’l m demonstrate some picture once again underneath:

So, if you would like have the awesome pics about (How To Write A Check For 8 Dollars), simply click save link to store these graphics to your personal pc. There’re all set for obtain, if you love and want to take it, just click save logo on the article, and it’ll be directly downloaded in your laptop.} At last if you need to receive new and latest picture related with (How To Write A Check For 8 Dollars), please follow us on google plus or bookmark this blog, we try our best to give you daily update with fresh and new photos. We do hope you like staying right here. For many up-dates and recent information about (How To Write A Check For 8 Dollars) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to offer you up grade periodically with all new and fresh photos, love your surfing, and find the right for you.

Thanks for visiting our website, contentabove (How To Write A Check For 8 Dollars) published . Nowadays we’re excited to declare that we have found an awfullyinteresting topicto be pointed out, namely (How To Write A Check For 8 Dollars) Many individuals attempting to find specifics of(How To Write A Check For 8 Dollars) and certainly one of these is you, is not it?/how-to-write-cents-on-a-check-315355-v3-5b73180dc9e77c0057af71ba.png)